Microeconomics B Lecture Notes

Lecture 1: Models in Economics and the Market

Reference: Chapter 1 of Varian and Essential reading for topic 1

Introduction

•

•

“The Theory of Economics does not furnish a body of settled conclusions immediately

applicable to policy. It is a method rather than a doctrine, an apparatus of the mind, a

technique of thinking which helps its possessor to draw correct conclusions”

o John Maynard Keynes

“…The real test of our success will not be merely how well we understand the general

principles that govern economic interactions, but how well we can bring this knowledge to

bear on practical questions of microeconomics engineering…”

What is a model?

•

•

•

•

“A model is a formal framework for representing the basic features of a complex system by a

few central relationships. Model take the form of graphics, mathematical equation, and

computer programs” (Samuelson and Nordhaus, 1998).

“A model or theory makes a series of simplification from which it deduces how people will

behave. It is a deliberate simplification of reality” (Begg, Fischer, and Donbusch, 2000).

Models are essential tools for economists. They use models to make testable predictions.

The main purpose of using them is to simplify the reality.

Economists test theories by checking whether predictions are correct.

Models are best if…

•

Some important characteristics of good models:

o Simple, parsimonious, ‘Kiss’ (2 agents, 2 goods, 2 inputs etc).

o General, rather than specific.

o Tractable, internally coherent

o Cross-contextual, rather than particular.

o Uses standardised language.

o Insightful, useful, credible worlds

Parallels with Models in Biology

•

•

•

•

Even for the broadest canvas, our models give insights applicable far beyond purely

economic content.

Adam Smith saw the possibility of a spontaneous order arising from competition between

large numbers of selfish individuals for limited resources.

His ‘invisible hand’ imagery from Wealth of Nations (1776) inspired Charles Darwin’s theory

of natural selection he presented in On the Origin of Species (1859).

Much later, models of strategies interdependence also influenced biologists. MaynardSmith’s (1976) predator-prey model was inspired by the solution concept of mixed-strategy

equilibria (MSE) to develop his evolutionary stable strategies (ESS) concept.

Modelling as Art

•

•

•

The simpler and more abstractly expressed a model is, the easier we can find analogies and

make inductive influences to understanding real problems.

This is economics as ‘a technique of thinking’, again.

The assumption that wed need, or can drop, depends, on which phenomena we are seeking

to model.

o Are we looking at individual choice or market patterns?

o Should we assume cognitive constraints, or selfishness, or can they be safely

ignored?

o Are the decisions made repeatedly, with strong incentives, or are they one-off

choices with weak or no incentives?

Why Models?

•

•

•

•

•

•

•

•

•

•

•

•

We may create a model to predict, explain or provide a basis for critique of some policy.

Models can be a powerful aid to reasoning.

Our model may also identify a ‘correct’ way to reason or to decide, whether it depicts reality

or not.

Advice and education may be needed for the decision taker.

Or, a model give advice consistent with its assumption, but in doing so raises previously

unsuspected questions about those assumptions!

Either way, a model can make a good benchmark against which to test our understandings

and our decisions. If we don’t conform to the predictions, ask why?

Economics is, after all, a technique of thinking and reasoning.

“Theories are not refuted, they are embarrassed” (A. Tversky)

Perhaps our models are of more use as a source of analogies than as a source of general

rules?

Our models can draw attention to analogies between cases including the case exemplified

by the model itself.

Enough similar cases may lead to generation to a new rule (induction). This can be a source

of insight and influence on policy.

A model may uncover a steady state, or equilibrium, as the outcome of the various forces

interacting in accord with the rules specified by the mode. This can show the direction real

outcomes tend towards, ceteris paribus.

A model can provide a simple analogy for inductive inference.

Example: Akerlof’s (1970) Market for Lemons

•

•

•

“The automobile market is used as a finger to illustrate and develop [his] thoughts. It should

be emphasised that this market is chosen for its concreteness and ease in understanding,

rather than for its importance or realism”

“Suppose (for the sake of clarity rather than realism) that there are just four types of cars:

new, used, good and bad”

Akerlof’s model shows that if the seller knows the quality of a used car and the buyer does

not, there must be just a single price (P) at which trade occurs, but at this price no used cars

will be bought. So no market for used cars would exist, even if there are gains from trade to

be had.

Example: Hotelling’s (1928) Location Game

•

•

•

•

Two sellers of similar goods must choose a location along Main Street. Let customers be

uniformly distributed along the street and only buy from the seller located closest to them.

His model shows they will locate very close to each other, at the centre of the town. Any

move away from the centre allows their rival to capture more than half the market. This

identifies the equilibrium of the ‘game’.

If we use abstract language (players, payoffs) we may notice an analogy to political

competition. Two parties compete for votes, voters are distributed along a political

spectrum. Which voters do they need their policies to appeal to, if they are to win the most

votes?

This insight gave us the ‘median voter theorem’! If the model was expressed in specific

language, this analogy may have been missed.

Economic Modelling

•

•

•

What causes what in economic systems?

At what level of detail shall we model an economic phenomenon?

Which variables are determined outside the model (exogenous) and what are to be

determined the model (endogenous)?

Modelling the Apartment Market

•

•

•

•

Who will rent close apartments?

At what price?

Will the allocation of apartments be desirable in any sense?

How can we construct an insightful model to answer these questions?

Economic Modelling Assumptions

•

Two basic postulates:

o Rational Choice: Each person tries to choose the best alternative available to him or

her.

o Equilibrium: Market price adjust until quantity demanded equals quantity supplied.

Modelling Apartment Demand

•

•

•

•

Demand: Suppose the most any one person is willing to pay to rent a close apartment is

$500/month. Then P= $500 results in Qd=1.

Suppose the price has to drop to $490 before a 2nd person would rent. Then P=$490 results

in Qd=2.

The lower is the rental rate P, the larger quantity of close apartments demanded:

o Price decreases, results in Qd increases.

The quantity demanded vs price graph is the market demand curve for close apartments.

Market Demand Curve for Apartments

Modelling Apartment Supply

•

Supply: It takes time to build more close apartments so in this short-run the quantity

available is fixed (at say 100).

Competitive Market Equilibrium

•

•

•

•

‘low’ rental price-> quantity demanded of close apartments exceeds quantity available->

price will rise.

‘high’ rental price-> quantity demanded less than quantity available-> price will fall.

Quantity demanded= quantity available-> price will neither rise nor fall.

So the market is at a competitive equilibrium.

•

•

•

•

•

Q: Who rents the close apartments?

A: Those most willing to pay.

Q: Who rents the distant apartments?

A: Those least willing to pay.

So the competitive market allocation is by “willingness-to-pay”

Comparative Statics

•

•

•

•

•

•

•

What is exogenous in the model?

o Price of distant apartments.

o Quantity of close apartments.

o Incomes of potential renters.

What happens if these exogenous variables change?

Suppose of the price of distant apartment rises.

Demand for close apartments increases (rightward shift), causing a higher price for close

apartments.

Higher demand=

Suppose there are more close apartments, supply is greater, so the price of close

apartments falls.

High Supply=

•

•

Suppose potential renters’ income rise, increasing their willingness-to-pay for close

apartments.

Demand rises (upward shift), causing higher prices for close apartments.

Taxation Policy Analysis

•

•

•

•

•

•

•

•

Local government taxes apartment owners.

What happens to:

o Price

o Quantity of close apartments rented?

Is any of the tax ‘passed’ to renters?

Market supply is unaffected.

Market demand is unaffected.

So the competitive market equilibrium is unaffected by the tax.

Price and the quantity of close apartments rented are not changed.

Landlords pay all of the tax.

