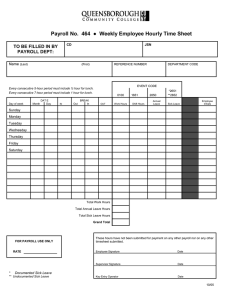

Tut 5 Chapter 9: Employee benefits Comprehension questions 1. What is a paid absence? Provide an example. 2. What is the difference between accumulating and non-accumulating sick leave? How does the recognition of accumulating sick leave differ from the recognition of nonaccumulating sick leave? 3. What is the difference between vesting and non-vesting sick leave? How does the recognition of vesting sick leave differ from the recognition of non-vesting sick leave? 4. Explain how a defined contribution superannuation plan differs from a defined benefit superannuation plan. Case study 9.1 Termination benefits The board of directors of Swinburne Ltd met in June 2016 and decided to close down a branch of the company’s operations when the lease expired in the following February. The chief financial officer advised that termination benefits of $2 million are likely to be paid. The company’s accountant has asked whether they should recognise a liability for termination benefits in its financial statements for the year ended June 2016. Required Advise the accountant, with reference to the requirements of AASB 119/IAS 19. Exercise 9.1 Accounting for the payroll Adelaide Ltd pays its employees on a monthly basis. The payroll is processed on the 6th day of the month and payable on the 7th day of the month. Gross salaries for July were $500 000, from which $125 000 was deducted in tax. All of Adelaide Ltd’s salaries are accounted for as expenses. Deductions for health insurance were $10 000. Payments for health insurance and employee withheld income taxes are due on the 15th day of the following month. Required 1. Prepare all journal entries to record the July payroll, the payment of July salaries and the remittance of deductions. 2. Calculate the balance of the Accrued Payroll account at the end of July. Exercise 9.4 Accounting for sick leave Auckland Ltd has 200 employees who each earn a gross wage of $140 per day. Auckland Ltd provides 5 days of paid non-accumulating sick leave for each employee per annum. During the year, 150 days of paid sick leave and 20 days of unpaid sick leave were taken. Staff turnover is negligible. Required Calculate the employee benefits expense for sick leave during the year and the amount that should be recognised as a liability, if any, for sick leave at the end of the year. Exercise 9.5 Accounting for annual leave Newcastle Ltd provides employees with 4 weeks (20 days) of annual leave for each year of service. The annual leave is accumulating and vesting up to a maximum of 6 weeks. Thus, all employees take their annual leave within 6 months after the end of each reporting period so that it does not lapse. Newcastle Ltd pays a loading of 17.5% on annual leave; that is, employees are paid an additional 17.5% of their regular wage while taking annual leave. Refer to the following extract from Newcastle Ltd’s payroll records for the year ended 30 June 2016. Employee Chand Kim Smith Zhou Wage/day $160 $125 $150 $100 AL 1 July 2015 Days 6 3 2 4 Increase in entitlement Days 20 20 20 20 AL taken Days 15 16 13 17 Required Calculate the amount of annual leave that should be accrued for each employee.