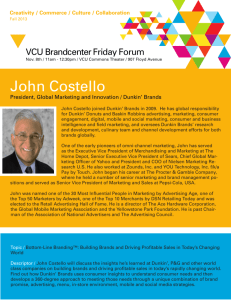

ATENEO DE DAVAO UNIVERSITY SCHOOL OF BUSINESS AND GOVERNANCE GRADUATE SCHOOL STRATEGIC MANAGEMENT DUNKIN BRANDS GROUP, INC., 2015 Submitted to: PROF. STEPHEN ANTIG Submitted by: ALGER, CHRISTINE JOYCE P. AROBO, ANA ROSE JULY 20, 2019 I. INTRODUCTION With more than 20,000 points of distribution in more than 60 countries, Dunkin’ Brands is one of the world’s leading franchisors of quick service restaurants (QSRs) serving hot and cold coffee and baked goods, as well as hard serve ice cream. Dunkin’ Brands is the parent company of two of the world’s most recognized and beloved brands: Dunkin’, America’s favorite all-day, everyday stop for coffee and baked goods, and Baskin-Robbins, the world’s largest chain of ice cream specialty shops. Dunkin’, founded in Quincy, Massachusetts in 1950, is famous for its combination of high-quality coffees, espresso beverages, baked goods and breakfast sandwiches served all day with fast, friendly service. Baskin-Robbins, founded in Glendale, California in 1945, is iconic for its variety of “31 flavors” of ice cream, along with the brand’s creative ice cream cakes, milkshakes and ice cream sundaes. Dunkin' Brands' 100 percent franchised business model currently includes more than 12,500 Dunkin' restaurants and nearly 8,000 Baskin-Robbins restaurants. Source: https://www.dunkinbrands.com/company/about/about-dunkin-brands II. VISION AND MISSION STATEMENT A. VISION STATEMENT OLD VISION STATEMENT We strive to be recognized as a company that responsibly serves our guests, franchisees, employees, communities, business partners, and the interests of our planet. Source: https://www.dunkinbrands.com/community/corporate-socialresponsibility/overview PROPOSED REVISED VISION STATEMENT We strive to be the world’s biggest everyday source of high-quality all-day coffee, baked goods and creative ice cream products whilst responsibly and sustainably serving our stakeholders. B. MISSION STATEMENT OLD MISSION STATEMENT Dunkin’ Brand’s website does not provide a written mission statement, however, below are listed as the company’s “priorities” broken down into four parts: Our Guests At Dunkin’ Brands, we approach everything we do – from product development to restaurant operations to communications – through a guest-centric lens. (Customer; Philosophy) We strive to offer all of our guests authentic, high-quality menu items. Our goal is to continuously improve our menu while offering guests the choice and great taste that they expect from Dunkin’ and Baskin-Robbins. (Product) Food safety continues to be a key priority for Dunkin’ and Baskin-Robbins restaurants and our supply chain. (Self-Concept) Our Planet When it comes to our impact on the environment, we recognize that what we do today will matter tomorrow. Guided by our Serving Responsibly commitment, we actively work to make business decisions that serve the interests of our guests, franchisees, communities and the planet today and for years to come – by reducing our packaging, improving the efficiency of our restaurants, and sourcing our ingredients more sustainably. (Survival, growth and profitability; Philosophy; Technology) Our People We are committed to improving the diversity of our employee, franchisee and supplier base and to fostering an inclusive environment for all who come in contact with our Brand. We strive to welcome diverse employees to our teams and to weave inclusion into the fabric of our culture. Our leaders and employees foster an environment where everyone is valued and respected; everyone matters here. (Employees) Our Neighborhoods At Dunkin’ Brands, we feel fortunate that our restaurants are part of the fabric of so many communities and neighborhoods around the globe, and our franchisees value the role they can play in strengthening their communities. (Public Image;Philosophy) Source: https://www.dunkinbrands.com/community/corporate-socialresponsibility/overview PROPOSED MISSSION STATEMENT Dunkin’ Brand is a global (3) source of high-quality all-day coffee, baked goods and creative ice cream products (2). With emphasis on food safety and our commitment to serve all our stakeholders responsibly (1,5,6,7,8,9) we are in continuous pursuit of developing sustainable products and overall operations while taking advantage of technological advancements (4,5,7,8). We foster an inclusive environment with a diverse team (9) who helps the