Imperfectly Competitive Markets

•

Amongst many possibilities are:

o A monopolistic landlord.

o A perfectly discriminatory monopolistic landlord.

o A competitive market subject to rent control.

A Monopolistic Landlord

•

•

•

•

•

When the landlord sets a rental price (P) he rents D(P) apartments.

Revenue= pD(p).

Revenue is low if P=0

Revenue is low if p is so high that D(p)=0.

An intermediate value for p maximises revenue.

Monopolistic Market Equilibrium

Perfectly Discriminatory Monopolistic Landlord

•

•

•

Imagine the monopolist knew everyone’s willingness-to-pay.

Charge $500 to the most willing-to-pay.

Charge $490 to the 2nd most willing-to-pay etc.

Discriminatory Monopolistic Market Equilibrium

Rent Control

•

Local government imposes a maximum legal price, Pmax<Pe, the competitive price.

Which Market Outcomes are Desirable?

•

Which is better?

o Rent control

o Perfect competition

o Monopoly

o Discriminatory Monopoly

Pareto Efficiency

•

•

•

•

•

•

•

•

•

•

•

•

•

Vilfredo Pareto; 1848-1923

A Pareto outcome allows no ‘wasted welfare’;

I.e. the only way one person’s welfare can be improved is to lower another person’s welfare.

Jill has an apartment; Jack does not.

Jill values the apartment at $200; Jack would pay $400 for it.

Jill could sublet the apartment to Jack for $300.

Both gain, so it was Pareto inefficient for Jill to have the apartment.

A Pareto inefficient outcome means there remain unrealised mutual gains-to-trade.

Any market outcome that achieves all possible gains-to-trade must be pareto efficient.

Competitive Equilibrium:

o All close apartment renters value them at the market price pe or more.

o All others value close apartments at less than pe.

o So no mutually beneficial trades remain.

o So the outcome is Pareto efficient.

Discriminatory Monopoly:

o Assignment of apartments is the same as with the perfectly competitive market.

o So the discriminatory monopoly outcome is also Pareto efficient.

Monopoly:

o Not all apartments are occupied.

o So a distant apartment renter could be assigned a close apartment and have higher

welfare without lowering anybody else’s welfare.

o So the monopoly is Pareto inefficient.

Rent Control:

o Some close apartments are assigned renters valuing them at below the competitive

price Pe.

o Some renters valuing a close apartment above Pe don’t get close apartments.

o Pareto inefficient outcome.

Session 2 and 3: Asymmetric Information

Introduction

•

•

•

•

In purely competitive market all agents are fully informed about traded commodities and

other aspects of the market.

What about markets for medical services, or insurance, or used cars?

A credit card owner knows more about her ability and willingness too pay than her bank.

A doctor knows more about medical services than does the buyer.

Asymmetric Information

•

•

•

•

•

•

•

An insurance buyer knows more about his riskiness than does the seller.

A used car’s owner knows more about it than does a potential buyer.

These are called ‘credence goods’

Markets with one side or the other imperfectly informed are markets with imperfect

information.

Imperfectly informed markets with one sided better informed than the other are markets

with asymmetric information.

In what ways can asymmetric information affect the functioning of a market?

Four applications will be considered:

o Adverse selection

o Signalling

o Moral hazard

o Incentives contracting.

Adverse Selection

•

•

•

•

Adverse selection refers to situations where one side of the market can’t observe the ‘type’

or quality of the goods on other side of the market. Sellers have information that buyers do

not have, or vice versa, about some aspect of product quality.

Adverse selection is sometimes called a hidden information problem which is a form of

market failure.

E.g. in the case of insurance, adverse selection is the tendency of those in dangerous jobs or

high-risk lifestyles to get life insurance.

Consider Akerlof’s (1970) used car market:

o Two types of cars; ‘lemons’ and ‘peaches’

o Each lemon seller will accept $1000; a buyer will pay at most $1200.

o Each peach seller will accept $2000; a buyer will pay at most $2400.

o If every buyer can tell a peach from a lemon, then lemons sell for between $1000

and $1200 and peaches sell for between $2000 and $2400.

o Gains-to-trade are generated when buyers are well informed.

o Suppose no buyer can tell a peach from a lemon before buying.

o Let q b the fractions of peaches. 1-q is the fraction of lemons.

o Expected value to a buyer of any car is at most:

▪ EV= $1200 (1-q)+ 2400q.

o Suppose EV>$2000.

o Every seller can negotiate a price between $2000 and $EV (no matter if the car is a

lemon or a peach).

o All sellers gain from being in the market.

•

•

•

•

•

•

•

•

•

•

o Suppose EV < $2000.

o A peach seller cannot negotiate a price above $2000 and will exit the market.

o So all buyers know that remaining sellers own lemons only.

o Buyers will pay at most $1200 and only lemons are sold.

Hence “too many” lemons “crowd out” the peaches from the market.

Gains-to-trade are reduced since no peaches are traded.

The presence of the lemons inflicts an external cost on buyers and peach owners.

How many lemons can be in the market without crowding out the peaches?

Buyers will pay $2000 for a car only if:

o EV= $1200 (1-q) + $2400q ≥ $2000

How many lemons can be in the market without crowding out the peaches?

Buyers will pay $2000 for a car only if:

o EV= $1200(1-q)+$2400q≥$2000.

▪ => q≥2/3.

o So if over one-third of all cars are lemons, then only lemons are traded.

A market equilibrium in which both types of cars are traded and cannot be distinguished by

the buyers is a pooling equilibrium.

A market equilibrium in which only one of the two types of cars is traded, or both are traded

but can be distinguished by the buyers, is a separating equilibrium.

What if there is more than two types of cars?

o Suppose that:

▪ Car equality is uniformly distributed between $1000 and $2000.

▪ Any car that a seller values at $X is valued by a buyer at $(X+300).

o Which cars will be traded?

•

•

•

•

•

•

Where does this unravelling of the market end?

Let vh be the highest seller value of any car remaining in the market.

The expected seller value of a car is::

o ½ X 1000 + ½ X VH.

So a buyer will pay at most:

o ½ x 1000 + ½ x vh + 300.

This must be the price which the seller of the highest value car remaining in the market will

just accept; i.e.

o ½ x 1000 + ½ x vh +300= VH

½ x 1000 +1/2 x vh+300= Vh= $1600.

o Adverse selectio0n drives out all cars valued by sellers at more than $1600.

Adverse selection with quality choice

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Now each seller can choose the quality, or value, of her product.

Two umbrellas; high-quality and low-quality.

Which will be manufactured and sold?

Buyers value a high-quality umbrella at $14 and a low-quality umbrella at $8.

Before buying, no buyer can tell quality.

Marginal production cost of a high-quality umbrella is $11.

Marginal product cost of a low-quality umbrella is $10.

Suppose every seller makes only high-quality umbrellas.

Every buyer pays $14 and sellers’ profit per umbrella is $14-$11= $3.

But then a seller can make low-quality umbrellas for which buyers still pay $14, so increasing

profit to $14-$10= $4.

There is no market equilibrium in which only high-quality umbrellas are traded.

Is there a market equilibrium in which only low-quality umbrellas are traded?

All sellers make only low-quality umbrellas.

Buyers pay at most $8 for an umbrella, while marginal production cost is $10.

There is no market equilibrium in which only low-quality umbrellas are traded.

Now we know there is no market equilibrium in which only one type of umbrella is

manufactured.

Is there an equilibrium in which both types of umbrella are manufactured?

A fraction q of sellers make high-quality umbrellas; 0 < q < 1.

Buyers’ expected value of an umbrella is:

o EV= 14q + 8 (1-q)= 8 + 6q.

Higher-quality manufacturers must recover the manufacturing cost,

o EV= 8 + 6q ≥ 11 -> q ≥ ½.

