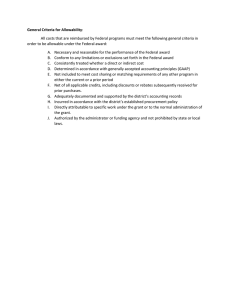

ADVANCED COST PRINCIPLES – AVOIDING COMMON PITFALLS Mary Jean White, CGMS MJ White Consulting mjwhite@mjwhiteconsulting.com www.mjwhiteconsulting.com (954) 501-1029 Business Management Research Associates WHAT WE WILL COVER TODAY Cost principles applicability can be a minefield for federal agencies as well as grantees and cooperative agreement partners. After a quick review of cost principle basics, we will discuss common areas of risk involving items of costs, and some examples demonstrating what can go wrong. • Cost Principles Review • Allowability • Allocability • Reasonableness • Necessity • Direct and Indirect Costs • Indirect Cost Rates WHAT WE WILL COVER TODAY • Justifying costs – tips for reviewing budgets • Common problem areas: Time and effort reporting, Travel, Procurement, Conflicts of Interest • Subawarding Issues • Dealing with questioned costs • Recipient responsibilities • Federal agency and pass-through responsibilities • Case Studies – a few examples of what can go wrong and avoiding pitfalls • Multiple choice assessment – test your knowledge DEFINING TERMS § 200.413 Direct costs • (a)General. Direct costs are those costs that can be identified specifically with a particular final cost objective, such as a Federal award, or other internally or externally funded activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. Costs incurred for the same purpose in like circumstances must be treated consistently as either direct or indirect (F&A) costs. See also § 200.405 Allocable costs. DEFINING TERMS § 200.56 Indirect (facilities & administrative (F&A)) costs for “Major nonprofit organizations Indirect (F&A) costs means those costs incurred for a common or joint purpose benefitting more than one cost objective, and not readily assignable to the cost objectives specifically benefitted, without effort disproportionate to the results achieved. To facilitate equitable distribution of indirect expenses to the cost objectives served, it may be necessary to establish a number of pools of indirect (F&A) costs. Indirect (F&A) cost pools must be distributed to benefitted cost objectives on bases that will produce an equitable result in consideration of relative benefits derived.” MORE DEFINITIONS 2 CFR 200, Subpart F, Appendix IV Indirect cost proposal means the documentation prepared by an organization to substantiate its claim for the reimbursement of indirect costs. This proposal provides the basis for the review and negotiation leading to the establishment of an organization's indirect cost rate. Cost objective means a function, organizational subdivision, contract, Federal award, or other work unit for which cost data are desired and for which provision is made to accumulate and measure the cost of processes, projects, jobs and capitalized projects. 2 CFR 200 – DIRECT/INDIRECT COSTS & COST PRINCIPLES 2 CFR 200, Subpart E and 45 CFR 75 Subpart E For-Profit Organizations - 48 CFR 31.2 (Contracts with Commercial Organizations) (FAR) 45 CFR Part 75, Appendix IX – For Profit and Non-Profit Hospitals DETERMINING ALLOWABILITY • Allowable – Under Cost Principles, program statutes and regulations, state and local law • Allocable – Must be tied to a particular cost objective, service or contract in proportion to benefits received • Reasonable - does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost; ordinary and necessary to support organization or contribute to performance • Necessary is important! FACTORS AFFECTING COST ALLOWABILITY • Be accorded consistent treatment. A cost may not be assigned to a Federal award as a direct cost if any other cost incurred for the same purpose in like circumstance has been allocated to the Federal award as an indirect cost • Be determined in accordance with GAAP • Not be included as a cost or used to meet cost sharing or matching requirements of any other federally-financed program in either the current or a prior period • Be adequately documented COMMON UNALLOWABLE COSTS (BUT THERE ARE ALWAYS EXCEPTIONS) • Certain types of advertising and public relation costs (§200.421) • Alcoholic beverages (§200.423) • Bad debt expense (§200.426) • Contingency provisions (§200.433) • Contributions or donations (§200.434) • Entertainment Costs (§200.438) • Fines and penalties (§200.441) • Fundraising and investment management costs (§200.442) • General Costs of Government (salaries of the chief executive, salaries of the board, etc.) (§200.444) • Goods or services for personal use (§200.445) • Lobbying (§200.450) • Selling and marketing (§200.467) THINGS FOR NON-FEDERAL ENTITIES TO CONSIDER POLICIES AND PROCEDURES • Review current policies for alignment with current regulations • Multiple policies and procedures should be reviewed, depending on the NFE • Have a strong policy in place that manages Conflicts of Interest, particularly for procurement – mirroring the funding agency policy is a safe bet • Review each line item in every budget and prior approval submitted for allowability, allocability, and reasonableness – always think about the next monitoring visit/audit • Training should be provided for program and financial personnel, including formal training, job aides, process flows and decision trees • Check for overlapping and conflicting policies and procedures – consistent treatment of costs is paramount • Submit a corrective action plan for all items of questioned costs, and follow it, including timelines for correction • Appeal procedures (if any) will vary by cognizant agency – guidance is provided by contract or grants officer in official notice of decision THINGS FOR AWARDING AGENCIES AND PASS-THROUGH ENTITIES TO CONSIDER MONITORING • Pre-Award – review initial NOFO/FOA budget