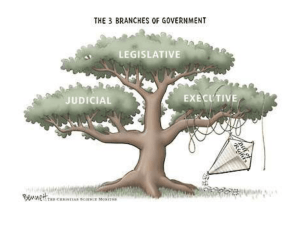

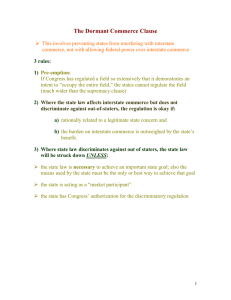

III. Separation of Powers A. Legislative Powers 1. Congress has the power to: a. Regulate alien naturalization, citizenship b. Regulate anything under rational basis c. Delegate its powers to administrative agencies but it has to tell them how to do so d. Regulate the election process 1) In determining whether regulation of the electoral process is valid, the Supreme Court will do a balancing test to see if the restriction on First Amendment activities is severe. If so, the regulation will be subject to strict scrutiny and must be narrowly tailored to achieve a compelling government interest. i. Ex. Requiring a candidate to obtain 4% of eligible voters’ signatures will be severe (1% is not severe) e. Enforce civil rights amendments f. Tax and spend g. Manage federal property h. Declare war i. Regulate Washington D.C. j. Say who can appoint inferior officers but can’t do the actual appointing 1) Permits Congress to vest appointments of inferior officers only in the President, the courts, or the heads of departments. Enforcement is an executive act therefore Congress cannot appoint members of a commission that exercises enforcement powers. = Congress can’t appoint its own members 2) A duly appointed commission does have the power to make rules and regulations governing the subject matter for which it is appointed; however, those rules are not criminal statutes. k. Require cause if an officer was appointed pursuant to a statute requiring a specific term or an officer who provides judicial/quasi-­‐judicial function also needs cause. 2. Property Power a. Congress has the power to make all needful rules and regulations respecting the territory or other property belonging to the U.S. Ex. Geologist takes ore out of national park in violation of federal law prohibiting that. The law is valid under the property clause. 3. Congressional Investigative Power a. Congress’ power to investigate is limited to matters on which it can legislate. 4. Spending Power a. Congress may regulate states through the spending power by imposing conditions on the grant of money to state or local governments. Such conditions will not violate the 10th Amendment if the conditions are (1) clearly stated; (2) relate to the purpose of the program; and (3) are not unduly coercive. i. Ex. Congress provides by statute that any state that does not enact a ban from texting while driving on state highways within the next year will be denied 10% federal highway construction funding. Here, the requirement is not unduly coercive and is related to making travel on highways safer. b. Federal Taxation Power 1) Congress has the power to lay and collect taxes and a tax will usually be upheld if it bears some reasonable relationship to revenue production or if Congress has the power to regulate the tax activity. i. Ex. Congress taxes individuals $25 for 5 most desirable destinations. Tax is valid because reasonably revenue raising. c. Foreign Commerce 1) The power to regulate foreign commerce lies exclusively with congress. The existence of legitimate state interests underlying the state legislation will not justify state regulation of foreign commerce. Ex. A state that adopts legislation requiring private venders to favor U.S. products over foreign products may be acting outside the scope of its powers by violating the commerce clause. 6. Commerce Power a. The commerce clause permits Congress to regulate any local or interstate activity that either in itself or in combination with other activities has an effect on interstate commerce. i. Ex. Persons engaged in the trade of barbering may only get licenses for babering in State A if they went to a State A barbering school. This is a burden on interstate commerce because it affects the economy/livelihood/business vs. Privileges and Immunities which is not about commerce but about discrimination against out of state citizens from receiving the benefits of that state. b. State Regulation of Commerce – The Commerce Clause generally prohibits states from discriminating against out of state businesses to benefit local economic interests. 1) Market Participant Exception – A state may show preferential treatment to its own citizens v. out of state citizens when the state is acting as a market participant. (A state will be a market participant if it’s involved in buying or selling products, hiring labor, etc.) i. Ex. State buys corn from in-­‐state farmers, turns corn into plastic, and sells plastic. In-­‐state purchasers get plastic for cost, out-­‐of-­‐state purchasers get it for cost + 25%. This pricing scheme is valid under the market participant exception. 