company pursue its commitments to all of its stakeholders especially in strengthening every community where the brand is established worldwide. (1,3,6,7,8). (80 words) (1) Customer, (2) Product or services, (3) Markets, (4) Technology, (5) Survival, growth and profitability, (6) Philosophy, (7) Self-Concept, (8) Public image, (9) Employees III. INTERNAL ASSESSMENT A. FINANCIAL ANALYSIS INCOME STATEMENT OVERVIEW Dunkin’ Brand’s revenues have increased to USD$ 34.9M in 2014. Although operating expenses have slightly decreased in 2014, its operating income has greatly decreased indicating a poor financial health. But overall net income has increased to USD 29.4M. (in thousands of USD) Income Statement Revenues Operating Expenses Operating Income EBIT Interest EBT Tax Other Items Net Income 12/28/2013 713,840 436,631 27,527 304,736 86,648 218,088 71,784 599 146,903 12/17/2014 748,709 432,535 22,684 338,858 83,125 255,733 80,170 794 176,357 Percent Change 4.88% -0.94% -17.59% 11.20% -4.07% 17.26% 11.68% 32.55% 20.05% BALANCE SHEET OVERVIEW Total assets of Dunkin’ Brands have decreased to USD 57.3M and their liabilities have decreased by USD 9.9M. Total equity also decreased by USD 37.3M. 2014’s overall financial position is really not looking good. (in thousands of USD) Income Statement 12/28/2013 12/17/2014 Percent Change Cash Accounts Receivable Inventories Other Current Assets Total Current Assets PPE Equity Investments Goodwill & Intangibles Other Assets Total Assets 256,933 79,765 125,062 461,760 182,858 170,644 2,343,803 75,625 3,234,690 208,080 105,060 129,478 442,618 182,061 164,493 2,317,167 71,044 3,177,383 Short-term Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-term Debt Deferred Income Taxes Other Liabilities Total Liabilities 5,000 12,445 326,853 344,298 1,818,609 561,714 97,781 2,822,402 3,852 13,814 337,853 355,519 1,807,081 540,339 99,494 2,802,433 -22.96% 11.00% 3.37% 3.26% -0.63% -3.81% 1.75% -0.71% Noncontrolling Interest Common Stock Retained earnings Treasury Stock Paid in Capital and other Total Equity Total Liabilities, noncontrolling Interest, & Equity 4,930 107 779,741 10,773 1,197,765 412,288 6,991 104 711,531 1,079,386 374,950 41.81% -2.80% -8.75% -100.00% -9.88% -9.06% 3,234,690 3,177,383 -1.77% - -19.01% 31.71% - 3.53% -4.15% -0.44% -3.60% -1.14% -6.06% -1.77% HISTORICAL RATIOS Historical Ratios Overview Based on their financial ratios – in terms of liquidity, their ratios dropped in 2014 but nevertheless they are still capable of paying their short-term obligations however this must be addressed accordingly to avoid liquidity problems in the future. In terms of operating performance – their efficiency dropped in 2014, but in terms of profitability their performance has increased. As to the financial health of the company, the company has a weak equity position. Their operation primarily capitalizes on debt thus financial risk is very high. In terms of overall growth, they are in a good position because it is higher than the previous year. 2013 Internal Liquidity Current Ratio Quick Ratio Operating Performance Total Asset Turnover Operating Profit Margin Net Profit Margin Risk Analysis Debt-Equity Ratio Long Term Debt/Capital Growth Analysis Return on Equity Net Profit Margin Return on Investments 2014 1.34 1.34 1.24 1.24 0.23 42.69 20.58 0.22 45.26 23.55 4.61 0.81 5.04 0.83 35.91 20.58 6.55 47.71 23.55 8.08 Du Pont Analysis Overview There’s an increase in Operational Efficiency (ROS), Marketing Excellence and overall Corporate Performance (ROE). However, financial risk is high because it is more than the industry tolerance of 3.3. RATIO DU PONT ANALYSIS DUNKIN' BRAND 2014 2013 NET INCOME 176,357 146,903 SALES 748,709 713,840 3,177,383 3,234,690 367,959 407,358 24% 0.24 8.64 48% 21% 0.22 7.94 36% TOTAL ASSETS EQUITY RETURN ON SALES ASSET TURNOVER EQUITY MULTIPLIER RETURN ON EQUITY INTERNAL FACTOR EVALUATION MATRIX (IFE MATRIX, IFEM) Strengths 1 2 3 4 5 Dunkin’ Brands is one of the largest franchisors of QSR and has a global reach and accessibility considering the presence of 11, 300 (Dunkin) and 7,000 (BR) restaurants across the world and considered as a speed leader in QSR Dunkin' Donuts has Centralized Manufacturing Locations (CML) were products are delivered fresh daily Dunkin' Franchisees in the United States pay 5% of gross sales for advertising fees No 1 in customer loyalty - Dunkin’ Donuts recognized as the #1 in coffee