Chapter 2. Dynamic panel data models

School of Economics and Management - University of Geneva

Christophe Hurlin, Université of Orléans

University of Orléans

April 2018

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

1 / 209

1. Introduction

De…nition (Dynamic panel data model)

We now consider a dynamic panel data model, in the sense that it contains

(at least) one lagged dependent variables. For simplicity, let us consider

yit = γyi ,t

1

0

+ β xit + αi + εit

for i = 1, .., n and t = 1, .., T . αi and λt are the (unobserved) individual

and time-speci…c e¤ects, and εit the error (idiosyncratic) term with

E(εit ) = 0, and E(εit εjs ) = σ2ε if j = i and t = s, and E(εit εjs ) = 0

otherwise.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

2 / 209

1. Introduction

Remark

In a dynamic panel model, the choice between a …xed-e¤ects formulation

and a random-e¤ects formulation has implications for estimation that are

of a di¤erent nature than those associated with the static model.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

3 / 209

1. Introduction

Dynamic panel issues

1

If lagged dependent variables appear as explanatory variables, strict

exogeneity of the regressors no longer holds. The LSDV is no longer

consistent when n tends to in…nity and T is …xed.

2

The initial values of a dynamic process raise another problem. It

turns out that with a random-e¤ects formulation, the interpretation

of a model depends on the assumption of initial observation.

3

The consistency property of the MLE and the GLS estimator also

depends on the way in which T and n tend to in…nity.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

4 / 209

Introduction

The outline of this chapter is the following:

Section 1: Introduction

Section 2: Dynamic panel bias

Section 3: The IV (Instrumental Variable) approach

Subsection 3.1: Reminder on IV and 2SLS

Subsection 3.2: Anderson and Hsiao (1982) approach

Section 4: The GMM (Generalized Method of Moment) approach

Subsection 4.1: General presentation of GMM

Subsection 4.2: Application to dynamic panel data models

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

5 / 209

Section 2

The Dynamic Panel Bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

6 / 209

2. The dynamic panel bias

Objectives

1

Introduce the AR(1) panel data model.

2

Derive the semi-asymptotic bias of the LSDV estimator.

3

Understand the sources of the dynamic panel bias or Nickell’s bias.

4

Evaluate the magnitude of this bias in a simple AR(1) model.

5

Asses this bias by Monte Carlo simulations.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

7 / 209

2. The dynamic panel bias

Dynamic panel bias

1

The LSDV estimator is consistent for the static model whether the

e¤ects are …xed or random.

2

On the contrary, the LSDV is inconsistent for a dynamic panel data

model with individual e¤ects, whether the e¤ects are …xed or random.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

8 / 209

2. The dynamic panel bias

De…nition (Nickell’s bias)

The biais of the LSDV estimator in a dynamic model is generaly known as

dynamic panel bias or Nickell’s bias (1981).

Nickell, S. (1981). Biases in Dynamic Models with Fixed E¤ects,

Econometrica, 49, 1399–1416.

Anderson, T.W., and C. Hsiao (1982). Formulation and Estimation of

Dynamic Models Using Panel Data, Journal of Econometrics, 18, 47–82.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

9 / 209

2. The dynamic panel bias

De…nition (AR(1) panel data model)

Consider the simple AR(1) model

yit = γyi ,t

1

+ αi + εit

for i = 1, .., n and t = 1, .., T . For simplicity, let us assume that

αi = α + αi

to avoid imposing the restriction that ∑ni=1 αi = 0 or E (αi ) = 0 in the

case of random individual e¤ects.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

10 / 209

2. The dynamic panel bias

Assumptions

1

The autoregressive parameter γ satis…es

jγj < 1

2

3

The initial condition yi 0 is observable.

The error term satis…es with E (εit ) = 0, and E (εit εjs ) = σ2ε if j = i

and t = s, and E (εit εjs ) = 0 otherwise.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

11 / 209

2. The dynamic panel bias

Dynamic panel bias

In this AR(1) panel data model, we will show that

b LSDV 6= γ

plim γ

n !∞

dynamic panel bias

b LSDV = γ

plim γ

n,T !∞

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

12 / 209

2. The dynamic panel bias

The LSDV estimator is de…ned by (cf. chapter 1)

b

αi = y i

n

b LSDV

γ

=

b LSDV y i ,

γ

T

∑ ∑ (yi ,t

1

1

1)

y i,

2

i =1 t =1

n

!

1

T

∑ ∑ (yi ,t

y i,

1

1 ) (yit

yi )

i =1 t =1

xi =

1

T

T

∑ xit

t =1

C. Hurlin (University of Orléans)

yi =

1

T

T

∑ yit

y i,

t =1

Advanced Econometrics II

1

=

1

T

!

T

∑ yi ,t

1

t =1

April 2018

13 / 209

2. The dynamic panel bias

De…nition (bias)

The bias of the LSDV estimator is de…ned by:

n

b LSDV

γ

γ =

T

∑ ∑ (yi ,t

1

y i,

i =1 t =1

n

1

T

∑ ∑ (yi ,t

1

i =1 t =1

C. Hurlin (University of Orléans)

1)

2

!

Advanced Econometrics II

y i,

1 ) ( εit

εi )

!

April 2018

14 / 209

2. The dynamic panel bias

The bias of the LSDV estimator can be rewritten as:

n

T

∑ ∑ (yi ,t

b LSDV

γ

γ=

C. Hurlin (University of Orléans)

i =1 t =1

n

1

y i,

1 ) ( εit

1

y i,

T

∑ ∑ (yi ,t

i =1 t =1

Advanced Econometrics II

1)

εi ) / (nT )

2

/ (nT )

April 2018

15 / 209

2. The dynamic panel bias

Let us consider the numerator. Because εit are (1) uncorrelated with αi

and (2) are independently and identically distributed, we have

plim

n !∞

=

plim

n !∞

|

1

nT

1

nT

n

T

∑ ∑ (yi ,t

∑ ∑ yi ,t

n !∞

|

C. Hurlin (University of Orléans)

1 ) ( εit

t =1 i =1

{z

1

nT

T

n

∑ ∑ y i,

t =1 i =1

{z

N3

plim

1 εit

N1

plim

y i,

1

i =1 t =1

T n

}

n !∞

|

1

nT

εi )

T

n

∑ ∑ yi ,t

t =1 i =1

{z

N2

1 T n

+ plim

∑ ∑ y i,

n !∞ nT t =1 i =1

}

|

{z

1 εit

N4

Advanced Econometrics II

1 εi

}

1 εi

}

April 2018

16 / 209

2. The dynamic panel bias

Theorem (Weak law of large numbers, Khinchine)

If fXi g , for i = 1, .., m is a sequence of i.i.d. random variables with

E (Xi ) = µ < ∞, then the sample mean converges in probability to µ:

1 m

p

Xi ! E (Xi ) = µ

m i∑

=1

or

plim

m !∞

C. Hurlin (University of Orléans)

1 m

Xi = E (Xi ) = µ

m i∑

=1

Advanced Econometrics II

April 2018

17 / 209

2. The dynamic panel bias

By application of the WLLN (Khinchine’s theorem)

N1 = plim

n !∞

1

nT

n

T

∑ ∑ yi ,t

1 εit

= E (yi ,t

1 εit )

i =1 t =1

Since (1) yi ,t 1 only depends on εi ,t

uncorrelated, then we have

E (yi ,t

1,

εi ,t

1 εit )

2

and (2) the εit are

=0

and …nally

N1 = plim

n !∞

C. Hurlin (University of Orléans)

1

nT

n

T

∑ ∑ yi ,t

1 εit

=0

i =1 t =1

Advanced Econometrics II

April 2018

18 / 209

2. The dynamic panel bias

For the second term N2 , we have:

N2 =

=

=

=

plim

n !∞

plim

n !∞

plim

n !∞

plim

n !∞

C. Hurlin (University of Orléans)

1

nT

1

nT

1

nT

n

T

∑ ∑ yi ,t

1 εi

i =1 t =1

n

T

∑ εi ∑ yi ,t

i =1

n

1

t =1

∑ εi T y i ,

1

as y i ,

i =1

n

1

εi y i ,

n i∑

=1

1

=

1

T

T

∑ yi ,t

1

t =1

1

Advanced Econometrics II

April 2018

19 / 209

2. The dynamic panel bias

In the same way:

