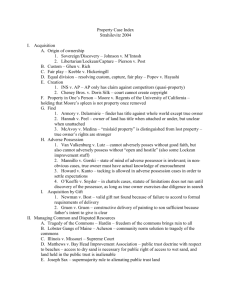

Professor Callies Sarah K. Kam Real Property I Part I: Sovereign Recognition of Private Property Rights 1. Defining Property: Some Basic Notions about Rights in Things Rights to Wild Animals Pierson v. Post (1805) Facts: π discovered a fox on wild and uninhabited land. In an attempt to capture the fox, π began to hunt and pursue the fox with his dogs. Even though Δ knew that π was hunting the fox, he killed the fox and took possession of it. π contends that he acquired title to the fox because he was the first to hunt it. Δ maintains that he acquired title to the fox because he killed the fox. Holding: Although Δ’s conduct was impolite and unkind, π did not have rights to the fox. Reasoning: If people could acquire property rights to animals in pursuit, there would be many quarrels and sources of litigation. This decision preserves peace and order in society. Rule: A hunter must either trap or mortally wound a wild animal in order to acquire title to it. Ghen v. Rich (1881) Facts: π shot and killed a whale, which sank to the bottom of the sea. Three days later Ellis found the whale on the shore and sold it to Δ. In killing the whale, π followed the local custom of Cape Cod. The custom is: Fishermen kill the whales with bomb-lances. Each fisherman’s lance leaves a unique brand so that the killer of the whale can be known. When the whales are killed, they sink to the bottom, but rise again to the surface in two or three days and eventually float ashore. When a whale floats ashore, the finder usually sends word to the killer. The killer retrieves the whale and usually pays a small fee to the finder. Holding: In this case title to the whale should be determined under custom but should be done so under very limited application. Reasoning: If usage is not sustained, the whaling industry would be destroyed. Rule: Title to a wild animal is acquired when a hunter apprehends the beast in accordance with custom. Finders of Lost Articles Benjamin v. Lindner Aviation, Inc (1995): Facts: Δ got ownership of a plane when owner defaulted on payments. Bank brought the plan in for an inspection to Δ2 (Lindner Aviation, π’s employer). π inspected it and found $18,000 hidden in the wing. π sued to keep it. 1 Professor Callies Sarah K. Kam Real Property I Holding: The money was mislaid. The bank has ownership against all but the true owner. Trial court’s decision to award a finder’s fee to π is reversed. Object Found in a Public Place: The finder of lost property holds it in trust for the benefit of the true owner, as a bailee. But the finder has rights superior to those of everyone except the true owner. Although the possessor of goods holds them in trust for the true owner, all states have statutes of limitations, at the end of which the true owner can no longer recover the good from the possessor. Usually, the statute of limitations does not start to run until the true owner knows or with reasonable diligence should know the possessor’s identity. Types of Found Property: (1) Lost: Owner accidentally and casually parted with possession and does not know where to find property. Finder entitled to possession against the world except the true owner. **Exceptions: If finder is a trespasser, employee, guest, or licensee or if property is found in a highly private locus or buried, owner of locus gets possessory rights. (2) Mislaid: Owner intentionally placed property in the sport where it is found and thereafter forgot it. Owner of premises entitled to possession against the world except the true owner because the owner might return to the locus looking for the item. (3) Abandoned: Owner voluntarily and intentionally relinquished ownership with intent to give up both title and possession. Finder obtains both possession and title if he exercises control over the property with intent to assert ownership. (4) Treasure Trove: Consists of coins or currency concealed by the owner. Must have been hidden or concealed for such a length of time that the owner is probably dead or undiscoverable. Belongs to the finder as against all but the true owner. Dayton, “Trust Fights Habitat Plans” pp. 8-9 Trust is fighting new plans by the federal government to declare trust lands in North Kona as critical habitat for two endangered species. Trust says that the habitat designation could cripple its plans to develop hundreds of acres of prime Kona real estate and would devastate the financial future of the estate. Is the land important to the recovery of the two plant species? Intent of the endangered species act is part of the Hawaiian tradition and a cultural approach to those issues. Trust says that land sacrificed to serve orphans and poor children should not be designated as critical habitat for plants. It is curious for the trust to put a shopping center ahead of protecting Hawaii’s culture. Tom Bethell, “Property Rights, Prosperity and 1000 Years of Lessons pp. 10-11 Private property is the guardian of every other right. Adam Smith-Property rights were to be held sacred and sacred things aren’t carefully examined. Marx-Insisted that private property should be abolished. Alfred Marshall-The need for private property reaches no deeper than the qualities of human nature. Private property is the long-hidden key to understanding economic history. 2 Professor Callies Sarah K. Kam Real Property I J.F. Garner, “Ownership and the Common Law” pp. 11-15 Ownership is the legal relationship between a person capable of owning and an object capable of being owned. Three basic rights of ownership: (1) The right to possess and enjoy (2) The right to alienate (3) The right to destroy. (1) The right to possess and enjoy is widest but may be limited by operation of the general law. (2) The right to alienate may be exercised in a number of ways. (3) Destruction of matter is not physically possible, but interests in intangibles can be destroyed by operation of law, by forfeiture or court order. Must feel that personal possessions are protected by the law if he is to enjoy any measure of freedom. Smith, “An Essay on Property Rights” pp. 16-23 Property definition #1: Dominion which one man claims and exercises over the external things of the world, in exclusion of every other individual. Property definition #2: It embraces every thing to which a man may attach a value and have a right; and which leaves to every one else the like advantage. (1) A free society cannot exist without the strong protection of individual property rights and the mechanism for their jealous protection. (2) No principle distinction can be made between political, religious, artistic, or personal liberty, and property rights or economic liberty. (3) We have as a society and legal system, at least since the progressive era, tended to be insensitive to property rights or economic liberty. Alberge, “Find in Field” pp. 24 David Rylett found the Wessex Jewel and since it was decided that it was abandoned, Mr. Rylett should be granted ownership. 2. Gifts Gift: A gift is a present transfer of property by one person to another without any consideration or compensation. (1) Gift inter vivos: A gift made during the donor’s life when the donor is under no impending threat of death. Required elements: Delivery of the property to the donee by transfer of possession and absolute dominion over the property. Present intention to make the gift. Donee must have complete control and dominion over the property. There must be evidence of complete delivery of title. Evidence to the continued enjoyment or maintenance of the property by the donor may speak to lack of complete transfer or title. Must be completed within the lifetime of the donor and are irrevocable. (Of course the donee could, if she wished, give it back.) (2) Gift causa mortis: A gift made in contemplation of immediately approaching death. A court may be more strict in the case of a gift causa mortis because there may be greater danger of fraudulent claims since th e donor is dead and cannot speak. Elements: 3 Professor Callies Sarah K. Kam Real Property I The gift must be made in apprehension of approaching death from existing sickness or peril. The donor must die from the contemplated sickness or peril. There must be actual, symbolic, or constructive delivery of the gift to the donee (stricter requirements than for inter vivos gifts). Present intention to make a gift. The gift is revocable at will. The gift is automatically revoked if the donor survives. The gift is revoked if the donor doesn’t die of the specific sickness or peril. A condition precedent to the gift invalidates it. (i.e. If I die, this is yours.) A condition subsequent validates the gift (i.e. This is yours so long as I die. Modern courts tend to disregard the distinction and focus on the donor’s intent. Three Requirements: There are three requirements for the making of a valid gift: (1) there must be a delivery from the donor to the donee; (2) the donor must possess intent to make a present gift; and (3) the donee must accept the gift. (1) Delivery: Control of the subject matter of the gift must pass from the donor to the donee. Therefore, a mere oral statement that a gift is being made will not suffice. Symbolic and Constructive Delivery: Delivery of something representing the gift, or of something that gives the donee a means of obtaining the gift, will suffice in the case of property which cannot be physically delivered (i.e. intangibles such as the right to collect a debt from another person) or which would be very inconvenient to deliver (i.e. heavy furniture). Delivery of something representing the gift, or of something that gives the donee a means of obtaining the gift, will suffice. Written Instrument: Most courts today hold that a written instrument (even if it’s not under seal) is a valid substitute for physical delivery of the subject matter of the gift. Reasons for the Delivery Requirement: (1) Protects the donor, (2) furnishes objective evidence of the donative intent of the donor and (3) furnishes the donee with concrete evidence to substantiate his claim. (2) Intent: The intent must be to make a present transfer, not a transfer to take effect in the future. (A promise to make a future gift is not enforceable because of lack of consideration). Present Gift of Future Enjoyment: However, a gift will be enforced if the court finds that it is a present gift of the right to the subject matter, even though the enjoyment of the subject matter is postponed to a later date. (3) Acceptance: The requirement that the gift be accepted by the donee has little practical importance. Even if the donee