category for 8 consecutive years by the Brand Keys Customer Loyalty Engagement Index Price of products are highly competitive Weight Weighted Score Rating 0.09 4 0.36 0.07 4 0.28 0.07 3 0.21 0.07 4 0.28 0.05 3 0.15 6 Has shown impressive growth in revenues (8.1%) and overall corporate performance 0.05 3 0.15 7 Was named top US ice cream and frozen dessert franchise 0.04 3 0.12 8 Can negotiate better pricing on food, packaging and othe supplies due to size compared to small scale entrepreneurs 0.04 3 0.12 9 Superb performance in new Markets - Dunkin Brands Group Inc. has built expertise at entering new markets and making a succes out of them 0.03 3 0.09 Already engaged in various CSR activities 0.02 3 0.06 10 Primary Implication from IFEM (Strengths) Dunkin’ Brands greatest strength is that they are the market speed leader in QSR. Dunkin’ has established. They have continuously received rewards for Customer Loyalty which is a good indicator that they have strong position in the market. They have established Central Manufacturing Locations making their operation more efficient which reflects their overall corporate performance. Weaknesses 1 Does not offer healthy options for health conscious customers Store cannibalization is becoming a problem Weight Weighted Score Rating 0.07 1 0.07 0.06 1 0.06 3 A few products have a high market share, while most of the products have a low market share. This reliance on a few products makes Dunkin Brands Group Inc vulnerable to external threats if these few products suffer for any reason 0.06 1 0.06 4 There is a lack of proper financial planning at Dunkin Brands Group Inc regarding cash flows, leading to certain circumstances where there isn’t enough cash flow as required leading to unnecessary unplanned borrowing 0.05 1 0.05 0.05 2 0.1 0.04 1 0.04 0.04 1 0.04 2 5 6 7 8 9 10 Total number of stores outside US territories have decreased in number The company’s financial risk is high due to high debt to equity ratio The company's ability to meet its short term financial obligations is low Dunkin Brands has no COO 0.04 2 0.08 Even though the product is a success in terms of sale but its positioning and unique selling proposition is not clearly defined which can lead to the attacks in this segment from the competitors 0.03 2 0.06 Dunkin Brands has limited control over employees at restaurants because they are employed and paid by franchisee 0.03 2 0.06 Total IFE Score 1 Primary Implication from IFEM (Weaknesses) Primary weakness is their lack of healthy options for health-conscious customers. This is the current consumer trend and if left unsolved can lead to reduction of revenues. They also have limited product offerings because they are primarily known as a breakfast restaurant. The company also have a high financial risk at the moment because of poor long-term debt management. 2.44 CURRENT ORGANIZATION CHART PROPOSED ORGANIZATIONAL CHART Reason: We added the COO because we noticed that they don’t have any second-incommand. As we all know the function of CEO is more concentrated on investments thus someone must be commissioned to oversee the business operations. MARKET MAP Overview: In terms of quality and price – Dunkin is in positioned lower than the competitors. EXISTING STRATEGY TO INCREASE REVENUE Drive-Thru Facility – to cater consumers in a hurry Loyalty and rewards program – enable company to collect data Dunkin’ K-Cup – helped Dunkin penetrate the market Use of Arabica Coffee – cheaper than other types of coffee Will open 65 Dunkin Donut Stores in Brasilia and additional stores 80 additional stores outside brazil 6) Rehauling stores to have “sip and sit” atmosphere 7) Offer dinner – friendly food 1) 2) 3) 4) 5) IV. EXTERNAL ASSESSMENT EXTERNAL FACTOR EVALUATION MATRIX (EFE MATRIX, EFEM) Opportunities New trends in the consumer behavior can open up new market for the Dunkin' Brands Group, Inc. It provides a great 1 opportunity for the organization to build new revenue streams and diversify into new product categories Weight Weighted Score Rating 0.09 4 0.36 0.08 4 0.32 0.07 0.06 4 4 0.28 0.24 There is still room for international expansion considering UK 5 re-opening was a success; other Asian countries still has room for expansion 0.06 3 0.18 6 The new technology provides an opportunity to Dunkin' Brands Group, Inc. 0.05 4 0.2 7 The local players have local expertise while Dunkin Brands can bring global processes and execution expertise on table. 