N3 = plim

n !∞

N4 = plim

n !∞

1

nT

1

nT

n

T

∑ ∑ y i,

i =1 t =1

n

∑

1 εit

= plim

n !∞

T

∑ y i,

i =1 t =1

C. Hurlin (University of Orléans)

1 εi = plim

n !∞

1

nT

n

T

∑ y i , 1 ∑ εit =

i =1

1

T

nT

t =1

plim

n !∞

n

∑ y i,

i =1

Advanced Econometrics II

1 εi = plim

n !∞

1 n

y i,

n i∑

=1

1 n

y i,

n i∑

=1

April 2018

1ε

1 εi

20 / 209

2. The dynamic panel bias

The numerator of the bias expression can be rewritten as

plim

n !∞

=

1

nT

0

|{z}

N1

=

plim

n !∞

n

T

∑ ∑ (yi ,t

1

y i,

1 ) ( εit

εi )

i =1 t =1

plim

n !∞

|

1 n

εi y i , 1

n i∑

=1

{z

}

1 n

y i,

n i∑

=1

C. Hurlin (University of Orléans)

N2

1 εi

plim

n !∞

|

1 n

y i,

n i∑

=1

{z

N3

Advanced Econometrics II

1 εi + plim

}

n !∞

|

1 n

y i,

n i∑

=1

{z

N4

April 2018

1 εi

}

21 / 209

2. The dynamic panel bias

Solution

The numerator of the expression of the LSDV bias satis…es:

plim

n !∞

1

nT

n

∑

T

∑ (yi ,t

1

y i,

1 ) ( εit

εi ) =

i =1 t =1

C. Hurlin (University of Orléans)

Advanced Econometrics II

plim

n !∞

1 n

y i,

n i∑

=1

1 εi

April 2018

22 / 209

2. The dynamic panel bias

Remark

n

T

∑ ∑ (yi ,t

b LSDV

γ

plim

n !∞

1

nT

n

∑

γ=

i =1 t =1

n

1

y i,

1 ) ( εit

1

y i,

T

∑ ∑ (yi ,t

i =1 t =1

1)

εi ) / (nT )

2

/ (nT )

T

∑ (yi ,t

1

y i,

1 ) ( εit

εi ) =

i =1 t =1

plim

n !∞

1 n

y i,

n i∑

=1

1 εi

b LSDV is biased when n

If this plim is not null, then the LSDV estimator γ

tends to in…nity and T is …xed.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

23 / 209

2. The dynamic panel bias

Let us examine this plim

plim

n !∞

1 n

y i,

n i∑

=1

1 εi

We know that

yit

=

=

=

=

γyi ,t

2

γ yi ,t

γ3 yi ,t

1

+ αi + εit

2 + αi (1 + γ ) + εit + γεi ,t 1

2

+ εit + γεi ,t

3 + αi 1 + γ + γ

1

+ γ2 εi ,t

2

...

= γt yi 0 +

C. Hurlin (University of Orléans)

1

1

γt

α + εit + γεi ,t

γ i

1

Advanced Econometrics II

+ γ2 εi ,t

2

+ ... + γt

1

April 2018

εi 1

24 / 209

2. The dynamic panel bias

For any time t, we have:

yit

For yi ,t

1,

= εit + γεi ,t 1 + γ2 εi ,t

1 γt

α + γt yi 0

+

1 γ i

2

+ ... + γt

1

εi 1

we have:

yi ,t

1

= εi ,t 1 + γεi ,t 2 + γ2 εi ,t 3 + ... + γt

1 γt 1

+

α + γt 1 yi 0

1 γ i

C. Hurlin (University of Orléans)

Advanced Econometrics II

2

εi 1

April 2018

25 / 209

2. The dynamic panel bias

yi ,t

1

= εi ,t

1 + γεi ,t

Summing yi ,t

1

2

2 + γ εi ,t

2

εi 1 +

1

γt 1

α + γt

1 γ i

1

yi 0

over t, we get:

T

∑ yi ,t

t

3 + ... + γ

1

= εi ,T

t =1

+

C. Hurlin (University of Orléans)

(T

1

+

1

1

γ2

εi ,T

γ

2

1)

T γ + γT

(1

γ )2

Advanced Econometrics II

+ ... +

αi +

1

γT 1

εi 1

1 γ

1 γT

yi 0

1 γ

April 2018

26 / 209

2. The dynamic panel bias

yi ,t

1

= εi ,t

1 + γεi ,t

2

2 + γ εi ,t

t

3 + ... + γ

2

εi 1 +

1

γt 1

α + γt

1 γ i

1

yi 0

Proof: We have (each lign corresponds to a date)

T

∑ yi ,t

1

= yi ,T

1

+ yi ,T

2

+ .. + yi ,1 + yi ,0

t =1

= εi ,T

1 + γεi ,T

+εi ,T

2

T

2 + .. + γ

+ γεi ,T

3

2

+ ... + γT

γT 1

αi + γT 1 yi 0

1 γ

1 γT 2

3

αi + γT 2 yi 0

εi 1 +

1 γ

εi 1 +

1

+..

+εi ,1 +

1

1

γ1

α + γyi 0

γ i

+yi 0

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

27 / 209

2. The dynamic panel bias

Proof (ct’d): For the individual e¤ect αi , we have

αi

1

=

=

=

γ

αi

1

γ

αi

1 γ

αi T

C. Hurlin (University of Orléans)

1

T

γ+1

1

γ

γ2 + ... + 1

γ2

..

γT

γT

1

1

1 γT

1 γ

T γ 1 + γT

T

(1

γ )2

Advanced Econometrics II

April 2018

28 / 209

2. The dynamic panel bias

So, we have

y i,

1

=

=

1

T

1

T

+

C. Hurlin (University of Orléans)

T

∑ yi ,t

1

t =1

εi ,T

T

+

1

Tγ

(1

1

1

γ2

εi ,T

γ

1 + γT

γ )2

2

+ ... +

αi +

Advanced Econometrics II

1

γT 1

εi 1

1 γ

!

1 γT

yi 0

1 γ

April 2018

29 / 209

2. The dynamic panel bias

Finally, the plim is equal to

plim

n !∞

= plim

n !∞

+

1 n

y i,

n i∑

=1

1 n

n i∑

=1

T

Tγ

(1

C. Hurlin (University of Orléans)

1 εi

1

T

εi ,t

1

1 + γT

γ )2

1 γT 1

+ ... +

εi 1

1 γ

!

1

1 γT

αi +

yi 0

(εi 1 + ... + εiT )

1 γ

T

+

1

1

γ2

εi ,t

γ

Advanced Econometrics II

2

April 2018

30 / 209

2. The dynamic panel bias

Because εit are i.i.d, by a law of large numbers, we have:

plim

n !∞

= plim

n !∞

+

=

σ2ε

T2

=

σ2ε

T2

1 n

y i,

n i∑

=1

1 n

n i∑

=1

T

Tγ

(1

1

1

T

1 εi

1

T

εi ,T

1

1 + γT

γ )2

1 γT 1

+ ... +

εi 1

1 γ

!

1 γT

1

αi +

yi 0

(εi 1 + ... + εiT )

1 γ

T

+

1

1

γ2

εi ,T

γ

γ 1 γ2

1 γT

+

+ ... +

γ

1 γ

1 γ

T

Tγ 1 + γ

(1

C. Hurlin (University of Orléans)

2

1

γ )2

Advanced Econometrics II

April 2018

31 / 209

2. The dynamic panel bias

Theorem

If the errors terms εit are i.i.d. 0, σ2ε , we have:

plim

n !∞

=

=

C. Hurlin (University of Orléans)

1

nT

plim

n !∞

n

T

∑ ∑ (yi ,t

1

y i,

n i∑

=1

σ2ε T

T2

1

y i,

1 ) ( εit

εi )

i =1 t =1

n

Tγ

(1

1 εi

1 + γT

γ )2

Advanced Econometrics II

April 2018

32 / 209

2. The dynamic panel bias

b LSDV

By similar manipulations, we can show that the denominator of γ

converges to:

1

n !∞ nT

plim

=

σ2ε

1

γ2

C. Hurlin (University of Orléans)

n

T

∑ ∑ (yi ,t

1

y i,

1)

2

i =1 t =1

1

1

T

2γ

(1

γ )2

Advanced Econometrics II

T

T γ 1 + γT

T2

!

