BSc20 - FMA (ACC2002L) - Ming Yen Tan 18 Dec 2017FINAL

advertisement

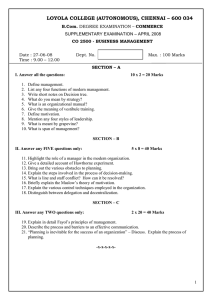

UNIVERSITY COLLEGE DUBLIN Bachelor of Science (Sri Lanka) Financial & Management Accounting (ACC2002L) STUDY GUIDE BSc 20 PT / Sri Lanka January 2017 1 Author: Dr. Ming Yen Tan (Jan 2017) This manual was prepared for University College Dublin as a comprehensive support for students completing the above mentioned Degree programme. © This publication may not be reproduced, in whole or in part without permission from University College Dublin. Module Co-ordinator: Dr. Ming Yen Tan Mobile: 86-13509692701 Office: 86-755-82680031 Email: mingyentan@gmail.com 2 TABLE OF CONTENTS PAGE WELCOME MESSAGE 4 1. INTRODUCTION 5 a. Background details b. Module aims c. Programme goals 2. MODULE OUTLINE 8 a. Module learning outcomes b. Themes and topics c. Learning materials 3. MODULE DELIVERY SCHEDULE 11 a. Session arrangements b. Student engagement c. Office hours arrangements 4. ASSESSMENT DETAILS 13 a. Assignments b. Module assessment components i. Assignment 1 – Individual assignment ii. Assignment 2 – Group project iii. Assignment 3 – Examination 5. GRADING 19 a. University grading policy b. Grade descriptors for assessment components 6. CONCLUDING COMMENTS 23 APPENDICES 24 1. 2. 3. 4. Student code of practice – Group Work Team agreement form Guidelines for submission Past year examination paper – Feb 2016 3 WELCOME MESSAGE As co-ordinator of the Financial & Management Accounting module, I wish to welcome you to the module. To operate effectively within the Global Business World, an understanding of the theory and practice of Accounting is essential. This module is designed to deepen your interest and expertise in the area of Accounting and the Study Guide is designed to support your learning. While much of the focus is on knowledge acquisition, attention is also given to enhancing and developing your professional and personal skills and competencies. To successfully complete this module, several learning activities (individual and group) are to be completed (prior to, and during the bloc sessions) which should provide enjoyment and fun, and also facilitate the attainment of the module learning outcomes. Should you require clarification on any matter pertaining to the module, please do not hesitate to contact me. Dr. Ming Yen Tan Module coordinator 4 PART 1: INTRODUCTION This Study Guide is designed to provide you with details of this module, the learning outcomes, delivery and assessment arrangements. The Study Guide consists of 6 parts. Part 1 gives background details to the subject area are provided and the broad aims of the module are set out. Part 2 consists of the module outline. In this part the (a) module learning outcomes, (b) the themes and topics to be explored are explained along with the (c) learning supports to be used. Part 3 gives details of the module delivery arrangements. It sets out the session arrangements and the expectations in relation to your prior preparation and student engagement. Part 4 provides details of the assessment techniques used in this module explaining the assessment components, their rationale. Part 5 explains the UCD grading policy and grade descriptors drawing on the university document are given for each assessment component (i) Assignment 1 and (ii) Examination (closed book). Part 6 presents the concluding comments. a. Background Details The aim of this module is to give students an introduction to the financial accounting environment in which organisations operate, including the preparation of financial statements and financial statement analysis. Students will understand/appreciate the information needs of managers and the strategic role of management accounting information b. Module Aims On completing this module students will be expected to be able to explain the factors which impact on the financial accounting environment, the purpose of financial accounting describe the primary uses and basic concepts of financial accounting information and undertake basic analysis of the performance and financial position of an organisation from its financial statements. Understand/appreciate the information needs of managers and the strategic role of management accounting information; Identify and use cost information for product/service costing, control and decision-making purposes; Apply decision-making concepts to a variety of business situations. 5 Programme Goals Bachelor of Science (BSc) Sri Lanka PROGRAMME GOAL LEARNING OUTCOME MODULE TITLE: Management Specific Knowledge Explain current theoretical underpinnings of Assignment 1 & Assignment 2 – business and organization management. short question Financial & Management Accounting Our graduates will be current in management theory and practice. Examination – Short Essay Question Apply business models and theory to identify Examination – and resolve problems in functional and across Short Essay Question functional areas. Demonstrate knowledge of and the usefulness Assignment 2 of quantitative techniques and controls in the short question business environment. Business Communication Our graduates will be able to design and deliver a short presentation (oral or written) on a current business topic. – Prepare short business presentations (written and oral) on a current topic to key stakeholders. Research and analyze specific business case Assignment 2 studies / problems / topics and write a concise short question report detailing the findings and recommended actions. – Locate information sources to facilitate the completion of research projects and the technologies to analyze and interpret the data collected. Personal Engage in module-related team activities Development & within and outside class. Reflective Learning Explain the essence of organization behaviour Our graduates will be pertinent to business managers and how they able to reflect on may apply in the workplace environment. their learning with a view to enhancing personal and Assignment 2 short question – Examination – Short Essay Question 6 professional pathways. career Global, Multicultural Identify the main factors and variables that and Diversity influence multinational entities’ business Perspectives operations, planning and competitive positioning. Our graduates will understand the impact of culture and social developments Recognize ethical and social responsibility on business issues in the business environment and know how to apply a process of ethical inquiry. management decisions. Assignment 2 – short question Examination – Short Essay Question Examine ethical and legal implications of Examination – managerial decisions and their effect on Short Essay Question organizational stakeholders. Identify business opportunities/problems and Assignment 2 – develop alternative solutions, taking account of short question Our graduates will be possible consequences (intended or Examination – able to critically unintended). Short Essay appraise business Question developments and advise on strategic Evaluate qualitative and quantitative data from business projects. multiple perspectives paying attention to sourcing, biases and logic. Strategic Thinking Analyze developments in key business sectors Examination – and comment critically on a firm operating in Short Essay Question the sector. 