![Finance Diana [2215835]](http://s3.studylib.net/store/data/025266725_1-1e2565ca5dfaa000d2a45eef52b8ca83-768x994.png)

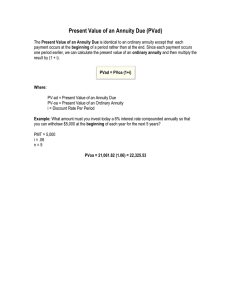

MBA 52i Managerial Finance Dr. Wael Moustafa Lecture 1 Chapter 1 Overview of Financial Management and the Financial Environment Finance is the Art and Science of managing money On a personal perspective: At the Corporate (Business) level: -Finance is concerned with an individual’s decisions regarding: -Involves the same types of decisions 1) How firm raise money from investors. 2) How firm invest money in an attempt to earn a profit. 3) How they decide whether to re-invest profit in the business or distribute it back to investors. 1) How much of their earnings they spend. 2) How much they save. 3) How they invest their savings. Balance Sheet tells us the financial position of a Company (firm) at a specific point of time (date) Assets Investing Decisions -Cash -A/R -Supplies -Pre-Paid Expenses -Inventory -Marketing securities e.g. Treasury bills *Current liabilities (short term Debt) (Obligations to be paid within 1 year) -A/P -Accruals payable (Salaries/ finance payable) *Long term Debt -Loans from Banks (Financial institutions). -Corporate Bonds (long term debt instrument issued by large corporation or Government ) *Non-current Assets (Revenue generator) 1-Tangible assets e.g. -Land -Equipment -Building (e.g. ESLSCA) 2- Intangible assets e.g. Goodwill-brand name -patency *Stockholder’s Equity -Common stock -Preferred Stock -R/E (retained earnings) (undistributed profit reinvest Profit in the business) + Financing Decisions Uses of Funds (money) converted into Cash within 1 accounting period) Sources of Funds (money) (What the company owns) *Current Assets (Assets that Can be Liabilities & Stockholder’s Equity Stockholder’s equity: what the company owes to the owner دى فلوس األونرز... دى مش فلوس الشركة Long Term Debt: what the company owes to the creditor Marketing securities: -Financial instruments that are very liquid & can be quickly converted into cash at reasonable price as its maturity is less than 1 year e.g. treasury bills Treasury bills: Short term debt instruments issued by the government Corporate Bonds Corporate Government Bond Issued Bond (Piece of paper), they will share face value 1000 L.E -Maturity Date: 10 years Return: Coupon Interest Rate (10%) is fixed annual interest paid by issuer to bond holder Investors Bond Holder (Creditor) سلف الشركة Idea of the bond: instead of borrowing money from the bank, will borrow it from investors -It is a contract (Piece of paper) between the Bond issuer (Corporate & Government) and the Bond Holder (Investors) -Bonds & Stocks can be tradable Timeline 0 1000 Each year he will pay 10% (i.e. 100 L.E) If market interest rate is lower than coupon interest rate (bond is sold at premium) If market interest rate is higher than coupon interest rate (bond is sold at discount) Stock is type of security that signifies ownership in a corporation (by dividing ownership into shares) 2 types of Stock: Common Stock)(األسهم العادية - Owner takes variable dividends according to firm performance & Board director decisions (B.O.D) -Have Voting rights. -Subordinated in case of liquidation or income distribution Preferred Stock )(األسهم الممتازة -Owners Take fixed dividends توزيع أرباح ثابت -Have no voting rights. -Senior in case of liquidation or income distribution بياخدوا فلوسهم األول:فى حالة تصفية الشركة Return to stockholder is dividend distributed from profits or capital gain ((زيادة سعر السهم -If I am stock → my return will be Dividends or Capital gain )(سعر السهم يزيد -But if I’m Bond holder → my return will be Coupon Interest Rate (Fixed Interest Rate) -Financial Manager’s first task in any company is to manage the networking (working) capital i.e.: to balance between current assets & current liabilities. -Networking Capital (the difference between Current Assets & Current Liabilities) -Networking Capital = C.A-C.L >0 -If networking Capital is –ve → No liquidity -If C.L > C.A → Cancer Case as it will eat from the part that generate revenue. Financial Manager’s second task is investment decision Financial Manager’s third task is financing decision including long term debts(loans or bonds) & stockholder equity(C.s / P.S / R/E) Decisions taken by Financial Manager: 1) Financing Decisions) 2) Investing Decisions 3) Managing Networking Capital Income statement What is Finance? Finance is concerned with the process, institutions (Banks), markets(EgX) and instruments (CDs & Stocks) involved in the transfer of money among and between individuals, business & governments Financial System (its main task is to transfer the money among and between these groups through financial system) Supplier of fund Financial System (Savers) Individuals Business Governments Financial