CAS 3 Fall 2007 Notes

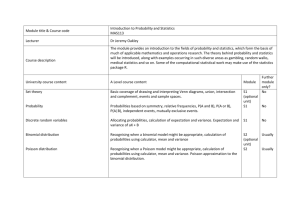

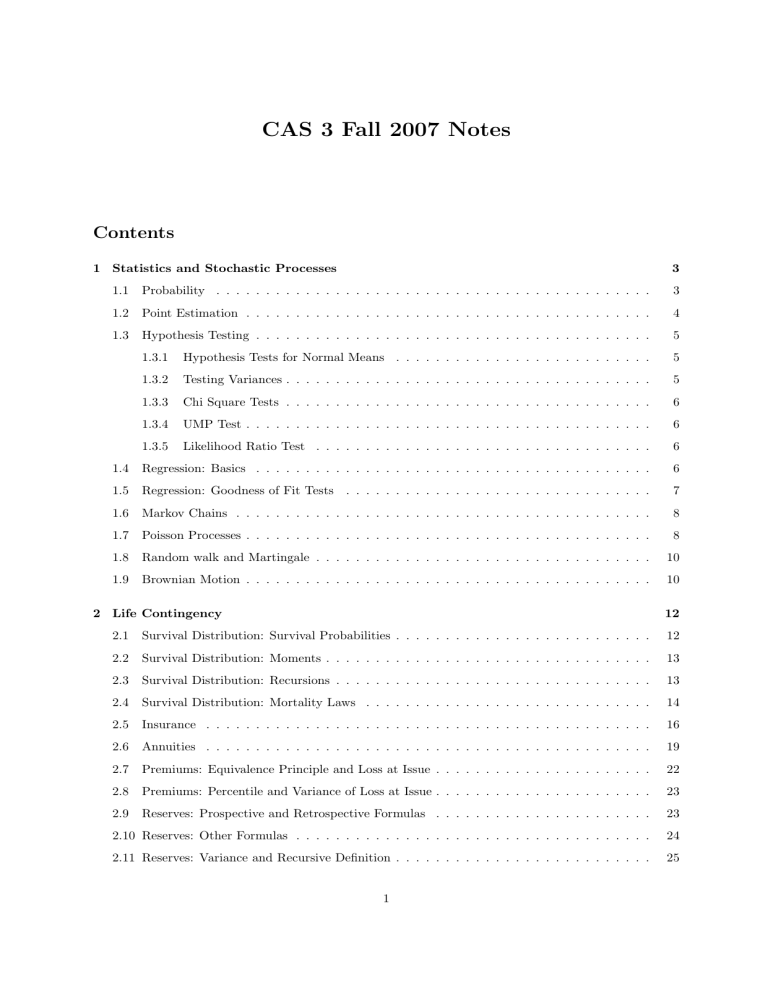

Contents

1 Statistics and Stochastic Processes

3

1.1

Probability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

1.2

Point Estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

1.3

Hypothesis Testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

1.3.1

Hypothesis Tests for Normal Means . . . . . . . . . . . . . . . . . . . . . . . . . .

5

1.3.2

Testing Variances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

1.3.3

Chi Square Tests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

1.3.4

UMP Test . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

1.3.5

Likelihood Ratio Test . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

1.4

Regression: Basics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

1.5

Regression: Goodness of Fit Tests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

1.6

Markov Chains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

1.7

Poisson Processes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

1.8

Random walk and Martingale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

1.9

Brownian Motion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

2 Life Contingency

12

2.1

Survival Distribution: Survival Probabilities . . . . . . . . . . . . . . . . . . . . . . . . . .

12

2.2

Survival Distribution: Moments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

2.3

Survival Distribution: Recursions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

2.4

Survival Distribution: Mortality Laws . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

2.5

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

2.6

Annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

2.7

Premiums: Equivalence Principle and Loss at Issue . . . . . . . . . . . . . . . . . . . . . .

22

2.8

Premiums: Percentile and Variance of Loss at Issue . . . . . . . . . . . . . . . . . . . . . .

23

2.9

Reserves: Prospective and Retrospective Formulas . . . . . . . . . . . . . . . . . . . . . .

23

2.10 Reserves: Other Formulas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

2.11 Reserves: Variance and Recursive Definition . . . . . . . . . . . . . . . . . . . . . . . . . .

25

1

CONTENTS

CONTENTS

2.12 Multiple Lives: Probabilities and Moments . . . . . . . . . . . . . . . . . . . . . . . . . .

25

2.13 Multiple Lives: Premiums and Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

2.14 Multiple Lives: Reversionary Annuity . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

2.15 Multiple Decrements Models

27

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Financial Economics

28

3.1

Forwards and Prepaid Forwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

3.2

Put-Call Parity and European and American Options . . . . . . . . . . . . . . . . . . . .

28

3.3

Binomial Option Pricing Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

3.4

Black-Scholes Formula . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

3.5

Delta Hedging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

3.6

Exotic Options: Asian Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

3.7

Exotic Options: Barrier Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

3.8

Exotic Options: Compound, Gap and Exchange Options . . . . . . . . . . . . . . . . . . .

35

3.9

Lognormal Model for Stock Prices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

3.10 Bonds and Interest Rate Caps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

3.10.1 Pricing Bond Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

3.10.2 Pricing Interest Rate Caps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

3.10.3 Pricing Forward Rate Agreements . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

3.11 Interest Rate Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

2

1

1

STATISTICS AND STOCHASTIC PROCESSES

Statistics and Stochastic Processes

1.1

Probability

Definitions and Formulas

Moments Related

What?

Equation

What?

Equation

µn

E(X − µ)n

Kurtosis

µ4

σ4

MGF, MX (t)

E(etX )

Coefficient of variation

σ/µ

What?

Equation

Skewness

µ3

σ3

Iterated Conditional Identities

EX (X) = EY EX (X|Y )

Var(X) = VarY (EX (X|Y )) + EY (VarX (X|Y ))

Iterated Expectation

Iterated Variance

Expected Value of Various Distribution and Nonnegative RV

• For X ∼ N (µ, σ 2 ), what is E(eX )?

eµ+0.5σ

• Mixture distribution: fZ (z) =

P

i

2

wi fZi (zi ) where sum of wi is 1. What is the k th moment?

E(Z k ) =

X

wi E(Zik )

i

• For nonnegative N , discrete or continuous, E(N ) is the sum of its survival function from 0 to ∞.

E(N )

=

=

∞

X

nP(N = n) =

n=0

∞ X

∞

X

n

∞ X

X

∞

Z

sN (n)∂n

∞

k=1

∞

X

P(N > k)

k=0

∞

Z

=

0

P(N ≥ k) =

P(N = n) =

k=1 n=k

Z

P(N = n)

n=0 k=1

∞

X

fN (y)∂y∂n

Z0 ∞ Zny

=

Z

∂nfN (y)∂y =

0

0

∞

yfN (y)∂y = E(N )

0

Random sum

Given random N and random sample X1 , . . . , XN , find the expected value and variance of S defined by

S=

N

X

Xk

k=1

E(S)

=

X

E(S|N = n)P(N = n) =

n

Var(S)

X

n

2

= E(N )Var(Xk ) + Var(N )E(Xk )

3

nE(Xk )P(N = n) = E(Xk )E(N )

(1)

by iterated variance formula

(2)

1.2

Point Estimation

1

STATISTICS AND STOCHASTIC PROCESSES

Order Statistics

X(k) is the k th largest value of the sample X1 , X2 , . . . , Xn . What is the PDF of X(k) ?

fX(k) (x) =

n!

[F (x)]k−1 f (x)[1 − F (x)]n−k

(k − 1)!(n − k)!

(k − 1) of the values smaller than, (n − k) values larger than, and 1 value equal to X(k) . Constant is the

number of ways of ordering the sample.

Chi-square, t Distribution, and F distribution

• If Zi are standard normal, what is distribution of

n

X

Zi2 ?

i=1

χ2n

• If Xi are normal with mean µ and variance σ 2 , what is the distribution of

2

n X

Xi − µ

i=1

σ

?

χ2n

2

• If Xi are normal with unknown mean µ and variance σ , what is the distribution of

2

n X

Xi − X̄

i=1

σ

?

χ2n−1

• If Z is standard normal and X is χ2r , then

Z

∼ tr

T =p

X/r

• If X is χ2r and Y is χ2s , then

X/r

∼ F (r, s)

Y /s

1.2

Point Estimation

Type of Estimators

1. MoM (Method of Moments). Set E(X k ) = n−1

n

X

Xik and solve for θ.

i=1

2. MLE (Maximum Likelihood). Find θ that maximizes the likelihood L(θ) or log-likelihood `(θ).

Invariance property: If θ̂ is MLE of θ, so is T (θ̂) of T (θ).

3. Equivalence of the two when the underlying distribution is: binomial with fixed n, Poisson, negative binomial with fixed r, exponential, gamma with fixed α, and normal when estimating both

parameters or just σ with fixed µ.

Evaluating Estimators

1. Bias: E(θ̂) − θ. Unbiased if equals to 0. Asymptotically unbiased if bias converges to 0.

2. Consistency: lim P(|θ̂ − θ| > ) = 0.

n→∞

2

3. MSE: Bias + Var(θ̂). If MSE converges to 0, consistency follows.

4. UMVUE: No other unbiased estimators have a lower variance. To find one, find T (θ̂) that is an

unbiased estimator of θ and θ̂ is also sufficient and complete (find in exponential families).