does not know of the gift (because delivery is made to a third person to hold for the benefit of the donee), the acceptance requirement is usually found to be met. However, if the donee repudiates the gift, then there is not gift. Hocks v. Jeremiah (1988): Facts: Robert Hocks (deceased) gave Jeremiah (D) a number of bonds and a diamond and put them all in a safe deposit box for D. Robert left two notes in the box bequeathing the contents to D. After Robert’s death, D removed the contents. P sues for replevin and conversion. Trial court dismissed P’s action. Holding: The evidence was insufficient to enable the trial court to find that Hocks made an inter vivos gift of the remaining contents. Handing over the sole key to a safe deposit box has usually been sufficient constructive delivery of the contents. But where the donor hands over one of two keys, and keeps the 4 Professor Callies Sarah K. Kam Real Property I other, the cases are divided as to whether this is constructive delivery. A number of courts have held that since the donor can still enter the box, the donor has not surrendered dominion and control. If the facts show that the donor did not, after delivering the key, go into the box, the case is stronger for a gift. Rule: Proof of a gift requires a showing that the donor made an actual or symbolic delivery of the property to the donee by the transfer of possession and absolute dominion over the property, accompanied by a manifested intention to make a present gift. Relevant Points: 1. Actual physical delivery is required. That’s why D didn’t get any of the things that Robert put into the box without actually physically giving them to her. 2. An action for replevin requires proof that D holds property that rightfully belongs to P. It is a defense that the D acquired the property as a gift. 3. Reasons for the requirement of delivery for a gift: a. Protects the donor because delivery indicates the finality of the action. b. Furnishes objective evidence of the donative intent of the donor. c. Furnishes the donee with concrete evidence to substantiate his claim. 4. The owner of personal property may make a valid gift thereof with the right of enjoyment in the donee postponed until the death of the donor, if the subject of the gift be delivered to a third person with the instruction to deliver it to the donee upon the donor’s death, and if the donor parts with all control over it, reserves no right to recall, and intends thereby a final disposition of the property given. 5. The notes indicated there was a lack of present intention to make the gift. Therefore, the gift was not inter vivos. Also unclear whether there was delivery (since 2 keys and both decedent and Jeremiah had access to safe deposit box. Also no release of control since in addition to access, he paid for and used the box, he continued to collect the interest on the bonds, he listed the bonds as his assets, Jeremiah understood that her interest would not become possessory until his death, and decedent’s notes indicate a belief that he owned the contents of the box, Matter of Cohn (1919): Facts: Leopold Cohn, in the presence of his entire family, in N.J., on his wife’s birthday, writes out and hands to his wife the following: “I give this day to my wife Sara as a birthday present 500 shares of Sumatra Tobacco Company stock. [signed] Leopold Cohn.” Cohn owns the stock, but it is in the name of his partnership and is in the firm’s safe deposit box in New York. The partnership has been dissolved but the shares have not yet been reregistered in Cohn’s name. Because it is impracticable to deliver the stock, the writing is a sufficient symbolic delivery and the gift is good. Caveat: This is a highly criticized case-How can you present a gift if you don’t have a right to possess? In this case there was legal impossibility. Holding: There was good constructive or symbolic delivery, consisting of the delivery of the instrument of gift, and the gift should be sustained. There was present, as evidenced by the writing of the deceased, not only the intention to then give, but also the intention to then deliver the thing given. The instrument of gift was a symbol which represented the donee’s right of possession. 5 Professor Callies Sarah K. Kam Real Property I Relevant Points: 1. In this case, the note evidenced an intention to then give the gift and an intention to then deliver the gift. It was only circumstance that stopped the delivery. 2. The note is an instrument of gift. 3. Generally, since a symbolical delivery is a substitute for delivery of the chattel itself, it can be resorted to only where delivery of the chattel itself is impossible or so inconvienient as to constitute an unreasonable burden. 4. Intestate: to die without leaving a will. Newman v. Bost (1898): Facts: O, lying on his deathbed, calls in his housekeeper, hands her the keys to all the furniture in the house, and says she is to have everything in the house. In his bedroom bureau, which one of the keys unlocks, is an insurance policy. O has not made a gift of the insurance policy because it is in the room where O lies dying and is capable of manual delivery. The housekeeper, however, receives as a gift all the furniture unlocked by the keys (either a constructive or symbolic delivery) because it is impractical to hand over the furniture manually. Rule: If you’re capable of delivery and there’s no delivery, then there’s no gift. Donatio Causa Mortis (whether factors met determined by jury): 1. An intention to make the gift; 2. A delivery of the thing given; and 3. Intention to give. McCarton v. Estate of Watson: Facts: π managed the apartment building where Δ, deceased, lived. As she sickened, π took her in. Δ gave π power of attorney and then specified, in front of witnesses, who to give her money to. It turns out that some of the stock certificates and bank books were nearby and Δ maybe could have hand delivered them. After Δ died, an earlier will was discovered which bequeathed her money to someone else. Trial court dismissed π’s complaint. Holding: Reversed and remanded. A gift causa mortis was established. Rule: A gift causa mortis is established when: 1. A gift is made in apprehension of approaching death from some existing sickness or peril. 2. The donor dies from such sickness or peril without having revoked the gift. 3. There is actual, constructive, or symbolical delivery of the gift to the donee or to someone for him. 4. The evidence reveals the donor’s present intent to pass title to the gift. Relevant Points: a. The delivery may be actual (possessory theory), constructive (evidentiary theory), or symbolical but it must be as perfect and complete as the nature of the property and the attendant circumstances and conditions will permit. 6 Professor Callies Sarah K. Kam Real Property I b. A gift causa mortis can be revoked up until death. 3. Defining Property: Intangibles Types of Intellectual Property: (1) (2) (3) (4) Patents-Useful invention that has utility and that is non-obvious and has to be novel. Copyrights Trademarks Trade secrets Right of Publicity Tennessee, ex rel. The Elvis Presley International Memorial Foundation v. Crowell: (Tenn. Ct. of App., 1987): Facts: P applied for the rights to use Elvis’ name and after being turned down, the Secretary of State granted the rights. The Presley estate then created The Elvis Presley Memorial Foundation. P sued to dissolve or enjoin the Presley estate (or its approved NPO) from using such a similar name. Trial court found that the Presley estate has Elvis’ descended right of publicity and granted summary judgment. Holding: Ct of App ruled that Elvis’ right of publicity was descendible under law. Rule: Right of publicity – an exclusive right in the individual plaintiff to a species of trade name, his own, and a kind of trademark in his likeness (Prosser). The right of publicity is intangible property because it has value and can be possessed and controlled. This right is descendible at death and is enforceable by the person’s estate. Relevant Points: 1. The right of publicity should be descendible because: a. It’s consistent with an individual’s right of testamentary distribution. b. “One may not reap where another has sown nor gather where another has strewn”. c. It’s consistent with a celebrity’s expectation that he is creating a valuable capital asset that will benefit his heirs and assigns. d. It recognizes the value of the contract rights of persons who have acquired the right to use a celebrity’s name and likeness. e. It furthers the public’s interest in being free from deception with regard to the sponsorship, approval, or certification of goods and services. Property in Ideas Downey v. General Foods: (NY Ct. of App., 1972): This is a DUH case!! 7 Professor Callies Sarah K. Kam Real Property I Facts: P submitted his idea to Jello-O suggesting that they call it Mr. Wiggly. D rejected the idea and three months later marketed the product. D produced evidence that they’d used the name “wiggle” in various forms for years. P moves for certified question. Holding: Reversed. Certified question answered in the negative, summary judgment dismissing the complaint granted. Rule: An idea can be property if it’s both novel and original. An idea may be a property right, but when one submits an idea to another, no promise to pay for its use may be implied, and no asserted agreement enforced, if the elements of novelty and originality are absent, since the property right in an idea is based upon these 2 elements. Despite an agreement, if the idea was not original and had been used before, the P could not recover for his idea (use of word “wiggle” was most obvious characteristic of jello and lacked novelty and originality. Also there was some indication the company had used the “wiggle” term years earlier) Ideas are NOT owned. Rule based in First Amendment. Allows expression without unreasonable restrictions. If ideas could be owned, would not be able to freely expound on ideas since someone else already had idea. You can contract to develop an idea (doesn’t mean you can exclude anyone else from coming up with the same idea) Editor’s note on p46 – “Idea Submittal Form” - negated any confidential relationship. Therefore no intellectual property rights were created. Copyright and Patent Holmes v. Hurst: (US S.Ct., 1899): Facts: P, executor of Holmes’ estate, sues for an injunction against D who collected chapters of a book Holmes wrote, published by chapter in the Atlantic Monthly, and published the chapters as a set, with a note saying they came from the magazine. The chapters were never copyrighted but the final book was after the chapters came out. Trial court dismissed and circuit court affirmed. Holding: Affirmed. Rule: The right of an author to a monopoly of his publications is measured and determined by statutes. Relevant Points: 1. The author’s right is to that arrangement of words which the author has selected to express his ideas. 