Seniors' Care Inc. Acquisition Analysis: Western Long-Term Care

advertisement

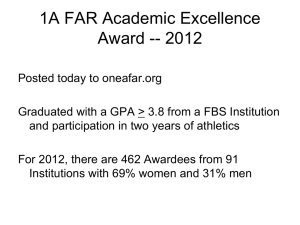

Seniors’ Care Inc. Acquisition of Western Long-Term Care Homes Inc. ACCO 435 Section B Professor Leanne Keddie Mercedes Chau 40026286 Noah Freedman 40007550 Patrice Gagnon 4006116 Narges Rezapour 40112538 Salem Tolouei 40012713 Table of Contents 1 Executive Summary…………………………………………………………………… 3 Introduction…………………………………………………………………………….. 5 Mission Statement…………………………………………………………………….. 5 Vision Statement………………………………………………………………………. 5 Stakeholder Preferences……………………………………………………………… 6 Problem Statement……………………………………………………………………. 6 Market Trends………………………………………………………………………….. 6 Porter’s Five Forces…………………………………………………………………… 7 Industry Key Success Factors……………………………………………………….. 7 Competitor Analysis………………………………………………………………….… 7 SWOT Analysis………………………………………………………………………… 8 Financial Analysis……………………………………………………………………… 9 Alternatives……………………………………………………………………………… 11 Recommendation………………………………………………………………………. 14 Strategy………………………………………………………………………………….. 15 Implementation Plan……………………………………………………………………. 15 Conclusion……………………………………………………………………………….. 17 Appendices………………………………………………………………………………. 18 References………………………………………………………………………………. 37 2 Executive Summary X Consulting Group has been assigned the responsibility to prepare a report for Seniors Care Inc (SCI) on the potential acquisition of Western Long Term Care Homes (WLT). The purpose of this report is to assess the “deal on the table” and to analyze the impact it would have on SCI from a qualitative and quantitative perspective. The aim of the report is to address the impact of post acquisition policies and to examine whether WLT has proposed an acceptable purchase valuation of their company valued at $180M. The scope of this report is to assess the current situation of both WLT and SCI, to evaluate the senior home care industry, to perform a proper business valuation of WLT for SCI stakeholders and managers, to issue alternatives based on the valuation, to provide a thoughtful recommendation and lastly to determine how to efficiently implement said recommendation. After several years of consistent earnings SCI is looking to grow their company and as of now operating within three divisions: 1) homes division 2) products division and 3) services division. SCI has experienced steady growth across their divisions as they offer reliable services and products while creating and illustrating true customer value. Their strong reputation and tactical strategies allows them to enjoy a 98% occupancy rate across their homes. Despite their success, brokers have given SCI mediocre ratings based on the lack of focus on one division. SCI is now looking to expand their division 1 operations by acquiring WLT whom in recent years has faced litigation settlements, pending lawsuits and multiple accusations and complaints about overcharging their customers. WLT fails to deliver on the value they promised their customers due to an inexperienced workforce who are overworked. This is worrisome for SCI as in recent years WLT has been tarnishing their reputation in the eyes of the public. In order to properly address these issues, three alternatives have been proposed. These alternatives analyze the impact on current share price and post acquisition earnings as well as the implementation of industry average targets where WLT does not meet them. SCI should acquire WLT and invest in all profitable homes while selling off those that are not profitable. With the sale of the unprofitable homes, SCI will be able to raise capital to decrease their debt and invest some capital to meet industry average targets. SCI will have to hire experienced workers to offer professional and premium services. An initial marketing investment will be needed in order to prove to customers that true value does exist in the products and services that they offer. The valuation of $180M made by WLT is too high as after a proper valuation $125M was reached while noticing that WLT is $1.54M below industry average in terms of revenue. Another option would be for SCI to acquire all assets of WLT and take over all their liabilities with a focus on increasing the occupancy rates by 278 residents across the unprofitable homes. WLT’s sole reason for having unprofitable homes, according to SCI management, is due to the occupancy rates. This will allow SCI to double their Senior 3 homes division (14 to 28 homes) without having the negative effects of the lingering accusations and previous and pending lawsuits against WLT. SCI will have to brand and market these homes as if they were their own as SCI has been able to prove to customers that their products and services are valuable while WLT has not. This option poses a revised net income of $21M after factoring in the $1.1M needed in training costs and $1.7M for the termination of WLT’s management. There may be a potential backlash from current caregivers and nurses as they will suffer a 5% reduction in pay to meet industry averages. If SCI chooses not to involve themselves with WLT, SCI should use their existing systems and relationships to grow the business over time rather than rapid inorganic growth. SCI will continue to pride themselves on providing top of the line products and services while emphasizing the customer value SCI creates. SCI will have to build homes in unexploited, lower competition areas across Canada. The major downside is management wants to see immediate results rather than a progressive organic growth. It is recommended that SCI acquires the assets and liabilities of WLT for $125M ($100M FV of NTA and $25M as goodwill) while focusing on increasing occupancy rates. It will be financed majoritively by issuing bonds (debt financed 70%) and partially by issuing shares (30%). This will increase post acquisition earnings and share price as it has the highest net income of the three ($21M). SCI will manage the potential backlash by emphasizing that the reduction in salary will be matched by a reduction in hours so that the employees will not be overworked. They will also receive paid training which