So at least half of the sellers must make high-quality umbrellas for there to be a pooling

market equilibrium.

But then a high-quality seller can switch to making low-quality and increase profit by $1 on

each umbrella sold.

Since all sellers reason this way, the fraction of high-quality sellers will shrink towards zero—

but then buyers will pay only $8.

So, there is no equilibrium in which both umbrella types are traded.

The market has no equilibrium:

o With just one umbrella type traded.

o With both umbrella types traded.

So, the market has no equilibrium at all.

Adverse election has destroyed the entire market!

How do we counter the bad effects of adverse selection?

Some of these are signalling by the informed party, others are screening by the less-informed.

•

•

•

•

Regulation: Food and medicines must meet certain safety standards.

Reputation: Must sell good quality items, or declare the true quality, so customers will

return to you. Check ratings on trip advisor for example.

Assurance: Pay an expert to check the car for you.

Warranty: Guarantee a certain standard (for a certain period of time) or return the money

to the customer.

Signalling

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Adverse selection is an outcome of an informational deficiency.

What if information can be improved by high-quality sellers signalling credibly that they are

high-quality?

E.g. warranties, professional credentials, references from previous clients etc.

A labour market has two types of workers; high-ability and low-ability.

A high-ability worker’s marginal product is aH.

A low-ability worker’s marginal product is aL.

o aL < aH.

A fraction H of all workers are high-ability.

1-H is the fraction of low-ability workers.

Each worker is paid his expected marginal product.

If firms knew each worker’s type they would:

o Pay each high-ability worker wH= aH.

o Pay each low-ability worker wL= aL.

If firms cannot tell workers’ types then every worker is paid the (pooling) wage rate; i.e. the

expected marginal product.

o Wp= (1-h) aL + haH.

Wp= (1-h) aL + haH < aH, the wage rate paid when the firm knows a worker really is highability.

So high-ability workers have an incentive to find a credible signal.

Workers can acquire “education”

Education costs a high-ability worker cH per unit and costs a low-ability worker cL per unit.

o cL > cH.

Suppose that education ahs no effect on workers’ productivities; i.e. the cost of education is

a deadweight loss.

High-ability workers will acquire eH education units if:

o (i) wh-wl= ah-al >cheh, and

o (ii) wh-wl= ah – al < cleh

(I) says acquiring eh units of education benefits high-ability workers.

(ii) says acquiring eh education units hurts low-ability workers.

Ah-al > cheh and ah-al < cleh

Together require

o Ah-al/cl <eh < ah-al/ch

Acquiring such an education level credibly signals high-ability, allowing high-ability workers

to separate themselves from low-ability workers.

Question: Given that high-ability workers acquire eh units of education, how much

education should low-ability workers acquire?

Answers: Zero. Low-ability workers will be paid wl=al so long as they do not have eh units of

education and they are still worse off if they do.

Example: Why study for a degree? For the human capital? Or as a signal of talent?

Signalling can improve information in the market.

But, total output did not change and education was costly so signalling worsened the

market’s efficiency.

So improved information nee not improve gains-to-trade.

•

•

•

Separating equilibrium: Each type of worker making a choice that allows him to separate

himself from the other type.

o This equilibrium is inefficient from a social point of view. The acquisition of signal is a

total waste from the society’s point of view.

Pooling Equilibrium: Each type of worker making the same choice.

o Signalling can make things better or worse depending on each case.

o The key requirement for education to separate the types is that education should be

sufficiently more costly for the unable workers than the able workers.

The actual signal sent by educational attainment is considerable more complex than the

simple model.

Moral Hazard

•

•

•

•

•

•

•

•

Moral hazard refers to situations where one side of the market can’t observe the actions of

the other. It is also called a hidden action problem.

It is a reaction to incentives that increase the risk of a loss and is a consequence of

asymmetric information.

If you have a full car insurance are you more likely to leave your car unlocked?

Example: Seatbelt Laws. After these were introduced, driver deaths fell but pedestrian and

cyclist death rose! This effect is called ‘risk compensation’

If an insurer knows the exact risk from insuring an individual, then a contract specific to that

person can be written.

If all people look alike to the insurer, then one contract will be offered to all insureds; highrisk and low-risk types are then pooled, causing low-risks to subsidize high-risks.

Examples of efforts to avoid moral hazard by using signals are:

o Higher life and medical insurance premiums for smokers or heavy drinks of alcohol.

o Lower car insurance premiums for contracts with higher deductibles or for drivers

with histories of safe driving.

Equilibrium typically involves some form of rationing- firms would like to provide more than

they do, but they are unwilling to do so since it will change the incentives of their customers.

Incentives Contracting

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

How can I get someone to do something for me?

A worker is hired by a principal to do a task.

Only the workers knows the effort she exerts (asymmetric information).

The effort exerted affects the principal’s payoff.

The principal’s problem: design an incentives contract that induces the workers to exert the

amount of effort that maximises the principle’s payoff.

e is the agent’s effort.

Principal’s reward is:

o Y= f(e)

An incentive contract is a function s(y) specifying the worker’s payment when the principal’s

reward is y. The principal’s profit is thus:

o TT= y- s(y) = f(e)-s (fe)).

Let U be the worker’s (reservation) utility of not working.

To get worker’s participation, the contract must offer the worker a utility of at least U.

The worker’s utility cost of an effort level e is c(e).

So the principal’s problem is choose e to:

o Max TTp= f(e)-s(f(e)).

▪ Subject to:

• S(f(e))-c(e) ≥U. (participation constraint).

To maximize his profit the principal designs the contract to provide the worker with her

reservation utility level. That is, …

Substitute for s(f(e)) and solve:

o Max TTp= f(e)-c(e)-U.

The principal’s profit if maximised within”

o F’(e)=c’(e).

F’(e)=c’(e) -> e=e*

o The contract that maximises the principal’s profit insists upon the worker effort level

e* that equalizes the worker’s marginal effort cost to the principal’s marginal payoff

from worker effort.

How can the principal induce the worker to choose e=e*?

o E-e* must be most preferred by the worker.

o So the contract s(y) must satisfy the incentive-compatibility constraint:

▪ S(f(e*))-c(e*)≥s(f€)-c(e), for all e≥0.

• In words: The utility to the worker from choosing e* must be greater

than the utility of any other choice of effort.

The incentive scheme must satisfy two conditions:

o First, it must give total utility to the worker for U.

o Second, it must take the marginal product of effort equal to the marginal cost of

effort at the effort level e*.

In essence, for an incentive scheme to be efficient, it must make sure that the person who

makes the effort decision is the residual claimant to the output. That is Marginal Benefit=

Marginal Product.

Session 4: Market Design

Introduction

•

•

•

•

•

In economics our usual assumption is that your demand for something will be matched with

a willing seller through the price mechanism.

If I wish to pay the market price p for a good, I am confident a willing seller can be found

easily. I do not need to worry about my offer being accepted; I do not need to court, or

pursue (or stalk) the owner of the good; market pricing takes care of everything.

Although this is true for many markets, it is not true for all markets. There are a number of

reasons for this.

However some allocation has to be made somehow! How do we ensure we have a good

mechanism in place, if market-clearing pricing can’t or won’t be introduced? That is, what do

we do if there is no price!

We will see some examples next.

What is the nature of the problem?

•

The operation of markets when there is no price.

o Two sides of the market need to be matched.

o Participants on both sides of the market have preferences over who they are

matches with.

o Prices cannot be used.

Examples

Some examples of market where prices (p) do not clear the markets. These examples need some

other way of matching participants in the market (other than price).

1. Marriage Markets

a. Women do not offer matrimony for a price p and accept marriage to the first man to

pay price p.