2. Authority of Congress to legislate in the area of intellectual property stems from Art. I, Sec.8 of the Constitution which provides it with the power “to promote the progress of science and useful arts by securing for limited time to authors and inventors the exclusive right to their respective writings and discoveries”. 3. Serial rights – give someone the right to publish parts of a book (e.g., “snippets” to entice others to buy the book) 4. Compilations – Bringing together an arrangement of several individual works. 5. Under the existing copyright act at the time, “the author is only entitled to a copyright of books not printed and published; and … as a preliminary to the recording of a copyright, he 8 Professor Callies Sarah K. Kam Real Property I must, BEFORE publication, deposit a printed copy of the title of such book.” (Holmes published parts of the book before title was registered and filed copyright after published book.) 6. If you express an idea, it goes into the public domain unless you claim ownership to it first (Put up the fence!) News and Its Presentation National Basketball Association v. Motorola (1997): Facts: D makes a special pager that transmits NBA stats real time. Trial court granted NBA an injunction that stops D from transmitting. Holding: P’s claim is preempted. No injunction. Rule: A “hot-news” INS-style claim is limited to cases where: 1. P gathers or generates information at a cost. 2. The information is time sensitive. 3. D’s use of the information constitutes free-riding on the P’s efforts. 4. D is in direct competition with a product or service offered by the P. 5. The abilities of other parties to free-ride on the efforts of P or others would so reduce the incentive to produce the product or service that its existence or quality would be substantially threatened. Relevant Points: a. Facts cannot be owned (public domain) b. The “hot-news” claim comes from International News Service v. Associated Press where INS went to AP’s bulletin boards and “stole” the news and then relayed it to their own newspapers. Supreme Court held that INS’s conduct was a common law misappropriation of AP’s property. Expansion of Property to Use of Intangibles Commonwealth v. Lund: (1977): Facts: D was a Ph.D. student who Needed to use a computer for his dissertation. His faculty advisor didn’t set up an account for him so he just illegally used the computers. D was caught and found guilty of grand larceny. Holding: Reversed and the indictment is quashed. Rule: Intangibles are now actionable. Relevant Points: The statutes, at that time, defined larceny as the taking of tangible goods and chattels. Computer time didn’t fit the category, so it couldn’t be stolen. 9 Professor Callies Sarah K. Kam Real Property I 4. Defining Property: Land and the Right to Exclude Rights to Land Private ownership of land in the United States ordinarily originated in a grant from the sovereign. Although many private individuals took possession of land in the public domain, their ability to claim legal title to it came only after the sovereign ceded it to their ownership, usually through some form of sale. The American legal system has ultimately recognized only those claims that can be traced back to a sovereign grant. Plume v. Steward and Thompson (1854): Facts: This was an act of ejectment to recover a lot in the city of Marysville.. Covillaud and others possessed a tract of land. In that tract of land was the lot in dispute and Covillaud and the others had the right of possession. Covillaud did not abandon the property and continued to assert title and exercise acts of ownership. Seward is in possession of the land. Plume is the successor to title of Covillaud. Couvillad passes possession to Plume, but Seward is in possession. Cannot eject anyone who is in possession unless you have a superior right. Couvillad created a whole town with the land. Couvillad had undisputed occupancy of the land; evidence of title. There is no original transfer to Couvillad. Trial court entered a nonsuit. Holding: The evidence of the character of the possession, and the nature of the inclosure were before the jury, and they ought to have been allowed to pass on the sufficiency of them. Plume should have had the opportunity to prove his title/right to ownership from Couvillad. Rule: Possession is prima facie evidence of title and sufficient to maintain ejectment. Relevant Points: 1. In many cases, marking the boundaries of one’s land operates as notice and carries possession of the whole tract. The character of the markings depends on the locality. 2. Acts of ownership necessary to constitute possession – 3. “Must be an actual bona fide occupation, a possession pedis, a subjection to the will and control, as contradistinguished from the mere assertion of title, and the exercise of casual acts of ownership, such as recording deeds, paying taxes … it is sufficient if it [the property] be subject to his use …” 4. Examples – falling of timber around a tract of land, building of a brush fence Limitations on the Right to Exclude It is generally accepted that the essence of private property is the right of the owner to exclude othersthe right to exclusive possession. Courts have traditionally granted great protection to this right. The reason for this type of protection is that if A wants to enter B’s land, B should bargain with A for this right and not seize it. However, the right to exclude has some limitations when important rights of others become involved. 10 Professor Callies Sarah K. Kam Real Property I (1) Mistaken Improver: When a neighbor mistakenly improves land not his own, but believing it is his, the owner of the land might not be able to remove the encroachment. But if the encroachment is knowing and willful, the improver must remove the encroachment. (2) Civil Rights Law: Civil rights laws may prohibit persons offering public accommodations or housing from discriminating based on race, ethnic origin, religion, or other grounds. Kaiser Aetna v. United States (1979): Facts: Bishop Estate, in HI, leased an area which included Kuapa Pond to Kaiser (P). Army Corps. Of Engineers told P that they didn’t need to get permits to dredge the pond and make a marina called Hawaii Kai. P controlled and restricted use of the marina. In 1972, there was a dispute between P and D as to whether P was precluded from denying public access to the pond because as a result of P’s improvements, the pond was now connected to the ocean and was a navigable water of the United States, over which the government has control under the Commerce Clause. District Court held that the pond was navigable water but that the government couldn’t open it to the public without paying compensation. Holding: The court held that the respondent was required to compensate petitioners if it wanted to open the marina to public access. Reversed. Rule: The right to exclude is a fundamental property right that the government can’t take without making compensation. Relevant Points: Navigational servitude doesn’t create a blanket exception to the Takings Clause whenever Congress exercises its Commerce Clause authority to promote navigation. What is a “Taking”? The government can “take property” in various ways. Where the government does not formally condemn title, but government action harms a property owner, there are two categorical rules for determining whether there has been a taking: (1) Taking Title: If the government formally exercises the power of eminent domain, bringing a condemnation proceeding and taking title to the land, the government has taken the property and must pay for it. (2) Taking Possession: If the government takes permanent possession of property, without taking title, this is a constitutional taking which must be paid for. Taking possession, which the valuable thing, is the functional equivalent of depriving the owner of title. The power of the owner to exclude others is the essence of property. Any permanent physical invasion is a taking. Custom and Public Access Doctrine of Custom: As a source of law doctrine of custom required that the custom be: (1) ancient or of long and general usage, (2) that the right be exercised without interruption, (3) the use be peaceable and free from dispute, (4) the use be reasonable, (5) certain, (6) obligatory, and (7) not repugnant or inconsistent with other customers or laws. 11 Professor Callies Sarah K. Kam Real Property I State of Oregon, ex rel. Thornton v. Hay (1969): Facts: Appellants challenged a decree enjoining them from constructing any fences or improvements on the dry sand area of their beachfront property. On appeal, the court affirmed. Holding: The court recognized that Oregon Revised Statutes provided for the creation of prescriptive easements in beachfront property for public use. However, the court found that since prescription applied to specific pieces of property, the doctrine of custom supported the lower court’s decree. Affirmed. Rule: Custom: Such a usage as by common consent and uniform practice has become the law of the place, or of the subject matter to which it relates. The First Amendment and Public Access Pruneyard Shopping Center v. Robins(1980): Facts: D’s, high school students, were distributing leaflets in a main area of P’s shopping center. P’s security guards threw the kids out. California Superior Court found for P. California Court of Appeals affirmed. California Supreme Court reversed. Holding: Here the requirement that appellants permit appellees to exercise state protected rights of free expression and petition on shopping center property clearly does not amount to an unconstitutional infringement of appellant’s property rights under the Taking Clause. Appellants have failed to demonstrate that the “right to exclude others” is so essential to the use or economic value of their property that the state authorized limitation of it amounting to a taking. USSCt affirmed CASCt. Rule: A shopping center may use time, place, and manner regulations to restrict expressive activity and minimize interference with its commercial functions. Relevant Points: D’s use of P’s shopping center for an expressive activity doesn’t amount to a taking because D’s activities won’t unreasonably impair the