7 PART 2: MODULE OUTLINE Module Title: Financial & Management Accounting Module Code: ACC2002L No. of ECTS: 10 Type Specified Learning Activities Lectures Autonomous Student Learning Total Hours 85 30 125 240 a. Module Learning Outcomes On completing this module, students will be expected to be able to: Have an understanding of the financial accounting environment, the purpose of financial accounting and the primary uses and basic concepts of financial accounting information. Be able to carry out basic analysis of the performance and financial position of an organisation from its financial statements. Understand/appreciate the information needs of managers and the strategic role of management accounting information; Identify and use cost information for product/service costing, control and decisionmaking purposes; Apply decision-making concepts to a variety of business situations. Students completing the Financial & Management Accounting module are expected to participate in session discussions and learning activities and be familiar with recent developments in the business world. b. Themes and topics Financial & Management Accounting Understand the role of accounting in an organisation. Appreciate the significance and limitations of accounting. Appreciate the basic rules and conventions under which statements are compiled. Identify & understand the basic components of financial statements. Prepare financial statements. 8 Interpretation of Financial Statements Identify the major categories of ratios that are used for analysis purposes. Be able to calculate important ratios and explain their meaning and significance. Understand their limitations and potential problems. Appreciate cost behaviour and the relevance of fixed and variable costs. Develop an awareness of the different types of costs, and the ways in which costs can be classified. Appreciate how the cost of a product or service is calculated based on the different elements of cost. Cost Behaviour Profit Cost Volume Analysis Understand break-even charts. Calculate point where target profit is made. Calculate the break-even point for any particular activity i.e. the point at which sales revenues and costs are equal. Calculate margin of safety. Explain the usefulness of absorption costing to managers. Understand how overheads are incorporated into the cost of a product or service. Calculate an overhead absorption rate and use this to derive a product cost. Explain and deal with the under- or over-absorption of fixed overheads. Costing Explain the reasons for and basis of Activity Based Costing. Costing/Job Costing Activity (ABC) Based Use the marginal cost equation to solve problems. Cash Flows Budgeting Compare traditional and ABC systems. Calculate product costs using ABC. Discuss the limitations of ABC. Understand the basis of cash flows budgeting. Explain why we produce cash flow budget. Module Text: Accounting – An Introduction: by Eddie McLaney & Peter Atrill 6th edition. (FT-Prentice-Hall, 2012). 9 c. Learning Materials For this module, please read the assigned chapters in the prescribed text and the additional readings assigned (see list below). Readings from Prescribed Text: Chapter 1-16 Other Assigned Readings (essential): Handouts supported by the lecturer. Exercises. Other useful sources Students completing this module are expected to participate in session discussions and learning activities and be familiar with recent developments in the business world. To facilitate this, the following source material is useful The Economist The Wall Street Journal The South China Morning Post The Financial Times Business Week Fortune 10 PART 3: MODULE DELIVERY SCHEDULE The module delivery relies on students’ ability to engage in prior preparation, to seek confirmation and clarification as appropriate and to be actively engaged during the sessions. a. Session Arrangements Each student is expected to attend and be prepared for all sessions. The tables below outline the structure for the session for each of the groups. Exercise and case studies will be given in class. Group 1: Module Delivery Schedule No. Topic Date Day 6 Jan 2017 Fri Time 9:00am to 12:30pm 1 Introduction to Accounting 1:30pm to 5:30pm Interpretation of Financial Statements 9:00am to 12:30pm 7 Jan 2017 2 Sat Cost Behaviour 1:30pm to 5:30pm Cost Volume Profit Analysis 9:00am to 12:30pm 8 Jan 2017 3 Sun Costing/Job Costing 1:30pm to 5:30pm Activity Based Costing (ABC) 9:00am to 12:30pm 9 Jan 2017 4 Mon Cash Flows Budgeting 1:30pm to 5:30pm Group 2: Module Delivery Schedule No. Topic Date Day 12 Jan 2017 Thu Time 9:00am to 12:30pm 1 Introduction to Accounting 1:30pm to 5:30pm Interpretation of Financial Statements 9:00am to 12:30pm 13 Jan 2017 2 Fri Cost Behaviour 1:30pm to 5:30pm Cost Volume Profit Analysis 9:00am to 12:30pm 14 Jan 2017 3 Sat Costing/Job Costing 1:30pm to 5:30pm Activity Based Costing (ABC) 9:00am to 12:30pm 15 Jan 2017 4 Cash Flows Budgeting Sun 1:30pm to 5:30pm 11 Group 3: Module Delivery Schedule No. Topic Date Day 19 Jan 2017 Thu Time 9:00am to 12:30pm 1 Introduction to Accounting 1:30pm to 5:30pm Interpretation of Financial Statements 9:00am to 12:30pm 20 Jan 2017 2 Fri Cost Behaviour 1:30pm to 5:30pm Cost Volume Profit Analysis 9:00am to 12:30pm 21 Jan 2017 3 Sat Costing/Job Costing 1:30pm to 5:30pm Activity Based Costing (ABC) 9:00am to 12:30pm 22 Jan 2017 4 Sun Cash Flows Budgeting 1:30pm to 5:30pm Preparation Required in Advance of Sessions / Seminars In addition to Assignment 1, you are expected to have read the above topics in advance of meeting the module coordinator / course lecturer at the seminars. Students are expected to be fully familiar with them. These readings are an important learning source and supplement the session and text materials. b. Student Engagement During the sessions, students are expected to be able to discuss issues arising from the assigned chapters and readings for the topics as scheduled above. Session participation is a vital element in the design of this module. Therefore, all students are expected to engage in class discussion and debate in order to facilitate the formation of their critical judgements. To support your learning, Power-Point slides will be available which may need to be upgraded / modified during or following the sessions depending on the issues raised. c. Office Hours I will be available from 30 minute before the start of every class. Please arrange with me in advance should you wish to meet me individually to discuss any aspect of this module. 