2. Organ transplants

a. People do not offer to supply a kidney, a cornea and such for a price p, with those

needing a transplant getting one if they can pay p, not otherwise.

3. Selective high schools and universities

a. Eton, Harvard, Berkeley, do not admit any student prepared to pay a market clearing

price, p. They use pricing, but only as a partial means of allocating scarce spaces to

potential students.

4. Public Housing

a. Assessment of need, rather than priority from ability to pay.

Over time a society may change the degree to which pricing is used for resource allocation in

different markets.

Market Design

•

•

•

•

What are markets and marketplaces?

o What are they for?

o How do they work?

o How do they fail?

o How can we fix them when they’re broken?

These may be centralised (e.g., organ exchange) or decentralised (e.g., dating sites)

What is the nature of the problem?

o Two sides of the market need to be matched

o Participants on both sides of the market have preferences over who they are

matched with

o Prices cannot be use

This problem forces us to think more deeply about markets

o How do markets work?

o How can markets can fail?

o What can we do when markets fail?

Normal Markets

•

•

•

•

When buying 100 shares of Apple on the New York Stock Exchange, you don’t need to worry

about whether the seller will pick you

o you don’t have to submit an application or engage in any kind of courtship. Likewise,

the seller doesn’t have to pitch himself to you.

The price does all the work, bringing the two of you together at the price at which supply

equals demand.

o on the NYSE, the price decides who gets what.

The market helps do “price discovery” to find prices that work.

‘Normal Markets’

o Prices do all the work, clearing the market at a price where supply is matched to

demand.

o The identity of the buyers and sellers does not matter.

When prices don’t do all the work…

•

•

•

•

•

•

•

•

•

•

•

•

•

Harvard and Stanford don’t raise tuition until just enough applicants remain to fill the

freshman class.

Selective colleges try to keep the tuition low enough so that many students would like to

attend, and then they admit a fraction of those who apply.

Colleges don’t rely on prices alone to equate supply and demand

Labour markets and college admissions are more than a little like courtship and marriage:

each is a two-sided matching market that involves searching and wooing on both sides.

Many universities don’t rely on prices alone to clear their market. Elite universities operate

as a two-sided matching market. We will look at these kinds of markets in more detail.

My application to university was in the UK before fees were introduced. We could apply to

up to 5 universities through UCCA (a clearing house).

No price allocation used. Instead, the 5 you select consider your application, pre-exams,

then make conditional offers.

WA has TISC, though price is a large part of the decision these days. Offers are post-exam

results.

UWA recently announced a move to ‘conditional offers’ before TEE results are known.

Should Murdoch follow suit? Should early acceptances be binding? Is UWA starting an

‘unraveling’ of the market?

Nobel Laureate Al Roth calls this ‘the curse of exploding early offers’, a sign of faulty market

design.

Example: Medical Residents

o Old system:

▪ Students and hospitals made contracts 2 years in advance of graduation.

▪ There was a large degree of mismatch since student quality and preference

were unknown so far out from graduation.

▪ Offers came earlier and expired quickly.

▪ This caused inefficiency, and doctors and hospitals tried to change their

system.

o Clearing House

▪ Students submitted rank order lists over hospitals and hospitals submitted

rank order lists over students. The clearing house used these lists to decide

who works where.

▪ Problem: clearinghouse might assign hospitals and residents to matches

they liked less than the ones they could arrange by themselves outside the

clearinghouse.

▪ Some reforms of the system in the 1990’s

Curse of Exploding Early Offers (based on Roth(2008):

o Offers typically expire quickly

o Students find themselves required to respond to their first offer before learning

what other offers might be forthcoming

o Universities find that if they give students time to consider offers that were

ultimately declined, then other candidates to whom they would like to make offers

would already be committed

o To avoid such an outcome, universities keep pushing forward the selection deadline

and cutting short the decision period.

o Result: Poor matches of student with their University.

Matching Markets

•

•

•

•

•

Matching refers to how we get the many things that we can’t simply choose and pay for.

You can't just inform Princeton that you’re enrolling, or Google that you are showing up for

work! You also have to be admitted or hired.

Neither can Google or Princeton simply choose who will come to them; we need to apply.

Nor can one spouse can simply choose another: each also has to be chosen.

Matching markets are markets where prices alone do not clear the markets

Matching Markets: 2-sided

•

•

•

•

•

•

•

•

•

A stable, efficient solution can be found for either men proposing to women or women to

men.

Example: In speed dating, a set of men and women, equal numbers, determine a ranking of

‘acceptable’ partners from the ‘market’. Below some threshold, the person prefers to be

matched to herself!

A ‘stable’ allocation is where no-one perceives further gains from trade. The Gale-Shapley

‘deferred acceptance’ algorithm leads to stable matching.

Assume men propose to women

Consider a marriage market where males (m) and females (f) are seeking to be matched

together.

o A match is a set of pairs (m,w) such that each individual has one partner.

o A matching is stable if

▪ Every individual is matched with an acceptable partner.

▪ There is no (m,w) pair who would prefer to match with each other rather

than their assigned partner

Men and women rank all potential partners

Deferred Acceptance (DA)

o Each man proposes the highest ranked woman on his list

o Each woman examines her matches and rejects all offers except her highest ranked

but defers accepting it.

o Each rejected man removes the woman from his list, and makes a new offer to his

second preferred woman on his list.

o Each woman examines her matches and rejects all offers except her highest ranked

but defers accepting it.

o Continue until no man wishes to more offers

o Woman accepts the proposal she holds

An alternative form starts with the woman making the offers and the men

accepting/rejecting. But this may result in a different set of stable matches to those when

the man proposes.

Theorem: The outcome of the DA algorithm is a stable one-to-one matching

•

•

•

•

•

•

•

Unstable Match: When two people who are not matched together would prefer to be

matched, rather than their current match

Step 1: Each man proposes to his first choice.

Step 2: Each woman looks at the set of proposals received (if any), retains her highest

preference but defers accepting it. She rejects the others.

Step 3: The men rejected in the first step now propose to their second preference. The

women reassess the best offer, keep the best, defer accepting and reject the rest.

Step 4: This process continues until no men wish to make further proposals.

Step 5: Each woman then accepts the proposal she holds (which may not be the first one she

held) and the process ends.

o It has been proven that no-one is matched to an ‘unacceptable’ mate and

unmatched men or women prefer to be unmatched in the remaining pool.

o The same solution can be implemented by a ‘clearing house’ for schools, kidney’s,

colleges etc.

o This Gale-Shapley ‘deferred acceptance’ algorithm also shows there is an advantage

to the proposing side!

Theorem: The outcome of the DA algorithm is a stable one-to-one matching.

o An alternative form starts with the woman making the offers and the men

accepting/rejecting. But this may result in a different set of stable matches to those

when the man proposes.

o In general, the side that is doing the proposing (making offers) is more likely to be

matched with their higher ranked partners.

What do marketplace do?

•

•

•

•

•

•

There have been many poorly designed ‘market failures' of design, particularly where not

guided by theory. Real-world markets can be complex; lab experiments are used to try out

different market designs to help.

What have we learned about market design?

o Thickness

o Congestion

o Safe to be truthful and simple

Thickness: sufficient buyers and sellers are needed to transact with each other.

Congestion: a thick market may need sufficient time for participants to consider sufficient

possibilities and complete the transactions

Safety: participants must believe truthful revelation and actions are in their best interests,

‘strategy-proof’, no game playing

Based on Roth (2008):

o To function properly, markets need to do at least three things.

o 1. They need to provide thickness. Markers need to bring together a sufficiently

large proportion of potential buyers and sellers to produce satisfactory outcomes for

both sides of a transaction.

o 2. They need to make it safe so that agents believe that truthful revelation and

actions are in their best interests. When a good market outcome depends on such

disclosure, the market must offer participants incentives to reveal some of what

they know.

o 3. They need to overcome the congestion that thickness can bring, by giving market

participants enough time, or the means to conduct transactions fast enough, to

make satisfactory choices when faced with a variety of alternatives.

