ATENEO

CENTRAL

'A

BAR OPERATIONS 2019

JORGE ALFONSO C. MELO

Bar Review Coordinator

LEILA S. LIM

Bar Review Secretariat

ATENEO CENTRAL BAR OPERATIONS

PATRICK EDWARD BALISONG

Chairman

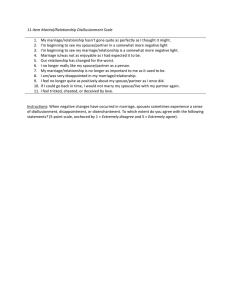

KATRINA Y. COSCOLLUELA

GENiCA THERESE ENDALUZ

JONATHAN VICTOR NOEL

JOHN STEPHEN PANGILINAN

CZARINA CHER CUERPO

BENIGNO ENCISO

Administration Committee Heads

Academics Committee Heads

Hotel Operations Committee Heads

VIVENCIO ABANO

FERDINAND CASIS

J. HECTOR HOFILENA (RET.)

JESS RAYMUND LOPEZ

AMPARITA STA. MARIA

CHRISTINE JOY TAN

TERESA VILLANUEVA-TIANSAY

CIVIL LAW Faculty Advisers

MARIA HAZEL BABELONIA

NINA ALISHA CAPATI

ISABELLE CAPISTRANO

JAMES CUEVAS

RACHELLE ANN L. GO

BERNADETTE LOUISE GUIA

MERYL GUINTU

LYNDON MONTES

NADJA VALERIE MURIA

PATRICE JANE ROMERO

MELAN ANTHONY YAP

CIVIL LAW Subject Heads

ROSEGAIL ABAS

KARLA NIZZA BUTIU

ANA BETTINA CARONONGAN

ALEEZAH GERTRUDE REGADO

JUSTIN NICHOLAS SY

CIVIL LAW Understudies

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

|

4. capacity to

succeed

I. G EN ER A L PR IN C IPLES

A.

Laws on

Forms and

Solemnities

EFFECT AND APPLICATION OF LAWS

Q: Summarize

principles.

the

governing

laws

or

A:

LAW

.....; -................

Penal Laws

Status Laws

(relating to

family

rights and

duties,

status,

condition,

legal

capacity)

Property

Laws

MATTERS/

PERSONS

BOUND

All those

who live or

sojourn in

Philippine

territory

Citizens of

the

Philippines,

even

though

living

abroad

Real and

personal

property

GOVERNING

PRINCIPLE/

DOCTRINE

Principle of

Territoriality:

Lex lo c i

celebrationis:

Law of the

country in

which they are

executed

Exception:

If

executed

before

Philippine

diplomatic

or

consular

officials

abroad,

Philippine laws

shall govern.

Law of the

place where

crime was

committed

Principle of

Nationality:

National law of

the person

Note:

Prohibitive

laws

which

have for their

object

public

order,

public

policy and good

customs shall

not

be

rendered

ineffective

by

laws

or

judgments

promulgated,

or

by

determinations

or conventions

agreed upon in

a

foreign

country.

Lex re i sitae:

Law of the

place where

property is

situated.

Exception:

In intestate and

testamentary

successions, it

is the national

law of the

person whose

succession is

under

consideration,

regardless of

the nature and

location of the

property, with

respect to:

1.

order

of

succession

2. amount of

successional

rights

3.

intrinsic

validity of will

Forms and

solemnities

of contracts,

wills, public

instruments

Q: A foreigner married to a Filipina had a

child. When they divorced abroad, the

foreigner refused to support the child stating

that under his country’s law, they are not

obliged to support a child. Is the foreigner’s

refusal valid?

A: No. While the provisions of the Family Code on

support only apply to Filipino citizens, the

foreigner in this case did not prove his country’s

law before the courts. Thus, the doctrine of

processual presumption applies, that is - if the

foreign law involved is not properly pleaded and

PAGE 1 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

proved, our courts will presume that the foreign

law is the same as our local or domestic or

internal law. Moreover, the-foreigner’s national

law would not find applicability in our jurisdiction

when such is contrary to an established public

policy of the forum. Prohibitive laws concerning

persons, their acts or property, and those which

have for their object public order, public policy

and good customs shall not be rendered

ineffective by laws or judgments promulgated, or

by determinations or conventions agreed upon in

a foreign country (Del Socorro, v. Van Wilsem,

3.

Locus Actus — place where an act has

4.

Lex

5.

6.

7.

8.

been done;

Fori— place where judicial or

administrative proceedings are instituted

or done;

Place where an act is intended to come

into Effect;

Situs of a thing;

Intention of the parties as to the

governing law;

Flag of a ship. (Saudi Arabian Airlines v.

Court o f Appeals, G.R. No. 122191, 1998

)

G.R. No. 193707,2014 (citing Bank o f America v.

American Realty Corp. G.R. No. 133876, 1999)).

Q: What is the

conveniens?

B, CONFLICTS OF LAW

Q: What are the phases involved in judicial

resolution of conflicts-of-law problems?

A:

1. Jurisdiction;*3

------ 2.— Choice of law;---------------------------------------3. Recognition

and

enforcement

of

judgments. ( Hasegawa v. Kitamura, G.R.

doctrine

of forum

non

A: The doctrine provides that a court, in conflicts

of law cases, may refuse impositions on its

jurisdiction where it is not the most “convenient”

or available forum and the parties are not

precluded from—seeking remedies elsewhere.

(Bank of America v. Court of Appeals, G.R. No.

120135,2003)

No. 149177, 2007)

Q: Under the doctrine of forum non

conveniens, when may a Philippine court or

agency choose to assume jurisdiction?

Q: Define “foreign element.”

A: A foreign element is a factual situation that cuts

across territorial lines and is affected by the

diverse laws of two or more states. ( Saudi

A:

1.

Arabian Airlines v. Court of Appeals, G.R. No.

122191, 1998)

2.

Q: Discuss

contacts.”

3.

the

concept

of

“minimum

A: One basic principle underlies all rules of

jurisdiction in international law, a state does not

have jurisdiction in the absence of some

reasonable basis

it. To be

reasonable, the jurisdiction must be based on

some minimum contacts that will not offend

traditional notions of fair play and substantial

justice. (HSBC v. Sherman, G.R. No. 72494,

Philippine court is one to which the

parties may conveniently resort to;

Philippine court is in a position to make

an intelligent decision as to the law and

the facts; and

Philippine court has or is likely to have

pow er.to enforce its decision. (The

Manila Hotel Corporation v. NLRC, G.R.

No. 120077, 2000)

Q: What is the doctrine of “processual

presumption?”

1989)

A: The doctrine provides that where a foreign law

is not pleaded, or even if pleaded is not proved,

the presumption is that foreign law is the same as

ours. (EDI-Staffbuilders International v. NLRC,

Q: What are the “points of contact?”

G.R. 145587. 2007)

A: The points of contract are: (DRONS-SAFESIF)

1. Domicile, Residence, place of Origin,

Nationality, or place of Sojourn of a

person;

2. Seat of a legal or juridical person;

Q: L, a Filipino and R, a Japanese citizen, were

married in in the Philippines in 2009. They

lived together in Japan. During their married

life, they would constantly quarrel due to R’s

philandering ways. As such, L and R

PAGE 2 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

submitted a “Divorce by Agreement” before

the city hall in Nagoya City, Japan in 2012.

Can the divorce be recognized under

Philippine Law?

4.

5.