4

1.3

Hypothesis Testing

1.3

1

STATISTICS AND STOCHASTIC PROCESSES

Hypothesis Testing

Definition and Notation

1. Θ0 and Θ1 are the sets of parameters specified in null and alternative hypothesis respectively.

2. Significance level: Probability of rejecting H0 (size of the critical region). Denoted α.

3. P-value: Probability of data observations given that the null hypothesis is true. Reject H0 if p-value

< α.

4. Power: Probability of rejecting H0 when H0 is false. Denoted β(θ) for θ ∈ Θ1 .

5. Type of errors: Type I, rejecting H0 when it is true and Type II, rejecting H1 when it is true.

Following relations hold:

P(Type I Error) = α

1.3.1

and P(Type II Error | θ ∈ Θ1 ) = 1 − β(θ)

Hypothesis Tests for Normal Means

• Given one sample (X1 , . . . , Xn ) normally distributed with known variance testing H0 : µX = µ0 , H1 :

µX > µ0 , use Z test.

• Given one sample (X1 , . . . , Xn ) normally distributed with unknown variance testing H0 : µX =

µ0 , H1 : µX > µ0 , use T test and estimate variance with sample variance.

• Given two samples, (X1 , . . . , Xm ) and (Y1 , . . . , Yn ), they are assumed to be normally distributed

with the same variance. To test the hypothesis: H0 : µX = µY , calculate t statistic

X̄ − Ȳ

T = q

1

s m

+

1

n

(m−1)s2 +(n−1)s2

x

y

where s is the sample pooled standard deviation, square root of s2 =

. Have to

m+n−2

assume same variances for it to work. Test it against a t-distribution has n + m − 2 degrees of

freedom.

• Given two samples and normally distributed with different variance and large samples, we can

approximate to normal.

X̄ − Ȳ

Z=r

s2y

s2x

+

m

n

1.3.2

Testing Variances

• Given unbiased sample variance S 2 , what is its distribution?

2

n X

Xi − X̄

i=1

σ

=

(n − 1) 2

S ∼ χ2n−1

σ2

This can be used to test hypotheses involving S 2 and form confidence intervals for S 2 . If µ is known,

the chi square distribution has n degrees of freedom.

• Describe a test that compares two variances.

Look at ratio of sample variances and perform hypothesis test (or confidence intervals) using F

distribution. If testing H1 : σx2 > σy2 , reject for large F .

5

1.4

Regression: Basics

1.3.3

1

STATISTICS AND STOCHASTIC PROCESSES

Chi Square Tests

One dimensional Chi-sqare test: testing cell probabilities are equal. For n observations, Oi in k categories

and probability of each category pk , compute

Q=

k

X

(Oi − npi )2

npi

i=1

and test for χ2k−1 .

Two dimensional chi-square test: test cell probabilities distributed among classes (2 sets of categories).

Let R be the number of categories in the row class and C be the number of categories in the column class

and pr and pc be respective categories probabilities. Calculate

Q=

R X

C

X

(Orc − npr pc )2

npc pr

r=1 c=1

and tests for χ2(R−1)(C−1) .

1.3.4

UMP Test

• Definition of UMP test?

A hypothesis test in class of hypothesis tests, C, and with power β(θ), is a uniformly most powerful

test of size α if β(θ) ≥ β 0 (θ) for every θ ∈ Θ1 and every power function β 0 (θ) in C.

• State the Neyman-Pearson Lemma (NP Lemma).

Testing simple hypothesis H0 : θ = θ0 , H1 : θ = θ1 , a test with critical region (rejection region) R

that satisfies

L(θ0 )

R = all the X such that LR =

≤ k for any 0 ≤ k ≤ 1

and P(X ∈ R | H0 ) = α

L(θ1 )

is a UMP level α test. If H1 is a composite hypothesis, such a region may not exist.

• How to apply NP Lemma?

Want LR to be as small as possible since it would mean H1 is more likely. If the ratio is a

monotonically decreasing function of T (X), some statistic defined on X, R can be of the form

{x : T (x) > k}. The inequality reverses otherwise.

1.3.5

Likelihood Ratio Test

Likelihood ratio is

λ=

maxΘ0 L(θ)

maxΘ L(θ)

Form of the likelihood ratio test is λ < k for 0 ≤ k ≤ 1. If H0 and H1 are simple hypotheses, LRT reduces

to NP Lemma.

1.4

Regression: Basics

Assumptions of simple linear regression:

• In the model Yi = β0 + β1 Xi + i , Xi are fixed.

IID

• i ∼ N (0, σ 2 )

6

1.5

Regression: Goodness of Fit Tests

1

STATISTICS AND STOCHASTIC PROCESSES

• β0 and β1 are fixed.

The problem: min

β0 ,β1

n

X

2

[Yi − β0 − β1 Xi ]

≡

i=1

n

Y

[Yi − β0 − β1 Xi ]2

max

exp −

β0 ,β1

2σ 2

i=1

What is the least squares solution (maximum likelihood estimator)?

P

P

(Xi − X̄)(Yi − Ȳ )

i Xi Yi − nX̄ Ȳ

P

βb0 = Ȳ − βb1 X̄, βb1 = i P

=

2

2

2

(X

−

X̄)

i

i

i Xi − nX̄

What are the variances of the least squares estimates?

σ2

2

i (Xi − X̄)

Var(βb0 ) = σ 2

Var(βb1 ) = P

1

X̄ 2

+P

2

n

i (Xi − X̄)

Other relevant facts:

• Sum of residuals is zero. So

P

•

i (Xi − X̄) = 0

1.5

P

i (Yi

− Ybi ) = 0

Regression: Goodness of Fit Tests

Notations and Formulas

• SSE, SSR, SST represent sum of squares error, sum of squares regression, and sum of squares total.

In formula

X

X

X

SSE =

(Yi − Ŷi )2 SSR =

(Ŷi − Ȳ )2 SST = SSE + SSR =

(Yi − Ȳ )2

i

i

i

• Shortcut for SSR:

SSR = β̂12

X

(Xi − X̄)2

i

• Variance of the regression:

SSE

n−q

q is degree of freedoms lost. For two-variable model, q = 2.

s2 =

• Coefficient of determination: R2 = SSR/SST . It is the percentage of variability in Yi explained by

the variability in Xi .

Goodness of Fit Tests for Regression

1. F-test to test the significance of the entire regression.

Calculate

SSR/1

F1,N −q =

SSE/(n − q)

2. T-test to test the significance of only one particular coefficient.

To test: H0 : β = b, calculate

β̂ − b

T =

SEβb

If σ 2 is known, then we use Z instead of T .

7

1.6

Markov Chains

1.6

1

STATISTICS AND STOCHASTIC PROCESSES

Markov Chains

Notation

• Qn : transition matrix at time n

• Mn : the state of chain at time n.

• k Q: transition matrix after k periods, k Qn : transition matrix from time n to time n + k.

(i)

• k P (i) : probability of staying in i for next k periods given currently in i, k Pn : is the same but

current time is n.

What?

Homogeneous

Nonhomogeneous

Transition probabilities depend on time?

No

Yes

Transition matrix after k periods

Staying probability for k periods (in state i)

kQ

kP

(i)

= Qk

k

= Q(i,i)

k Qn

(i)

k Pn

= Qn Qn+1 · · · Qn+k−1

(i,i)

(i,i)

(i,i)

= Qn Qn+1 · · · Qn+k−1

Table 1: Markov Chain Comparison

Absorbing Chain

If Q has an absorbing state S and starts in non-absorbing state i, the probability k Q(i,S) is the probability

of starting from i and going to S within k periods and not during period k.

Sum Triple Product

Actuarial present value can be calculated as summation of a product of three values: probability of

cashflow occurring, values of cashflow and discount factor.

1.7

Poisson Processes

Definition and Notation

• What is a counting process and what properties must a process Nt satisfy o be a counting process?

Counting process represents the total number of arrivals by time t. Nt ≥ 0, Nt is integer-valued, if

s < t. then Ns ≤ Nt , and for s < t, N (t) − N (s) represents the number of arrivals in the interval

(s, t].

• What does ‘independent increments’ and ‘stationary increments’ mean?

A process has independent increments if number of arrivals in two disjoint periods of time are

independent of each other. A process has stationary increments if the distribution of Ns+t − Ns is

independent of s or t.

• Let Xk be the time the interarrival time between (k − 1) occurrence and k th occurrence. Define

Wn = X1 + X2 + . . . + Xn for n > 0

This is the waiting time until the occurrence of the nth arrival

• What is a Poisson Process and its properties?

Poisson process is a counting process with exponential interarrival times (i.e. Xk are exponential),

independent increments and stationary increments. Other properties include

8

1.7

Poisson Processes

1

STATISTICS AND STOCHASTIC PROCESSES

1. N0 = 0

2. P(Nh = 1) = λh + o(h)

3. P(Nh ≥ 2) = o(h)

Homogeneity means the process has constant intensity λ.

• The intensity of a nonhomogeneous Poisson Process is a function of time, denoted λ(t). What is

the mean number of arrivals between time a and b?

b

Z

λ(t)∂t

a

Interarrival times

What is the distribution of Wn for Poisson Process? Since Xk is exponential for a Poisson Process with

intensity λ, Wn is Gamma with parameters n and 1/λ.

Fewer arrivals means waiting time is longer. More arrivals means waiting time is shorter. Therefore,

Wn ≤ t ⇔ Nt ≥ n

Combining, Mixing and Thinning a Process

What do we get from combining two independent Poisson Processes and from selecting a fraction of

arrivals, p, from a Poisson process? The latter is called thinning a process.

