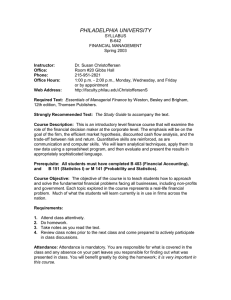

NEW YORK INSTITUTE OF TECHNOLOGY SCHOOL OF MANAGEMENT Financial Management (Finc 601) Fall 2019 I. Professor: Dr. Paul Kutasovic Office: Room 320, Wisser Library OW campus Office hours: Tuesday and Thursday: 3:45 to 5:45 pm And by appointment Voice: (516) 686-7739 E-mail: pkutasov@nyit.edu II. Catalog Description: This course focuses on the foundations of business finance utilizing a decision making approach. A balanced presentation of financial theory and its application to the solution of practical problems is maintained. Topics include: evaluation and selection of assets (investment decisions), evaluation of securities, cost of capital, leverage and financial structure decisions. Focus is on the evaluation of financial courses of action with respect to their risk-return trade-offs. III. Objective: This is a 3-credit course and is designed as a foundation core Managerial/Corporate Finance course for all MBA students. We shall explore the fundamental concepts in Financial Management. The course will then cover the theoretical framework and analytical tools for decision making in financial management. IV. Student learning outcomes: After successfully completing this course, the student will be able to: 1. Analyze corporate financial statements. 2. Demonstrate the understanding of two basic financial questions: What investments should the firm make? How to finance the investments? 3. Apply time value concepts to value a business and a capital investment project. 4. Understand risk-return analysis, cost of capital and capital budgeting. 5. Comprehend capital structure theory and dividend policy of a firm. V. Texts: (Required) Brigham & Ehrhardt: Financial Management – Theory & Practice, 15th edition, South-Western Cengage Learning, 2017. (Optional) Study guide to the above text. (Suggested Reading) The Wall Street Journal, Financial Times. Computer-based supplements: 1. http://swlearning.com/finance/brigham 2. www.bloomberg.com 1 3. www.cnbc.com 4. www.cnnfn.com 5. www.finance.yahoo.com VI. Calculator: Financial Calculator with NPV and IRR key (HP - 10B-II recommended). Your textbook follows this calculator. VII. Preparation: 1) Participation in class discussion is strongly encouraged. 2) Read assigned chapter(s) before scheduled class meetings. 3) Homework problems, projects and cases will be assigned from time to time which may be collected for grading. However, it is to your best interest to keep up with the assigned work diligently for class participation and exam preparation. VIII. Class schedule: Please see the following page. The professor retains the right to change the schedule as and when necessary. This is a function of the progress of the class as a whole. IX. Attendance: Since we meet once a week for 14 weeks and the teaching method includes class discussion and participation, class attendance is mandatory. More than one unexcused absences may result in a lower grade. X. Academic Integrity and Plagiarism Policies: Each student enrolled in a course at NYIT agrees that, by taking such course, he or she consents to the submission of all required papers for textual similarity review to any commercial service engaged by NYIT to detect plagiarism. Each student also agrees that all papers submitted to any such service may be included as source documents in the service’s database, solely for the purpose of detecting plagiarism of such papers. Plagiarism is the appropriation of all or part of someone else’s works (such as but not limited to writing, coding, programs, images, etc.) and offering it as one’s own. Cheating is using false pretenses, tricks, devices, artifices or deception to obtain credit on an examination or in a college course. If a faculty member determines that a student has committed academic dishonesty by plagiarism, cheating or in any other manner, the faculty has the academic right to 1) fail the student for the paper, assignment, project and/or exam, and/or 2) fail the student for the course and/or 3) bring the student up on disciplinary charges, pursuant to Article VI, Academic Conduct Proceedings, of the Student Code of Conduct. The complete Academic Integrity Policy may be found on various NYIT web-pages, including: http://www.nyit.edu/about/administration/academic_affairs/academics/resources_faculty.html XI. Grading: Your final grade will be determined by your performance on the following basis: 2 Midterm Exam Final Exam Cases (3) Class participation Grade distribution: A B+ B C+ C F XII. 30% 40% 20% 10% 90% 85% 80% 75% 70% 0-69% Missed Examination Policy: There will be no make-up exam. A missed exam is a guaranteed zero – except, only serious medical reasons or other excuses that are verifiable and acceptable to the instructor. It is the student’s responsibility to arrange for the makeup prior to the class exam date. XIII. Special needs: Students with disabilities who need special accommodations for this class are encouraged to meet with me or the appropriate disability service provider on campus as soon as possible. 3 Topical Outline Week 1: Ch. 1 – An Overview of Financial Management Ch. 4. –Time Value of Money Week 2 Ch. 4 – Time Value of Money Weeks 3 and 4: Ch. 5 – Bonds, Bond Valuation and Interest Rates Week 5: Ch. 6 – Risk, Return & CAPM Weeks 6 and 7: Ch. 7 – Valuation of Stocks and Corporations Ch. 2 – Financial Statements, Cash Flow and Taxes Week 8 Midterm exam Week 9: Ch. 3 – Analysis of Financial Statements Weeks10 and 11: Ch. 9 – The Cost of Capital Week 12: Ch. 10 – Basics of Capital Budgeting Week 13: Ch. 12 – Corporate Valuation and Financial Planning Week 14: Ch. 14 – Distribution to Shareholders Week 15: Final Exam 4