Alcohol Excise Tax: Opinion Essay on Social Impact & Policy

advertisement

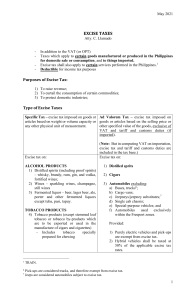

Aguelo, Jana Elline Maruquez, Marsha Resma, Michelle F2B We are certainly pleased with this news of increasing alcohol excise tax rate since excessive alcohol consumption often occurs and has become a major concern for the well-being of society. Anything excess is always bad. It is good to know that there is still a senator like Pia Cayetano whose reason for pushing the bill is that she has the duty as a nation server, to act regarding the protection of the Filipinos. Senator Cayetano made a great move in proposing higher tax rates for alcohol to at least change the behavior of alcoholic consumers while concerning its promotion of safeguarding the health and welfare of all people. It would be better to have higher excise tax for alcohol to lessen the number of alcoholic person. We all know that many people affords drinking so much alcohol nowadays because of its lower price. And we think that this action can possibly discourage them to drink alcohol. We all know that we can't stop them, but at least we can minimize or lessen the number of the alcoholic drinkers.To support, we definitely agree to the upsurge of alcohol tax for the reason that consumption of alcohol does not only affect the drinker but it also leads to situations where it distresses the lives of other innocent people. The grief and sorrows brought about by the life taken away accidentally or due to negligence can’t be in any way sufficed by any amount of taxes paid by the alcohol users. It impacts the social, physical, and psychological state and relations of people being affected. We also apprehend that if it is really for the greater good then strike the root cause. It must be focused on the character building of those people inclined most especially the heavy drinkers to sacrifice and know their responsibilities. On the other hand, we are quite dissatisfied that if the government can approve such a proposal, why can’t they do a bigger opportunity like banning the drinking of alcohol in the country? This leads us to the realization that the government still abuses its entrusted power through corruption. The suggested higher alcohol tax rates will only lessen the problem but it will still occur since the upper class can always afford and consume alcohol anytime and anywhere. No matter how much taxes the government impose on sin products, consumers who are addicted or regular users of such will still buy it no matter how expensive it could get. Moreover, we oppose to what she said that imposing higher excise taxes on alcohols is the singular, reasonable, and patriotic conclusion to eradicate or reduce the personal health costs, socioeconomic costs and massive economic cost that alcohol abuse brings. We believe that a more transparent and informative government could also help give solution to the problem. The government should provide more information regarding the cons and diseases that can be acquired in taking alcohols and it must be effective enough for the users to believe. The bottom line here is that, whether the excise tax increases, the decision is and will always be in the hands of the users of such products. The government should be an effective aide towards protecting the citizens’ health. We are hoping that the taxes that will be collected would be put in the right place, with just and rational allocation for the public purpose.