A: Yes, under Art. 26 (2) of the Family Code,

whether the Filipino spouse initiated the foreign

divorce or not, a favourable decree dissolving

their marriage bond and capacitating his or her

alien spouse to remarry will have the same result:

the Filipino spouse will effectively without a

husband or wife. A Filipino who initiated a foreign

divorce proceeding is in the same place and in

like circumstances as a Filipino who is at the

receiving end of an alien initiated proceedings.

The subject provision should not make a

distinction. In both instance, it is extended as a

means to recognize the residual effect of the

foreign divorce decree on Filipinos whose marital

ties to their alien spouses are severed by

operation of the latter’s national law. (Morisono v.

Morisono, G.R. No. 226013, 2018 (citing

Republic v. Manalo, G.R. No. 221029, 2018))

Q: How is divorce acquired in a foreign

country proven in the PH courts for judicial

recognition?

A: In order for a divorce obtained abroad be

recognized in our jurisdiction, it must be shown

that the divorce decree is valid according to the

national law of the foreigner. Both the divorce

decree and the governing personal law of the

alien spouse must be proven. Our courts do not

take judicial notice of foreign laws and judgment,

our law on evidence requires that both the divorce

decree and the national law of the alien must be

alleged and proven like any other fact. ( Koike v.

6.

7.

the appointment of the arbitrator or of the

arbitration proceedings;

Party against whom the award is invoked

was Unable to present his case;

Award deals with a Difference not

contemplated within the terms of the

submission to arbitration;

Composition of the arbitral authority or

the arbitral procedure was not in

accordance with the agreement of the

parties or with the law of the country

where the agreement took place;

Award has not yet become binding on the

parties or has been Set aside or

suspended by a competent authority of

the country in which that award was

made.

Based on the finding of the competent authority:

1. Subject matter is not capable of

settlement by arbitration under the law of

that country;

2. Recognition or enforcement of the award

would be contrary to the public policy of

that country. ( New York Convention on

the Recognition and Enforcement of

Foreign Arbitral Awards, Art. V)

C. HUMAN RELATIONS (ARTICLES 19-221

Q: What are the standards to observe in the

exercise of one’s rights and performance of

duty:

A: (Art. 19)

1. Act with justice

2. Give everyone his due

3. Observe honesty and good faith.

Koike, G.R. No. 215723, 2016)

Q: What are the grounds to reject an arbitral

award?

A: At the request of the party against whom it is

invoked: (ln2-NU-DICS)

1. incapacity of the parties to the

agreement;

2. Invalidity of the agreement under the law

to which the parties have submitted it to

or under the law of the country where the

award was made;

3. Party against whom the award was

invoked was not given proper Notice of

Q: P was employed as an SA Bookkeeper of a

bank since 1977. In 2007, he suffered a mild

stroke

due to

hypertension

which

subsequently impaired

his

ability

to

effectively pursue his work. He wrote a letter

to his employer expressing his intention to

avail of an early retirement package. He was

only 55 years old at this time. His request

remained unheeded. He was separated from

employment in the latter part of 2007 due to

his poor and failing health. Can the abuse of

right doctrine under Art. 21 apply in this case?

A: No. The elements of abuse of right are as

follows: 1) there is a legal right or duty; 2)

PAGE 3 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

exercised in bad faith; and, 3) for the sole intent

of prejudicing or injuring another. All elements

were not present in this case. Since he was only

55 at the time of his retirement, he fell short with

respect to the 60 year age requirement to be

entitled to the retirement benefits. Hence, there is

no right or duty on the part of the employer to

grant his request. The employer’s denial has

basis and was not exercised in bad faith. Neither

was the intent of the employer to prejudice or

injure P in this case. (Padillo v. Oropeza, G.R. No.

199338, 2013)

Q: What are the 2 requisites for the principle

of unjust enrichment to apply?

A: The two requisites are;

1. that a person is benefited without a valid

basis or justification, and

2. that such benefit is derived at the

expense of another.

The main objdttve of the principle against unjust

enrichment is to prevent one from enriching

himself at the expense of another without just

cause or consideration. (Antonio Locsin II v.

Mekeni Food Corporation, G.R. No. 192105,

December 9, 2013).

Q: W, a Dutch national, and A, a Filipina, are

married. After several years, the Court

declared the nullity of their marriage on the

basis of

the former’s

psychological

incapacity. During the dissolution of their

conjugal properties, A received the parcels of

land they bought during marriage and these

lands were considered as paraphernal

property of A. W claimed reimbursement for

the purchase price of the said parcels of land,

but was denied. W raised unjust enrichment

for not being reimbursed for money spent on

purchase of Philippine land. Can unjust

enrichment be invoked?

A: No, the provision of unjust enrichment does not

apply if the action is proscribed by the

Constitution. An action of recovery of what has

been paid without just cause will not prosper if the

action is proscribed by the Constitution or by the

application of the pari delicto doctrine. Nor would

the denial of his claim amount to an injustice

based on his foreign citizenship. The purpose of

the prohibition is to conserve the national

patrimony which the court is duty bound to

protect. (Beum erv. Amores, G.R. 195670, 2012)

PAGE 4 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Q: Can the phrase "prying into the privacy of

another’s residence" under Art. 26 of the Civil

Code be invoked against surveillance of

business office that is located within the same

premises of a person’s residence?

A: Yes, this provision includes "any act of

intrusion into, peeping or peering inquisitively into

the residence of another without the consent of

the latter." It may extend to places where he has

the right to exclude the public or deny them

access. The phrase "prying into the privacy of

another’s residence," therefore, covers places,

locations, or even situations which an individual

considers as private. (Spouses Hing _ v.

Choachuy, Sr., G.R. No. 179736, 2013)

Q: Does Article 28 of the Civil Code prohibit

competition with regard to enterprises?

A: No. What is being sought to be prevented is

not competition per se but the use of unjust,

oppressive or highhanded methods which may

deprive others of a fair chance to engage in

business or earn a living. (Willaware Products

Corp. v. Jesichris Manufacturing Corp., G.R. No.

195549, 2014)

l II. PERSONS AND FAMILY RELATIONS \

A. PERSONS

Q: When is a child considered bom?

A: A child is considered born if it is alive at the

time of its complete delivery from the maternal

womb.

USE OF SURNAMES

Q: Can an illegitimate child use the surname

of his/her father?

A: Yes. Article 176 of the Family Code provides

that illegitimate children shall use the surname

and shall be under the parental authority of their

mother, and shall be entitled to support in

conformity with this Code. However, illegitimate

children may use the surname of their father if

their filiation has been expressly recognized by

the father through the record of birth appearing in

the civil register, or when an admission in a public

document or private handwritten instrument is

made by the father. Provided, the father has the

right to institute an action before the regular

courts to prove non-filiation during his lifetime.

The legitime of each illegitimate child shall consist

of one-half of the legitime of a legitimate child (As

amended by R.A. No. 9225).

ABSENCE

Q: What are the two kinds of absences?

A: Ordinary Absence (CIVIL CODE, ART. 390)

a. 4 years - person presumed dead for

purposes of remarriage of the spouse

present

b. 7 years - presumed dead for all purposes

EXCEPT for those of succession

c. 10 years - person presumed dead for

purposes

of

opening

succession

EXCEPT if he disappeared after the age

of 75, an absence of 5 years is sufficient

EXCEPTION: A fetus it is not deemed born if it

had an intra-uterine life of less than 7 months and

dies within 24 hours after complete delivery from

the womb. (CIVIL CODE, ART. 41)

Q: When do you use the Civil Code in

determining survivorship?

