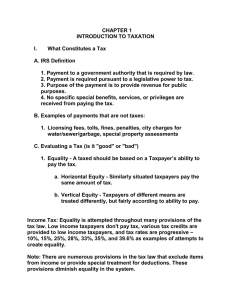

Name: _________________________________ Section (circle one): 12:30 pm / 2:00 pm / 3:30 pm Chapter 1 Homework 1. The table below gives the taxable income and taxes for three taxpayers under a hypothetical tax system. A) Is the tax rate structure of this tax system Taxpayer Income Taxes proportional, regressive, or progressive? A $50,000 $20,000 __________________ B $100,000 $35,000 B) Give a real world example of a type of tax C $150,000 $45,000 that has this tax rate structure: _________________ 2. The table below gives the taxable income and taxes for three taxpayers under a hypothetical tax system. A) Is the tax rate structure of this tax system Taxpayer Income Taxes proportional, regressive, or progressive? A $50,000 $5,000 __________________ B $100,000 $10,000 B) Give a real world example of a type of tax C $150,000 $15,000 that has this tax rate structure: _________________ 3. The table below gives the taxable income and taxes for three taxpayers under a hypothetical tax system. A) Is the tax rate structure of this tax system Taxpayer Income Taxes proportional, regressive, or progressive? A $50,000 $5,000 __________________ B $100,000 $15,000 B) Give a real world example of a type of tax C $150,000 $30,000 that has this tax rate structure: _________________ 4. Please list the three largest sources of tax revenue for the federal government in order (consider the personal income tax and corporate income tax as separate sources): 1) _______________ 2) _______________ 3) _______________ 5. Please list the three largest expenses for the federal government (order doesn’t matter): ________________ ________________ ________________ 6. Circle one option: The city of Springfield recently raised the per pack tax on cigarettes. The city government assumed the total number of cigarettes purchased in the city would remain roughly the same and estimated the tax increase would raise approximately $20 million in revenue. However, the tax only raised $15 million because many Springfield residents started to drive outside of the city limits to buy all of their cigarettes. The city government overestimated the revenue impact of the cigarette tax increase because it used ( Static / Dynamic ) revenue forecasting which assumes taxpayer behavior will not change. 7. Circle one option in each set of parenthesis: The idea that some people will work fewer hours after a tax rate decrease because they care about maintaining the same after-tax income is referred to as the ( Income / Substitution ) effect. The idea that some people will work more hours after a tax rate decrease because the after-tax returns to work are greater is referred to as the ( Income / Substitution ) effect. 8. Compared to the old tax law, 24 million less taxpayers are expected to take the mortgage interest deduction under the new tax law. Thus, homeowners and renters with the same pretax income should be more likely to pay similar taxes under the new tax law. As a result, the new tax law increases ____________ equity between home owners and those who rent. a. horizontal b. vertical For questions 9 and 10, you need to access Apple Inc. most recent 10-K for the period ending September 30, 2018. I recommend just using the website www.sec.gov to access it. 9. What was Apple’s GAAP effective tax rate for the year ending September 30, 2018? 10. What was Apple’s cash effective tax rate for the year ending September 30, 2018?