value or use of P’s property as a shopping center. Note – It’s always possible for a state to expand a civil right. The US Constitution is the floor. Pruneyard can’t discretionarily exclude who they want but Callies can exclude whoever he wants on his private property. This is because the public is generally invited…students were generally invited to his property. Different situation if the protest was taking place in a small convenience store….would have to overcome the argument of economic interest. ECONOMIC INTEREST cannot be affected. Reasonableness. Can’t pick and choose is you are inviting everybody in unless it affects your economic interest extremely adversely. Problem if you are only charging this group and not i.e. the red cross, girl scouts and salvation army. 12 Professor Callies Sarah K. Kam Real Property I 5. Reasonable Use by the Owner: Nuisance and Support Nuisance Nuisance: An unreasonable interference with the use or enjoyment of land. Restatement §827 and 828: Weighs the gravity of the harm to the plaintiff against the defendant’s use. Regarding the plaintiff’s harm, the Restatement directs one to look at: (1) The character of the harm; (2) The social value of the use invade; and (3) The suitability of that use to the character of the area. The overriding question is: Is it reasonable for the defendant to be doing what he/she is doing where he/she is doing it? Types of Nuisances: (1) Private Nuisance: Involves an invasion of the interest in the enjoyment of land. (2) Public Nuisance: An interference with the rights of the public. (3) Nuisance Per Se: Conduct that is a nuisance itself (a house of prostitution). (4) Nuisance per accidents: Otherwise lawful conduct that is wrongful because of the particular circumstances of the case (where it is located). (Halfway houses and soup kitchens might be nuisances in residential areas, but are not nuisances per se. Private Nuisances: A landowner may sue another person for “private nuisance.” Private nuisance is an interference with a landowner’s use and enjoyment of his land. Substantial Interference: The interference with the π’s use and enjoyment must be substantial. Thus if π’s damage consists of his being inconvenienced or subjected to unpleasant smells, noises, etc., this will be “substantial” damage only if a person of normal sensitivity would be seriously bothered. Remedies: P can get an injunction and/or damages. Enjoined party may also collect damages from P. Bove v. Donner-Hanna Coke Corp (1932): Facts: P bought a house in a developing factory town. D operates a coke mill opposite P’s house. P alleges that the air is filthy, she’s getting unhealthy, and no one wants to rent out her rooms. P argued for nuisance per se. Trial court found for D. Holding: The trial court was amply justified in refusing to interfere with the operation of the defendant’s coke ovens. Non consideration of public policy or private rights demands any such sacrifice of this industry. Affirmed. 13 Professor Callies Sarah K. Kam Real Property I Rule: An owner is at liberty to use his property as he sees fit, without objection or interference from his neightbor, provided such use does not violate a statute. Exception to the general rule – An owner will not be permitted to make an unreasonable use of his premises to the material annoyance of his neighbor, if the latter’s enjoyment of life or property is materially lessened thereby. Relevant Points (key considerations when determining nuisance) Whether the use to which one puts his property is a nuisance is generally a question of fact, and depends on whether such use is reasonable under all the surrounding circumstances. The inconvenience caused must not be fanciful, slight, or theoretical, but certain and substantial, and must interfere with the physical comfort of the ordinary reasonable person. One who lives in the city is expected to endure the discomforts that accompany city life. In this case the plaintiff voluntarily chose to live in the smoke and turmoil of this industrial zone. This is some evidence at least that any annoyance which she has suffered from the dirt, gas, and odor which have emanated from defendant’s plant is more imaginary and theoretical than it is real and substantial. Δ’s plant is modern and up-to-date and as efficient as it can be. Even though π was there first, her property was in an area that was zoned as industrial…but growing community change is inevitable. π voluntarily moved into this area. Courts cannot override zoning decisions unless bad faith is involved. The Right to Support Generally: Every landowner is entitled to have his land receive the necessary physical support from adjacent and underlying soil. The right to support from adjoining soil is called the right of “lateral” support. The right to support from underneath the surface is known as the right to “subjacent” support. Lateral Support: The right to lateral support is absolute. Once support has been withdrawn and injury occurs, the responsible person is liable even if he used utmost care in his operation. Building: But the absolute right to lateral support exists only with respect to land in its natural state. If the owner has constructed a building, and the soil under the building subsides in part due to the adjacent owner’s acts, but also in part because of the weight of the building itself, the adjacent owner is not liable unless he has been negligence. (If π’s building is damaged, and he can show that his land would have been damaged even with no building on it, courts are split as to whether Δ is liable in the absence of negligence. Subjacent Support: The right to subjacent support arises only where sub-surface rights (i.e., mineral rights) are severed from the surface rights. When such a severance has taken place, the owner of the surface interest has the right not to have the surface subside or otherwise be damaged by the carrying out of the mining. Structures Existing: The surface owner has the absolute right to support, not only of the unimproved land, but also support of all structures existing on the date when the severance tookplace. Noone v. Price (1982): 14 Professor Callies Sarah K. Kam Real Property I Facts: In 1960, P’s bought a house on a hill. By 1964, the house was sliding down. D lived in an older house below P’s. There was a wall on D’s land that D had let fall into disrepair (although it was in disrepair when she bought the land). The wall was structurally placed to keep P’s house stable. Circuit court granted summary judgment. Holding: Adjacent landowner is obligated to support his neighbor’s property. If the support is insufficient and the land slips, the adjacent landowner is liable for both the damage to the land and the damage to any buildings that might be on the land. Reversed and remanded. The development of an appropriate factual record is required. Rule: Where an actor removes necessary support from land, he is liable for damage caused, and this liability can’t be avoided by transferring the land. Relevant Points: Many cases of lateral and subjacent support in Hawaii. May have an obligation to keep up the retaining wall regardless of your needs….have to consider the neighbors. Unreasonableness may lead to negligence. Δ was not required to strengthen the wall to the extent that it would provide support for the weight of π’s buildings. Δ only had the obligation to maintain the wall. Spur Industries v. Del E. Webb Development Co. (1972): Facts: Spur owned a cattle feedlot well outside Phoenix for years, but when Webb’s residential development grew to that area, Webb wanted the feedlot removed. P (developer of residential subdivision in close proximity to Ds operations) sought injunction to stop D from operating its feedlot because it was a public nuisance. Holding: SCt affirmed that D could be enjoined but also held that P must compensate/indemnify D for their loss. Rules: An otherwise lawful activity can becomes a nuisance because others have entered the area of activity, and thus be enjoined; if the party requesting the injunction, however, is the one that creates the need for the injunction, that party can be required to provide compensation for the cost of moving or shutting down the activity. Where the injury is slight, the remedy for minor inconveniences lies in an action for damages rather that in one for an injunction. Injunction appropriate where public nuisance is danger to public health (flies) Courts of equity also seek to protect the operator of a lawful, though noxious, business from the result of a knowing and willful encroachment by others near his business. 15 Professor Callies Sarah K. Kam Real Property I Relevant Points: In Hawaii there are right to farm laws-cannot shut down farms. Where Agriculture is still viable, what about the encroachment of residential areas-who are we going to make shut down? Where is the fairness? Does the lesser value operation move? What is the remedy? There should be a remedy no matter how small of an operation you are. The judgment of the trial court permanently enjoining the operation of the feedlot is affirmed. o Spur’s operation was an enjoinable public nuisance as far as the people in the southern portion of Del Webb’s Sun City were concerned. Can also be considered a private nuisance. o Public nuisance-Any condition or place in populous areas which constitutes a breeding place for flies, rodents, mosquitoes and other insects which are capable of carrying and transmitting disease-causing organisms to any person or persons. o Private Nuisance-One affecting a single individual or a definite small number of persons in the enjoyment of private rights not common to the public. o Del Webb, having shown a special injury in the loss of sales thereby giving them standing. A suit to enjoin a nuisance sounds in equity and the courts have long recognized a special responsibility to the public when acting as a court of equity. Having brought people to the nuisance to the foreseeable detriment of Spur, Webb must indemnify Spur for a reasonable amount of the cost of moving or shutting down: o The granting or withholding of relief may properly be dependent upon considerations of public interest. o Courts of equity are concerned with protecting the operator of a lawfully (albeit noxious) business from the result of a knowing and willful encroachment by others near his business. o “Coming to the nuisance”-Landowner may not have relief if he knowingly came into a neighborhood reserved for industrial or agricultural endeavors and has been damaged thereby. o Spur is required to move not because of any wrongdoing on the part of spur, but because of a proper and legitimate regard of the courts for the rights and interests of the public. o Del Webb is entitled to relief prayed for (a permanent injunction) because of the damage to the people who have been encouraged to purchase homes in Sun City. 6. Air, Water and Sunlight Rights to Water Four Kinds of Water Rights: (1) Prior Appropriation i. Water rights are obtained first-come-first-served. ii. Appropriators do not have to be riparian owners. iii. The water may only be appropriated for beneficial uses. iv. HI has abandoned this rule in favor of Riparian Rights. (Robinson) 16 Professor Callies Sarah K. Kam Real Property I (2) Riparian Rights: Rights to water afforded to owners of land abutting or touching a stream or lake. Only riparian owners have riparian rights. i. Natural Flow Theory 1. The riparian owner is entitled to have the water flow maintained in its natural state with respect to quality and quantity. 