submittals for allowability, allocability, reasonableness and necessity • Compare agreement budget to actual expenditures • Check for costs charged as direct that are normally charged indirect • Know any cost restrictions in the program statute • Monitor for NFE internal controls, compliant policies and procedures – check Conflict of Interest procedures • Follow-up on monitoring and audit findings, along with corrective action plans COMMON ISSUES WITH ITEMS OF COST • Misallocation of costs • Excessive cost transfers • Inaccurate time and effort reporting • Incomplete/non-existent documentation • Inadequate subrecipient monitoring • Lack of documentation for travel – all travel should follow non-federal entity policies and procedures, be documented for necessity, and provide evidence of attendance at meetings, conferences, events, etc. COMMON TIME AND EFFORT REPORTING ISSUES • Reporting time based on the budgeted amounts without regard to what employee actually worked • Lack of maintaining source documentation (Personnel Activity Reports, or PARs) to support salary costs • Failing to recognize a change in position, duties, or funding may result in a change of reporting • Entire day’s schedule not accounted for (only federal time reported) IMPORTANT POINTS - TIME AND EFFORT REPORTING • Personnel Activity Reports must show actual time spent working on each award or cost activity • Budget estimates are just that and do NOT qualify as support for charges to Federal awards • Back-up documentation for Time and Effort reporting must survive audit and monitoring scrutiny PERSONNEL ACTIVITY REPORTS (PARs) PARs should: • Be completed after-the-fact • Reflect actual work performed (not budgeted) • Account for total activity of employee • Submitted at least monthly • Signed and dated by employee • Maintained for ALL staff members/employees whose compensation is charged in part to the award • Best practice – save other documentation (calendars, meeting agendas and minutes, etc.) to support PARs if further documentation is needed CASE STUDIES/EXAMPLES Problem #1 An accountant who works for the City of Honestville reclasses several budget items expended as part of a federally-funded park project; the accountant provides an explanation that says “to correct an accounting error.” The city’s internal auditor has a big problem with this. Why? CASE STUDIES/EXAMPLES Problem #1 Explanation • Accounting error transfers must be supported by documentation that fully explains how the error occurred and a certification of the correctness of the new charge by a responsible organization official • Transfers of costs from one project to another or from one competitive segment to the next solely to cover cost overruns are not allowable CASE STUDIES/EXAMPLES Problem #2 Dr. Smartypants thinks she has discovered a brand new type of mycoplasma that is way too miniscule to be studied with his current equipment. She needs a shiny, stateof-the-art microscope to continue to study this possible new cell, but the University is in year three of a three year project, and doesn’t have the funds available. She notices that there are some unobligated funds left from year 2, so she decides to use those to purchase the equipment. Can Dr. Smartypants do this? CASE STUDIES/EXAMPLES Discussion of Problem #2 The answer is quite possibly! • Review the Notice of Award (NoA) for specified carryover authority • Many research grant programs are excluded from automatic carryover provisions for unobligated balances. These grants and others would require agency prior approval unless a special term or condition is included in the NoA • Cost principles – purchases paid for with grant funds must be allocable to that award, and would need prior approval for items not included in the original budget CASE STUDIES/EXAMPLES Problem #3 The Principle Investigator (PI) on an NSF grant receives a new award from a private foundation, on which he is also the PI. He needs to reduce his effort on the existing grant from the initial approved level of 60% to 20%. Does the University need prior approval? What if the PI reduced his effort from 50% to 40%? Would the University still need prior approval CASE STUDIES/EXAMPLES Discussion of Problem #3 Yes for the first part of the example - 200.308(c)(1)(iii) states that reduction in time devoted to the project by key personnel specified in the award notice by 25% or more must have prior approval. No for the second part – the level of effort does not meet the 25% or more threshold CASE STUDIES/EXAMPLES Problem #4 You are a grants administrator for a University of Questionable Ethics research department. You heard that an administrator at another university has been arrested and charged with taking cash kickbacks from a contractor in exchange the administrator securing more work for the contractor. You are concerned. The university that the arrested employee works for also receives a subaward from your university. You confide in your boss, and your boss tells you to stay out of it. What do you do? CASE STUDIES/EXAMPLES Discussion of Problem #4 As the non-federal entity recipient of a federal award, your institution is legally responsible and accountable to the awarding agency for appropriate use of funds and for the performance of the project. This includes the appropriate use and performance of any subawards. CASE STUDIES/EXAMPLES Discussion of Problem #4 Possible next steps • Report to your institution • Report directly to the agency who funds the grant • Make a formal allegation to the agency Office of Inspector General (OIG) YOUR QUESTIONS AND COURSE ASSESSMENT • This was a fast-moving presentation - any questions on the material or other cost issues? • A quick assessment to test your knowledge