Institutions or intermediaries e.g. Commercial Banks (Indirect Finance: Supplier doesn’t know the demander) Financial Markets (Direct Finance) suppliers know borrowers Demander of fund (borrowers) Individuals Business Governments Certificate of Deposit (CD): is a financial instrument شهادات األستثمار Spread: is the difference between loan Interest rate & market Interest, i.e. so here he has spread (3%) Investment Banks are related to creation of capital for companies, government & other entities for example it aids in sales of securities. Securities: Financial instruments that hold some type of monetary value *represents ownership position in publicly-traded corporation (via stock) *represents creditor relationship with governmental body or corporation (represented by owing that entity’s bond Bank has two main sources of revenue: *Loans *Investment securities that can provide banks with a source of liquidity when they are sold. Financial markets and financial intermediaries facilitate the flow of funds from savers to borrowers. Financial management involves the efficient use of financial resources in the production of goods. Finance goal …… make better personal finance decisions Financial market To Start up a new Business: (e.g. Cupcake Project) Family & Friends Crowd Finance Angel Capital Cairo Angels Investment Bank Venture Capital IPO (Initial Public Offering) Ideavelopers & Citadel *Start-up business couldn’t take Bank loan because he doesn’t have Assets nor Records (History) * Ideavelopers: it is considered as both Angel Capital & Venture Capital (they support the business) Accounting Major Areas & Opportunities in Finance 1. Financial service: concerned with the design and delivery of advice and financial products to individuals, business & government found as Financial analysis and Financial advisor Career opportunities include banking, personal financial planning, investments, real estate, and insurance. 2. Managerial finance: is concerned with the duties of the financial manager working in a business. Financial managers administer the financial affairs of all types of businesses—private and public, large and small, profit-seeking and not-for-profit. They perform such varied tasks as: -developing a financial plan or budget. -extending credit to customers. -evaluating proposed large expenditures, and -raising money to fund the firm’s operations. 2/10, n/30 (2% discount if you paid within 10 days & the full payment within 30 days with 0 discount) It is set by financial manager to pay Long term liabilities. Lecture 2 What’s our concern is Managerial finance or financial management which is the duties of the CFO (Chief Financial officer), …they perform a financial plan or Capital budget. Career Opportunities in Finance: Managerial Finance: (Importance of finance after global financial crisis) The recent global financial crisis and subsequent responses by governmental regulators, 1) increased global competition, and 2) rapid technological change also 3) increase the importance and complexity of the financial manager’s duties. i.e. we are taking into consideration different types of risk in order to take our financial decision. i.e. instead of taking the firm specific risk, taking external risk by the foreign exchange risk e.g. country risk I’ve to take into consideration while taking financial decision in order to increase the value of the firm. How to increase the value of the firm? There are 3 Major Questions that any financial manager should answer? 1) How much short - term cash flow does a company need to pay its bills? (Managing the networking capital) 2) How the firm can raise the money for the required investments? (Making Financing decision) 3) What long - term investments should the firm engage in? (Making Investing Decision) **Raising money wither from Debt or Equity To create value, the financial manager should: -Try to make smart investment decisions (Determine the mix and type of assets found on the left - hand side of a firm balance sheet) -Try to make smart financing decisions (i.e. by trying to reduce the cost of the capital by either debt or issuing stocks, or using your R/E ) ( Deal with right - hand side of a firm balance sheet) --After raising the fund, you should find a way to generate the maximum revenue, so you’ve to take smart investment decisions & smart financing decisions. Legal Forms of Business Organization Sole proprietorship (owned by only 1 owner) Family & Friends Corporation Partnership Angel Capital Sole proprietorship A business owned by one person and operated for his or her own profit Investment Bank Venture Capital Partnership Corporation A business owned by two or more people and operated for profit. -It has 2 types: 1) General partnership (unlimited liability): In case of bankruptcy or liquidation هو اللى