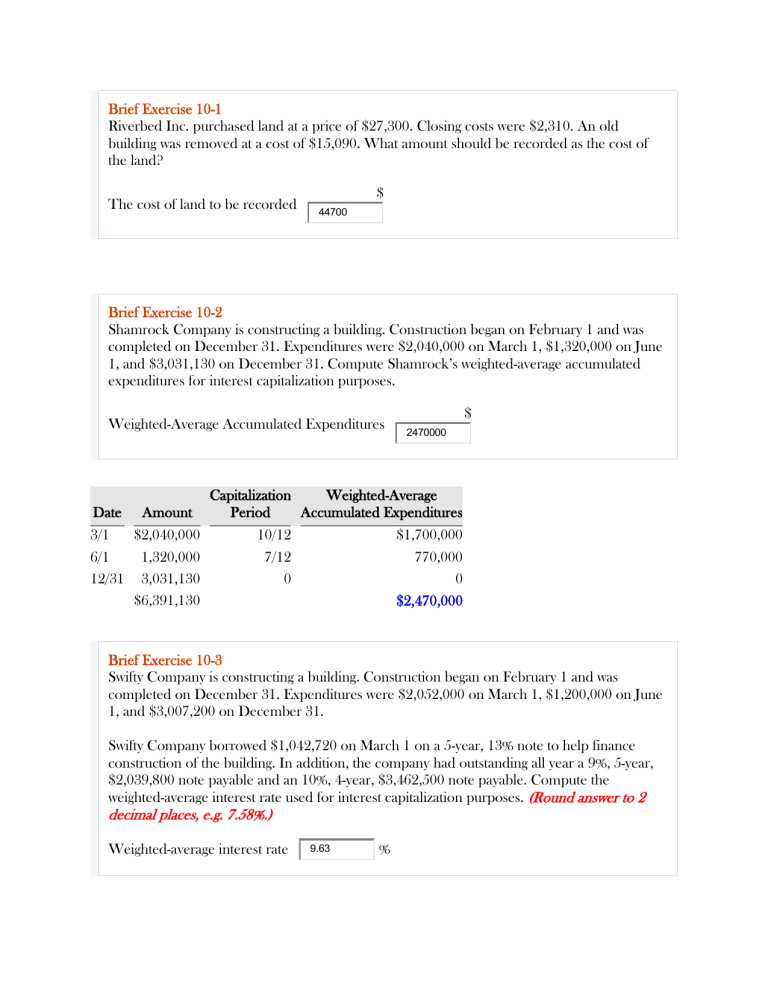

Brief Exercise 10-1 Riverbed Inc. purchased land at a price of $27,300. Closing costs were $2,310. An old building was removed at a cost of $15,090. What amount should be recorded as the cost of the land? The cost of land to be recorded $ 44700 Brief Exercise 10-2 Shamrock Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,040,000 on March 1, $1,320,000 on June 1, and $3,031,130 on December 31. Compute Shamrock’s weighted-average accumulated expenditures for interest capitalization purposes. Weighted-Average Accumulated Expenditures Date Amount 3/1 $2,040,000 6/1 1,320,000 12/31 3,031,130 $6,391,130 $ 2470000 Capitalization Weighted-Average Period Accumulated Expenditures 10/12 7/12 0 $1,700,000 770,000 0 $2,470,000 Brief Exercise 10-3 Swifty Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,052,000 on March 1, $1,200,000 on June 1, and $3,007,200 on December 31. Swifty Company borrowed $1,042,720 on March 1 on a 5-year, 13% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,039,800 note payable and an 10%, 4-year, $3,462,500 note payable. Compute the weighted-average interest rate used for interest capitalization purposes. (Round answer to 2 decimal places, e.g. 7.58%.) Weighted-average interest rate 9.63 % Principal Interest 9%, 5-year note $2,039,800 $183,582 10%, 4-year note 3,462,500 346,250 $5,502,300 $529,832 Weighted-average interest rate = $529,832 = 9.63% $5,502,300 Brief Exercise 10-4 Novak Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $2,064,000 on March 1, $1,212,000 on June 1, and $3,017,300 on December 31. Novak Company borrowed $1,158,300 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 10%, 5-year, $2,118,200 note payable and an 11%, 4-year, $3,544,100 note payable. Compute avoidable interest for Novak Company. Use the weighted-average interest rate for interest capitalization purposes. (Round percentages to 2 decimal places, e.g. 2.51% and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest Date Amount 3/1 $2,064,000 6/1 1,212,000 12/31 3,017,300 $6,293,300 $ 273859 Capitalization Weighted-Average Period Accumulated Expenditures 10/12 7/12 0 $1,720,000 707,000 0 $2,427,000 Principal Interest 10%, 5-year note $2,118,200 $211,820 11%, 5-year note 3,544,100 389,851 $5,662,300 $601,671 Weighted-average interest rate = $601,671 = 10.63% $5,662,300 Weighted-Average Accumulated Expenditures Interest Avoidable × Rate = Interest $1,158,300 12% $138,996 1,268,700 10.63% 134,863 $2,427,000 $273,859 Brief Exercise 10-5 Riverbed Corporation purchased a truck by issuing an $100,800, 5-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 11%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Trucks 59820 Discount on N 40980 Notes Payable Credit 100800 Trucks = ($100,800 x 0.59345) = $59,820 (See table 6.2 for PVFn,i) Brief Exercise 10-6 Shamrock Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $434,700. The estimated fair values of the assets are land $82,800, building $303,600, and equipment $110,400. At what amounts should each of the three assets be recorded? (Round intermediate percentage calculations to 5 decimal places e.g. 18.25124 and final answers to 0 decimal places, e.g. 5,275.) Recorded Amount Land Building Equipment $ 72450 $ 265650 $ 96600 Fair Value % of Total Cost Recorded Amount Land $82,800 82.80/496.80 × $434,700 $72,450 Building 303,600 303.60/496.80 × $434,700 265,650 Equipment 110,400 110.40/496.80 × $434,700 96,600 $496,800 $434,700 Brief Exercise 10-7 Cullumber Company obtained land by issuing 3,370 shares of its $20 par value common stock. The land was recently appraised at $172,760. The common stock is actively traded at $50 per share. Prepare the journal entry to record the acquisition of the land. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Land Land Debit Credit 168500 Common Stock 67400 Paid-in Capital 101100 = (3,370 × $50) = $168,500 Common Stock = (3,370 × $20) = $67,400 Brief Exercise 10-8 Stellar Corporation traded a used truck (cost $23,600, accumulated depreciation $21,240) for a small computer with a fair value of $3,894. Stellar also paid $590 in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Equipment 3894 Accumulated D 21240 Credit Gain on Dispo 944 Cash 590 Trucks 23600 Brief Exercise 10-9 Larkspur Corporation traded a used truck (cost $20,000, accumulated depreciation $18,000) for a small computer worth $4,158. Larkspur also paid $630 in the transaction. Prepare the journal entry to record the exchange, assuming the exchange lacks commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Equipment 2630 Accumulated D 18000 Credit Cash 630 Trucks 20000 Equipment = ($4,158 – $1,528) = $2,630 Brief Exercise 10-10 Tamarisk Company traded a used welding machine (cost $12,420, accumulated depreciation $4,140) for office equipment with an estimated fair value of $6,900. Tamarisk also paid $4,140 cash in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Equipment 6,900 Accumulated D 4,140 Loss on Dispo 5,520 Credit Machinery 12,420 Cash 4,140 Brief Exercise 10-11 Monty Company traded a used truck for a new truck. The used truck cost $46,500 and has accumulated depreciation of $41,850. The new truck is worth $57,350. Monty also made a cash payment of $55,800. Prepare Monty’s entry to record the exchange. (The exchange lacks commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Trucks (new ) 57,350 Accumulated Depreciation-Trucks 41,850 Loss on Disposal of Trucks 3,100 Credit Trucks (used) 46,500 Cash 55,800 Brief Exercise 10-12 Skysong Corporation traded a used truck for a new truck. The used truck cost $24,200 and has accumulated depreciation of $20,570. The new truck is worth $42,350. Skysong also made a cash payment of $39,930. Prepare Skysong’s entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Trucks (new ) 42,350 Accumulated Depreciation-Trucks 20,570 Loss on Disposal of Trucks 1,210 Credit Trucks (used) 24,200 Cash 39,930 Brief Exercise 10-13 Indicate which of the following costs should be expensed when incurred. (a) $13,000 paid to rearrange and reinstall machinery. No (b) $200,000 paid for addition to building. No (c) $200 paid for tune-up and oil change on delivery truck. Yes (d) $7,000 paid to replace a wooden floor with a concrete floor. No (e) $2,000 paid for a major overhaul on a truck, which extends the useful life. No Brief Exercise 10-14 Culver Corporation owns machinery that cost $24,000 when purchased on July 1, 2014. Depreciation has been recorded at a rate of $2,880 per year, resulting in a balance in accumulated depreciation of $10,080 at December 31, 2017. The machinery is sold on September 1, 2018, for $12,600. Prepare journal entries to (a) update depreciation for 2018 and (b) record the sale. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation (a) Depreciation E Debit 1,920 Accumulated D (b) Credit 1,920 Cash 12,600 Accumulated D 12,000 Machinery 24,000 Gain on Dispo 600 (a) Depreciation Expense = ($2,880 × 8/12) = $1,920 (b) Accumulated Depreciation-Machinery = ($10,080 + $1,920) = $12,000 Brief Exercise 10-15 Carla Corporation owns machinery that cost $25,600 when purchased on July 1, 2014. Depreciation has been recorded at a rate of $3,072 per year, resulting in a balance in accumulated depreciation of $10,752 at December 31, 2017. The machinery is sold on September 1, 2018, for $6,656. Prepare journal entries to (a) update depreciation for 2018 and (b) record the sale. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit (a) Depreciation E 2,048 Accumulated D (b) 2,048 Cash 6,656 Loss on Dispo 6,144 Accumulated D 12,800 Machinery 25,600 (a) Depreciation Expense = ($3,072 × 8/12) = $2,048 (b) Accumulated Depreciation-Machinery = ($10,752 + $2,048) = $12,800 Exercise 10-1 The expenditures and receipts below are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(280,800 ) (b) Payment for construction from note proceeds (c) Cost of land fill and clearing (d) Delinquent real estate taxes on property assumed by purchaser (e) Premium on 6-month insurance policy during construction 12,360 (f) Refund of 1-month insurance premium because construction completed early (2,060 ) (g) Architect’s fee on building 28,020 (h) Cost of real estate purchased as a plant site (land $208,600 and building $50,000) (i) Commission fee paid to real estate agency 8,480 (j) Installation of fences around property 3,960 (k) Cost of razing and removing building 10,190 (l) Proceeds from salvage of demolished building (4,840 ) 280,800 12,020 7,470 258,600 (m) Interest paid during construction on money borrowed