April 2018

33 / 209

2. The dynamic panel bias

So, we have :

b LSDV

plim (γ

n !∞

1

nT

= plim

n !∞

=

C. Hurlin (University of Orléans)

γ)

n

T

∑ ∑ (yi ,t

y i , 1 ) (εit

1

i =1 t =1

n T

1

y i , 1 )2

nT ∑ ∑ (yi ,t 1

i =1 t =1

σ2ε (T

T2

σ2ε

1 γ2

1

1

T

εi )

T γ 1 + γT )

(1 γ )2

2γ

(1 γ )2

Advanced Econometrics II

(T T γ 1 + γT )

T2

April 2018

34 / 209

2. The dynamic panel bias

This semi-asymptotic bias can be rewriten as:

b LSDV

plim (γ

γ)

n !∞

=

1 γ

1 +γ

T

T2

T

2γ

(1 γ )2

(1 + γ ) T

=

(1

C. Hurlin (University of Orléans)

γ) T 2

T

1 + γT

Tγ

(T

Tγ

2γ

(1 γ )2

Advanced Econometrics II

Tγ

1 + γT )

1 + γT

(T

Tγ

1 + γT )

April 2018

35 / 209

2. The dynamic panel bias

Fact

If T also tends to in…nity, then the numerator converges to zero, and

denominator converges to a nonzero constant σ2ε / 1 γ2 , hence the

LSDV estimator of γ and αi are consistent.

Fact

b LSDV and

If T is …xed, then the denominator is a nonzero constant, and γ

b

αi are inconsistent estimators when n is large.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

36 / 209

2. The dynamic panel bias

Theorem (Dynamic panel bias)

In a dynamic panel AR(1) model with individual e¤ects, the

semi-asymptotic bias (with n) of the LSDV estimator on the autoregressive

parameter is equal to:

b LSDV

plim (γ

n !∞

(1 + γ ) T

γ) =

C. Hurlin (University of Orléans)

(1

γ) T 2

T

Tγ

2γ

(1 γ )2

Advanced Econometrics II

1 + γT

(T

Tγ

1 + γT )

April 2018

37 / 209

2. The dynamic panel bias

Theorem (Dynamic panel bias)

For an AR(1) model, the dynamic panel bias can be rewriten as :

b LSDV

plim (γ

n !∞

γ) =

C. Hurlin (University of Orléans)

1+γ

T 1

1

1

(1

1 1 γT

T 1 γ

2γ

γ ) (T

Advanced Econometrics II

1)

1

1 γT

T (1 γ )

April 2018

1

38 / 209

2. The dynamic panel bias

Fact

b LSDV is caused by having to eliminate the individual

The dynamic bias of γ

e¤ects αi from each observation, which creates a correlation of order

(1/T ) between the explanatory variables and the residuals in the

transformed model

(yit

0

B

y i ) = γ @yi ,t

0

+ @εit

C. Hurlin (University of Orléans)

y i, 1

| {z }

1

1

depends on past value of εit

εi

|{z}

depends on past value of εit

Advanced Econometrics II

1

C

A

A

April 2018

39 / 209

2. The dynamic panel bias

Intuition of the dynamic bias

y i ) = γ (yi ,t

(yit

with cov (y i ,

cov (y i ,

1 , εi )

1

y i,

1 ) + ( εit

6= 0 since

1 , εi )

= cov

= cov

=

C. Hurlin (University of Orléans)

1

T

1

T

T

∑ yi ,t

t =1

T

∑ yi ,t

t =1

1

1,

T

1

1,

T

T

∑ εit

t =1

T

∑ εit

t =1

1

cov ((yi 1 + ... + yiT

T2

Advanced Econometrics II

εi )

!

!

1 ) , ( εi 1

+ ... + εiT ))

April 2018

40 / 209

2. The dynamic panel bias

Intuition of the dynamic bias

(yit

y i ) = γ (yi ,t

1

y i,

1 ) + ( εit

εi ) with cov (y i ,

If we approximate yit by εit (in fact yit also depend on εit

we have

cov (y i ,

1 , εi )

=

'

'

C. Hurlin (University of Orléans)

1,

1 , εi )

εt

6= 0

2 , ...)

then

1

cov ((yi 1 + ... + yiT 1 ) , (εi 1 + ... + εiT ))

T2

1

(cov (εi ,1 , εi ,1 ) + ... + (cov (εi ,T 1 , εi ,T 1 )))

T2

(T 1) σ2ε

6= 0

T2

Advanced Econometrics II

April 2018

41 / 209

2. The dynamic panel bias

Intuition of the dynamic bias

(yit

y i ) = γ (yi ,t

1

y i,

1 ) + ( εit

εi ) with cov (y i ,

1 , εi )

6= 0

If we approximate yit by εit then we have

cov (y i ,

1 , εi )

=

1) σ2ε

(T

T2

By taking into account all the interaction terms, we have shown that

plim

n !∞

1 n

y i,

n i∑

=1

1 εi = cov (y i ,

C. Hurlin (University of Orléans)

1 , εi ) =

σ2ε (T

T2

Advanced Econometrics II

1) γ

(1

1 + γT

γ )2

April 2018

42 / 209

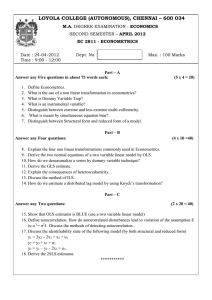

2. The dynamic panel bias

Remarks

b LSDV

plim (γ

n !∞

γ) =

1+γ

T 1

1

1

(1

1 1 γT

T 1 γ

2γ

γ ) (T

1)

1

1 γT

T (1 γ )

1

1

When T is large, the right-hand-side variables become asymptotically

uncorrelated.

2

For small T , this bias is always negative if γ > 0.

3

The bias does not go to zero as γ goes to zero.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

43 / 209

2. The dynamic panel bias

Dynam ic pane l bias

Semi-asymptotic bias

0

-0.05

-0.1

-0.15

-0.2

T=10

T=30

T=50

T=100

-0.25

-0.3

0

C. Hurlin (University of Orléans)

0.2

0.4

0.6

Advanced Econometrics II

0.8

1

April 2018

44 / 209

2. The dynamic panel bias

T=10

1

T=30

1

True value of

plim of the LSDV estimator

True value of

plim of the LSDV estimator

0.8

semi-asymptotic bias

semi-asymptotic bias

0.8

0.6

0.4

0.2

0.4

0.2

0

0

-0.2

-0.2

0

0.2

0.4

0.6

0.8

0

1

T=50

1

0.2

0.4

0.6

0.8

1

0.6

0.8

1

T=100

1

True value of

plim of the LSDV estimator

True value of

plim of the LSDV estimator

0.9

0.8

0.8

semi-asymptotic bias

semi-asymptotic bias

0.6

0.6

0.4

0.2

0.7

0.6

0.5

0.4

0.3

0.2

0

0.1

-0.2

0

0

0.2

C. Hurlin (University of Orléans)

0.4

0.6

0.8

1

0

0.2

Advanced Econometrics II

0.4

April 2018

45 / 209

2. The dynamic panel bias

0

Dynam ic bias for T=10 (in % of the true value )

relative bias (in %)

-20

-40

-60

-80

T=10

T=30

T=50

T=100

-100

-120

0.1

C. Hurlin (University of Orléans)

0.2

0.3

0.4

0.5

0.6

Advanced Econometrics II

0.7

0.8

0.9

April 2018

46 / 209

2. The dynamic panel bias

Monte Carlo experiments

How to check these semi-asymptotic formula with Monte Carlo

simulations?

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

47 / 209

2. The dynamic panel bias

Step 1: parameters

Let assume that γ = 0.5, σ2ε = 1 and εit

i .i .d .

N (0, 1) .

Simulate n individual e¤ects αi once at all. For instance, we can use a

uniform distribution

αi

U[ 1,1 ]

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

48 / 209

2. The dynamic panel bias

Step 2: Monte Carlo pseudo samples

Simulate n (typically n = 1, 000) i.i.d. sequences fεit gTt=1 for a given

value of T (typically T = 10)

Generate n sequences fyit gTt=1 for i = 1, .., n with the model:

yit = γyi ,t

1

+ αi + εit

Repeat S times the step 2 in order to generate S = 5, 000 sequences

n

o

(s ) T

yit

for s = 1, .., S for each cross-section unit i = 1, ..., n

t =1

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

49 / 209

2. The dynamic panel bias

Step 3: LSDV estimates on pseudo series

For each pseudo sample s = 1, ..., S, consider the empirical model

yits = γyis,t

1

+ αi + µit

i = 1, .., n

t = 1, ...T

b sLSDV .

and compute the LSDV estimates γ

b LSDV based on

Compute the average bias of the LSDV estimator γ

the S Monte Carlo simulations

av .bias =

C. Hurlin (University of Orléans)

1

S

S

∑ γbsLSDV

γ

s =1

Advanced Econometrics II

April 2018

50 / 209

2. The dynamic panel bias

Step 4: Semi-asymptotic bias

1

Repeat this experiment for various cross-section dimensions n:

when n increases,the average bias should converge to

b LSDV

plim (γ

n !∞

2

γ) =

1+γ

T 1

1

1

(1

1 1 γT

T 1 γ

2γ

γ ) (T

1)

1

1

1 γT

T (1 γ )

Repeat this this experiment for various time dimensions T : when T

increases,the average bias should converge to 0.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

51 / 209

2. The dynamic panel bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

52 / 209

2. The dynamic panel bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

53 / 209

2. The dynamic panel bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

54 / 209

2. The dynamic panel bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

55 / 209

2. The dynamic panel bias

350

Histogram of the LSDV estimates for=0.5, T=10 and n=1000

300

Number of simulations

250

200

150

100

50

0

0.3

0.31

0.32

0.33

0.34

h

C. Hurlin (University of Orléans)

0.35

0.36

0.37

0.38

at

Advanced Econometrics II

April 2018

56 / 209

2. The dynamic panel bias

Click me!