12 PART 4: ASSESSMENT DETAILS Assessment is undertaken to establish the extent of student learning on completing a module and according to Biggs and Tang1 (2009) it is the senior partner of teaching and learning. This module has three assessment components with specific weightings and marks awarded totalling 1002. The purpose of each assessment is as follows: Assessment 1 – Individual Assignment: This assignment aims to develop learning interest of students to the module of Financial & Management Accounting. Assessment 2 – Group Project: This assignment is designed to assess the broad understanding and application of financial and management accounting principles to various management decisions. Assignment 3 – Examination: This assignment is the formal closed book examination which aims to get insights on your understanding of accounting theory and practice addressed in the module. Students are expected to complete all assignments ensuring that they are submitted by the specified date. All submissions must be typed, be well laid out, written in an academic style with appropriate headings (introduction, main part and concluding comments) and sections. Please ensure that all submissions are entirely your own work – for UCD’s policy on plagiarism click on the link http://www.ucd.ie/registry/academicsecretariat/plag_pol_proc.pdf Students are expected to complete all assignments ensuring that they are submitted by the specified date. The weighting assigned for each component is shown in Table 2 below. (* I = Individual; G = Group) Table 2 – Assessment Components Assessment components Weighting Individual / Group* 1. Assignment 1 10% Individual 2. Assignment 2 20% Group (maximum 3 students) 3. Assignment 3 70% Individual Module Assessment Components 1 Biggs, J. and Tang, C. 2009, Teaching for Quality Learning at University, Maidenhead: Open University/McGraw Hill. 2 As the Overseas Programme modules are worth 10 ECTS they should be graded out of 200 marks. 13 In the following pages, further details of each assessment component are presented along with expectations in relation to prior preparation and completion. To support student learning, provide detailed grade descriptors for their submission – indicate what standards need to be met for a student to get an A, B, C, D, E, F, G or NG grade are listed in Table 3: UCD Grading System. (i) Assignment 1 – Individual Assignment; Date: 19th February 2017 Assignment 1 addresses on fundamental concepts in financial accounting and management accounting. Answer both Question 1 and Question 2. Maximum words count for Assignment 1 is 800 words. Please read the Grade Descriptors in Assignment 1 Grade Descriptor Table in Table 4. Assignment 1 Question 1 (60 marks) Explain the strengths and weaknesses of these kinds of business ownership: sole proprietorship, partnership and limited company. Question 2 (40 marks) Discuss 4 main distinctions/ differences between Financial Accounting and Management Accounting. (Total: 100 marks) (End) 14 (ii) Assignment 2: Group Project Assignment 2 is aimed to enhance students’ understanding on the board concepts and theories of financial and management accounting and their application in business decision making. Both quantitative questions and qualitative questions are set to assess students’ capacity in correct calculation and critical discussion on the use of the calculated results for decision making purpose. Answer both Question 1 and Question 2. Maximum words count for Assignment 2 is 1,500 words. This assignment must be completed in group of 3 persons. As this is a group assignment, all members of the group will receive the same mark for the written submission of the project. However, all members are also required to submit an individual paper recording their contribution to group project. These individual papers should include reflections and experiences of working on the project within the group context. Reflections should include such elements as how the project contributed to the student’s overall learning on the module, how the group worked together, limitations within the activity, etc. You should also complete the Team Agreement Form which can be found in the Orientation folder on the Programme Area on Blackboard and is also included in the appendices at the end of this study guide. Please refer to Appendix 2. Please read the Grade Descriptors in Assignment 2 Grade Descriptor Table in Table 5. 15 Assignment 2 Deadline 3rd March 2017 Question 1 (50 marks) Best Ltd, an advertising agency, is considering a purchase of new equipment at the end of November. The investment has been budgeted at €250,000. The management needs to evaluate how much cash will be available at the end of the year, so that they can decide how to finance new investment. The Accounting Department provided you with the following information: 1. Cash available at the end of August 2016 is €10,000. 2. Sales in July were €220,000 and they increasing of 10% on monthly basis. 3. 70% of sales is collected in cash, the remaining 30% is collected with two months credit. 4. Monthly purchases are 60% of the previous month sales. All purchases are on credit basis and are paid in first month after purchase. 5. Wages and commission are paid each month. Wages are fixed amount of €12,000 and commission is 7% of previous month sales. 6. Management overheads are €20,000 and are paid on monthly basis 7. The company has set up a standing order to pay the rent and council tax. The payments will start in January and the amount is €12,000 every two months. 8. Telephone, heating and electricity bills to pay are estimated to be €17,000 every month. 9. The depreciation charge for the companies fixed assets is €13,000 per month. 10. A loan of €150,000 has been taken in January 2016. The interest rate is 10% p.a. Best Ltd, is repaying the interest on the loan on bi-monthly basis, starting from February 2016. 11. The tax bill is €30,000 and it has to be paid in November. 