A: When two or more persons are called to

succeed each other and there is absence of proof

as to who died first ( CIVIL CODE, ART. 43).

Whoever alleges the death of one prior to the

other shall prove the same; in the absence of

proof, it is presumed that they died at the same

time and there shall be no transmission of rights

from one to the other (Id.).

PAGE 5 OF 120

Extraordinary

Absence

(CIVIL

CODE,

ART.391)

a.

b.

c.

If a person rode an airplane or sea vessel

lost in the course of voyage, from the

time of loss of the airplane or sea

vessel

If a person joined the armed forces who

has taken part in war, from the time he

is considered missing in action

Danger

of

death

under other

circumstances,

disappearance

from

time

of

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Q: When does a declaration of absence of a

missing person take effect?

Q: What are the grounds that would warrant a

change of a person’s first name or nickname?

A: 6 months after the publication of the

declaration of absence (CIVIL CODE, ART. 386).

A:

1.

CIVIL REGISTER

2.

Q: What are the matters recorded in the civil

register?

3.

A:

4.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Acts, events and judicial decrees

concerning the civil status of persons

Birth

Marriage

Death

Legal separation

Annulment of marriage

Judgments declaring marriage void from

the beginning

Legitimation

Adoption

Acknowledgement of natural children

Naturalization

Loss of citizenship

Recovery of citizenship

Civil interdiction

Judicial determination

Voluntary emancipation of a minor

Change of name

General Rule: Entries in the civil register may be

changed or altered only upon a judicial order.

Exception: Clerical or typographical errors or

change in the name or nickname can be changed

administratively through verified petition with the

local office of the civil registrar.

Who may file petition: Any person having direct

and personal interest in any act, event, order or

decree concerning the civil status of persons or

change of name.

Q: What are the procedural requirements for a

Petition of Change of Name?

A:

1.

2.

3.

3 years residency in the province where

change is sought prior to the filing

Must not be filed within 30 days prior to

an election

Petition must be verified

5.

Petitioner's true and official name is

ridiculous;

Petitioner’s true and official name is

tainted with dishonor

Petitioner’s true and official name is

extremely difficult to write or pronounce

New first name or nickname has been

habitually and continuously used by the

petitioner and he has been publicly

known by the first names and nicknames

in the community

When the change is necessary to avoid

confusion (Sec. 4, R.A. 9048)

With Judicial

Authority

Matters which may be

made

by

the

concerned

city or

municipal registrar or

consul general (R.A.

9048, as amended

by R.A. 10172):

•

Clerical or

typographical

errors and

change of first

name or

nickname, the

day and month

in the date of

birth, or sex of a

person where it is

patently clear that

there was a

clerical or

typographical

error or mistake

in the entry

•

Petition must be

accompanied by

earliest school

record or

documents such

as but not limited

to medical

records,

baptismal

certificate, and

other documents

PAGE 6 OF 120

W ithout Judicial

A u th o rity .....

Change of surname

can only be done

through

a

court

proceeding

EXCEPT when the

request for change is

a consequence of a

change

of status,

such as when a

natural

child

is

acknowledged

or

legitimated

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

The remedies available to a person whose name

has been usurped are:

1. Civil (insofar as private persons are

concerned)

a. Injunction

b. Damages (actual and moral)

2. Criminal (when public affairs are

prejudiced)

issued by

religious

authorities, nor

shall any entry

involving change _r

of gender

corrected except

if the petition is

accompanied by

a certification

Q: When is the use of another’s name not

actionable?

issued by an

accredited

government

physician

attesting to the

fact that the

petitioner has

not undergone

sex change or

sex transplant

A: When used as stage, screen, or pen name,

provided:

1. Use of name is in good faith; and

2. By using the name of another, no injury

is caused to that person's right

3. When use is motivated by modesty, a

desire to avoid unnecessary trouble, or

other reason not prohibited by law or

morals

NOT nationality, age,

civil status - needs

court order.

Note: R.A. 9048 does not sanction a change of

first name on the ground of sex reassignment.

Rather than avoiding confusion, changing the first

name to make it compatible with the sex he

transformed himself into through surgery may

only create grave complications in the civil

registry and the public interest. (Silverio vs.

Note: R.A. 9048 applies only to clerical and

typographical errors entries of name and does

not modify the rules mentioned above

•

If the correction is clerical: summary

proceeding

•

If the rectification affects the civil status,

citizenship or nationality of a party

(substantial): adversarial proceeding.

B. MARRIAGE

Republic, G.R. No. 174689, 2007)6

6.

When the request for change is a

consequence of a change of status,

such as when a natural child is

acknowledged or legitimated

Q: What is usurpation of name?

Q: What are the essential requisites of

marriage?

A: Legal capacity of the contracting parties who

must be a male and a female; and Consent freely

given in the presence of the solemnizing officer

{FAMILY CODE, ART. 2).

A: Implies some injury to the interests of the

owner of the name. It consists in the possibility of

confusion of identity between the owner and the

usurper. Its elements are:

1. An actual use of another's name by the

defendant

2. Use is unauthorized

3. Use of another's name is to designate

personality or to identify a person

Q: Will the irregularity in the formal requisites

affect the validity of the marriage?

A: No. An irregularity in the formal requisites (i.e.

authority of solemnizing officer, marriage license,

marriage ceremony) shall not affect the validity of

the marriage.

The party responsible for the irregularity shall,

however,

be

civilly,

criminally,

and

administratively liable (FAMILYCODE, ART. 4).

PAGE 7 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Q: Is the venue for the celebration of marriage

limited to the chambers of the judge or in

open court, in church, or chapel?

A: No. Art. 8 provides that would-be spouses can

make a written request to the solemnizing officer

for a change in venue.

Q: What is the

Celebrationis?

concept

of

Lex

Loci

A: All marriages solemnized outside the

Philippines, in accordance with the laws in force

in the country where they were solemnized, and

valid there, shall also be valid in this country.

EXCEPTIONS: Contracting party under Phil. Law

a.) has no capacity to marry because of age, is

psychologically incapacitated, because of civil

status (bigamous/ polygamous), is against public

policy, incestuous; b.) no consent due to mistake

in identity, c.) non-compliance with Art. 53, and

d.) void because no solemnization of marriage.

particularly on divorce of Y, because the

books presented were not duly authenticated

by the Philippine Consul in Japan as required

by Sections 24 and 25 of the Rule 132. Is the

RTC correct?

A: Yes. Since our courts do not take judicial notice

of foreign laws and judgment, our law on

evidence requires that both the divorce decree

and the national law of the alien must be alleged

and proven like any other fact. This means that

the foreign judgment and its authenticity must be

proven as facts under our rules on evidence,

together with the alien's applicable national law to

show the effect of the judgment on the alien

himself or herself. (Medina v. Koike, G.R. No.

215723, July 27, 2016.)

*Starting May 14, 2019 (Effective date of

the

Apostille

Convention),

Public

documents

executed

in

Apostille­

contracting countries and territories

(except for Austria, Finland, Germany

and Greece) to be used in the Philippines

no longer have to be authenticated bv the

P h ilip p in e E m b a s s y

or

Consulate

General once apostillized.

(FAMILYCODE, ART. 26).

Q: X and Y, both Filipinos, were married. X

filed for divorce from Y abroad and sought the

settlement of their properties in the same

action. Both were granted by the foreign

court. X subsequently married Z. Are the

divorce and the settlement of property valid?

A: No. X ’s subsequent marriage to Z is void for

being bigamous because the divorce decree

obtained abroad between Filipinos is void under

the nationality rule. (Lavadia vs. Heirs of Luna,

G.R. 171914, 2014).'

