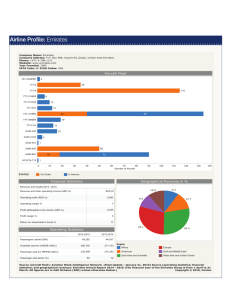

MOHD NAZMI BIN AHMAD MAHMOD 53276113048 FIKRI AIMAN BIN DIMSHARI 53276113071 R A J A M U H A M M A D F I K R I B I N R A J A M A M AT 53276113019 NOR MOHD FUAD BIN AB RASHID 53276113121 N U R F AT I N B I N T I A H M A D 53276113119 INTRODUCTION Based in Dubai, United Arab Emirates. Subsidiary of The Emirates Group, fully owned by government of Dubai's Investment Corporation of Dubai. Hub at Dubai International Airport with a total of 52,516 employees. Operating nearly 3,400 flights per week from its hub at Dubai International Airport, to more than 142 cities in 78 countries across 6 continents. Cargo activities are undertaken by the Emirates Group's Emirates SkyCargo division. ITEM 2014 (AED M) 2013 (AED M) % CHANGES Revenue 80,717 71,159 + 13.43% Other operating income 1,919 1,954 - 1.79% Operating Cost (78,376) (70,274) + 11.53% Operating Profit 4,260 2,839 + 50.05% Finance Income 247 406 - 39.16% Finance Cost (1,179) (900) + 31% Share of result of investments accounted for using the equity method 136 127 + 7.09% Profit before income tax 3,464 2,472 + 40.13% Income tax expenses (47) (64) - 26.56% Profit of the year 3,417 2,408 + 41.9% Profit attributable to non controlling interest 163 125 + 30.4% Profit attributable to Emirates Owner 3,254 2,283 + 42.53% 2014 – 2013 % changes in Income Statement 60% 50% 50% 40% 40% 42% 43% 30% 20% 13% % CHANGES 10% 0% Revenue Operating Profit before Profit of the Profit Profit tax year attribute to Emirates Owner R E V E N U E SERVICE 2014 (AED m) 2013 (AED m) % changes Passengers 65,405 57,477 + 13.79% Cargo 11,263 10,346 + 8.86% Excess baggage 412 388 + 6.19% Hotel operation 395 234 + 68.80% Destination & leisure 228 226 + 0.88% Others 459 307 + 49.51% 78,162 68,978 + 13.31% 2013 (AED m) % changes SALES OF GOODS 2014 (AED m) Consumer goods 1,313 1,196 + 9.78% Food & beverage 625 502 + 24.05% In-flight catering 617 483 + 27.74% 2,555 2,181 + 17.15% 80,717 71,159 + 13.43% 2014 – 2013 % changes in Revenue 80% 70% 60% 50% 40% 30% 20% 10% 0% 68.80% 50% 14% Passenger 9% Cargo 13.43% 6% Excess baggage 0.88% Hotel Destination & Operations leisure % changes Others Sale of Goods OPERATING COST 2014 (AED m) 2013 (AED m) % changes Jet fuel 30,685 27,855 + 10.16% Employee 10,230 9,029 + 13.30% Aircraft operating leases 6,548 5,916 + 10.68% Depreciation and amortization 6,421 5,136 + 25.02% Sales and marketing 5,421 5,270 + 2.87% Handling 4,648 4,073 +14. 12% In-flight catering and related costs 3,529 3,159 + 11.71% Overflying 2,386 2,086 + 14.38% Aircraft maintenance 2,146 1,865 +15 06% Office accommodation and IT costs 1,878 1,649 + 13.89% Landing and parking 1,568 1,335 + 17.45% Cost of goods sold 1,190 1,042 + 14.20% Corporate overhead 1,726 1,859 - 7.15% 78,376 70,274 +11.53% 2014 – 2013 % changes in Operating Cost 30% 25% 25% 20% 15% 10% 5% 10% 13% 14% 11% 12% 16% 14% 15% 14% 14% 3% % changes 0% -5% -10% -7% Finance Income And Cost Finance Income 2014 (AED m) 2013 (AED m) % changes Interest income on short term bank deposits 228 341 - 33.13% Related parties 19 65 - 70.77% 247 406 - 39.16% 2014 (AED m) 2013 (AED m) % changes Aircraft financing costs (816) (717) + 13.81% Interest charges on bond and term loans (252) (96) + 162.5% Other finance costs (111) (87) + 27.59% (1,179) (900) + 31% Finance Costs 2014 – 2013 % changes in Finance Income and Cost Finance Income Finance Cost 0% -10% Interest Income on Short term bank deposits Related parties -20% -30% -40% Finance Income -33% -50% -60% -70% -80% -71% 180% 160% 140% 120% 100% 80% 60% 40% 20% 0% 162% Finance Cost 14% A/c Financing costs 28% Interest Other charges on finance cost bond and term loans NON- CURRENT ASSETS Property, plant and equipment 2014 (AED m) 2013 (AED m) % changes 71,582 57,039 + 25.50% Intangible assets 928 910 + 1.98% Investment accounted for using the equity method 495 485 + 2.06% Advance lease rentals 812 807 + 0.62% Loans and other receivables 428 508 - 15.75% Derivative financial instruments 5 92 - 94.57% Deferred income tax assets - 15 74,250 59,856 CURRENT ASSETS 2014 (AED m) + 24.05% 2013 (AED m) % changes Inventories 1,706 1,564 + 