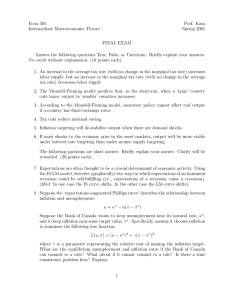

1 A. Mansoorian Sample Questions for Final Econ. 2450 Question 1: D A stock market crash will likely lead to each of the following except A) it will likely cause a recession B) it will likely reduce government tax revenues from capital gains C) it will likely reduce government tax revenues from incomes D) it will likely lead to a reduction in the size of the government budget deficit Question 2: C In the New Keynesian model with overlapping labour contracts . A) when output is above full employment firms resists wage cuts because they are worried about their competitive position relative to other firms. B) when output is above full employment workers resists wage increases because they are worried about their competitive position relative to other workers. C) when output is below full employment workers resists wage cuts because they are worried about their position relative to other workers. D) None of the above. Question 3: D In the IS-LM model with flexible exchange rates an increase in the use of credit cards will A) increase the demand for money. B) will shift the LM curve to the left. C) will increase the interest rate. D) will increase output. Question 4: B Choose the best correct answer A) According to the Phillips curve if there is cyclical unemployment then output is below its potential level. B) According to the Okun’s law if there is cyclical unemployment then output is below its potential level. C) According to the Phillips curve if the unemployment rate is above its natural rate the inflation rate is higher than its expected rate then. D) both B and C. 2 Question 5: D Suppose the government is spending on maintaining roads and other investments in public infrastructure. Such expenditures will benefit mainly the current residents of the country; and they should be A) financed mainly by taxing the current taxpayers. B) Such expenditures will benefit the future residents of the country; and they should be financed mainly by borrowing. Such expenditures will benefit the future residents of the country; and they should be financed by C) mainly taxing the current taxpayers. Such expenditures will benefit mainly the current residents of the country; and they should be D) financed mainly by borrowing. Question 6: C Choose the best correct answer A) In the 1960s the Phillips Curve kept shifting upward B) In the 1970s the central banks tried to reduce inflation by adopting low inflation targets. C) In the 2000s we had a relatively stable Phillips Curve D) In the 1990s there was an upward shift in the Phillips curve. Question 7: C By the Taylor rule the real interest rate is reduced . A) when the target inflation rate is reduced. B) when the actual inflation rate increases. C) when actual output falls. D) Both A and B. Question 8: A The Phillips curve is a relationship between . A) the unemployment rate and the inflation rate. B) employment and potential output. C) the unemployment rate and the real GDP. D) the interest rate and the exchange rate. 3 Question 9: A Choose the best correct answer: A) Automatic fiscal stabilizers include progressive income taxes and welfare payments. B) Automatic fiscal stabilisers include the money supply and the exchange rate C) Automatic fiscal stabilizers tend to reduce the size of the actual government budget deficits in recessions. D) Automatic fiscal stabilizers tend to reduce the size of the cyclically adjusted government budget deficit in recessions. Clarification: Notice, the cyclically adjusted budget deficits abstracts completely from the effects of automatic stabilizers. Hence, these stabilizers do not affect the cyclically adjusted budget deficits. Question 10: A In the IS-LM model with flexible exchange rates, a loss of confidence by currency speculators in the fundamental value of the Canadian dollar will . A) increase output in Canada B) reduce the real exchange rate ε. C) will reduce interest rates in Canada. D) the increase the money supply in Canada. Question 11: B If all prices and wages are fully flexible then . A) there will be no unemployment. B) there will be some unemployment due to industrial restructuring. C) monetary policy will be effective in reducing unemployment. D) None of the above. Clarification: If prices and wages are fully flexible then unemployment will be at U*. But monetary policy cannot affect U*. Hence, when prices and wages are fully flexible then monetary policy cannot affect unemployment. 