is promising for employees whom plan to excel within their profession. If the workforce is still not happy SCI is capable of firing employees whom lack experience as they are not unionized. SCI will implement their own internal systems, controls and strategies that have worked so well for them to ensure proper handling of accounts and an increased occupancy of WLT homes. Although SCI plans to release additional shares to finance the project, shareholders will be compensated by a healthy net earnings (post acquisition) which in turn will increase their share price. Since SCI plans to double their division #1 operations, they will need to allocate resources and increase their focus which will show brokers that SCI is re-focussing their strategy more towards a single division. Choosing this alternative will eliminate the risks that come from acquiring WLT as a whole. In the short run, SCI will implement stringent policies to meet industry averages. In the long run, economies of scale will be used to increase margins while implementing policies to increase medication division within the homes. The purpose of this report was to assess if WLT should be acquired for 180M and the impact it would have on SCI from a qualitative and quantitative standpoint. This solution along with the proper risk mitigations and implementation will give SCI the rapid growth they are seeking with additional future growth. 4 Introduction X Consulting Group is responsible to provide a recommendation on the acquisition of Seniors’ Care Inc. More specifically, X Consulting Group will provide a report on SCI’s potential acquisition of Western Long-Term Care Homes Inc (WLT) currently owned and operated by the Lair Family Holding Company. The purpose of the report is to analyze the impact of the acquisition of WLT for SCI from both a qualitative and quantitative perspective. The aim is to determine the acceptable valuation of WLT, the impact of postacquisition policies on WLT valuations, and to examine the $180 million valuation that current owners of WLT have determined. The report’s scope includes: ● Assessing current situation of WLT and SCI ● Evaluating the senior care home industry ● Performing a proper business valuation of WLT for SCI stakeholders and managers ● Issuing alternatives based on proper business valuation ● Providing the best recommendation based on qualitative and quantitative data ● Determining a ten year implementation plan Mission Statement “At Senior’s Care Inc., we are focused on building valuable, long-lasting relationships through multi-disciplinary offerings, catering to senior citizens for their every need. We start the relationship by offering comfortable living conditions and expanding our services to fulfill all their needs from quality medication to offering wide range of assistance. Our aim is to be the only friend they will ever need.” Vision Statement “At SCI, we own and operate senior care homes. Through these homes we’ve built peripheral product and service offerings for our seniors through production and sale of medication as well as a multitude of services for their everyday need. Our vision is to expand our customer base through the expansion of new homes and potential competitor acquisitions. With more beds and high occupancy rate, we can increase our medication production and expand our market share for senior care services. We want to be the leading Canadian senior care product and service company.” 5 Stakeholder Preferences SCI and the Lair Family are both stakeholders of the group. SCI is interested in a proper valuation of the acquisition. All relevant data should be included in the valuation as this will provide the best possible decision. SCI would prefer to pay the lowest price possible for WLT; and it is assumed that SCI will want to pay special attention to unfavorable data that can have major influence on valuations. SCI is also interested in industry averages. A proper comparison to industry will be very important as well as a reasonable analysis of impact on valuation as SCI will put a lot of emphasis on this data. The Lair Family will want the highest possible price for WLT. They will put more emphasis on positive data for their valuation. Problem Statement The problem statement that needs to be addressed is the following: In a market dominated by large competitors and increasing consumer demand, is SCI’s optimal growth strategy to acquire WLT based on their business valuation? Market Trends (PESTEL) In order for Seniors’ Care Inc. to adapt properly, it must analyze the market and see which direction the market is shaping into. Out of the five major components of the PESTE analysis (Appendix 1), Seniors’ Care Inc. should focus on the political and sociocultural factors. The industry must assess the government’s intervention, specifically the amount of funding catered towards seniors. Currently, the government funding has been reduced by $350 per client. Provincial health insurance plans under the Canada Health Act receive little to no coverage, however other funding options include non-profit organizations and private insurance (Comfort Life, 2019). In certain cases where seniors rather live on their own, favourable tax credits apply for making changes to their own homes (Government of Canada, 2019). Federal sources of monthly income such as CPP and OAS are helpful in paying for care. However, elders admit that there is low financial support provided by the government (A Place for Mom, 2019). Furthermore, this industry must consider social factors, including the increase in aging population, currently at 17% of the total population and the increase in waitlist for a room at a senior home (Government of Canada, 2014). Technological factors should not be the main concern of this industry, however it is an opportunity to consider in order to gain more assistance with automated machinery, and lower the needs for nurses to better serve clients and increase the bottom line (Aging, 2019). Currently, senior homes are not greatly impacted by economic and environmental issues. 