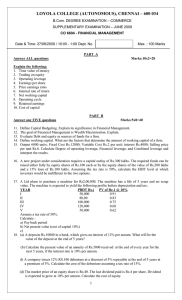

![financial management [www.accfile.com]](http://s3.studylib.net/store/data/025355418_1-26f593a124e276b4e7fc51802474cce8-768x994.png)