0.05 3 0.15 8 The price of Arabica coffee bean is lower compared to other variety of coffee bean (Robusta) 0.04 3 0.12 0.04 3 0.12 0.03 3 0.09 Technology is becoming more advanced in term of food 2 preparation, marketing, packaging innovations and so much more 3 Intense price competitiveness among rival firms 4 Consumers are becoming more health conscious Dunkin' Brands can develop an agreement to Colombia, the 2nd world's Arabica grower 10 Customer crave convenience because of busy lifestyle 9 Opportunities Implications: Consumer behavior has changed and is now leaning towards consuming healthy options. Technology is more accessible now to companies who wanted to develop their products, packaging, and services. Threats As the company is operating in numerous countries it is 1 exposed to currency fluctuations especially given the volatile political climate in number of markets across the world. 2 More competition in the breakfast category Incidents involving food-borne illnesses, food tampering, or 3 food contamination could create negative publicity and significantly harm in Dunkin’s operating results Weight Weighted Score Rating 0.06 2 0.12 0.05 2 0.1 0.05 2 0.1 New technologies developed by the competitor or market 4 disruptor could be a serious threat to the industry in medium to long-term future. 0.05 2 0.1 Changing consumer buying behavior from online channel 5 could be a threat to the existing physical infrastructure driven supply chain model. 0.05 2 0.1 Intense competition – Stable profitability has increased the number of players in the industry over last two years which has 6 put downward pressure on not only profitability but also on overall sales 0.04 1 0.04 There’s a looming supply crisis in the coffee industry as well as the increase of prices to 50% 0.04 1 0.04 In 2014 KKD, Starbucks and Dunkin’ Brand Group increased to 6.5, 10.1 and 4.9 percent respectively. The quick service 8 restaurant segment is highly competitive, and competition could lower revenues. 0.04 2 0.08 Trade Relation between US and China can affect Dunkin Brands growth plans - This can lead to full scale trade war 9 which can hamper the potential of Dunkin Brands to expand operations in China. 0.03 1 0.03 0.02 1 0.02 7 Many mom-and-pop stores can open anytime promising 10 cheaper product offerings because they don’t have to pay franchise fees and royalties Total EFE Score 1 2.79 Threats Implications: Currently, competition in the breakfast industry is very tight. Due to intense competition, competitors have upgraded their services with the help of technology and are currently ahead in the game in terms of taste and quality. THE COMPETITORS a. “MOM-AND-POP” DOUGHNUT SHOPS Not really a dominant rival, however there are thousands of “mom-andpop” doughnut and specialty shops worldwide eating a portion of the market. b. STARBUCKS CORPORATION (SBUX) Starbucks is the world’s largest specialty coffee retailer with more than 18,000 coffee shops in 60 countries. It offers coffee drinks and pastries, roasted beans, coffee accessories, and teas. The company owns about 9,400 of its own shops (mostly in the United States), while licensees and franchisees operate roughly 8,650 units worldwide (primarily in shopping centers and airports). In 2014, Starbucks began offering beer and wine, as well as fancy snacks, chicken skewers, chocolate fondue, and other items. By year-end 2014, only 40 Starbucks offered these new items. The company also owns the Seattle’s Best Coffee and Torrefazione Italia coffee brands. Starbucks markets its coffee through grocery stores and licenses its brand for other food and beverage products. The company is determined to get the afternoon and evening customer, whereas historically it has mainly been a breakfast place. That is why the beer, wine, and more food is being rolled out at more and more Starbucks outlets. The company sees afternoon and dinner also as a way to differentiate itself from Dunkin’ Donuts and Krispy Kreme Doughnuts that historically have been more about quick service than sit down and stay, which is the venue Starbucks plans to enter aggressively globally. Starbucks now offers 10 standard small dinner plates as part of its evening menu, such as truffle macaroni and cheese. There are also five choices of red wine, three white wines, a sparkling rose, and prosecco. c. KRIPY KREME DOUGHNUTS (KKD) Krispy Kreme Doughnuts