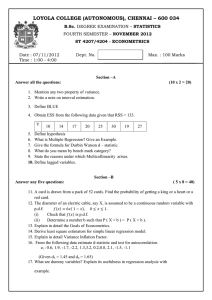

Simple Linear Regression Analysis: Econometrics Chapter

advertisement

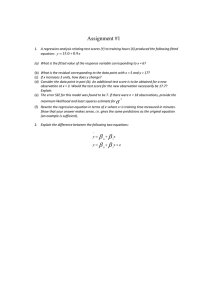

Chapter 2 Simple Linear Regression Analysis The simple linear regression model We consider the modeling between the dependent and one independent variable. When there is only one independent variable in the linear regression model, the model is generally termed as simple linear regression model. When there are more than one independent variables in the model, then the linear model is termed as the multiple linear regression model. The linear model Consider a simple linear regression model y 0 1 X where y is termed as the dependent or study variable and X is termed as independent or explanatory variable. The terms 0 and 1 are the parameters of the model. The parameter 0 is termed as intercept term and the parameter 1 is termed as slope parameter. These parameters are usually called as regression coefficients. The unobservable error component accounts for the failure of data to lie on the straight line and represents the difference between the true and observed realization of y . There can be several reasons for such difference, e.g., the effect of all deleted variables in the model, variables may be qualitative, inherit randomness in the observations etc. We assume that is observed as independent and identically distributed random variable with mean zero and constant variance 2 . Later, we will additionally assume that is normally distributed. The independent variable is viewed as controlled by the experimenter, so it is considered as non-stochastic whereas y is viewed as a random variable with E ( y ) 0 1 X and Var ( y ) 2 . Sometimes X can also be a random variable. In such a case, instead of simple mean and simple variance of y , we consider the conditional mean of y given X x as E ( y | x) 0 1 x and the conditional variance of y given X x as Var ( y | x) 2 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 1 When the values of 0 , 1 and 2 are known, the model is completely described. The parameters 0 , 1 and 2 are generally unknown in practice and is unobserved. The determination of the statistical model y 0 1 X depends on the determination (i.e., estimation ) of 0 , 1 and 2 . In order to know the values of these parameters, n pairs of observations ( xi , yi )(i 1,..., n) on ( X , y ) are observed/collected and are used to determine these unknown parameters. Various methods of estimation can be used to determine the estimates of the parameters. Among them, the methods of least squares and maximum likelihood are the popular methods of estimation. Least squares estimation Suppose a sample of n sets of paired observations ( xi , yi ) (i 1, 2,..., n) are available. These observations are assumed to satisfy the simple linear regression model and so we can write yi 0 1 xi i (i 1, 2,..., n). The method of least squares estimates the parameters 0 and 1 by minimizing the sum of squares of difference between the observations and the line in the scatter diagram. Such an idea is viewed from different perspectives. When the vertical difference between the observations and the line in the scatter diagram is considered and its sum of squares is minimized to obtain the estimates of 0 and 1 , the method is known as direct regression. yi (xi, Y 0 1 X (Xi, xi Direct regression Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 2 Alternatively, the sum of squares of difference between the observations and the line in horizontal direction in the scatter diagram can be minimized to obtain the estimates of 0 and 1 . This is known as reverse (or inverse) regression method. yi Y 0 1 X (xi, yi) (Xi, Yi) xi, Reverse regression method Instead of horizontal or vertical errors, if the sum of squares of perpendicular distances between the observations and the line in the scatter diagram is minimized to obtain the estimates of 0 and 1 , the method is known as orthogonal regression or major axis regression method. yi (xi Y 0 1 X (Xi ) xi Major axis regression method Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 3 Instead of minimizing the distance, the area can also be minimized. The reduced major axis regression method minimizes the sum of the areas of rectangles defined between the observed data points and the nearest point on the line in the scatter diagram to obtain the estimates of regression coefficients. This is shown in the following figure: yi ( x i y i) Y 0 1 X (Xi, Yi) xi Reduced major axis method The method of least absolute deviation regression considers the sum of the absolute deviation of the observations from the line in the vertical direction in the scatter diagram as in the case of direct regression to obtain the estimates of 0 and 1 . No assumption is required about the form of probability distribution of i in deriving the least squares estimates. For the purpose of deriving the statistical inferences only, we assume that i ' s are random variable with E ( i ) 0, Var ( i ) 2 and Cov ( i , j ) 0 for all i j (i, j 1, 2,..., n). This assumption is needed to find the mean, variance and other properties of the least squares estimates. The assumption that i ' s are normally distributed is utilized while constructing the tests of hypotheses and confidence intervals of the parameters. Based on these approaches, different estimates of 0 and 1 are obtained which have different statistical properties. Among them the direct regression approach is more popular. Generally, the direct regression estimates are referred as the least squares estimates or ordinary least squares estimates. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 4 Direct regression method This method is also known as the ordinary least squares estimation. Assuming that a set of n paired observations on ( xi , yi ), i 1, 2,..., n are available which satisfy the linear regression model y 0 1 X . So we can write the model for each observation as yi 0 1 xi i , (i 1, 2,..., n) . The direct regression approach minimizes the sum of squares n n i 1 i 1 S ( 0 , 1 ) i2 ( yi 0 1 xi ) 2 with respect to 0 and 1 . The partial derivatives of S ( 0 , 1 ) with respect to 0 is n S ( 0 , 1 ) 2 ( yt 0 1 xi ) 0 i 1 and the partial derivative of S ( 0 , 1 ) with respect to 1 is n S ( 0 , 1 ) 2 ( yi 0 1 xi )xi . 1 i 1 The solutions of 0 and 1 are obtained by setting S ( 0 , 1 ) 0 0 S ( 0 , 1 ) 0. 1 The solutions of these two equations are called the direct regression estimators, or usually called as the ordinary least squares (OLS) estimators of 0 and 1 . This gives the ordinary least squares estimates b0 of 0 and b1 of 1 as b0 y b1 x b1 sxy sxx where n n i 1 i 1 sxy ( xi x )( yi y ), sxx ( xi x ) 2 , x 1 n 1 n , x y i yi . n i 1 n i 1 Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 5 Further, we have n 2 S ( 0 , 1 ) 2 (1) 2n, 02 i 1 n 2 S ( 0 , 1 ) 2 xi2 12 i 1 n 2 S ( 0 , 1 ) 2 xt 2nx . 0 1 i 1 The Hessian matrix which is the matrix of second order partial derivatives in this case is given as 2 S ( 0 , 1 ) 02 H* 2 S ( , ) 0 1 0 1 2 S ( 0 , 1 ) 0 1 2 S ( 0 , 1 ) 12 nx n n 2 nx xi2 i 1 ' 2 , x x ' where (1,1,...,1) ' is a n -vector of elements unity and x ( x1 ,..., xn ) ' is a n -vector of observations on X . The matrix H * is positive definite if its determinant and the element in the first row and column of H * are positive. The determinant of H is given by n H * 2 n xi2 n 2 x 2 i 1 n 2n ( xi x ) 2 i 1 0. n The case when (x x ) i 1 2 i 0 is not interesting because all the observations in this case are identical, i.e. xi c (some constant). In such a case there is no relationship between x and y in the context of regression analysis. Since n (x x ) i 1 i 2 0, therefore H * 0. So H * is positive definite for any ( 0 , 1 ); therefore S ( 0 , 1 ) has a global minimum at (b0 , b1 ). Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 6 The fitted line or the fitted linear regression model is y b0 b1 x. The predicted values are yˆi b0 b1 xi (i 1, 2,..., n). The difference between the observed value yi and the fitted (or predicted) value yˆi is called as a residual. The i th residual is defined as ˆi yi ~ yˆi (i 1, 2,..., n) . We consider it as ˆi yi yˆi yi (b0 b1 xi ). Properties of the direct regression estimators: Unbiased property: Note that b1 sxy and b0 y b1 x are the linear combinations of yi (i 1,..., n). sxx Therefore n b1 ki yi i 1 where ki ( xi x ) / sxx . Note that n ki 0 and i 1 n k x i 1 i i 1, so n E (b1 ) ki E ( yi ) i 1 n ki ( 0 1 xi ) . i 1 1. This b1 is an unbiased estimator of 1 . Next E (b0 ) E y b1 x E 0 1 x b1 x 0 1 x 1 x 0 . Thus b0 is an unbiased estimators of 0 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 7 Variances: Using the assumption that yi ' s are independently distributed, the variance of b1 is n Var (b1 ) ki2Var ( yi ) ki k j Cov( yi , y j ) i 1 = = 2 i (x x ) j i 2 i i sxx2 (Cov( yi , y j ) 0 as y1 ,..., yn are independent) 2 sxx sxx2 2 sxx . The variance of b0 is Var (b0 ) Var ( y ) x 2 Var (b1 ) 2 xCov( y , b1 ). First we find that Cov( y , b1 ) E y E ( y )b1 E (b1 ) E ( ki yi 1 ) i 1 E ( i )( 0 ki 1 ki xi ki i ) 1 i n i i i i i 1 0 0 0 0 n 0 So 1 x2 Var (b0 ) 2 n sxx . Covariance: The covariance between b0 and b1 is Cov(b0 , b1 ) Cov( y , b1 ) xVar (b1 ) x 2 . sxx Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 8 It can further be shown that the ordinary least squares estimators b0 and b1 possess the minimum variance in the class of linear and unbiased estimators. So they are termed as the Best Linear Unbiased Estimators (BLUE). Such a property is known as the Gauss-Markov theorem which is discussed later in multiple linear regression model. Residual sum of squares: The residual sum of squares is given as n SSres ei2 i 1 n ( yi yˆi ) 2 i 1 n ( yi b0 b1 xi ) 2 i 1 n yi y b1 x b1 xi 2 i 1 n ( yi y ) b1 ( xi x ) 2 i 1 n n n i 1 i 1 ( yi y ) 2 b12 ( xi x ) 2 2b1 ( xi x )( yi y ) i 1 s yy b s 2b s 2 1 xx 2 1 xx s yy b12 sxx 2 s s yy xy sxx sxx sxy2 s yy sxx s yy b1sxy . n where s yy ( yi y ) 2 , y i 1 1 n yi . n i 1 Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 9 Estimation of 2 The estimator of 2 is obtained from the residual sum of squares as follows. Assuming that yi is normally distributed, it follows that SSres has a 2 distribution with (n 2) degrees of freedom, so SSres 2 ~ 2 (n 2). Thus using the result about the expectation of a chi-square random variable, we have E ( SSres ) (n 2) 2 . Thus an unbiased estimator of 2 is s2 SSres . n2 Note that SSres has only (n 2) degrees of freedom. The two degrees of freedom are lost due to estimation of b0 and b1 . Since s 2 depends on the estimates b0 and b1 , so it is a model dependent estimate of 2 . Estimate of variances of b0 and b1 : The estimators of variances of b0 and b1 are obtained by replacing 2 by its estimate ˆ 2 s 2 as follows: 2 (b ) s 2 1 x Var 0 n sxx and 2 (b ) s . Var 1 sxx It is observed that since n ( yi yˆi ) 0, so i 1 n e i 1 i 0. In the light of this property, ˆi can be regarded as an estimate of unknown i (i 1,..., n) . This helps in verifying the different model assumptions on the basis of the given sample ( xi , yi ), i 1, 2,..., n. Further, note that (i) n xi ei 0, i 1 (iii) n n i 1 i 1 yi yˆi and (ii) n yˆ e i 1 i i 0, (iv) the fitted line always passes through ( x , y ). Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 10 Centered Model: Sometimes it is useful to measure the independent variable around its mean. In such a case, model yi 0 1 X i i has a centered version as follows: yi 0 1 ( xi x ) 1 x (i 1, 2,..., n) 1 ( xi x ) i * 0 where 0* 0 1 x . The sum of squares due to error is given by n n i 1 i 1 2 S ( 0* , 1 ) i2 yi 0* 1 ( xi x ) . Now solving S ( 0* , 1 ) 0 0* S ( 0* , 1 ) 0, 1* we get the direct regression least squares estimates of 0* and 1 as b0* y and b1 sxy sxx respectively. Thus the form of the estimate of slope parameter 1 remains same in usual and centered model whereas the form of the estimate of intercept term changes in the usual and centered models. Further, the Hessian matrix of the second order partial derivatives of is positive definite at S ( 0* , 1 ) with respect to 0* and 1 0* b0* and 1 b1 which ensures that S ( 0* , 1 ) is minimized at 0* b0* and 1 b1 . Under the assumption that E ( i ) 0,Var ( i ) 2 and Cov( i j ) 0 for all i j 1, 2,..., n , it follows that E (b0* ) 0* , E (b1 ) 1 , Var (b0* ) 2 n , Var (b1 ) 2 sxx . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 11 In this case, the fitted model of yi 0* 1 ( xi x ) i is y y b1 ( x x ), and the predicted values are yˆi y b1 ( xi x ) (i 1,..., n). Note that in centered model Cov(b0* , b1 ) 0. No intercept term model: Sometimes in practice, a model without an intercept term is used in those situations when xi 0 yi 0 for all i 1, 2,..., n . A no-intercept model is yi 1 xi i (i 1, 2,.., n). For example, in analyzing the relationship between the illumination of bulb ( y ) and electric current ( X ) , the illumination is zero when current is zero. Using the data ( xi , yi ), i 1, 2,..., n, the direct regression least squares estimate of n n i 1 i 1 1 is obtained by minimizing S ( 1 ) i2 ( yi 1 xi ) 2 and solving S ( 1 ) 0 1 gives the estimator of 1 as n b * 1 yx i 1 n i i x i 1 . 2 i The second order partial derivative of S ( 1 ) with respect to 1 at 1 b1 is positive which insures that b1 minimizes S ( 1 ). Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 12 Using the assumption that E ( i ) 0,Var ( i ) 2 and Cov( i j ) 0 for all i j 1, 2,..., n , the properties of b1* can be derived as follows: n E (b ) * 1 x E( y ) i i 1 i n x 2 i i 1 n x 2 i i 1 n 1 x 2 i i 1 1 This b1* is an unbiased estimator of 1 . The variance of b1* is obtained as follows: n Var (b1* ) x Var ( y ) 2 i i i 1 n 2 xi i 1 n 2 2 x i 1 2 i n 2 xi i 1 2 2 n x i 1 2 i and an unbiased estimator of 2 is obtained as n y i 1 2 i n b1 yi xi i 1 n 1 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 13 Maximum likelihood estimation We assume that i ' s (i 1, 2,..., n) are independent and identically distributed following a normal distribution N (0, 2 ). Now we use the method of maximum likelihood to estimate the parameters of the linear regression model yi 0 1 xi i (i 1, 2,..., n), the observations yi (i 1, 2,..., n) are independently distributed with N ( 0 1 xi , 2 ) for all i 1, 2,..., n. The likelihood function of the given observations ( xi , yi ) and unknown parameters 0 , 1 and 2 is 1/ 2 n 1 L( xi , yi ; 0 , 1 , 2 ) 2 i 1 2 1 exp 2 ( yi 0 1 xi ) 2 . 2 The maximum likelihood estimates of 0 , 1 and 2 can be obtained by maximizing L( xi , yi ; 0 , 1 , 2 ) or equivalently ln L( xi , yi ; 0 , 1 , 2 ) where n n 1 n ln L( xi , yi ; 0 , 1 , 2 ) ln 2 ln 2 2 ( yi 0 1 xi ) 2 . 2 2 2 i 1 The normal equations are obtained by partial differentiation of log-likelihood with respect to 0 , 1 and 2 and equating them to zero as follows: ln L( xi , yi ; 0 , 1 , 2 ) 1 2 0 ln L( xi , yi ; 0 , 1 , 2 ) 1 2 1 n (y i 1 i 0 1 xi ) 0 0 1 xi )xi 0 n (y i 1 i and ln L( xi , yi ; 0 , 1 , 2 ) n 1 2 4 2 2 2 n (y i 1 i 0 1 xi ) 2 0. The solution of these normal equations give the maximum likelihood estimates of 0 , 1 and 2 as b0 y b1 x n b1 ( x x )( y y ) i i 1 i n (x x ) i 1 2 sxy sxx i and n s 2 ( y b i 1 i 0 b1 xi ) 2 n respectively. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 14 It can be verified that the Hessian matrix of second order partial derivation of ln L with respect to 0 , 1 , and 2 is negative definite at 0 b0 , 1 b1 , and 2 s 2 which ensures that the likelihood function is maximized at these values. Note that the least squares and maximum likelihood estimates of 0 and 1 are identical. The least squares and maximum likelihood estimates of 2 are different. In fact, the least squares estimate of 2 is s2 1 n ( yi y )2 n 2 i 1 so that it is related to maximum likelihood estimate as s 2 n2 2 s . n Thus b0 and b1 are unbiased estimators of 0 and 1 whereas s 2 is a biased estimate of 2 , but it is asymptotically unbiased. The variances of b0 and b1 are same as of b0 and b1 respectively but the mean squared error MSE ( s 2 ) Var ( s 2 ). Testing of hypotheses and confidence interval estimation for slope parameter: Now we consider the tests of hypothesis and confidence interval estimation for the slope parameter of the model under two cases, viz., when 2 is known and when 2 is unknown. Case 1: When 2 is known: Consider the simple linear regression model yi 0 1 xi i (i 1, 2,..., n) . It is assumed that i ' s are independent and identically distributed and follow N (0, 2 ). First we develop a test for the null hypothesis related to the slope parameter H 0 : 1 10 where 10 is some given constant. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 15 Assuming 2 to be known, we know that E (b1 ) 1 , Var (b1 ) 2 sxx and b1 is a linear combination of normally distributed yi ' s . So 2 b1 ~ N 1 , sxx and so the following statistic can be constructed Z1 b1 10 2 sxx which is distributed as N (0,1) when H 0 is true. A decision rule to test H1 : 1 10 can be framed as follows: Reject H 0 if Z1 Z / 2 where Z /2 is the / 2 percent points on normal distribution. Similarly, the decision rule for one sided alternative hypothesis can also be framed. The 100 (1 )% confidence interval for 1 can be obtained using the Z1 statistic as follows: P z /2 Z1 z /2 1 b1 1 z /2 1 P z /2 2 sxx 2 2 P b1 z /2 1 b1 z /2 1. sxx sxx So 100 (1 )% confidence interval for 1 is 2 2 , b1 z / 2 b1 z / 2 sxx sxx where z / 2 is the / 2 percentage point of the N (0,1) distribution. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 16 Case 2: When 2 is unknown: When 2 is unknown then we proceed as follows. We know that SSres 2 ~ 2 (n 2) and SS E res 2 . n2 Further, SSres / 2 and b1 are independently distributed. This result will be proved formally later in next module on multiple linear regression. This result also follows from the result that under normal distribution, the maximum likelihood estimates, viz., the sample mean (estimator of population mean) and the sample variance (estimator of population variance) are independently distributed, so b1 and s 2 are also independently distributed. Thus the following statistic can be constructed: t0 b1 1 ˆ 2 sxx b1 1 SSres (n 2) sxx which follows a t -distribution with (n 2) degrees of freedom, denoted as tn 2 , when H 0 is true. A decision rule to test H1 : 1 10 is to reject H 0 if t0 tn 2, / 2 where tn 2, / 2 is the / 2 percent point of the t -distribution with (n 2) degrees of freedom. Similarly, the decision rule for one sided alternative hypothesis can also be framed. The 100 (1 )% confidence interval of 1 can be obtained using the t0 statistic as follows: Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 17 Consider P t /2 t0 t /2 1 b1 1 P t /2 t /2 1 2 ˆ sxx ˆ 2 ˆ 2 P b1 t /2 1 b1 t / 2 1. sxx sxx So the 100 (1 )% confidence interval 1 is SSres SS res , b1 tn 2, /2 b1 tn 2, /2 . (n 2) sxx (n 2) sxx Testing of hypotheses and confidence interval estimation for intercept term: Now, we consider the tests of hypothesis and confidence interval estimation for intercept term under two cases, viz., when 2 is known and when 2 is unknown. Case 1: When 2 is known: Suppose the null hypothesis under consideration is H 0 : 0 00 , where 2 is known, then 1 x2 using the result that E (b0 ) 0 , Var (b0 ) 2 and b0 is a linear n sx combination of normally distributed random variables, the following statistic Z0 b0 00 1 x2 n sxx 2 has a N (0,1) distribution when H 0 is true. A decision rule to test H1 : 0 00 can be framed as follows: Reject H 0 if Z 0 Z /2 where Z /2 is the / 2 percentage points on normal distribution. Similarly, the decision rule for one sided alternative hypothesis can also be framed. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 18 The 100 (1 )% confidence intervals for 0 when 2 is known can be derived using the Z 0 statistic as follows: P z /2 Z 0 z /2 1 b0 0 P z /2 z /2 1 1 x2 2 n s xx x2 x2 21 21 P b0 z /2 0 b0 z /2 n sxx n sxx 1. So the 100 (1 )% of confidential interval of 0 is 1 x2 x2 21 b0 z / 2 2 , b z 0 /2 n sxx n sxx . Case 2: When 2 is unknown: When 2 is unknown, then the following statistic is constructed t0 b0 00 SSres 1 x 2 n 2 n sxx which follows a t -distribution with (n 2) degrees of freedom, i.e., tn 2 when H 0 is true. A decision rule to test H1 : 0 00 is as follows: Reject H 0 whenever t0 tn 2, / 2 where tn 2, / 2 is the / 2 percentage point of the t -distribution with (n 2) degrees of freedom. Similarly, the decision rule for one sided alternative hypothesis can also be framed. The 100 (1 )% confidence interval of 0 can be obtained as follows: Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 19 Consider P tn 2, /2 t0 tn 2, /2 1 P tn 2, /2 b0 0 tn 2, /2 1 SS res 1 x 2 n 2 n sxx SSres 1 x 2 SS res 1 x 2 P b0 tn 2, /2 b t 0 0 n 2, /2 n 2 n sxx n 2 n sxx 1. So 100(1 )% confidence interval for 0 is SS res 1 x 2 SSres 1 x 2 b0 tn 2, / 2 , b0 tn 2, / 2 n 2 n sxx n 2 n sxx . Test of hypothesis for 2 We have considered two types of test statistics for testing the hypothesis about the intercept term and slope parameter- when 2 is known and when 2 is unknown. While dealing with the case of known 2 , the value of 2 is known from some external sources like past experience, long association of the experimenter with the experiment, past studies etc. In such situations, the experimenter would like to test the hypothesis like H 0 : 2 02 against H 0 : 2 02 where 02 is specified. The test statistic is based on the result SS r es 2 ~ n2 2 . So the test statistic is C0 SS r es 02 ~ n2 2 under H 0 . The decision rule is to reject H 0 if C0 n2 2, /2 or C0 n2 2,1 /2 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 20 Confidence interval for 2 A confidence interval for 2 can also be derived as follows. Since SSres / 2 ~ n2 2 , thus consider SS P n2 2, /2 res n2 2,1 /2 1 2 SS SS P 2 res 2 2 res 1 . n 2, / 2 n 2,1 / 2 The corresponding 100(1 )% confidence interval for 2 is SSres SS , 2 res . 2 n 2,1 / 2 n 2, / 2 Joint confidence region for 0 and 1 : A joint confidence region for 0 and 1 can also be found. Such region will provide a 100(1 )% confidence that both the estimates of 0 and 1 are correct. Consider the centered version of the linear regression model yi 0* 1 ( xi x ) i where 0* 0 1 x . The least squares estimators of 0* and 1 are b0* y and b1 sxy sxx , respectively. Using the results that E (b0* ) 0* , E (b1 ) 1 , Var (b0* ) Var (b1 ) 2 n 2 sxx , . When 2 is known, then the statistic b0* 0* 2 n ~ N (0,1) and b1 1 2 ~ N (0,1). sxx Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 21 Moreover, both the statistics are independently distributed. Thus 2 2 * * b0 0 ~ 12 2 n and b1 1 ~ 2 1 2 s xx are also independently distributed because b0* and b1 are independently distributed. Consequently, the sum of these two n(b0* o* ) 2 2 sxx (b1 1 ) 2 2 ~ 22 . Since SSres 2 ~ n2 2 and SSres is independently distributed of b0* and b1 , so the ratio n(b0* 0* ) 2 sxx (b1 1 ) 2 2 2 2 ~ F2, n 2 . SSres 2 (n 2) Substituting b0* b0 b1 x and 0* 0 1 x , we get n 2 Qf 2 SSres where n n i 1 i 1 Q f n(b0 0 ) 2 2 xt (b0 1 )(b1 1 ) xi2 (b1 1 ) 2 . Since n 2 Q f P F2, n 2 1 2 SSres holds true for all values of 0 and 1 , so the 100 (1 ) % confidence region for 0 and 1 is n 2 Qf F2, n 2;1 . . . 2 SSres This confidence region is an ellipse which gives the 100 (1 )% probability that 0 and 1 are contained simultaneously in this ellipse. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 22 Analysis of variance: The technique of analysis of variance is usually used for testing the hypothesis related to equality of more than one parameters, like population means or slope parameters. It is more meaningful in case of multiple regression model when there are more than one slope parameters. This technique is discussed and illustrated here to understand the related basic concepts and fundamentals which will be used in developing the analysis of variance in the next module in multiple linear regression model where the explanatory variables are more than two. A test statistic for testing H 0 : 1 0 can also be formulated using the analysis of variance technique as follows. On the basis of the identity yi yˆi ( yi y ) ( yˆi y ), the sum of squared residuals is n S (b) ( yi yˆi ) 2 i 1 n n n i 1 i 1 i 1 ( yi y ) 2 ( yˆi yi ) 2 2 ( yi y )( yˆi y ). Further consider n n i 1 i 1 ( yi y )( yˆi y ) ( yi y )b1 ( xi x ) n b12 ( xi x ) 2 i 1 n ( yˆi y ) 2 . i 1 Thus we have n i 1 The term n n i 1 i 1 ( yi y ) 2 ( yi yˆi ) 2 ( yˆi y ) 2 . n ( y y) i 1 i 2 is called the sum of squares about the mean, corrected sum of squares of y (i.e., SScorrected), total sum of squares, or s yy . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 23 The term n ( y yˆ ) i i 1 2 i describes the deviation: observation minus predicted value, viz., the residual sum of n squares, i.e., SS res ( yi yˆi ) 2 i 1 n whereas the term ( yˆ y ) i 1 2 i describes the proportion of variability explained by regression, n SS r e g ( yˆi y ) 2 . i 1 n If all observations ( y yˆ ) yi are located on a straight line, then in this case i 1 i 2 i 0 and thus SScorrected SS r e g . Note that SSr e g is completely determined by b1 and so has only one degrees of freedom. The total sum of n squares s yy ( yi y ) 2 has (n 1) degrees of freedom due to constraint i 1 n ( y y) 0 i 1 i and SS res has (n 2) degrees of freedom as it depends on the determination of b0 and b1 . All sums of squares are mutually independent and distributed as df2 with df degrees of freedom if the errors are normally distributed. The mean square due to regression is MS r e g SS r e g 1 and mean square due to residuals is MSE SSres . n2 The test statistic for testing H 0 : 1 0 is F0 MS r e g MSE . If H 0 : 1 0 is true, then MSr e g and MSE are independently distributed and thus F0 ~ F1, n 2 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 24 The decision rule for H1 : 1 0 is to reject H 0 if F0 F1,n 2;1 at level of significance. The test procedure can be described in an Analysis of variance table. Analysis of variance for testing H 0 : 1 0 Source of variation Sum of squares Degrees of freedom Mean square Regression SSr e g 1 MSr e g Residual SS res n2 MSE Total s yy n 1 F MSr e g / MSE Some other forms of SSreg , SSres and s yy can be derived as follows: The sample correlation coefficient then may be written as sxy rxy sxx s yy . Moreover, we have b1 sxy sxx rxy s yy sxx . The estimator of 2 in this case may be expressed as 1 n 2 ei n 2 i 1 1 SS res . n2 s2 Various alternative formulations for SS res are in use as well: n SSres [ yi (b0 b1 xi )]2 i 1 n [( yi y ) b1 ( xi x )]2 i 1 s yy b12 sxx 2b1sxy s yy b12 sxx s yy ( sxy ) 2 sxx . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 25 Using this result, we find that SScorrected s yy and SSr e g s yy SS res ( sxy ) 2 sxx b s 2 1 xx b1sxy . Goodness of fit of regression It can be noted that a fitted model can be said to be good when residuals are small. Since SSres is based on residuals, so a measure of quality of fitted model can be based on SSres . When intercept term is present in the model, a measure of goodness of fit of the model is given by R2 1 SS res s yy SS r e g s yy . This is known as the coefficient of determination. This measure is based on the concept that how much variation in y ’s stated by s yy is explainable by SSreg and how much unexplainable part is contained in SS res . The ratio SS r e g / s yy describes the proportion of variability that is explained by regression in relation to the total variability of y . The ratio SSres / s yy describes the proportion of variability that is not covered by the regression. It can be seen that R 2 rxy2 where rxy is the simple correlation coefficient between x and y. Clearly 0 R 2 1 , so a value of R 2 closer to one indicates the better fit and value of R 2 closer to zero indicates the poor fit. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 26 Prediction of values of study variable An important use of linear regression modeling is to predict the average and actual values of study variable. The term prediction of value of study variable corresponds to knowing the value of E ( y ) (in case of average value) and value of y (in case of actual value) for a given value of explanatory variable. We consider both the cases. Case 1: Prediction of average value Under the linear regression model y 0 1 x , the fitted model is y b0 b1 x where b0 and b1 are the OLS estimators of 0 and 1 respectively. Suppose we want to predict the value of E ( y ) for a given value of x x0 . Then the predictor is given by ( y | x0 ) ˆ y / x0 b0 b1 x0 . E Predictive bias Then the prediction error is given as ˆ y| x E ( y ) b0 b1 x0 E ( 0 1 x0 ) 0 b0 b1 x0 ( 0 1 x0 ) (b0 0 ) (b1 1 ) x0 . Then E ˆ y| x0 E ( y ) E (b0 0 ) E (b1 1 ) x0 00 0 Thus the predictor y / x0 is an unbiased predictor of E ( y ). Predictive variance: The predictive variance of ˆ y| x0 is PV ( ˆ y| x0 ) Var (b0 b1 x0 ) Var y b1 ( x0 x ) Var ( y ) ( x0 x ) 2 Var (b1 ) 2( x0 x )Cov( y , b1 ) 2 n 2 ( x0 x ) 2 sxx 0 1 ( x x )2 2 0 . sxx n Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 27 Estimate of predictive variance The predictive variance can be estimated by substituting 2 by ˆ 2 MSE as 2 ( ˆ ) ˆ 2 1 ( x0 x ) PV y| x0 sxx n 1 ( x0 x ) 2 MSE . sxx n Prediction