Uploaded by

Misbauddin Opu

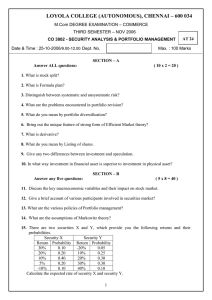

Investment Analysis Course Outline, North Western University

advertisement

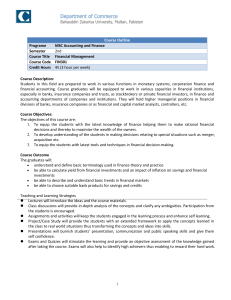

North Western University, Khulna Exam Semester: Fall-2019 th BBA 4 Year 1st Semester (Major: Finance) Course Outline Introduction: Course Conductor: S. M. Misbauddin, Department of Business Administration, North Western University, Khulna. Course Information: Course Name: Investment Analysis and Portfolio Management Course Code: FIN-4105 Credit Hours of the Course: 03 Course Evaluation: In-Course Class Attendance: Class Test: Assignment / Presentation: Semester Final: Total: 10 20 10 60 100 Books Recommended: 1. Prof. Dr. M. Abu Misir: Security Analysis and Portfolio Management, any latest version. 2. S. Kevin: Security Analysis and Portfolio Management, any latest version 3. Reilly/Brown: Investment Analysis and Portfolio Management, any latest version Course Objectives: The purpose of this course is to provide the students with the necessary skills and tools to make investment decision. Securities market play a crucial role in a capitalistic economy. At the end of this course, students are expected to have knowledge and perform the management of investments in different assets like shares, stocks, bonds, debentures which are traded in the securities market. In order to provide a useful treatment of these topics in an environment that is changing rather rapidly, it is necessary to stress the fundamentals and to study some important applications. The topics to be covered are: Security analysis, economy analysis, industry analysis, risk and return calculation, security valuation and efficient market hypotheses. Lecture Schedule: Number of Lectures Chapter Lecture 1- 3 Chapter 6 and Chapter 7 Lecture 4 Lecture 5 – 6 Contents of the Chapter Economy Analysis and Industry Analysis: Fundamental analysis, Inflation, Determinants of stock price, Industry life cycle, Characteristics Presentation Chapter 8 and Chapter 9 Company Analysis and Technical Analysis: Stock price movements, Analysis of company variables, Technical indicators, Dow theory Lecture 7 Class test 1 Lecture 8 - 10 Chapter 5 Risk and Return: Patterns of return, Measurement of returns, Portfolio Standard deviation, Beta Calculation, Correlation Coefficient, Residual Variance Lecture 11 - 12 Chapter 11 Debt Market Securities: Bond Yield and Prices, Bond duration, Bond volatility, Yield to Maturity, Yield to Call, Spot Interest Rate Lecture 13 Class test 2 Lecture 14 - 15 Chapter 12 Lecture 16 - 18 Chapter 18 and Chapter 19 ______________________________ Signature of the Course Conductor Equity Market Securities: Common Stock Valuation Models, Preferred stock, Forms of Dividend, Dividend Policy, Valuation of share, Capital Asset Pricing Model and Efficient Market Theory: Capital Market Line, Security and Capital Market line, Pricing of capital assets, Efficient Capital market, Efficient Market hypotheses