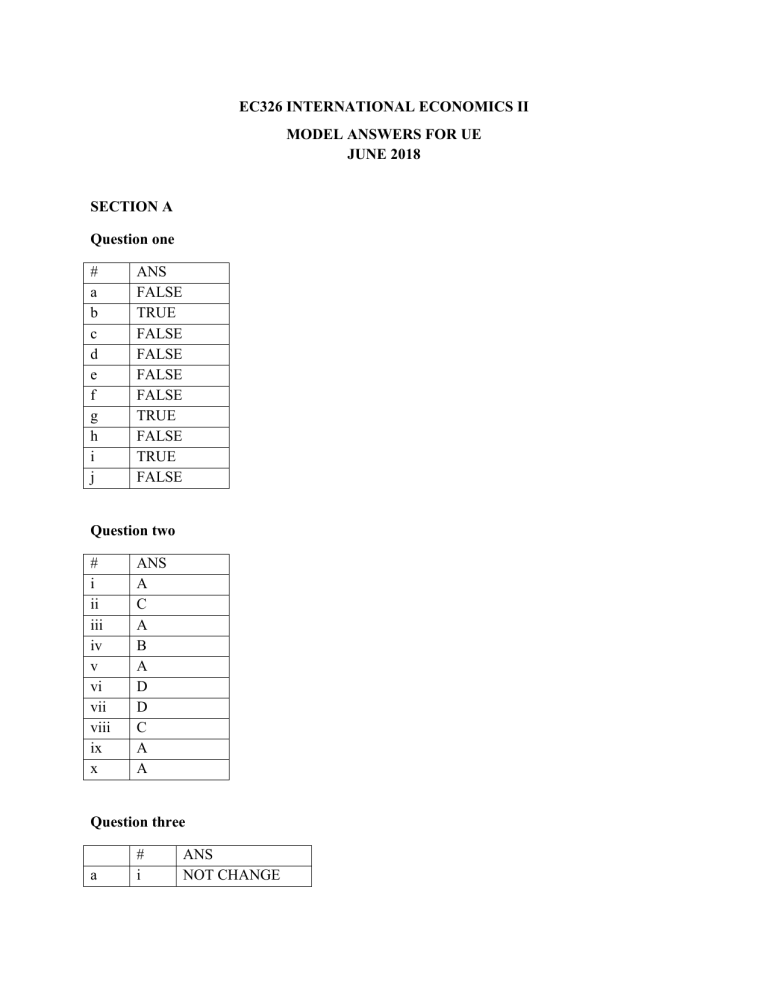

EC326 INTERNATIONAL ECONOMICS II MODEL ANSWERS FOR UE JUNE 2018 SECTION A Question one # a b c d e f g h i j ANS FALSE TRUE FALSE FALSE FALSE FALSE TRUE FALSE TRUE FALSE Question two # i ii iii iv v vi vii viii ix x ANS A C A B A D D C A A Question three a # i ANS NOT CHANGE ii iii INCREASE DECREASE b i ii iii NOT CHANGE NOT CHANGE NOT CHANGE c i ii iii iv INCREASE NOT CHANGE NOT CHANGE NOT CHANCE Question four a) b) c) d) S=750 I=750, NX=0, Real exch. rate =1. SECTION B Question five We have seen from q3c, as a result of increase in government expenditure the variables involved will change in the following ways Equilibrium income will increase Nominal exchange rate will not change Trade balance will not change The following is the economic reasoning why Implementation of this policy will raise aggregate demand in the economy and hence output will increase However the resulting government budget deficit increases the demand for loanable funds which increases interest rate Increased interest rate will lead to currency appreciation But the CB is committed to maintaining a fixed exchange rate: this will force the CB to implement expansionary monetary policy to decrease interest rate. The resulting lower interest rates will depreciate the currency back to its fixed level Since there is no change in exchange rate, trade balance will not change because exchange rate is the only determinant of trade balance in the Mundell-Fleming model Since the period under analysis is short run, the Mundell-Fleming model assumes that there is rigidity in prices; that is prices have no enough time to respond to changes in demand conditions in economy This is illustrated by the following diagram of the Mundell-Fleming model In the above diagram.. The increase in government expenditure shifts the IS curve from IS1 TO IS2 . This raises output from Y1 to Y2, this puts an upward pressure on exchange rate by forcing it to appreciate. However the CB is committed to maintain the level of exchange rate at e1. Therefore, the CB will have to implement expansionary monetary supply that shifts the LM curve form LM1 to LM2. Question six a) Under flexible exchange rate a reduction in interest rate reduces the demand for domestic assets which in turn reduces the demand for domestic currency. Lower demand for domestic currency leads to currency depreciation. This causes output to increase in two ways Lower interest rate increases incentives for investment which raises aggregate demand Currency depreciation lowers the relative prices of domestic goods leading to an increase in net exports. Increase in net exports in turn increase aggregate demand Consumption will increase. Consumption is a function of disposable income. Due to an increase in output or income, disposable income will increase leading to an increase in consumption (5 Marks) Investment will increase (5 marks with explanation): investment will increase because of the following two reasons Because interest rate is a price of borrowing financial resources for investment, Lower interest rate increases incentives for investment Increase in output will boost investors confidence on the economy and will induce more investment b) If we assume net exports depend on both exchange rate and income, the effect on net exports is ambiguous. Net exports have negative relationship with income and positive relationship with exchange rate. From the explanation in a above, lower interest rates leads to currency depreciation and an increase in income. Whereas currency depreciation lowers the relative prices of domestic goods leading to an increase in net exports, increased output increases imports that lead to a decrease in net exports. In this case the effect on net exports is ambiguous If we assume net exports only depend on exchange rate, net exports will increase. Currency depreciation lowers the relative prices of domestic goods leading to an increase in net exports (10 marks) Question seven Question eight Economic growth refers to the rate at which output per capita is increasing over time. The Solow model offers a fundamental explanation of ways in which economic growth takes place. According to the Solow model, a country can achieve and sustain higher rates of economic growth by achieving technological progress. However the Solow model is silent about the causes of technological progress: that is technological progress is endogenous in the Solow model. The endogenous growth theory covers this gap by attributing technological progress to investment s in human capital. According to the two-sector model, there are two sectors, the research sector and manufacturing sector. According to this model, increasing the number of people employed in the research sector leads to an increase in the rate of technological progress. Workers in the research institution are important for technological change as they engage in research and development activities regarding new production methods to be used in the manufacturing sector. Therefore investment in education is crucial for achieving sustainable increase in standard of living