9.08% Trade and other receivables 9,086 8,744 + 3.91% 1 67 - 98.51% Short term bank deposits 8,754 18,048 - 51.49% Cash and cash equivalents 7,807 6,524 + 19.67% 27,354 34,947 - 21.73% 101,604 94,803 + 7.17% Derivative financial instruments Total assets 2014-2013 % changes in Balance Sheet 30.00% 20.00% 24.05% 10.00% 10.59% 8.04% 3.54% 0.00% -10.00% -21.73% -20.00% -30.00% % changes Non-current assets Current assets Equity Non-current libilities Current Liabilities 24.05% -21.73% 10.59% 8.04% 3.54% % changes COMMON-SIZE STATEMENTS FOR THE YEAR ENDED 2013 ITEM MAS (%) Emirates (%) Revenue 95.30 96.63 Other operating income 4.56 2.65 (104.93) (95.42) Operating Profit / Loss (5.07) 3.86 Unrealized foreign exchange (loss)/ gain (1.07) - Finance Income 0.14 0.55 Finance Cost (2.97) (1.22) - 0.17 Profit / Loss before income tax (8.97) 3.36 Income tax expenses (0.1) (0.09) Profit / Loss of the year (9.07) 3.27 - (0.17) (9.07) 3.10 Operating Cost Share of result of investments accounted for using the equity method Profit / Loss attributable to non controlling interest Profit / Loss attributable to Emirates Owner Current Ratio 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑦 2014 2013 (AED m) (AED m) 27,354 = 32,428 34,947 = 31,319 0.844 1.116 From the ratio analysis we can say that the company can cover the liabilities on 2013 more than 2014 because the current ratio is above 1.00 So it is suggested that the business still can be re-invested in the longer term but slightly changes in term of 2013 strategy. Acid test ratio= 𝐶𝑎𝑠ℎ+𝑆ℎ𝑜𝑟𝑡−𝑡𝑒𝑟𝑚 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡+𝑛𝑒𝑡 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 2013 4211+18048+8744 71771 2014 4771+8754+9086 76133 = 0.43 = 0.29 Ratio analysis : Emirates Airline can pay all the current liability immediately because the company has stable financial. The inventory turnover ratio of emirates in 2013 is much more lower compare to 2014 from 2.52 to 2.79. This indicates that over the year, Emirates has strong sale or ineffective buying. This also means better liquidity in the year 2014. The days in inventory ratio of emirates decrease from the year 2013 to 2014. The days in inventory ration change from 145 to 131. This indicate that in 2014 Emirates has shorter days(131 days) for them to sell inventories within 131 days. If inventory sits longer that, it can start costing Emirates extra money Gross profit percentage in 2013 increasing from 3.9% to 5.2% in 2014 .This indicate that in 2014 Emirates make a much more reasonable profit and able to control its production cost better. Account receivable turnover ratio in 2014 is higher than the receivable turnover ratio in 2013 which is 88.21 and 74.10 respectively. This define that in 2014 Emirates has shorter time between the sale and collecting the cash for that sale compare to the year 2013. Days Sales in average account receivable= 365 74.10 365 2014 88.21 2013 365 𝑑𝑎𝑦𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑟𝑎𝑡𝑖𝑜 = 4.92 = 4.08 In 2013 the day sales in average account receivable is 4.92 decrease to 4.08 at 2014. That means emirates has lower the average number of days it takes to collect an account receivable. In 2013 the debt ratio of Emirates is 0.75 which is higher from the debt ratio in 2014 which is 0.74. This decreasing debt ratio value show that in 2014 Emirates has more stable business with the potential of longevity with lower overall debt. Debt to equity= 71771 2013 23032 76133 2014 25471 𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 = 3.11 = 2.98 In year 2013 the ratio for debt to equity of emirates is 3.11 and has decrease to 2.98 in 2014. That means Emirates has lower in debt and financially has stable business. Times − interes𝑡 𝑒𝑎𝑟𝑛𝑒𝑑 𝑟𝑎𝑡𝑖𝑜 = 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝐵𝑒𝑓𝑜𝑟𝑒 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑇𝑎𝑥𝑒𝑠 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 2472 2013 = 25.75 96 3464 2014 = 13.74 252 The time interest ration decreased from 25.75 in 2013 to 13.74 in 2014.This trend shows that emirates the frequency annual interest expenses covered by net operating