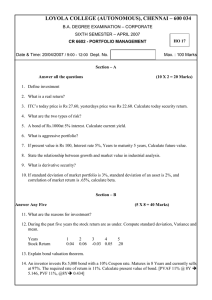

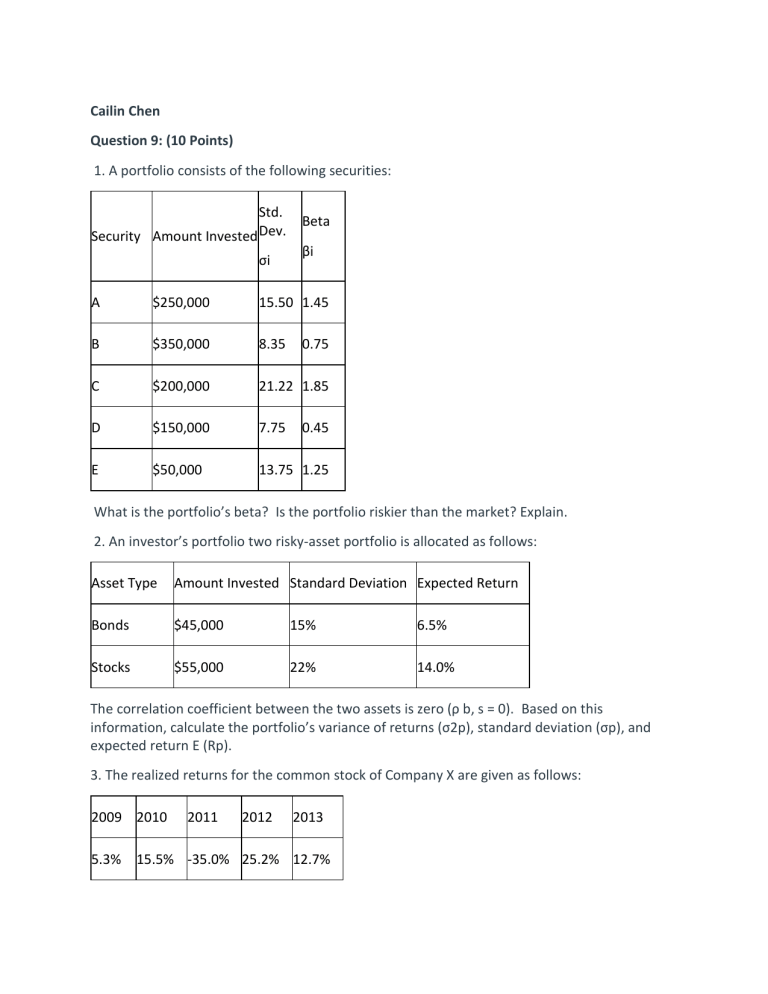

Cailin Chen Question 9: (10 Points) 1. A portfolio consists of the following securities: Std. Security Amount Invested Dev. σi Beta βi A $250,000 15.50 1.45 B $350,000 8.35 C $200,000 21.22 1.85 D $150,000 7.75 E $50,000 13.75 1.25 0.75 0.45 What is the portfolio’s beta? Is the portfolio riskier than the market? Explain. 2. An investor’s portfolio two risky-asset portfolio is allocated as follows: Asset Type Amount Invested Standard Deviation Expected Return Bonds $45,000 15% 6.5% Stocks $55,000 22% 14.0% The correlation coefficient between the two assets is zero (ρ b, s = 0). Based on this information, calculate the portfolio’s variance of returns (σ2p), standard deviation (σp), and expected return E (Rp). 3. The realized returns for the common stock of Company X are given as follows: 2009 2010 5.3% 2011 2012 2013 15.5% -35.0% 25.2% 12.7% Based on this information calculate the stock’s average return, variance of returns, and standard deviation. Portfolio beta solution 1: It is computed in a tabular form with formulas: Std. Dev. σi Amount Security Invested Beta βi Weights= invest/total investment Porfolio beta(weights* beta) A $250,000 15.5 1.45 0.25 0.3625 B $350,000 8.35 0.75 0.35 0.2625 C $200,000 21.22 1.85 0.2 0.37 D $150,000 7.75 0.45 0.15 0.0675 E $50,000 13.75 1.25 0.05 0.0625 $1,000,000 Porfolio beta 1.125 The portfolio is riskier to market as the portfolio beta is more than 1 .Higher the beat higher the risk of the portfolio Solution 2: Expected Return WEights Expected return Difference Square Variance = square *prob Asset Type Amount Standard Invested Deviation Bonds $45,000 15% 6.50% $0.45 $0.03 -$0.04 00017015625 $0.00077 Stocks $55,000 22% 14.00% $0.55 $0.08 $0.03 00011390625 $0.00063 Portfolio variance $0.11 $0.00139 To compute the portfolio S.D = weight ^2 * variance ^2 + weight^2 * variance ^2 + 2* (0) because correlation is zero = .45^2 *.00077^2 + .55^2 *.00063^2 = .00024 Solution 3: Year Average return return Difference Square 2009 5.30% 0.56% 0.0031% 2010 15.50% 10.76% 1.1578% 2011 -35.00% -39.74% 15.7927% 2012 25.20% 20.46% 4.1861% 2013 12.70% 7.96% 0.6336% 0.0474 Variance S.d = SQRT variance / n-1 = SQRT (.0544) S.D = .233 Question 10: (10 Points) 1. Use the following scenario analysis for Stocks X and Y: 21.7733% Scenario Description Probability of Occurrence Expected Outcome (HPR) Expected Outcome (HPR) Stock X Stock Y 1 Bear Market .25 -5.5% -10.5% 2 Normal Market .45 6.0% 8.0% 3 Bull Market .30 11.5% 18.5% Based on this information: a. Calculate the expected returns for Stocks X and Y. b. Calculate the standard deviations of returns on Stocks X and Y. c. Which stock is riskier? Explain your answer. Hint: You may want to interpret and compare the standard deviation for each stock. d. Assume that 90% of your $100,000 portfolio is invested in Stock X, while the rest (or 10%) is invested in Stock Y. What is the expected return of your portfolio? 2. Use the CAPM to calculate the required rate of return (expected return) to Stock X if: the risk-free rate of return is 4%, the expected return of the market is 12% and the stock’s beta coefficient is 1.25. What is the stock’s alpha if its actual return was 12.5%? Is the stock overpriced or underpriced? Explain. a.Expected returns for Stocks X and Y. Stock X E(R ) = (0.25*-0.055)+(0.45*0.06)+(0.3*0.115) = -0.01375+0.027+0.0345 = 0.04775 or 4.775% Stock Y E(R ) = (0.25*-0.105)+(0.45*0.08)+(0.3*0.185) = -0.02625+0.036+0.0555 = 0.06525 or 6.525% b. Standard deviations of returns on Stocks X and Y. Variance Stock X = 0.25(-0.055-0.04775)+0.45(0.06-0.04775)+ 0.3(0.115-0.04775) =000263939+000006750+000135677=000406366 Standard deviation Stock X= 000406366)^0.5 =006374684 or 6.37% Variance Stock Y = 0.25(-0.105-0.06525)+0.45(0.08-0.06525)+ 0.3(0.185-0.06525) =000724627+000009810+000430202 = 001164638 Standard deviation Stock Y= 001164638)^0.5 =01079184 or 10.79% c. Which stock is riskier? Stock Y is more risker as it has Standard deviation of 10.79% compare to stock X 6.37%. d. Assume that 90% of your $100,000 portfolio is invested in Stock X, while the rest (or 10%) is invested in Stock Y. Expected return of your portfolio =( 0.9 *0.04775) +(0.1*0.06525) = 0.0495 or 4.95% 2.Using CAPM E(R) = Rf+Beta (Rm- Rf) = 4% +1.25 ( 12%-4%) = 14% Stock’s alpha if its actual return was 12.5% = 12.5% -14% = -1.5% Stock X is undervalued since forcasted return is higher than actual return.