6 Porter’s Five Forces Next, exploring each of Porter’s Five Forces (Appendix 2) helps analyze the strengths and weaknesses of Seniors’ Care Inc position in the industry and how this impacts their long-term profitability. The threat of new entrants is low because it requires a high amount of capital and expertise. Overall, this helps reduce the level of competition and threat of substitutes. There is low to medium bargaining power for buyers and suppliers. The health industry has decreased in inelasticity for consumers because even if patients are willing to invest in proper care and medical treatment (Babalola O, 2017), seniors can only afford so much (Canadian Dimension, 2018). Healthcare expenditure of Canadians has only increased from 44.3% to 46% within ten years (CIHI, 2018). More specifically, depending on the patient’s age and needs, a senior will be ready to spend on average $2200 per month (Claxton, Gary & Sawyer, Bradley, 2019). As for bargaining with suppliers, there is the opportunity to earn favourable contracts because of the volume of purchases needed for operations in the senior care industry. The above analysis concludes that this industry is attractive because of the low competitive environment excluding the high barriers to entry, which is actually favourable to Seniors’ Care Inc. and other key players today. More specifically, this combination helps Seniors’ Care Inc. decrease the number of entrants and face less competition in the current market. This tool examines other factors that could impact the profitability of an industry. Industry Key Success Factors The senior care industry key success factors include having sufficient and qualified personnel and the ability to provide a broad spectrum of care while being familiar with customers taste and preferences. Having a competent and well-trained staff enables companies to offer professional services. Lastly, it is important to reach a customer’s standards by catering to their needs and offer a high quality of comfort within this industry (IBIS World 2019). Competitor Analysis Without further information about the competition, it is assumed that key players exist in the market. Given the fact that Seniors’ Care Inc. is a mid-sized Canadian company suggest that there are bigger competitors. Specifically, having Seniors’ Care Inc. acquire WLT shows that the company is eager to grow and compete with top competitors in the industry. In order to stay competitive and expand, Seniors Care Inc. must continue to differentiate themselves in terms of the quality of service offered. 7 SWOT Analysis Furthermore a proper SWOT analysis (Appendix 3) will provide sufficient information to assess the strengths and weaknesses of each company while exploring the opportunities and threats that SCI faces. WLT has 14 senior care homes, 11 of which are located in Western Canada which allows them to have a strong presence within that part of Canada. They have demonstrated throughout their existence that they have strong and reliable financials as WLT has received an unqualified audit report every year that they’ve been in business. Between four executives there is 46 years of experience demonstrating a highly knowledgeable and dedicated BOD. Despite such experience being present within the BOD, WLT suffers from inexperienced workers whom are overworked (customer value not present, paying for superb care but receiving mediocre) and a presence of poor internal controls of handling of accounts which has hindered their public appearance. SCI is a publicly traded company on the TSX that has a market capitalization of $154 million meaning it can obtain more capital resources from potential investors. Current shareholders can play a key role on the board by overseeing managements work and influencing strategic and operational decisions while ensuring objectives, which are aligned with their interests, are achieved. This allows SCI to plan ahead to ensure profitability and company growth. SCI operates over three divisions while maintaining sufficient capital resources to allocate across all divisions. This indicates their ability to produce consistent and stable earnings while diversifying their sources of revenue indicating that if one division were to fail, SCI would still have two other divisions to focus on and grow. Unfortunately, SCI’s stock has been given mediocre ratings by several brokers which can result in disinterested investors. SCI has been given the opportunity to double its division #1 operations with the proposal of acquiring WLT whom is in need of liquidity in order to expand their favoured division of sports-related businesses. With this knowledge SCI can have the upper hand by using this to their advantage when negotiating the acquisition. SCI can also expand into new business segments or even into a new industry that would compliment their current divisions. This would diversify SCI’s portfolio and increase streams of revenue. All of the above opportunities can be financed through the issuance of shares of equity instead of debt. Revenues within the senior home care industry will decrease as government is cutting funding by $350/patient which will not be matched by an increase in cost to the customer but rather a decrease in revenues earned by the company. Given the opportunity of acquiring WLT, SCI will face multiple threats such as the possibility of losing a license and a potential tarnished reputation for acquiring a company which has 36 accusations of overcharging as well as other complaints and pending lawsuits. Another red flag discovered by the SCI’s lawyers is that WLT paid an abnormally high amount to 8 settle a lawsuit which based on historical data has been settled for much less in the past which raises the question; why was there an overpayment? Financial Analysis SCI must consider: 1. Financials of WLT in comparison to the industry 2. Business valuation of WLT 3. SCI’s capital structure and financing 1) Industry Comparison Comparing key operational factors of WLT with the industry (Appendix 4) shows the following: ● Based on number of residents, revenue is $15.4 million less than the average revenue of the industry. ● Contribution margin of WLT is 52.5% (Appendix 1), which is significantly less than the industry (gov. code: NAICS 6233) at 83%. This indicates a negative variance of more than 30% for WLT’s contribution margin. ● Salary expense for care workers and nurses is the most costly for WLT, consisting of $97.9 million of direct expenses. Comparing this amount with the industry shows that WLT’s salaries are $8.7 million higher than average. From this number, $4.4 million is attributed to 5% higher salaries of workers and $4.3 million is the variance in hiring more than the average number of workers per resident. ● Advertising expense of WLT is $1.1 million higher than the industry’s average. Based on industry comparison, WLT seems not operating effectively and efficiently. 