بيشيل الليلة -He makes the day to day activity as well as decisions. -In case of liquidation, all the loans are their responsibilities -It is dividing the ownership into shares (Common Shares & Preferred Shares) - Is a legal entity separate from its owners and managers. -File papers of incorporation with state. -Charter. - Bylaws. - Owners have limited liability which guarantees that they cannot lose more than they invested. - Can achieve large size through sale of stock. - Subject to greater government regulation 2) limited (Silent) partnership(limited liability): the maximum lose could be what he has invested. -He will lose only his capital under liquidation Disadvantage: 1) unlimited liability (i.e. in case of bankruptcy ;افالسppl will take discount from the fund) - allowing the owner’s total wealth to be taken to satisfy creditors 2) Limited sources of finance الفلوس معايا غير لما يكون معايا شركة 3) Difficult to raise capital to support growth Corporation Advantage: 1) Ease of formation. 2) Subject to few regulations 3) No corporate income taxes (i.e. personal taxes & not corporate taxes). Example: majority are found in the wholesale, retail, service and construction industry. Corporate Organization All Accounting Activities All Financing Activities Forecasting for the future (for the expected cash flow) Limited Liability Organization Limited Liability Corporation (Company) A limited liability company (LLC) is a type of business entity formed that can be taxed like a partnership but protects its shareholders from liability beyond their investment . How it works/Example? -Investors can decide to set up any type of legal business structure they like. However, if they want to protect themselves from additional liability beyond their own investment, a LLC is a likely choice. Some of the other major attributes of this type of business entity also include more flexible management style and fewer formalities required by state law. -Owners of a LLC are referred to as members. Once members decide on a LLC, they should file an operating agreement with the state that defines how the LLC will be run, how members are obligated financially, and how the profits and losses are to be allocated. **Shareholders = Corporation **Members = LLC (Limited Liability Corporation) Managerial Finance Function • Managerial finance function depends on the size of the firm. • In small firms, the finance function is generally performed by the accounting department (finance + Accounting) with each other in the same department. • As a firm grows, the finance function typically evolves into a separate department linked directly to the company president or CEO through the chief financial officer (CFO). • Treasurer: (the firm’s chief financial manager) is responsible for the firm’s financial activities such as financial planning and fund raising. • Controller: (the firm’s chief accountant) is responsible for the firm’s accounting activities, such as cost accounting. Relationship to Economics: -The field of finance is closely related to economics. -The primary economic principle used in managerial finance is Marginal Analysis. Marginal Analysis: (Added Benefit) -Economic principle that states that financial decision should be made & actions taken only when added benefit exceeds the added costs. Example on relationship between Economics & Finance A company is evaluating a decision to buy a new production line that requires an immediate cash investment of $ 5M. This production line will have a useful life of 5 years. The net cash flow during this useful life had been estimated and it has a net present value of $ 8M. The company has an existing production line that may be sold today for $ 1M. It is expected that the existing production line has 3 years left in its useful life; the net cash flow during these 3 years are estimated & its NPV $ 3M. ➢ Cost of new product line 5M$ ➢ Proceed from Selling old production line 1M$ ➢ Added (Marginal) Cost 4M$ Added (Marginal) Benefit 5M$ Net Benefit = 5M$ - 4M$ = 1M$ ➔ Do buy the new machine ➢ Expected benefit of new production line 8M$. ➢ Benefit of old production line 3M$ ➢ Added (Marginal) Benefit 5M$ > Added (Marginal) Cost 4M$ Relationship Between Accounting & Finance Finance Accounting Future Take the financial decision Current Market Value Cash basis (recognizes revenues & expenses only with respect to actual inflows & outflow of cash) Past Record financial transaction Historical Cost Accrual Basis بسجل (recognizes revenues at the point of sale & recognizes expenses when incurred (A/R & A/P) Relationship to Accounting: Accountants: devote most of their attention to the collection and presentation of financial data. Financial managers: evaluate the accounting statements, develop additional data, and make decisions on the basis of their assessment