Hence, any settlement of property between X and

Y, submitted as an incident of a divorce obtained

in a foreign country lacks competent judicial

approval and cannot be enforceable against the

assets of the husband who contracts a

subsequent marriage.

Q: X, a Filipino citizen, married Y, a Japanese

national. Subsequently, pursuant to the laws

of Japan, they were divorced. X filed a petition

for judicial recognition of foreign divorce and

declaration of capacity to remarry. X

presented

several

foreign

documents,

including a duly authenticated Divorce

Certificate and two books on the Civil Code of

Japan for years 2000 and 2009. The RTC ruled

that X fell short of proving the national law,

Q: X was married to Y, a Japanese citizen. X

and Y submitted a “Divorce by Agreement” in

Japan, which was eventually approved. Thus,

X filed a petition for recognition of the divorce

decree before the RTC, which denied X’s

petition, invoking the nationality principle

under Article 26(2) of the FC. The decision

was grounded on the fact that X admittedly

initiated the divorce proceedings and since X

is a Filipino citizen whose national laws do not

allow divorce, then the divorce decree

obtained in Japan is not binding in the

Philippines. Is the RTCTcorrect? ~

A: No. Pursuant to Republic v. Manalo, foreign

divorce decrees obtained to nullify marriages

between a Filipino and an alien citizen may

already be recognized in this jurisdiction,

regardless of who between the spouses initiated

the divorce; provided that the party proves the

divorce as a fact and demonstrates its conformity

to the foreign law allowing it. In this case, X has

yet to prove the fact of her "Divorce by

Agreement" obtained in Japan, in conformity with

prevailing Japanese iaws on divorce. (Morisono

v. Morisono, G.R. No. 226013, July 2, 2018.)

PAGE 8 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Q: There are certain marriages where the

requirement of a marriage license is not

required. What are these marriages?

A:

a.

b.

c.

d.

Art. 27 - where either or both of the

contracting parties are at the point of

death (marriage in articulo mortis)

Art. 28 - where the residence of either

party is so located that there is no means

of transportation to enable such party to

appear personally before the local civil

registrar (marriage in a remote place)

Art. 33 - marriage among Muslims or

among members of the ethnic cultural

communities;

if

solemnized

in

accordance with their customs, rites or

practices.

Art. 34 - marriage of a man and a woman

who have lived together as husband and

wife for at least 5 years and without legal

impediment to marry each other (5-Year

Cohabitation Rule).

Q: When must psychological incapacity

manifest to be a ground for termination of

marriage?

A: Art. 36 provides that psychological incapacity

must appear at the time of the celebration of the

marriage, even if such incapacity becomes

manifest only after its solemnization.

Q: In a case for declaration of nullity of

marriage under Art. 36, the Court denied the

petition on the ground that the expert

opinions on the psychological incapacity of

the wife was solely based on the husband’s

version of the events. Is there a requirement

of personal examination to declare a spouse

as psychologically incapacitated?

A: No. There is no requirement for one to be

declared psychologically incapacitated to be

personally examined by a physician, because

what is important is the presence of evidence that

adequately establishes the party’s psychological

incapacity. Hence, if the totality of evidence

presented is enough to sustain a finding of

psychological incapacity, then actual medical

examination of the person concerned need not be

resorted to. The conclusions reached by the

expert witnesses having been drawn from the

case records and affidavits should not anymore

be disputed after the RTC itself had accepted the

veracity of the factual premises (Kalaw v.

Fernandez, G.R. No. 166357, 2015).

Q: X and Y were married in 1972. Then Y

married Z in 1979. Z filed a declaration of

nullity of marriage against Y on the ground of

bigamy. Meanwhile, Y was able to secure a

judgment declaring the 1972 marriage void

due to the absence of a marriage license. Will

Z’s petition for declaration of nullity of

marriage against Y prosper?

A: No. the requirement of a judicial decree of

nullity

does

not

apply

to

marriages

celebrated before the effectivity of the Family

Code, particularly if the children of the parties

were born while the Civil Code was in force. The

first marriage of Y being void for lack of license,

there was no need for judicial declaration of its

nullity before she could contract the second

marriage with Z. Hence, the second marriage to

Z is valid. Neither can Y be held liable for bigamy.

Moreover, the provisions of the Family Code

cannot be retroactively applied to the present

case, as they would prejudice the vested rights of

Y and the legitimate status of her children under

the Civil Code. (Castillo v. De Leon-Castillo, G.R.

No. 189607, 2016)

For marriages celebrated after the effectivity of

the Family Code, a judicial declaration of absolute

nullity of marriage is expressly required where the

nullity of a previous marriage is invoked for

purposes of contracting a second marriage.

Q: A declaration of nullity of marriage on the

ground of psychological incapacity was filed

by the husband citing his incapacity to

perform marital obligation and that he did not

love his wife and was unprepared to get

married at the time of marriage. Is the

husband psychologically incapacitated?

A: No, Psychological incapacity under Article 36

of the Family Code, must be limited to cases

where there is a downright incapacity or inability

to assume and fulfill the basic marital obligations,

not a mere refusal, neglect or difficulty, much

less, ill will, on the part of the errant spouse. X’s

testimony that he was able to comply with his

marital obligations negates the existence of a

grave and serious psychological incapacity on his

PAGE 9 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

part. X fulfilled his duty to support and take care

of his family, as he categorically stated that he

loves their children and that he was a good

provider to them. (Republic v. Romero, G.R. No.

209180, 2016)

Q: X and Y got married but eventually parted

ways because of violent fights and jealous

fits. They became even more estranged when

Y became focused on his career and

supported his parents and siblings. Y filed a

petition for declaration of nullity of marriage

on the ground of psychological incapacity to

comply with his essential marital obligations.

Y argued that he married X not out of love but

out of the desire to please the latter's parents

who were kind and accommodating to him. He

also presented a Psychological Evaluation

Report that he was suffering Obsessive

Compulsive Personality Disorder (OCPD),

which made him obsessed with any endeavor

he chooses. Should the petition be granted?

A: No. To warrant the declaration of nullity of

marriage, the psychological incapacity must: (a)

be grave or serious such that the party would be

incapable of carrying out the ordinary duties

required in a marriage; (b) have juridical

antecedence, i.e., it must be rooted in the history

of the party antedating the marriage, although the

overt manifestations may emerge only after the

marriage; and (c) be incurable, or even if it were

otherwise, the cure would be beyond the means

of the party involved. In this case, the medical

report did not establish that Y's incapacity existed

long before he entered into marriage. In such

case, any doubt should be resolved in favor of the

validity of marriage. Marriages entered into for

other purposes, limited or otherwise, such as

convenience, companionship, money, status, and

title, provided thatthey comply with all the legal

requisites, are equally valid. Love, though the

ideal consideration in a marriage contract, is not

the only valid cause for marriage. (Republic v.

Romero II, G. R. No. 209180, February 24, 2016.)

Psychological incapacity under Art. 36 must be

more than just a difficulty, refusal or neglect in the

performance of marital obligations; it is not

enough that a party prove that the other failed to

meet the responsibility and duty of a married

person. There must be proof of a natal or

supervening disabling factor in the person which

must be linked with the manifestations of the

psychological incapacity. (Del Rosario v. D el

Rosario, G.R No. 222541, February 15, 2017)

The gravity, juridical antecedence and incurability

of the psychological incapacity must be proven.

