PLX Q2 2019 Update: Vietnam National Petroleum Group Analysis

advertisement

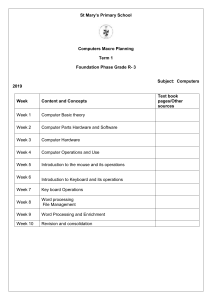

Vietnam National Petroleum Group Ticker: PLX Bloomberg: PLX VN Oil and Gas Industry Q2/2019 Update Report June 18, 2019 NEUTRAL Recommendation In Q1 2019, though revenue decreased by 8%, PLX's profit increased by 20%YoY, mainly thanks to the reversal of provision for devaluation of over VND500 billion inventories. Excluding this reversal, PLX's gross profit margin is Target price (VND) 68,500 Market price (6/18/2019) 61,000 In Q2 2019, BVSC forecasts gross profit margin will increase to 8.2%, as in April Expected Return 12.3% 2019, PLX's retail price has increased in line with Brent oil price. This could ensure that PLX's gross margin in April will remain as low as in Q1 2019 (7.8%). In addition, in the remaining 2 months of Q2, Brent oil price fell sharply (15.7%) while retail gasoline price has not been adjusted down with the corresponding STOCK INFORMATION HOSE Exchange 52-week price range 50,740-70,250 72,825 Capitalization Outstanding shares 7.8%, much higher than 7.1%YoY. 1,293,878,081 10-day average volume 867,807 % foreign ownership 11.57% Beta margin. PLX's strongest price adjustment (5.1% reduction) was applied at the end of Q2 (June 17, 2019), while the previous price adjustments were less than the decrease in Brent oil prices. In the second half of 2019, we believe that Brent oil price will be favorable for PLX, OPEC's output back to equilibrium supports our forecast that oil prices in the remaining 2 quarters of 2019 will more stable. The profit in the second half of 2019 is forecast to be better than the same period last year and the gross profit margin for 2019 is estimated at 7.6%. For 2019, we forecast that PLX will achieve VND202,502 billion in revenue and VND4,676 billion in net profit, up 5.5% and 15.4%YoY, respectively. We rate NEUTRAL on PLX based on the valuation results of P/E, P/S, FCFE and FCFF methods at VND68,500/share. Valuation Analyst Nguyen Nguyen (84 4) 3928 8080 ext. 213 nguyenbinhnguyen@baoviet.com.vn Target price Ratio Average P/S 74,200 25% 18,550 P/E 59,900 25% 14,975 FCFE 73,700 25% 18,425 FCFF 66,200 25% 16,550 Reasonable price 68,500 June 18, 2019 PLX Q2/2019 Update Report Q1 2019 PLX spent about VND2,500 billion from price stabilization fund In Q1 2019, PLX spent almost VND2,500 billion from price stabilization fund as the global petrol price has increased following crude oil price’s increase but domestic petrol price did not increase with the corresponding margin due to government’s policy of keeping gasoline prices from a "shock" increase during Tet holiday together with electricity prices. In Q1 2019, Brent oil price increased by almost 20% compared to the beginning of the year but PLX's retail price of gasoline only increased by 5%. PRICE STABILIZATION FUND – FIRST 5 MONTHS OF 2019 VND/liter 01/01 16/01 31/01 15/02 02/03 18/03 02/04 17/04 02/05 17/05 01/06 500 300 300 300 300 300 300 300 300 300 300 0 0 0 0 0 0 0 0 0 100 100 Kerosene 700 300 300 300 300 300 300 300 300 300 300 Diesel 800 300 300 300 300 300 300 300 300 300 300 Mazut of different types 500 300 300 300 300 300 300 300 300 300 300 0 645 825 1,171 1,250 2,061 1,304 743 283 0 0 550 1,462 1,673 1,932 2,000 2,801 2,042 1,456 925 457 398 Kerosene 0 295 652 1,078 1,078 1,065 0 0 0 0 0 Diesel 0 430 1,003 1,354 1,354 1,343 0 0 0 0 0 Mazut of different types 0 583 1,196 1,699 1,400 1,640 362 0 0 0 0 1,950 -2,215 -4,149 -6,034 -5,882 -7,710 -2,508 -999 -8 843 902 -240 -400 -405 -316 Reserves