Example: Should Kidneys be bought and sold?

•

•

•

•

•

•

•

•

It’s illegal to buy or sell organs for transplantation

o Some people think it would be a good idea to allow kidneys to be bought and sold,

and others think it’s a horrible idea

Repugnance as a constraint on markets:

o We need to understand a lot more about how economic and business transactions

are understood by typical people. Prices could do the work, but we don’t want them

to.

Transplants are standard treatment for patients with failed kidneys.

Transplants come from two sources:

o Donors who have died.

o Living donor transplants

There is a shortage of transplant kidneys

Buying and selling kidneys is illegal

For a successful transplant, the donor kidney needs to be compatible with the patient. For

example, blood types(O, A, B and AB)

o O type patients can receive kidneys from O type donors

o A type patients can receive kidneys from O or A type donors

o B type patients can receive kidneys from O or B type donors

o AB type patients can receive kidneys from donors of any blood type (that is, O, A, B

or AB)

How to increase the supply of live donors? The problem is that the market for kidneys lacks

thickness

Kidney Exchange: Biological incompatibility

•

Good health and good will are not sufficient for a donor to be able to give a kidney to a

patient because of biologically incompatibility:

o Different blood types, or

o The patient’s immune system has already produced antibodies to some of the

donor’s protein.

Kidney Exchange: (an “in kind” exchange)

•

•

•

For a successful transplant, the donor kidney needs to be compatible with the patient. For

example, blood types(O, A, B and AB)

o O type patients can receive kidneys from O type donors

o A type patients can receive kidneys from O or A type donors

o B type patients can receive kidneys from O or B type donors

o AB type patients can receive kidneys from donors of any blood type (that is, O, A, B

or AB)

Donor 1 can match only match with Recipient 2

Donor 2 can match only match with Recipient 1

Kidney Exchange: List Exchange

•

Sometimes a different kind of exchange had also been accomplished, called a list exchange:

o A patient’s incompatible donor donated a kidney to someone who had high priority

on the waiting list for a cadaver kidney;

o In return, the donor’s intended patient received high priority to receive the next

compatible cadaver kidney that became available.

2-Way exchange involves 4 simultaneous surgeries

•

•

Donor 1 can match only match with Recipient 2 (two surgeries)

Donor 2 can match only match with Recipient 1 (two surgeries)

3-pair exchange (6 simultaneous surgeries)

•

•

•

•

•

For a successful transplant, the donor kidney needs to be compatible with the patient. For

example, blood types(O, A, B and AB)

o O type patients can receive kidneys from O type donors

o A type patients can receive kidneys from O or A type donors

o B type patients can receive kidneys from O or B type donors

o AB type patients can receive kidneys from donors of any blood type (that is, O, A, B

or AB)

Donor 1 can match only match with Recipient 2

Donor 3 can match only match with Recipient 1

Donor 2 can match only match with Recipient 3

Kidney Chain

o A kidney donor chain starts with one donor who donates their kidney.

o Suppose there is a recipient who has an incompatible match but is compatible with

the donor (at the top of the chain). The recipient receives the compatible donor

kidney.

o There is now an unmatched donor.

o Suppose there are another incompatible donor and recipient. The recipient could be

matched with the unmatched donor. Leaving their incompatible donor to be

matched with another compatible recipient.

o And so on….

o Provided the donors and recipients can be appropriately matched, the kidney chain

is a way for increasing thickness in the market for kidney transplants.

Market for New Economists

•

•

•

•

•

•

•

•

•

•

•

•

•

•

US Economics departments advertise in early autumn (Sept 1- Nov 30).

American Economic Association (AEA) publishes Job Openings for Economists (JOE).

PhD graduates apply with letters of reference and are invited for preliminary interview at

annual AEA meeting in January.

The (spot) market (Illinois Skills Match)-> thick market but congested because only a small

fraction of candidates was interviewed.

Departments have to make strategic decision: how much the department likes but also how

likely it can successfully hire a candidate.

The act of sending an application does not itself send a strong signal of how interested the

candidate might be.

Following the January meetings, ‘flyouts’ invitation is carried out, candidates visit campus

and make presentation and meet department staff.

Market is still congested: only a small subset of candidates are interviewed because of

financial constraint.

This part of the market is less organised and less well coordinated in time:

o Some hosts flyouts in January before making offers but some make offers while still

interviewing other candidates.

o Some offers have moderate deadlines while other are exploding (i.e. Take-it-orleave-it offers).

By March, the market becomes thin. Offers might not be accepted and it is how difficult to

know which candidates may still be on the market.

Similarly, candidates whose interviews and flyouts where not successful may find it difficult

to know which departments are still actively searching.

Institute a ‘scramble’ web page where departments with unfilled positions and applicants

still on the market could identify each other.

To avoid coordination failures in 2006-2007 job market, the committee introduce signalling

mechanism: applicants could have the AEA transmit to no more than two departments a

signal indicating their interest in an interview at the meetings.

The JOE, the January meetings, scramble web page and the signalling facility are

marketplace institutions that attempt to help the market provide thickness and deal with

congestion.

Session 5: Auctions

Economics of Auctions

•

•

•

•

•

•

Goods sold through auctions include treasury bills, oil exploration rights, art and houses.

On-line auction sites such as eBay are very popular.

This is part of a broader topic called ‘market design’, Nobel price in 2012.

Allocation mechanism for 2G licenses in the UK only raised $40 000 per license.

Several years later, the 3G license winners in 2000 paid a total $22.5 bn.

Why?

Classification of Auctions

•

The economic classification of auction involves two considerations:

o 1) What is the nature of the good that is being auctioned?

o 2) What are the rules of bidding?

With respect to the nature of the good, economists distinguish between private-value auctions and

common-value auctions.

Different kinds of auction

•

•

•

What type of good are we auctioning?

Private Value Auction:

o Each bidder has their own idea of how valuable the good is.

o My valuation is independent of your valuation.

Common Value Auction

o True value of the item is the same to all, although bidders may have different signals

of its true value.

o Imagine a larger jar full of coins, we each place a bid to purchase it but out bids are

unlikely to be equal.

o Wisdom of crowds: Mean guess likely to be closer to truth than average absolute

distance of individuals.

Wisdom of Crowds

•

•

•

•

•

Th wisdom of crowds refers to the fact that collective wisdom is better than most, if not all

the individuals in the crowd.

The conclusion was first drawn by Francis Galton, a statistician and scientist in the early 20th

century. He observed this phenomenon by examining the weights of an ox given by a crowd

at a country fair.

Later examples are Challenger Spacecraft (Morton Thiokol’s share went down) and Scorpion

Submarine (220 yards from where it was found).

Four criteria for the wisdom of crowds to be an effective tool:

o Independence- Guess must be independent.

o Diversity- Must have a diverse set of guesses.

o Decentralisation- Guess makers must be able to draw on their private, local

knowledge.

o Aggregation (Way of aggregating guesses into a single guess).

‘’

Rules of auction

•

•

•

What rules will govern the auction process?

The most common types are:

o The first price sealed bid

o Dutch (also known as descending auction)

o Second prices sealed bid.

o English (also known as open-outcry ascending auction)

Regardless of type, all sellers prefer more bidders to fewer.

English Auction

•

•

•

•

•

•

•

•

•

•

…or an open ascending bid auction.

Bidders offer successively higher prices, each drops out until no-one wishes to outbid

anymore; one bidder remains.