12. The minimum amount of cash the company needs to retain at the end of each month is €20,000. Required: (a) Prepare a report that presents the company cash position over the period of September 2016 to November 2016. Based on your findings advice Best Ltd td on possibility of financing purchase of new equipment. (30 marks) (b) In the future Best Ltd is considering using one of the two approaches: top down budget and bottom up budgets. Write a statement critically discussing the use of each of those two types of budget. Explain advantages and disadvantages of each approach. (20 marks) 16 Question 2 (50 marks) Super Automotive is a small automotive engineering company that produces a single product called the “Wonderful”, which is used as an alternative to the standard alternator in cars and vans. The summarized profit and loss account for the year ended 31st December 2016 is shown below: € Sales (30,000 units) Direct materials Direct labour Variable overheads Fixed overheads Profit 60,000 120,000 90,000 110,000 € 600,000 (380,000) 220,000 Required: (a) Calculate the following amounts: (i) Contribution per unit (2 marks) (ii) Break-even point in units (2 marks) (iii) Margin of safety in units (2 marks) (iv) Profit or loss if the sales were 12,000 units (2 marks) (v) The number of units required to produce a profit of €159,000, assuming the selling price, variable cost per unit and the fixed costs were to remain the same. (2 marks) (b) Draw the breakeven graph. Make sure to label the graph correctly. (Note: Please draw the graph accurately and legibly. Marks are awarded for accuracy. (10 marks) (c) The management evaluate a proposal of reducing the selling price by 10% this will cause sales to rise by 3,000 units. Calculate the new breakeven point. (10 marks) (d) Explain to somebody who has no background in accounting what the breakeven point is, what are its benefits and drawbacks and demonstrate why everything sold after the breakeven point is actually profit to the company. (20 marks) (End) 17 (iii) Assignment 3: Examination: The examination (3 hours) and it will take place on Saturday the 18th March 2017. It will focus on module themes and the material covered in the text, cases, assigned readings and class discussions. For this, students are expected to demonstrate their understanding of theory and practice addressed throughout the module. The examination question format will be designed to allow you show your understanding of the topics discussed and also reveal your learning (new and prior). More specific guidelines regarding the examination paper format and questions will be provided during the final session. The examination paper has three sections. Students are required to answer all the three sections according to the following format: Section A Compulsory 25 multiple-choice questions from financial accounting and management accounting topics. Section B Answer 1 question from a choice of 2 questions on financial accounting topics. Section C Answer 1 question from a choice of 2 questions on management accounting topics. Short questions are developed which require students to make correct calculations using various financial accounting and management accounting methods as described in the module outline. Students will have the opportunity to ask questions about its design and style and be advised the type of answers expected. Please read the Grade Descriptors in Assignment 3 Grade Descriptor Table in Table 6. A recent past examination paper is included in Appendix of this Study Guide, please noted and prepared for the different style of examination format and questions. The purpose of the past examination paper is to specific the level of the type of questions asked in the examination. No solution to be provided. 18 PART 5: GRADING This section of the Study Guide provides students with details of the UCD grading system and also explains criterion referenced grading (UCD Policy). Under criterion referenced grading, students are graded on the quality of their work without reference to other students (norm referenced). For instance, the submission that meets the required guidelines in terms of writing style, analysis, description and / or summary will be awarded according to the standards set out. All students’ work is graded to indicate the standard attained using the criterion referenced approach. Table 3: UCD Grading System Grade Description A+ A Grade Point 4.2 Excellent 4.0 A- 3.8 B+ 3.6 B Very good 3.4 B- 3.2 C+ 3.0 C Good 2.8 C- 2.6 D+ 2.4 D Acceptable D- 2.2 2.0 E Marginal 1.6 F Fail (unacceptable, no compensation) 1.0 G Fail (Wholly unacceptable; no compensation) 0.4 Fail (Wholly unacceptable; no relevant attempt) 0.0 NG 19 More specific grade descriptors are set out for your assessment components in the following pages. Table 4 below provides descriptors for Assignment 1 – please read them prior to submitting your work. Table 4: Grade Descriptors – Assignment 1 (Individual Assignment) Grade A Criteria A comprehensive, highly-structured, focused and concise response to the assessment task, consistently demonstrating: an extensive and detailed knowledge of the subject matter a highly-developed ability to apply this knowledge to the task set A thorough and well-organised response to the assessment task, demonstrating: B a broad knowledge of the subject matter considerable strength in applying that knowledge to the task set An adequate and competent response to the assessment task, demonstrating: C adequate but not complete knowledge of the subject matter omission of some important subject matter or the appearance of several minor errors capacity to apply knowledge appropriately to the task albeit with some errors The minimum acceptable standard of response to the assessment task which: D E F shows a basic grasp of subject matter but may be poorly focussed or badly structured or contain irrelevant material has one major error and some minor errors demonstrates the capacity to complete only moderately difficult tasks related to the subject material Inadequate and incompetent response to the assessment task, demonstrating: inadequate and incomplete knowledge of the subject matter omission of major important subject matter or the appearance of several major errors lack capacity to apply knowledge appropriately to the task albeit with major errors Unacceptable standard of response to the assessment task which: shows minimum grasp of subject matter and poorly focussed or badly structured and has some major errors and minor errors lack capacity to complete moderately difficult tasks related to the subject material Minimum evidence of attempting the assessment task G Lack evidence of relevant answers to the questions Lack capacity to understand fully the expectation of the questions Not answering the questions asked in the assessment task at all. NG Lack evidence of relevant answers to the questions Did not understand the expectation of the questions While the criteria detailed above refer to A – D grades (inclusive) only, please note that all bands will be used (A+, A and A-; B+, B and B- etc) for grading assignments. 