Combining two independent Poisson Processes with intensities λ1 and λ2 gives a Poisson Process with

intensity λ1 + λ2 . Thinning a Poisson Process gives a new Poisson Process with intensity pλ.

What’s the difference between mixing and thinning?

Thinning a process is decomposing arrivals into subsets of arrivals from a main process with intensity λ.

Mixing a process is having different sets of arrivals but they are not obtained from decomposing down a

larger process. For example, if we think of arrivals as claims, mixing involves different types of insured:

high risk, average, low risk and thinning involves different types of claims: claims over 50k and claims

under 50k.

Most important difference is that the number of arrivals in a mixed process follows a mixture of two

Poisson distributions and is not a single Poisson. In mixing, λ differs by risk and thus it is random. For

problems like this, they may require Baye’s Theorem to solve.

Number of Different Arrivals

• Given n independent Poisson Processes with intensities λ1 , · · · , λn , what is the probability the first

arrival comes from process k?

λk

n

X

λi

i=1

• Given 2 independent Poisson Processes with intensities λ1 and λ2 , what is the probability of seeing

n events from process 1 before k events from process 2?

It is equal to the probability of seeing AT LEAST n events from process 1 before the (n + k)th

arrival. Sum up the binomial probabilities from n to n+k −1 using success probability, λ1 /(λ1 +λ2 ).

• Given n independent Poisson Processes with intensities λ1 , · · · , λn , what is the probability of seeing

9

1.8

Random walk and Martingale

1

STATISTICS AND STOCHASTIC PROCESSES

at least one of each type before time t?

P(every process with at least one arrival by t)

=

=

n

Y

i=1

n

Y

P(at least 1 arrival from process i by t)

1 − e−λi t

i=1

Compound Poisson Process

Suppose now for each arrival, we get a process pair (Ns , Ys ). Ys can be anything, for example, for arrival

of claims, Ns , Ys can be claim amount. This is a compound poisson process. What is the expected value

and variance of the aggregate value of Y 0 s, S, over a period of t units?

This is a random sum problem. Using formulas (1) and (2), we have

Var(S) = λtE(Y 2 )

E(S) = λtE(Y )

1.8

Random walk and Martingale

• What is a random walk? What is a symmetric random walk?

Let Xt be 1 with probability p and −1 with probability 1 − p for non-negative integers t. Then

Pt

St = i=1 Xt is a random walk. A symmetric random walk is a random walk with p = 0.5.

• What is a martingale?

A random process is a martingale if the conditional expected value of a future value given the current is the current. E(Xn+1 | Xn ) = Xn .

Example: Symmetric random walk.

E(Sn+1 | Sn ) = E(Sn + Xn−1 | Sn ) = Sn + E(Xn+1 | Sn ) = Sn

1.9

Brownian Motion

Standard Brownian Motion

• Standard Brownian Motion Z(t) satisfies what basic properties?

Z(t) is continuous, Z(0) = 0, Z(t + s) − Z(t) ∼ N (0, s), and Z(t + s1 ) − Z(t) is independent of

Z(t) − Z(t − s2 ).

• What is the distribution of Z(t)?

√

Z(t) ∼ N (0, t)

• What is the relationship between Standard Brownian Motion and a symmetric random walk?

√

Take a symmetric random walk, take m steps of size 1/ m and each step takes time 1/m. As

m → ∞, it approaches a Standard Brownian Motion.

√

√

Let ∂t represents the time in between steps so ∂t = 1/m. Thus, each step

√ is size 1/ m = ∂t.

Then, for a symmetric random walk with each step requiring ∂t and size dt, we have a standard

Brownian Motion on (0, 1). So,

√

∂Z(t) = St ∂t

and is also a martingale.

Arithmetic and Geometric Brownian Motion

10

1.9

Brownian Motion

1

STATISTICS AND STOCHASTIC PROCESSES

• How to write Arithmetic Brownian Motion X(t) in terms of Z(t)?

X(t) = µt + σZ(t), µ is called the drift and σ is the volatility.

• Arithmetic Brownian Motion X(t) satisfies what properties?

It is continuous, has independent increments and X(t + s) − X(t) ∼ N (µs, σ 2 s).

• X(t) is a Geometric Brownian Motion if log X(t) is a .....? What is the distribution of log X(t) −

log X(0)?

X(t) is a Geometric Brownian Motion if log X(t) is an Arithmetic Brownian Motion.

X(t)

log

∼ N ((µ − 0.5σ 2 )t, σ 2 t)

X(0)

• Geometric Brownian Motion X(t) satisfies what properties?

√

X(t) is continuous, X(t + s)/X(t) is lognormal with parameters µs and σ s, and ratios of disjoint

time intervals are independent.

11

2

2

LIFE CONTINGENCY

Life Contingency

2.1

Survival Distribution: Survival Probabilities

Notations:

1. X is the age at death. T (x) is the number of years until death for (x) (also known as complete

survival time).

2. t px = P(X > x + t X ≥ x) is the probability that (x) survives an additional t years.

3. t qx = 1 −t px is the probability that (x) dies within t years.

4.

t|u qx

= P(x + t < X ≤ x + t + u X ≥ x)

5. `x is the expected number of lives in year x and dx is the expected number of deaths in year x.

Z ∞

6. µx is the mortality rate given survival to age x. Valid if

µx ∂x = ∞.

0

Formulas:

What?

t px

=

Relations to

Equals to

`x

`x+t

`x

qx

`x

dx

`x+1 − `x

=

`x

`x

t qx

s(x)

s(x) − s(x + t)

s(x)

t|u qx

`x

µx

s(x)

t px

µx

u px

· t px+u

`x+t − `x+t+u

= t px −

`x

t+u px

f (x)

∂

=−

log s(x)

s(x)

∂x

x+t

Z

exp −

µx ∂x

x

Z

t|u qx

µx ,

x+t+u

Z

t px

x+t

t|u qx

−

∂

t px

∂t

qx+t ,

x+t+u

fT (t)∂t =

t px

t px

x+t

t px

µx , t px

·

u qx+t

t px µx+t

12

· µx+t ∂t

2.2

2.2

Survival Distribution: Moments

2

LIFE CONTINGENCY

Survival Distribution: Moments

Notations

1. e̊x = E[T (x)]: mean number of years until death for (x). Also known as complete life expectancy.

2. e̊x:n̄ = E[min{T (x), n}]: mean number of years lived within the next n years. Also known as n-year

temporary complete life expectancy.

3. ex = E[K(x)]: mean future lifetime not counting last fraction of year (number of complete years

lived).

Formulas

The first and second moments can be derived using integration by parts.

Z ∞

Z ∞

4 e̊x

=

t · t px µx+t ∂t = −tt px ]∞

+

t px ∂t

0

0

know this

0

∵ lim t · t px = 0

t px ∂t

t→∞

0

know this

=

∂

t px = t px µx+t

∂t

∞

Z

=

4 E T (x)2

∵−

Z

∞

t · t px ∂t

2

0

n

Z

4 e̊x:n̄

t · t px µx+t ∂t + n ·

=

n px

0

know this

n

Z

=

t px ∂t

0

2

4 E[min{T (x), n} ]

know this

=

Z

n

t · t px ∂t

2

0

4 e̊x

know this

4 e̊x

know this

4 ex:n̄

know this

=

=

=

ω−x

if the remaining lifetime for (x) is uniform

2

ω−x

If the remaining lifetime for (x) is beta

α+1

n−1

X

k

k| qx

+ n n px =

k=0

4 E[min{K(x), n}2 ]

know this

=

n−1

X

k px

k=1

k2

2

k| qx + n n px =

k=0

2.3

n

X

n

X

(2k − 1) k px

k=1

Survival Distribution: Recursions

Notations

Z

∞

1. Tx is the total future lifetime of a group of `x individuals. Tx =

`x+t ∂t

0

2.

n Lx

is the total future lifetime of a group of `x individuals over the next n years.

Z

n Lx

n

`x+t ∂t ≈

=

0

n−1

X

k=0

13

`x+k + `x+k+1

2

2.4

Survival Distribution: Mortality Laws

2

LIFE CONTINGENCY

3. mx , also known as central death rate, is the number of deaths divided by the average number alive

during the period. Also, n mx is the average death rate for n years. For n > 1, it is smaller than

n qx since the latter is the total death rate. In general,

n mx

=

n dx

n Lx

4. a(x) is the fraction of the year lived by those dying during the year.

Lx − `x+1

dx

a(x) =

5. Percentile π of survival time is time t that satisfies t px = 1 − π.

Life Expectancy Identities

What?

Using

Equals to

e̊x

quantities from notations above

Tx

`x

e̊x:n̄

quantites from notations above

n Lx

`x

Recursion Identities

Formulas for recursive computations of life expectancies. Use when mortality changes.

e̊x = e̊x:n̄| +

ex =

ex:n̄| +

n px

n px

·e̊x+n

· ex+n

ex:n̄| =

m px

· ex+m:n−m|

for n 6= 1

(4)

p (1 + e

x

x+1 )

ex:m| +

(3)

for n = 1

for 1 < m < n (can be replaced by e̊x )

(5)

px 1 + e

x+1:n−1|

for n = 1

Think of life expectancy being broken into two pieces: (1) life expectancy for first n years, in addition,

(2) life expectancy at (x + n) weighted by the probability of surviving n years.

2.4

Survival Distribution: Mortality Laws

Mortality Laws: Parameterized models for X

1. Exponential, F (x) = 1 − e−µx (has memoryless property: probability of survival from age x to x + t

is the same as from 0 to t). As a result, µx = µ is constant.

2. Uniform(0, ω), F (x) =

x

ω

⇒ µx =

1

ω−x .