2) Business Valuation A) Tangible asset backing (TAB): WLT has a net book value of assets of $100.2 million (Appendix 5) in which SCI can earn if 100% of WLT is disposed. B) Capitalized earning method: normalized earnings of WLT includes factors such as the reduction of government funding, potential lawsuit, management salaries, and interest on the debt that has been exchanged with the redundant asset, all totalling to $21.3 (Appendix 6). C) The risk evaluation factors for industry and company specific are identified as following: 9 Industry Specific Risk o mature industry (positive) o healthy industry (positive) o increase in aging population by 56.7% from 2017 to 2050 (United Nations, 2017) (positive) o increase in waitlist for a room at a senior home due to a shortage of supply by 0.5% (Prime Corp, 2017) (positive) o reduction in government funding by $350 (negative) o health insurance plans receive little to no coverage (negative) Company Specific Risk o employees are not unionized (positive) o solvency ratios better than average (positive) o profitability ratios less than average (negative) o not meeting industry averages for economy and effectiveness (negative) o risk of complaints and threat to revoke of license (negative) o ROI less than average (negative) o half of homes are not profitable/excess capacity (negative) o number of workers per resident is above average (negative) o workers are not trained (negative) Considering the discount rate determined by the given risks (Appendix 7) and normalized earnings of WLT, a valuation range from $115.2 million to $136.2 million is estimated (Appendix 8). 3) SCI Capital Structure and Financing SCI currently has a debt to equity ratio of 37%. Although SCI is not focused only on senior home care industry, two other divisions of medical production for seniors and services to seniors, are closely related and bear almost the same market risk. The average debt to equity ratio for the industry is 95%. One can see that SCI’s capital structure is much less leveraged than average. It is inferred that there is an option for SCI to increase its debt up to 95% of its equity (Appendix 9). Alternatives 10 After assessing all internal and external factors, three alternatives have been derived to solve the central problem. All alternatives along with a detailed qualitative and quantitative explanation are explained in the following. Acquiring 100% shares of WLT Seniors’ Care Inc. should acquire 100% of WLT where it invests in all profitable homes and sells the unprofitable divisions. With selling the unprofitable homes, SCI is able to raise capital to lower their debt and choose to invest more money to reach the industry’s average services offered. More specifically, SCI will invest in training workers to offer premium service in order to raise the occupancy rates to 98%, matching the rate that SCI was targeting from the beginning prior to acquisition. Currently WLT’s revenue is under the industry’s average by $15.42 million, however focusing in marketing newly acquired homes will target the proper market and prove customers that the product and service offered are valuable. By computing the business valuation, the total fair market value averages to $125,667,221 million, which is less than WLT’s valuation of $180 million. Although it is reasonable based on the comparison with TAB of $100,151,000, there is large debt associated initially with the acquisition and certain qualitative factors that negatively impact this option. Furthermore, WLT may not accept this acquisition since it is below the expected amount. To explain more in detail, the advantages and disadvantages for this alternative are outlined below: Advantages: ● Greater market exposure and brand recognition ● Ability to lower current debt with profitable divisions Disadvantages: ● Requires a high initial and continuous investment ● Lacking expertise in acquiring a regional company with potentially different values and ways of operating the business ● Big loss associated with the liquidation and sale of unprofitable divisions of WLT ● Negative reaction associated with the difference business valuations computed by both stakeholder groups 11 In all, alternative one is very costly to implement and it requires significantly more risk because of operating a bigger company. The growth potential is very high, however the implementation of merging the companies together will lead to unguaranteed success. Acquiring Assets & Liabilities of WLT Another feasible and promising option would be to purchase WLT’s assets while taking on their liabilities. Seniors Care Inc should then use their tactical positioning and marketing strategies to increase the occupancy rates in the current unprofitable homes that WLT will transfer to SCI. The sole reason WLT has some unprofitable divisions is due to their lack of residents in some homes. This will allow SCI to increase their Senior homes division by fourteen homes without having the negative effects of the lingering accusations and previous and pending lawsuits against WLT. SCI will have to brand and market these homes as if they were their own as SCI has been able to prove to customers that the product and service that they are offering is valuable while WLT has not. Here are a few advantages and disadvantages to pursuing this alternative: Advantages: ● ● ● ● Ability to increase occupancy rates by 278 residents in WLT’s