Here, tne-report failed to show that X ’s personality

disorder existed prior the marriage and failed to

explain the juridical antecedence or its

incurability.

A clear

and

understandable

causation between the party’s condition and the

party’s inability to perform the essential marital

Covenants must be shown. (Republic v. Tecag,

G.R No. 229272, November Ip, 2018)

Q: X and Y are husband and wife. X filed a

verified complaint for declaration of nullity of

marriage alleging that Y was psychologically

incapacitated to comply with her essential

marital obligations. X testified, among others,

that after he decidedto join and train with the

army, Y left their conjugal home and sold their

house without X’s consent. Y entered into two

separate relationships with other men. From

the time Y abandoned X, X was left to take

care of their two daughters and he exerted

earnest efforts to save their marriage which,

however, proved futile because of Y’s

psychological incapacity that appeared to be

incurable. Should the marriage be nullified?

A: No. Psychological incapacity, as a ground to

nullify a marriage under Article 36 of the FC,

should refer to no less than a mental — not

merely physical — incapacity that causes a party

to be truly incognitive of the basic marital

covenants thdt concomitantly must be assumed

and discharged by the parties to the marriage

which, as so expressed in Article 68 of the FC,

among others, include their mutual obligations to

live together, observe love, respect and fidelity

and render help and support. It is confined in the

most serious cases of personality disorders

clearly demonstrative of an utter insensitivity or

inability to give meaning and significance to their

marriage. Psychological incapacity must not

merely due to a person’s youth, immaturity or

sexual promiscuity, in this case, the SC found

insufficient factual or legal basis to conclude that

Y ’s emotional immaturity, irresponsibility or even

promiscuity, can be equated with psychological

incapacity. (Republic v. De Gracia, G.R. No.

171557, Feb. 12, 2014).

Q: What are the essential requisites for the

declaration of presumptive death under Art.

41?

PAGE 10 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

A: (MR-BF)

1. That the absent spouse has been

Missing for four consecutive years, or

two consecutive

years

if

the

disappearance occurred where there is

danger

of

death

under

the

circumstances laid down in Article 391 of

the Civil Code;

2. That the present spouse wishes to

Remarry;

3. That the present spouse has a wellfounded Belief that the absentee is dead;

and

4. That the present spouse Files a

summary proceeding for the declaration

of presumptive death of the absentee.

the resource persons named. Therefore, X ’s

efforts failed to. satisfy the degree of diligence

required to create “a well-founded belief of his

death. (Republic v. Tampus, G.R. No. 214243,

March 16, 2016.)

Q: What are the prescriptive periods for

annulment?

A:

a.

(Republic vs Sarehogon, G.R. No.

199194, 2016 (citing Republic v. Cantor,

G.R. No. 184621, 2013)).

b.

Q: X and Y were married. Y, a member of the

AFP, left X and went to Sulu where he was

assigned. Since then, X heard no news from

Y. After 33 years without communication and

trying everything to locate him such as asking

his parents, relatives, and neighbors about

his whereabouts, and with the firm belief that

he is already dead, X filed a petition to declare

him presumptively dead for purposes of

remarriage. RTC and CA granted the petition

ruling that X exerted efforts to find Y. The

lapse of 33 years coupled with the fact that Y

was sent on a combat mission to Jolo, Sulu

gave rise to X’s well-founded belief that Y was

dead. Is the CA correct?

A: No. There are 4 requisites for the absent

spouse to be declared presumptively dead under

Art. 41; 1) absent spouse missing for 4

consecutive years or 2 consecutive years if the

disappearance occurred where there is danger of

death under circumstances in Art. 391 of CC, 2)

that the present spouse wishes to remarry, 3) that

present spouse has well-founded belief that

absentee is dead, and 4) present spouse filed a

summary proceeding for the declaration of

presumptive death of absentee. Under the third

requisite, the present spouse has to prove that

his/her belief was the result of diligent and

reasonable efforts to locate the absent spouse.

X’s could have called AFP headquarters to

request information about her husband, but failed

to do so. Her testimony as to her efforts were not

corroborated by any additional witness nor were

c.

d.

e.

For no parental consent, by the parent,

guardian, or the person having legal

charge of the contracting party before the

latter reaches 21; for the contracting

party who is below 21, within 5 years after

attaining the age of 21, unless ratified by

cohabitation.

For unsound mind, the sane spouse with

no knowledge of insanity or guardian of

insane spouse at any time before death

of either party or by the insane spouse,

during lucid interval or after gaining

sanity, unless ratified by cohabitation.

Within 5 years after the discovery of

FRAUD, unless ratified by cohabitation.

Within 5 years from the time the vice

disappeared or ceased if the ground is

VITIATION OF CONSENT (i.e. force,

intimidation and undue influence), unless

ratified by cohabitation.

Within 5 years after the celebration of

marriage if the ground is IMPOTENCE or

STD which is found to be serious and

appears incurable ( FAMILY CODE, ART.

47).

C. LEGAL SEPARATION

Q: When does an action for legal separation

prescribe?

A: After five years from the time of the occurrence

of the cause (FAMILY CODE, ART. 57). The time

of discovery of the ground for legal separation is

not material in the counting of the prescriptive

period ( STA. MARIA, Persons and Family

Relations Law 366, 2010).

PAGE 11 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

D. RIGHTS AND OBLIGATIONS BETWEEN

HUSBAND AND WIFE

Q: Who has the power to fix the family

domicile?

A: Both the husband and the wife. In case of

disagreement, however, the court shall decide.

(FAMILY CODE, ART. 69).

E.

PROPERTY RELATIONS BETWEEN

HUSBAND AND WIFE

Q: What governs property relations between

spouses?

A: Property relations between husband and wife

are governed in the following order: By the will of

the spouses in the marriage settlement: the

Family Code and Local Customs. (FAMILY

CODE, ART. 74) In the absence of a marriage

settlement, or when the regime agreed upon is

void, the system of absolute community of

property shall govern. (FAMILY CODE, ART. 75)

NOTE: Prior to the effectivity of the Family Code

on August 3, 1988, the system of conjugal

partnership of gains governed the property

relations of husband and wife.

Q: What are the requisites for

enforceability of marriage settlements?

the

A: (WSB-TC-CR)

1. In Writing

2. Signed by the parties

3. Executed Before the celebration of

marriage

4. To fix the Terms and conditions of their

property relations

5. If the party executing the settlement is

under Civil interdiction or any other

disability, the guardian appointed by the

court must be made a party to the

settlement

6. Registration (only to bind 3rd persons)

(FAMILY CODE, ART. 77).

Q: In gratitude, the groom’s parents made a

donation of a property in writing to the bride’s

parents shortly before their children’s

wedding. The donation was accepted. What is

the nature of the donation?

A: It is an ordinary donation since it was not given

to the bride or groom. Donations by reason of

marriage or propter nuptias are those made

before its celebration, in consideration of the

same, and in favor of one or both of the future

spouses (FAMILYCODE, ART. 82).

•

Q: Lots A and B are registered in the Torrens

system under the name of Spouses X (wife)

and Y (husband). X sold the lots to Spouses C

and D. X showed them an SPA executed by Y

authorizing her to sell the lots. Even after the

execution of a deed of absolute sale, X did not

turn over the owner’s duplicate copy of lot A

to C and D. The buyers subsequently

discovered that the owner’s duplicate copy

was actually in the possession of the attorney

brother of Y who was given authority by Y to

sell lots A and B. X asked a fake notary public

to notarize the SPA with the forged signature

of Y. Attorney Brother wants to get back the

properties from C and D saying that Art. 124

of the Family Code (FC) should apply. C and

D state that they are buyers in good faith. Can

Attv. Brother still get the lots?

