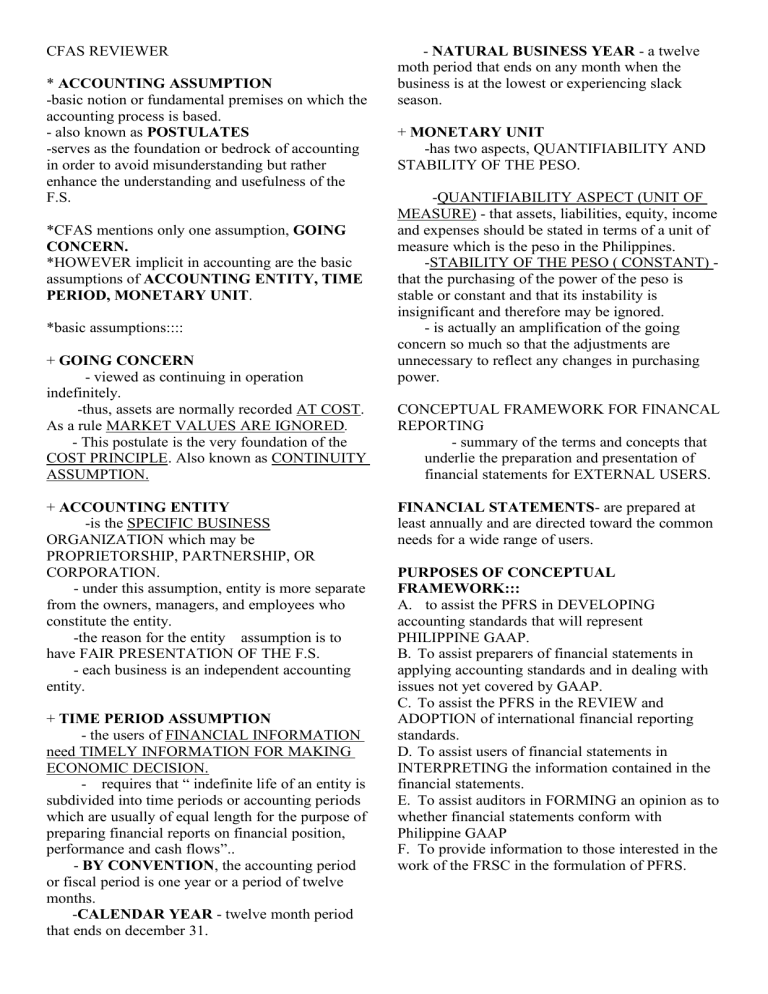

CFAS REVIEWER * ACCOUNTING ASSUMPTION -basic notion or fundamental premises on which the accounting process is based. - also known as POSTULATES -serves as the foundation or bedrock of accounting in order to avoid misunderstanding but rather enhance the understanding and usefulness of the F.S. *CFAS mentions only one assumption, GOING CONCERN. *HOWEVER implicit in accounting are the basic assumptions of ACCOUNTING ENTITY, TIME PERIOD, MONETARY UNIT. *basic assumptions:::: + GOING CONCERN - viewed as continuing in operation indefinitely. -thus, assets are normally recorded AT COST. As a rule MARKET VALUES ARE IGNORED. - This postulate is the very foundation of the COST PRINCIPLE. Also known as CONTINUITY ASSUMPTION. + ACCOUNTING ENTITY -is the SPECIFIC BUSINESS ORGANIZATION which may be PROPRIETORSHIP, PARTNERSHIP, OR CORPORATION. - under this assumption, entity is more separate from the owners, managers, and employees who constitute the entity. -the reason for the entity assumption is to have FAIR PRESENTATION OF THE F.S. - each business is an independent accounting entity. + TIME PERIOD ASSUMPTION - the users of FINANCIAL INFORMATION need TIMELY INFORMATION FOR MAKING ECONOMIC DECISION. - requires that “ indefinite life of an entity is subdivided into time periods or accounting periods which are usually of equal length for the purpose of preparing financial reports on financial position, performance and cash flows”.. - BY CONVENTION, the accounting period or fiscal period is one year or a period of twelve months. -CALENDAR YEAR - twelve month period that ends on december 31. - NATURAL BUSINESS YEAR - a twelve moth period that ends on any month when the business is at the lowest or experiencing slack season. + MONETARY UNIT -has two aspects, QUANTIFIABILITY AND STABILITY OF THE PESO. -QUANTIFIABILITY ASPECT (UNIT OF MEASURE) - that assets, liabilities, equity, income and expenses should be stated in terms of a unit of measure which is the peso in the Philippines. -STABILITY OF THE PESO ( CONSTANT) that the purchasing of the power of the peso is stable or constant and that its instability is insignificant and therefore may be ignored. - is actually an amplification of the going concern so much so that the adjustments are unnecessary to reflect any changes in purchasing power. CONCEPTUAL FRAMEWORK FOR FINANCAL REPORTING - summary of the terms and concepts that underlie the preparation and presentation of financial statements for EXTERNAL USERS. FINANCIAL STATEMENTS- are prepared at least annually and are directed toward the common needs for a wide range of users. PURPOSES OF CONCEPTUAL FRAMEWORK::: A. to assist the PFRS in DEVELOPING accounting standards that will represent PHILIPPINE GAAP. B. To assist preparers of financial statements in applying accounting standards and in dealing with issues not yet covered by GAAP. C. To assist the PFRS in the REVIEW and ADOPTION of international financial reporting standards. D. To assist users of financial statements in INTERPRETING the information contained in the financial statements. E. To assist auditors in FORMING an opinion as to whether financial statements conform with Philippine GAAP F. To provide information to those interested in the work of the FRSC in the formulation of PFRS. USERS OF FINANCIAL INFORMATION::: + INTERNAL USERS A. MANAGEMENT B. ACTIVE OWNERS + EXTERNAL USERS A. INVESTORS B. EMPLOYEES C. LENDERS D. SUPPLIES AND OTHER TRADE CREDITORS E. CUSTOMERS (RETAILERS TO WHOLESAILERS) F. GOVERNMENT AND ITS AGENCIES G. INACTIVE OWNERS ( USUALLY ATE THE END OF THE YEAR) QUALITATIVE CHARACTERISTICS - qualities or attributes that make financial accounting information USEFUL TO THE USERS IN MAKING ECONOMIC DECISIONS. A. RELEVANCE - capacity of information to influence a decision. + PREDICTIVE VALUE - if it can be used as an input to processes employed by the users to predict future outcome - (FORECASTING OUTCOME OF EVENTS) + CONFIRMATORY VALUE - when it enables users confirm or correct earlier expectation. + MATERIALITY - also known as DOCTRINE OF CONVINIENCE - is really