is chain of doughnut outlets with about 695 locations throughout the United States and in about 20 other countries. The shops are popular for their glazed doughnuts that are served fresh and hot out of the fryer, as well as cake and filled doughnuts, crullers, and fritters. Hot coffee and other beverages also are sold. KKD outlets are almost all owned and operated by franchisees; the company owns and operates 90 locations. Aside from doughnuts and coffee, no other food items of substance are offered. The company markets its doughnuts through grocery stores and supermarkets. Green Mountain Coffee Roasters Inc. (GMCR) and KKD have agreed to widen the home- made single-serve coffee options for Keurig users, whereby KKD’s upcoming coffees—Smooth and Decaf—will be available in K-Cup packs for Keurig brewers. Krispy Kreme’s K-Cup packs will be available at the online shopping sites of Keurig and KKD, along with the participating KKD shops, grocery, and many other retail outlets. The convenience of Keurig brewers will enhance the popularity of KKD coffee among Keurig fans. The fiscal fourth-quarter results for KKD on March 12, 2014, saw revenue rise 3.3 percent to $112.7 million. Company-owned same-store sales rose 1.6 percent, and franchise same-store sales soared 6.7 percent. Adjusted net income grew 37 percent to $8.3 million. It was the fifth full year and 21st quarter in a row of same-store KKD sales gains. d. TIM HORTONS, INC. Tim Hortons is Canada’s leading quick-service restaurant brand, having more than 4,250 cof- fee and donut shops across the country, and in several U.S. states. Tim Hortons was acquired by Burger King Worldwide in late 2014 in an $11 billion deal, and BKW immediately created Restaurant Brands International (RBI). RBI is now the second largest global quickservice restaurant in the world. Today, BKW is headquartered in Oakville, outside of Toronto, Canada. The Tim Horton menu features a variety of coffees and cappuccino, along with donuts, Dutchies, bagels, and other baked goods. In addition, Tim Hortons serves a lunch menu of soup, sandwiches, and chili. The chain includes freestanding as well as kiosk and mall-based outlets; all but about 20 of the locations are operated by franchisees. The company owns the Cold Stone Creamery ice cream shop chain. Tim Hortons’ revenues in a recent quarter increased 10.7 percent, and adjusted earnings-per-share grew 6 percent. DUNKIN BRANDS VERSUS RIVAL FIRMS No of Employees 1% 1% Dunkin Krispy Kreme 98% Starbucks 2500 2000 1500 1000 500 0 Dunkin Krispy Kreme Starbucks Net Income Market Capital 7% 2% Dunkin Krispy Kreme 91% Starbucks COMPETITIVE PROFILE MATRIX (CPM) DNKN Critical Success Factors Price competitiveness Product quality Advertising Market share Financial position Customer loyalty Global expansion Top management Customer service Union relations Technological advantages Location of facilities Social responsibility Totals SBUX KKD Weight Rating Score Rating Score Rating Score 0.15 0.13 0.12 0.11 0.1 0.08 0.07 0.06 0.05 0.04 4 2 4 3 2 4 4 2 3 2 0.6 0.26 0.48 0.33 0.2 0.32 0.28 0.12 0.15 0.08 2 4 2 4 4 2 3 3 4 3 0.3 0.52 0.24 0.44 0.4 0.16 0.21 0.18 0.2 0.12 3 3 3 2 3 3 2 4 2 4 0.45 0.39 0.36 0.22 0.3 0.24 0.14 0.24 0.1 0.16 0.04 0.03 0.02 1.00 3 3 4 40.00 0.12 0.09 0.08 3.11 4 4 2 41.00 0.16 0.12 0.04 3.09 2 2 3 36.00 0.08 0.06 0.06 2.80 Note: We only considered the two major competitors of Dunkin’ Brands for this analysis. Primary implications from CPM From viewing the competitive profile matrix, Dunkin Brands ranks the second out of its two main competitors Starbucks and Krispy Kreme in its total critical success factors. The company’s low-ranking stems are from their weaker financial profit, top management, union relations, and lower product quality. However, Dunkin’ Brands still dominates its two competitors over price competitiveness, advertising, customer loyalty, social responsibility, and in global expansion. V. STRATEGY FORMULATION a. SWOT MATRIX This matrix shows possible strategies for the company. Condition was a comprehensive analysis of internal and external factors and their influence on the company. INTERNAL SWOT MATRIX EXTERNAL OPPORTUNITIES 1. New trends in the consumer behavior can open up new market for the Dunkin' Brands Group, Inc. It provides a great opportunity for the organization to build new revenue streams and diversify into new product categories 2. Technology is becoming more advanced in term of food preparation, marketing, packaging innovations and so much more 3. Intense price competitiveness among rival firms 4. Consumers are becoming more health conscious 5. There is still room for international expansion considering UK re-opening was a success; other Asian countries still has room for expansion 6. The new technology provides an opportunity to Dunkin' Brands Group, Inc. 7. The local players have local expertise while Dunkin Brands can bring global processes and execution expertise on table. 