A: Yes, Atty. Brother can still get the lots. Article

124 of the FC states that if case a spouse is

incapacitated or otherwise unable to participate in

the administration of the conjugal properties, the

other spouse may assume sole powers of

administration. These powers do not include

disposition or encumbrance without authority of

the court or the written consent of the other

spouse. In this case, no written authority was

obtained from Y.

In order to be considered as buyers in good faith,

there following diligence must be shown: (a) the

diligence in verifying the validity of the title

covering the property; and (b) the diligence in

inquiring into the authority of the transacting

spouse to sell conjugal property in behalf of the

other spouse. In this case, C and D merely relied

on the SPA given by X and did not do further

questioning despite knowing that the lots were

conjugal property. (Spouses Aggabao v. Dionlsio

PAGE 12 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Parulan and Ma. Elena Parulan,

165803, 2010).

G.R. No.

Q: A and B are husband and wife. As such

they bought a house and cohabited therein,

but the title is issued only in the name of the

husband A and the Torrens title indicated that

he was single. The relationship of the spouses

became strained and B filed a case for

concubinage and legal separation against A.

B later learned that her husband had the

intention of selling the property to C, their

neighbor, so B then advised C of the

existence of the case and cautioned C against

buying the property until the cases are closed

and terminated. Nonetheless, A still sold the

property to C, without the consent of B. B

contends that the sale is void as it was

without her consent. C argues that he is an

innocent-purchaser for value and had the

right to rely on the Torrens title. Is C correct?

A: No, the sale is void. One spouse cannot sell

community property without the written consent of

the other spouse or the authority of the court. The

purchaser was not in good faith. While the law

does not require a person dealing with registered

land to inquire further than what the Torrens Title

on its face indicates (Nobleza v. Nuega G.R. No.

193038, March 11, 2015), this rule shall not apply

when the party has actual knowledge of facts and

circumstances that would impel a reasonably

cautious person to make inquiry into the status of

the title of the property, or when the purchaser

has knowledge of a defect or the lack of title in his

vendor. Malabanan v. Malabanan (G.R. No.

187225, March 6, 2019)

Q: D Corp. obtained a loan from C Corp. Mr. X

served as surety for the loan. Since D. Corp.

was unable to pay, Mr. X was ordered by the

court to pay and as such, three of the conjugal

properties of Mr. X were auctioned. It is being

argued that the said properties should not be

levied because the loan did not redound to the

benefit of the family. Is the contention

correct?

A: Yes. If the money or services are given to

another person or entity, and the husband acted

only as a surety or guarantor, that contract

cannot, by itself, alone be categorized as falling

within the context of obligations for the benefit of

the conjugal partnership. The contract of loan or

services is clearly for the benefit of the principal

debtor and not for the surety or his family. No

presumption can be inferred that, when a

husband enters into a contract of surety or

accommodation agreement, it is for the benefit of

the

conjugal

partnership. Proof must be

presented to establish benefit redounding to the

conjugal partnership (Ayala Investment v. CA,

G.R. No. 118305, 1998, reiterated in Security

Bank v. Mar Tierra Corp. G.R. No. 143382,

2006)).

Q: What constitutes Conjugal Partnership of

Gains?

A: (FOLCHIC)

1. Fruits of conjugal property due or

received during the marriage and net

fruits of separate property

2. Those acquired through Occupation

3. Livestock in excess of what was brought

to the marriage

4. Those acquired during the marriage with

Conjugal funds

5. Share in Hidden treasure

6. Those obtained from labor, Industry,

work or profession of either or both

spouse

7. Those acquired by Chance (FAMILY

CODE, ART. 117).

Q: What are exclusive properties of spouses

in a Conjugal Partnership of Gains?

A: (OGRE)

1. That which is brought to the marriage as

his or her Own;

2. That which each acquires during the

marriage by Gratuitous title;

3. That which is acquired by right of

Redemption, by barter or by exchange

with property belonging to only one of the

spouses; and

4. That which is purchased with Exclusive

money or wife of the husband (FAMILY

CODE, ART. 109).

Q: Solomon sold his coconut plantation to

Aragon, Inc. for P100 million, payable in

installments of P10 million per month with 6%

interest per annum. Solomon married Lorna

after 5 months and they chose conjugal

partnership of gains to govern their property

relations. When they married, Aragon had an

PAGE 13 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

unpaid balance of P50 million plus interest in

Solomon’s favor. To whom will Aragon’s

monthly payments go after the marriage?

Q: Can an extrajudicial dissolution of the

conjugai partnership without judicial approval

be valid?

A: The principal shall go to Solomon while the

interests go to the conjugal partnership.

A: An extrajudicial dissolution of the conjugai

partnership without judicial approval is void. A

notary

public

should

not facilitate

the

disintegration of a marriage and the family. In so

doing a notary public may be held accountable

administratively (Rodolfo Espinoso v. Juliet

The fruits, natural, industrial, or civil, due or

received during the marriage from the common

property, as well as the net fruits from the

exclusive property of each spouse are included in

the coniugal partnership properties (FAMILY

CODE, ART. 117(3)).

Omana, A,C. 9081, 2011).

Q: What constitutes “net profits” for purposes

of the dissolution of property regime?

Q: What is the rule on the ownership of

improvements made on the separate property

at the expense of the conjugal partnership?

A: When the cost of the improvement made by

the conjugal partnership and any resulting

increase in value are

1. MORE than the value of the property AT THE

TIME OF IMPROVEMENT - entire property of

one of the spouses shall belong to the

coniugal partnership

2, LESS than the value of property - said

property shall be retained in ownership by the

owner-spouse

in both instances: subject to reimbursement of

the cost of the improvement. (FAMILY CODE,

ART. 120).

Q: When may a spouse assume sole powers

of administration?

A: if one spouse is incapacitated or otherwise

unable to participate in the administration of the

conjugal properties. Also, If a spouse without just

cause abandons the other or fails to comply with

his or her obligation to the family (FAMILY CODE,

ART. 128).

These powers do not include disposition or

encumbrance without authority of the court or the

written consent of the other spouse.

NOTE: In the absence of such authority or

consent, the disposition or encumbrance shall be

void, but may be perfected as a binding contract

upon the acceptance by the other spouse or

authorization by the court before the offer is

withdrawn. (FAMILY CODE, ART. 124).

A: For an absolute community regime, the net

profits shall be the increase in value between the

market value of the community property at the

time of the celebration of the marriage and the

market value at the time of its dissolution. For a

conjugal partnership o f gains regime, the net

profits of the conjugal partnership of gains are ail

the fruits of the separate properties of the

spouses and the products of their labor and

industry. In this case, since the petitioner is the

guilty party in the legal separation, his share from

the net profits is forfeited in favor of the common

children. In both regimes (assuming that it was

ACP), petitioner, as the guilty spouse, is not

entitled to any property at all. The husband and

the wife did not have any separate properties.

Therefore, there is no separate property which

may be accounted for in the guilty party’s favor

(Quiao v. Quiao G.R. No. 176556, 2012).

Q: When A and 8 married, they chose

conjugal partnership of gains to govern their

property relations.

After 3 years, B

succeeded in getting her marriage to A

declared null and void on ground of the

latter’s psychological incapacity.

What

liquidation procedure will they follow in

disposing of their assets?