4 Question 12: D The IS curve will shift to the left if A) . firms become optimistic about the future level of economic activity. B) the money supply decreases. C) a financial innovation reduces the demand for money. D) there is a recession abroad. Question 13: C Consider the money market equilibrium (with real money supply and liquidity preference) with fixed prices. In that model an increase in the money supply will . A) leave the nominal interest rates unchanged. B) shift out the liquidity preference curve. C) increase bond prices. D) None of the above. Question 14: C According to the Phillips Curve Y −Y * Y* A) (u − u* ) = −α × B) Y −Y * = θ × (π − π e ) Y* C) π = π e − β × (u − u * ) D) r = r * + δ ×(π − πT) + (Y − Y*) . 5 Question 15: A Choose the best correct answer: A) An unexpected increase in the inflation rate rewards firms and hurts workers B) An unexpected increase in the inflation rate rewards lenders and hurts borrowers C) Zero inflation rate makes labour markets operate more smoothly. D) When the inflation rate is lower households and firms spend more time and energy managing their money holdings. Question 16: A Choose the best correct answer A) Policy lags are longer for fiscal rather than monetary policies. B) Monetary policy is very effective in changing output under a fixed exchange rate system. C) Monetary policy changes will have maximum effect on output if Forward Guidance is practiced by the central bank. D) Both A and C Clarification: To changes taxes and government expenditures the government needs the approval of the Parliament, which is time consuming. With monetary policy no such approval is required. Hence, policy lags are longer for fiscal policy. Question 17: C All of the following are true except A) In much of the 1960s the Phillips curve was relatively stable. B) In the 1970s the central banks were trying to reduce unemployment by creating unexpected inflation. C) Between 1981 and 1984 the Banks of Canada had a zero inflation target. D) Since mid 1990s we have had a relatively stable Phillips curve. 6 Question 18: D In the IS-LM model with flexible exchange rates an increase in government expenditures will A) reduce the real interest rate and increase the real exchange rate ε. B) reduce the real interest rate and reduce the real exchange rate ε. C) increase the real interest rate and increase the real exchange rate ε. D) increase the real interest rate and reduce the real exchange rate ε. Question 19: D Under a fixed exchange rate system, if a country's currency is credibly revalued (i.e., e decreases now and for ever into the future) then A) the country’s money supply will fall. B) output will fall in the short run C) the country’s central bank will find itself gaining foreign exchange. D) both A and B Question 20: C If Canada were to unilaterally fix the value of the Canadian dollar versus the U.S. dollar then A) the U.S. Federal Reserve will have to intervene in the foreign exchange market. B) the activities of the U.S. Federal Reserve will not affect the Canadian money supply. C) an increase in the money supply in the U.S. will result in an increase in the money supply in Canada. D) both A and C. Clarification: Unilateral means Canada is fixing the exchange rate and does not care what exchange rate policies other countries adopt. In this case, the effects of shocks on the Canadian economy will be the same as what we would have with a Reserve Currency Standard. 7 Question 21: D Each of the following is a benefit of a flexible exchange rate system except A) With flexible exchange rates the central bank can follow independent monetary policy to stabilize business cycles. B) The economy is better insulated from foreign business cycles with flexible exchange rates. C) With flexible exchange rates the central bank does not have to be preoccupied with keeping the value of the exchange rate fixed. D) Exchange rate fluctuations encourage trade and international investment. Clarification: Why is B a correct statement? With flexible exchange rates a recession abroad will shift the IS curve to the left. This will reduce interest rates, which will boost investment and net exports. This boosting of investment and net exports tends to stabilize the economy. Such stabilization effect is absent with fixed exchange rates. With fixed exchange rates when interest rates fall people try to sell their Canadian bonds, take their $s to the foreign exchange market to convert into euros to buy European bonds. To keep the exchange rate fixed the central bank buys $s in exchange for euros, which will reduce the money supply and increase interest rates back to its original level. Hence, with fixed exchange rates the activities of the central bank re-enforce the effects of foreign recessions on the economy. Question 22: C The AD curve has a negative slope because when the inflation rate increases the central bank ___________interest rates, which investment and net exports. A) increases; increases B) decreases; increases. C) increases; decreases. D) decreases; decreases. Question 23: A Higher inflation expectations by the public in the 1970s A) resulted in an upward shift in the Phillips curve. B) resulted in a downward shift in the Phillips curve. C) resulted in higher inflation but lower unemployment. D) had no effect on the Phillips curve. 