of the associated returns and risks. Example: ABC company had sales account of $1 M during last year; out of which 60% is cash. The cost of good sold is $800,000 out of which 80% is cash Required: a) What is the accounting net profit or loss for the company? b) What is the Net Cash Flow for the company? a) Net Accounting (Accrual basis) Profit= Sales Revenue – COGS 1M$ - 800,000$ =200,000 $ (profit) 60% b) Net Cash flow = 80% Cash inflow – Cash outflow 600,000$ - 640,000$ = (40,000$) → Deficit Example: The following data is extracted from XYZ company for the last quarter of 2003 Oct. Nov. Dec Sales $1 M 800,000 $1 M (-) Exp. 800,000 800,000 700,000 The company policy is to sell 40% cash, and the rest is on credit to be collected after 2 months. The expenses are paid 70% cash, and the rest is after 1 month. Calculate the NCF during December Cash inflow 60% after 2 month before 40% in the same month Cash inflow (Dec.) =40% of Dec. Sales +60% of Oct. Sales i.e. 40% x 1M +60% x 1M 1M Cash outflow 30% after 1 month 70% in the same month Cash outflow (Dec.) =70% of Dec. expe. +30% of Nov. expe. i.e. 70% x 700 +30% x 800 730,000$ Net Cash flow (NCF) of December = 1M – 730,000 = 270,000$ How to measure the profitability of any firm? by Earning per Share (EPS) Income Statement (Accrual basis & not Cash) Sales Revenue (-) C.O.G.S Gross Profit (-) Operating Expens. EBIT XX (XX) XX (XX) Business Risk: e.g. مطعم فى الساحل الشمالى the firm inability to generate enough dollar sales to cover its C.O.G.S & Operating expenses XX (Earnings before Interest & Taxes) (-) Investing Expense. EBT (-) Taxes EAT (-) P.S dividends (XX) XX XX XX (XX) Earning Available for common stock XX 90,000 Firm Specific Risk Financial Risk: the firm inability to generate enough dollar sales to cover financial obligations (Interest to creditors, taxes to government & P.S dividends) **Investing Expenses: which pays to creditors Stocks Authorized Shares (legal Shares) i.e. legal number of shares to be issued 100,000 Shares Issued Shares Outstanding Shares Actual no. of shares tradable 40,000 Shares Re-purchased 10,000 shares from Treasury Stock 30,000 Shares Profitability per share (owner) is Calculated by EPS (Earning per share) E.P.S = Earning available for C.S Number of Shares outstanding = 90,000 = 3$ per share مش ثمن السهم – لكن كا أونر نصيبه من المكسب بتاعى3$ 30,000 as you increase the treasure, the equity decreases Outstanding = Issued – Treasury so if the issued =0 so Outstanding =Treasury EPS (3$) B.O.D meet and decide 20% payout ratio dividends / share i.e. 0.6$ per share 80% R/E Retention Ratio المحتجزة -Which means that 20% of the EPS will be distributed as dividends. -10% of the 20% is distributed as dividends to workers. As Retention ratio increases this means that the firm has high GR Substantial GR= Retention Ratio x R.O.E Goal of a firm: -Corporations commonly measure profits in terms of Earnings per share (EPS) -Maximizing profit ; is it a correct goal???? NO Profit maximization ignores Cash available for C.S Time Value of money Risk Because they are not cash, they are accrual basis Profit maximization may not lead to the highest possible share price for at least three reasons: 1. Profits do not necessarily result in cash flows available to stockholders 2. Timing is important—the receipt of funds sooner rather than later is preferred 3. Profit maximization fails to account for risk 1)Ignores cash flow available for stockholders: -Profits do not necessarily result in cash flow available to the stockholders. -Owners receive cash flow in the form of: cash dividends & capital gain . -High EPS do not necessarily mean that B.O.D will vote to increase dividends payments. -High EPS do not necessarily translate into a higher stock price; only when earnings increases are accompanied by increased future cash flows would a higher stock price be expected. (example: firm sold a high-quality product= increase in earnings due to reducing it equipment maintenance expenditures=expenses decrease ---- profits increased BUT product quality decreased = losing competitive position; therefore, stock price drops due to recognition of LOWER FUTUR CASH FLOWS 2) Profit maximization doesn't consider the timing of return ( time value of money) The receipt of funds sooner rather than later is preferred ( the larger returns in year 1 could be reinvested to provide greater future earnings) Which Investment is Preferred? (the sooner, the better) كل ما تاخد فلوسك يبقى أحسن 3) Risk is also not considered Risk: it means variation of the expected return from the actual return -- tradeoff between return ( cash flow) & risk - Cash flow & Risk affect share price differently : *HIGH CASH FLOW LEAD TO HIGH SHARE PRICE. *HIGH RISK LEAD TO LOWER SHARE PRICE ( ex. Death of highly successful CEO) *In general , Stockholders