for construction 12,880 (n) Cost of parking lots and driveways 18,540 (o) Cost of trees and shrubbery planted (permanent in nature) 13,540 (p) Excavation costs for new building 3,100 Identify each item by letter and list the items in columnar form, using the headings shown below. All receipt amounts should be reported in parentheses. (Enter receipt amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Item (a) Land $enter a dollar amount Land Improvements $enter a dollar amount Building $enter a dollar amount Other Non-Property, Plant, and Equipment $enter a dollar amount (280,800) (b) enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 280,800 (c) enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 12,020 (d) enter a dollar amount 7,470 (e) enter a dollar amount 12,360 (f) enter a dollar amount enter a dollar amount enter a dollar amount (2,060) enter a dollar amount (g) enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 28,020 (h) enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 258,600 (i) enter a dollar amount 8,480 (j) enter a dollar amount 3,960 (k) enter a dollar amount 10,190 (l) enter a dollar amount (4,840) (m) enter a dollar amount 12,880 (n) enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 18,540 (o) enter a dollar amount 13,540 (p) enter a dollar amount 3,100 No PPE accounts are affect by the transaction in (a). The entry would be: Debit Cash Notes Payable Credit 275,000 275,000 Exercise 10-4 Sweet Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year 2017. Purchase Cash paid for equipment, including sales tax of $6,900 $144,900 Freight and insurance cost while in transit 2,760 Cost of moving equipment into place at factory 4,278 Wage cost for technicians to test equipment 5,520 Insurance premium paid during first year of operation on this equipment 2,070 Special plumbing fixtures required for new equipment Repair cost incurred in first year of operations related to this equipment 11,040 1,794 Construction Material and purchased parts (gross cost $276,000; failed to take 2% cash discount) Imputed interest on funds used during construction (stock financing) Labor costs $276,000 19,320 262,200 Allocated overhead costs (fixed-$27,600; variable-$41,400) 69,000 Profit on self-construction 41,400 Cost of installing equipment 6,072 Compute the total cost for each of these two pieces of equipment. $ Purchase equipment 168,498 $ Construction equipment 607,752 Purchase Cash paid for equipment, including sales tax of $6,900 Freight and insurance while in transit Cost of moving equipment into place at factory Wage cost for technicians to test equipment Special plumbing fixtures required for new equipment Total cost $144,900 2,760 4,278 5,520 11,040 $168,498 The insurance premium paid during the first year of operation of this equipment should be reported initially as prepaid insurance and then adjusted to insurance expense, and not be capitalized. Repair cost incurred in the first year of operations related to this equipment should be reported as repair and maintenance expense, and not be capitalized. Both these costs relate to periods subsequent to purchase. Construction Material and purchased parts ($276,000 × 0.98) $270,480 Labor costs 262,200 Overhead costs 69,000 Cost of installing equipment 6,072 Total cost $607,752 Note that the cost of material and purchased parts is reduced by the amount of cash discount not taken because the equipment should be reported at its cash equivalent price. The imputed interest on funds used during construction related to stock financing should not be capitalized or expensed. This item is an opportunity cost that is not reported. Profit on self-construction should not be reported. Profit should only be reported when the asset is sold. Exercise 10-5 Vaughn Supply Company, a newly formed corporation, incurred the following expenditures related to Land, to Buildings, and to Machinery and Equipment. Abstract company’s fee for title search $884 Architect’s fees 5,389 Cash paid for land and dilapidated building thereon Removal of old building Less: Salvage 147,900 $34,000 9,350 24,650 Interest on short-term loans during construction 12,580 Excavation before construction for basement 32,300 Machinery purchased (subject to 2% cash discount, which was not