homes Mitigates the litigation risks and liabilities faced by WLT Maintain SCI’s good reputation while doubling their division 1 operations Revised net income of $21 million Disadvantages: ● Increase in training costs by $1.1 million to properly train employees at the WLT homes ● Potential backlash from current WLT employees due to 5% reduction in pay to meet industry averages ● $1.7 million severance pay package to WLT management after termination of their contracts This alternative proposes a good solution for SCI as it allows them to increase their operations and expand the size of their company without hindering their reputation in the eyes of the public. Stakeholders will be content as the company is expanding in one division increasing the focus of that division and annual net income is projected to grow. Their may be some unforeseen difficulties in the meshing of the new employees to the standards that SCI prides themselves on. 12 Opting not to move forward with WLT Acquisition The third alternative is for SCI not to move forward with the acquisition of WLT. Instead, the recommendation for this alternative is to maintain current operations and use existing systems and relationships to grow the business at a slower but more manageable rate. The current brand image of SCI is one of quality service and SCI values industry standards which it maintains with its own operations. Instead of acquiring a company that is in an unfavourable position relative to industry and trying to fix the company with a heavy amount of management and changes to their operations, SCI can simply build upon themselves. For this alternative, it is recommend that SCI acquire and build homes in un-exploited, lower competition areas across Canada. This will require a lot cash for initial construction and renovations of homes. However, because of SCI’s previous track record in terms of profitability and customer satisfaction, it is reasonably assumed that if the locations respond to the standards outlined above, SCI will be able to effectively take advantage of the opportunity. The advantages and disadvantages for this alternative are outlined below: Advantages: ● SCI avoids the risks associated with the acquisition of WLT ● SCI grows using their established brand identity which is associated with a quality service ● SCI builds on their existing operations, this approach is manageable for a relatively small company like SCI Disadvantages: ● The growth is at a much slower pace which doesn’t correspond with SCI’s vision statement ● Doesn’t eliminate the need for cash as new locations will still need quite a lot of cash ● Will require a lot of R&D to find exploitable locations in Canada ● WLT will remain a competitor and will also be open for acquisition from another Senior Care company ● There is a lack of a new revenue stream, it will be hard for SCI to increase their margins Overall, this alternative is the best way to avoid the risks associated with WLT, however, it does not correspond to the vision statement of SCI and will only provide a business as usual approach for SCI, which the company has expressed a desire to change. 13 Recommendation SCI must buy the assets and liabilities of WLT. The valuation range of $115 to $136 million is reasonable based on the capitalized earnings of WLT (Appendix 8). The recommended price averages to $125 million, which indicates $100 million fair value of net tangible assets (Appendix 5) plus 25% value of goodwill of WLT. It is recommended that the acquiring price ($125 million) be financed 70% by issuing bonds (debt-financed) and 30% by issuing shares (Appendix 9). This will lead SCI to obtain an average debt to equity ratio of 0.95:1, similarly to the industry. After acquisition, capital structure of SCI will be more leveraged and riskier. On the other hand, there will be an increase in earnings per share. As a result, an increase in share price of SCI after acquisition is expected. SCI also needs to implement policies to increase the average occupancy rate of WLT homes from 92% to SCI’s current occupancy rate of 98%. These policies must make all unprofitable homes turn profitable. The recommended strategy map for this purpose is presented in Appendix 8 and is discussed in the following. Strategy The recommended strategy for this acquisition is to buy assets and liabilities and merge the two companies in order to use tax advantages and to avoid any contingencies or potential liabilities. A strategy to mitigate certain risks and strengthen weaknesses post acquisition is to maximize profitability through customer satisfaction derived from the strategy map (Appendix 10). The main weaknesses identified is the lack of training and controls. In this strategy two main drivers should be considered in the learn and growth aspect: 1. Staff retreat and adaptive leadership in place 2. Care workers and nurses team training 14 Both drivers need to be empowered by effective supervision by upper management and quality control procedures. Lean process mapping should also be used to increase the value stream. By implementing these procedures, we can expect a decrease in the number of errors and complaints and rather a bigger market for new senior residents. The strategy also recommends a negotiation for increasing care payments to compensate government funding reduction, especially in higher priced areas. However, it is highly expected for SCI’s competitors to have the same reaction. The financial results are supported by the increase in occupancy rate and also by the increase in care home revenue. This strategy will help SCI to strengthen its operational weaknesses and also lead to higher profit. Having an increase of 5% occupancy rate per home significantly helps reduce the training costs of $1.1 million. There is the potential backlash from current WLT employees due to the 5% reduction in pay, however working hours will be reduced in order to compensate the overworked employees. Furthermore, extra non-monetary benefits such as insurance, health, and wellness can be offered. While these benefits work in SCI’s favour due to the fact that the company is part of the senior care industry, this also enables workers to stay motivated. Implementation Plan Short-Term Plan Buying WLT assets and liabilities is advantageous because it already has an established customer base, a good reputation and experienced workers. SCI must follow the following steps based on our recommendation provided within the first year. 1. Hire a broker (first month): WLT is valued at $180 million, which is more than the amount computed by SCI. An independent appraiser helps both parties evaluate the fair market value of WLT at acquisition date and reduce bureaucracy throughout the purchasing process by several months. A full appraisal procedure will cost $25,000 (Schroeder Steven, 2018). 