Accounting Definitions, Components, and Profession Overview

advertisement

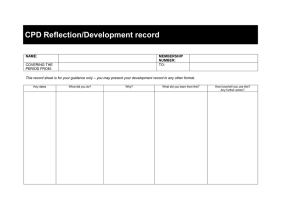

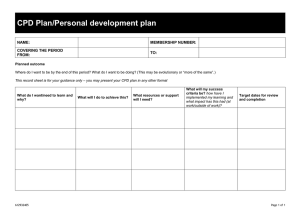

DEFINITIONS OF ACCOUNTING Accounting is a service activity. Its function is to provide quantitative information, primarily financial in nature to be useful in making economic decisions. ASC Accounting is an art of recording, classifying, & summarizing transactions and events. AICPA Accounting is the process of identifying, measuring, & communicating economic information. AAA PS: this definition has stood the test of time IMPORTANT POINTS: 1. Quantitative 2. Financial in nature 3. Useful in decision making COMPONENTS OF ACCOUNTING: 1. IDENTIFYING – the analytical component - Recognition and nonrecognition of accountable events Not all business activities are accountable. An event is accountable or quantifiable if it has effect on assets, liabilities, & equity. Sociological & psychological matters are not a concern of accounting The subject matter of accounting is economic activity or measurement of economic resources (assets) & economic obligations (liabilities) Economic activities (transactions) can be classified into: a. External – involves another entity Examples: Purchase, borrowing, sale, payment b. Internal – involves the entity and within the entity only. Examples : *Production – process by which resources are transformed into products *Casualty – sudden & unanticipated loss from fire, quake, flood and other events termed as act of God. COMPONENTS OF ACCOUNTING: 2. MEASURING – technical component - assigning of peso amounts PHILIPPINE PESO - Unit of measure MEASUREMENT BASES: a. Historical Cost – most common measure b. Current Value – fair value, value in use, fulfillment value, & current cost. Accounting as an information system measures, processes, and communicates the financial statements – a document that report particularly to owners & creditors the financial information about an entity and tell us how well an entity is performing in terms of profit and loss. COMPONENTS OF ACCOUNTING: 3. COMMUNICATING – preparing & distributing accounting report - through communicating, accounting is considered as the “universal language of business” COMMUNICATING PROCESS: a. RECORDING/JOURNALIZING - process of systematically maintaining a record of transactions identified & measured. b. CLASSIFYING – sorting or grouping of similar transactions. - done by posting to the ledger – a group of accounts categorized into assets,liabilities,equity,revenue, & expense. c. SUMMARIZING – preparation of financial statements THE ACCOUNTANCY PROFESSION REPUBLIC ACT NO. 9298 (Philippine Accty. Act of 2004) - Law regulating practice of accountancy. PS. Accountancy has a status equal to that of law & medicine. *BOA – promulgates rules & regulations in the practice of accountancy profession. - responsible for preparing & grading the Philippine CPA Examination. LIMITATION OF PRACTICE OF PUBLIC ACCOUNTANCY Single practitioners & partnerships for practice of public accountancy shall be CPAs - - - - A certificate of accreditation shall be issued to CPAs in public practice by the PRC, they are required a minimum of 3 years of meaningful experience in any areas of public practice. The SEC shall not register any corporation organized for public practice. The PRC shall issue the Certificate of Registration to practice public accountancy which shall be valid for 3 years and renewable every 3 years CPAs, firms & partnership shall be registered with BOA & PRC for the practice of public accountancy 3 MAIN AREAS OF CPA PROFESSION: 1. PUBLIC ACCOUNTING - render independent & expert financial services to the public 3 KINDS OF PUBLIC SERVICES: a. Auditing/External Auditing – primary service offered - examination of financial statements to express opinion as to fairness & if it has complied with the GAAP *External auditing is the attest function of independent CPAs b. Taxation – reparation of annual income tax returns - accountant must be familiar with tax laws & regulations, must be updated with changes c. Management Advisory Services - became increasingly important in recent years - has no precise coverage 3 MAIN AREAS OF CPA PROFESSION: 2. PRIVATE ACCOUNTING - employed in business entities as accounting staff, chief accountant, internal auditor, & controller – highest accounting officer The major objective of private accountant is to assign management in planning & controlling the entity’s operations. 3. GOVERNMENT ACCOUNTING - concerned with transactions involving the government funds & property - its focus is the custody & administration of public funds. CONTINUING PROFESSIONAL DEVELOPENT (CPD_ - Acquisition o advanced knowledge, proficiency after registration of CPA into professional practice & lifelong learning. - It raises & echances technical skill & competence - Mandary for CPAs Republic Act no. 10912 - Law mandating the CPD program CPD CREDIT UNITS - CPD credit hours required for renewal of CPA license & accreditation New BOA Resolution, all CPA are required to comply with 120 CPD credit units CPD unit is gradual: 2017 – 80 units 2018 – 100 units 2019 – 120 units Excess units earned can’t be carried over to the next 3 years except units earned for masteral & doctoral degrees. A CPA is exempted from CPD for renewal of license but not to accreditation upon age of 65