20 TABLE 5: Grade Descriptors – Assignment 2 (Group Project) Grade A B Criteria A comprehensive, highly-structured, focused and concise response to the assessment task, consistently demonstrating: an extensive and detailed knowledge of the subject matter a highly-developed ability to apply this knowledge to the task set A thorough and well-organized response to the assessment task, demonstrating: a broad knowledge of the subject matter considerable strength in applying that knowledge to the task set An adequate and competent response to the assessment task, demonstrating: C D adequate but not complete knowledge of the subject matter omission of some important subject matter or the appearance of several minor errors capacity to apply knowledge appropriately to the task albeit with some errors The minimum acceptable standard of response to the assessment task which: shows a basic grasp of subject matter but may be poorly focussed or badly structured or contain irrelevant material has one major error and some minor errors demonstrates the capacity to complete only moderately difficult tasks related to the subject material Inadequate and incompetent response to the assessment task, demonstrating: E F inadequate and incomplete knowledge of the subject matter omission of major important subject matter or the appearance of several major errors lack capacity to apply knowledge appropriately to the task albeit with major errors Unacceptable standard of response to the assessment task which: shows minimum grasp of subject matter and poorly focussed or badly structured and has some major errors and minor errors lack capacity to complete moderately difficult tasks related to the subject material Minimum evidence of attempting the assessment task G Lack evidence of relevant answers to the questions Lack capacity to understand fully the expectation of the questions Not answering the questions asked in the assessment task at all. NG Lack evidence of relevant answers to the questions Did not understand the expectation of the questions While the criteria detailed above refer to A – D grades (inclusive) only, please note that all bands will be used (A+, A and A-; B+, B and B- etc) for grading assignments. 21 TABLE 6: Grade Descriptors – Assignment 3 (Formal Closed Book Examination) Grade A B Criteria A comprehensive, highly-structured, focused and concise response to the assessment task, consistently demonstrating: an extensive and detailed knowledge of the subject matter a highly-developed ability to apply this knowledge to the task set A thorough and well-organized response to the assessment task, demonstrating: a broad knowledge of the subject matter considerable strength in applying that knowledge to the task set An adequate and competent response to the assessment task, demonstrating: C D adequate but not complete knowledge of the subject matter omission of some important subject matter or the appearance of several minor errors capacity to apply knowledge appropriately to the task albeit with some errors The minimum acceptable standard of response to the assessment task which: shows a basic grasp of subject matter but may be poorly focussed or badly structured or contain irrelevant material has one major error and some minor errors demonstrates the capacity to complete only moderately difficult tasks related to the subject material Inadequate and incompetent response to the assessment task, demonstrating: E F inadequate and incomplete knowledge of the subject matter omission of major important subject matter or the appearance of several major errors lack capacity to apply knowledge appropriately to the task albeit with major errors Unacceptable standard of response to the assessment task which: shows minimum grasp of subject matter and poorly focussed or badly structured and has some major errors and minor errors lack capacity to complete moderately difficult tasks related to the subject material Minimum evidence of attempting the assessment task G Lack evidence of relevant answers to the questions Lack capacity to understand fully the expectation of the questions Not answering the questions asked in the assessment task at all. NG Lack evidence of relevant answers to the questions Did not understand the expectation of the questions While the criteria detailed above refer to A – D grades (inclusive) only, please note that all bands will be used (A+, A and A-; B+, B and B- etc) for grading assignments. 22 PART 6: CONCLUDING COMMENTS This Study Guide is designed to assist and guide your learning for this module. It is important that you read it regularly and do so in conjunction with the core text, the assigned readings and session materials. Should you need clarification on issues covered, please let me know during the seminar sessions. I hope you enjoy the module and wish you good luck with the rest of your study and for the future. Dr. Ming Yen Tan January 2017 23 APPENDIX 1 UCD SCHOOL OF BUSINESS STUDENT CODE OF PRACTICE – GROUP WORK3 There are many reasons for using group work in higher education such as enhancing student learning, promoting social interaction among students, developing generic skills (including negotiation, delegation and leadership) and the individual students’ strengths and expertise. There is an onus on the group to ensure that individual members provide maximum effort in completing the assigned task/project. There is evidence to suggest that individuals frequently exert less effort on collective tasks than on individual tasks (Williams and Karau, 1991)4. As the group size increases the Ringlemann Effect emerges: there can be an inverse relationship between the size of the group and effort expended. It is fair to assume that group effectiveness will increase when members work on tasks that are mutually important and when each member believes they are contributing to an end goal. UCD School of Business personnel are obliged to ensure that the operation and management of assigned group-work are consistent with the integrity of the university assessment process. It is also expected that, where the group-work contributes to a module grade, members are awarded grades that accurately reflect their contribution to the completion of the task. This Code of Practice is developed to guide the work of student groups within an academic setting and safeguard the integrity of group-based projects as part of our assessment of student learning outcomes. 