are Risk - averse → Therefore; The goal of the firm is TO MAXIMIZE THE WEALTH OF THE OWNERS *The wealth of corporate owners is measured by share price of the stock (by increasing the expected Cash flow) *Financial managers should accept only those actions that are expected to increase share price Lecture 3 Individual versus Institutional Investors Individual investors: are investors who purchase relatively small quantities of shares in order to earn a return on idle funds, build a source of retirement income, or provide financial security. Institutional investors: are investment professionals who are paid to manage other people’s money. -Institutional investors are more beneficial than individual investors because they have more money. They hold and trade large quantities of securities for individuals, businesses, and governments and tend to have a much greater impact on corporate governance.حوكمة الشركات Governance and Agency: -Corporate Governance • Corporate governance refers to the rules, processes, and laws by which companies are operated, controlled, and regulated. • It defines the rights and responsibilities of the corporate participants such as the shareholders, board of directors, officers and managers, and other stakeholders, as well as the rules and procedures for making corporate decisions. -The Agency issue Principle Agent Corporation (Managers) # Conflict (Agency Problem) Main goal is to maximize profit Shareholders (Owners) Main goal is wealth maximization How to resolve the conflict between Managers & Owners? -let the managers take performance share to be shareholders (owners) so instead of giving him profit, give him performance share. → Drawback of performance share → External factors affecting it like Revolution -A principal-agent relationship is an arrangement in which an agent acts on the behalf of a principal. For example, shareholders of a company (principals) elect management (agents) to act on their behalf. -Agency problems arise when managers place personal goals ahead of the goals of shareholders. - Agency costs arise from agency problems that are borne by shareholders and represent a loss of shareholder wealth. (in order to resolve the agency problem) Financial Institutions & Markets: Financial institutions an intermediary that channels the saving of individual , business & government into loans or investment. -The major financial institutions are commercial banks, investment banks & insurance companies. -The key supplier and demanders of fund in financial institutions are: → individuals------ net supplier of funds (save more than borrow). → Business firm--- net demander of funds. → Government------net demander of funds **Sources of money for any bank are deposits - In Egypt we’ve 3 types of deposits (current deposits, Ceiling deposit, CDs) and on the other hand, it gets loans and investment securities. -There is LTD (Loan to deposit ratio): percentage of loans to deposits (before the revolution it was 53%) Assets liabilities Loans & Deposits institutional (i.e. 100) securities So if the deposit 100$; automatically 10% will be legal reserve according to CBE (Central Bank of Egypt) Commercial Banks, Investment Banks, and the Shadow Banking System • Commercial banks are institutions that provide savers with a secure place to invest their funds and that offer loans to individual and business borrowers. • Investment banks are institutions that assist companies in raising capital, advise firms on major transactions such as mergers or financial restructurings, and engage in trading and market making activities. Financial Institution Commercial Banks Investment Banks Financial Markets Spot Market (Stock Market) Derivative market (Future Market) Forward Market Future Market Option Market Financial Market (Spot Market) Divided According to maturity Money Market For short term funds (< 1 year) e.g. 1) Treasury bills (Short term debt instrument issued by the government) Capital Market For long term funds e.g. 1) Stocks (Stock market) (P.S & C.S) 2) Commercial paper (not in Egypt) (Short term debt instrument issued by large corporations) 2) Bond Market (Corporate bond) Financial markets: provide a forum in which supplier of funds and demanders of funds can transact business directly. The two key financial markets : -Money market ( for short - term fund ) -Capital market ( for long - term fund ) 1 )The Money Market: a financial relationship created between supplier & demanders of short - term funds. -Most money market transactions are made in marketable securities i.e. can be liquidated easily ( short – term debt instrument such as government treasury bills and commercial paper) **In Egypt, there are three types of T-Bills i.e. 91 days, 182 days and 364 days. For any firm to raise money, firms can use either private placement or public offering Private placement: the sale of a new security issue, typically bonds or preferred stock, directly to an investor or group of investors such as insurance companies & pension funds Public offering: (IPO) the nonexclusive sale of either bonds or stocks to general public Primary market: financial markets in which securities are initially issued.