This is the basic De Moivre Law.

14

2.4

Survival Distribution: Mortality Laws

2

LIFE CONTINGENCY

α

. Beta distribution with parameters θ = ω, a = 1, b = α.

ω−x

3. Generalized De Moivre Law. µx =

4. Gompertz: Death rate is the sum of age dependent factors: µx = BC x . Makeham states that it is

the sum of independent and dependent factors: µx = A + BC x .

5. Weibull: F (x) = 1 − exp{(− xθ )τ }

Uniform Distribution of Deaths (UDD)

Assumes a uniform distribution of deaths within each year of age.

For 1 ≥ s ≥ 0, `x+s = `x − s · dx

In words, the meaning: Number of remaining lives after s years for (x) decreases linearly with time on a

unit time interval. Using this, it can be shown that s qx = sqx and s px = 1 − sqx for 0 ≤ s ≤ 1.

−

µx+t =

d

(t px )

qx

dt

=

p

1

−

tqx

t x

Other formula:

s qx+t

=

sqx

1 − tqx

for 0 ≤ s + t ≤ 1

DeMoivre’s Law

Different from UDD. Uniform not on unit intervals [x, x + 1] but on an entire lifetime [0, ω]. The force of

mortality for the uniform case and in general is

µx =

1

ω−x

and

α

ω−x

µx =

Constant Force of Mortality

Force of mortality is constant, µx = µ and the survival probability is exponential, i.e. t px = exp{−tµ}

What?

DeMoivre’s Law

s(x)

ω−x

ω

µx

1

ω−x

1−

t px

ex

n·

n px

t

ω−x

+

n

2

ω−x

ω

α

α

ω−x

1−

ω−x

2

e̊x

e̊x:n

Modified DeMoivre’s Law

t

ω−x

ω−x

α+1

·

Exponential

e−µx

µ

α

e−µt

1

µ

n qx

ω−x−1

2

Table 2: Mortality Formulas for DML and Constant Mortality

15

2.5

Insurance

2.5

2

LIFE CONTINGENCY

Insurance

Notations

Z is the actuarial present value of the benefit paid out by a life insurance policy. bt and vt are the benefit

and discount rate at time t respectively. K(x) is the curtate future lifetime of (x). This is the discrete

version of T (x).

Z ∞

n

For payment at time of death: E(Z ) =

bnt vtn px µx+t ∂t

0

For payment at end of year: E(Z n )

=

∞

X

bnk v n(k+1) P(K = k) =

k=0

∞

X

bnk v n(k+1)

k| qx

k=0

Life Insurance

Symbol for E(Z)

Z (at death)

Z (end of year)

Whole

Āx

vT

v K+1

n-year term

Ā1x:n̄|

v T if T ≤ n, 0 otherwise

v K+1 if K < n, 0 otherwise

n-year deferred

n| Āx

v T if T > n, 0 otherwise

v K+1 if K ≥ n, 0 otherwise

n-year deferred m-year term

n|m Āx

v T if n < T ≤ n + m, 0 otherwise

v K+1 if n < K ≤ n + m, 0 otherwise

v n if T ≥ n, 0 otherwise

same

v min{T,n}

v K+1 if K < n, v n otherwise

n-year pure endowment

n-year endowment

1

Ax:n̄|

or

n Ex

Āx:n̄|

Table 3: Table assumes bt = b = 1. For end of year payment insurance, there are no bar on top of A.

What?

DeMoivre’s Law

Exponential

Āx

aω−x

ω−x

µ

µ+δ

Ax

aω−x

ω−x

1

µ+δ

āx

Table 4: Insurance and Annuity Formulas for DML and Constant Mortality

Useful Facts and Identities

• What is variance of the present value variable Z?

Actuarial present value at double the force of interest, 2δ, minus the square of actuarial present

value at δ.

• A whole life end-of-year payment insurance is the sum of n-year term and (x + n) whole life endof-year insurance discounted back n years.

1

Ax = A1x:n̄ + vn px Ax+n = A1x:n̄ + Ax:n̄|

· Ax+n = A1x:n̄ + (Ax:n − A1x:n̄ ) · Ax+n

16

2.5

Insurance

2

LIFE CONTINGENCY

• Rules for actuarial PV notations

The bar over A indicates payment at the moment of death. No bar means payment at end of

year. Subscript to the left of A indicates deferral period. The superscript 1 right on top of n pays

a benefit only if T > n. To the left of n means benefit is paid only if T ≤ n.

• How to find the variance of n-year endowment?

PV of endowment (Z) is the sum of the PV of n-year term insurance (Z1 ) and PV of n-year

pure endowment (Z2 ). Then apply definition for a variance of a sum. So,

Z = Z1 + Z2 ⇒ Var(Z) = Var(Z1 ) + Var(Z2 ) − 2E(Z1 )E(Z2 ) since Z1 and Z2 are disjoint

• What is the distribution of Z for a large group of insured?

Find E(Z) and Var(Z) for one person and apply Central Limit Theorem.

• How to find percentile of Z?

Assume benefit is level.

P(Z < z) = p ⇒ P(v T < z) = p ⇒ P(T > z ∗ ) = p

So 100p percentile of Z is 100(1 − p) percentile of T . For Z, a monotonic function of T , t that

satisfies t px = p is 100(1 − p) percentile of T and 100p percentile of Z. To calculate 100p percentile

for n-year deferred insurance, find x > n such that P(n ≤ T ≤ x) = 1 − p. In figure 1, if we want to

find 80th percentile of Z, let v t equal to the value of Z that is exceeded by only 20% of the values

of Z. Then find t such that 5 px − t px = 0.20.

Another way to derive FZ (z) for Figure 1 is to realize it’s equal to 5 qx + t px .

Recursive Formulas

Ax

= vqx + vpx Ax+1 ends until px = 0

Ax:n̄

= vqx + vpx Ax+1:n−1 ends until x + n − 1

n| Ax

= vpx

n−1| Ax+1

ends when deferral period ends

The term vqx is the term insurance for 1 year. For continuous payment insurance, replace A with

Ā and vqx with Āx:1̄| .

Increasing and Decreasing Life Insurance

n-year increasing insurance pays k if death occurs in year k until year n. n-year decreasing insurance

pays n if death occurs in year 1, (n − 1) in year 2, etc. The symbols are (IA)1x:n̄ and (DA)1x:n̄ for

n-year increasing and decreasing term insurance. Some recursive identities:

(IA)1x:n̄

(DA)1x:n̄

= A1x:n̄ + vpx (IA)1x+1:n−1

= nA1x:1̄ + vpx (DA)1x+1:n−1

17

2.5

Insurance

2

LIFE CONTINGENCY

Z

(t,z)

5

t

T

Figure 1: Pain graph of 5-year deferred life insurance.

(DA)1x:n̄ = nA1x:1̄ + vpx (DA)1x+1:n−1

nA1x:1̄

(DA)1x+1:n−1

Figure 2: Rectangle shortcut to derive recursive relation for increasing/decreasing insurance

18

2.6

Annuities

2.6

2

LIFE CONTINGENCY

Annuities

Formulas and Notes for Continuous Annuities

• Denote actuarial present value for annuities by E(Y )

• n-year certain and life annuity is the sum of n-year annuity certain and n-year deferred life.

• For āx ,

∞

Z

āx

āt̄| · t px µx+t ∂t (Expectation formula)

=

Z0 ∞

=

v t t px ∂t (Current payment technique)

0

• āx =

1 − Āx:n̄|

1 − Āx

and āx:n̄| =

. So,

δ

δ

n| āx

= āx − āx:n̄ =

Āx:n̄| − Āx

δ

Life Annuity

Symbol

Description

Payment logic

Whole

āx

Pays until death T

1, ∀t ≤ T

n-year temporary

āx:n̄

pays until earliest between T and n

1, ∀t ≤ min(T, n), 0 otherwise

n-year deferred

n| āx

starts after n years until death

1, ∀n < t ≤ T, 0 otherwise

n-year deferred

m-year temporary

n|m āx

starts after n years

and ends n + m in years

1, ∀n < t ≤ n + m and t ≤ T

0 otherwise

n-year certain and life

āx:n̄|

Until latest date between n and death

1, ∀t ≤ max(T, n)

Table 5: Summary of life annuities with continuous payments.

Formulas and Notes for Discrete Annuities

Type

Whole

Annuity-Due

äx =

∞

X

v

k−1

k−1 px

äx:n̄| =

n

X

ax =

∞

X

v t t px

t=1

k=1

Temporary

Annuity-Immediate

v k−1

k−1 px

ax:n̄| =

n

X

v t t px

t=1

k=1

Table 6: Discrete Annuities: Current Payment Technique

19

2.6

Annuities

2

LIFE CONTINGENCY

• Useful Identities

ax:n̄ = äx:n+1| − 1

ax:n̄ = äx:n̄| − 1 +

äx:n̄ = äx −

sx:n̄ = Ex+n s̈x:n+1| −

sx:n̄ = s̈x:n̄| + 1 −

n Ex

1

n Ex

1

n Ex

n Ex äx+n

• Shortcuts for Whole Life Annuity-due and immediate:

For K, curtate lifetime, äK+1| =

1 − v K+1

. Take expected value to get actuarial present value.

d

äx =

For whole life annuity immediate, denoted aK̄ =

vax =

1 − Ax

d

1 − vK

. So,

i

v − Ax

⇒ iax = 1 − (1 + i)Ax

i

• Temprary Life Annuity-due and immediate:

For temporary life annuity-due,

1 − Ax:n̄|

d

Temporary life annuity-due by definition of expectation:

äx:n̄| =

äx:n̄| =

n

X

äk̄|

k−1 px qx+k−1

+ än̄| ·

n px

k=1

k−1 px qx+k−1

is the probability of living k − 1 full years and fewer than k full years.