1. All Group members (whether assigned or self selected) are expected to contribute actively and equitably to the completion of the exercise/project. 2. All groups will set out and agree basic ground rules for their group in terms of group communication procedures, performance targets, arranging and organizing meetings, records, progress reports, solving problems, finalizing the project and signing off. 3. Roles (such as leader, convener or facilitator) might be assigned to particular group members to facilitate the working of the group and specific milestones (weekly) agreed. 4. Group membership diversity (cultural, professional etc.) needs to be acknowledged, valued and utilized as appropriate. 3 Members of the School of Business Teaching and Learning Committee contributed to the development of this protocol. 4 Williams, K.D., & Karau, S. J. (1991). Social loafing and social compensation: The effects of expectations of co-worker performance. Journal of Personality and Social Psychology, 61(4), 570-581. 24 5. Group work undertaken by UCD School of Business students is subject to UCD policy on academic programmes. For further details on this policy go to http://www.ucd.ie/registry/academicsecretariat/student_code.pdf 6. UCD promotes an environment upholding the dignity and respect of all students as set out in its policy on Dignity and Respect – University College Dublin is committed to the promotion of an environment for work and study which upholds the dignity and respect of the individual and which supports every individual’s right to study and/or work in an environment which is free of any form of harassment, intimidation or bullying. The university recognizes the right of every individual to such an environment and requires all members of the University community to recognize their responsibilities in this regard. Students are advised to read this policy document – click on: http://www.ucd.ie/equality/policieslegislation/dignity_respect_policy.pdf 7. Any group member who is concerned about a member’s contribution to the group work (and associated activities) must firstly communicate this (at the earliest time possible) to the group members, and they must strive to resolve the problem. 8. If a group member believes that his/her concerns have not been addressed satisfactorily within the group, the matter should be brought to the attention of the module coordinator. The module coordinator/learning support officer (LSO) should strive to resolve the issue at group level. Where this has not been achieved, the Academic Coordinator and/or the School Head of Teaching and Learning will be informed. 9. Should the issues not be resolved, the parties above, taking into consideration the stipulations of this code and the University policy documents to which it refers, will to seek to mediate to find a solution, which is acceptable to group members and which retains the integrity of the group work assessment process. 25 APPENDIX 2: TEAM AGREEMENT FORM TEAM MEMBERS CONTACT DETAILS MOBILE EMAIL 1 2 3 4 5 INFORMAL COMMUNICATION We have decided 1) 2) 3) MEETINGS We have decided 1) 2) 3) MAKING DECISIONS We have agreed 1) 2) 3) 4) 5) SANCTIONS We hope to work in harmony together. We have different strengths. We accept that this is a group piece of work and we are all responsible for doing our best. However we agree now that If individuals have difficulties in working with the team or on the task, we will try to sort them out promptly by talking with each other We will seek advice - as soon as is possible - from our tutor for those serious problems which we cannot resolve ourselves. SIGNED 26 APPENDIX 3: 2 Important Documents GUIDELINES FOR SUBMISSION You are advised to read the following important documents before you commence your studies on this module: 1. Guidelines for the Late Submission of Coursework This document provides a detailed outline of the rules and regulations surrounding the presentation, submission and marking of assignments. The guidelines provided must be adhered at all times to avoid an unnecessary loss of marks. Further details on www.ucd.ie/registry/academicsecretariat/late_sub.pdf 2. A Briefing Document for Students on Academic Integrity and Plagiarism. The University understands plagiarism to be the inclusion of another person’s writings or ideas or works, in any formally presented work (including essays, theses, examinations, projects, laboratory reports, oral, poster or slide presentations) which form part of the assessment requirements for a module or programme of study, without due acknowledgement either wholly or in part of the original source of the material through appropriate citation. Further details please go to www.ucd.ie/registry/academicsecretariat/plag_pol_proc.pdf Plagiarism is a form of academic dishonesty. In any assignment, plagiarism means that you have presented information or ideas belonging to someone else falsely as being your own original thoughts on a subject. All assessments/projects submitted must be the result of your own work. The following statement must be included on the cover page of all assignments submitted: I declare that all materials included in this essay/report/project/dissertation is the end result of my own work and that due acknowledgement have been given in the bibliography and references to ALL sources be they printed, electronic or personal. Signed: Student name/s, student number Date: 27 APPENDIX 4 – Past Examination Paper - Note to Students: Providing a copy of this paper does not signify that future papers will follow the exact same format. SEMESTER I EXAMINATION – 2016 ACADEMIC YEAR - 2015/2016 Bachelor of Business (Sri Lanka) BSc19 Part-Time Financial & Management Accounting ACC2002L Professor Eamonn Walsh Dr. Antoinette Flynn Dr. Ming Yen Tan* Time Allowed: 3 Hours Instructions for candidates The examination paper has three sections. Students are required to answer all three sections as follows: Section A Compulsory 25 multiple choice questions. Section B Answer 1 of 2 questions. Section C Answer 1 of 2 questions. Instructions for Invigilators Non-programmable calculators without a long-term data memory are permitted. 28 Section A – Multiple Choice Questions (Total: 50 marks) The following 25 items consist of a statement followed by FOUR possible answers. You are required to select the most appropriate answer. Please enter your answers in your exam script in the following format Q1 A Q2 B Q3 C Q4 A and so on. Each item carries 2 marks. Negative marking will NOT apply. 