لما اروح اشترى عربية من المعرض -The only market in which the issuer is directly involved in the transaction. E.g. IPO -This is done through an intermediate named investment bank Secondary market: financial markets in which pre - owned securities ( those that are not new issues) are traded.سوق التالت أو سوق الجمعة -The intermediate is the stock market. اشتريت السهم من الIPO و بيبعهولك -Example: NASDAQ or New York stock exchange and EGX Types of securities Equity(my money) Capital Shares ( both represent the owned capital & they have no maturity ) C.S.: Take variable dividends depend on: 1)The amount of net earnings. 2)The decision to distribute or to retain the earning. Have the right to vote (every share=one vote) P.S.: Take fixed dividends before common stock 1) Preferred stock are bought for the benefit of its low risk as it has a fixed dividends regardless of - Amount of net earning - The decision of distributing or retaining earnings *Interest: is an expense Debt(borrowed) Long –term debts Bonds Bondholders: 1)Take interest on the par value of the bond 2) Has a maturity date The shareholder’s: claim on firm value is the residual amount that remains after the debt holders are paid *Dividends: is paid only when there is net earning Chapter 5 Time Value of money To identify the Cash flow pattern of any company Annuities (Equal stream of cash flow) Single Cash Flow (Cash in & out) Mixed Stream of Cash flow (Unequal stream of cash flow) Ordinary Annuity Annuity Due Perpetuity e.g. -Salaries. -Payment at the end of each year e.g. -Rent -Payment at the beginning of each year n=∞ دفع مدى الحياة -Payment amount of cash flow Interest Rate Cost of borrowing money or Cost of return in case of lending money Simple IR Compounding IR 1 100 10% 110 2 100 10% 120 3 100 10% 130 1 100 10% 110 2 110 10% 120 3 120 10% 131.1 (You’re taking interest on Interest) (you’re not taking interest on interest but you’re taking interest on principle) Single Cash flow 0 Deposit Timeline Value of money Compounding IR i=10% n=1 No. of compounding periods 1 110 100 Future Value of a single C.F (FV) Present Value of a single C.F (PV) Compounding process (moving forward) 110 = 100 + 100 x 10% FV = PV + PV x i Future Value of a single C.F FV = PV x (1 + i)n Future Value Interest Factor (FVIF)→ (1 + i)n Whenever i or n inc. → F.V inc. 0 Discounting IR or Opportunity Cost Rate i=20% 4 n=4 100,000 ?? Future Value of a single C.F (FV) Present Value of a single C.F (PV) Discounting process (moving backward) FV = PV x (1 + i)n PV = FV x 1/(1 + i)n Present Value of a single C.F =100,000 x PVIF 20%, 4 Present Value Interest Factor (PVIF)→ 1/(1 + i) n Table A-3 Whenever i or n inc. →P.V dec.. =100,000 x 0.4823 = 48,230 $ If N is not given 0 i=20% 100 ?? n=?? FV = PV x (1 + i) 200 n 200 = 100 x (1 + 0.1) 200/100 = 1.1 n n 2 = 1.1 n Ln (2) = n Ln (1.1) n = Ln (2)/ Ln (1.1) N = 7 years If i is not given 0 i=?? 100 فى الجدول2 بدور على 4 n=4 FV = PV x (1 + i)n 200 = 100 x (1 + i) 2 = (1 + i) 4 200 4 ∜ 2 = (1 + i) 1.18 = 1 + i i = 0.18 x 100 = 18% Lecture 4 Annuities (Equal stream of cash flows) Ordinary Annuity Annuity Due e.g. -Salaries. -Payment at the end of each year e.g. -Rent -Payment at the beginning of each year Period Cash flow 1 100 2 100 3 100 Required: Calculate the F.V of Annuities (Ordinary & Due) with i=10% 0 1 2 3 100 100 100 0 1 2 100 100 100 F.V = 100 x (1 + 0.1) 0= 100 3 F.V = 100 x (1 + 0.1) 1= 110 F.V = 100 x (1 + 0.1) 1= 110 F.V = 100 x (1 + 0.1) 2= 121 F.V = 100 x (1 + 0.1) 2 = 121 F.V = 100 x (1 + 0.1) 3 = 133.1 N=2 N=3 F.V.A ordinary = 100 + 110 + 121 = 331 $ (Future Value of ordinary Annuities) F.V.A Due = 110 + 121 + 133.1= 364.1 $ (Future Value of Annuity Due) F.V.A ordinary = PMT x FVIFA i% , n =100 x FVIFA 10%, 3 F.V.A Due = F.V.A ordinary x (1 + i) = 331 x (1 + 0.1) = 364.1$ = 100 x 3.31 = 331$ 0 1 2 100 100 3 0 100 1 2 100 100 P.V = 100/(1+0.1)0 P.V = 100/(1+0.1)1 P.V = 100/(1+0.1)2 P.V = 100/(1+0.1)3 P.V.A ordinary = PMT x PVIFA i% , n P.V = 100/(1+0.1)1 P.V = 100/(1+0.1)2 P.V.A Due = P.V.A ordinary x (1 + i) = 100 x PVIFA 10%, 3 =100 x 2.486 = 248.6$ -The Annuity Due is always greater than Ordinary Annuity whatever we are discounting or compounding. -The difference between Due & Annuity → 1 more interest for Due 3 100 Perpetuity Annuity: 0 1 ?? 