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

57 / 209

2. The dynamic panel bias

-0.15

Theoretical semi-asymptotic bias

MC average bias

-0.155

-0.16

-0.165

-0.17

-0.175

-0.18

0

200

400

600

800

1000

Sample size n

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

58 / 209

2. The dynamic panel bias

Question: What is the importance of the dynamic bias in micro-panels?

”Macroeconomists should not dismiss the LSDV bias as

insigni…cant. Even with a time dimension T as large as 30, we

…nd that the bias may be equal to as much 20% of the true value

of the coe¢ cient of interest.” (Judson et Owen, 1999, page 10)

Judson R.A. and Owen A. (1999), Estimating dynamic panel data models: a

guide for macroeconomists. Economics Letters, 1999, vol. 65, issue 1, 9-15.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

59 / 209

2. The dynamic panel bias

Finite Sample results (Monte Carlo simulations)

n

T

γ

10

10

0.5

50

10

0.5

b LSDV

Avg. γ

100

10

10

Avg. bias

0.3282

0.1718

0.3317

0.1683

0.5

0.3338

0.1662

50

0.5

0.4671

0.0329

50

50

0.5

0.4688

0.0321

100

50

0.5

0.4694

0.0306

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

60 / 209

2. The dynamic panel bias

Finite Sample results (Monte Carlo simulations)

n

T

γ

10

10

0.3

50

10

0.3

100

10

10

b LSDV

Avg. γ

Avg. bias

0.3686

0.0686

0.3743

0.0743

0.3

0.3753

0.0753

50

0.3

0.3134

0.0134

50

50

0.3

0.3133

0.0133

100

50

0.5

0.3142

0.0142

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

61 / 209

2. The dynamic panel bias

Fact (smearing e¤ect)

The LSDV for dynamic individual-e¤ects model remains biased with the

introduction of exogenous variables if T is small; for details of the

derivation, see Nickell (1981); Kiviet (1995).

yit = α + γyi ,t

1

0

+ β xit + αi + εit

b LSDV and b

In this case, both estimators γ

βLSDV are biased.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

62 / 209

2. The dynamic panel bias

What are the solutions?

Consistent estimator of γ can be obtained by using:

1

ML or FIML (but additional assumptions on yi 0 are necessary)

2

Feasible GLS (but additional assumptions on yi 0 are necessary)

3

LSDV bias corrected (Kiviet, 1995)

4

IV approach (Anderson and Hsiao, 1982)

5

GMM approach (Arenallo and Bond, 1985)

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

63 / 209

2. The dynamic panel bias

What are the solutions?

Consistent estimator of γ can be obtained by using:

1

ML or FIML (but additional assumptions on yi 0 are necessary)

2

Feasible GLS (but additional assumptions on yi 0 are necessary)

3

LSDV bias corrected (Kiviet, 1995)

4

IV approach (Anderson and Hsiao, 1982)

5

GMM approach (Arenallo and Bond, 1985)

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

64 / 209

2. The dynamic panel bias

Key Concepts Section 2

1

AR(1) panel data model

2

Semi-asymptotic bias

3

Dynamic panel bias (Nickell’s bias)

4

Monte Carlo experiments

5

Magnitude of the dynamic panel bias

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

65 / 209

Section 3

The Instrumental Variable (IV) approach

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

66 / 209

Subsection 3.1

Reminder on IV and 2SLS

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

67 / 209

3.1 Reminder on IV and 2SLS

Objectives

1

De…ne the endogeneity bias and the smearing e¤ect.

2

De…ne the notion of instrument or instrumental variable.

3

Introduce the exogeneity and relevance properties of an instrument.

4

Introduce the notion of just-identi…ed and over-identi…ed systems.

5

De…ne the IV estimator and its asymptotic variance.

6

De…ne the 2SLS estimator and its asymptotic variance.

7

De…ne the notion of weak instrument.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

68 / 209

3.1 Reminder on IV and 2SLS

Consider the (population) multiple linear regression model:

y = Xβ + ε

y is a N

1 vector of observations yj for j = 1, .., N

X is a N K matrix of K explicative variables xjk for k = 1, ., K and

j = 1, .., N

β = ( β1 ..βK )0 is a K

ε is a N

1 vector of parameters

1 vector of error terms εi with (spherical disturbances)

V ( ε j X ) = σ 2 IN

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

69 / 209

3.1 Reminder on IV and 2SLS

Endogeneity we assume that the assumption A3 (exogeneity) is violated:

E ( εj X) 6= 0N

with

plim

C. Hurlin (University of Orléans)

1

1 0

X ε = E (xj εj ) = γ 6= 0K

N

Advanced Econometrics II

1

April 2018

70 / 209

3.1 Reminder on IV and 2SLS

Theorem (Bias of the OLS estimator)

If the regressors are endogenous, i.e. E ( εj X) 6= 0, the OLS estimator of

β is biased

b

E β

OLS 6 = β

where β denotes the true value of the parameters. This bias is called the

endogeneity bias.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

71 / 209

3.1 Reminder on IV and 2SLS

Theorem (Inconsistency of the OLS estimator)

1 X0 ε

If the regressors are endogenous with plim N

estimator of β is inconsistent

where Q = plim N

C. Hurlin (University of Orléans)

b

plim β

OLS = β + Q

1

= γ, the OLS

γ

1 X0 X.

Advanced Econometrics II

April 2018

72 / 209

3.1 Reminder on IV and 2SLS

Proof: Given the de…nition of the OLS estimator:

b

β

OLS

=

X0 X

1

X0 y

=

X0 X

1

X0 (Xβ + ε)

= β + X0 X

1

X0 ε

We have:

b

plim β

OLS

C. Hurlin (University of Orléans)

= β + plim

= β+Q

1

1 0

XX

N

1

plim

1 0

Xε

N

γ 6= β

Advanced Econometrics II

April 2018

73 / 209

3.1 Reminder on IV and 2SLS

Remarks

1

2

b

plim β

OLS = β + Q

1

γ

The implication is that even though only one of the variables in X is

b

correlated with ε, all of the elements of β

OLS are inconsistent,

not just the estimator of the coe¢ cient on the endogenous variable.

This e¤ects is called smearing e¤ect: the inconsistency due to the

endogeneity of the one variable is smeared across all of the least

squares estimators.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

74 / 209

3.1 Reminder on IV and 2SLS

Example (Endogeneity, OLS estimator and smearing)

Consider the multiple linear regression model

yi = 0.4 + 0.5xi 1

0.8xi 2 + εi

where εi is i.i.d. with E (εi ) . We assume that the vector of variables

de…ned by wi = (xi 1 : xi 2 : εi ) has a multivariate normal distribution with

wi

with

N (03

1 , ∆)

0

1

1 0.3 0

∆ = @ 0.3 1 0.5 A

0 0.5 1

It means that Cov (εi , xi 1 ) = 0 (x1 is exogenous) but Cov (εi , xi 2 ) = 0.5

(x2 is endogenous) and Cov (xi 1, xi 2 ) = 0.3 (x1 is correlated to x2 ).