For temporary life annuity-immediate (don’t memorize),

ax:n̄ + 1 −n Ex = äx:n̄| =

1 − Ax:n̄|

1 − (1 + i)Ax:n̄ + in Ex

1 − Ax:n̄ + iA1x:n̄

⇒ ax:n̄ =

=

d

i

i

• Annuity-due, in general: E(Y ) =

∞

X

bt v t−1

t−1 px ,

bt is payment in beginning of year t.

t=1

• Accumulated Values

s̈x:n̄| =

äx:n̄|

n Ex

Variance of Annuities

Use the shortcut definition for calculating life annuities (involving insurance).

Var(āT ) = Var

1 − vT

δ

2

=

Āx − Ā2x

δ2

The same applies to n-year temporary life annuity (use shortcut definition with endowment). For annuitydue, the denominator is d2 .

20

2.6

Annuities

2

LIFE CONTINGENCY

Percentile of Annuities

Y , the present value of annuities, increases with T . So percentile p of Y is percentile p of T . Therefore

to find the percentile of Y , first find the same percentile of T , call it t. Then plug in t into the formula

for Y , i.e.

1 − vT

Y =

δ

to get the percentile of Y .

Recursive Formulas

• Whole Life Annuities

ax = E(v K | K ≥ 1)P(K ≥ 1) + E(v K | K < 1)P(K < 1) = (v + vax+1 )px + 0 · qx = vpx + vpx ax+1

äx = E(v K+1 | K ≥ 1)P(K ≥ 1) + E(v K+1 | K < 1)P(K < 1) = (1 + väx+1 )px + 1 · qx = 1 + vpx äx+1

āx = āx:1 + vpx āx+1

• Temporary Life Annuities

ax:n̄| = vpx + vpx ax+1:n−1|

äx:n̄| = 1 + vpx äx+1:n−1|

āx:n̄| = āx:1 + vpx āx+1:n−1|

• n-year certain and life annuities: If death occurs, annuity-certain payments. If no death, recurse

further.

ax:n̄| = v + vqx an−1 + vpx ax+1:n−1|

äx:n̄| = 1 + vqx än−1 + vpx äx+1:n−1|

āx:n̄| = ā1 + vqx ān−1 + vpx āx+1:n−1|

• Best to work out these formulas from graphs than to memorize them. Take following as example.

äx:n äx+1:n−1

1

1

1

1

1

Figure 3: Annuity recursion picture shortcut. Suppose n = 5

We know 1 is the first payment of äx:n . So äx:n = 1 + something. From the picture, the future expected

payment (consists of all payments in the future) is äx+1:n−1 , if (x) survives the current year. So we

discount äx+1:n−1 by the probability of surviving the current year and interest rate.

21

2.7

Premiums: Equivalence Principle and Loss at Issue

2.7

2

LIFE CONTINGENCY

Premiums: Equivalence Principle and Loss at Issue

Definition

• Equivalence Principle: Actuarial present value of benefit premiums must equal to the actuarial

present value of death benefits.

• Fully continuous insurance: Death benefit is paid at the moment of death and the premiums are

payable continuously.

• Full discrete insurance: Death benefit is paid at the end of year and the premiums are payable at

beginning of the year

• Loss at issue: Mathematically it is

0L

= APV(Benefits) − APV(Premiums)

So the random variable is the excess of benefits over premiums or how much the insurer is expected

to lose. Equivalence principle determines the premium to ensure E(0 L) = 0.

Premium Formulas by Equivalence Principle

Name

Fully Continuous

Whole Life

P̄ (Āx ) =

Āx

āx

Fully Discrete

Px =

Ax

äx

=

Āx

āx:n

n Px

=

Ax

äx:n

n-year Endowment

P̄ (Āx:n ) =

Āx:n

āx:n

Px:n =

Ax:n

äx:n

n-year Term

P̄ (Ā1x:n ) =

Ā1x:n

āx:n

1

Px:n

=

A1x:n

äx:n

n-payment Whole Life

n P̄ (Āx )

Other Premiums Formulas by Equivalence Principle

Deferred Insurance: n-year deferred insurance assuming payments are made during the deferral period

only,

n| Āx

P̄ (n| Āx ) =

āx:n

Deferred Annuity: n-year deferred annuity assuming payments are made during the deferral period only,

P̄ (n| āx ) =

n| āx

āx:n

Premium Refunds

For an insurance that refunds all premiums without interest, then the refund of premiums forms an

increasing insurance. If π is the premium and lasts forever,

APV(Death Benefits) = Ax + π(IA)x

22

2.8

Premiums: Percentile and Variance of Loss at Issue

2

LIFE CONTINGENCY

If there are only n payments of π, then

APV(Death Benefits) = Ax + π[(IA)x:n̄ + n ·

2.8

n| Ax ]

Premiums: Percentile and Variance of Loss at Issue

Percentile of Loss at Issue

By definition, a 100p percentile of 0 L, L0 satsifies

P(0 L < L0 ) = 1 − p

(6)

0L

decreases as T increases. For level non-deferred insurance, the probability (6) corresponds to finding

t of (t, L0 ) such that

1 − p = P(T ≤ t) = 1 − P(T > t) = 1 − t px

Variance of Loss at Issue

The variance of loss at issue for continuous case is

Var(0 L) =

2

Āx − Ā2x

1+

π 2

δ

Var(0 L) =

2

Āx − Ā2x

1+

π 2

d

For the discrete case,

These work for only endowment and whole life insurance.

Derivation:

0L

⇒ Var(0 L)

π π

= v T − πāT = v T 1 +

−

δ

δ

π 2

= Var(v T ) 1 +

δ

=

2.9

2

Āx − Ā2x

1+

π 2

δ

Reserves: Prospective and Retrospective Formulas

Definition

• t L represents the prospective loss after t. It is the excess of the APV of death benefits after t over

the APV of premiums that will be received after t.

• E(t L | T > t) = t V is the reserve after t. It’s how much to save for years after t. In other words,

the reserve and the APV of the premiums should be enough to cover the APV of death benefits.

APVt (Premiums) + t V = APVt (death benefits)

• Prospective loss is always correct in calculating reserves.

• Retrospective loss at t is the accumulated value of benefit premiums minus the accumulated cost

of insurance to time t. If premiums determined through equivalence principle, reserves may be

calculated retrospectively.

• t kx is the accumulated cost of the past insurance. In most cases,

t kx

=

23

A1x:t|

t Ex

2.10

Reserves: Other Formulas

2

Type of Reserves

Prospective

k Vx

Whole Life

LIFE CONTINGENCY

Retrospecitve

= Ax+k − Px äx+k

k Vx

= Px s̈x:k −

k kx

Endowment

k Vx:n̄

= Ax+k:n−k − Px:n̄ äx+k:n−k

k Vx:n̄

= Px:n̄ s̈x:k −

k kx

Term

k Vx:n̄

1

= A1x+k:n−k − Px:n̄

äx+k:n−k

k Vx:n̄

1

= Px:n̄

s̈x:k −

k kx

h-pay whole life

h

k Vx:n̄

=

Ax+k −

h Px äx+k:h−k

k<h

h

k Vx:n̄

A

x+k

k≥h

=

h Px s̈x:k −

k kx

h Px s̈x:h

−

k−h Ex+h

k kx

k<h

k≥h

Table 7: Reserves Prospective and Retrospective Formula

2.10

Reserves: Other Formulas

• Premium Difference Formula:

Factor out the annuity from the prospective formula. For example,

h

i

t V̄ (Āx:n| ) = P̄ (Āx+t:n−t| ) − P̄ (Āx:n| ) āx+t:n−t|

• Paid Out Insurance Formula:

Factor out the insurance from the prospective formula. For example,

#

"

P̄ (Āx:n| )

Āx+t:n−t|

t V̄ (Āx:n| ) = 1 −

P̄ (Āx+t:n−t| )

• Three Premium Principle

Given two insurances with identical death benefits through time n, difference of benefit reserves at

time n is the actuarial AV at time n of their benefit premiums. Note that 1/s̈x:n = Px:n1 .

Between

Endowment and term

Endowment and whole life

Endowment and n-pay life

n-pay life and whole life

n-pay life and term

whole life and term

Formula

1

(Px:n − Px:n

)s̈x:n = 1

(Px:n − Px )s̈x:n = (1 − n Vx )

(Px:n − n Px )s̈x:n = (1 − Ax+n )

(n Px − Px )s̈x:n = (Ax+n − n Vx )

1

(n Px − Px:n

)s̈x:n = Ax+n

1

(Px − Px:n )s̈x:n = n Vx

Table 8: Three Premium Principle

• Annuity ratio and Insurance Ratio

Works for whole life insurance and endowment with premiums rated under equivalence principle.

äx+t:n−t

annuity ratio

äx:n̄

Ax+t:n−t − Ax:n̄

insurance ratio

1 − Ax:n̄

t Vx:n

= 1−

t Vx:n

=

24

2.11

Reserves: Variance and Recursive Definition

2.11

2

LIFE CONTINGENCY

Reserves: Variance and Recursive Definition

Variance of prospective loss

Under equivalence principle,

Var(t L | T (x) ≥ t)

2

P

= Var(Z) 1 +

δ

2

=

2

=

Ax+t − A2x+t

(1 − Ax+t )2

general

whole life

Ax+t:n−t − A2x+t:n−t

(1 − Ax+t:n−t )2

endowment

Recursion

Works for fully discrete reserves only: Reserve up to t accumulated to t + 1 must be enough to cover for

deaths during t + 1 and those who die after (t + 1).