Highest bid win, winner pays slightly above second highest bid.

A common variant is for the seller to include a reserve price.

What is your optimum strategy in an English auction?

Assume that your true valuation of the item is V, but you want to bid a bit less than this, so

you bid V-X.

Assume that the other highest bid is W.

i.e. when you bid V-X there are three possibilities:

o 1. V-X > W

▪ Therefore you win, and pay W. You would still have won and paid W even if

we had bid V.

o W>V

▪ Therefore you lose, and you would have lost if you had just bet V anyway.

o V>W>V-X

▪ Therefore you lose, but if you had bid V, you would have won, paid W, and

had a surplus of V-W.

A similar argument can be made for bidding V+X.

Bidding V is a weakly dominant strategy and is Pareto Efficient

Dutch Auction

•

•

•

•

•

•

…or an open descending bid auction.

A very high price is quoted and then slowly reduced.

When someone accepts, that bidder wins, and must pay the accepted price.

Can be inefficient if the highest bidder delays too long and misses out.

Example: Flowers in the Netherlands.

Outcome should be the same as first price sealed-bid auction (see later), though in practice

bids are a little lower for the Dutch auction, perhaps via utility from seeing the price fall!

First-Price Sealed Bid Auction

•

•

•

•

•

•

•

•

All bidders must decide how much to offer, write it down, seal it, and submit it,

simultaneously.

The item goes not the highest bidder (or lower cost).

Outcomes can be inefficient due to false beliefs.

Say I value the good at $100, and wrongly believe you value it at $80, when you actually

value it at $90.

I may then submit a sealed bid for $85 and lose out.

If I don’t bid < V, I may win but have zero consumer surplus.

Optimal ‘shading’ of bids depends on n: n-1/n; more aggressive if more bidders; so bid ½

your value if n=2. This is Nash Equilibrium.

The same logic applies to Dutch Auctions

Second-Price Sealed Bid (Vickrey) Auction

•

•

•

•

•

•

•

•

•

•

•

Bidders submit a sealed bid, but the winner only pays the bid of the second highest bidder,

plus a minimum increment.

Bids are still private information, submitted simultaneously.

Highest bidder wins still.

It is Pareto Efficient, if no reserve price is set.

Example: Online Wine Auction

o I bid my V= $40 for a 2011 Penfolds Bin 389.

o If the second highest bid is $28, the current price is listed as $29.

o If another bidder submits a maximum value of $35, I still lead but the price rises to

$36.

o The leader after fixed time period gets the wine and pays the listed ‘current’ price,

not V.

o As in the English Auction, bidding v is optimal and the outcome is Pareto efficient.

o NB: Not a ‘classic’ example as can observe current high bid abnd can modify our own

bids throughout.

These auctions satisfy Pareto efficient with a zero reservation price, but a positive

reservation price may result in the good not being sold.

A reserve price is effectively a ‘phantom bid’ by the seller.

Observing a home auction where all bids are phantom is a surreal experience!

Although inefficient, a reserve (from the seller) can raise expected revenues, even with the

risk the good may not sell.

A reserve price should not be too high or the good may not sell; the risks and benefits should

be in balance.

Example: Assume two bidders, each with one of two values for the good, $30 and $100.

o We think these are equally likely to be true.

o Assume a $1 increment and ties are resolved with a coin-toss.

o Th possible outcome as:

▪ (30,30); (30,100);(100,30);(100,100).

o The winning bid in each scenario is:

▪ 30,31,31,100.

o Expected revenue is therefore:

▪ 1/3 x (30+31+31+100)= $48.

o But with a reservation price of $100, expected revenue is ¾ x (100)= $75.

o This is because the winning bids are 0, 100, 100 and 100.

Do Real Bidders Always Bid V?

•

•

•

•

•

•

Bidders delay rising the current price until the last seconds. Why?

Suppose I am willing to pay $40 as is the other bidder.

If we both enter $40 the winner must pay $40 and earn a zero surplus.

If we underbid, let the current price be $30. If he ‘attacks’ my bid in the last minute, I will try

to counter-attack.

This is risky as I may lose the item at, say, $36. But perhaps over many auctions I save even

more?

This is sometimes called ‘sniping’ (late bidding)

Truth Revelation in Vickrey Auction

•

•

•

•

•

•

•

•

Suppose you are an antique-china collector and you value a nineteenth-century Meissen

“Blue Onion” tea set in sealed-bid, second price auction at $3, 000. You do not know the

valuations of other bidders.

Your bid is B (which can be any of its possible values).

The success of your bid will obviously depend on the bids submitted by other bidders but

only the largest bid (called r) among them will affect your outcome.

If B>3000, there are three possible cases to consider.

o If r<3000, you win at the price R. Your profit which depends only on what you pay

relative to your true valuation, i.e. 3000-R.

o If 3000<R<B: you are forced to take the tea set for more than it is worth to you. So,

you would have done better if you bid $3000. You would not have gotten the tea

set, but you would not lose R- $3000 in lost profit either.

o Your rival bids even more than you do B<R. You don’t get the tea set, but you would

not have gotten it even had you bid your true valuation.

Putting the above three cases together, bidding your true valuation is never worse, and

sometimes better than bidding something higher.

If your shade, i.e. you bid B < $3000:

o If R < B: You get the tea set for R. You could have gotten the same result by bidding

$3000.

o If B < R < $3000: Your rival get the tea set. If you bid $3000 in this case, you would

have gotten the tea set, paid R, and make a profit of $3000 – R.

o $3000 < R: You do not get the tea set but if you had bit $3000, you still would have

not gotten it, so there would have been no harm in doing so.

Her again, bidding your true valuation is no worse, and sometimes better, than bidding

something lower.

To recap: If truthful bidding is never worse and sometimes better than bidding either above

or below your true valuation, then you do best to bid truthfully. It is your dominant strategy.

Revenue Equivalence

•

Auctions are “revenue equivalent” if they result in the same expected sales price (E.g. the

Dutch and first-price auctions and the English and Vickery auctions).

Revenue Equivalence Theorem:

• If all bidders are risk neutral and have independent private values, and hold on average

correct beliefs about bidders’ values, then all four of the standard single unit auction forms

have the same expected sales price. Don’t bid more than your estimate of second highest

bid..

• But…

• In the first-price Dutch auctions, risk-averse bidders will pay to raise their chances of winning

if a bid is raised above the optimal risk-neutral, but not in English and Vickery Auctions.

The Winner’s Curse!

•

•

•

•

•

•

•

•

•

•

•

In a common-value auction, although the item has the same value to all, bidders have

different signals and beliefs about its magnitude.

Let the true value be v, but let each of the i bidders estimate this with an error εi, which can

be positive or negative

A bidder then bids v + εi

If each bidder bids their true estimate, the winner is the bidder with the maximum error

εmax

But if this is positive then the winner is bidding more than the item’s true value! This is the

so-called Winner’s Curse!

Remember bidding for the large jar of coins!

Although the mean guess will be accurate, the highest guess is not likely to be; if you pay

that sum, you will lose

So we should bid less than v in common-value auctions

If you are the most optimistic of bidders, be afraid!

An optimal strategy is to bid below your true value…

…and bid even further below, the more bidders there are!

The Escalation Auction

•

•

•

•

•

Also called ‘all pay’ auctions

Example: Political lobbying for favours over a contested issue.

Also some legal battles, as everyone pay the lawyer even though only one side will win the

case.

Also war…incentive to ‘bid’ aggressively

Try auctioning a $10 note in class! What do you expect to happen?

The UK 3G Spectrum Auction of 2000

•

•

•

•

•

•

•

In the UK in 2000, game theorists were hired by the government to design the best auction

for the sale of 3G telephony rights.

