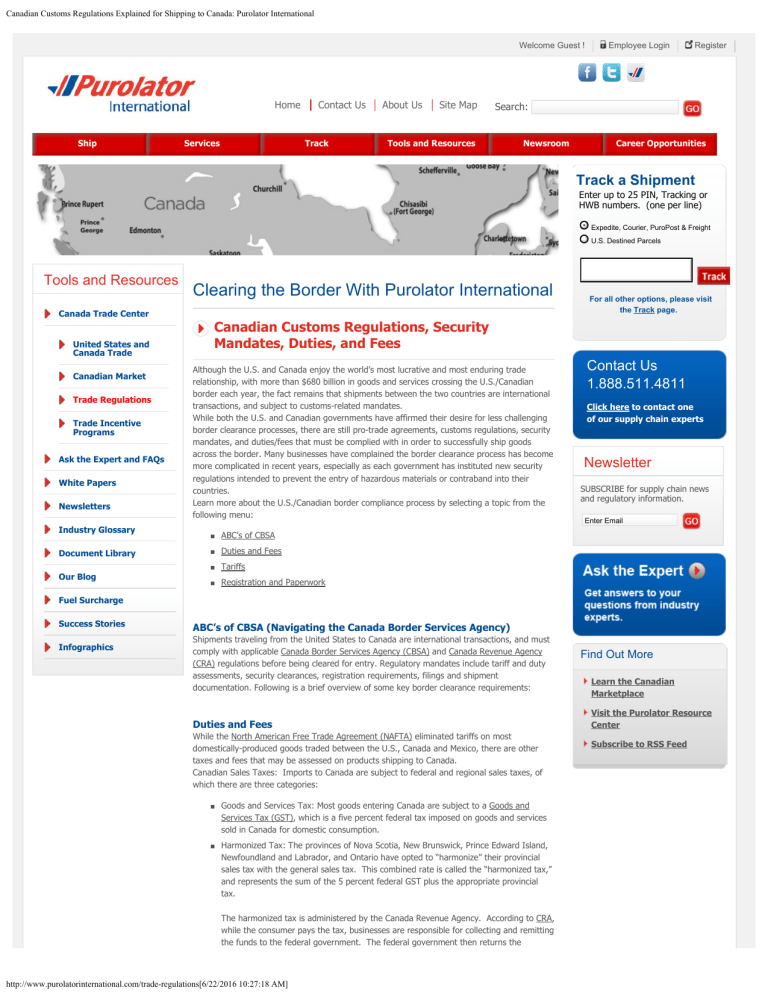

Canadian Customs Regulations Explained for Shipping to Canada: Purolator International Welcome Guest ! Home Ship Services Contact Us Track About Us Site Map Employee Login Register Search: Tools and Resources Newsroom Career Opportunities Track a Shipment Enter up to 25 PIN, Tracking or HWB numbers. (one per line) Expedite, Courier, PuroPost & Freight U.S. Destined Parcels Tools and Resources Canada Trade Center United States and Canada Trade Canadian Market Trade Regulations Trade Incentive Programs Ask the Expert and FAQs White Papers Newsletters Industry Glossary Document Library Our Blog Clearing the Border With Purolator International For all other options, please visit the Track page. Canadian Customs Regulations, Security Mandates, Duties, and Fees Although the U.S. and Canada enjoy the world’s most lucrative and most enduring trade relationship, with more than $680 billion in goods and services crossing the U.S./Canadian border each year, the fact remains that shipments between the two countries are international transactions, and subject to customs-related mandates. While both the U.S. and Canadian governments have affirmed their desire for less challenging border clearance processes, there are still pro-trade agreements, customs regulations, security mandates, and duties/fees that must be complied with in order to successfully ship goods across the border. Many businesses have complained the border clearance process has become more complicated in recent years, especially as each government has instituted new security regulations intended to prevent the entry of hazardous materials or contraband into their countries. Learn more about the U.S./Canadian border compliance process by selecting a topic from the following menu: Contact Us 1.888.511.4811 Click here to contact one of our supply chain experts Newsletter SUBSCRIBE for supply chain news and regulatory information. Enter Email ABC’s of CBSA Duties and Fees Tariffs Registration and Paperwork Fuel Surcharge Success Stories Infographics ABC’s of CBSA (Navigating the Canada Border Services Agency) Shipments traveling from the United States to Canada are international transactions, and must comply with applicable Canada Border Services Agency (CBSA) and Canada Revenue Agency (CRA) regulations before being cleared for entry. Regulatory mandates include tariff and duty assessments, security clearances, registration requirements, filings and shipment documentation. Following is a brief overview of some key border clearance requirements: Duties and Fees While the North American Free Trade Agreement (NAFTA) eliminated tariffs on most domestically-produced goods traded between the U.S., Canada and Mexico, there are other taxes and fees that may be assessed on products shipping to Canada. Canadian Sales Taxes: Imports to Canada are subject to federal and regional sales taxes, of which there are three categories: Goods and Services Tax: Most goods entering Canada are subject to a Goods and Services Tax (GST), which is a five percent federal tax imposed on goods and services sold in Canada for domestic consumption. Harmonized Tax: The provinces of Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland and Labrador, and Ontario have opted to “harmonize” their provincial sales tax with the general sales tax. This combined rate is called the “harmonized tax,” and represents the sum of the 5 percent federal GST plus the appropriate provincial tax. The harmonized tax is administered by the Canada Revenue Agency. According to CRA, while the consumer pays the tax, businesses are responsible for collecting and remitting the funds to the federal government. The federal government then returns the http://www.purolatorinternational.com/trade-regulations[6/22/2016 10:27:18 AM] Find Out More Learn the Canadian Marketplace Visit the Purolator Resource Center Subscribe to RSS Feed Canadian Customs Regulations Explained for Shipping to Canada: Purolator International provincial portion of the tax. Businesses that collect the GST/HST are required to register with the government and receive a registration number. Provincial Sales Taxes: Most provinces that do not participate in the HST collection process do impose their own taxes. The tax is collected at the local level, rather than through the Canada Revenue Agency. Provincial sales taxes vary by province, but range from a low of five percent imposed by Saskatchewan to a high of 9.975 percent collected in Quebec. Following is an overview of the tax structure in each province and territory: Province GST PST HST Alberta 5% 0 NA British Columbia** 5% 7% NA Manitoba 5% 7% NA New Brunswick 5% NA 13% Newfoundlanc & Labador 5% NA 13% Northwest Territories 5% NA NA Nova Scotia 5% NA 15% Nunavet 5% Onatario 5% NA 13% Prince Edward Island* 5% 9% 14% Quebec 5% 9.975% (QST) NA Saskatchewan 5% 5% NA Yukon 5% 0 NA In addition, certain categories of goods are subject to excise taxes, or excise duties. Examples of goods subject to excise tax include: Automobile air conditioners Certain passenger vehicles Certain fuels Tobacco and certain alcohol products Tariffs According to the U.S. Department of Commerce, a tariff, also called a duty, is defined as a tax levied by governments on the value, including freight and insurance, of imported products. Different tariffs are applied on different products by different