8. The price of Arabica coffee bean is lower compared to other variety of coffee bean (Robusta) 9. Dunkin' Brands can develop an agreement to Colombia, the 2nd world's Arabica grower 10. Customer crave convenience because of busy lifestyle THREATS 1. As the company is operating in numerous countries it is exposed to currency fluctuations especially given the volatile political climate in number of markets across the world. 2. More competition in the breakfast category 3. Incidents involving food-borne illnesses, food tampering, or food contamination could create negative publicity and significantly harm in Dunkin’s operating results 4. New technologies developed by the competitor or market disruptor could be a serious threat to the industry in medium to long-term future. 5. Changing consumer buying behavior from online channel could be a threat to the existing physical infrastructure driven supply chain model. 6. Intense competition – Stable profitability has increased the number of players in the industry over last two years which has put downward pressure on not only profitability but also on overall sales 7. There’s a looming supply crisis in the coffee industry as well as the increase of prices to 50% 8. In 2014 KKD, Starbucks and Dunkin’ Brand Group increased to 6.5, 10.1 and 4.9 percent respectively. The quick service restaurant segment is highly competitive, and competition could lower revenues. 9. Trade Relation between US and China can affect Dunkin Brands growth plans - This can lead to full scale trade war which can hamper the potential of Dunkin Brands to expand operations in China. 10. Many mom-and-pop stores can open anytime promising cheaper product offerings because they don’t have to pay franchise fees and royalties STRENGTHS 1. Dunkin’ Brands is one of the largest franchisors of QSR and has a global reach and accessibility considering the presence of 11, 300 (Dunkin) and 7,000 (BR) restaurants across the world and considered as a speed leader in QSR 2. Dunkin' Donuts has Centralized Manufacturing Locations (CML) were products are delivered fresh daily 3. Dunkin’ Franchisees in the United States pay 5% of gross sales for advertising fees 4. No 1 in customer loyalty - Dunkin’ Donuts recognized as the #1 in coffee category for 8 consecutive years by the Brand Keys Customer Loyalty Engagement Index 5. Price of products are highly competitive 6. Has shown impressive growth in revenues (8.1%) and overall corporate performance 7. Dunkin’ Franchisees in the United States pay 5% of gross sales for advertising fees 8. Can negotiate better pricing on food, packaging and other supplies due to size compared to small scale entrepreneurs 9. Superb performance in new Markets - Dunkin Brands Group Inc. has built expertise at entering new markets and making a success out of them 10. Already engaged in various CSR activities WEAKNESSES 1. Does not offer healthy options for health-conscious customers 2. Store cannibalization is becoming a problem 3. A few products have a high market share, while most of the products have a low market share. This reliance on a few products makes Dunkin Brands Group Inc vulnerable to external threats if these few products suffer for any reason 4. There is a lack of proper financial planning at Dunkin Brands Group Inc regarding cash flows, leading to certain circumstances where there isn’t enough cash flow as required leading to unnecessary unplanned borrowing 5. Total number of stores outside US territories have decreased in number 6. The company’s financial risk is high due to high debt to equity ratio 7. The company's ability to meet its short-term financial obligations is low 8. Dunkin Brands has no COO 9. Even though the product is a success in terms of sale, but its positioning and unique selling proposition is not clearly defined which can lead to the attacks in this segment from the competitors 10. Dunkin Brands has limited control over employees at restaurants because they are employed and paid by franchisee SO WO 1. 