(t V + πt )(1 + i)

|

{z

}

reserve accumulated from t to t + 1

=

qx+t · bt+1 +

| {z }

pay bt+1 if death

px+t · t+1 V

|

{z

}

keep rest for survivors

Rearrange and get

t+1 V

= (t V + πt )(1 + i) − qx+t (bt+1 −

(bt+1 −

t+1 V

2.12

Multiple Lives: Probabilities and Moments

t+1 V

)

) is net amount at risk and t V + πt is the initial reserve during [t, t + 1].

Notation

• Joint life probability pxy or px:y

• Last survivor probability pxy or px:y

t pxy

t qxy

What

under independence

under independence

t pxy

t qxy

t|u qxy

t|u qxy

e̊xy

T (xy) + T (xy)

T (xy) · T (xy)

Equals to

t px t py

1 − t px t py

t px + t py − t pxy

t qx t qy

p

−

p

t xy

t+u xy or t pxy u qx+t:y+t

t pxy − t+u pxy

e̊xy +e̊xy = e̊x +e̊y

T (x) + T (y)

T (x) · T (y)

Table 9: Multiple Lives Probabilities and Moments Properties

Other Formulas

∞

Z

e̊xy =

Z

t pxy dt

e̊xy =

0

Z

e̊xy:n̄ =

∞

t pxy

dt

0

n

Z

t pxy

dt

Var[T (xy)] = 2

0

0

25

∞

t t pxy dt −e̊2xy

2.13

Multiple Lives: Premiums and Insurance

2

LIFE CONTINGENCY

Cov(T (xy), T (xy)) = Cov(T (x), T (y)) + (e̊x −e̊xy )(e̊y −e̊xy )

Derivation of covariance formula:

Cov(T (xy), T (xy))

= E[T (xy) · T (xy)] − ET (xy)ET (xy)

= E[T (x) · T (y)] − ET (xy) · E(T (x) + T (y) − T (xy))

= E[T (x) · T (y)] − (e̊xy e̊x +e̊xy e̊y −e̊2xy ) +e̊x e̊y −e̊x e̊y

= Cov(T (x), T (y)) + (e̊x −e̊xy )(e̊y −e̊xy )

Caution! Wrong Formulas for Last Survivor Probabilities

1.

t+u pxy

2.

t|u qxy

2.13

= t pxy u px+t:y+t

= t pxy u qx+t:y+t

Multiple Lives: Premiums and Insurance

Multiple Lives Identities for

1. Discount factor v

v T (x) + v T (y) = v T (xy) + v T (xy)

2. Annuity

āx + āy = āxy + āxy

3. Insurance

Āx + Āy = Āxy + Āxy

For non whole-life insurance, put cap symbol on top of xy in Āxy to represent that x and y are

treated as a joint status. Endowment as an example:

Ax:n̄ + Ay:n̄ = A xy :n̄ + Axy:n̄

Note: Above works for all kind of insurance and shortcut formulas for annuity and insurance still

work in multiple lives.

2.14

Multiple Lives: Reversionary Annuity

Reversionary annuity pays an annuity to one status after another status has failed. Annuity that pays

(y) after (x) has died is ax|y

ax|y = ay − axy

Other kind of annuities:

Paying while either one of them is alive: ax + ay

Paying while one of (x) and (y) is alive and the other is dead: ax|y + ay|x

26

2.15

Multiple Decrements Models

2.15

2

LIFE CONTINGENCY

Multiple Decrements Models

Notation

• J (or j) represents type of failure or decrement.

(j)

• t qx is the probability of (x) failing within t years due to decrement j. If t = ∞, it’s te probability

of ever failing due to decrement j.

• p(τ ) is the probability of surviving all the decrements.

• Distribution function FT,J (t, j) = P(T ≤ t and J ≤ j)

(j)

• bt

is benefit paid at time t for decrement j

Formulas

What

Equals to

(j)

t−1| qx

(τ ) (j)

t−1 px qx+t−1

t

Z

(j)

t qx

(τ ) (j)

s px µx+s ∂s

0

∞

X

single benefit premium

X (j)

(j)

)

v t t−1 p(τ

qx+t−1 bt

x

t=1

j

Z t

(τ )

exp −

µx+s ∂s

(τ )

t px

0

Table 10: Multiple Decrement Model Formulas

Caution!

(τ )

t px

Z t

(τ )

= exp −

µx+s ∂s

BUT NOT:

(j)

t px

Z t

(j)

= exp −

µx+s ∂s

0

0

Formula Derivation

(j)

t−1| qx

=

(τ ) (j)

t−1 px qx+t−1

Comments: Must survive all decrements first before dying due to (j). First probability represents the

probability of surviving all decrements for t − 1 years.

∂FT,J (t, j)

∂j

(j)

µx+t

=

f (t, j)

(τ )

t px

(j)

= P(T ≤ t and J = j) = t q0

(j)

=

∂ t qx

∂t

1

(τ )

t px

⇒

(j)

t qx

Z

=

t

(τ ) (j)

s px µx+s ∂s

0

Comments: f (t, j) is the joint pdf of T and J and is also the derivative of F (t, j). Second equation

derived from definition of force of mortality.

27

3

3

FINANCIAL ECONOMICS

Financial Economics

3.1

Forwards and Prepaid Forwards

No dividend

Discrete Dividend

Continuous Dividend

3.2

Forward (F0,T )

S0 erT

rT

S0 e − FV(Dividends)

S0 e(r−δ)T

P

Prepaid Forward (F0,T

)

S0

S0 − PV(Dividends)

S0 e−δT

Put-Call Parity and European and American Options

Put-Call Parity

No strike asset:

P

C(S, K, T ) − P (S, K, T ) = F0,T

− Ke−rT

Exchange options (want to purchase S1 with S2 as strike):

P

P

C(S1 , S2 , T ) − P (S1 , S2 , T ) = C(S1 , S2 , T ) − C(S2 , S1 , T ) = F0,T

(S1 ) − F0,T

(S2 )

Currency options: Similar to exchange options in that there’s a currency rate you want to purchase and

one that serves as strike rate. For S0 in the prepaid forward pricing, use the spot exchange rate x0 . For a

C1 -denominated option on C2 , strike price and premiums are in the currency C1 and C2 is the rate getting

purchased.

Early exercise or sell American Options

For non-dividend paying stocks, it is not better to exercise an American call early (as opposed to selling

it). Put-call partiy shows that the American call premium is strictly greater than the early exercise payoff

at time t, St − K. For dividend paying stocks, it is possible that it is more optimal to exercise early.

Again, put-call parity shows this. For American put options, there is a possibility that it is optimal

to exercise early regardless of whether dividends are paid. For calls, dividends are the reason to

receive stock early and for puts, interest on the strike is the reason to receive the strike

price early.

Different Strike Price

Assume strike prices K1 < K2 < K3 . Here are three inequalities that apply to option premiums (for

non-arbitrage to hold).

1.

C(S, K1 , T ) ≥ C(S, K2 , T )

P (S, K1 , T ) ≤ P (S, K2 , T )

Arbitrage opportunity: If first not true, buy low-strike call and sell high-strike call. If second not

true, buy high-strike put and sell low-strike put.

2.

C(S, K1 , T ) − C(S, K2 , T ) ≤ K2 − K1

P (S, K2 , T ) − P (S, K1 , T ) ≤ K2 − K1

Arbitrage opportunity: If first not true, sell low-strike call and buy high strike call. If second not

true, buy low-strike put and sell high strike put.

28

3.3

Binomial Option Pricing Models

3 FINANCIAL ECONOMICS

3. Interpretation: Call premiums decrease at a decreasing rate as strike increases and put premiums

increase at an increasing rate as strike increases.

C(S, K1 , T ) − C(S, K2 , T )

K2 − K1

P (S, K2 , T ) − P (S, K1 , T )

K2 − K1

≥

≤

C(S, K2 , T ) − C(S, K3 , T )

K3 − K 2

P (S, K3 , T ) − P (S, K2 , T )

K3 − K2

Arbitrage opportunity: If either condition were not true, then there is an asymmetric butterfly

spread with positive profits at all prices.

3.3

Binomial Option Pricing Models

Notation

1. S0 is price of stock at time 0. Sω is stock price after a sequence of movements ω ∈ 2{u,d} . B:

amount that we lend at period 0. ∆: number of shares invested inside the replicating portfolio. r

is the risk-free rate and δ is the continuous dividend rate. σ is the volatility (standard deviation) of

stock movements annualized. p∗ is risk neutral probability. C is the option premium or also known

as arbitrage-free price.

2. u and d are up and down factors that satisfy d < e(r−δ)h < u. Cω after movements ω. If binomial

model is built using forward rates, then for a h-year binomial model,

u = e(r−δ)h+σ

√

h

and

d = e(r−δ)h−σ

√

h

It ensures no arbitrage will occur.

3. γ is the true discount rate for the option when risk-neutrality is not used (p the true probability is

used). α is the discount rate of the stock (or the expected return on a stock).

Formulas:

What?

