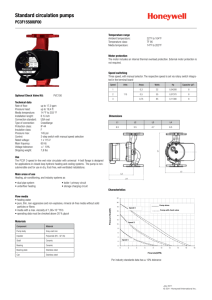

Energy Economics In-Class Worksheet 1 Problem 1. A company is looking at installing variable frequency drives VFD’s on its process water pumps. The process water flow is currently restricted to 60% flow with control valves. There are currently five 20 horsepower motors. They run 6000 hours per year at 80% load. The company pays $0.06 per kWh. The current annual cost for electrical energy to operate the pumps is about: 5 𝑚𝑜𝑡𝑜𝑟𝑠 × 20-ℎ𝑝 0.746 𝑘𝑊 $0.06 × 80% 𝑙𝑜𝑎𝑑𝑒𝑑 × × 6000 ℎ𝑜𝑢𝑟𝑠 × = $𝟐𝟏, 𝟒𝟖𝟒. 𝟒𝟎⁄𝒚𝒆𝒂𝒓 𝑚𝑜𝑡𝑜𝑟 ℎ𝑝 𝑘𝑊ℎ CURRENT SYSTEM INPUTS Term Operating hours per year (HPY) Pump rated power (HP) Measured pump power (MP) Pump Motor Efficiency (Eff) Efficiency Penalty (EP) Electricity Cost (CE) Carbon Intensity Electricity (CIE) Estimated Pump Efficiency at PA (ηA) Estimated Pump Efficiency at PB (ηB) Estimated Pump Efficiency at PC (ηC) % of time at 20% flow (F20) % of time at 50% flow (F50) % of time at 100% flow (F100) Value 6,000 100.0 60.0 90% 10% $0.0600 1.95 85% 80% 75% 30% 30% 40% Units hr/yr hp kW /kWh lb-CO2/kWh - PROPOSED SYSTEM INPUTS Term Frac flow rate required (F) = F20 x 0.20 + F50 x 0.50 + F100 x 1 Value Units 0.6 - CALCULATIONS AND SAVINGS Term Pump power (PB) = MP Fluid Work (WB) = PB x ηB Pump electricity use (E1) = PB x HPY Pump power (PA) = HP x (0.746 kW/hp) Fluid Work (WA) = PA x ηA Fluid Work (WC) = WA x F^3 Pump power (PC) = WC / ηC Pump electricity use (E2) = PC x HPY Electricity savings (ES) = E1 - E2 CO2 emission savings (Csav) = ES x CIE / (2,205 lb/tonne) Electricity cost savings (ECS) = ES x CE Value 60.0 48.0 360,000 74.6 63.4 13.70 18.26 109,572 250,428 221 $15,026 Units kW kW kWh/yr kW kW kW kW kWh/yr kWh/yr tonnes/yr /year The estimated annual electricity savings are $𝟏𝟓, 𝟎𝟐𝟔/𝐲𝐞𝐚𝐫. The estimated cost of installation of the 5 VFD’s is about $4,150 per motor for a total estimated installation cost of $𝟐𝟎, 𝟕𝟓𝟎. What will be the estimated Present Worth of the electrical savings in 7 years? The company has a Minimum Attractive Rate of Return, (MARR) of 14%. What will be the fnt Worth or Net Present Value? 1−(1+0.14)−7 $15026 ( 0.14 ) = $64436 $64436 − $20750 = $43686 𝑁𝑃𝑉 Problem 2. What is the Simple Payback Period, in months, of the example above? Calculate the Present Worth or Present Value and the Net Present Worth or Net Present Value using the Uniform Series Cash Flow equation. $20750 SP = InitialCost / SavingsPerYear = $15026/𝑦𝑒𝑎𝑟 = 1.381 years = 16.57 months or 17 months Problem 3. What is the Present Worth or Present Value of the savings, the Net Present Worth or Net Present Value, the Annual Worth and the Simple Payback of the cash flow given below? The Minimum Attractive Rate of Return, (MARR) is 13%. Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: -$35,000 $10,200 (1 + 0.13)−1 $8,800 (1 + 0.13)−2 $9,300 (1 + 0.13)−3 $10,800 (1 + 0.13)−4 $12,400 (1 + 0.13)−5 = $35718 𝑃 = 𝐹(1 + 𝑖)−𝑛 −$35000(1 + 0.13)−0 + $10200(1 + 0.13)−1 + $8800(1 + 0.13)−2 + $9300(1 + 0.13)−3 + $10800(1 + 0.13)−4 + $12400(1 + 0.13)−5 = $718 𝑁𝑃𝑉 Problem 4. What is the Internal Rate of Return of the two sets of cash flows given below? Which one would you consider to be the best investment? Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: IRR: Case 1 -$35,000 $10,200 $8,800 $9,300 $10,800 $12,400 14% Case 2 -$45,000 $14,000 $14,000 $14,000 $14,000 $14.000 17% Problem 5. A standard efficiency 40-hp electric motor costs $2,382 and a premium efficiency 40-hp electric motor costs $177 more or $2,559. The standard efficiency motor is 89.9% efficient at 75% load and the premium efficient motor is 93.1% efficient at 75% load. The cost of electricity in $0.075 per kWh. The motors will operate 6000 hour per year and have an expected life of 15 years. Compare the Life-Cycle Cost of each motor at a 15% discount rate. Which motor would be recommended? What is the Simple Payback of the premium motor and what is the Internal Rate of Return (IRR)? Problem 6. What would be the Life-Cycle Cost of the two 40-hp motors in the example above, 10% discount rate, in 7 years, if the cost of electricity increased 3% per year?