2. 3. OPTIMIZE CMLS BY DIVERSIFYING PRODUCT PORTFOLIO BY ADDING HEALTHY OPTIONS USING ADVANCE TECHNOLOGY (S2, O2, O4) DEVELOP COLOMBIA AS A SUPPLY PARTNER TO INCREASE COFFEE PRODUCTION AS PART OF DUNKIN’S CSR ACTIVITES (S10, O10) DEVELOP PRODUCTS HEALTHY PRODUCTS TO INCREASE REVENUES AND (S6, O4) ST 1. 2. 1. 2. USE TECHNOLOGICAL ADVANCMENTS TO DEVELOP HEALTHY PRODUCT OPTIONS AND PACKAGING (W1, W2) INTENSIFY PROMOTIONAL ACTIVITIES USING MEDIA BUY AND ONLINE PLATFORMS TO PENETRATE MARKET (W9, O2,06) WT OPTIMIZE THE 5% FRANCHISEE ADVERTISING FEES TO INTENSIFY PROMOTIONAL ACTIVITIES (S5, T5) PROMOTE DUNKIN FOOD SAFETY POLICY USING ADVERTISING FUND TO GAIN CONSUMER TRUST (S3, T3) 1. INSTALL A COO TO OVERSEE AND STREAMLINE THE WHOLE GLOBAL BUSINESS OPERATIONS (WS1,T1,T3,T6,T3, T9) b. IE MATRIX Result of our IE matrix indicated that our tactical strategies should focus on market penetration and product development. c. QUANTITATIVE STRATEGIC PLANNING MATRIX (QSPM) Product development Online channel Promotional event Strengths Weight Dunkin' Brands is one the largest franchisors of QSR and has a global reach and accessibility considering the presence of 11,300 (Dunkin) and 7,000 (BR) restaurants across the world and 1 considered as a speed leader in QSR 0.09 Dunkin' Donuts has Centralized Manufacturing Locations (CMLs) 2 were products are delivered fresh daily 0.07 Dunkin' Franchisees in the US pay 5% of gross sales for 3 advertising fees 0.07 No. 1 in customer loyalty - Dunkin' Donuts recognized as the # in coffee category for 8 consecutive years by the Brand Keys 4 Customer Loyalty Engagement Index 0.07 5 Price of products are highly competitive 0.05 Has shown impressive growth in revenues (8.1%) and overall 6 corporate performance 0.05 7 Was named top US ice cream and frozen dessert franchise 0.04 Can negotiate better pricing on food, packaging and other 8 supplies due to size compared to small scale entrepreneurs 0.04 Superb performance innew markets - Dunkin' Brand Groups Inc. has built expertise at entering new markets and making a success 9 out of them 10 Already engaged in various CSR activities 0.03 0.02 AS TAS AS TAS AS TAS 4 0.36 3 0.27 1 0.09 4 0.28 2 0.14 1 0.07 2 0.14 3 0.21 4 0.28 2 3 0.14 0.15 1 2 0.07 0.1 0 0 0 0 4 3 0.2 0.12 3 4 0.15 0.16 1 1 0.05 0.04 4 0.16 2 0.08 3 0.12 4 2 0.12 0.04 3 1 0.09 0.02 2 3 0.06 0.06 Product development Online channel Promotional event Weaknesses Weight 1 Does not offer healthy options for health conscious customers 0.07 2 Store cannibalization is becoming a problem 0.06 A few products have a high market share, while most of the products makes Dunkin' Brands Group Inc. vulnerable to external 3 threats if these few products suffer for any reason 0.06 4 There is a lack of proper financial planning at Dunkin' Brands 0.05 Group Inc. regarding cash flows, leading to certain circumstances where there isn't enough cash flow as rrquired leading to unnecessary unplanned borrowing Total number of stores outside US territorieshave decreased in 5 number 0.05 The company's financial risk is high due to high debt to equity ratio 6 0.04 The company's ability to meet its short term financial obligations is 7 low 0.04 8 Dunkin' Brands Group Inc. has no COO 0.04 Even though the product is a success in terms of sales but its positioning and unique selling proposition is not clearly defined 9 which can lead to the attacks in the segment from the competitors 0.03 Dunkin' Brands has limited control over employees at restaurants 10 because they are employed and paid by the franchisee 0.03 AS 4 4 TAS 0.28 0.24 4 2 AS 2 2 TAS 0.14 0.12 0.24 0.1 0 3 2 0.1 1 AS 3 3 TAS 0.21 0.18 0 0.15 1 0 0.06 0 4 0.2 0 0 0.04 3 0.12 0 0 2 0 0.08 0 4 2 0.16 0.08 0 0 0 0 2 0.06 3 0.09 4 0.12 0 0 3 0.09 0 0 Product development Online channel Promotional event Opportunities Weight New trends in the consumer behavior can open up new market for the Dunkin' Brands Group, Inc. It provides a great opportunity for the organization to build new revenue streams and diversify into 1 new product categories 0.09 Technology is becoming more advanced in term of food preparation, marketing, packaging innovations and so much more 2 0.05 3 Intense price competitiveness among rival firms 0.05 4 Consumers are becoming more health conscious 0.06 There is