Single Period

∆, ∆ω

B, Bω

Cu − Cd

S0 (u − d)

uCd − dCu

u−d

−δh

N -Periods

e

e−rh

Cω,u − Cω,d

Sω (u − d)

uCω,d − dCω,u

u−d

e−δh

e−rh

p∗

e(r−δ)h − d

u−d

e(r−δ)h − d

u−d

C (option premium), Cω

S0 ∆ + B = e−rh [p∗ Cu + (1 − p∗ )Cd ]

e−rh [p∗ Cω,u + (1 − p∗ )Cω,d ]

Table 11: For an European option with h-year periods

Derivation for Formulas of ∆ and B

Solve the equations

∆uS0 eδh + Berh = Cu and ∆dS0 eδh + Berh = Cd

29

3.3

Binomial Option Pricing Models

3 FINANCIAL ECONOMICS

Options on Futures Contracts and Currency

Futures contract

pay dividends. A futures contract of T years has price F = S0 e(r−δ)T . Also,

√ does not

1−d

∗

u, d = exp(±σ h) and p = u−d

.

For currency, S0 is the spot exchange rate and dividend yield is the foreign (currency you are buying)

risk-free rate.

Discount Rate of Options under p

What is the formula for true probability of going up?

S0 eαh = (uS0 )eδh p + (1 − p)(dS0 )eδh ⇒ p =

e(α−δ)h − d

u−d

What is the formula for the true discount rate of a replicating portfolio?

The discount rate for replicating portfolio is weighted average of the discounting rates of the stock and

bond. So

eγh =

∆S0

B

eαh +

erh ⇒ Ceγh = ∆S0 eαh + Berh

∆S0 + B

∆S0 + B

(7)

Difference from using p or p∗ and different discount rates?

The value of the option is the same whether one uses risk neutral probability with r as discount rate or

uses true probability p with γ.

Schroder Method

Given an asset with fixed dividends, the stock may end up negative in a binomial model. To avoid

that, Schroder method suggests using the pre-paid forward price as the new starting value in

binomial tree.

What is the starting price and the formula for σF , volatility of pre-paid forward? Also how about u, d, p∗ ?

F = S − PV(Dividends)

and

S

σF

=

σS

F

Calculations for u, d, p∗ remain the same.

How to find the call premium Cw ?

For an American call option, the real stock price at ω is S 0 = Sω + PV(dividends) and

Cω = max{(S 0 − K)+ , e−r E∗ (Cω+1 )}

For an European call option, the stock price remains the same and

Cω = e−r E∗ (Cω+1 )

where

E∗ (Cw+1 ) = p∗ Cω,U + q ∗ Cω,D

30

3.4

Black-Scholes Formula

3 FINANCIAL ECONOMICS

Other Topics

√

1. Cox-Ross-Rubinstein Tree: u, d = exp{±σ h}. Arbitrage won’t happen for small h.

√

2. Lognormal Tree: u, d = exp{(r − δ − 0.5σ 2 )h ± σ h}. Arbitrage happens only for very large values

of σ and h.

3. To estimate volatility σ, find the unbiased sample variance of log(St /St−1 ). To annualize, find σ 2 h,

where h is the number of observations that would be gathered in a year. Square root that to get

the estimated volatility.

3.4

Black-Scholes Formula

Black-Scholes Formula

The call and put premiums are given by

C(S, K, σ, r, t) = F P (S)Φ(d1 ) − F P (K)Φ(d2 )

where

and P (S, K, σ, r, t) = F P (K)Φ(−d2 ) − F P (S)Φ(−d1 )

√

P

F (S)

1

σ h

d1 , d2 = √ log

±

F P (K)

2

σ h

• For an option on a t-year future contract and forward price F , F P (S) = F e−rt .

Greeks (Definition, Formula, Graph)

1. ∆

Def: Increase in option price as stock price increases. Formula: ∂C

∂S

Can be interpreted as number of shares necessary to replicate the option. A call can be replicated

through purchasing ∆ = e−δt Φ(d1 ) shares of stock and buying Ke−rt Φ(d2 ). The signs of d1 and d2

reverse for put options.

2. Γ

2

Def: Increase in ∆ as stock price increases. Formula: ∂∂SC2

Always positive and hump shaped. So call and put options are convex.

3. Vega

Def: Increase in option price for every percentage point increase in volatility. Formula: 0.01 ∂C

∂σ

Hump usually to the left of strike price. Longer the period to expiration, usually larger the Vega.

4. θ

1 −∂C

Def: Increase in option price as time to expiry t decreases. Formula: 365

∂t

Mostly negative for calls with short expiration (especially at-the-money). Usually negative for puts

unless in-the-money. For longer expirations, θ as function of S is flatter than shorter expirations:

gradual decrease unless δ is large.

5. ρ

Def: Increase in option price as r increases. Formula: 0.01 ∂C

∂r

ρ is positive for call and negative for put. As function of stock price, it is increasing (the more

in-the-money, it’s worth more).

6. Ψ

Def: Increase in option price as δ increases. Formula: 0.01 ∂C

∂δ

As a function of stock price, it is decreasing. Negative for calls and positive for puts.

31

3.5

Delta Hedging

3 FINANCIAL ECONOMICS

Change in Portfolio Value

To find the change of a position due to change in r, δ, or σ, multiply the respective greek to the percentage

change in r, δ or σ. So change in option value due to 2% change in r would be ρ × 2.

Put-Call Parity and Greeks

Put-call parity can be used to derive formulas involving greeks between calls and puts. For ∆:

C − P = Se−δt − Ke−rt ⇒ ∆C − ∆P = e−δt after taking partial derivative with respect to S

As a result, ΓC = ΓP .

Useful Measures

• Greek of a portfolio: Greeks are linear in nature: Greek of portfolio is sum of Greeks of individual

derivatives.

• Elasticity: The ratio of percent change in option price to the percent change in stock price. Let be change in stock price.

∆/C

∆S

=

E=

/S

C

• Option Volatility: σC = σS |E|

• Risk Premiums and Sharpe Ratio: Risk premium is the excess of return rate of an asset over the

risk free rate. For stock, it’s α − r and for option it is γ − r. From (7), (γ − r) = E(α − r)

Sharpe ratio is the risk premium over the volatility.

E(α − r)

α−r

γ−r

=

=

σC

EσS

σS

Miscellaneous Topics

• Profit on options before maturity

A N -day European option that is h days old is the same as an N − h day European option. The

profit of the option after h days is

CN −h − FV(CN ) compounded over

h

365

years

• Calendar Spreads

Calendar spread is an option spread where the options you sell and buy have the same strike price

on the same underlying stock but with different expiration dates. The one that is purchased has

a longer expiration date. Usually a desirable option strategy is the market is neutral, that is the

stock price is not very volatile. If the market is neutral, value of the calendar spread increases with

time; the shorter option expires without value and the long option gains profit.

3.5

Delta Hedging

Basic Delta-Hedging

If a market maker sells a call, he can hedge his position by purchasing ∆ shares because of fears stock

rises in price. This is delta-hedging. It is also possible to sell a put and that position is hedged

by shorting ∆ shares of underlying stock.

• Steps of delta-hedging?

Delta hedging follows 3 steps:

1. Sell an option (in some cases buy an option)

32

3.5

Delta Hedging

3 FINANCIAL ECONOMICS

2. Purchase δ shares of underlying stock

3. Borrow money for the first two transactions

• Overnight profit of delta-hedging?

The overnight profit of delta-hedging is

−[C(Sh ) − C(S0 )] + ∆(Sh − S0 ) − erh/365 − 1 (∆S0 − C(S0 ))

(8)

• How to approximate change in option value using Delta-gamma-theta approximation?

Use Taylor series with f (x) = C(S) around x0 = S0 . Then include the effects of time on option

premium, θh. θ has to be given on per-year basis. The Delta-gamma-theta approximation states

1

C(Sh ) − C(S0 ) = ∆(Sh − S0 ) + Γ(Sh − S0 )2 + θh

2

(9)

• What is market maker profit from delta-hedging using Delta-gamma-theta approximation?

For small h, erh/365 − 1 = rh. Then, the profit is

1

−rh(∆S0 − C(S0 )) − Γ(Sh − S0 )2 − θh

2

(10)

This can also be used to approximate profit in general. Suppose we are not delta hedging, but

bought and sold a call at time 0. Then −rh(∆S0 − C(S0 )) in equation (10) can be replaced by the

accumulated interest on the difference in the call premiums paid and received at time 0.

• For what stock price does the market-maker break even?

√

One standard deviation up or down in stock price for a delta-hedged position. S ± Sσ h

• What is the Black-Scholes equation? √

Set (10) to 0 and let (Sh − S0 ) = S0 σ h.

1

rC(S0 ) = r∆S0 + σ 2 S02 Γ + θ

2

(11)

• Why can’t we gamma-hedge or theta-hedge with stocks? What can we use to hedge with other Greeks

and how?

Greeks are defined as partial derivatives with respect to stock price and time so Greeks for the

stock are all zero except for ∆ which is 1. To hedge other Greeks, buy options as well as stocks.

Suppose we purchased option P and want to delta-gamma hedge it with option Q and stock. We

need to equate the Greek of the hedged position to the Greek of our portfolio (which contains P ).

To equate ∆,

number of stocks · ∆S + number of options · ∆Q = ∆P

and to equate Γ,

number of stocks · ΓS + number of options · ΓQ = ΓP

with ∆S = 1 and ΓS = 0.

Rehedging

Assume market-maker has written a call, delta-hedged by buying ∆ shares of stock and rehedged at

regular time intervals h. If stock

√ price moves Z standard deviations over a time period of length h, in

other words, Sh = S0 ± ZS0 σ h, then the market maker profit is

1 2 2

σ S0 Γh(1 − Z 2 )

2

33

3.6

Exotic Options: Asian Options

3 FINANCIAL ECONOMICS

So the variance of the profit is 2−1 (σ 2 S02 Γh)2 . In a total time period of s during which market-maker

rehedges s/h times, the variance of the total profit is the sum of the variance in each individual periods

of length h. So the variance would be

s 2 (σ 2 S02 Γh)2

(σ 2 S02 Γh)2

h

= sh

h

2

2

So more frequent market maker rehedges, the variance of total profit decreases.