1000 i=10% 2 n=∞ 1000 P.V perpetuity = PMT/i جنيه مدى الحياة1000 احط كام دلوقتى علشان تطلعلى كل سنة =1000/10% = 10,000 All Laws 1) Future Value of a single C.F Equation FV = PV x (1 + i) n Table A-1 FV = PV x FVIF i%, n (i) is compounding rate or inflation rate 2) Present Value of a single C.F Equation PV = FV x 1/ (1 + i) n Table A-3 PV = FV x PVIF i%, n (i) is discounting rate or Opportunity cost 3) Future Value of Ordinary Annuity Table A-2 F.V.A ordinary = PMT x FVIFA i%, n 4) Future Value of Annuity Due F.V.A Due = F.V.A ordinary x (1 + i) 5) Present Value of Ordinary Annuity Table A-4 P.V.A ordinary = PMT x PVIFA i%, n 6) Present Value of Annuity Due P.V.A Due = P.V.A ordinary x (1 + i) 7) Present Value of Perpetuity Annuity P.V perpetuity = PMT/i n=∞ Equation 0 5 i=?? 10,200$ 15,000$ FV = PV x (1 + i)n 5 15,000 = 10,200 x (1 + i) 15,000/10,200 = (1 + i) 5 1.47 = (1 + i) 5 See in the table 1.47 at year 5, it’ll be 8% 5√ Table 1.47 = (1 + i) FV = PV x FVIF i%, n 15,000 = 10,200 x FVIF i%, 5 1.47 = FVIF i%, 5 i = 8% 0 ?? Equation PV = FV x 1/(1 + i)n =28,500 x (1+0.11)3 1 i= 11% 2 3 28,500$ Table PV = FV x PVIF 11%, 3 =28,500 x 0.7312 = 20,839 $ 0 3 10,000 ?? 7 i=5% 20,000 Calculate both P.V & F.V (Subtraction) 0 i=9% ?? 20 20,000 n=30 i=11% Death rate PMT P.V.A ordinary = PMT x PVIFA i% , n = 20,000 x PVIFA 11%, 30 = 20,000 x 8.6938 = 173,876 (F.V) PV = FV x PVIF i%, n PV = 173,876 x PVIF 9%, 20 PV = 173,876 x 0.1784 = 31,019$ 0 5 i = 7% Alternative 1 24,000 FV = PV x FVIF 7%, 5 = 24,000 x 1.4026 = 33,661$ 0 1 2 3 4 2,000 4,000 6,000 8,000 10,000 5 Alternative 2 10,000 x FVIFA 7%, 1 8000 x FVIFA 7%, 2 6000 x FVIFA 7%, 3 4000 x FVIFA 7%, 4 2000 x FVIFA 7%, 5 0 1 2 30,000 25,000 3 i = 12% 15,000 PMT 9 10 10,000 30,000 / (1+0.12)1 25,000 / (1+0.12)2 PVA at year 2 / (1+0.12)2 10,000 / (1+0.12)10 P.V.A ordinary at year 2= PMT x PVIFA 12 % , 7 Compounding Interest More Frequently Than Annually • Compounding more frequently than once a year results in a higher effective interest rate because you are earning on interest on interest more frequently. • As a result, the effective interest rate is greater than the nominal (annual) interest rate. • Furthermore, the effective rate of interest will increase the more frequently interest is compounded. m → no. of compounding period n → no. of periods Annually Semi-Annually Quarterly Monthly Weekly Daily Continuous Compounding m=1 m=2 / i/m & n x m m=4 m=12 m=52 m=365 m=∞ / exponential / e i x n e.g. Gold/oil Let’s assume: Deposit: 100$...Invest in 2 years …i=10% So if we calculate F.V Annually: F.V = 100 x (1 + 0.1)2 = 121 But if we calculate F.V Semi-Annually: F.V = 100 x (1 + 0.1/2)2 x 2 = 121.55 Semi-annually > Annually Effective Annual Rate: (Semi-Annually) EAR = (1 + i/m) m - 1 EAR = (1 + 0.1/2) 2 - 1 = (1.05)2 - 1 = 0.1025 = 10.25 % Effective Annual Rate > Nominal Annual Rate n=5 i = 6% 0 1 2 3 4 5 PMT PMT PMT PMT 30,000 F.V.A ordinary = PMT x FVIFA 6% , 5 30,000 = PMT x 5.637 PMT = 30,000/ 5.637 = 5.321$ = Special Applications of Time Value: Loan Amortization • Amortization tables are widely used--for home mortgages, auto loans, business loans, retirement plans, and more. They are very important! • Financial calculators (and spreadsheets) are great for setting up amortization tables. Loan: 6000…i= 10%...n=4 years 0 1 2 3 4 6,000 PMT PMT PMT PMT P.V. A ordinary 2002 1,250 P.V Interest 2003 Principle 2004 2005 2006 1,520 F.V n=4 FV = PV x (1 + g)n 1,520 = 1,250 x (1 + g)4 4 √1520/1250= 1 + g Lecture 5 Chapter 3 Financial Statements, Cash flows & Taxes -Free Cash flow is important for firm Valuation. -In statement of cash flow, we should have (2 comparative balance sheet & 1 income statement). -Any ↑ in any asset → Cash outflow. -Any ↓ in any asset → Cash inflow. -Any ↑ in Liability & Stockholder’s equity → Cash inflow. -Any ↓ in Liability & Stockholder’s equity → Cash outflow. -Since we’ve 2 comparative balance sheet: → The beginning of account balance & the ending of account balance of 2 years. Dr. A/R Sales Revenue Cash A/P Cr. XX XX XX XX -If we have ↑ in A/R → Sales on account → so Sales revenue will ↑ → so net income will ↑ → it’s not cash → it is cash outflow → So it decreases the accrual basis into cash basis. -Any purchases i.e. A/P → will be included in the C.O.G.S → so net income will ↓ Cash flow Statement (Purpose: want to know the amount of cash I want to receive from each activity & amount of cash I want to pay for each activity) Cash flow from Operating Activity Cash flow from Investing Activity Cash flow from Financing Activity Indirect Method Net Income: XX accrual basis → Cash basis Adjustment to reconcile net income to net C.F from operating activities Adjustments: 1) Add back the non-cash expenses (Depreciation expenses, Amortization expens,….). 2) -Add: loss on sale of non C.A. -Subtract: gain on sale of non C.A. 3) Check changes for current assets except for cash. *∆C.A↑ → outflow *∆C.A↓ → inflow 4) Check changes for current liabilities. *∆C.L↑ → inflow *∆C.L↓ → outflow 1) ∆ in Non-current Assets. 