2. Landowners may use the water for natural purposes or for extraordinary needs when there is not material effect on the water and the use is in connection with the riparian land. ii. Reasonable Use Theory 1. Allows for full use of the watercourse in any way that is beneficial to the riparian owner provided that it doesn’t unreasonably interfere with the beneficial use of others. 2. There may be an alteration of the natural state of the water if the use is reasonable and there is no material effect on the reasonable use of another. 3. Courts are split as to whether it’s reasonable to use riparian rights water for parcels of land that are connected to riparian land. (3) Surface Water Rights: Diffused surface water that has no channel and just passes over the land. i. Common Enemy Rule: Surface water is a common enemy. A landowner may dispose of surface water in any manner the owner chooses (p109). A landowner is allowed to push surface water off his land by building a drainage channel or a dam. No cause of action arises from such use of the water unless it’s done with malice. ii. Civil Law Doctrine: An owner is subject to liability if he interferes with the natural flow of surface waters to the detriment of another in the use and enjoyment of the land. iii. Reasonableness of Use Rule: Each possessor is allowed to make reasonable use of his land, even though the flow of water is altered thereby and causes some harm to others. Liability is incurred only when the possessor’s use of his land is unreasonable and damage from surface water is caused thereby. To determine what is reasonable requires a balancing of interests. (Hawaii adopted this rule – Yonadi) (4) Underground Water Rights (Rules differ depending on whether water is moving or not) i. Underground Streams (p 110 water flowing in a distinct watercourse): Treated as though flowing on the surface. Therefore, follow either rules of riparianism or prior appropriation would apply.. ii. Percolating or Ground Water (p 110 underground water, but does not flow in any distinct direction): Waters that ooze, seep, and filter through soil beneath the surface without a defined channel or course, or in a course that’s not discoverable from surface observation without excavation. 1. Traditional Rule (p 110) – The surface owner is free to use as much water as he or she could pump out of the ground. 2. Modern Rule (p 110, p 18) – Reasonable use standard – Be used for nonwasteful purposes and that it not be transported away from the land from which it was extracted. A landowner can take as much as he can reasonably use as long as he does not cause unreasonable harm to his neighbors. He is liable for harm caused from the withdrawal of percolating water if it is not reasonably necessary for some useful purpose. 17 Professor Callies Sarah K. Kam Real Property I 3. English Rule: (Absolute Ownership Rule) A landowner may take as much water from below as he wants, so long as he doesn’t waste it or take it with malice. He is not liable for any resulting harm. 4. Correlative Rights: The rights of all landowners over a common source of percolating water are coequal and one cannot extract more than his share of water, even for use on his own land, where others rights are injured thereby. 5. Restatement 858A: A possessor of land who withdraws ground water from the land and uses it for a beneficial purpose is not liable for interference with the use of water by another, unless the withdrawal causes unreasonable harm. Evans v. Merriweather (1842): Facts: In 1834, Smith and Baker bought land with a branch of water on it and made a steam mill. One or two years later, Evans (D) bought adjacent land and built a steam mill and depended on the well and water branch to run his engine. Smith and Baker then sold their mill to Merriweather (P). There was a drought, the branch was insufficient to supply D with water. D’s hired hands disregarded D’s instructions not to divert any water and put up a dam and diverted the branch adversely affecting Ps operations (branch went dry). Trial court found for P (rendered a verdict of $150 and declared dam illegal). Holding: Affirmed. Rule: Where there is a common source of water, there must be reasonable use. True test of reasonable use principle is whether other proprietors are injured. Water flows in its natural course and should be permitted thus to flow, so that all through whose land it naturally flows may enjoy the privilege of using it. Relevant Points 1. People are allowed to use the water or else the branch would be useless. The test of the extent of use permissible is whether it is to the injury of the other proprietors or not. 2. Question as to how much each owner may use without infringing on the rights of others is left to the jury to decide as no fast rule can be made. Yonadi v. Homestead Country Homes: (1956) Facts: Yonadi (P) owns a golf course and restaurant. Homestead (D), a developer, erected new housing developments on land that was previously farmland. Prior to development surface water from the 40 acres naturally drained onto the Yonadi property. After development water run-off increased 3.5 times. This created a surface water flow onto P’s property. However, P’s filled in pipes that could have solved the problem and “hard-topped” a parking lot which increased surface water flow. Trial court followed common enemy rule and entered a mandate against P. Holding: Where surface water is concentrated through a drain or other artificial means and is conducted to some place substantially where it otherwise would have flowed, the defendant will not be liable even though by reason of improvements he has made in the land, the water is brought there in larger quantities and with greater force than would have occurred prior to the improvements. NJ Ap Div found for D (denied P’s application for recall of the mandate). Rule: 18 Professor Callies Sarah K. Kam Real Property I Neither the diversion nor the altered transmission, repulsion or retention of surface water gives rise to an actionable injury. Therefore, he who improves or alters land is not subjected to liability because of the consequences of his acts upon the flow of surface water. Common enemy rule - permits any landowner to dispose of surface water in any manner the owner chooses Reasonable use rule - permits each landowner to make reasonable use of his land even though he alters the flow of water thereby harming other landowners. Civil law rule – subjects a landowner to liability whenever the landowner interferes with the natural flow of surface water. Equities to D and P should be examined to see if use of land is actionable. Relevant Points: 1. App Ct did not recall mandate as to retroactively apply reasonable use rule. If reasonable use rule applied, developer would have had to factor in the drainage costs to the sale price of the homes. 2. In determining what constitutes reasonable use, courts usually attempt to balance the benefit derived by the (usually) upstream user against the harm suffered by the (usually) downstream owner, subject to the qualification that the downstream owner is always guaranteed sufficient water for his domestic needs. Kahana Sunset Owners Association v. The County of Maui: (1997): Facts: JGL Enterprises (one of Ds) applied for a Special Management Area permit to build multi-family residential homes at Napili. Maui Planning Commission (MPC) granted KSOA’s (P) petition to intervene. A contested case hearing over the SMA was held. MPC granted the SMA permit and concluded that no environmental assessment was required. KSOA appealed the granting of the SMA without an environmental assessment to the circuit court. Trial court upheld the MPC’s decisions (granting permit w/o EA). Holding: SCt vacated the granting of the SMA and held that an EA was required. SMA would be reconsidered after completion of the environmental assessment. Rule: COMMON ENEMY DOCTRINE (where it’s okay to cause surface water to flow in its natural direction) NO LONGER APPLIED IN HAWAII! Reasonable Use Rule (adopted by SCt in disposal of surface water) – Allows each possessor of land to alter the flow of surface water so long as his interference with the flow is not unreasonable under the circumstances of the particular case Rights to Natural Resources: Air Airspace: 19 Professor Callies Sarah K. Kam Real Property I Navigable Airspace: Airspace, apart from the immediate reaches above the land, is part of the public domain. The government has taken an easement in navigable airspace and it does not need to pay compensation. Private Ownership of Airspace: A landowner owns at least as much of the space above his land as he can occupy and use in connection with the land. The fact that he doesn’t occupy it is immaterial. Takings: Flights over private land are not a taking unless they are so low and so frequent as to be a direct and immediate interference with the enjoyment and use of the land. Whitesell v. Houlton (1981): Facts: Houlton (D) had a huge banyan tree in his yard and the branches extended onto Whitesell’s (P) land. Since D took no action after P requests, P rented equipment and cut the intruding branches, and repaired damages to his garage caused by the tree. Later Ps car was also damaged by branches hanging over the street. Trial court found for P and reimbursed P for his costs (cost of hiring tree trimmer split 50/50 between P and D). Holding: Non-noxious plants ordinarily are not nuisances. A landowner may always, at his own expense cut away only to his property line above or below the surface of the ground any part of the adjoining owner’s trees or other plant life. Affirmed for P. Rule: General Rule – Non-noxious plants ordinarily are not nuisances; Overhanging branches that cast shade or drop leaves/fruits are not nuisances. (Even if the overhanging branch causes large $ damages, it would not be a nuisance since the party could have cut the tree to the property line.) (Callies said this in class, but not sure of this still applies to HI) If the branches and roots from your neighbor’s tree offend you or your property, you must cut them back yourself. You may not require him to do so or to pay for the damages – Mass. Rule) If the owner knows or should know that his tree constitutes a danger, he is liable if it causes personal injury or property damage on or off his property. (Hawaii Rule). Such being the case, we think he is duty bound to take action to remove the danger before damage or further damage occurs. Overhanging branches or protruding roots are nuisances only when they cause or there is imminent danger of them causing sensible harm to non-plant property, other than through shade or dropping flowers, leaves, or fruit. (Modified VA rule adopted by HI) Relevant Points: 1. Non-noxious plants ordinarily aren’t nuisances. 