Several years earlier for 2G licenses, a different mechanism only raised £40,000 per license.

For 3G they created 5 licenses as 4 incumbents; impose limit of 1 license per bidder

At the end of the auction in 2000, the five license winners paid £22.5bn in total!

Switching to auctions provided a huge windfall for the government.

UK raised 30x per capita revenue than Switzerland!

Netherlands also created 5 licenses, but as 5 incumbents it failed!

Lecture 6: Behaviour Economics

Behavioural Economics

•

•

1960-2000

o Traditional economic models were roughly as follows:

▪ Perfectly rational decision-makers maximising personal material rewards.

▪ They calculate probabilities and maximise expected value or “expected

utility”

▪ If reliable, we can influence behaviour with financial incentives (taxes,

subsidies) and information (education, dislosure).

o Policy prescription: Focus and manipulate incentives.

2000- onwards:

o Modern behavioural economics allows for…

▪ Human cognitive limitations and biases

▪ Imperfect self-regulation

▪ Multiple motivations, social norms and altruism.

o To influence behaviour, we need to target the psychological roots of behaviour.

Some of our biases

•

•

Humans are… human (limited, biased, emotional, social)

We can have…

o Present bias- underweight the future in favour of present.

o Loss aversion- care more about potential losses than gains.

o Status quo bias- tend to continue doing the same thing.

o Cognitive limits- forget things and delay decisions.

o Imperfect self control- tempted to make bad choices when aroused.

o Implicit bias- allow irrelevant characteristics to affect choice.

o Social norms- care about fitting in with others.

o Altruism- care about others.

o Planning fallacy- unrealistic optimism about time needed to complete a project.

o Anchoring- tend to use a readily available number as starting point to value goods.

o Availability bias- assess likelihood of event by how readily examples come to mind.

o Overconfidence- overestimate abilities.

o Mindless choosing- we tend to act on “auto-pilot”

o Mental accounting- assign money to different ‘mental accounts’ for different

purposes.

Decision context: Heuristics and Biases

•

•

•

•

Self-serving bias- tend to attributes successes to our own character or effort but blame

failures on others or outside forces.

Fundamental attribution error- tend to over-emphasise personal character rather than

situational factors in explaining actions of others.

Kathneman (2012) explains how our decisions draw on an intuitive ‘system 1’ and a rational,

analytical ‘system 2’

o System 1: Fast, intuitive, prone to many biases.

o System 2: Careful, effortful, calculating, lazy.

The laziness of system 2 leads us to exhibit numerous errors and biases in our judgements

and decisions form our system 1.

Some Examples: Decision Trap #1 Overconfidence

•

•

•

•

•

•

•

•

Feeling (or claiming) more confidence in our judgments than is justified by our accuracy.

o “I’m certain she’s the right person for the job”

o “I’m 90% sure the project will take between four and six weeks”

Chicago MBA students about to begin a class are asked where in the distribution they expect

to score at the finish. Fewer than 5% expect to score in the bottom 50%; more than 50%

expect to score in the top 20%

94% of Professors at a large US university thought they were better than the average

Professor!

o ‘In the village of Wobegone, all the children are above average”

Is everyone overconfident all the time?

o No.

Are a lot of people overconfident a lot of the time?

o Basically, yes!

o Enough to worry about, anyway.

Encourage people to express their doubts in the planning stage; best not in execution stage!

o “Diversity in counsel, unity in command” (Cyrus).

A partial solution is a ‘pre-mortem’

Just before confirming your big decision, imagine that in 12 months it is a major failure.

Decision Trap #2: Anchoring

•

•

•

•

•

•

•

•

•

Unconscious overweighting of unimportant features of a decision.

We anchor on some value then adjust it, up or down.

But some influence remains from the anchor.

High and low arbitrary numbers can influence willingness to pay for products, even final

digits on a social security card affect what people offer to pay for a variety of goods (Ariely et

al, 2003).

But even though they were arbitrary in absolute level, prices offered were consistent with

other goods that could be easily compared (e.g. pay more for a vintage wine than a new

wine): Coherent Arbitrariness.

A charity can raise more money if donor options on the solicitation are [$100, $250, $1000,

$5000] than if the options are [$25, $50, $100, $200].

Tins of Campbell’s soup compared sales for signs saying “limit of 10 per person” with “no

limit per person”. Customers bought twice as many under the former sign!

Speed limit signs can act as a coordinating device at that speed, i.e. as an anchor, rather than

a ‘limit’

Judges rolling dice after reading a description of a shoplifting offence were then asked to

judge the length of sentence to give. Those rolling 9 said eight months; those rolling 3 said

five months, on average.

How to reduce the impact of anchors?

•

•

•

•

•

View a problem from different perspectives

Avoid being anchored by others’ ideas.

Be open-minded.

Avoid anchoring your advisers, consultants, and others from whom you solicit information

and counsel.

Be particularly wary of anchors in negotiations and use anchors to your advantages.

Trap #3: Availability (Representativeness) Bias

•

•

•

•

•

•

•

•

•

We judge the likelihood of an event by how easy it is to recall other instances of it, or how

representative it is:

o Linda is 31 years old, single, outspoken, and very bright. She majored in philosophy.

As a student, she was deeply concerned with issues of discrimination and social

justice, and also participated in anti-nuclear demonstrations.

Which is more likely?

o Linda is a bank teller.

o Linda is a bank teller and is active in the feminist movement.

Representativeness tells us Linda is a feminist, even though feminist bank tellers are a subset

of bank-tellers, so the former is more likely.

In business, the bias leads to ‘competitor neglect’ and an ‘inside view’- how long do I think

each step will take, rather than an ‘outside view’- how long did a similar project take us, or

another firm, last time?

This in turn can lead to gross errors such as the ‘planning fallacy’

Our automatic system 1 kicks in and tells us to fear Ebola, tornadoes, plane crashed more

than diabetes, stroke, asthma.

Our system 2 knows the latter are much more common but it is an effort to think sensibly!

Strokes cause twice the deaths as all accidents combined but 80% believe the accidents are

more common. Tornadoes were believed to kill more people than asthma; the latter kills 20x

more!

Media coverage and the dramatic nature of some deaths hit us between the eyes, causing

major errors in judging frequency of events.

Trap #4: Loss Aversion

•

•

•

•

•

We often put more weight in losses than we do on gains of the same size (roughly 2:1)

relative to a reference point. Median willingness-to-sell prices of an object are often double

median willingness-to-pay prices.

If I toss a coin, heads I win $100 from you, tails you win #100 from me; is it attractive to you?

Why?

Loss aversion can lead us to be too risk averse, hold on to ‘losing’ stocks’ or other

investments when we should sell, etc.

Can help explain puzzling behaviour such as reluctance to sell possessions at a price we

would never now pay to acquire them (e.g. my collection of mostly 1970s ‘Marvel Comics’)

Leads to a status quo bias and an endowment effect.

Trap #5: Illusions of Neutrality

•

•

•

•

•

•

•

•

We have a useful skill

o Being able to make sense of ambiguous information.

But the skill exacts a cost

o We recall the story we invented to make sense of the facts,, not the facts

themselves.

Note the power of the first mover

o If you get to tell the story, you get to define reality!

Take care if you, or a colleague, ‘like’ a project, or a policy, or a job candidate…

The ‘affect heuristic’ (a mental shortcut) can lead you to seek out only supporting evidence,

down playing the costs and overestimating the benefits of that choice.

A tendency to selectivity notice or look for new information that confirms one’s beliefs, and

not notice or avoid information that would contradict prior beliefs. Sometimes called a ‘selfserving bias’

This bias can lead to bargaining impasses, as both sides believe their proposal is fair, not

recognising their own biases.