income of emirates is lower in 2014. Emirates may face difficulties to raise funds for their operations. Rate of Return on Net Sales = 2014 ( AED m) = = 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 78,162 x 100% 2013 (AED m) 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 3,417 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 x 100% x 100% = 4.37 % = = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 2,408 68,978 x100% x 100% = 3.49 % Emirates generates a lot of revenues from year to year. They got a lot of profit in 2014 compare to 2013 in term of an increasing the economy class seat factor, cargo business, the introduction of six new services as well as the increased frequencies or capacity to existing destinations. Rate of return on total assets = 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒+𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 2013 = 71159+252 50802 = 1.40 2014 =80717+96 47401 =1.71 The trend of “rate of return on total asset” of Emirates Airline is increasing from, 2013 as much as 1.40 to 1.71 in 2014 hence indicate the company’s profitability is improving . Assets Turnover Ratio Assets turnover ratio= 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 2013=71159 50802 =1.40 2014=80717 47401 =1.70 The assets turnover ratio of Emirates Airlines in increasing from the year 2013 as much as 1.40 to 1.70 in 2014 .This increasing ratio value shows Emirates Airline is generating sales from the assets that they have. = 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 −𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 𝑒𝑞𝑢𝑖𝑡𝑦 2013=71159-22176 21993 =2.23 2014=80717-22762 36557 =1.58 Since the rate of return on common stockholders equity in 2013 is 2.23 which is higher compared to 2014 which is 1.58 , it explains that in 2013 Emirates Airline generates more dollars net income have been earned for each AED invested by the common stakeholders compare to 2013 .This conclude in 2013 , Emirates gains higher profitability and stronger financial position compared to 2014. = 𝑀𝑎𝑟𝑘𝑒𝑡 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑜𝑓 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠𝑡𝑜𝑐𝑘 𝐸𝑎𝑟𝑛𝑖𝑛𝑔 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 4.60 2013= 0.8038 =5.72 2014= 4.80 0.8038 =5.97 From year 2014, the price earning ratio of Emirates increase to 5.97 from 5.72 in 2013. This can be define that emirates has higher investors are anticipating higher growth in 2014 compare to 2013. This also can means that emirates stock in 2014 is much more expensive compare to previous year in 2013 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑜𝑓 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠𝑡𝑜𝑐𝑘 𝑀𝑎𝑟𝑘𝑒𝑡 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝑜𝑓 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠𝑡𝑜𝑐𝑘 2013=837 9 =93 2014= 964 9 =107.1 The dividend yield on common stock of Emirates Airlines is increasing from the year 2013 to 2014 from the ratio 93 to 107.1 . This shows that the amount of dividends per share have increased compared to the stock price ( The stock price has declined compared to the dividends per share ) = 𝐴𝑛𝑛𝑢𝑎𝑙 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝐸𝑎𝑟𝑛𝑖𝑛𝑔 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 2013=837 0.8038 =1041.3 2014=964 0.8038 = 1199.3 The dividend payout for Emirates increase from the year 2013 to 2014 from 1041.3 to 1199.3. A consistent trend in this ration is usually more important than high or low ratio. However the higher ratio conclude that in 2014, Emirates give higher percentage of net income that is distributed to shareholders in the form dividends during the year 2014. • Emirates had shown that the experience, knowledge and positive performance of the Emirates Group is characterized by high efficiency and flexibility of the company itself. • This is the result of adopting and encouraging fair competition, transparency and an open skies policy. • The future of Emirates group is bright because they implement high professional standards and commitment in their works. The End THANK YOU FOR GIVING ATTENTION TO OUR PRESENTATION. LOTS OF LOVE.