A: The liquidation of a co-ownership applies since

the declaration of nullity of the marriage brought

their property relation under the chapter on

property regimes without marriage. When a man

and a woman who are capacitated to marry each

other, live exclusively with each other as husband

and wife without the benefit of marriage or under

a void marriage, their wages and salaries shall be

owned by them in equal shares and the property

acquired by both of them through their work or

PAGE 14 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

industry shall be governed by the rules on coownership (FAMILY CODE, A RT.147).

Q: In the property relations based on Art. 148,

is there a presumption that the contributions

to the property between the man and woman

are equal?

A: No. It is necessary for each of the partners to

prove his or her actual contribution to the

acquisition of property in order to be able to lay

claim to any portion of it. Presumptions of coownership and equal contribution do not apply

(Ventura v. Spouses Paulino, G.R. No. 202932,

2013).

Q: X, was the owner of a parcel of land which

was sold at a public auction. A redeemed the

same then filed for the issuance of a new title

in its name, which the RTC granted. The

original title states "X,

married to Z."

Subsequently, Y, claiming to be the legitimate

son of X, filed a Petition for Relief from

Judgment, claiming that A fraudulently failed

to implead him and Z, his mother. He

contended that Z was an indispensable party,

being the owner of half of the subject

property, which Y claimed to be conjugal in

nature. However, he did not establish that the

subject property was acquired during the

marriage of his parents. Is Y correct?

A: No. Article 160 of the New Civil Code provides

that all property of the marriage is presumed to

belong to the conjugal partnership, unless it is

proved that it pertains exclusively to the husband

or to the wife. However, the presumption refers

only to the property acquired during the marriage

and does not operate when there is no showing

as to when the property alleged to be conjugal

was acquired. The party who asserts this

presumption must first prove the said time

element. In this case, the records are bereft of

any evidence of the actual date of acquisition of

the subject property; therefore, it is considered as

X ’s exclusive property. ( Onstott v. Upper Tagpos

Neighborhood Association, Inc.,

221047, September 14, 2016.)

G.R.

No.

Q: X, a Dutch National, and Y, a Filipina, are

husband and wife. The RTC declared the

nullity of their marriage on the basis of

psychological incapacity. Subsequently, X

filed a Petition for Dissolution of Conjugal

Partnership and prayed for the distribution of

several properties claimed to be acquired

during the subsistence of their marriage. In

the trial, X admitted that he is aware of the

constitutional prohibition against foreign

ownership of Philippine lands and even

asseverated

that,

because

of

such

prohibition, he and Y registered the subject

properties in the name of Y. However, X

claimed that he had a right to be reimbursed

on the basis of equity. Is X correct?

A: No. A similar case, In Re: Petition for

Separation o f Property-Elena Buenaventura

Muller, denied a claim for reimbursement of the

value of purchased parcels of Philippine land

instituted by a foreigner against his former Filipina

spouse. The foreigner spouse cannot claim

reimbursement on the ground of equity where it is

clear that he willingly and knowingly bought the

property despite the prohibition against foreign

ownership of Philippine land enshrined under

Sec. 7, Art. XII of the 1987 Philippine Constitution.

Clearly, X ’s actuations showed his palpable intent

to skirt the constitutional prohibition. (Beumer v.

Amores, G.R. No. 195670, Dec. 3, 2012).

F. FAMILY

1. The family as an institution

Q: X is a lessee of parcels of land which he co­

owns with his sister Y, nephews and nieces.

In 2003, Y offered to sell to X the said lands to

which X agreed. However, in 2010, Y decided

to cancel their agreement and informed X of

her intent to convert X’s partial payments as

rentals instead. X disapproved and claimed

that without his consent, Y and her children

sold all their shares to Z. The RTC dismissed

X’s complaint for failure to comply with Art.

151 of the Family Code that no earnest efforts

were made before filing a suit. The CA

affirmed the decision. Is Art. 151 applicable in

the instant case?

A: No. The Court ruled that Art. 151 of the Family

Code is inapplicable because the instant case

does not exclusively involve members of the

same family. Art. 151 must be construed strictly,

it being an exception to the general rule. Here, it

is undisputed that X and Y are siblings, and the

children of Y are the nieces and nephews of X. It

then follows that the children of Y are considered

"strangers" to X insofar as Article 151 of the

PAGE 15 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Family Code is concerned. (Moreno v. Kahn, G.R

No. 217744, July 30, 2018)

Q: Janice and Jennifer are sisters. Janice

sued Jennifer and Laura, Jennifer’s business

partner for recovery of property with

damages. The complaint did not allege that

Janice exerted efforts to come to a

compromise with the defendants and such

efforts failed. The judge dismissed the

complaint outright for failure to comply with a

condition precedent. Is the dismissal in

order?

A: No, since Laura is a stranger to the sisters,

Janice has no moral obligation to settle with her.

Art. 151 of the Family Code provides that no suit

between members of the same family shall

prosper unless it should appear from the verified

complaint or petition that earnest efforts toward a

compromise have been made, but that the same

have failed. If it is shown that no such efforts were

in fact made, the same case must be dismissed.

Under Art. 150, family relations include those: (a)

Between husband and wife; (b) Between parents

and children; (c) Among brothers and sisters,

whether of the full or half-blood. ( FAMILY CODE,

ART. 150).

2. The Family Home

Q: Until when is a family home exempt from

execution?

A: So long as any of its beneficiaries actually

resides therein (FAMILY CODE, ART. 153). The

beneficiaries are: the husband and wife, or an

unmarried person who is the head of a family; and

their parents, ascendants, descendants, brothers

and sisters, whether the relationship be legitimate

or illegitimate, who are living in the family home

and who depend upon the head of the family for

legal support (FAMILY CODE, ART. 154).

waived or be barred by laches by failure to set up

and prove the status of the property as a family

home at the time of levy. (De Mesav. Acero, G.R.

No. 185064, 2012)

Q: What are the rules regarding subsequent

improvements of family home?

A: Any subsequent improvement of the family

home by the persons constituting it, its owners, or

any of its beneficiaries will still be exempt from

execution, forced sale or attachment provided the

following conditions obtain:

1. the actual value of the property at the

time of its constitution is below the

statutory limit (Php 300,000 in urban

areas and Php 200,000 in rural areas

under FAMILY CODE. ART. 157); and

2. the improvement or does not result in an

increase in its value exceeding the

statutory limit.

Otherwise, the family home can be the subject of

a forced sale, and any amount above the

statutory limit is applicable to the obligations

under Articles 155 and 160. To warrant the

execution sale of a family home under Article 160,

the following facts should be established:

1. there was an increase in its actual value;

2. the increase resulted from voluntary

improvements on the property introduced

by the persons constituting the family

home, its owners or any of its

beneficiaries; and

3. the increased actual value exceeded the

maximum allowable under Article 157.

(Eulogio v. Bell, G.R. No. 186322, 2015)

Q: In a forced sale of a family home, when

should the exemption from execution of the

family home be invoked?

Q: Spouses A and B leased a piece of land

belonging to B's parents for 25 years. The

spouses built their house on it worth

P300,000,00, Subsequently, in a case that C

filed against A and B, the court found the

latter liable to C for P200,000.00. When the

sheriff was attaching their house for the

satisfaction of the judgment, A and B claimed

that it was exempt from execution, being a

family home. Is this claim correct?

A: The right to exemption from forced sale is a

personal privilege granted to the judgment debtor

which must be asserted before the public auction.

