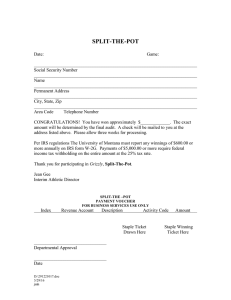

EVERYTHING YOU NEED TO KNOW ABOUT W-2G’S AND HOW TO DO IT RIGHT EVERY TIME CONTENTS: Cover W-2G Introduction Blank W-2g………………………………….…………………… Pg. 5 Regular W-2g – Handpay Ticket & ID-How-To……………….……Pg. 6 & 7 Withholding W-2g –Handpay Ticket & ID- How –To………..…… Pg. 8 & 9 Alien Withholding W-2g – Handpay Ticket & ID – How-To……….Pg. 10, 11 & 12 What To Do for Withholding If Missed at Cashing Station………..Pg. 13 OTB W-2g – How –To…………………………………………….. Pg. 14 Acceptable ID’s & W-9’s...…………………………………………. Pg. 15-20 Corrections……………………………………………………… Pg. 21 Scanning and Emailing………………………………………………Pg. 22-25 A Few Things Need to Know………………………………………Pg. 26 W-2G INTRODUCTION W-2G is a form that is used to report gambling winnings to the federal government. In Pari-Mutuel wagering (OTB and HHR) we are subject to the rules and regulations set forth by the federal government in the reporting of certain gambling winnings and the following rules trigger a W-2G situation: The winnings reduced, at the option of the payer, by the wager are: a. $600 or more, and b. At least 300 times the amount of the wager, or The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding). As you read through the following pages please keep in mind that the majority of all jackpots and OTB winnings are probably going to be signed for by a legal citizen of the United States. Approximately 1or 2% of all taxable winnings are signed for by a foreign person and will be subject to a higher withholding rate of 30%. THIS IS THE BLANK W-2G FORM THAT YOU WILL USE FOR JACKPOT WINNINGS ON HHR AND FOR WINNINGS ON OTB. THIS FORM HAS 8 TOTAL PAGES. PAGES 5 & 8 ARE INSTRUCTION PAGES. • Have the winner sign the top 2 copies. We keep the first page, Copy A, signed and dated by the winner along with a copy of this page and the accompanying ID’s and handpay ticket (winning ticket and taxes ticket for OTB). • The winner receives all other copies for their records. JACKPOT HANDPAY TICKET FROM CASHING STATION W-2G FILLED OUT USING HANDPAY TICKET Date box #2 Transaction box # 5 Window box #10 These are all the boxes that require information from the handpay ticket for a regular W-2g payout. WINNER IDENTIFICATIONS W-2G FILLED OUT USING HANDPAY TICKET Social Security # in boxes 9 & 12 Name and Address On DL last name is listed first then the first name and middle name or initial. These are all the boxes that require information from the Driver’s License and Social Security Card . The amount in box #1 is the total amount of the winnings. The amount in box # 4 is the federal withholding calculated at 24%. The rest of the form is filled out like normal. The federal income tax withheld shows up on the handpay ticket when you touch the ticket on the screen and the tell the system to withhold the taxes. 24% FEDERAL INCOME TAX MUST BE WITHHELD ON WINNINGS OF $5000 OR HIGHER. *30% for Alien Withholding* This is ONLY for JACKPOT HANDPAY tickets. NOT for cancelled credit handpays. To calculate the Alien withholding you must run the handpay out and then calculate the withholding at 30% of the winnings and handwrite the information on the handpay ticket. If this person had a Cuban driver’s license that would be used along with the passport as it would show his address in Cuba Alien withholding must be done on all jackpots subject to taxation. This is 30% withholding on any taxable amount and must be done if the winner is not a citizen of the United States only the following will be accepted as proof of identity: • FOREIGN PASSPORT/DRIVER’S ID – Only has a foreign passport or driver’s license with photo • *Please see pages 14-16 for details* As you can see here the withholding was not done at the cashing station. However, if you catch this BEFORE filling out the W-2g you can make the corrections on the ticket itself and fill out the form accordingly. *Please see page 10 for making a correction on the handpay ticket.* **PLEASE NOTE AS OF JANUARY 2018 THE WITHHOLDING AMOUNT WAS CHANGED TO 24% WHICH IS NOT REFLECTED ON THE HANDPAY TICKET PICTURED HERE.** When a taxable winnings is hit for OTB the manned terminal will tell you by asking for the winners Tax ID when you put the ticket into the machine to pay. At that time you will type in the winner’s social security number, hit enter and the terminal will read the winning ticket and issue 2 TAXES tickets. All the information you will need for the form is contained on the TAXES ticket. We keep the winning ticket and 1 of the TAXES ticket with the signed form. The other TAXES ticket goes to the winner with their copies of the W-2g. ACCEPTABLE ID’S – U.S. ID’s THE IRS REQUIRES 2 FORMS OF IDENTIFICATION TO SIGN FOR A W-2G: Except for a payee of winnings of a state-conducted lottery, a payee of gambling winnings meeting the withholding thresholds from horse racing, dog racing, jai alai, sweepstakes, wagering pools, lotteries, and certain other wagering transactions must present two forms of identification, one of which must include the payee's photo. A completed and signed Form W-9 is acceptable as the other form of identification. NEVER, AT ANY TIME, WILL A PHOTO COPY OF AN ID OR SOCIAL CARD BE ACCEPTED AS PROOF OF ANYTHING. The only “photo copy” that would be accepted is of a driver’s license that has been given to that person until their new permanent license arrives in the mail. **PLEASE NOTE: All W-9 forms MUST be filled out and signed by the winner. We can type in their name and address but the remainder MUST be filled in by the winner themselves and signed and dated for the W-9 to be valid-NO EXCEPTIONS.