2. Roots which interfere with other plant life only aren’t nuisances. 3. The harmed or threatened neighbor can recover damages and have the owner cut the tree back or after a reasonable time, he can cut it back himself and charge the owner. 20 Professor Callies Sarah K. Kam Real Property I 4. A neighbor can always cut a tree (above or below surface) back only to his property line at his own expense. He can also most likely harvest any fruit from a tree that extends over his property line. 5. Doesn’t say anything about standard of care and consequential damages…does not mention if you removed the roots and consequently the tree dies and crashes into a house…what will the court do? Rights to Natural Resources: Sunlight Right to Sunlight 1. Ancient Lights: Under this English doctrine, if a landowner had received sunlight across adjoining property for a specified period of time, the landowner was entitled to continue to receive unobstructed access to sunlight across the adjoining property. The landowner acquired a negative prescriptive easement and could prevent the adjoining landowner from obstructing access to light. This doctrine only applied to sunlight coming in through windows???. This doctrine has been repudiated in US courts. (Prah and notes p. 118) 2. Majority View: A property owner has no right to the free flow of sunlight and air across an adjoining property. Thus, there can be no claim or nuisance for obstruction of light. 3. Minority View: Obstruction of sunlight can be recognized as a basis for a nuisance claim. 4. Spite Fence Doctrine: The malicious obstruction of sunlight is an actionable nuisance. (Prah) 4. Policy Basis for Rejecting Access to Sunlight: a. Property rights are no longer considered to be absolute. Society has been seen to regulate the use of land for the general welfare. b. Sunlight is not just for illumination anymore but can be used as a source of energy. c. In the past, development was more encouraged. Now it’s restricted and controlled. Generally, a landowner has no right to sunlight. For instance, an owner almost never acquires an easement of “light and air” by implication or even by necessity. So if A and B are adjoining owners, B can, without liability, build in such a way that A’s sunlight is blocked. (But if A uses sunlight as a source of solar energy, it is possible that he might have a claim-perhaps in nuisance-against B for blocking that energy source by a tall building). Prah v. Maretti (1982): Facts: P constructed a residence in 1978-79 which functioned on solar power. D commenced construction on a house that met the Architectural Control Committee’s approval. However, D’s proposed house would cut off much of P’s sunlight. P sues, alleging that D’s house is a nuisance. Circuit court dismissed on a 12(b)(6). Holding: Dismissal is reversed. 21 Professor Callies Sarah K. Kam Real Property I Rule: That obstruction of access to light might be found to constitute a nuisance in certain circumstances does not mean that it will be or must be found to constitute a nuisance under all circumstances. The result in each case depends on whether the conduct complained of is unreasonable. Relevant Points 1. The rights of neighboring landowners are relative; the uses by one must not unreasonably impair the uses or enjoyment of the other. 2. Restatement 2nd Torts section 821(D): A private nuisance is a nontrespassory invasion of another’s interest in the private use and enjoyment of land. 3. Cujus est solum, ejus est usque ad coelum et ad infernos: The owner of land owns up to the sky and down to the center of the earth. 4. American courts honor express easements to sunlight. But an easement to light and air over adjacent property CANNOT be acquired by prescription or implication. 5. Spite fence cases – Courts will protect an owner from the malicious obstruction of access to light. 6. Wisconsin is the only state that’s granted a solar easement. Dissent: (Callow) a. “I firmly believe that a landowner’s right to use his property within the limits of ordinances, statutes, and restrictions of record where such use is necessary to serve his legitimate needs is a fundamental precept of a free society which this court should strive to uphold.” b. Solar heating is an “unusually sensitive use”, and P cannot, by devoting his own land to an unusually sensitive use, such as a drive in motion picture theater easily affected by light, make a nuisance out of conduct of the adjoining D which would otherwise be harmless. 7. Involuntary Transfers – Abandonment, Adverse Possession and Lien Enforcement Abandonment Definition: Abandonment is the intentional relinquishment of possession. If the possessor abandons the property for any period of time, without intent to return, continuity of adverse possession is lost. The adverse possession comes to an end, and possession returns constructively to the true owner. If the adverse possessor later returns, the statute of limitations begins to run anew. Maritime Law of Salvage: Historically, courts have apply this when ships or their cargo have been recovered from the bottom of the sea by those other than their owners. Under this law, the original owners still retain their ownership interests in such property, although the salvors are entitled to a very liberal salvage award. Such awards often exceed the value of the services rendered, and if no owner should come forward to claim the property, the salvor is normally awarded its total value. Law of salvage makes it more difficult for the finder to win. Common Law of Finds: “Finders Keepers.” Traditionally only applied to maritime property which had never been owned by anybody, such as ambergris, whales and fish. A relatively recent trend in the law has seen the law of finds applied to long lost and abandoned shipwrecks. Columbus-America Discovery Group v. Atlantic Mutual Insurance Co. (1992): 22 Professor Callies Sarah K. Kam Real Property I Facts: In 1857, the SS Central America sunk with a billion dollars in gold. P has been recovering the gold and wanted to be declared the owners. D’s were the original insurers of the gold. Trial court found for P, applying finds law based on D’s assumed abandonment. Holding: The lower court clearly erred when it found an abandonment and applied the law of finds. Reversed and remanded. Must apply law of salvage. Rule: Maritime law of salvage (same whether in intl or US waters) – re: when ships or their cargo recovered from bottom of sea by those other than their owners. Original owners still retain their ownership interests in such property. However the salvors are entitled to a very liberal salvage award (generally exceed the value of services rendered). And if no owner comes forward to claim the property, salvor is normally awarded its total value. When a previous owner claims long lost property that was involuntarily taken from his control, the law is hesitant to find an abandonment and such must be proved by clear and convincing evidence. Relevant Points 1. Modern courts apply law of salvage. 2. Courts in admiralty prefer applying salvage law than finds law. 3. Common law of finds, “finders keepers.” Traditionally only applied to maritime property which had NEVER been owned by anybody (ambergris – secretion from whale intestine, whales, and fish). Later applied to long lost and abandoned shipwrecks. 4. Under finds, true owner entitled to property first unless clearly abandoned. 5. Finds law - Courts apply to previously owned sunken property only when that property has been abandoned by its previous owners. Abandonment more than just leaving the property (since if lost at sea title of the owner still remains). Still no abandonment when one discovers property and, even after extensive efforts, is unable to locate the owner. 6. Abandonment – Voluntary act which must be proved by a clear and unmistakable affirmative act to indicate a purpose to repudiate ownership. STRONG PROOF REQUIRED. 7. Law of finds concerns title and thus encourages people to act secretively and hide their recoveries. 8. The law of salvage concerns the preservation of property on oceans and waterways. This encourages less competition and secrecy. 9. Once an article has been lost at sea, lapse of time and nonuser are not sufficient, in and of themselves, to constitute an abandonment. 