Failure to do so would estop the party from later

claiming on the exemption. It is a right that can be

A: No, since the land does not belong to A and B,

it cannot qualify as a family home. The Family

Code provides that the family home must be part

of the properties of the absolute community or the

conjugal partnership, or of the exclusive

PAGE 16 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

properties of either spouse with the latter’s

consent. It may also be constituted by an

unmarried head of a family on his or her own

property (FAMILY CODE, ART. 156). Thus, the

home must be owned and not merely leased.

By the very definition of the law that the family

home is the dwelling house where a person and

his family resides and the land on which it is

situated (FAMILY CODE, ART. 152), it is

understood that the house should be constructed

on a land not belonging to another. ( Taneo v. CA,

G.R. No. 108532, 1999).

G. PATERNITY AND FILIATION

c.

If the child was born after the death of the

husband. (FAMILYCODE, A R T . 171)

Q: Is a birth certificate identifying a person as

the father competent evidence to prove

paternity, even though said person denies

having something to do with the entries in

said birth certificate?

A: No. A certificate of live birth purportedly

identifying the putative father is not competent

evidence of paternity when there is no showing

that the putative father had a hand in the

preparation of said certificate. (Perla v. Baring,

G.R. No. 172471, 2012)

Q: Fidel married Gloria. Before the marriage,

Gloria confessed to Fidel that she was two

months pregnant with another man who had

left the country for good. When the child was

born, Fidel could not accept the child. What is

the status of the child?

A: Legitimate, because the child was born within

a valid marriage. Article 164 of the Family Code

provides that children conceived or born during

the marriage of the parents are legitimate

(FAMILYCODE, ART. 164).

Q: Are children conceived as a result of

artificial insemination considered legitimate?

Q: What are the periods for impugning the

legitimacy of a child?

A: If the husband (or his heirs, in proper cases)

resides in the SAME city or municipality -1 year

If the husband (or his heirs) does not reside in the

city / municipality where the child’s birth took

place or recorded but his residence is IN THE

PHILIPPINES - 2 years.

If the child’s birth took place or was recorded in

the Philippines while the husband has his

residence abroad, or vice-versa - 3 years

(FAMILY CODE, A R T 170).

A: Yes, provided both husband and wife

authorized and ratified such insemination in a

written instrument executed and signed by them

before the birth of the child (FAMILYCODE, ART.

Note: The period shall be counted from the

knowledge of the child’s birth OR its recording in

the civil register (Id.).

164).

HOWEVER, if the child’s birth was concealed

from or was unknown to the husband or his heirs,

the period shall be counted from the discovery or

knowledge of the birth of the child or of the act of

registration of said birth, whichever is earlier

Q: A left B, his wife, in the Philippines to work

in Egypt but died in that country after a year’s

continuous stay. Two months after A ’s death,

B gave birth to a child, claiming it is A ’s child.

Who can assail the legitimacy of the child?

(Id.).

A: A’s other heirs apart from B. Under Art. 171 of

the Family Code, the heirs of the husband may

impugn the filiation of the child within the period

prescribed in Art. 170, only in the following cases:

a. If the husband should die before the

expiration of the period fixed for bringing

this action;

b. If he should die after the filing of the

complaint without

having

desisted

therefrom; or

PAGE 17 OF 120

ATENEO CENTRAL

CIVIL LAW

BAR OPERATIONS 2019

Q: What are the rules regarding the

requirement of affixing the signature of the

acknowledging

parent

in any

private

handwritten instrument wherein an admission

of legitimate or illegitimate child is made?

under the Family Code his action cannot

prosper because he did not bring the action

for recognition during the lifetime of his

putative father. If you were the judge in this*

case, how would you rule?

A:

A: The action for recognition as an illegitimate

child based on open continuous possession of

the status of an illegitimate child may be brought

during the lifetime of the alleged parent. Since the

putative father has already died, the action for

recognition based on such ground, as indicated

by support and regular spending of the time with

the child and mother, cannot prosper. (Guy v.

1.

2.

Where the private handwritten instrument

is the lone piece of evidence submitted to

prove filiation, there should be strict

compliance with the requirement that the

same

must

be

signed

by

the

acknowledging parent.

Where the private handwritten instrument

is accompanied by other relevant and

competent evidence, it suffices that the

claim of filiation therein be shown to have

been made and handwritten by the

acknowledging parent as it is merely

corroborative of such other evidence.

(Aguilar vs. Siasat, G.R. 200169, 2015)

Q: Is a SSS E-1 Form, a public document,

subscribed and made under oath by the

putative father during his employment which

bears signature and thumb marks and

indicates that the child is his son and

dependent, sufficient to establish legitimate

filiation by a child with his or her father?

A: Yes. SSS Form E-1 satisfies the requirement

for proof of filiation under Article 172 of the Family

Code. Filiation may be proved by an admission of

legitimate filiation in a public document or a

private handwritten instrument and signed by the

parent concerned, and such due recognition in

any authentic writing is, in itself, a consummated

act of acknowledgment of the child, and no further

court action is required. (Rodolfo S. Aguilar v.

Edna G. Siasat, G.R. 200169, 2015)

Q: Julie had a relationship with a married man

who had legitimate children. A son was born

out of that illicit relationship in 1981. Although

the putative father did not recognize the child

in his certificate of birth, he nevertheless

provided the child with all the support he

needed and spent time regularly with the child

and his mother. When the man died in 2000,

the child was already 18 years old so he filed

the petition to be recognized as an Illegitimate

child of the putative father and sought to be

given his share in his putative fathers estate.

The legitimate family opposed, saying, that

Court o f Appeals, G.R. No. 163707, September

16,2006)

Q: The document executed by the putative

father evidencing his voluntary recognition of

T and E as his illegitimate children is being

questioned because it is merely affixed by the

putative father’s thumbprint. Is the said

document valid as an admission of legitimate

filiation in a public document or a private

handwritten instrument and signed by the

parent concerned?

A: Yes. A thumbmark has been repeatedly

considered as a valid mode of signature, even if

putative father is still able to write. (Gloria Zoleta-

San Agustin v. Ernesto Sales, G.R. No. 189289,

August 31, 2016).

Q: What are the rights of illegitimate children?

A: Illegitimate children shall use the surname and

shall be under the parental authority of their

mother, and shall be entitled to support in

conformity with this Code. The legitime of each

illegitimate child shall consist of one-half of the

legitime of a legitimate child (FAMILY CODE,

ART. 176).

NOTE: R.A. 9255, which took effect March 19,

2004, is an Act allowing an illegitimate child to use

the surname of the father.

Q: X and Y, although not suffering from any

impediment, cohabited as husband and wife

without the benefit of marriage. Following the

birth of their child, the couple got married. A

year after, however, the court annulled the

marriage and issued a decree of annulment.

What is the present status of the child?

PAGE 18 OF 120

ATENEO CENTRAL

CIVIL-LAW

BAR OPERATIONS 2019

A: Legitimated. The Family Code provides that

only children conceived and born outside of

wedlock of parents who, at the time of the

conception of the former, were not disqualified by

any impediment to marry each other may be

legitimated (FAMILY CODE, ART. 177).

Legitimation shall take place by a subsequent

valid marriage between parents. The annulment

of a voidable marriage shall not affect the

legitimation (FAMILY CODE, ART. 178).

Q: The testator executed a will following the

formalities required by the law on succession

without designating any heir. The only

testamentary disposition in the will is the

recognition of the testator's illegitimate child

with a popular actress. Is the will valid?

A: Yes, the recognition of an illegitimate heir can

be made in a will. The due recognition of an

illegitimate child in a record of birth, a will, a

statement before a court of record, or in any

authentic writing is, in itself, a consummated act