2. Take a closer look (third to last month): SCI’s banker, accountant, and attorney play a vital role in due diligence, where the verification of all relevant information about the business is being taken under consideration. Professional fees of $6.5 15 million (legal fees equal to 5% of final sale price and accounting fees totalling to $250,000) associated with mergers and acquisitions can be capitalized (Kurman, Offit, 2016). 3. Evaluate assets and liabilities (third month): Receive a list of all assets and liabilities except cash and determine their classification, as well as revise the cost of the asset or the value of the liability compared to the current value. This step is important because findings from this evaluation can contribute to SCI’s negotiation. 4. Evaluate audited financial statements for the past five years (third month): Despite the fact that WLT has always received an unqualified audit report, it must evaluate and compare the financial statements to its tax returns. 5. Compare the indicators of WLT with industry average (fifth month): Since WLT is not meeting industry averages, recognizing variances and determining how to meet industry averages is important to determine future profit potential. 6. Assessing location and market area (sixth month): SCI has to consider the location of WLT and the surrounding areas, including the economic outlook, demographics, and competition. 7. Negotiating a fair price (eighth month): SCI is now able to determine the best price for the assets and liabilities of WLT. It is estimated that SCI will acquire WLT for $125 million. 8. Restructuring (ninth month): Certain operating activities, specifically change in management require immediate change. This will cost $1.7 million to terminate all WLT’s management contracts. Medium-Long-Term Plan Major immediate changes are not suggested due to WLT’s negative employees attitudes and unproductive management behavior. The main objective is to increase profit and consequently the share price of SCI, while always closely following industry standards. Therefore, the following activities would be suggested to achieve this target during the next five years. 1. Using economies of scale and scope (first year): negotiate for lower prices (1520% less) with suppliers; effectively increasing margins for all divisions due to the fact that SCI will have a greater total market share. This enables the company to create bigger orders and contracts. Furthermore, synergy is formed between both production and home care division with the acquisition of more homes. 16 2. Implementing policies and standards (second year): SCI management would implement strict policies to meet industry average through improving the training of workers by 20% and high quality control. Standardization of salary per nurse and care worker and improving the quality of services. 3. Increasing revenue per resident (third to fifth year): Once improving the quality of services, SCI should increase revenue per resident by 5% per year for three years. 4. Revising unprofitable homes (fifth year): Revise and close down homes that remain significantly unprofitable due to occupancy rates of less than 80%. Furthermore, use income from profitable homes to salvage break-even homes by investing in marketing, as well as improving in product and quality of service. Conclusion In conclusion, WLT’s approach to sell the business has given the opportunity for SCI to expand. With extensive quantitative and qualitative measurements, purchasing WLT’s assets and liabilities as well as increasing the occupancy rates of unprofitable homes is SCI’s best option. Avoiding a high initial capital investment will enable the company to grow at a slower pace and therefore decrease the company’s risk by implementing specific projects as mentioned above throughout the next five years. Appendix 1: PESTE 17 Political ● Decrease in government funding of 350$ per client (Western Long-Term Care Homes Inc. Exhibit 3) ● Seniors (65 years old and older) receive financial assistance (Government of Canada, 2019) ● Multiple safety regulations in the Healthcare sector ● Provincial health insurance plans under the Canada Health Act receive little to no coverage, but there are some help available in certain situations depending on the province you live in. (Comfort Life, 2019) ● Funding options: government, non-profit organizations, private insurance, and yourself (Comfort Life 2019) ● Favourable tax credits for seniors to making changes to their homes (Government of Canada, 2019) ● Federal sources of monthly income that can be helpful in paying for care include: CPP, old age security (A Place for Mom, 2019) Economic ● Canada’s facing a recession (higher job loss, falling incomes and less consumer spending) (Quilty, 2011) ● Losing jobs can force elders to retire earlier (Quilty, 2011) Social ● Long waitlist (increasing demand) (Prime Corp, 2017) ● In 2016, 2.2% of the overall Canadian population were 85 and older (Comfort Life, 2019) ● By 2030: 23% of the overall Canadian population will be a senior (Comfort Life, 2019) ● 2018: 17% of the total population over 65 (Government of Canada, 2014) ● From 2017 to 2050: 56.7% increase in aging population (United Nations 2017) Technological ● Increase in tech leads to more automated machines. More assistance gives the opportunity to replace employees, which leaves nurses more room to better serve clients. ● Higher attraction and