Petrol of different types E5 Usage Petrol of different types E5 Difference (VND/liter) Price stabilization fund 1,930 outstanding balance (billion VND) 89 Sources: Petrolimex, BVSC Research Thanks to the price stabilization fund, although the retail price of petroleum has not kept up with the input price, PLX's gross margin in Q1 2019 still reached 7.8%. In Q1 2019, PLX also reversed the provision for devaluation of over VND500 billion inventories. Gross profit margin of 7.8% also eliminated the effect of this reversal. Gross profit margin in Q2 is expected to improve from Q1 due to a faster increase in retail price than in input price Since early Q2 2019, PLX's retail price has started to increase sharply. According to our estimates, the retail price increase is equal to the increase in Brent oil price June 18, 2019 PLX Q2/2019 Update Report at the end of April 2019. In April 2019, PLX's retail price increased by 20% while new Brent oil price increased by about 6%. The price stabilization fund has also improved since early May 2019, the difference in revenue and expenditure has returned to the equilibrium level in early May 2019 and then increased sharply in May & June 2019. After that, observably Brent oil prices fell by 15.7% while the new retail price of A95 gasoline dropped by 9.3% from the peak of VND22,190/liter until the end of Q2 2019. Thus, there are two reasons for us to be confident that PLX's gross profit margin in Q2 will be better than Q1 2019: ❑ First, in April 2019, PLX's retail price increased in line with Brent oil price. This will ensure that PLX's gross margin in April could remain low as in Q1 2019 (7.8%). ❑ In the remaining 2 months of Q2, Brent oil price fell sharply (15.7%) and PLX's strongest price adjustment (5.1% reduction) was applied at the end of Q2 (June 17, 2019), while the previous price adjustments were less than the decrease in Brent oil prices. We estimate that gross profit margin in Q2 2019 is about 8.2%. Brent price and PLX's retail price 23000 Since 1/1/2019, PLX's retail price includes VND1,000/liter of envrironmental taxation (up from VND3,000 to VND4,000/liter Domestic gasoline prices as of the end of April 2019 have caught up with the increase in Brent oil prices 22000 90 80 21000 20000 70 19000 60 18000 In the remainder of Q2 (May and June 2019), PLX's retail price is adjusted at a lower pace than Brent oil price. 17000 16000 50 Petrol 95 PLX's actual price (VND/liter) - Right column Jun-19 May-19 Apr-19 Mar-19 Feb-19 Jan-19 Dec-18 Nov-18 Oct-18 Sep-18 Aug-18 Jul-18 Jun-18 May-18 Apr-18 Mar-18 Feb-18 Jan-18 Dec-17 Nov-17 Oct-17 Sep-17 Aug-17 Jul-17 Jun-17 May-17 Apr-17 Mar-17 Feb-17 40 Jan-17 15000 Petrol 95 PLX's price with 2018 environmental taxation Brent oil price (USD/barrel) - Left column Notably, VND is losing about 0.9% against USD. Meanwhile, due to business characteristics, PLX trades largely in USD, according to our calculations, exchange rate losses can increase to VND160 billion. The second half of 2019 forecasted that Brent oil price would be more favorable for PLX June 18, 2019 PLX Q2/2019 Update Report Oil prices are forecast to be more stable in he second half of 2019. In 1H2019, oil price increased strongly as OPEC and Russia agreed to cut 1.2 million barrels a day within 6 months from 01/01/2019. OPEC is also considering to extend the agreement until year end but we doubt that it would happen: 1. Russia is not really interested in continuing to cut output. 