10. An abandonment of sunken cargo so as to lose possession must be shown not by mere cessation of attempts to recover, but by the owner’s positive relinquishment of his rights in the property. Adverse Possession Function: All states have statutes of limitation that eventually bar the owner of the property from suing to recover possession from one who has wrongfully entered the property. (Suits to recover property are called “ejectment” suits). Once the limitations period has passed, the wrongful possessor effectively gets title to the land. This title is said to have been gained by “adverse possession.” Requirements: The possessor must satisfy four requirements to obtain title by adverse possession (1) he must actually possess the property, and this possession must be “open, notorious and visible”; (2) 23 Professor Callies Sarah K. Kam Real Property I the possession must be “hostile,” i.e., without the owner’s consent; (3) the possession must be continuous; and (4) the possession must be for at least the length of the statutory period (perhaps longer if the owner was under a disability). “Open, Notorious and Visible”: The possessor’s use of the property must be similar to that which typical owner of similar property would make. “Hostile” Possession: Possession must be without the owner’s consent. Bad Faith Possessor: A minority of courts impose the additional requirement that the possessor must have a bona fide belief that he has title to the property. Thus in these minority states, a mere “squatter” never gets title. Boundary Disputes: Adverse possession is most frequently used to resolve mistakes about the location of boundary lines. Most courts hold that one who possesses an adjoining landowner’s land, under the mistaken belief that he has only possessed up to the boundary of his own land, meets the requirement of “hostile” possession and can become an owner by adverse possession. Continuity of Possession: Adverse possession must be continuous throughout the statutory period, as a general rule. Interruption by Owner: If the owner reenters the property in order to regain possession, this will be an interruption of the adverse possession. When this happens, the adverse possessor must start his occupancy from scratch. Tacking: Possession by two adverse possessors, one after the other, may be “tacked” if the two are in “privity” with each other. Their periods of ownership can be added together for purposes of meeting the statutory period. No Privity: But if the two successive adverse possessors are not in “privity,” i.e., do not have some continuity of interest, then tacking will not be allowed. Length of Time: The length of the holding period for adverse possession varies from state to state but is usually 15 years or longer. Disabilities: If the true owner of property is under a disability, in nearly all states he is given extra time within which to bring an ejectment action. Tacking on Owner’s Side: There is effectively “tacking” on the owner’s as well as the possessor’s side. Rights of Adverse Possessor: Once the statutory period expires, the adverse possessor effectively gets title. However, the possessor usually cannot record title (since he has no deed). But he can apply for a judicial determination of adverse possession, and if he gets it, that determination can be recorded as if it were a deed. Need to Inspect: Since a title gained by adverse possession usually cannot be recorded, a buyer of property cannot be sure that the record owner still owns it (and that the record owner can therefore convey a good deed) unless the buyer physically inspects the property. Scope of Property Obtained: Normally, the possessor acquires title only to the portion of the property “actually” occupied. Constructive Adverse Possession: **Exception-by the doctrine of constructive adverse possession, one who enters property under “color of title” (i.e., a written instrument that is defective for some reason) will gain title to the entire area described in the instrument, even if he “actually” possesses only a portion. Conflicts: If there is a conflict between two person’s whose interests are solely possessory, the general rules is that the first possessor has priority over the subsequent one. 24 Professor Callies Sarah K. Kam Real Property I Rule of Mistaken Boundary: When an owner of land, by mistake as to the boundary line of his land, takes actual, visible, and exclusive possession of another’s land, and holds it as his own continuously for the statutory period of 20 years, he thereby acquires the title as against the real owner. Uniform Rule in Equity: The statute of limitation does not begin to run until the injured party discovers, or with reasonable diligence might have discovered, the facts constituting the injury and cause of action. Until then the owner cannot know that his possession has been invaded. Marengo Cave Co. v. Ross: Facts: Appellee and appellant were the owners of adjoining land. On appellant’s land was located the opening to a subterranean cavity known as the Marengo Cave. This cave extended under a considerable portion of appellant’s land, and the southeastern portion thereof extended under lands owned by appellee. Holding: Appellant’s possession for 20 years or more of that part of “Marengo Cave” underlying appellee’s land was not open, notorious, or exclusive as required by the law applicable to obtaining title to land by adverse possession. Rule: To establish a title by adverse possession: 1. The possession must be actual. 2. The possession must be visible and open to common observer. 3. The possession must be open and notorious. Mere possession not enough. Owner must have knowledge or possession must be so open, notorious and visible as to warrant inference that the owner must or should have known of it. 4. The possession must be exclusive. 2 or more persons cannot hold one tract of land adversely to each other at the same time. 5. The possession must be under claim of ownership and hostile to the owner of the legal title. 6. The possession must be continuous for the full period prescribed by the statute. Relevant Points a. An owner of land who stands by for the statutory period and makes no effort to protect his title from being occupied by another should not be allowed to maintain an action for recovery of his land, as long as all the elements of adverse possession were met. b. Visible possession: The nature and character is such as is calculated to apprise the world that the land is occupied and who the occupant is. c. Notorious possession: It must be so conspicuous that it is generally known and talked of by the public. “It must be manifest to the community.” d. To require an owner to take notice of a trespass on underground areas when it takes place is an impossibility, and to hold that the statute begins to run on the date of trespass is in most cases to take away the remedy of the injured party before he can know that an injury has been done to him. e. It has been the uniform rule in equity that the statute of limitation does not begin to run until the injured party discovers, or with reasonable diligence might have discovered, the facts constituing the injury and cause of action. Campbell v. Hipawai Corp. (1982): Facts: Dispute between landowners over location of common boundary between their properties. Campbell (P) contends possession of land (parcel 15) by virtue of royal patent and Hipawai (D) contends possession by conveyances and adverse possession. Parcel 15 was cultivated with parcel 14 since 1918 25 Professor Callies Sarah K. Kam Real Property I and parcel 15 was conveyed to D in 1968. D contents that the trial judge erred in instructing the jury that the statute of limitations was twenty years. Trial court entered a judgment quieting title in P. Holding: Reversed and remanded. Tr Ct should have instructed statutory period as 10 years (pre-1973 limitation). Rule: Once title by adverse possession has vested, continued possession is not required. Relevant Points 1. The policy behind adverse possession is that the land should go to a productive user as opposed to a nonproductive user where the true owner doesn’t seem to care over a 20 year period. 2. Elements of adverse possession: hostile or adverse actual visible, notorious, and exclusive continuous under claim of ownership must prove clear & positive evidence the location of the boundaries claimed – such boundaries must be established at the inception during continuance, and at completion of the period of adverse possession. HI Statute – limits property that can be transferred adversely to 4 acres. 3. Disability: Gives the true owner 5 years from the date the disability expires to bring action, even if the adverse possession statute has already run out. Disabilities can be insanity, imprisonment, under 18, etc. While the periods of adverse possession can be “tacked” together, periods of disability can’t. Disability must have commenced BEFORE the adverse possession commences. 4. If none of the adverse possessors held the land for the statutory period, should it be sufficient to meet the statutory period if their collective adverse possession exceeds 20 years? The traditional rule is that consecutive, continuous periods of adverse possession can be “tacked” together if there is “privity” between the successors in the adverse possession. In this context, privity means either that the previous adverse possessor transferred his or her “interest” to the successor with a deed or similar document or else that the successor was the heir or devisee of the previous possessor. Consequently, an adverse possessor who ousts the prior adverse occupant will not gain benefit of his predecessor’s possession. Lien Enforcement When landowners lose their property as a result of a mortgage foreclosure, the ensuing transfers are not completely involuntary, in that the owners knew (or should have known) that the impending unfortunate event was at least a possibility. Foreclosure: Requires the intervention of the judicial system and in most states, the lost property does not immediately pass directly to the creditor who initiated the foreclosure. Instead, the property is soljd at auction, and if the sale results in an amount greater than the debt, the mortgagor (the debtor) gets to 26 Professor Callies Sarah K. Kam Real Property I keep the surplus. However, in a very small number of states, the mortgagee (the creditor) has the right to take title to the property directly, even if it is worth more than the amount owed. Strict Foreclosure Statute: Permits a mortgagee to receive any surplusage remaining after the proceeds from the mortgaged land have been applied in payment of the mortgagee’s debt and costs as found in the foreclosure decree. Dieffenbach v. Attorney General of Vermont (1979): Facts: P challenges Vermont’s strict foreclosure laws. US District Court granted D’s motion for summary judgment. Holding: Vermont’s strict foreclosure laws are constitutional. Rule: The appropriate standard for analyzing the foreclosure laws under the Equal Protection Clause is whether they are rationally related to conceivable legitimate state interest. Relevant Points a. One possible purpose of strict foreclosure is to make it easier for banks or other creditors to lend by giving them a speculative interest in the property, for the bank realizes that it may retain the excess if the property’s value happens to exceed the debt. b. Title state: A state where a mortgage temporarily conveys title to the property to the mortgagee (lender) while the mortgagor (borrower) generally remains in possession. c. Lien state: A state where the title to the property does not pass to the mortgagee, but instead creates an enforceable lien in favor of the mortgagee. d. Strict foreclosure: Permits the mortgagee to take the property in cancellation of the debt. In this event, the mortgagor gives up any right to a surplus of value on a sale, and the mortgagee gives up any right to pursue a deficiency in the event that the property value is less than the existing debt. e. Lien enforcement: Statutes generally protect the borrower. f. Substantive Due Process Test: Whether the laws are rationally related to a legitimate state interest, though the focus of substantive due process analysis is not whether the State has treated similarly situated classes differently but whether its interest is burdening a Single class outweighs the due process interests of that class. 