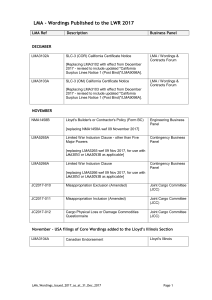

KNOWLEDGE BITES | THE FUTURE AT LLOYD’S On beginning of October 2019, Lloyd’s of London has unveiled a blueprint for action to facilitate its Future at Lloyd’s project, which aims to “build the most advanced insurance marketplace in the world.” This first blueprint, called “Blueprint One,” sets out six ideas of improved ways of working, with a focus on digital, data and technology to deliver greater benefits to customers. It will be updated, at least, on an annual basis. The six integrated solutions are: Complex risk platform: A digital, end-to-end that complements face-to-face negotiation to submit, quote, bind, issue, endorse and renew complex risks for insurance and reinsurance business. Lloyd’s risk exchange: An exchange for underwriting relatively non-complex, high-volume, low-value risks, which enables policies to be created and bought digitally. Claims solution: A solution designed to transforms the claims process by automating simple claims, using straight-through processing, resolving standard claims handling on behalf of the market and empowering lead underwriters to handle the most complex claims. Capital solution: A solution that offers alternative capital providers more options to attach risk more flexibly, for the benefit of all market participants, supported by a new capital platform. Syndicate-in-a-Box: A new way to bring innovative, accretive, and profitable business into the market for a set period, without the need for a physical presence in Lloyd’s, but subject to the same performance and regulatory controls as all new market entrants. Services hub: A set of high-quality, value-add services to support the market’s business, including access to Lloyd’s data, insights and analytics, business support functions, and product innovation accelerators. All these resources will be access via an online portal. let’s talk business | https://www.youtube.com/letstalkbusiness