2. OPEC can hardly cut production again as the output of some member countries has reached the minimum level. Specifically: Saudi Arabia's production Iran's production Venezuela's production (million barrels/day) (million barrels/day) (million barrels/day) 11,1 3,9 2,5 3,5 3,1 2,7 0,5 5 year average domestic demand 5 year average domestic demand Oct-18 Mar-19 Dec-17 May-18 Jul-17 Feb-17 May-19 Dec-18 Jul-18 Feb-18 Sep-17 Apr-17 0,0 Nov-16 Mar-19 Oct-18 Dec-17 May-18 Jul-17 Feb-17 Apr-16 Sep-16 Jun-15 Nov-15 Jan-15 1,5 Sep-16 8,7 1,0 1,9 Jun-16 9,0 2,3 Jan-16 9,3 Saudi Arabia's oil production has fallen by 1.2 million barrels/day to 9.9 million barrels/day, the lowest level in four years. The difference between production and domestic demand is narrowed to only ~250,000 barrels/day Apr-16 9,6 1,5 Nov-15 9,9 Jun-15 10,2 2,0 US sanctions caused Iran's output to drop ~ 1.5 million barrels to 2.3 million barrels/day, of which domestic demand was ~ 2 million barrels and export oil output was close to ~ 0.2. million barrels/day. 10,5 Jan-15 10,8 OPEC output’s return to equilibrium supports our anticipation that oil prices in 2H2019 will be more stable. PLX's petroleum business are quite stable disregard for input price thanks to the profit from selling gasoline based on the profit margin. However, the business environment in which input prices are stable or increasing will be more beneficial for PLX than if they fall too sharply. Retail prices of petroleum products are determined based on the base price without exceeding 2% of the announced price. Thus, the retail price will fluctuate following the input price. Profit of petroleum businesses will be in the norm profit of VND300/liter and the capability of saving costs as the norm cost in the state base price is fixed. However, as PLX's average inventory days are 20-24 days, the sharp decline in oil prices in a long time will drop gross profit margin of not only PLX but other peers due to the provision for devaluation of inventories. Adversely, stable oil prices will be a favorable condition for PLX to maximize the advantage of leading enterprises with over 50% market share and efficient distribution system (60% of production is distributed via COCO channel with the highest gross profit margin.) We forecast that the profit in 2H2019 will be better than the same period last year and the gross profit margin of 2019 is estimated at 7.6%. Environmental taxes raise gasoline prices by about 2.5% but PLX does not benefit from this increase June 18, 2019 PLX Q2/2019 Update Report Since January 1, 2019, the environmental protection taxation on petroleum products in Vietnam has increased in accordance with Resolution 579/2018/UBTVQH14. According to our calculations, retail prices of gasoline products will only be marginally higher, about 2.5% compared to the same period last year and PLX will not benefit from this tax increase. VND/liter Previous tax New tax* Petroleum (excluding Ethanol) 3,000 4,000 DO 1,500 2,000 FO 300 1.000 Mazut 900 2.000 (*) applied from 01/01/2019 The output of exported petrol and oil is forecast to grow slower than 2018 In 2018, domestic petroleum export volume reached about 9.1 million m 3/ton, an increase of almost 4% from the same period in 2017. With the forecast of Vietnam's economic growth in 2019 of 6.6% - 6.7%, we believe that Petrolimex's domestic petroleum production growth this year will be lower than 2018, at about 3%. The biggest contribution is still RON 95, Ron 92 and E5 have not achieved growth as expected as consumers remain skeptical about the quality of bio-petrol. Forecast of petroleum production for domestic sale Sources: Petrolimex, BVSC Research 10.000.000 9% 9.000.000 8% 8.000.000 7% 7.000.000 6% 6.000.000 5% 5.000.000 4% 4.000.000 3% 3.000.000 2.000.000 2% 1.000.000 1% 0 0% 2014 2015 2016 2017 2018 2019F KO Mazut DO Ron 92 E5 Ron 95 Production growth June 18, 2019 PLX Q2/2019 Update Report 2019 business forecast We forecast that PLX will achieve VND202,502 billion in revenue and VND4,676 billion in net profit in 2019, up 6% and 15%YoY respectively. This result has not included benefits from the merger of PG Bank and HD Bank. Target Revenue 2019 2018 Forecast Base 202,502 191,932 Revenue is forecast to increase 6% thanks to: 1. Production growth for domestic sales of 3% 2. Growth in petroleum products price of 2.5% COGS Gross profit 187,111 178,041 15,390 13,891 In Q1 2019, excluding the reversal of provision for devaluation of inventories in cost of goods sold, PLX's gross profit margin will be 7.8%. In Q2 2019, as analyzed above, gross profit margin is forecast at 8.2%. With the forecast that Brent oil price will not fluctuate strongly around $60-70/barrel for the remainder of 2019, BVSC believes that profit in 2H2019 will be better over the same period last year. On a prudent basis, we believe that gross profit margin for the whole year may reach 7.6%, higher than 7.2% in 2018. Financial income Financial expense 891 1,223 994 1,508 In 2018, PLX recorded an exchange rate difference loss of almost VND600 billion due to the strong fluctuation of USD/VND in 06-09/2018 (VND dropped 2.3% against USD). In 1H2019, VND devalued 0.8%, forecasting a yearly depreciation of about 1.6% against the USD, therefore the exchange rate difference loss in 2019 is forecast to decrease. In which: Interest 807 865 670 635 expense Lợi nhuận từ công ty liên doanh liên kết Selling expense G&A expense 9,130 8,560 Selling expense is forecast at 4.6% of gross profit, the average of previous two years. 926 575 G&A expense is forecast at 0.4% of gross profit, the average of previous two years. Net profit from 5,672 4,877 264 250 90 85 business activities Other income Other expenses June 18, 2019 PLX Q2/2019 Update Report Profit after tax 4,676 4,048 Profit of shareholders parent company 4,272 3,650 EPS 3,302 2,766 Recommendation Valuation by comparison method: We selected the leading enterprises in the petroleum business in regional countries with economic conditions equivalent to Vietnam, but not owning petrochemical refinery to compare with PLX. The valuation result by P/E method is VND59,900/share, P/S is VND74,200/share. Valuation by discounted cash flow method: FCFE fair price is VND73,700/share, FCFF of VND 66,200/share, assuming that Brent oil price will maintain around $60-70/barrels in 2019 and USD/VND slippage rate 1.6%. Growth in demand for diesel and fuel products is about 4.5%/year. The cost of equity (Re) and the average cost of capital (WACC) are assumed at 11.4% and 9.5% respectively. Valuation Target price Ratio Average P/S 74,200 25% 18,550 P/E 59,900 25% 14,975 FCFE 73,700 25% 18,425 FCFF 66,200 25% 16,550 Reasonable price 68,500 In summary, we estimate the fair value for PLX stock is VND68,500/share. We rate NEUTRAL on PLX stocks. Country Market cap P/E P/S Taiwan 419 17.47 0.58 ESSO THAILAND PCL Thailand 1,038 14.08 0.16 PETD MK Equity PETRONAS DAGANGAN BHD Malaysia 6,108 27.76 0.85 SHLPH PM Equity PILIPINAS SHELL PETROLEUM Philippines 1,295 13.26 0.31 18.14 0.47 Ticker Company name 9937 TT Equity NATIONAL PETROLEUM CO LTD ESSO TB Equity Average June 18, 2019 PLX Q2/2019 Update Report Financial forecast Business Results Billion VND 2016 