services lead to higher sales opportunity with advanced products (virtual/robot assistants) ● Health issues are relieved with advanced patches and implants (Aging, 2019) 18 Environmental ● Increase in pollution, poor air quality, and extreme weather due to global warming all increases the risk of illnesses amongst elders (EPA United States Environmental Protection Agency, 2016) 19 Appendix 2: Porter’s Five Forces Force Level of Threat Comments Barriers to entry High ● Entering into the market requires high amount of capital and expertise. Bargaining power of buyers Medium ● While each consumer has their own preferences and compare the services offered by each home, there is a big waitlist and demand for senior homes. ● Today, the market is less inelastic, specifically where consumers can only spend so much on their health based on their retirement income, even if it is their top priority (Babalola O, 2017). Bargaining power of supplier Low to medium ● It is assumed that certain companies like Seniors’ Care, also manufactures and sells medical products. ● Senior home companies purchase either a large quantity (i.e: beds) or a small quantity (i.e: certain machines) of products from a supplier. Large quantities give less power to suppliers while small quantities give more power to the supplier. Threat of substitute Low ● With the high level of expertise and unique services offered by personnel, it is rather difficult to be replaced. ● Seniors can choose to live on their own. Competition and rivalry Medium ● There is the presence of key players and smaller competitors. ● Since there is a high barrier to entry, competition is medium. ● The industry raises the opportunity to merge with other companies causing a shift between competitors. 20 Appendix 3: SWOT Strengths ● Experienced management team (46 years total together between 4 executives) ● Received yearly unqualified audit reports ● SCI is a public company as it is traded on the Toronto Stock Exchange. Along with its market capitalization of over $154M, it can obtain more capital resources from potential investors and current shareholders can play a key role in the board. They oversee management’s work, influence strategic and operational decisions, all while ensuring that their interests align and their objectives have been achieved. Essentially, they plan ahead to ensure profitability and growth of the company. ● It operates three divisions: Home division, Products division, and Services division. Through different divisions, SCI can obtain various sources of revenues and with 98% of occupancy rate, it can maintain or continue to increase their revenues. Additionally, if one division were to fail, SCI would still have two other divisions. ● SCI has sufficient capital resource, enough to efficiently allocate them across its divisions. In fact, stable earnings have been stabled with over $13M from previous fiscal year. ● As average current ratio is slightly better, then it indicates that SCI is able to pay its current obligations with its current assets. 21 Weaknesses ● With its long-term debt and shareholder’s equity, its long-term debt to equity ratio is higher than 1, indicating that the company is largely financed through debt rather than equity. SCI should achieve a balance as large debts can indicate potential issues concerning with its payback and even more so, in the long-term, going-concern issue should debt continue to accumulate. ● Cannot control the BOD without encountering a large settlement payment ● Several brokers have mediocre ratings on SCI stock, which could potentially result in potential investors being disinterested in investing SCI. Opportunities ● Increase market share and increase revenues of SCI’s division by increasing its number of homes. ● SCI can expand into new business segments or even in a different industry, but that would complement its current divisions. This would diversify its portfolio and increase sources of revenues. ● Issuance of shares would allow the company to finance its operation through equity rather than debt. Threats ● Government cutting funding by $350/patient ● Potential loss of senior home licensing due to accusation of withdrawing funds from residents trust account without authority ● Settlement of painkiller lawsuit seems abnormally high compared to historical cases. Such lawsuit can potentially tarnish SCI’s reputation and result in higher costs. ● There are several problems such as complaints of overcharging and other accusations could lead to complications and reputation tarnishment. 22 Appendix 4: Industry Comparison COMPARISON WITH INDUSTRY A) ADVERTISING EXPENSE number of beds 4877 average advertising per bed 5000 industry 24385000 WLT 25512000 $ (1,127,000 variance ) 23 B) SALARIES- CARE WORKERS AND NURSING number of residents 4502 salary per resident 19813.33333 industry 89199626.67 WLT 97950000 $ (8,750,373 variance ) if 5% variance be reasonable 93659608 WLT 97950000 $ (4,290,392 variance ) C) REVENUE 24 number of residents 4502 revenue per resident per month 5000 revenue per resident per year 60000 industry 270120000 WLT 254701000 variance $ (15,419,000) D) CONTRIBUTION MARGIN % industry WLT https://www.ic.gc.ca/app/smepme/bnchmrkngtl/rprtflw.pub?execution=e1s3 >84% 0.52573017 25 variance (>31%) 26 Appendix 5: TAB TAB METHOD NBV ASSETS 101387 NBV LIABILITIES -44636 FMV INCREMENTS 39000 FUTURE TAX 4400 TAB $ 100,151,000 27 Appendix 6: Capitalized Earnings Method NORMALIZED EARNINGS NI before tax $ 32,430,000 interest on redundant asset debt $ revenue loss due to gov. funding $ (18,908,400) extraordinary lawsuit* $ 9,750,000 CM due to increase in occupancy rate to 98% $ 8,128,191 advertising reduction to industry benchmark $ 1,127,000 wages and salaries reduction to industry benchmark $ 4,290,392 management salaries reduction to industry benchmark $ training and supervision expense (our policy) $ (1,127,000) NI before tax $ 35,505,527 Tax $ 14,202,211 Normalized NI $ 21,303,316 (394,656 210,000 28 * Not completely removed lawsuit, because 36 complaints are being dealt. However half of this amount was unusual based on our lawyers' estimate. 