8 Question 24: B For the target inflation rate to be credible it must be . A) the equilibrium inflation rate in the short run. B) the equilibrium inflation rate in the long run. C) the equilibrium inflation rate in the short run and the long run. D) the equilibrium inflation rate neither in the short run nor in the long run. Question 25: D The AD curve will shift to the left if . A) firms become pessimistic about the future level of economic activity. B) there is an fiscal austerity program. C) there is a recession abroad. D) All of the above. Question 26: C The Austrian (or New Classical) theory of business cycles implies all of the following except A) business cycles reflect mainly changes in the natural rate of unemployment. B) recessions lead unproductive firms to exit the economy. C) business cycles are due to price and wage rigidities. D) governments should not try to stabilize business cycles. Question 27: A The cyclical rate of unemployment . A) is the unemployment we have as a result of sticky prices and wages. B) is the result of industrial restructuring in the economy. C) would be higher if labour unions were less powerful. D) all of the above. Clarification: Why is not C correct? Reason: The activities of the unions work in a way that is similar to the effects of labour laws. When unions are strong it is harder to fire workers. Then, firms will be more cautions when hiring workers, which would increase U*. 9 Section II: Short Answer Questions Question 1: i. (3 marks) Write down the equation for the Taylor Rule. (You should explain what each term in this equation stands for). This straight from your lecture notes ii. (4 marks) Explain why the Taylor Rule represents the equation of the effective LM curve. Recall along the LM curve the money supply is fixed. With Taylor Rule the central bank does not keep the money supply fixed; rather, it adjusts the money supply to obtain the desired level of interest rates as given by the Taylor Rule. Hence, with the Taylor Rule the TR curve gives for each Y the appropriate level of r as desired by the central bank, and the corresponding level of the money supply which brings equilibrium to the money market for that r. In that sense, the TR curve replaces the LM curve. Question 2: i. (9 marks) Use the Aggregate Supply-Aggregate Demand diagram with overlapping contract (i.e., the New Keynesian model) in order to explain the effects of an unanticipated fall in the inflation target on output and inflation. In your answer explain both the short term effect as well as the adjustment to the long run equilibrium. See your lecture notes. This is when the central bank does not announce its policies in advance. The equilibrium shifts from B to D in Figure 1 (on the following page) when the policy is implemented. After that, it moves down the AD1 curve gradually until it is at F. ii. (4 marks) Explain how your answer to part ii of this question would change if the policy change was anticipated. This is when the policy is announced in advance. The advanced announcement allows some workers and firms to adjust their contracts, shifting AS to AS1. As a results, when the policy is implemented the equilibrium moves to H in Figure 1. After that, it moves down the AD1 curve gradually until it is at F. Question 3: (8 marks) Explain how one can derive the aggregate demand curve with the inflation rate measured on the vertical axis. (7 marks) Explain how this aggregate demand curve will shift if there is a reduction in the inflation rate target. Question 4: Re-do question 2 for the case where the contracts do not overlap (New Classical model). Answer: See your lecture notes. For part (i): This is when the central bank does not announce its policies in advance. The equilibrium shifts from B to D in Figure 1 when the policy is implemented. At the beginning of the next period, when all the contracts are renegotiated the equilibrium moves to F. 10 For part (ii): This is when the policy is announced in advance. The advanced announcement allows all workers and firms to adjust their contracts, shifting AS to ASF. As a results, when the policy is implemented the equilibrium moves to F.