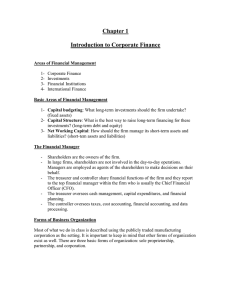

Chapter 1 Introduction to Financial Management Key Concepts and Skills Have a good understanding of: • The basic types of financial management decisions and the role of the financial manager • The goal of financial management • The financial implications of the different forms of business organization • The conflicts of interest that can arise between owners and managers Chapter Outline 1.1 1.2 1.3 1.4 1.5 1.6 Finance: A Quick Look Business Finance and The Financial Manager Forms of Business Organization The Goal of Financial Management The Agency Problem and Control of the Corporation Financial Markets and the Corporation Basic Areas of Finance 1. 2. 3. 4. Corporate finance = Business Finance Investments Financial institutions International finance Corporate finance • The main focus of this class • How much and what types of assets to acquire? • How to raise capital needed to purchase assets? • How to run the firm to maximize its value? Investments • Security analysis • Find the proper value for individual securities (stocks, bonds, etc.) • Risks versus rewards • Portfolio theory • How to structure portfolio of securities (asset allocation) Financial markets and institutions • Study of capital and money markets • Determinants of prices and interest rates in these markets • Financial intermediaries • • • • • Banks – commercial and investment, credit unions, savings and loans Insurance companies Brokerage firms Mutual funds Pension funds International Finance • An area of specialization within each of the areas discussed so far • Add to the analysis exchange rates and political risk. Basic Areas Of Finance INTERNATIONAL DOMESTIC Corporate Finance Financial Institutions Investments Corporate Organization Chart Financial Manager & Business Finance • The top financial manager within a firm is usually the Chief Financial Officer (CFO) • Treasurer – oversees cash management, credit management, capital expenditures, and financial planning • Controller – oversees taxes, cost accounting, financial accounting, and data processing Financial Management Decisions • Capital budgeting • What long-term investments or projects should the business take on? • Capital structure • How should we pay for our assets? • Should we use debt or equity? • Working capital management • How do we manage the day-to-day finances of the firm? Forms of Business Organization Three major forms in the United States • Sole proprietorship • Partnership • General • Limited • Corporation • S-Corp • Limited liability company Sole Proprietorship Business owned by one person • Advantages • • • • Easiest to start Least regulated Single owner keeps all of the profits Taxed once as personal income • Disadvantages • Limited to life of owner • Equity capital limited to owner’s personal wealth • Unlimited liability • Difficult to sell ownership interest Partnership Business owned by two or more persons • Advantages • • • • Two or more owners More capital available Relatively easy to start Income taxed once as personal income • Disadvantages • Unlimited liability • General partnership • Limited partnership • Partnership dissolves when one partner dies or wishes to sell • Difficult to transfer ownership Corporation A legal “person” distinct from owners and a resident of a state • Advantages • Limited liability • Unlimited life • Separation of ownership and management • Transfer of ownership is easy • Easier to raise capital • Disadvantages • Separation of ownership and management (agency problem) • Double taxation (income taxed at the corporate rate and then dividends taxed at personal rate, while dividends paid are not tax deductible) Goal of Financial Management • What should be the goal of a corporation? • Maximize profit? • Minimize costs? • Maximize market share? • Managers’ goal: Maximize the current value per share of the company’s existing stock • More generally: Maximize the market value of the existing owners’ equity (more adequate for firms with no traded stocks) Corporate governance • Some managers use company resources for private reasons (perks), divert money (fraud), maximize their compensation packages (fat cat managers). Tend to remain in the board also in presence of bad performance (entrenchment). • The board of directors often does not intervene. (why?) • What can shareholders do? What are other disciplinary forces? The Agency Problem • Agency relationship • Principal hires an agent to represent its interests • Stockholders (principals) hire managers (agents) to run the company • Agency problem • Conflict of interest between principal and agent • Management goals and agency costs • Management may tend to overemphasize organizational survival to protect job security. Do Managers Act in the Shareholders’ Interests? The following factors could affect managerial behavior: • Managerial compensation (board intervention) • Incentives can be used to align management and stockholder interests • Incentives need to be carefully structured to insure that they achieve their goal • Stock options • Corporate control & market intervention • Proxy fights – mechanism by which unhappy shareholders act to replace managers • Threat of a takeover may result in better management • Other stakeholders: bondholders, suppliers, customers • Regulatory intervention Regulatory intervention • Sarbanes-Oxley Act (2002) • Driven by corporate scandals: Enron, Tyco, WorldCom, Adelphia • Intended to strengthen protection against accounting fraud and financial malpractice • Compliance very costly. Firms driven to: • Go public outside the U.S. • Go private (“go dark”) • Dodd–Frank Wall Street Reform and Consumer Protection Act (2010) • “An Act To promote the financial stability of the United States by improving accountability and transparency in the financial system, to end ‘‘too big to fail’’, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes.” The Capital Allocation Process • In a well-functioning economy, capital flows efficiently from those who supply capital to those who demand it. • Suppliers of capital – individuals and institutions with “excess funds”. These groups are saving money and looking for a rate of return on their investment. • Demanders or users of capital – individuals and institutions who need to raise funds to finance their investment opportunities. These groups are willing to pay a rate of return on the capital they borrow. Cash Flows Between the Firm and the Financial Markets Financial Markets • A financial market is a place where individuals and organizations wanting to borrow funds are brought together with those having a surplus of funds. • Primary vs. secondary markets What is an IPO? • An initial public offering (IPO) is where a company issues stock in the public market for the first time. • “Going public” enables a company’s owners to raise capital from a wide variety of outside investors. Once issued, the stock trades in the secondary market. • Public companies are subject to additional regulations and reporting requirements. Secondary markets • Auction markets have a physical location – brokers match buyers and sellers (dealers play limited role) • Over-the-counter markets have no physical location and dealers are market makers (brokers are to some extent important too) • NYSE • NASDAQ