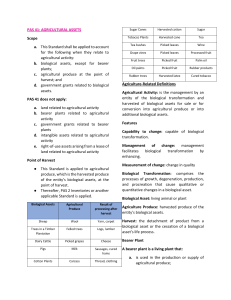

UNIVERSITY OF SANTO TOMAS UST-Alfredo M. Velayo – College of Accountancy España, Manila IAC 11 – INTEGRATED REVIEW IN FINANCIAL ACCOUNTING AND REPORTING 2ND TERM, ACADEMIC YEAR 2019-2020 AGRICULTURE 1. All of the following must be satisfied before a biological asset can be recognized, except a. The entity controls the asset as a result of past event. b. It is probable that future economic benefits relating to the asset will flow to the entity. c. An active market for the asset exists. d. The fair value or cost of the asset can be measured reliably. 2. Which of the following statements is true regarding agricultural produce? a. In all cases, an entity shall measure agricultural produce at fair value less cost of disposal at the point of harvest. b. The fair value of agricultural produce at the point of harvest can always be measured reliably. c. The fair value measurement of agricultural produce stops at the time of harvest. d. All of these statements are true regarding agricultural produce. 3. An entity had a plantation forest that is likely to be harvested and sold in 30 years. How should income be accounted for? a. No income should reported annually until first harvest and sale in 30 years. b. Income should be measured annually and reported using a fair value approach that recognizes and measures biological growth. c. The eventual sale proceeds should be estimated over the 30year period. d. The plantation forest should be valued every five years. 4. Animals related to recreational activities, for example, game parks and zoos, including the natural breeding of animals in zoos, shall be accounted for under what standard? a. PAS 41 – Agriculture b. PAS 16 – Property, plant and equipment c. PAS 40 – Investment property d. Either PAS 41 or PAS 16 5. According to IASB, bearer plants, such as grape vines, rubber trees and oil palms which are used solely to grow produce over several periods should be accounted for as a. Biological assets with disclosure b. Biological assets without disclosure c. Property, plant and equipment d. Noncurrent investments 6. Which of the following typically would a result in a deferred tax liability? a. Warranty expense b. Bad debt expense c. Installment sales method for tax purposes and accrual accounting for financial reporting d. Unearned rental income 7. If the fair value of the biological asset cannot be determined reliably, the biological asset should be measured at a. Cost b. Net realizable value c. Current cost d. Cost less accumulated depreciation and accumulated impairment losses 8. Agricultural activity a. Is the aggregation of similar animals or plants b. Is the detachment of agricultural produce from a biological asset c. Comprises the processes of growth, degeneration, production and procreation of a biological asset d. Is the management by an entity of biological transformation of biological asset into agricultural produce or additional biological asset 9. All of the following items are classified as biological assets, except a. Dairy cattle b. Chickens c. Eggs d. Trees 10. Biological assets are measured at a. cost. b. lower of cost and net realizable value. c. net realizable value. d. fair value less cost of disposal. 11. Agricultural produce is harvested product of biological asset and measured at a. fair value. b. fair value less cost of disposal at the point of harvest. c. net realizable value. d. net realizable value less normal profit margin. 12. The costs to sell of biologic al assets and agricultural produce include all of the following, except a. Commissions to brokers and dealers b. Levies by regulatory agencies c. Transfer taxes and duties d. Transport costs 13. In rare circumstances where the fair value cannot be determined reliably, the biological asset shall be measured at a. Cost. b. Cost less accumulated depreciation. c. Cost less accumulated impairment losses. d. Net realizable value. depreciation and accumulated 14. A gain or loss arising on the initial recognition of biological asset and from a change in fair value less cost of disposal of a biological asset shall be included in a. The profit or loss for the period. b. Other comprehensive income. c. A separate revaluation reserve. d. A general reserve. 15. When agricultural produce is harvested, the harvest should be accounted for as “inventory”. For this purpose, the initial cost of the inventory is a. Fair value less cost of disposal at the point of harvest b. Historical cost of the harvest c. Historical cost less impairment d. Market value 16. Land that is related to agricultural activity is measured a. At fair value b. At fair value in combination with the biological asset that is being grown on the land. c. At the resale value separate from the biological asset that is being grown on the land. d. In accordance with PAS 16 Property, plant and equipment or PAS 40 Investment property. END