** W-9 is used when a Social Security card or other proof of social is not available. This form must be filled out and signed by the winner, including the social. As you can see here the name and address were typed in but the social and signature and date are done *NOT TO BE USED FOR ALIEN WITHHOLDING!* State Issued Drivers License Non Expired Acceptable forms of picture ID-U.S. Included in this would be any photo ID that has been issued by a governing body, either federal, state or county is acceptable. State Issued Identification Card Non Expired US Gov’t Issued Passport Non Expired ALL OF THESE EXAMPLES ARE ACCEPTABLE FOR SOCIAL SECURITY PROOF If a social security card or an item issued by a governing authority such as federal, state or county is not available a W-9 is acceptable. Medicare Cards are only acceptable if the claim number on the card does not end with the letter “D” This is a Green Card issued by the United States Government showing a resident status. As long as this person has a social security card or proof of social (photo copy of a social card is not acceptable) we would not need to withhold 30%. If this card is expired and the winner has no social security card to show with this we would have to do 30% alien withholding. ID’S SIGNALING ALIEN WITHHOLDING A picture ID is all that is required for alien withholding. DO NOT USE FORM W-9! When making corrections to a form that has already been signed by the winner you MUST do the following: • Check the CORRECTED box at the top of the form • Either cross out or draw a line through the items that are incorrect. • Write in the correct information. • MUST DO THIS TO ALL COPIES WE HAVE • Make a copy of the corrected form and get it to the winner for their records. • Re-scan and re-email. When it is all done and ready to go you will need to email the finished W-2g and W-9’s to the correct people. Regular (non-withholding) W-2g’s need to be emailed to the following: Tom Tucker @ tomptucker@gmail.com Margaret Edwards @ margarete@wyominghorseracing.com Nina Condos @ ninahorseracing@Hotmail.com SUBJECT LINE: W-2G Last Name ALL Withholding (including and particularly Alien withholding) W-2g’s email to: Tom Tucker @ tomptucker@gmail.com Maggie Skiver @ maggies@wyominghorseracing.com Eugene Joyce @ eugenej@wyominghorseracing.com Margaret Edwards @ margarete@wyominghorseracing.com Tim Lattner @ timl@wyominghorseracing.com Nina Condos @ ninahorseracing@Hotmail.com SUBJECT LINE: W-2G Withholding Last Name ***PLEASE NOTE IF A CORRECTION TO A W-2G IS NEEDED PLEASE REEMAIL TO THE CORRECT PEOPLE LISTED ABOVE.**** This is a shot looking down on the scanner glass from above. The social security card and photo ID’s are at the top of the glass, then the signed form then the handpay ticket. Everything is pushed to the to very top edge of the scanner glass so that none of the handpay ticket is cut off. While the items are on the screen for scanning make 2 copies of this. 1 for us and 1 for the winner. Here is the copy made from the items on the scanner. As you can see the drivers license and social are easy to see and the signed form is intact with phone number and the handpay ticket at the bottom isn’t cut off. We make 2 copies, 1 for us to keep and 1 for the winner. All easy to read at a glance. Here is the finished and stapled W-2G ready to be put in the safe. The copy of the ID’s, form and handpay ticket is on the bottom of the pile. Then the ½ page of the original signed W-2g is on top and the winning ticket is stapled on the very top of the page. *PLEASE NOTE* If you have a W-9 you would put that form on the bottom of the pile. HERE ARE A FEW THINGS THAT YOU NEED TO KNOW ABOUT W-2G’S: First, this is a Federal document and any falsification in any way can be considered fraud and comes with some harsh penalties courtesy of the federal Government and Wyoming Horse Racing LLC. FALSIFICATIONS INCLUDE: Knowingly allowing someone else to sign for the actual winner. Changing of any of the information on a signed form WITHOUT checking the corrections box at the top of the form and/or not getting a corrected form to the winner. Penalties Include: Immediate termination for knowingly allowing someone else to sign for the actual winner. Verbal write up for changing any information without checking the corrections box and not getting the corrected copies to the winner or the company. Second, when making a correction to a form that is already signed for by the winner you MUST check the Corrected box at the top of the form. Then you MUST get a copy to the winner (even if you have to snail mail it). You MUST correct all copies you have with the changed information. You must email that corrected form to the correct people *see page 21* With the following SUBJECT LINE: *Corrected W-2g Last Name Third, we (Wyoming Horse Racing LLC) are responsible for all the information contained on the W-2g’s and that information is sensitive (social security #, address etc..). Therefore it is EXTREMELY important that we secure that information correctly by putting all W-2g’s and W-9’s in a secure spot (either the safe or locking filing cabinet) please consult your site Manager or Assistant Manager for where the form needs to be stored. ALL W-2g’s must be snail mailed to the corporate office in Evanston (PO Box 3210, Evanston, WY 82931) where they will be kept for 1 calendar year. The Manager or Assistant Manager are responsible for sending the W-2g’s to the Corporate office every month, if you get too many and are afraid of losing some please send them in batches throughout the month or however many times a month to keep them from being lost or torn up.