We experience information-gathering as neutral, accurate, “Just the facts”. It isn’t! We

“see”:

o Only what we’re attending to

o What our skills allow us to see

o What we expect to see

o What the context suggests we see

o What makes sense to us

In a Nutshell…

•

•

•

•

•

The problem we work on may not be ‘the’ problem, and not what others are working on.

We bring a variety of skills to bear

o (Reading, focusing, interpreting, sense-making).

But the skills come with costs

o We have small short-term memories.

o Decision problems can get big quickly

o Information overload is an ever-present threat.

We suffer from “WHAT YOU SEE IS ALL THERE IS!’

Perhaps too many choices

Some possible responses to biases

•

•

•

•

•

•

•

•

Present bias- e.g. commitments and planning prompts

Loss aversion- e.g. focus messaging on costs.

Status quo bias- e.g. improve defaults and allow opt-outs.

Cognitive limits- e.g. reminders, checklists, advice.

Self-control- e.g. lock-boxes.

Implicit bias- e.g. blind reviews, joint-evaluations of options.

Social norms- e.g. reference points and rankings.

Altruism- e.g. focus on impacts for others.

Example: Incentives

•

•

•

Israeli day-care centres had a problem with parents arriving late to collect their children,

forcing teachers to stay after closing time. They introduced a monetary fine for late-coming

parents.

For day-care where the fine was introduced, parents immediately started showing up late;

lateness levelled out at twice the pre-fine level.

Introducing a fine caused twice as many parents to show up late!

Defaults… (Sunstein, 2015)

•

•

A substantial body of empirical research has shown that non-binding default options are

strongly affect consumption and saving decisions.

Default effects have been documented in decisions including:

o Retiring savings (Madrian and Shea 2001, Beshears et al. 2008, Chetty et al. 2014)

o Participant in workplace training (Borghans and Golsteyn 2014, Consumers’ choice

of insurance coverage, product specification, and utility contracts (Johnson et al.

1993, Levav et al. 2010, Ebeling 2013)

o Consent to post-mortem organ donations (Johnson and Goldstein 2003).

Some Implications of BE

•

•

Think hard about the “choice architecture” we present to individuals- the procedures,

options, information.

Re-design this architecture to allow for human limitations and biases and sociality-make it

more “human friendly”

o Default rules do matter

o Financial incentives may not always mater

o Choice architecture is very important

o Choice architecture is not avoidable

o Simplicity is very important

o People can use a good nudge!

Nudging Payment of Taxes and Fines

•

•

UK BIT targeted late tax payers (small businesses and individuals) and tried two

approaches…

o Legalese message “you have 6 weeks’

o Social norms message “9 out of 10 Exeter residents pay on time”

Result: produced 9-15 percentage point increase in payment- an estimated $30 m annual

increase in revenue.

Some examples of framing

•

•

•

•

•

‘Double demerits’ when driving during holidays or ‘50% off’ demerits at other times?

‘90% fat free’ or ‘10% fat’

A woman’s ‘right to choose’ or protecting the ‘rights of the unborn’

On TV, more ‘repeats’ or ‘another chance to see

credit card ‘surcharge’ or cash ‘discount’

Framing surgery vs radiation therapy

•

•

238 ambulatory patients with different chronic medical conditions chose between surgery

and radiation therapy in two different frames… (NJEJM, 2982)

Frame

o If they frame the surgery vs radiation therapy through the lens of ‘survival’, I.e. 90

out of 100 people live then 82% elect the surgery.

o Whilst if they frame surgery vs radiation therapy through the lens of mortality ], I.e.

10 people die out of 100, only 56% choose surgery (as no one died in the radiation

therapy treatment in the first year)

Examples of framing

•

•

•

•

•

•

1. Consider a lottery choice:

o A) would you accept a 10% chance of $95 with a 90% chance lose $5.

o B) would you pay $5 to play a lottery with 10% chance of $10p and a 90% chance of

0?

Many people say no to a) and yes to b): losing a gamble is painful, buying a ticket that

doesn’t win much less painful.

2. Which change saves more fuel in a year if both Eric and Jasmine travel 20,000km?

o A) Eric switches from 6km/L car to an 8km/L car.

o B) jasmine switches from a 20km/L car to a 30km/L car.

Eric saves 833 litres, Jasmine only saves 334 litres.

For cars, km/l is a poor frame.

In general, broader and more inclusive frames are better at recruiting system 2 thinking

More examples- the truth about relativity

•

•

•

•

•

Ariely (2008) use the example os]f subscriptions to the Economist magazine. Reader offered

three options:

o A) internet only- $59/yr

o B) Print only, $125/yr

o C) print and internet, $125/yr

Which do you prefer?

His students chose 16% for a), 0% for b) and 84% for C)

Now when B was eliminated 68% chose A) and only 32% chose B)

Adding an asymmetrically dominated ‘decoy’ option raises much more revenue for the

Economist!

How to deal with framing?

•

•

•

•

•

Don’t easily accept the initial frame.

Try to frame the problem differently.

Look for distortions caused by the frames.

Pose problems in a neutral and redundant way that combines gains and losses.

Think hard throughout your decision making process about the framing problem.

More formally…

•

•

•

•

In most decision theories of choice under risk, transitivity of preferences is regarded as a

defining characteristic of rational choice.

Transitivity is natural for quantities like weight, height, age – single attribute items that can

map one-to-one to numbers

Whether the choice set is {A, B}, {B, C}, {C, A} or {A, B, C} the ranking will not change when

expanded/contracted.

There is a tendency to extrapolate this appeal of transitivity to multi-attribute objects. Fine if

objects are evaluated separately, but not in general for ‘joint evaluation’ where attributes

may be compared.

Attraction, compromise and similarity effects: for Cars A versus B: C, D and S boost

choice for A

Perception Effects

•

•

•

•

•

Attraction Effect: Add asymmetrically dominated D to A, B:

o Compared to {A, B} there will be a substantial shift in choice towards A when the

new choice set is {A, B, D], without choosing D

Compromise Effect: Again, a substantial shift towards A for the new choice set {A, B, C}

compared with {A, B}; A seems a good compromise

Similarity Effect: Another shift towards A in the new choice set {A, B, S} as S harms the more

similar B and now seems less desirable relative to A

Question: How might these effects be recruited to boost ‘better’ choices? Are they currently

being used ‘badly’ by marketers? Nudge implications? Public policy implications?

Example: Discrimination in hiring

o Joint vs. Separate Evaluation of Job Candidates: Joint reduces gender discrimination

from 16 percentage points to zero!

The general lesson: how preference works

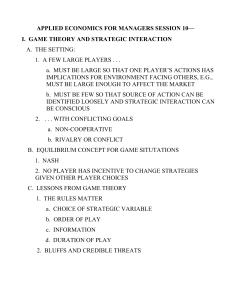

Session 7 and 8: Game Theory and Applications

Thinking Strategically

•

•

•

We can now apply the ‘economic way of thinking’ to strategies interactions. Game theory is

the science of strategy.

Aim: to focus attention of the motives and choices others. Try to understand issues from

their point of view to predict their responses.

We then use this knowledge to choose the best strategy from our point of view.

How are Strategic Situations like games?

•

•

•

•

Interactive games, such as poker, chess, noughts and crosses, share many features with

strategic situations.

A strategic is a complete plan of action that covers all eventualities through to the end of the

strategic situation (game).

There are rules of play (but they may not be well defined)

o A set of available actions.

o The list of players

o A relationship between actions and outcomes.

o No actor individually determines the outcome.

o Advantages can be gained by considering the responses of others to your actions

(and they will be doing the same).

Assumption: Players have a common understanding of the rules

Basic ideas of game theory