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

75 / 209

3.1 Reminder on IV and 2SLS

Example (Endogeneity, OLS estimator and smearing (cont’d))

Write a Matlab code to (1) generate S = 1, 000 samples fyi , xi 1 , xi 2 gN

i =1

of size N = 10, 000. (2) For each simulated sample, determine the OLS

estimators of the model

yi = β1 + β2 xi 1 + β3 xi 2 + εi

b = b

Denote β

β1s b

β2s b

β3s

s

0

the OLS estimates obtained from the

simulation s 2 f1, ..S g . (3) compare the true value of the parameters in

the population (DGP) to the average OLS estimates obtained for the S

simulations

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

76 / 209

3.1 Reminder on IV and 2SLS

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

77 / 209

3.1 Reminder on IV and 2SLS

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

78 / 209

3.1 Reminder on IV and 2SLS

Question: What is the solution to the endogeneity issue?

The use of instruments..

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

79 / 209

3.1 Reminder on IV and 2SLS

De…nition (Instruments)

Consider a set of H variables zh 2 RN for h = 1, ..N. Denote Z the N

matrix (z1 : .. : zH ) . These variables are called instruments or

instrumental variables if they satisfy two properties:

H

(1) Exogeneity: They are uncorrelated with the disturbance.

E ( εj Z) = 0N

1

(2) Relevance: They are correlated with the independent variables, X.

E (xjk zjh ) 6= 0

for h 2 f1, .., H g and k 2 f1, .., K g.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

80 / 209

3.1 Reminder on IV and 2SLS

Assumptions: The instrumental variables satisfy the following properties.

Well behaved data:

plim

1 0

Z Z = QZZ a …nite H

N

H positive de…nite matrix

1 0

Z X = QZX a …nite H

N

K positive de…nite matrix

Relevance:

plim

Exogeneity:

plim

C. Hurlin (University of Orléans)

1 0

Z ε = 0K

N

Advanced Econometrics II

1

April 2018

81 / 209

3.1 Reminder on IV and 2SLS

De…nition (Instrument properties)

We assume that the H instruments are linearly independent:

E Z0 Z

is non singular

or equivalently

rank E Z0 Z

C. Hurlin (University of Orléans)

=H

Advanced Econometrics II

April 2018

82 / 209

3.1 Reminder on IV and 2SLS

The exogeneity condition

E ( εj j zj ) = 0 =) E (εj zj ) = 0H

can expressed as an orthogonality condition or moment condition

0

1

E @ zj

(H ,1 )

yj

xj0 β A = 0H

(1,1 )

(H ,1 )

So, we have H equations and K unknown parameters β

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

83 / 209

3.1 Reminder on IV and 2SLS

De…nition (Identi…cation)

The system is identi…ed if there exists a unique vector β such that:

E zj yj

xj0 β

=0

where zj = (zj 1 ..zjH )0 . For that, we have the following conditions:

(1) If H < K the model is not identi…ed.

(2) If H = K the model is just-identi…ed.

(3) If H > K the model is over-identi…ed.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

84 / 209

3.1 Reminder on IV and 2SLS

Remark

1

Under-identi…cation: less equations (H) than unknowns (K )....

2

Just-identi…cation: number of equations equals the number of

unknowns (unique solution)...=> IV estimator

3

Over-identi…cation: more equations than unknowns. Two equivalent

solutions:

1

Select K linear combinations of the instruments to have a unique

solution )...=> Two-Stage Least Squares (2SLS)

2

Set the sample analog of the moment conditions as close as possible to

zero, i.e. minimize the distance between the sample analog and zero

given a metric (optimal metric or optimal weighting matrix?) =>

Generalized Method of Moments (GMM).

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

85 / 209

3.1 Reminder on IV and 2SLS

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

86 / 209

3.1 Reminder on IV and 2SLS

Assumption: Consider a just-identi…ed model

H=K

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

87 / 209

3.1 Reminder on IV and 2SLS

Motivation of the IV estimator

By de…nition of the instruments:

plim

1

1 0

Z ε = plim Z0 (y

N

N

Xβ) = 0K

1

So, we have:

plim

1 0

Zy=

N

plim

1 0

ZX

N

β

or equivalently

β=

C. Hurlin (University of Orléans)

plim

1 0

ZX

N

1

plim

Advanced Econometrics II

1 0

Zy

N

April 2018

88 / 209

3.1 Reminder on IV and 2SLS

De…nition (Instrumental Variable (IV) estimator)

b of parameters

If H = K , the Instrumental Variable (IV) estimator β

IV

β is de…ned as to be:

b = Z0 X 1 Z0 y

β

IV

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

89 / 209

3.1 Reminder on IV and 2SLS

De…nition (Consistency)

b is

Under the assumption that plim N 1 Z0 ε = 0, the IV estimator β

IV

consistent:

p

b !

β

β

IV

where β denotes the true value of the parameters.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

90 / 209

3.1 Reminder on IV and 2SLS

Proof: By de…nition:

b = Z0 X

β

IV

1

Z0 y = β +

1 0

ZX

N

1

1 0

Zε

N

So, we have:

b = β + plim

plim β

IV

1 0

ZX

N

1

plim

1 0

Zε

N

Under the assumption of exogeneity of the instruments

plim

1 0

Z ε = 0K

N

1

So, we have

C. Hurlin (University of Orléans)

b =β

plim β

IV

Advanced Econometrics II

April 2018

91 / 209

3.1 Reminder on IV and 2SLS

De…nition (Asymptotic distribution)

b is asymptotically

Under some regularity conditions, the IV estimator β

IV

normally distributed:

p

where

b

N β

IV

QZZ = plim

K K

C. Hurlin (University of Orléans)

d

β ! N 0K

1 0

ZZ

N

1, σ

2

QZX1 QZZ QZX1

QZX = plim

K K

Advanced Econometrics II

1 0

ZX

N

April 2018

92 / 209

3.1 Reminder on IV and 2SLS

De…nition (Asymptotic variance covariance matrix)

b is

The asymptotic variance covariance matrix of the IV estimator β

IV

de…ned as to be:

b

Vasy β

IV

=

σ2

Q 1 QZZ QZX1

N ZX

A consistent estimator is given by

b

b asy β

V

IV

C. Hurlin (University of Orléans)

b 2 Z0 X

=σ

1

Z0 Z

Advanced Econometrics II

X0 Z

1

April 2018

93 / 209

3.1 Reminder on IV and 2SLS

Remarks

1

If the system is just identi…ed H = K ,

Z0 X

1

= X0 Z

1

QZX = QXZ

the estimator can also written as

2

b 2 Z0 X

=σ

1

b

ε0b

ε

1

=

N K

N K

N

b

b asy β

V

IV

Z0 Z

Z0 X

1

As usual, the estimator of the variance of the error terms is:

b2 =

σ

C. Hurlin (University of Orléans)

∑

i =1

Advanced Econometrics II

yi

b

xi0 β

IV

2

April 2018

94 / 209

3.1 Reminder on IV and 2SLS

Relevant instruments

1

2

Our analysis thus far has focused on the “identi…cation” condition

for IV estimation, that is, the “exogeneity assumption,” which

produces

1

plim Z0 ε = 0K 1

N

A growing literature has argued that greater attention needs to be

given to the relevance condition

plim

1 0

Z X = QZX a …nite H

N

K positive de…nite matrix

with H = K in the case of a just-identi…ed model.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

95 / 209

3.1 Reminder on IV and 2SLS

Relevant instruments (cont’d)

plim

1 0

Z X = QZX a …nite H

N

K positive de…nite matrix

1

While strictly speaking, this condition is su¢ cient to determine the

asymptotic properties of the IV estimator

2

However, the common case of “weak instruments,” is only barely

true has attracted considerable scrutiny.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

96 / 209

3.1 Reminder on IV and 2SLS

De…nition (Weak instrument)

A weak instrument is an instrumental variable which is only slightly

correlated with the right-hand-side variables X. In presence of weak

instruments, the quantity QZX is close to zero and we have

1 0

Z X ' 0H

N

C. Hurlin (University of Orléans)

K

Advanced Econometrics II

April 2018

97 / 209

3.1 Reminder on IV and 2SLS

Fact (IV estimator and weak instruments)

b has a poor

In presence of weak instruments, the IV estimators β

IV

precision (great variance). For QZX ' 0H K , the asymptotic variance

tends to be very large, since:

b

Vasy β

IV

=

σ2

Q 1 QZZ QZX1

N ZX

As soon as N 1 Z0 X ' 0H K , the estimated asymptotic variance

covariance is also very large since

b

b asy β

V

IV

C. Hurlin (University of Orléans)

b 2 Z0 X

=σ

1

Z0 Z

Advanced Econometrics II

X0 Z

1

April 2018

98 / 209

3.1 Reminder on IV and 2SLS

Assumption: Consider an over-identi…ed model

H>K

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

99 / 209

3.1 Reminder on IV and 2SLS

Introduction

If Z contains more variables than X, then much of the preceding derivation

is unusable, because Z0 X will be H K with

rank Z0 X = K < H

So, the matrix Z0 X has no inverse and we cannot compute the IV

estimator as:

b = Z0 X 1 Z0 y

β

IV

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

100 / 209

3.1 Reminder on IV and 2SLS

Introduction (cont’d)

The crucial assumption in the previous section was the exogeneity

assumption

1

plim Z0 ε = 0K 1

N

1

That is, every column of Z is asymptotically uncorrelated with ε.