2017 2018 2019E Revenue 123,098 153,697 191,932 202,501 Cost of goods sold 108,967 141,401 178,041 187,111 Gross profit 14,131 12,297 13,891 15,390 935 791 994 891 -875 -791 1,508 1,020 Profit after tax 5,166 3,912 4,048 4,676 Profit of shareholders - parent company 4,665 3,468 3,650 4,272 2018 2019E 14,223 10,220 12,389 Financial Income Financial expenses Balance Sheet Billion VND Cash & Cash equivalent 2016 11,394 Short-term receivables 6,961 Inventories 2017 7,462 7,458 7,869 8,615 12,868 10,295 10,862 Fixed assets 13,753 13,326 13,088 12,950 Total assets 54,238 61,769 56,171 60,011 Short-term liability 27,699 35,758 31,576 34,531 Long-term liability 3,336 2,627 1,611 1,500 Shareholders’ Equity 23,204 23,384 22,984 23,981 Total liability and shareholders’ equity 54,238 61,769 56,171 60,011 Financial indicators Target 2016 2017 2018 2019E -16.2% 24.9% 24.9% 5.5% 69.0% -24.3% 3.5% 15.4% 11.5% 8.0% 7.2% 7.7% Net profit margin (%) 4.2% 2.5% 2.1% 2.4% ROA (%) 9.5% 6.3% 7.2% 8.0% ROE (%) 22.3% 16.7% 17.6% 20.0% Total debt/Total assets (%) 57.2% 62.1% 59.1% 60.0% Total debt/Total equity (%) 1.3 1.6 1.4 1.5 4,254 3,013 2,766 3,302 17,932 18,071 17,762 18,532 Annual Growth Revenue growth (%) After-tax profit growth (%) Profitability Gross profit margin (%) Capital Structure Earnings per share EPS (VND/share) BVPS (VND/share) June 18, 2019 PLX Q2/2019 Update Report DISCLAIMER I, analyst Nguyen Nguyen, confirm that I am totally honest and have no personal motivation in making this report. All information in this report has been verified carefully and is deemed to be the most reliable; however, I shall take no responsibilities with regard to the accuracy and completeness of the information provided herein. Viewpoints, comments and assessments in this report are of our personal opinions with no purpose of advising the readers to buy, sell or hold any securities. This report is only for the purpose of providing information; readers should only use this analysis report as a source of reference. Bao Viet Securities Joint-stock Company (BVSC) and I shall take no responsibilities to investors as well as subjects mentioned in this report for losses incurring during investments or incorrect information about the enterprise. This report is an asset of Bao Viet Securities Joint-stock Company. Therefore, no part of this report may be (i) copied or duplicated in any form by any mean or (ii) redistributed without the prior consent of Bao Viet Securities Joint-stock Company. CONTACT Research and Investment Advisory Department - Bao Viet Securities Joint-stock Company Equity Research Macro & Market Research Luong Luu Phuong Le Dung Pham Deputy Head of Research Deputy Head of Research Deputy Head of Research luuvanluong@baoviet.com.vn ledangphuong@baoviet.com.vn Pham.tiendung@baoviet.com.vn Ha Nguyen Ngoc Nguyen Yen Tran Banking. Insurance Real Estate Economist nguyenthuha@baoviet.com.vn nguyenchihongngoc@baoviet.com.vn tranhaiyen@baoviet.com.vn Nguyen Nguyen Phu Truong Bach Tran Natural Rubber Automobiles & Parts Technical analyst nguyenbinhnguyen@baoviet.com.vn truongsyphu@baoviet.com.vn tranxuanbach@baoviet.com.vn Hang Ha Clothing & Accessories hathithuhang@baoviet.com.vn Hao Thai Water Infrastructure ngokim.thanh@baoviet.com.vn Hoa Le Building materials lethanhhoa@baoviet.com.vn June 18, 2019 PLX Q2/2019 Update Report BaoViet Securities Joint Stock Company Hanoi Headquarter: Ho Chi Minh Branch: ▪ No 72 Tran Hung Dao, Hoan Kiem, Hanoi ▪ 8 Floor, No 233 Dong Khoi, Dist, 1, HCM city ▪ Tel: (84 4) 3 928 8080 ▪ Tel: (84 8) 3 914 6888