still room for international expansion considering UK reopening was a success; other Asian countries still has room for 5 expansion 0.08 The new technology provides an opportunity to Dunkin' Brands 6 Group, Inc. The local players have local expertise while Dunkin Brands can 7 bring global processes and execution expertise on table. The price of Arabica coffee bean is lower compared to other 8 variety of coffee bean (Robusta) Dunkin' Brands can develop an agreement to Colombia, the 2nd 9 world's Arabica grower 10 Customer crave convenience because of busy lifestyle AS TAS AS TAS AS TAS 4 0.36 2 0.18 3 0.27 4 4 4 0.2 0.2 0.24 3 3 2 0.15 0.15 0.12 1 2 3 0.05 0.1 0.18 4 0.32 2 0.16 3 0.24 0.06 3 0.18 0 0 0 0 0.04 4 0.16 0 0 2 0.08 0.04 4 0.16 0 0 3 0.12 0.03 0.07 3 4 0.09 0.28 4 1 0.12 0.07 0 1 0 0.07 Product development Online channel Promotional event 1 2 3 4 5 6 7 8 9 10 Threats Weight As the company is operating in numerous countries it is exposed to currency fluctuations especially given the volatile political climate in number of markets across the world. 0.06 More competition in the breakfast category 0.05 Incidents involving food-borne illnesses, food tampering, or food contamination could create negative publicity and significantly harm in Dunkin’s operating results 0.04 New technologies developed by the competitor or market disruptor could be a serious threat to the industry in medium to long-term future. 0.05 Changing consumer buying behavior from online channel could be a threat to the existing physical infrastructure driven supply chain model. 0.03 Intense competition – Stable profitability has increased the number of players in the industry over last two years which has put downward pressure on not only profitability but also on overall sales 0.04 There’s a looming supply crisis in the coffee industry as well as the increase of prices to 50% 0.04 In 2014 KKD, Starbucks and Dunkin’ Brand Group increased to 6.5, 10.1 and 4.9 percent respectively. The quick service restaurant segment is highly competitive, and competition could lower revenues. 0.05 Trade Relation between US and China can affect Dunkin Brands growth plans - This can lead to full scale trade war which can hamper the potential of Dunkin Brands to expand operations in China. 0.05 Many mom-and-pop stores can open anytime promising cheaper product offerings because they don’t have to pay franchise fees and royalties 0.02 STAS AS TAS AS TAS AS TAS 1 2 0.06 0.1 3 3 0.18 0.15 1 1 0.06 0.05 4 0.16 2 0.08 3 0.12 3 0.15 4 0.2 1 0.05 0 0 2 0.06 0 0 2 0.08 0 0 0 0 4 0.16 3 0.12 2 0.08 4 0.2 2 0.1 3 0.15 4 0.2 0 0 3 0.15 4 0.08 6.23 3 0.06 4.34 2 0.04 3.15 d. STRATEGY CONCLUSION Based on the results of the models used, tactical strategies should focus on product development and market penetration. VI. STRATEGY IMPLEMENTATION Dunkin Brands should maintain current strategies and focus on product development and market penetration– especially in creating healthy menu for health-conscious people. A healthy hearty selection must be added on the menu like, but not limited to the ff: 1. 2. 3. 4. 5. Dunkin Low-calorie beverages line Dunkin exclusive Mixed juices line Low-calorie bagels line Vitamin enriched breads Low-calorie ice cream and cakes The new products will be advertised extensively using media buys and other online platforms for better market penetration. To better streamline the operations, a COO should be installed to oversee the business and make sure that all strategies are implemented. Thus, the organizational structure will be changed to: ORGANIZATIONAL STRUCTURE THE PROJECTED VALUES Increase in revenue: Assumptions: We still expect a growth of 4.88% targeting a total of 8.8% by the end of the third year. With the new product line, we are targeting a gradual increase on the 40% of the revenues from 5% on the first year, upto 10% on the 3rd year. December 28, 2013 Revenues 713,840 Computation: 1st year 2nd year Remarks rd 3 year 36,537.00 39,050.74 42,518.45 14974.18 51,511.18 32,008.81 71,059.55 34,851.19 77,369.64 800,220.18 871,279.73 948,649.37 8.88% Total increase in revenues for the next 3 year 4.88% increase across the board 5% increase in growth 1st year 10% increase 2nd-3rd year Total revenue per year December 27, 2014 748,709 VII. STRATEGY EVALUATION Prepare a balance scorecard to measure both qualitative and quantitative factors affecting the success of the implemented strategy.