countries. Domestically produced goods traveling between the U.S. and Canada are almost entirely exempt from duties, as outlined in NAFTA. While NAFTA did eliminate tariffs on all goods manufactured in the U.S. that are shipped to Canada – it does impose fees on non-U.S. manufactured components that are shipped to Canada from U.S. businesses. If your business manufactures products that include parts obtained from non-U.S. suppliers, you will have to pay a tariff on those parts. To determine if your shipment is eligible for a tariff waiver or reduction, businesses must file a “NAFTA Certificate of Origin” form, which must accompany shipping documentation. Every item entering – or leaving – Canada must be assigned an appropriate tariff classification code. Canada is among the vast majority of countries that adhere to the international Harmonized System of tariff codes. The harmonized system is a uniform list of codes for roughly 5,000 different commodity groups. Each commodity is assigned a six-digit code. Because of HS, a product originating in one country will carry the same HS code as the same product manufactured in a different country. In Canada, the six-digit harmonized system code is supplemented by a four-digit Canadian Customs Tariff. The additional four digits are used by the Canadian government as a way to capture additional information about goods entering and leaving the country. Improper coding could result in overpayment of duties, or in the failure to benefit from applicable trade agreement provisions. If the HS code applied results in an underpayment of duties, it could result in the application of interest on the underpayment, trigger an audit, and possibly result in fines. Registration and Paperwork http://www.purolatorinternational.com/trade-regulations[6/22/2016 10:27:18 AM] Canadian Customs Regulations Explained for Shipping to Canada: Purolator International Several agencies within the Canadian government have authority over various aspects of the international commerce process, each agency has its own set of processes and requirements that must be followed. Following is an abbreviated overview of the regulations a business may face: Any business importing or exporting goods to Canada must register with the Canada Revenue Agency and obtain a “business number” to be used on all paperwork. CBSA requires that a cargo control document (CCD) be submitted for each shipment, along with an invoice and customs coding form. These forms provide examiners with information including: description of the goods, direct shipment date, tariff treatment, country of origin, tariff classification, value for duty, appropriate duty or tax rates and calculation of duties owed. Advance Commercial Information: ACI is administered by CBSA as a way to obtain advance notification about shipments heading to the Canadian border. By requiring advance notice, CBSA is able to anticipate potential contraband or hazardous shipments, and to pre-clear “non-threatening” shipments. ACI includes the mandatory eManifest filing system, which provides an electronic portal through which all necessary information can be transmitted. Automated Export System (AES). The U.S. government imposes a similar electronic filing mandate on U.S. exporters. While businesses have always had to submit paperwork, as of September 30, 2008, all filings were required to be done electronically, through the Automated Export System (AES). NAFTA Certificate of Origin: The 1994 NAFTA agreement eliminated virtually all tariffs on goods traveling within the U.S., Canada and Mexico that originate in the exporting country. For example, a U.S. business shipping footwear to Canada will be exempt from tariffs if every component of the footwear – leather, canvas, heels, eyelets, etc. – is U.S.-made. If however, any of the materials contained in these components was obtained from a non-U.S. source, then tariffs must be paid on those non-U.S. parts. The NAFTA Certificate of Origin must be completed as a way to (a) verify that a shipment should be exempt from tariffs or (b) list those parts of the shipments that are liable for tariff assessment. Shipper’s Export Declaration: This is a form required by the U.S. Census Bureau that must accompany all shipments leaving the United States that include more than US$2,500 worth of a single commodity. Harmonized System Tariff Code: Before a shipment can clear the border, it must have an appropriate Harmonized System code attached. The Harmonized System is an international agreement to classify goods and commodities using the same coding standards worldwide. Thus, a shipment of televisions originating in Italy would have the same six-digit harmonized code as a shipment of televisions coming from Korea. Each country then attaches its own supplemental code, which allows it to further categorize goods to meet its unique recordkeeping and reporting requirements. Proper tariff code assignment is essential to ensure that proper tariffs are paid, shipments benefit from all applicable favorable trade provisions, and to avoid penalties and possible punitive action. Home | Services | Contact Us | Track | Ship | About Us | Tools and Resources | Newsroom | Site Map | Career Opportunities | Privacy Policy | Terms and Conditions © 2016 Purolator International. All rights reserved. http://www.purolatorinternational.com/trade-regulations[6/22/2016 10:27:18 AM]