3.6

Exotic Options: Asian Options

Two ways to average stock price

n

X

Arithmetic average: n−1

Sk Geometric average:

n

Y

k=1

k=1

!1/n

Sk

Remember not to include S0 in the average.

Differences between average price option and average strike option

• In payoff: Payoff of average price option is based on the average price of the asset over a period

of time and the strike is set. Average strike option has no set strike. The payoff is the difference

between the final price of the asset and the average price. So the strike is the average price for an

average strike option.

Payoff

Average Price

Average Strike

Call

(A(S) − K)+

(S − A(S))+

Put

(K − A(S))+

(A(S) − S)+

Table 12: Payoff of Asian option

• Value compared to European option: Average price options worth less than European options since

average prices are less volatile than stock price. Geometric average is less than arithmetic average.

So geometric average price calls worth less than arithmetic average price calls. The opposite is true

for average price puts. Geometric average strike calls worth more than arithmetic average strike

calls. The opposite is true for average strike puts.

Binomial Model for Asian Options

Trees do not recombine because of the averaging. For a N period binomial model, consider all 2N end

nodes. Calculate the probability of reaching each node using the risk neutral probability

e(r−δ)h − d

u−d

Then find the expected payoff through weighting (using risk neutral probabilities as weights). Then

present value the expected payoff back N periods.

3.7

Exotic Options: Barrier Options

• Knock-out options:

Up-and-out means if price rises to the barrier, the option doesn’t pay. Down-and-out means if price

falls to the barrier the option doesn’t pay.

34

3.8

Exotic Options: Compound, Gap and Exchange Options

3

FINANCIAL ECONOMICS

• Knock-in options:

Unlike before when the option won’t pay if the asset hits the barrier, this type of options pays only

if the asset hits the barrier.

• Rebate options:

Pays a fixed amount if the barrier is hit. Payment can be made end of year or immediately when

it’s hit.

Most important: Down-and-in and down-and-out call/put options having the same barrier

and strike K correspond to having a normal call/put option. Same for up-and-in and upand-out options.

For which type of knock-in/knock-out options is worth more, consider which makes more money for the

buyer. The more it can make, it’s worth more. For example, a knock-out call gets more expensive as

barrier increases.

3.8

Exotic Options: Compound, Gap and Exchange Options

Definition and Notation

• Compound option is an option to buy/sell another option which expires at a later time.

• 4 types of compound options?

PutOnCall (sell call option), PutOnPut (sell put option), CallOnCall (buy call option), CallOnPut

(buy a put option)

• K strike price on the stock, x strike price of compound option, σ volatility of underlying stock, t1

expiration date of compound option, T expiration date of underlying option

• K2 is trigger of gap option

Compound Option Parity and Pricing American Options

Compound options can be priced by a binomial option pricing model but also can be priced by put-call

parity.

CallOnCall − PutOnCall

= C(S, K, σ, r, t, σ) − xe−rt1

CallOnPut − PutOnPut

= P (S, K, σ, r, t, σ) − xe−rt1

Compound options can be used to price American call option with one discrete dividend. Assume a stock

pays a single dividend of D at time t1 prior to expiration T of the American call option. At the time of

dividend payment, we can either exercise the option at strike K and receive St1 + D or not exercise the

option. If we don’t exercise the option after dividend payment, we don’t exercise it until T .

At the time of dividend payment t1 , what is the value of the American call?

PV(max[St1 + D − K, C(St1 , T − t1 )])

By put-call parity, C(St1 , T − t1 ) = St1 − Ke−r(T −t1 ) + P (St1 , T − t1 ). So

h

i

max[St1 + D − K, C(St1 , T − t1 )] = St1 + D − K + max 0, P (St1 , T − t1 ) + K 1 − e−r(T −t1 ) − D

Present value back to time 0, the call premium is

h

i

S0 − Ke−rt1 + CallOnPut S, K, D − K 1 − e−r(T −t1 )

35

3.9

Lognormal Model for Stock Prices

3 FINANCIAL ECONOMICS

Gap Options

Gap options pay when the stock price is either higher or lower than the trigger K2 . Can have a negative

payoff.

Gap Options

Payoff

Option Premium

d1 , d 2

Call

Put

S − K if S > K2

K − S if S < K2

Se−δT Φ(d1 ) − K1 e−rT Φ(d2 ) K1 e−rT Φ(−d2 ) − Se−δT Φ(−d1 )

same except use the trigger as strike in the formula

Table 13: payoff and premiums of gap options

Exchange Options

Instead of a strike price, exchange options use a strike asset and compares that to the underlying asset.

The option pays off if an underlying asset outperforms the strike asset. If S and Q are the underlying

and strike assets, then the payoff of a exchange call is (ST − QT )+ at time T . Black-Scholes formula:

Se−δS T Φ(d1 ) − Qe−δQ T Φ(d2 )

for call

Volatility of exchange option is

q

p

2 − 2ρσ σ

Var(S − Q) = σS2 + σQ

S Q

3.9

Lognormal Model for Stock Prices

Let R be the continuously compounded return from 0 to t. So

St /S0 = eR ⇒ log(St /S0 ) = R

R is expected to be (α − δ)t. Suppose its variance scales with time, i.e. σ 2 t. Black-Scholes formula is

derived under the assumption stock price is modeled by Geometric Brownian Motion. So R follows an

Arithmetic Brownian Motion. In other words,

St

R = log

∼ N ((α − δ − 0.5σ 2 )t, σ 2 t)

S0

Questions

• Why subtract 0.5σ 2 ?

So that the expected value of R comes out to be (α − δ)t.

St

S0

E(St )

=

√

exp{(α − δ − 0.5σ 2 )t + σ tZ}

√

E exp{σ tZ}

= S0 e(α−δ−0.5σ

2

)t

= S0 e(α−δ−0.5σ

2

)t 0.5σ 2 t

e

= S0 e(α−δ)t

• What differential equation does an Arithmetic and Geometric Brownian Motion satisfy?

For St = S0 + (µ − δ)t + σZt , differential is dSt = (µ − δ)dt + σdZt .

For log(St ) = log(S0 )+(µ−δ −0.5σ 2 )t+σZt , the differential is d(log(St )) = (µ−δ −0.5σ 2 )dt+σdZt

or dSt = (µ − δ)St dt + σSt Zt

36

3.10

Bonds and Interest Rate Caps

3 FINANCIAL ECONOMICS

• What’s dt × dt, dZ × dt, dZ × dZ?

dZ × dZ = dt, rest are 0.

• What is Ito’s Lemma?

If C(St , t) is a twice-differentiable function of S and t then

dC =

∂C

∂C

∂2C

dS + 0.5 2 (dS)2 +

dt

∂S

∂S

∂t

• What is the Sharpe ratio for two processes based on the same dZ?

Equal

3.10

Bonds and Interest Rate Caps

Notation

• Pt (T, T + s): price to be paid at time t to purchase a zero-coupon bond for 1 issues at time T

maturing at time T + s. If t = T , subscript t can be left out, e.g. P (T, T + S).

• Ft,T [P (T, T + s)]: forward price at time t for agreement to purchase a bond at time T maturing at

T + s.

• Let RT be interest rate during year T + 1 and K be the interest rate cap

3.10.1

Pricing Bond Options

What is the formula for Ft,T [P (T, T + s)]?

P (t, T )Ft,T [P (T, T + s)] = P (t, T + s)

Right-hand side is how much to pay at time t to receive a bond that matures for 1 at T + s. Another way

to get 1 at T + s is to enter a forward agreement at time T for a bond that matures at T + s - by paying

Ft,T [P (T, T +s)] at time T . To accumulate that much at T , we pay the quantity on left-hand side at time t.

What is the premium of an option at time 0 to buy/sell a bond at time T which matures at time T + s?

Prepaid forward prices are P (0, T )F , where F = F0,T [P (T, T +s)] and similarly prepaid strike is P (0, T )K.

So,

where d1 , d2 =

3.10.2

Call premium

= P (0, T )[F Φ(d1 ) − KΦ(d2 )]

(12)

Put premium

= P (0, T )[KΦ(−d2 ) − F Φ(−d1 )]

(13)

log(F/K) σ √

√

±

h and h is number of years until maturity.

2

σ h

Pricing Interest Rate Caps

• What is an interest rate cap?

Provides someone with a variable rate loan protection against increases in interest rates.

37

3.10

Bonds and Interest Rate Caps

3 FINANCIAL ECONOMICS

• How to price it using Binomial Tree?

RT − K

The payoff at the beginning of year T + 1 (end of year T ) is max 0,

.

1 + RT

To value the cap using binomial tree, calculate payoff at each node (not just the leaf nodes), multiply

each payoff by their path probabilities, and sum the products.

• What is a caplet?

Caplets are individual payments of an interest rate cap. For a cap bought over n years, its payment

is the sum of the caplet payments: payment at time 0, after year 1, . . . , after year n − 1.

• How to price a cap using Black Formula?

Price individual caplets using Black Formula and sum up the values.

Caplet is a put on a 1-year bond; caplets pay interest for 1 year which is like selling a bond with

maturity 1, equivalently, is a put on a 1-year bond. Mathematically, payoff of a caplet is

RT − K

1 + Rt

+

=