2

That also means that every linear combination of the columns of Z

is also uncorrelated with ε, which suggests that one approach would

be to choose K linear combinations of the columns of Z.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

101 / 209

3.1 Reminder on IV and 2SLS

Introduction (cont’d)

Which linear combination to choose?

A choice consists in using is the projection of the columns of X in the

column space of Z:

b = Z Z0 Z 1 Z0 X

X

b for Z, we have

With this choice of instrumental variables, X

b

β

2SLS

=

=

C. Hurlin (University of Orléans)

b 0X

X

1

b 0y

X

X0 Z Z0 Z

1

Z0 X

Advanced Econometrics II

1

X0 Z Z0 Z

1

Z0 y

April 2018

102 / 209

3.1 Reminder on IV and 2SLS

De…nition (Two-stage Least Squares (2SLS) estimator)

The Two-stage Least Squares (2SLS) estimator of the parameters β is

de…ned as to be:

1 0

b

b0

by

β

X

2SLS = X X

1

b = Z Z0 Z

where X

Z0 X corresponds to the projection of the columns of

X in the column space of Z, or equivalently by

0

0

b

β

2SLS = X Z Z Z

C. Hurlin (University of Orléans)

1

Z0 X

1

Advanced Econometrics II

X0 Z Z0 Z

1

Z0 y

April 2018

103 / 209

3.1 Reminder on IV and 2SLS

Remark

By de…nition

Since

1

b

b0

β

2SLS = X X

b = Z Z0 Z

X

1

b 0y

X

Z0 X = PZ X

where PZ denotes the projection matrix on the columns of Z. Reminder:

PZ is symmetric and PZ PZ0 = PZ . So, we have

b

β

2SLS

C. Hurlin (University of Orléans)

1

0

=

X0 PZ X

=

X0 PZ PZ X

=

b 0X

b

X

0

1

b 0y

X

b 0y

X

Advanced Econometrics II

1

b 0y

X

April 2018

104 / 209

3.1 Reminder on IV and 2SLS

De…nition (Two-stage Least Squares (2SLS) estimator)

The Two-stage Least Squares (2SLS) estimator of the parameters β

can also be de…ned as:

b

b0 b

β

2SLS = X X

1

b 0y

X

b

It corresponds to the OLS estimator obtained in the regression of y on X.

b

Then, the 2SLS can be computed in two steps, …rst by computing X, then

by the least squares regression. That is why it is called the two-stage LS

estimator.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

105 / 209

3.1 Reminder on IV and 2SLS

A procedure to get the 2SLS estimator is the following

Step 1: Regress each explicative variable xk (for k = 1, ..K ) on the H

instruments.

xkj = α1 z1j + α2 z2j + .. + αH zHj + vj

Step 2: Compute the OLS estimators b

αh and the …tted values b

xkj

b

xkj = b

α1 z1j + b

α2 z2j + .. + b

αH zHj

Step 3: Regress the dependent variable y on the …tted values b

xki :

yj = β1 b

x1j + β2 b

x2j + .. + βK b

xKj + εj

b

The 2SLS estimator β

2SLS then corresponds to the OLS estimator

obtained in this model.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

106 / 209

3.1 Reminder on IV and 2SLS

Theorem

If any column of X also appears in Z, i.e. if one or more explanatory

(exogenous) variable is used as an instrument, then that column of X is

b

reproduced exactly in X.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

107 / 209

3.1 Reminder on IV and 2SLS

Example (Explicative variables used as instrument)

Suppose that the regression contains K variables, only one of which, say,

the K th , is correlated with the disturbances, i.e. E (xKi εi ) 6= 0. We can

use a set of instrumental variables z1 ,..., zJ plus the other K 1 variables

that certainly qualify as instrumental variables in their own right. So,

Z = (z1 : .. : zJ : x1 : .. : xK

1)

Then

b = (x1 : .. : xK

X

1

:b

xK )

where b

xK denotes the projection of xK on the columns of Z.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

108 / 209

3.1 Reminder on IV and 2SLS

Key Concepts SubSection 3.1

1

Endogeneity bias and smearing e¤ect.

2

Instrument or instrumental variable.

3

Exogeneity and relavance properties of an instrument.

4

Instrumental Variable (IV) estimator.

5

Two-Stage Least Square (2SLS) estimator.

6

Weak instrument.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

109 / 209

Subsection 3.2

Anderson and Hsiao (1982) IV approach

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

110 / 209

3.2 Anderson and Hsiao (1982) IV approach

Objectives

1

Introduce the IV approach of Anderson and Hsiao (1982).

2

Describe their 4 steps estimation procedure.

3

Introduce the …rst di¤erence transformation of the dynamic model.

4

Describe their choice of instruments.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

111 / 209

3.2 Anderson and Hsiao (1982) IV approach

Consider a dynamic panel data model with random individual e¤ects:

yit = γyi ,t

1

0

0

+ β xit + ρ ω i + αi + εit

αi are the (unobserved) individual e¤ects,

xit is a vector of K1 time-varying explanatory variables,

ω i is a vector of K2 time-invariant variables.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

112 / 209

3.2 Anderson and Hsiao (1982) IV approach

Assumption: we assume that the component error term vit = εit + αi

E (εit ) = 0, E (αi ) = 0

E (εit εjs ) = σ2ε if j = i and t = s, 0 otherwise.

E (αi αj ) = σ2α if j = i, 0 otherwise.

E (αi xit ) = 0, E (αi ω i ) = 0 (exogeneity assumption for ω i )

E (εit xit ) = 0, E (εit ω i ) = 0 (exogeneity assumption for xit )

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

113 / 209

3.2 Anderson and Hsiao (1982) IV approach

The K1 + K2 + 3 parameters to estimate are

yit = γyi ,t

1

0

0

+ β xit + ρ ω i + αi + εit

1

γ the autoregressive parameter,

2

β is the K1

variables,

1 vector of parameters for the time-varying explanatory

3

ρ is the K2

1 vector of parameters for the time-invariant variables,

4

σ2ε and σ2α the variances of the error terms.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

114 / 209

3.2 Anderson and Hsiao (1982) IV approach

Remark

If the vector ω i includes a constant term, the associated parameter can be

interpreted as the mean of the (random) individual e¤ects

yit = γyi ,t

1

0

αi = µ + αi

0

1

1

B zi 2 C

C

ωi = B

@ ... A

(K 2 ,1 )

ziK 2

C. Hurlin (University of Orléans)

0

+ β xit + ρ ω i + αi + εit

E ( αi ) = 0

0

1

µ

B ρ C

2 C

ρ =B

@ ... A

(K 2 ,1 )

ρK 2

Advanced Econometrics II

April 2018

115 / 209

3.2 Anderson and Hsiao (1982) IV approach

Vectorial form:

yi = yi ,

εi , yi and yi ,

Xi a T

1

are T

1γ

0

+ Xi β + ω i ρe + αi e + εi

1 vectors (T is the adjusted sample size),

K1 matrix of time-varying explanatory variables,

ω i is a K2

1 vector of time-invariant variables,

e is the T

1 unit vector, and

0

E (αi ) = 0 E αi xit

C. Hurlin (University of Orléans)

0

= 0 E αi ω i = 0

Advanced Econometrics II

April 2018

116 / 209

3.2 Anderson and Hsiao (1982) IV approach

In the dynamic panel data models context:

The Instrumental Variable (IV) approach was …rst proposed by

Anderson and Hsiao (1982).

They propose an IV procedure with 2 choices of instruments and 4

steps to estimate γ, β, ρ and σ2ε .