1. On 1 July 2013 Jason bought a machine for €15,500. He depreciates machinery at a rate of 20% per annum on the reducing balance basis. A full year’s depreciation is charged in the year an asset is purchased. His year end is October 31. What is the depreciation charge on the machine for the year to 31 October 2015? A. B. C. D. 2. In September 2015 Alice paid €15,600 for rent for the four months from 1 October 2015. What should be reported on Alice’s balance sheet at 30 November 2015? A. B. C. D. 3. An accrual of € 7,800. A prepayment of € 7,800. An accrual of € 3,900. A prepayment of € 3,900. Which of the following is a current liability? A. B. C. D. 4. € 1,984. € 3,100. € 2,480. € 2,232. Prepayment Accrual Cash at bank balance Closing balance of inventory Which of the following accounting equations is correct? A. B. C. D. current assets = current liabilities assets + capital = total liabilities current assets less current liabilities = net current assets fixed assets less current liabilities = capital 29 5. A business borrowed € 6,800 from its bank, and used the cash to buy a new computer. How is the accounting equation affected by these transactions? A. B. C. D. 6. Liabilities Decreased Increased Increased Decreased Using the following information, calculate the working capital: € Trade Receivables 6,000 Current Tax payable 3,000 Bank overdraft 3,000 Loan receivable within one year 1,000 Trade Payables 4,000 A. B. C. D. 7. Assets Unchanged Unchanged Increased Increased € Nil € (3,000) € (5,000) € 3,000 The accountant for the golf club shop has valued the shop inventory at the end of the year as being €10,000. The accounting records show the following amounts for the year from the books: € Purchases 84,000 Goods returned to 2,000 suppliers Inventory at the beginning 16,000 The mark up on cost is 100%. What are the sales for the year? A. B. C. D. 8. €122,000 €156,000 €150,000 €176,000 An organisation’s balance sheet represents: A. B. C. D. A summary of the cash inflows and out flows of the organisation during a particular period. The trading performance of the organisation from a particular period. The financial position of the organisation at a particular point in time. The reconciliation of the balance per the bank statement with the company’s own records 30 Information common to Question 9 and Question 10: € Sales 120,000 Rent expense 8,000 Interest expense 1,600 Cost of sales 64,000 Trade receivables 24,000 Salaries expense 16,000 Advertising expense 4,000 Office supplies expense 4,000 Corporation tax expense 2,960 9. Gross profit is: A. € 104,000 B. € 56,000 C. € 32,000 D. € 8,000 10. Net profit before interest and tax (PBIT) is: A. B. C. D. €40,000 €24,000 €22,400 €19,440 11. In a traditional manufacturing company, product costs include: A. B. C. D. Direct materials only. Direct materials and direct labour only. Direct materials, direct labour, and factory overhead. Direct materials, direct labour, factory overhead, and selling and administrative expenses. 12. The most likely strategy to reduce the breakeven point, would be to A. B. C. D. Increase both the fixed costs and the contribution margin. Decrease both the fixed cost and the contribution margin. Decrease the fixed costs and increase the contribution margin. Increase the fixed costs and decrease the contribution margin. 13. Prime cost can be defined as: A. The total costs of manufacturing a product. B. The cost of the first stage of the manufacture of a product. C. The total costs of operating the production department where the product is made. 31 D. The total direct costs of manufacturing a product. 14. Bravo Limited is a single product company and the following information is provided: Selling price (unit) €20 Expected sales 5,000 units sold Variable cost (unit) €12 Fixed costs (total) €25,000 What is the company’s margin of safety percentage for the budget period? A. 62.6% B. 37.5% C. 28.5% D. 27.5% 15. Of the four costs shown below, which would NOT be included in the cash budget of an insurance firm? A. B. C. D. Depreciation of non-current assets. Commission paid to agents. Office salaries. Capital cost of a new computer. 16. Which of these is NOT immediately a cash inflow? A. B. C. D. Credit sales Interest received Cash from customers for goods Cash from sale of fixed assets 17. The direct costs of a paint manufacturer would usually include: A. B. C. D. Bad debts. Straight-line depreciation of equipment in the mixing process. Labour costs of supervisory personnel. Labour costs of workers working at the production line. 18. The following data are provided by Bravo Manufacturing Limited: Budgeted labour hours 8,500 Budgeted overhead €148,750 Actual labour hours 7,928 Actual overhead €146,200 Based on the data given above, what is the predetermined labour hour overhead absorption rate? 32 A. B. C. D. € 18.76 per hour € 18.44 per hour € 17.50 per hour € 17.20 per hour 19. A Manufacturing Company predicted the following figures for the year starting 1 January 2015: Production overhead Direct labour (hours) Hours of machine time Department A €36,000 20,000 10,000 Department B €32,000 16,000 10,000 The company uses departmental overhead rates in absorbing production overheads with the “cost driver” being machine-hours for Department A and direct labour hours for Department B. The following estimates relate to Job 101 processed during the above year: Direct labour hours worked Hours of machine time taken Department A 150 75 Department B 160 80 The total overhead to be assigned (for both departments) to Job 101, based on the above information is: A. B. C. D. € 270 € 320 € 590 €1,116 20. A manufacturing company has a highly automated manufacturing plant producing many different products. What is the most appropriate basis of applying factory overhead costs to units of output? A. B. C. D. Direct labour hours Direct labour cost Machine hours Cost of materials used. 21. Which of the following is most likely to be a variable cost, where the cost driver is the number of units produced? A. B. C. Advertising of a new product. The cost of material used in manufacturing a new product. The rent on factory premises for a new product. 33 D. Straight line depreciation of equipment in the factory which produces the new product. 22. When administered intelligently, budgets should: A. B. C. D. Compel managers to look ahead Provide a yardstick for evaluation Promote communication and coordination All of the above. 