interval estimation: The 100(1- )% prediction interval for E ( y / x0 ) is obtained as follows: The predictor ˆ y| x0 is a linear combination of normally distributed random variables, so it is also normally distributed as ˆ y| x ~ N 0 1 x0 , PV ˆ y| x 0 0 . So if 2 is known, then the distribution of ˆ y| x E ( y | x0 ) 0 PV ( ˆ y| x0 ) is N (0,1). So the 100(1- )% prediction interval is obtained as ˆ y| x0 E ( y | x0 ) z /2 1 P z /2 PV ( ˆ y| x0 ) which gives the prediction interval for E ( y / x0 ) as 1 ( x x )2 ( x0 x ) 2 2 1 ˆ ˆ y| x0 z /2 2 0 , z y| x0 /2 . sxx sxx n n When 2 is unknown, it is replaced by ˆ 2 MSE and in this case the sampling distribution of ˆ y|x E ( y | x0 ) 0 1 ( x x )2 MSE 0 sxx n is t -distribution with (n 2) degrees of freedom, i.e., tn 2 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 28 The 100(1- )% prediction interval in this case is P t /2,n 2 ˆ y| x0 E ( y | x0 ) t 1 . ,n2 1 ( x x )2 2 MSE 0 n s xx which gives the prediction interval as 1 ( x x )2 1 ( x0 x ) 2 ˆ ˆ y| x0 t /2, n 2 MSE 0 , t MSE . y| x0 /2, n 2 sxx sxx n n Note that the width of prediction interval E ( y | x0 ) is a function of x0 . The interval width is minimum for x0 x and widens as x0 x increases. This is expected also as the best estimates of y to be made at x values lie near the center of the data and the precision of estimation to deteriorate as we move to the boundary of the x -space. Case 2: Prediction of actual value If x0 is the value of the explanatory variable, then the actual value predictor for y is ŷ0 b0 b1 x0 . The true value of y in the prediction period is given by y0 0 1 x0 0 where 0 indicates the value that would be drawn from the distribution of random error in the prediction period. Note that the form of predictor is the same as of average value predictor but its predictive error and other properties are different. This is the dual nature of predictor. Predictive bias: The predictive error of ŷ0 is given by yˆ 0 y0 b0 b1 x0 ( 0 1 x0 0 ) (b0 0 ) (b1 1 ) x0 . Thus, we find that E ( yˆ 0 y0 ) E (b0 0 ) E (b1 1 ) x0 E ( 0 ) 000 0 which implies that ŷ0 is an unbiased predictor of y0 . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 29 Predictive variance Because the future observation y0 is independent of ŷ0 , the predictive variance of ŷ0 is PV ( yˆ 0 ) E ( yˆ 0 y0 ) 2 E[(b0 0 ) ( x0 x )(b1 1 ) (b1 1 ) x 0 ]2 Var (b0 ) ( x0 x ) 2 Var (b1 ) x 2Var (b1 ) Var ( 0 ) 2( x0 x )Cov(b0 , b1 ) 2 xCov(b0 , b1 ) 2( x0 x )Var (b1 ) [rest of the terms are 0 assuming the independence of 0 with 1 , 2 ,..., n ] Var (b0 ) [( x0 x ) 2 x 2 2( x0 x )]Var (b1 ) Var ( ) 2[( x0 x ) 2 x ]Cov(b0 , b1 ) Var (b0 ) x02Var (b1 ) Var ( 0 ) 2 x0Cov(b0 , b1 ) 1 x2 x 2 2 2 x02 2 2 x0 sxx sxx n sxx 1 ( x x )2 2 1 0 . sxx n Estimate of predictive variance The estimate of predictive variance can be obtained by replacing 2 by its estimate ˆ 2 MSE as 1 ( x x )2 PV ( yˆ 0 ) ˆ 2 1 0 sxx n 1 ( x x )2 MSE 1 0 . sxx n Prediction interval: If 2 is known, then the distribution of yˆ 0 y0 PV ( yˆ 0 ) is N (0,1). So the 100(1- )% prediction interval is obtained as yˆ y0 z /2 1 P z /2 0 PV ( yˆ 0 ) which gives the prediction interval for y0 as 1 ( x x )2 1 ( x0 x ) 2 2 ˆ yˆ 0 z /2 2 1 0 , y z 1 0 /2 . sxx sxx n n Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 30 When 2 is unknown, then yˆ 0 y0 ( yˆ ) PV 0 follows a t -distribution with (n 2) degrees of freedom. The 100(1- )% prediction interval for ŷ0 in this case is obtained as yˆ y0 t /2, n 2 1 P t /2,n 2 0 ( yˆ ) PV 0 which gives the prediction interval 1 ( x x )2 1 ( x0 x ) 2 ˆ yˆ 0 t /2,n 2 MSE 1 0 , y t MSE 0 /2,n 2 1 . n s n s xx xx The prediction interval is of minimum width at x0 x and widens as x0 x increases. The prediction interval for ŷ0 is wider than the prediction interval for ˆ y / x0 because the prediction interval for ŷ0 depends on both the error from the fitted model as well as the error associated with the future observations. Reverse regression method The reverse (or inverse) regression approach minimizes the sum of squares of horizontal distances between the observed data points and the line in the following scatter diagram to obtain the estimates of regression parameters. yi (xi, yi) Y 0 1 X (Xi, Yi) x, Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur Reverse regression method 31 The reverse regression has been advocated in the analysis of gender (or race) discrimination in salaries. For example, if y denotes salary and x denotes qualifications and we are interested in determining if there is a gender discrimination in salaries, we can ask: “Whether men and women with the same qualifications (value of x) are getting the same salaries (value of y). This question is answered by the direct regression.” Alternatively, we can ask: “Whether men and women with the same salaries (value of y) have the same qualifications (value of x). This question is answered by the reverse regression, i.e., regression of x on y.” The regression equation in case of reverse regression can be written as xi 0* 1* yi i (i 1, 2,..., n) where i ’s are the associated random error components and satisfy the assumptions as in the case of usual simple linear regression model. The reverse regression estimates ˆOR of 0* and ˆ1R of 1* for the model are obtained by interchanging the x and y in the direct regression estimators of 0 and 1 . The estimates are obtained as ˆOR x ˆ1R y and ˆ1R sxy s yy for 0 and 1 respectively. The residual sum of squares in this case is SS res sxx * sxy2 s yy . Note that sxy2 ˆ 1R b1 rxy2 sxx s yy where b1 is the direct regression estimator of slope parameter and rxy is the correlation coefficient between x and y. Hence if rxy2 is close to 1, the two regression lines will be close to each other. An important application of reverse regression method is in solving the calibration problem. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 32 Orthogonal regression method (or major axis regression method) The direct and reverse regression methods of estimation assume that the errors in the observations are either in x -direction or y -direction. In other words, the errors can be either in dependent variable or independent variable. There can be situations when uncertainties are involved in dependent and independent variables both. In such situations, the orthogonal regression is more appropriate. In order to take care of errors in both the directions, the least squares principle in orthogonal regression minimizes the squared perpendicular distance between the observed data points and the line in the following scatter diagram to obtain the estimates of regression coefficients. This is also known as major axis regression method. The estimates obtained are called as orthogonal regression estimates or major axis regression estimates of regression coefficients. yi (xi, yi) Y 0 1 X (Xi, Yi) xi Orthogonal or major axis regression If we assume that the regression line to be fitted is Yi 0 1 X i , then it is expected that all the observations ( xi , yi ), i 1, 2,..., n lie on this line. But these points deviate from the line and in such a case, the squared perpendicular distance of observed data ( xi , yi ) (i 1, 2,..., n) from the line is given by di2 ( X i xi ) 2 (Yi yi )2 where ( X i , Yi ) denotes the i th pair of observation without any error which lie on the line. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 33 The objective is to minimize the sum of squared perpendicular distances given by n i 1 di2 to obtain the estimates of 0 and 1 . The observations ( xi , yi ) (i 1, 2,..., n) are expected to lie on the line Yi 0 1 X i , so let Ei Yi 0 1 X i 0. The regression coefficients are obtained by minimizing n d i 1 2 i under the constraints Ei ' s using the Lagrangian’s multiplier method. The Lagrangian function is n n i 1 i 1 L0 di2 2 i Ei where 1 ,..., n are the Lagrangian multipliers. The set of equations are obtained by setting L0 L L L 0, 0 0, 0 0 and 0 0 (i 1, 2,..., n). X i Yi 0 1 Thus we find L0 ( X i xi ) i 1 0 X i L0 (Yi yi ) i 0 Yi L0 0 L0 1 n i 1 i 0 n X i 1 i i 0. Since X i xi i 1 Yi yi i , so substituting these values in Ei , we obtain Ei ( yi i ) 0 1 ( xi i 1 ) 0 i 0 1 xi yi . 1 12 Also using this i in the equation n i 1 i 0 , we get Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 34 n ( i 1 0 1 xi yi ) 1 12 0 and using ( X i xi ) i 1 0 and n X i 1 i i 0 , we get n ( x ) 0. i 1 i i i 1 Substituting i in this equation, we get n ( x x i 1 2 1 i 0 i yi xi ) (1 12 ) n 1 ( 0 1 xi yi ) 2 i 1 (1 12 ) 2 Using i in the equation and using the equation n ( i 1 0 1 xi yi ) 1 12 0. n i 1 i (1) 0 , we solve 0. The solution provides an orthogonal regression estimate of 0 as ˆ0OR y ˆ1OR x where ˆ1OR is an orthogonal regression estimate of 1. Now, substituting 0OR in equation (1), we get n (1 i 1 2 1 2 ) yxi 1 xxi x xi yi 1 y 1 x 1 xi yi 0 n 2 1 i i 1 or (1 12 ) n n i 1 i 1 2 xi yi y 1 ( xi x ) 1 ( yi y ) 1 ( xi x ) 0 or n n i 1 i 1 (1 12 ) (ui x )(vi 1ui ) 1 (vi 1ui ) 2 0 where ui xi x , vi yi y . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 35 n Since n u v i i 1 n i 1 i i 1 0, so u v 1 (ui2 vi2 ) ui vi 0 2 1 i i or 12 sxy 1 ( sxx s yy ) sxy 0. Solving this quadratic equation provides the orthogonal regression estimate of 1 as ˆ1OR s yy sxx sign sxy ( sxx s yy ) 2 4s 2xy 2 sxy where sign( sxy ) denotes the sign of sxy which can be positive or negative . So 1 if sxy 0 . sign( sxy ) 1 if sxy 0. Notice that this gives two solutions for solution maximizes n d i 1 2 i ˆ1OR . We choose the solution which minimizes and is in the direction perpendicular to the n d i 1 2 i . The other optimal solution. The optimal solution can be chosen with the sign of sxy . Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 36 Reduced major axis regression method: The direct, reverse and orthogonal methods of estimation minimize the errors in a particular direction which is usually the distance between the observed data points and the line in the scatter diagram. Alternatively, one can consider the area extended by the data points in certain neighbourhood and instead of distances, the area of rectangles defined between corresponding observed data point and nearest point on the line in the following scatter diagram can also be minimized. Such an approach is more appropriate when the uncertainties are present in study as well as explanatory variables. This approach is termed as reduced major axis regression. yi (xi yi) Y 0 1 X (Xi, Yi) xi Reduced major axis method Suppose the regression line is Yi 0 1 X i on which all the observed points are expected to lie. Suppose the points ( xi , yi ), i 1, 2,..., n are observed which lie away from the line. The area of rectangle extended between the i th observed data point and the line is Ai ( X i ~ xi )(Yi ~ yi ) (i 1, 2,..., n) where ( X i , Yi ) denotes the i th pair of observation without any error which lie on the line. The total area extended by n data points is n n A (X i 1 i i 1 i ~ xi )(Yi ~ yi ). All observed data points ( xi , yi ), (i 1, 2,..., n) are expected to lie on the line Yi 0 1 X i Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 37 and let Ei* Yi 0 1 X i 0. So now the objective is to minimize the sum of areas under the constraints Ei* to obtain the reduced major axis estimates of regression coefficients. Using the Lagrangian multiplies method, the Lagrangian function is n n i 1 i 1 LR Ai i Ei* n n i 1 i 1 ( X i xi )(Yi yi ) i Ei* where 1 ,..., n are the Lagrangian multipliers. The set of equations are obtained by setting LR L L L 0, R 0, R 0, R 0 (i 1, 2,..., n). X i Yi 0 1 Thus LR (Yi yi ) 1i 0 X i LR ( X i xi ) i 0 Yi LR n i 0 0 i 1 LR n i X i 0. 1 i 1 Now X i xi i Yi yi 1i 0 1 X i yi 1i 0 1 ( xi i ) yi 1i y 0 1 xi i i . 