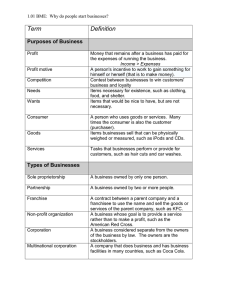

Business finance Lecture Week 1 Some important questions that are answered using finance: • What long-term investments should the firm take on? • Where will we get the long-term financing to pay for the investment? • How will we manage the everyday financial activities of the firm? Business finance, broadly speaking, is the study of ways to answer these questions. Emphasise that ‘business finance’ is just another name for the ‘corporate finance’ mentioned under the four basic types. Students often get confused by the terminology, especially when different terms are used to refer to the same thing. Financial manager Financial managers try to answer some or all of these questions. The top financial manager within a firm is usually the chief financial officer (CFO). • Treasurer: oversees cash management, credit management, capital expenditure and financial planning • Accountant: oversees taxes, cost accounting, financial accounting and data processing Financial management decisions Capital budgeting What long-term investments or projects should the business take on? Capital budgeting: The process of planning and managing a firm’s long-term investments. Capital structure How should we pay for our assets? Should we use debt or equity? Capital structure: The mixture of debt and equity maintained by the firm. Working capital management How do we manage the day-to-day finances of the firm? Working capital: Firm’s short-term assets and liabilities. The three areas of corporate financial management—capital budgeting, capital structure and working capital management—are very broad categories. These broad areas will be discussed in detail in the chapters ahead. Provide some examples of capital budgeting decisions, such as what products or service will the firm sell, should it replace old equipment with newer, more advanced equipment, etc. Be sure to define debt and equity. Provide some examples of working capital management, such as who should the firm sell to on credit, how much inventory should it carry, when should it pay its suppliers, etc. Investments • • • • Working with financial assets such as shares and bonds Value of financial assets Risk versus return and asset allocation Job opportunities • Stockbroker • Financial advisor • Portfolio manager • Security analyst Financial institutions • • Companies that specialise in financial matters • Banks • Insurance companies • Brokerage firms Job opportunities • • Client advisor International finance • • • • An area of specialisation within one of the areas discussed so far. May allow you to work in other countries or at least travel on a regular basis. Need to be familiar with exchange rates and political risk. Need to understand the customs of other countries and you would benefit from being fluent in a foreign language. Forms of business organisation Three major forms in Australia and New Zealand 1. Sole proprietorship 2. Partnership General Limited 3. Corporation Sole proprietorship: A business owned by a single individual Partnership: Business owned by two or more individuals or entities Corporation: A business created as a distinct legal entity owned by one or more individuals or entities, and having many of the rights, duties and privileges of an actual person. Sole Proprietiship Business Owned By one Person Partnership Business owned by two or more persons Corporation A legal ‘person’ distinct from owners The taxation of corporations is a significant disadvantage, being a legal person it not only pays tax but also the money paid to shareholders in the form of dividends is taxed again as income to those shareholders. Goal of financial management What should be the goal of a corporation? • Maximise profit? • Minimise costs? • Maximise the current value per share of the company’s existing shares? • Maximise the market value of the existing owners’ equity? ‘ It does not matter whether the business is a sole proprietorship, a partnership or a corporation. For each of these, good financial decisions increase the market value of the owners’ equity and poor financial decisions decrease it. The goal does not imply that the financial manager should take illegal or unethical actions in the hope of increasing the value of the equity in the firm. The financial manager best serves the owners of the business by identifying investment projects that add value to the firm because they are desired and valued in the free marketplace. The Agency problem Agency cost: When managers fails to take advantage of a valuable opportunity available to the firm. Do managers act in the shareholders’ interests? Managerial compensation • Incentives can be used to align management and shareholder interests. • The incentives need to be structured carefully to make sure that they achieve their goals. Corporate control • The threat of a takeover may result in better management. Other stakeholders Proxy fight: A mechanism whereby a group of unhappy shareholders solicit proxy votes to replace existing management. Stakeholders: Someone other than a shareholder or creditor who potentially has a claim on the cash flows of the firm. Incentives—discuss how incentives must be carefully structured. For example, tying bonuses to profits might encourage management to pursue short-run profits and forgo projects that require a large initial outlay. Stock options may work, but there may be an optimal level of insider ownership. Beyond that level, management may be in too much control and may not act in the best interests of all stockholders. The type of stock can also affect the effectiveness of the incentive. Corporate control—ask the students why the threat of a takeover might make managers work towards the goals of stockholders. Other groups also have a financial stake in the firm. They can provide a valuable monitoring tool, but they can also try to force the firm to do things that are not in the owners’ best interests. Financial markets Cash flows between the firm and the financial markets Figure 1.2