23. Activity-based costing could be appropriate in which of the following types of organization? A. B. C. D. Airline companies Hospitals Financial institutions All of the above. Question 24 and Question 25 are based on the following information: Maintenance expenses of a company were analysed for purposes of cost prediction. Examination of past records disclosed the following costs and volume measures: Cost per month Machine hours High Low €39,200 €32,000 24,000 15,000 24. Using the high-low method of analysis, the estimated variable cost per machine hour is: A. B. C. D. € 1.25 €12.50 € 0.80 € 0.08 25. Using the high-low technique, the estimated monthly fixed costs for maintenance expenditure are: A. B. C. D. €240,000 € 20,000 € 12,000 € 19,200 34 Section B – Financial Accounting Answer ONE question only from this section. All questions carry equal marks. Question 1 (Total: 25 marks) The following balance has been extracted from the ledgers of Jack Trading on 31 December 2015. € Purchases 37,364 Sales 98,480 Bad debts 392 Light and heat 2,080 Repairs 2,280 Trade receivables 18,600 Discount allowed 1,720 General expenses 1,840 Travelling expenses 2,600 Inventory as at 1st Jan 2015 15,920 Cash in hand 160 Printing and Stationary 700 Capital account 42,292 Trade payables 6,160 Equipment 31,000 Rates 1,520 Loan interest paid 300 Fixtures & fittings 14,000 Drawings 3,000 Rent received 1,380 Salaries and wages 14,596 Cash at bank 6,240 6% bank loan payable in 6,000 2017 The following notes are also relevant: 1. Make a Bad Debts Provision of € 900. 2. Depreciation for Fixtures and Fittings is to be charged at a rate of 10% of cost. 3. Depreciation for Equipment is to be based on straight line method with no residual value at the end of its useful life. The useful life is 5 years. 4. Adjustment need to be made for the following items at the end of the year: - Rent received in advance € 60. - Rates prepaid € 120. - Wages accrued due € 100. 5. Inventory as at 31 December 2015 was valued at € 6,744. 6. Taxation of € 3,600 is to be provided on the profit of the year. Required: (a) Prepare an Income Statement for the year ended 31 December 2015. (12 marks) 35 (b) Prepare a Balance Sheet as at the 31 December 2015. (13 marks) (Total: 25 marks) Question 2 (Total: 25 marks) Apple Limited and Orange Limited are two companies that are similar in size and in the same industry. The summarised final accounts of the two companies are as follows: €'000 Non-Current Assets Current Assets Inventories Trade debtors Bank 1,800 1,200 600 Current Liabilities Trade creditors Bank overdraft 1,000 - Balance sheet as at 30 June 2015 Apple Ltd Orange Ltd €'000 €'000 €'000 2,400 2,200 3,600 1,000 2,600 1,760 880 - 1,144 1,276 2,640 2,420 220 Net Current Assets 5,000 2,420 Financed by: Ordinary shares of €1 each, fully paid Retained Earnings 3,000 2,200 2,000 5,000 220 2,420 Trading and profit and loss for the year ended 30 June 2015 Apple Ltd Orange Ltd €'000 €'000 Sales 6,500 5,500 Less: Cost of goods sold 5,150 4,840 Gross Profit 1,350 660 Operating expenses 950 880 Profit (Loss) for the year 400 (220) Note: Purchases for the year ended 30 June 2015 are as follow: Apple Limited - €5,350,000 36 Orange Limited - €4,750,000 Required (a) Calculate to two decimal places the following ratios for Apple Limited and Orange Limited for the year 2015: (i) Gross profit ratio (2 marks) (ii) Net profit ratio (2 marks) (iii) Return on capital employed (2 marks) (iv) Current ratio (2 marks) (v) Acid test ratio (2 marks) (vi) Debtors’ collection period (2 marks) (vii) Creditors’ repayment period (2 marks) (b) Write a brief comment on the financial performance of the two companies in terms of profitability. (4 marks) (c) Write a brief comment on the financial position of the two companies in terms of short-term liquidity. (4 marks) (d) Identify THREE limitations of ratio analysis. (3 marks) (Total: 25 marks) 37 Section C – Management Accounting Answer ONE question only from this section. All questions carry equal marks. Question 3 (Total: 25 marks) Brown Manufacturing Limited is engaged in the processing and selling of Product SUPER. During the coming year, the management has determined the following cost structure for Product SUPER. Cost of material Processing costs: Variable Fixed € 708 per kilogram € 210 per kilogram € 1,920,000 per year Marketing costs: Variable Fixed € 162 per kilogram € 960,000 per year Administrative costs All fixed, € 1,740,000 per year It is estimated that the company can sell all its output for the coming year at €1,500 per kilogram of material processed. Assume there is no loss or gain during the processing of material. Required: (a) What is the contribution margin for Brown Manufacturing Limited? (2 marks) (b) What is the break-even point (in revenue) for Brown Manufacturing Limited? (3 marks) (c) How many units does Brown Manufacturing Limited need to sell if the company wants a profit of € 1,797,600? (3 marks) (d) What is the maximum amount that Brown Manufacturing Limited can afford to pay per kilogram of material and still break-even and selling only 120,000 kilogram of material during the current year? (5 marks) (e) List THREE reasons to explain why break-even analysis can be a really useful management tool. (6 marks) (f) List THREE limitations of Cost-Volume Profit Analysis. (6 marks) 38 (Total: 25 marks) Question 4 (Total: 25 marks) The following data relate to costs, output volume and cost drivers of Ace Supplies Ltd. for June: Product A Product B Product C Production and Sales (Units) 6,000 4,000 3,000 Direct Production Costs Direct materials Direct labour € per unit 12 3 15 Labour hours per unit Machine hours per unit No. of production runs No. of deliveries to customers No. of production orders No. of deliveries into store 0.5 2 8 3 30 17 Production Overhead Costs Machining Set-up costs Materials handling (receiving) Packing costs (dispatching) Engineering € 143,000 21,000 70,000 45,000 51,000 330,000 € per unit 11 6 17 1 1 2 2 5 3 € per unit 8 2 10 0.33 2 10 10 15 20 Indirect production overheads that are not driven by production volume are: Item Cost Driver Set-up costs Production runs Materials handling Deliveries of materials Packing Deliveries to customers Engineering Production orders Required: (a) Calculate the full production cost per unit of Product C if overheads were absorbed on the basis of direct labour hours. (4 marks) (b) Calculate the full production cost per unit of Product C using activity-based costing and the cost drivers described above, with overheads that are driven by production volume allocated on a machine hour basis. (10 marks) (c) Comment briefly on any conclusions which may be drawn from (a) and (b) above, which could have pricing and profit implications. (5 marks) 39 (d) Describe THREE benefits which might results from introducing ABC system. (6 marks) (Total: 25 marks) oOo 40