2) Additional information (Disclosure). (e.g. you may make changes by issuing bonds & stocks in exchange for purchasing lands) → it’ll be written in the footnote (Note below). 1) ∆ in Long term Debt. 2) ∆ in Stockholder’s equity. (except R/E). 3) Deduct the Cash dividends.(because it is distribution of profit so it is considered cash outflow) In Cash flow from operating activity: Assume: Purchase equipment: 100,000$ Useful Life: 5 years & Sell it after 2 years. so, Book Value (B.V) of equipment after 2 years = 100,000 – (2 x 20,000) = 60,000$ Selling Price 30,000$ 70,000$ Loss on Sale: 30,000$ Gain on Sale: 10,000$ -It is investing decisions because it is equipment (Cash inflow). -So, the 70,000 will go in investing activity, and the gain on Sale (10,000$) will be subtracted from the operating activity (Net income) because it is already found in the operating activity. Statement of R/E: -Beginning of R/E + Net Income after taxes (-) Cash dividends (C.S/P.S) End of R/E Selling Price XX XX (Net Cash from operating activity) √ (XX) (Deducted from financing activity) √ XX -It will decrease the net income. -It will be added in the net income (Operating activity) because I didn’t pay for it. Statement of Cash flow for the year ended Dec. 31st, 2008 **Cash flow from Operating Activity: Net income 145,000 (It is accrual basis so it has to adjusted to be cash basis) Adjustment to reconcile Net income to Cash flow from operating activities 1) Add: Depreciation expenses 9,000 (It is a non-cash expenses; it is deducted & I’ve to return it again) 2) Add: loss on sale of equipment 3,000 (Also, Check Additional Information no. 4) ()أنا متأكد انى مادفعتهاش 3) ∆ in C.A except for Cash - Add: Dec. in A/R - Subtract: inc. in Inventory - Subtract: inc. in prepaid exp. 10,000 (Cash inflow) (5,000) (Cash outflow) (4,000) (Cash outflow) i.e. Cash paid in advance 4) ∆ in C.L - Add: inc. in A/P 16,000 (Cash inflow) (Any inc. in C.L will be Cash inflow as if I borrowed money) - Subtract: dec. in income tax payable(2,000) (Cash outflow) Net Cash flow provided by Operating Activities 172,000 172000 لكن الكاش فلو من األوبراتينج اكسبنس لوحده145000 )أنا كسبان على الورق **Cash flow from Investing Activity: Purchase of equipment Purchase of building Sale of equipment (25,000) (Cash outflow) (Check Additional Information no. 2) (120,000) (Cash outflow) (Check Additional Information no. 2) 4,000 (Cash inflow) (Check Additional Information no. 4) Net Cash flow used by Investing Activities (141,000) (It is a good indicator which mean that the company is investing, but if it was +ve this means that the company is out of business) **Cash flow from Financing Activity: Issuing of C.S Dividends Payment 20,000 (Cash inflow) (Check Additional Information no. 5) (29,000) (Cash outflow) (Check Additional Information no. 1) Net Cash flow used by Financing Activities (9,000) ***Net Change in Cash: (172,000 – 141,000 – 9000) = 22,000$ Beginning Cash Balance (2007) = 33,000$ End Cash Balance (2008) = 55,000$ **Note: Issued 110,000$ long term bond for purchasing land **(Redemption of bonds → a cash outflow) What is free cash flow (FCF)? Why is it important? • FCF is the amount of cash available from operations for distribution to all investors (including stockholders and debt holders) after making the necessary investments to support operations. • A company’s value depends upon the amount of FCF it can generate. What are the five uses of FCF? (Exam) 1. Pay interest on debt. Both are paid to debt holder 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. (e.g. Treasury Stock) 5. Buy non-operating assets (e.g., marketable securities, investments in other companies, etc.). What are operating current assets? Operating current assets are the CA needed to support operations. –Op CA include: cash, inventory, receivables. –Op CA exclude: short-term investments, because these are not a part of operations. Calculate the Operating C. A (10,000) (exclude marketable securities) Cash Inventory A/R Calculate the Operating C. L (8,000) (exclude Notes Payable )الكمبياالت A/P Accurals Anything Payable Net Operating working Capital (NOWC) = Operating CA – Operating C.L = 2,000 Total net operating capital (also called operating capital) Operating Capital= NOWC + Net fixed assets. – Operating Capital 2007 = $1,317,842 + $939,790 = $2,257,632. (Actual) – Operating Capital 2006 = $1,138,600. (Anticipated) Net Operating Profit after Taxes (NOPAT) NOPAT = EBIT (1 - Tax rate) (Operating profit x (1-Tax)) Free Cash Flow (FCF) for 2007 FCF = NOPAT - Net investment in Operating capital = $10,464 - ($2,257,632 - $1,138,600) = $10,464 - $1,119,032 = -$1,108,568. (Deficit) Return on Invested Capital (ROIC) ROIC = NOPAT / operating capital ROIC07 = $10,464 / $2,257,632 = 0.5%. ROIC06 = 11.0%