a quantitative “threshold” linked very closely to the qualitative characteristic of RELEVANCE -materiality of an item depends on RELATIVE SIZE rather than absolute size. (FACTORS OF MATERIALITY) - REALTIVE SIZE - realtion to the total of the group to which the items belongs is taken into account. - NATURE OF THE ITEM -may be inherently material because by its very nature it affects economic decision. B. FATIHFUL REPRESENTATION - means that financial reports represent economic phenomena or transactions in words and numbers - means that the actual effects of the transaction shall be properly accounted for and reported in the financial statements. + COMPLETENES -requires that relevant information should be presented in a way that facilitates understanding and avoids erroneous implications. - result of ADEQUATE DISCLOSURE STANDARD or THE PRINCIPLE OF FULL DISCLOSURE. ++ STANDARD OF ADEQUATE DISCLOSURE -means that all significant and relevant information leading to the preparation of financial statements shall be clearly reported. - best described by DISCLOSURE OF ANY FINANCIAL FACTS SIGNIFICANT ENOUGH TO INFLUENCE THE JUDGEMENT OF INFORMED USERS +NEUTRALITY - “WITHOUT BIAS’ in the preparation or presentation of financial information - FREE FROM BIAS -synonymous with all encompassing PRINCIPLE OF FAIRNESS. + FREE FROM ERROR - means that there are no errors or omissions in the description of the phenomenon or transaction. - does not mean all perfectly accurate in all respects. --example, estimate of an unobservable price or value cannot be determined to be accurate or inaccurate. ((NO DISCUSSION OF CONSERVATISM AND PRUDENCE IN THE CFAS)) +CONSERVATISM -possible errors in measurement be in the direction of understatement rather than overstatement of net income and net assets. - in case of doubt, record any loss and do not record any gain. +PREDUNCE -desire to exercise caution when dealing with the uncertainties in the measurement process such that assets or income not overstated and liabilities or expense are not understated.. ENHANCING QUALITATIVE CHARACTERISTICS - to increase the usefulness of the financial information that is relevant and faithful represented. A. COMPARABILITY -the ability to bring together for the purpose of noting points of likeness and difference. ++WITHIN AN ENTITY -quality of information that allows comparisons within a single entity through time or from one accounting period to the next. ++BETWEEN AND ACROSS ENTITY -quality of information that allows comparison between two or more entities engaged in the same industry. + CONSISTENCY -implicit in the comparability is the PRINCIPLE OF CONSISTENCY -comparability is the goal and consistency helps to achieve the goal. B. UNDERSTANDABILITY -requires that financial information must be COMPREHENSIBLE AND INTELLIGIBLE if it is to be most useful. -clearly and concisely making it understandable -readily understandable by users. C. VERIFIABILITY - means that different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement,that a particular depiction is a faithful representation. -provides result that would be substantially DUPLICATED BY MEASURES using the same measurement method. ++ DIRECT VERIFICATION -verifying an amount or other representation through direct observation, for example, by counting cash. ++INDIRECT VERIFICATION -checking the inputs to a model, formula or other technique and recalculating the inputs using the same methodology. D. TIMELINESS -financial information must be available or communicated early enough when a decision is to be made. - enhances the truism that “WITHOUT KNOWLEDGE OF THE PAST,THE BASIS FOR PREDICTION WILL USUALLY BE LACKING AND WITHOUT THE INTEREST IN THE FUTURE, KNOWLEGE OF THE PAST IS STERILE”. COST CONSTAINT ON USEFUL INFORMATION. - COST is a pervasive constraint on the information that can be provided by financial reporting. -COST CONSTRAINT is a consideration of the cost incurred in generating financial information against the benefit to be obtained from having the information. - the evaluation of the COST CONSTRAINT is substantially a JUDGEMENTAL PROCESS