Anderson, T.W., and C. Hsiao (1982). Formulation and Estimation of

Dynamic Models Using Panel Data, Journal of Econometrics, 18, 47–82.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

117 / 209

3.2 Anderson and Hsiao (1982) IV approach

The Anderson and Hsiao (1982) IV approach

1

First step: …rst di¤erence transformation

2

Second step: choice of instruments and IV estimation of γ and β

3

Third step: estimation of ρ

4

Fourth step: estimation of the variances σ2α and σ2ε

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

118 / 209

3.2 Anderson and Hsiao (1982) IV approach

The Anderson and Hsiao (1982) IV approach

1

First step: …rst di¤erence transformation

2

Second step: choice of instruments and IV estimation of γ and β

3

Third step: estimation of ρ

4

Fourth step: estimation of the variances σ2α and σ2ε

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

119 / 209

3.2 Anderson and Hsiao (1982) IV approach

First step: …rst di¤erence transformation

Taking the …rst di¤erence of the model, we obtain for t = 2, .., T .

(yit

yi ,t

1)

= γ (yi ,t

1

yi ,t

2) +

0

β (xit

xi ,t

1 ) + εit

εi ,t

1

The …rst di¤erence transformation leads to "lost" one observation.

But, it allows to eliminate the individual e¤ects (as the Within

transformation).

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

120 / 209

3.2 Anderson and Hsiao (1982) IV approach

The Anderson and Hsiao (1982) IV approach

1

First step: …rst di¤erence transformation

2

Second step: choice of instruments and IV estimation of γ and β

3

Third step: estimation of ρ

4

Fourth step: estimation of the variances σ2α and σ2ε

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

121 / 209

3.2 Anderson and Hsiao (1982) IV approach

Second step: choice of the instruments and IV estimation

(yit

yi ,t

1)

= γ (yi ,t

yi ,t

1

2) +

0

β (xit

xi ,t

1 ) + εit

εi ,t

1

A valid instrument zit should satisfy

E (zit (εit

E (zit (yi ,t

C. Hurlin (University of Orléans)

εi ,t

1

1 ))

yi ,t

= 0 Exogeneity property

2 ))

6= 0 Relevance property

Advanced Econometrics II

April 2018

122 / 209

3.2 Anderson and Hsiao (1982) IV approach

Anderson and Hsiao (1982) propose two valid instruments:

1

First instrument: zi ,t = yi ,t

E (yi ,t

E (yi ,t

2

2

2

(εit

(yi ,t

εi ,t

1

2

1 ))

yi ,t

E ((yi ,t

2

2

C. Hurlin (University of Orléans)

yi ,t

yi ,t

3 ) ( εit

3 ) (yi ,t 1

6= 0 Relevance property

2 ))

Second instrument: zi ,t = (yi ,t

E ((yi ,t

= 0 Exogeneity property

εi ,t

3)

2

yi ,t

1 ))

= 0 Exogeneity property

yi ,t

2 ))

Advanced Econometrics II

6= 0 Relevance property

April 2018

123 / 209

3.2 Anderson and Hsiao (1982) IV approach

Remarks

The initial …rst di¤erences model includes K1 + 1 regressors.

The regressor (yi ,t

The regressors (xit

C. Hurlin (University of Orléans)

1

yi ,t

xi ,t

1)

2)

is endogeneous.

are assumed to be exogeneous.

Advanced Econometrics II

April 2018

124 / 209

3.2 Anderson and Hsiao (1982) IV approach

De…nition (Instruments)

Anderson and Hsiao (1982) consider two sets of K1 + 1 instruments, in

both cases the system is just identi…ed (IV estimator):

zi

(K 1 +1,1 )

zi

(K 1 +1,1 )

C. Hurlin (University of Orléans)

=

=

(yi ,t

yi ,t

2

(1,1 )

: (xit

yi ,t 3 )

2

(1,1 )

xi ,t

(1,K 1 )

: (xit

Advanced Econometrics II

1)

0

!0

xi ,t 1 )

(1,K 1 )

0

!0

April 2018

125 / 209

3.2 Anderson and Hsiao (1982) IV approach

IV estimator with the …rst set of instruments

b IV

γ

b

βIV

n

= Z0 X

T

(yi ,t

(xit

∑∑

i =1 t =2

n

T

∑∑

i =1 t =2

xit

C. Hurlin (University of Orléans)

1

1

Z0 y =

2 ) yi ,t 2

yi ,t

xi ,t

yi ,t 2

xi ,t

1 ) yi ,t 2

1

(yi ,t

0

yi ,t 2 (xit xi ,t 1 )

(xit xi ,t 1 ) (xit xi ,t

!

yi ,t

1)

0

!!

1

1)

Advanced Econometrics II

April 2018

126 / 209

3.2 Anderson and Hsiao (1982) IV approach

IV estimator with the second set of instruments

b IV

γ

b

βIV

n

1

= Z0 X

T

(yi ,t

(xit

∑∑

i =1 t =3

n

T

∑∑

i =1 t =3

1

yi ,t

xit

C. Hurlin (University of Orléans)

Z0 y =

yi ,t

xi ,t

2

2 ) (yi ,t 2

1 ) (yi ,t 2

yi ,t 3

xi ,t 1

yi ,t

yi ,t

(yi ,t

3)

3)

yi ,t

Advanced Econometrics II

(yi ,t

(xit

!

2

yi ,t

xi ,t

3 ) (xit

1 ) (xit

xi ,t

xi ,t

1

1)

1)

April 2018

127 / 209

0

3. Instrumental variable (IV) estimators

Remarks

1

The …rst estimator (with zit = yi ,t 2 ) has an advantage over the

second one (with zit = yi ,t 2 yi ,t 3 ), in that the minimum number

of time periods required is two, whereas the …rst one requires T

3.

2

In practice, if T

3, the choice between both depends on the

correlations between (yi ,t 1 yi ,t 2 ) and yi ,t 2 or (yi ,t 2 yi ,t

=> relevance assumption.

3)

Anderson, T.W., and C. Hsiao (1981). Estimation of Dynamic Models with

Error Components, Journal of the American Statistical Association, 76,

598–606

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

128 / 209

3.2 Anderson and Hsiao (1982) IV approach

The Anderson and Hsiao (1982) IV approach

1

First step: …rst di¤erence transformation

2

Second step: choice of instruments and IV estimation of γ and β

3

Third step: estimation of ρ

4

Fourth step: estimation of the variances σ2α and σ2ε

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

129 / 209

3.2 Anderson and Hsiao (1982) IV approach

Third step

yit = γyi ,t

1

0

0

+ β xit + ρi ω i + αi + εit

b IV and b

Given the estimates γ

βIV , we can deduce an estimate of ρ,

the vector of parameters for the time-invariant variables ω i .

Let us consider, the following equation

yi

b IV y i ,

γ

with vi = αi + εi .

1

0

b

βIV x i = ρ0 ω i + vi

i = 1, ..., n

The parameters vector ρ can simply be estimated by OLS.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

130 / 209

3.2 Anderson and Hsiao (1982) IV approach

De…nition (parameters of time-invariant variables)

A consistent estimator of the parameters ρ is given by

n

b

ρ

=

(K 2 ,1 )

with hi = y i

b IV y i ,

γ

C. Hurlin (University of Orléans)

1

∑ ωi ωi0

i =1

!

1

n

∑ ωi hi

i =1

!

0

b

βIV x i .

Advanced Econometrics II

April 2018

131 / 209

3.2 Anderson and Hsiao (1982) IV approach

The Anderson and Hsiao (1982) IV approach

1

First step: …rst di¤erence transformation

2

Second step: choice of instruments and IV estimation of γ and β

3

Third step: estimation of ρ

4

Fourth step: estimation of the variances σ2α and σ2ε

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

132 / 209

3.2 Anderson and Hsiao (1982) IV approach

Fourth step: estimation of the variances

De…nition

b IV , b

Given γ

βIV , and b

ρ, we can estimate the variances as follows:

with

b2α =

σ

bεit = (yi ,t

b2ε =

σ

1 n

yi

n i∑

=1

yi ,t

C. Hurlin (University of Orléans)

1)

T n

1

∑ bε2it

n (T 1) t∑

=2 i =1

b IV y i ,

γ

b IV (yi ,t

γ

0

1

1

b

βIV x i

yi ,t

Advanced Econometrics II

2

b

ρ0 zi

2)

0

b

βIV (xi ,t

1 2

b

σ

T ε

xi ,t

1)

April 2018

133 / 209

3.2 Anderson and Hsiao (1982) IV approach

Theorem

The instrumental-variable estimators of γ, β, and σ2ε are consistent when

n (correction of the Nickell bias), or T , or both tend to in…nity.

b IV = γ

plim γ

n,T !∞

plim b

βIV = β

n,T !∞

b2ε = σ2ε

plim σ

n,T !∞

The estimators of ρ and σ2α are consistent only when n goes to in…nity.

plim b

ρ=ρ

n !∞

C. Hurlin (University of Orléans)

b2α = σ2α

plim σ

n !∞

Advanced Econometrics II

April 2018

134 / 209

3.2 Anderson and Hsiao (1982) IV approach

Key Concepts SubSection 3.2

1

Anderson and Hsiao (1982) IV approach.