2 1 Substituting i in n i 1 i 0 , the reduced major axis regression estimate of 0 is obtained as ˆ0 RM y ˆ1RM x where ˆ1RM is the reduced major axis regression estimate of 1 . Using X i xi i , i and n X i 1 i i ˆ0 RM in 0 , we get Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 38 yi y 1 x 1 xi yi y 1 x 1 xi xi 21 21 i 1 n 0. Let ui xi x and vi yi y , then this equation can be re-expressed as n (v u )(v u 2 x ) 0. Using 1 i i i 1 n n u V i 1 n i v i 1 2 i i 1 i 1 i i 1 0, we get n 12 ui2 0. i 1 Solving this equation, the reduced major axis regression estimate of 1 is obtained as ˆ1RM sign( sxy ) s yy sxx 1 if sxy 0 where sign ( sxy ) 1 if sxy 0. We choose the regression estimator which has same sign as of sxy . Least absolute deviation regression method The least squares principle advocates the minimization of sum of squared errors. The idea of squaring the errors is useful in place of simple errors because the random errors can be positive as well as negative. So consequently their sum can be close to zero indicating that there is no error in the model which can be misleading. Instead of the sum of random errors, the sum of absolute random errors can be considered which avoids the problem due to positive and negative random errors. In the method of least squares, the estimates of the parameters 0 and yi 0 1 xi i . (i 1, 2,..., n) are chosen such that the sum of squares of deviations 1 in the model n i 1 2 i is minimum. In the method of least absolute deviation (LAD) regression, the parameters 0 and 1 are estimated such that the sum of absolute deviations n i 1 i is minimum. It minimizes the absolute vertical sum of errors as in the following scatter diagram: Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 39 yi (xi, Y 0 1 X (Xi, xi Least absolute deviation The LAD estimates ˆ0 L and ˆ1L are the estimates of 0 and 1 , respectively which minimize n LAD( 0 , 1 ) yi 0 1 xi i 1 for the given observations ( xi , yi ) (i 1, 2,..., n). Conceptually, LAD procedure is simpler than OLS procedure because e (absolute residuals) is a more straightforward measure of the size of the residual than e 2 (squared residuals). The LAD regression estimates of 0 and 1 are not available in closed form. Rather they can be obtained numerically based on algorithms. Moreover, this creates the problems of non-uniqueness and degeneracy in the estimates. The concept of non-uniqueness relates to that more than one best lines pass through a data point. The degeneracy concept describes that the best line through a data point also passes through more than one other data points. The non-uniqueness and degeneracy concepts are used in algorithms to judge the quality of the estimates. The algorithm for finding the estimators generally proceeds in steps. At each step, the best line is found that passes through a given data point. The best line always passes through another data point, and this data point is used in the next step. When there is non-uniqueness, then there are more than one best lines. When there is degeneracy, then the best line passes through more than one other data point. When either of the problem is present, then there is more than one choice for the data point to be used in the next step and the algorithm may go around in circles or make a wrong choice of the LAD regression line. The exact tests of hypothesis and confidence intervals for the LAD regression estimates can not be derived analytically. Instead they are derived analogous to the tests of hypothesis and confidence intervals related to ordinary least squares estimates. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 40 Estimation of parameters when X is stochastic In a usual linear regression model, the study variable is supped to be random and explanatory variables are assumed to be fixed. In practice, there may be situations in which the explanatory variable also becomes random. Suppose both dependent and independent variables are stochastic in the simple linear regression model y 0 1 X where is the associated random error component. The observations ( xi , yi ), i 1, 2,..., n are assumed to be jointly distributed. Then the statistical inferences can be drawn in such cases which are conditional on X . Assume the joint distribution of X and y to be bivariate normal N ( x , y , x2 , y2 , ) where x and y are the means of X and y; x2 and y2 are the variances of X and y; and is the correlation coefficient between X and y . Then the conditional distribution of y given X x is univariate normal conditional mean E ( y | X x) y| x 0 1 x and conditional variance of y given X x is Var ( y | X x) y2| x y2 (1 2 ) where 0 y x 1 and 1 y . x When both X and y are stochastic, then the problem of estimation of parameters can be reformulated as follows. Consider a conditional random variable y | X x having a normal distribution with mean as conditional mean y| x and variance as conditional variance Var ( y | X x) y2| x . Obtain n independently distributed observation yi | xi , i 1, 2,..., n from N ( y| x , y2| x ) with nonstochastic X . Now the method of maximum likelihood can be used to estimate the parameters which yields the estimates of 0 and 1 as earlier in the case of nonstochastic X as Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 41 b y b1 x and s b1 xy sxx respectively. Moreover, the correlation coefficient E ( y y )( X x ) y x can be estimated by the sample correlation coefficient n ( y y )( x x ) ˆ i 1 i n ( xi x )2 i 1 i n ( y y) i 1 2 i sxy sxx s yy s b1 xx . s yy Thus ˆ 2 b12 sxx s yy sxy b1 s yy n s yy ˆi2 i 1 s yy R2 which is same as the coefficient of determination. Thus R 2 has the same expression as in the case when X is fixed. Thus R 2 again measures the goodness of fitted model even when X is stochastic. Econometrics | Chapter 2 | Simple Linear Regression Analysis | Shalabh, IIT Kanpur 42