2) State Taxation on Commerce a) States may impose “doing business taxes,” such as gross receipts tax, on companies engaged in interstate commerce as long as the tax does not discriminate against or unfairly burden interstate commerce. A tax will impose an unfair burden unless: (i) the activity taxed has a substantial nexus to the taxing state; (ii) the tax is fairly apportioned; and (iii) the tax fairly relates to the services provided by the state. i. Ex. If a tax applies to revenue derived from the company’s plants located in other states, this will impose an unfair burden on the company because those plants may already be subject to a similar tax in those states and the relationship between the tax and services provided by the state in which the company is located is tenuous. c. Racial Discrimination 1) Congress has addressed the problem of racial discrimination primarily the commerce power and the Thirteenth Amendment enables Congress to do so. 7. Federal Commerce Power a. There are four areas where commerce can be regulated: (1) channels of commerce (highways, waterways, air traffic) (2) instrumentalities (people/things used to carry out commerce; i.e. safety features on trucks) (3) regulate articles moving in interstate commerce (data bases about drivers, etc.) (4) regulate anything that has a substantial effect on commerce (any activity arguably commercial in nature) 8. How the 10th Amendment Affects Commerce Power a. Any power not delegated to the U.S. or prohibited to the states is reserved to the states. b. Laws of general applicability do not apply. c. Congress cannot commandeer states to pass laws. 9. Taxing and Spending 1) This doesn’t give states extra power, it just limits Congress. a. Taxes can be regulatory in nature as long as the tax is reasonable revenue raising and doesn’t have to be related to that which is being regulated. b. Limits on taxing power 1) Excise and customs duty must be uniform in U.S. c. Can’t tax exports from states i. Ex. Tax cigarettes but use revenue for schools i. Ex. Can’t have 10 cent tax in VT and 30 cent tax in CA. d. Congress can spend its $ on whatever it wants as long as it’s in furtherance of the general welfare. e. Congress can use conditions on spending, encourage states to do what Congress wants by using incentives or restrictions. i. Ex. Give you highway funds if you raise the driving age to 21. f. Spend for common defense, pay debts, and general welfare. 8. Congress can delegate its powers to the President, but when it does, it must state the objective to the delegate and state adequate criteria the delegate must follow. 9. Legislative Veto a. Occurs when Congress delegates a power, then says after the act is done by delegate, Congress can cancel that action if it doesn’t work out. B. Executive Powers 1. The President: a. has the power to carry out the laws b. can enter into executive agreements c. has the power to do day to day foreign relations d. has the power to pardon (only federal crimes) e. has the power to enter into treaties, treaties have to be approved by 2/3 Senate f. has veto power – can veto congressional legislation g. has war power – deploy troops of immediate threat to U.S. or humanitarian reasons h. has the power to appoint presidential commissions – advisory in nature. 1) The committees have no power or authority. 2) The President can do it without congressional approval as long as the funds spent were properly appropriated by Congress. i. has the power to appoint federal executive officers. 1) Principal officers are cabinet level, ambassadors, members of panels ad commissions with significant executive power. j. can hire and remove federal officers with or without cause. 2. President’s job is to execute laws, not make laws. 3. President cannot do a line item veto – it is unconstitutional a. The Supreme Court has held that members of Congress lack standing to challenge a law authorizing the President to exercise a line item veto since the injury is not concrete and personal but rather it is institutional in that it is shared by all members of Congress. The Supreme Court has ruled that the President has no power to exercise a line item veto of just part of a bill. 4. There is no necessary and proper clause with President’s behavior but some implied powers for President to work around to do some things that aren’t specifically enumerated. 5. The Attorney General is a member of the executive branch and is the discretion of the executive branch as to whether or not to prosecute. The legislative branch can’t force the executive branch to prosecute somebody. War Powers: Congress President Declare War Commit Troops Immediate Danger Humanitarian or Other Reaons C. Impeachment 1. House votes to indict – needs a majority 2. Senate tries the case 3. 2/3 needed to convict 4. If conviction results, then removal from office. 5. Congress cannot remove any executive officer – need impeachment 6. Federal judges can only be removed by impeachment D. Legislative and Executive Immunity 1. Speech and Debate Clause a. Gives members of Congress immunity for any speech or debate in either house. This shields them from: 1) civil or criminal suits relating to their legislative actions or 2) grand jury investigations relating to their legislative actions b. This immunity also applies to assistants, if the act done by the assistant would be immunized if done by congressman. 2. Executive Immunity a. President has absolute civil immunity for all of his official acts. b. All other federal officials including presidential aids have a qualifying immunity for their acts. 3. Executive Privilege a. Have a qualified right to refuse to disclose confidential information relating to their performance of their duties. The qualification may be outweighed by other compelling governmental interests.