taken) 93,500 Freight on machinery purchased 2,278 Storage charges on machinery, necessitated by noncompletion of building when machinery was delivered 3,706 New building constructed (building construction took 6 months from date of purchase of land and old building) 824,500 Assessment by city for drainage project 2,720 Hauling charges for delivery of machinery from storage to new building 1,054 Installation of machi3nery 3,400 Trees, shrubs, and other landscaping after completion of building (permanent in nature) 9,180 Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Company uses net method to record discount. (Please leave spaces blank if there is no answer. Do not enter zeros in those spaces.) Land Buildings $ Abstract company’s fee for title search Machinery and Equipment Other $ $ $ 884 5,389 Architect’s fees Cash paid for land and old building 147,900 Removal of old building 24,650 Interest on short-term loans during construction 12,580 Excavation before construction for basement 32,300 Machinery purchased 91,630 Freight on machinery purchased 2,278 1,870 3,706 Storage charges on machinery 824,500 New building constructed Assessment by city for drainage project 2,720 1,054 Hauling charges 3,400 Installation of machinery Trees, shrubs, and other landscaping 9,180 $ 185,334 Exercise 10-7 $ 874,769 $ $ 97,308 6,630 Stellar Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,800 on January 1, 2017. Stellar expected to complete the building by December 31, 2017. Stellar has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2016 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2018 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2021 $1,994,600 1,593,100 995,900 Assume that Stellar completed the office and warehouse building on December 31, 2017, as planned at a total cost of $5,236,900, and the weighted-average amount of accumulated expenditures was $3,795,900. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final answers to 0 decimal places, e.g. 5,275.) $ Avoidable Interest 426,327 Avoidable Interest Weighted-Average Interest Avoidable Accumulated Expenditures × Rate = Interest $1,994,600 12% $239,352 1,801,300 10.38% 186,975 $3,795,900 $426,327 Weighted-average interest rate computation 10% short-term loan Principal Interest $1,593,100 $159,310 11% long-term loan 995,900 109,549 $2,589,000 $268,859 Total Interest $268,859 = Total Principal $2,589,000 = 10.38% Compute the depreciation expense for the year ended December 31, 2018. Stellar elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $302,700. (Round answer to 0 decimal places, e.g. 5,275.) Depreciation Expense $ 178,684 Actual Interest Construction loan $1,994,600 × 12% = $239,352 Short-term loan $1,593,100 × 10% = 159,310 Long-term loan $995,900 × 11% = 109,549 Total $508,211 Because avoidable interest is lower than actual interest, use avoidable interest. Cost $5,236,900 Interest capitalized 426,327 Total cost $5,663,227 $5,663,227 – $302,700 Depreciation Expense = 30 years = $178,684 Exercise 10-11 Ivanhoe Engineering Corporation purchased conveyor equipment with a list price of $10,800. Presented below are three independent cases related to the equipment. (a) Ivanhoe paid cash for the equipment 8 days after the purchase. The vendor’s credit terms are 2/10, n/30. Assume that equipment purchases are initially recorded gross. (b) Ivanhoe traded in equipment with a book value of $1,900 (initial cost $7,200), and paid $9,300 in cash one month after the purchase. The old equipment could have been sold for $300 at the date of trade. (The exchange has commercial substance.) (c) Ivanhoe gave the vendor a $11,400 zero-interest-bearing note for the equipment on the date of purchase. The note was due in one year and was paid on time. Assume that the effectiveinterest rate in the market was 8%. Prepare the general journal entries required to record the acquisition and payment in each of the independent cases above. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation (a) Equipment Debit Credit 10,800 Accounts Payable 10,800 (To record the purchase of equipment on account.) Accounts Payable 10,800 Equipment 216 Cash 10,584 (To record the payment on account.) (b) Equipment (New ) 9,600 Loss on Disposal of Equipment 1,600 Accumulated Depreciation- Equipment 5,300 Accounts Payable 9,300 Equipment (Old) 7,200 (To record the purchase of equipment on account.) Accounts Payable 9,300 Cash 9,300 (To record the payment on account.) (c) Equipment 10,556 Discount on Notes Payable 844 Notes Payable (To record the purchase of equipment with a note.) 11,400 Interest Expense 844 Notes Payable 11,400 Discount on Notes Payable 844 Cash 11,400 (To record the payment of the note.) (a) Equipment = ($10,800 × 0.02) = $216 (b) Accumulated Depreciation-Equipment = ($7,200 – $1,900) = $5,300 Cost $7,200 Less: Accumulated depreciation 5,300 Book value of equipment (old) 1,900 Less: Fair value of equipment (old) 300 Loss on disposal of equipment $1,600 Cost ($9,300 + $300) $9,600 (c) Equipment = ($11,400 × 0.92593) = $10,556 Discount on Notes Payable = ($11,400 – $10,556) = $844 Exercise 10-16 Pina Industries purchased the following assets and constructed a building as well. All this was done during the current year. Assets 1 and 2: These assets were purchased as a lump sum for $340,000 cash. The following information was gathered. Description Initial Cost on Seller’s Books Depreciation to Date on Seller’s Books Book Value on Seller’s Books Appraised Value Machinery $340,000 $170,000 $170,000 $306,000 Equipment 204,000 34,000 170,000 102,000 Asset 3: This machine was acquired by making a $34,000 down payment and issuing a $102,000, 2-year, zero-interest-bearing note. The note is to be paid off in two $51,000 installments made at the end of the first and second years. It was estimated that the asset could have been purchased outright for $122,060. Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Facts concerning the trade-in are as follows. Cost of machinery traded $340,000 Accumulated depreciation to date of sale 136,000 Fair value of machinery traded 272,000 Cash received Fair value of machinery acquired 34,000 238,000 Asset 5: Equipment was acquired by issuing 100 shares of $27 par value common stock. The stock had a market price of $37 per share. Construction of Building: A building was constructed on land purchased last year at a cost of $510,000. Construction began on February 1 and was completed on November 1. The payments to the contractor were as follows. Date Payment 2/1 $408,000 6/1 1,224,000 9/1 1,632,000 11/1 340,000 To finance construction of the building, a $2,040,000, 12% construction loan was taken out on February 1. The loan was repaid on November 1. The firm had $680,000 of other outstanding debt during the year at a borrowing rate of 8%. Record the acquisition of each of these assets. (Round intermediate calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Acquisition of Assets 1 and 2 Machinery 255,000 Equipment 85,000 Cash 340,000 Acquisition of Asset 3 Machinery 122,060 Discount on N 13,940 Cash 34,000 Notes Payable 102,000 Acquisition of Asset 4 Machinery 178,500 Accumulated D 136,000 Cash 34,000 Machinery 340,000 Gain on Dispo 8,500 Acquisition of Asset 5 Equipment 3,700 Common Stock 2,700 Paid-in Capital 1,000 (To record acquisition of Office Equipment) Land 510,000 Buildings 3,780,460 Cash 4,114,000 Interest Expen 176,460 PINA INDUSTRIES Acquisition of Assets 1 and 2 Use appraised values to break-out the lump-sum purchase Description Appraisal Percentage Lump-Sum Value on Books Machinery $ 306,000 306/408 340,000 255,000 Equipment 102,000 102/408 340,000 85,000 $ 408,000 Acquisition of Asset 3 Use the cash price as a basis for recording the asset with a discount recorded on the note. Discount on Notes Payable = ($136,000 – $122,060) = $13,940 Acquisition of Asset 4 Since the exchange lacks commercial substance, a gain will be recognized in the proportion of cash received ($34,000/$272,000) times the $68,000 gain (FMV of $272,000 minus BV of $204,000). The gain recognized will then be $8,500 with $59,500 of it being unrecognized and used to reduce the basis of the asset acquired. Machinery = ($238,000 – $59,500) = $178,500 Acquisition of Asset 5 In this case the Office Equipment should be placed on Pina’s books at the fair market value of the stock. The difference between the stock’s par value and its fair market value should be credited to Paid-in Capital in Excess of Par—Common Stock. Equipment = (100 × $37 per share) = $3,700 Common Stock = (100 shares × $27 par) = $2,700 Construction of Building Schedule of Weighted-Average Accumulated Expenditures Date February 1 February 1 June 1 September 1 November 1 Amount Current Year Weighted-Average Accumulated Capitalization Period Expenditures $510,000 408,000 1,224,000 1,632,000 340,000 $4,114,000 9/12 9/12 5/12 2/12 0/12 $382,500 306,000 510,000 272,000 0 $1,470,500 Note that the capitalization is only 9 months in this problem. Avoidable Interest Weighted-Average Accumulated Expenditures $1,470,500 Interest Rate × 12% Avoidable Interest = $176,460 The weighted expenditures are less than the amount of specific borrowing; the specific borrowing rate is used. Building Cost = ($3,604,000 + $176,460) = $3,780,460 Note to instructor: Total interest recorded / paid during the year on this borrowing would have been $183,600 ($2,040,000 X 12% X 9/12). The entry to record the capitalized interest will reverse the interest expense by $176,460, such that there will be interest expense on that borrowing of $7,140 ($183,600 - $176,460) recorded during the year. Exercise 10-23 Plant assets often require expenditures subsequent to acquisition. It is important that they be accounted for properly. Any errors will affect both the balance sheets and income statements for a number of years. For each of the following items, indicate whether the expenditure should be capitalized or expensed in the period incurred. Items (a) Improvement. Capitalized (b) Replacement of a minor broken part on a machine. Expensed (c) Expenditure that increases the useful life of an existing asset. Capitalized (d) Expenditure that increases the efficiency and effectiveness of a productive asset but does not increase its salvage value. Capitalized (e) Expenditure that increases the efficiency and effectiveness of a productive asset and increases the asset’s salvage value. Capitalized (f) Expenditure that increases the quality of the output of the productive asset. Capitalized (g) Improvement to a machine that increased its fair market value and its production capacity by 30% without extending the machine’s useful life. Capitalized (h) Ordinary repairs. Expensed Exercise 10-24 On December 31, 2017, Pina Inc. has a machine with a book value of $1,353,600. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value $1,872,000 518,400 $1,353,600 Depreciation is computed at $86,400 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fire completely destroys the machine on August 31, 2018. An insurance settlement of $619,200 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation August 31, 2018 Depreciation E Debit Credit 57,600 Accumulated D 57,600 (To record current depreciation.) August 31, 2018 Loss on Dispo 676,800 Cash 619,200 Accumulated D 576,000 Machinery 1,872,000 (To record loss of the machine.) Depreciation Expense = (8/12 × $86,400) = $57,600 Loss on Disposal of Machinery = ($1,872,000 – $576,000) – $619,200 = $676,800 Accumulated Depreciation—Machinery = ($518,400 + $57,600) = $576,000 On April 1, 2018, Pina sold the machine for $1,497,600 to Dwight Yoakam Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date April 1, 2018 Account Titles and Explanation Depreciation E Debit 21,600 Accumulated D 21,600 (To record current depreciation.) April 1, 2018 Credit Cash 1,497,600 Accumulated D 540,000 Machinery 1,872,000 Gain on Dispo 165,600 (To record sale of the machine.) Depreciation Expense = (3/12 × $86,400) = $21,600 Accumulated Depreciation—Machinery = ($518,400 + $21,600) = $540,000 Gain on Disposal of Machinery = [$1,497,600 – ($1,872,000 – $540,000)] = $165,600 On July 31, 2018, the company donated this machine to the Mountain King City Council. The fair value of the machine at the time of the donation was estimated to be $1,584,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date July 31, 2018 Account Titles and Explanation Depreciation E Debit Credit 50,400 Accumulated D 50,400 (To record current depreciation.) July 31, 2018 Contribution Ex 1,584,000 Accumulated D 568,800 Machinery 1,872,000 Gain on Dispo 280,800 (To record donation of the machine.) Depreciation Expense = (7/12 × $86,400) = $50,400 Accumulated Depreciation—Machinery = ($518,400 + $50,400) = $568,800 Gain on Disposal of Machinery = [$1,584,000 – ($1,872,000 - $568,800)] = $280,800