29 Appendix 7 : Build Up Method and Business Valuation MULTIPLIER BUILDUP lower higher Risk Free Rate 1% 1 Public Market Equity Risk Premium 6% 6 Liquidity Risk 3% 4 2% 3 4% 5 private (negative) 100% ownership (positive) Industry Specific Risk mature industry (positive) healthy industry (positive) increase in aging population (positive) increase in waitlist for a room at a senior home (positive) reduction in government funding (negative) health insurance plans receive little to no coverage (negative) Company Specific Risk employees are not unionized (positive) 30 solvency ratios better than average (positive) profitability ratios less than average (negative) not meeting industry averages for economy and effectiveness (negative) risk of complaints and threat to revoke of license (negative) ROI less than average (negative) half of homes are not profitable/excess capacity (negative) number of workers per resident is above average (negative) workers are not trained (negative) range 16% 1 Multiplier 6.25 5 31 Appendix 8: Capitalized Earnings Method CAPITALIZED EARNINGS METHOD Normalized NI 21303315.97 21303315 6.25 5.2631578 Multiplier Capitalized Earnings $ 133,145,725 $ 112,122,716 4,758,000 $ (1,725,000) $ (1,725,000) $ 136,178,725 $ 115,155,717 $ 100,151,000 $ 100,151,000 $ Additional debt available 4,758,001 $ Management termination settlement Total Fair Market Value Range a) TAB Gap between TAB and Capitalized Earnings valuation* 0.35973405 0.1498209 * The gap is reasonable, because less than 35% 32 b) EPS for SCI 0.8346760 Price of SCI share estimated multiplier of industry by brokers* 5.9903479 *The range is reasonable, because this multiplier fall within this range. 33 Appendix 9: Capital Structure and Financing FINANCING ACQUISITION SCI TOTAL ASSETS $ 126,500,000 DEBT $ 34,000,000 R/E $ 48,000,000 S/C $ 44,500,000 DEBT/EQUITY 37% ASSETS ADDED BY ACQUISITION $ 125,000,000 TOTAL ASSETS AFTER ACQUISITION $ 251,500,000 34 INDUSTRY TARGET DEBT/EQUITY 95/100 251.5M=1.95X X= 12897435 9 TARGETED DEBT $ 122,525,641 TARGETED EQUITY $ 128,974,359 FINANCED WITH DEBT $ 88,525,641 71% FINANCED WITH ISSUING SHARES $ 36,474,359 29% $ 125,000,000 100 % TOTAL VALUE OF WLT 35 Appendix 10: Strategy Map 36 Appendix 11: GANTT Chart Y1 Y2 Y3 Implementation of the recommendation Negotiation with suppliers and formation of synergy Implementation of certain policies to meet industry average, improve workers training, and standardize salary of workers and quality of services towards residents Increase in revenue by 5% per year per resident Revision of unprofitable homes (occupancy rates with less than 80%). Invest earnings into marketing and quality of service if needed to break-even. 37 Y4 Y5 Reference List Aging. (2019). 7 Ways Technology Has Improved Senior Care. Retrieved from https://www.aging.com/7-ways-technology-has-improved-senior-care/ A Place For Mom. (2019). How to Pay for Senior Housing in Canada? Retrieved from https://www.aplaceformom.com/canada/how-to-pay-for-senior-housing Babalola O. (2017). Consumers and Their Demand for Healthcare. J Health Med Econ. Vol. 3 No. 1:6 Retrieved from http://health-medicaleconomics.imedpub.com/consumers-and-their-demand-for-healthcare.php?aid=21061 Canadian Dimension (2018). Don’t Blame Seniors for Rising Healthcare Costs. Retrieved from https://canadiandimension.com/articles/view/dont-blame-seniors-forrising-healthcare-costs Claxton, Gary & Sawyer, Bradley. (2019). How do Health Expenditures Vary Across the Population? Retrieved from https://www.healthsystemtracker.org/chart-collection/healthexpenditures-vary-across-population/#item-most-of-the-population-reports-being-ingood-or-better-health_2016 CIHI. (2018). Has the Share of Health Spending on Seniors Changed? Retrieved from https://www.cihi.ca/en/has-the-share-of-health-spending-on-seniors-changed-2017 Comfort Life. (2019). Government Assistance for Seniors in a Retirement Home. Retrieved from https://www.comfortlife.ca/retirement-communities/government-help-to-pay-for-your-retirementresidence Comfort Life. (2019). Our Aging Population Statistics. Retrieved from https://www.canada.ca/en/financial-consumer-agency/services/retirement-planning/cost-seniorshousing.html#toc2 EPA United States Environmental Protection Agency. (2016). Climate Change and the Health of Older Adults. Retrieved from https://www.cmu.edu/steinbrenner/EPA%20Factsheets/olderadults-health-climate-change.pdf 38 Government of Canada. (2014). Action for Seniors Report. Retrieved from https://www.canada.ca/en/employment-social-development/programs/seniors-action-report.html Government of Canada. (2016). Research and business intelligence: Financial performance data. Retrieved from https://www.ic.gc.ca/app/sme-pme/bnchmrkngtl/rprt-flw.pub?execution=e1s3 Government of Canada. (2019). Housing Options for Seniors. Retrieved from https://www.canada.ca/en/financial-consumer-agency/services/retirement-planning/cost-seniorshousing.html#toc2 IBIS World. (2019). Competitive Landscape Key Success Factors. Retrieved from https://clients1-ibisworld-ca.libezproxy.concordia.ca/reports/us/industry/competitivelandscape.aspx?entid=5597 Schroeder, Steven. (2018). How Much Should a Business Appraisal Cost? Retrieved from https://www.inc.com/articles/2003/07/25684.html Kurman, Offit. (2016). M&A FAQs: How Much Does M&A Cost? Retrieved from https://www.offitkurman.com/blog/2016/08/17/ma-faqs-how-much-does-ma-cost/ Prime Corp. (2017). Demand Outpacing Supply in Ontario’s Seniors Housing Market for 2017. Retrieved from https://www.primecorp.ca/newsroom/2017/11/demand-is-growing-greater-thansupply-for-seniors-housing-ontario-2017/ Quilty, David. (2011). 9 Effects of the Recession on Families and How to Cope. Retrieved from https://www.moneycrashers.com/effects-recession-families/ Shore, Randy. (2018). Seniors Care in B.C. Months in Hospital Waiting for Residential Care Not Uncommon. Retrieved from https://vancouversun.com/news/local-news/five-months-in-ahospital-waiting-for-residential-care United Nations. (2017). World Population Ageing. Retrieved from https://www.un.org/en/development/desa/population/publications/pdf/ageing/WPA2017_Highligh ts.pdf 39