2

The 4 steps of the estimation procedure.

3

First di¤erence transformation of the dynamic panel model.

4

Tow choices of instrument.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

135 / 209

Section 4

Generalized Method of Moment (GMM)

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

136 / 209

4. The GMM approach

Let us consider the same dynamic panel data model as in section 3:

yit = γyi ,t

1

0

0

+ β xit + ρ ω i + αi + εit

αi are the (unobserved) individual e¤ects,

xit is a vector of K1 time-varying explanatory variables,

ω i is a vector of K2 time-invariant variables.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

137 / 209

4. The GMM approach

Assumptions: we assume that the component error term vit = εit + αi

E (εit ) = 0, E (αi ) = 0

E (εit εjs ) = σ2ε if j = i and t = s, 0 otherwise.

E (αi αj ) = σ2α if j = i, 0 otherwise.

E (αi xit ) = 0, E (αi ω i ) = 0 (exogeneity assumption for ω i )

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

138 / 209

4. The GMM approach

De…nition (First di¤erence model)

The GMM estimation method is based on a model in …rst di¤erences, in

order to swip out the individual e¤ects αi and th variables ω i :

(yit

yi ,t

1)

= γ (yi ,t

1

yi ,t

2) +

0

β (xit

xi ,t

1 ) + εit

εi ,t

1

for t = 2, .., T .

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

139 / 209

4. The GMM approach

Intuition of the moment conditions

Notice that yi ,t 2 and (yi ,t 2 yi ,t

instruments for (yi ,t 1 yi ,t 2 ).

All the lagged variables yi ,t

E (yi ,t

E (yi ,t

2 j

2 j

(εi ,t

(yi ,t

εi ,t

1

2 j,

1 ))

yi ,t

3)

are not the only valid

for j

0, satisfy

= 0 Exogeneity property

2 ))

6= 0 Relevance property

Therefore, they all are legitimate instruments for (yi ,t

C. Hurlin (University of Orléans)

Advanced Econometrics II

1

yi ,t

April 2018

2 ).

140 / 209

4. The GMM approach

Intuition of the moment conditions

The m + 1 conditions

E (yi ,t

2 j

(εi ,t

εi ,t

1 ))

= 0 for j = 0, 1, .., m

can be used as moment conditions in order to estimate

θ = β, γ, ρ, σ2α , σ2ε

Arellano, M., and S. Bond (1991). “Some Tests of Speci…cation for Panel

Data: Monte Carlo Evidence and an Application to Employment Equations,”

Review of Economic Studies, 58, 277–297.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

141 / 209

4. The GMM approach

Remark: The moment conditions

E (yi ,t

2 j

(εi ,t

εi ,t

1 ))

= 0 for j = 0, 1, .., m

mean that there exists a vector of parameters (true value)

0

0

0

θ 0 = β0 , γ0 , ρ0 , σ2α0 , σ2ε0

such that

E yi ,t

where ∆ = (1

2 j

∆yit

γ0 ∆yi ,t

1

0

β0 ∆xit

=0

L) and L denotes the lag operator .

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

142 / 209

4. The GMM approach

We consider two alternative assumptions on the explanatory variables xit

1

The explanatory variables xit are strictly exogeneous.

2

The explanatory variables xit are pre-determined.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

143 / 209

4. The GMM approach

We consider two alternative assumptions on the explanatory variables xit

1

The explanatory variables xit are strictly exogeneous.

2

The explanatory variables xit are pre-determined.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

144 / 209

4. The GMM approach

Assumption: exogeneity

We assume that the time varying explanatory variables xit are strictly

exogeneous in the sense that:

0

E xit εis

C. Hurlin (University of Orléans)

= 0 8 (t, s )

Advanced Econometrics II

April 2018

145 / 209

4. The GMM approach

De…nition (moment conditions)

For each period, we have the following orthogonal conditions

E (qit ∆εit ) = 0,

t = 2, .., T

= yi 0 , yi 1 , .., yi ,t

qit

(t 1 +TK 1 ,1 )

0

0

0

where xi = xi 1 , .., xiT , ∆ = (1

C. Hurlin (University of Orléans)

0

2 , xi

0

L) and L denotes the lag operator

Advanced Econometrics II

April 2018

146 / 209

4. The GMM approach

Example (moment conditions)

0

The condition E (qit ∆εit ) = 0, qit = (yi 0 , yi 1 , .., yi ,t 2 , xi0 ) at time t = 2

becomes

!

yi 0

E

qi 2 ∆εi 2 = E

0

( εi 2 εi 1 ) =

xi0

(1 +TK 1 ,1 )

(1 +TK 1 ,1 ) (1,1 )

0

0

0

where xi = xi 1 , .., xiT . At time t = 3, we have

E

qi 3 ∆εi 3

(2 +TK 1 ,1 ) (1,1 )

C. Hurlin (University of Orléans)

!

00

1

yi 0

= E @ @ yi 1 A ( ε i 3

xi0

Advanced Econometrics II

1

εi 2 ) A =

0

(2 +TK 1 ,1 )

April 2018

147 / 209

4. The GMM approach

Under the exogeneity assumption, what is the number of moment

conditions?

E (qit ∆εit ) = 0, t = 2, .., T

Time

Number of moment conditions

t=2

1 + TK1

t=3

2 + TK1

...

...

t=T

total

C. Hurlin (University of Orléans)

T

T (T

1 + TK1

1) (K1 + 1/2)

Advanced Econometrics II

April 2018

148 / 209

4. The GMM approach

Proof: the total number of moment conditions is equal to

r

= 1 + TK1 + 2 + TK1 .. + TK1 + (T 1)

= T (T 1) K1 + 1 + 2 + .. + (T 1)

T (T 1)

= T ( T 1 ) K1 +

2

1

= T ( T 1 ) K1 +

2

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

149 / 209

4. The GMM approach

Stacking the T

∆yi

(T 1,1 )

1 …rst-di¤erenced equations in matrix form, we have

= ∆yi ,

β + ∆εi

1 γ + ∆Xi

(T 1,K 1 )(K 1 ,1 )

(T 1,1 )

(T 1,1 )(1,1 )

i = 1, .., N

where :

∆yi

(T 1,1 )

0

B

=B

@

yi 2

yi 3

yiT

C. Hurlin (University of Orléans)

1

yi 1

yi 2

..

yi ,T

C

C ∆yi ,

A

(T

1

1

1,1 )

0

B

=B

@

Advanced Econometrics II

yi 1

yi 2

1

yi 0

yi 1

..

yiT

1

yi ,T

2

C

C

A

April 2018

150 / 209

4. The GMM approach

Stacking the T

∆yi

(T 1,1 )

1 …rst-di¤erenced equations in matrix form, we have

= ∆yi ,

β + ∆εi

1 γ + ∆Xi

(T 1,K 1 )(K 1 ,1 )

(T 1,1 )

(T 1,1 )(1,1 )

i = 1, .., N

where :

∆Xi

(T 1,K 1 )

0

B

=B

@

C. Hurlin (University of Orléans)

xi 2

xi 3

xiT

1

xi 1

xi 2

..

xi ,T

1

C

C

A

∆εi

(T 1,1 )

Advanced Econometrics II

0

B

=B

@

εi 2

εi 3

εiT

1

εi 1

εi 2

..

εi ,T

1

C

C

A

April 2018

151 / 209

4. The GMM approach

De…nition (moment conditions)

The conditions E (qit ∆εit ) = 0 for t = 2, .., T , can be written as

E

0

B

B

B

Wi = B

B

B

@

where r = T (T

Wi

∆εi

(r ,T 1 )(T 1,1 )

qi 2

0

!

= 0

(m,1 )

...

0

(1 +TK 1 ,1 )

0

qi 3

(2 +TK 1 ,1 )

0

..

..

qiT

(T 1 +TK 1 ,1 )

1

C

C

C

C

C

C

A

1) (K1 + 1/2) is the number of moment conditions.

C. Hurlin (University of Orléans)

Advanced Econometrics II

April 2018

152 / 209

4. The GMM approach

Example (moment conditions, vectorial form)

At time t = 2, we have

E (qi 2 ∆εi 2 ) = E

yi 0

xi0

( εi 2

εi 1 )

=0

In a vectorial form we have the …rst set of 1 + TK1 moment conditions

0

0

11

εi 2 εi 1

B