8. Transfer to the Sovereign: Eminent Domain Eminent Domain: State and federal governments have the power to take private property for public use. This is usually done through condemnation proceedings, in which the government brings a judicial proceeding to obtain title to land that it needs for some public use. Alternatively, the government occasionally simply makes use of a landowner’s property without bringing formal condemnation proceedings; here, the landowner may bring an “inverse condemnation” action, in which he seeks a court declaration that his property has been taken by the government and must be paid for. ONLY A GOVERNMENT HAS EMINENT DOMAIN! 27 Professor Callies Sarah K. Kam Real Property I Two Requirements: (1) Public Use: This requirement is imposed by the Taking Clause of the Fifth Amendment. It is very loosely interpreted. So long as the state’s use of eminent domain power is “rationally related” to a “conceivable public purpose,” the public-use requirement is satisfied. Urban Renewal: Thus as part of an urban renewal project, a city may condemn private land, then turn it back to a private developer for private use. (The renewal program meets the “public use” requirement even if the particular parcel condemned is not a slum.) (2) Just Compensation: The government must pay the fair market value of the property at the time of the taking. Highest and Best Use: This fair market value is usually based on the “highest and best use” that may be made of the property (at least under current zoning regulations). Thus if a vacant parcel is zoned for subdivision, the value that must be paid is the value the land would have to a subdivider, not the value based on the current rental value of vacant land. The Public Use Doctrine The Public Use Doctrine: Based on the Fifth Amendment to the federal constitution and comparable state constitutional provisions, developed differently in the states and in the federal courts. Fifth Amendment: Property can only be taken for “public use” with just compensation. Public Use Test: Satisfied if the use benefited the public. This shift in emphasis clearly opened the way for more aggressive use of the eminent domain power, especially since the scope of the public benefit that would justify the use was open to judicial interpretation and extension. Hawaii Housing Authority v. Midkiff (1984): Facts: Half of Hawaii’s land was owned by only seventy-two people, and the State wanted them to break up their estates. Hawaii legislature enacted the Land Reform Act of 1967 which created a mechanism for condemning residential tracts and transferring ownerships to existing lessees. In 1997, Hawaii Housing Authority (Δ) held a hearing concerning the acquisition of Midkiff’s (π) land. π sued to have act declared unconstitutional. District court found compulsory arbitration and compensation formulae provisions of the act unconstitutional, but all other parts of the act to be constitutional. Holding: USSCt reversed CT of Ap and remanded. The act is constitutional. Rule: A taking involving the transfer of property from one private person to another satisfies the Public Use Clause of the Fifth Amendment if it is rationally related to a conceivable public purpose. Relevant Points (Public Use Determination) 1. Look to legislative declaration of public use/interest in State’s exercise of eminent domain. This act may not meet its objective but the constitutional requirement is satisfied if the state legislature rationally believed that the act would promote its objective. To be a “rational belief” must not be an impossibility or without reasonable foundation. 2. It’s not necessary that the entire community, nor even any considerable portion, directly enjoy or participate in any improvement in order for it to constitute a public use. Thus, the exercise of eminent domain must be rationally related to a conceivable public use. 28 Professor Callies Sarah K. Kam Real Property I 99 Cents Only Stores v. Lancaster Redevelopment Agency (2001): Facts: City of Lancaster (D) established redevelopment plan to revitalize area; authorized D to condemn blighted property. As part of redevelopment, shopping center was developed. 99 Cents (P) acquired lease on property next to Costco (anchor tenant). Costco wanted P’s space to expand. D offered to purchase P’s leasehold interest but P rejected. D authorized condemnation proceedings of P’s property (though no findings of blight). US District Ct granted P’s motion for summary judgment. Holding: The notion of avoiding “future blight” as a legitimate public use is entirely speculative and wholly without support in California redevelopment law. The court concludes that Lancaster’s condemnation efforts violate the Public Use Clause of the Fifth Amendment. Rules: 5th Amendment to US Constitution – prohibits taking of private property for public use without just compensation. Taking must serve legitimate purpose. Taking for purely private use, even with compensation, is unconstitutional. Taking need be rationally related to a conceivable public purpose. Court accept avowed public purpose unless public use findings palpably without reasonable foundation. No judicial deference required where public use is demonstrably pretextual. Future blight does not satisfy public use requirement. Invalid argument. “Determinations of blight are to be made on the basis ofr an area’s existing use, not its potential use.” Control of Highway Access Government can also condemn or impair interests in land that are less than full title, as with highway and street access. Individuals need access to be able to enter and leave their properties. Businesses need access so they will be readily accessible to patrons. Without access, a business may fail. Now that the interstate system is completed, denial of access problems are more likely to arise when highways are reconstructed or improved. Rubano v. Department of Transportation (1995): Facts: D (DOT) built a new highway and the construction cut off local access to main roads at Rubano’s (P) commercial property, thus lowering its value. Trial court found for P. App court reversed and certified a question to Supreme Court. Holding: Certified question (was rerouting of traffic a compensable taking) answered in the negative. (not a taking in this case) Rule: Access, as a property interest, does not include a right to traffic flow even though commercial property might suffer adverse economic effects. Relevant Points 1. Diversions of traffic – not compensable. Loss of most convenient access not compensable where other suitable access continues to exist. No person has a vested right in the maintenance of a public highway in any particular place because the sate owes no person a 29 Professor Callies Sarah K. Kam Real Property I duty to send traffic past his door. Access, as a property interest, does not include a right to traffic flow even though commercial property might very well suffer adverse economic effects as a result of reduced traffic. 2. The fact that a portion or even all of one’s access to an abutting road is destroyed does not constitute a taking, unless, when considered in light of the remaining access to the property, it can be said that the property owner’s right of access was substantially diminished. 3. To make the state liable for damages caused by all road construction would place an impossible burden upon the taxpayers, would reduce the number of projects that increase road safety, and would hamper the expansion of the system of public roads. 4. Inverse condemnation: Where a government agency, by its conduct or activites, has effectively taken private property without a formal exercise of the power of eminent domain. Acierno v. State of Delaware (1994): Facts: D sought to acquire land from P for the realignment of a highway. P contends that the amount awarded by the condemnation commissioners was inadequate. Superior court found for D. Holding: Affirmed. Rule: Just compensation in a partial taking case is calculated by: 1. Value of the whole property before the taking - value of the remainder after the taking.Any benefits or advantages which accrue to the landowner as a result of the taking will be set off against whatever damages are caused by the severance. Set-off is permissible only with respect to special benefits accruing to the remaining land. General benefits (benefits accruing to the entire community) may not be set-off. Relevant Points a. Conditions which result from the partial taking of a condemnee’s land may actually increase the value of the remaining property. For such benefits to be considered, they must be capable of being estimated in monetary value. b. Propective benefits, which only pose the future possibility of enhancement of the present value of the property, may not be considered in a condemnation proceeding. c. Special benefits: Benefits which directly affect the property remaining after the partial taking. Arise from the unique relation of the property to the public improvement. d. General benefits: Incidental benefits which are shared by the general public (or common tenants) within the surrounding area of the taking. e. Generally, increased traffic flow resulting from the construction of a new highway or public access by itself is insufficient to qualify as a special benefit. f. A government agency can claim a special benefit offset only when it takes part of a landowner’s land. When there’s a total taking, there is no remaining land on which a special benefits claim can be made. g. Severance damage: Damage to the remainder of property from government improvements. It requires the payment of compensation in addition to compensation for the part taken. h. Almost all jurisdictions allow the deduction of special benefits from severance damages to the remainder. 30 Professor Callies i. Sarah K. Kam Real Property I A majority of states don’t allow the value of special benefits to be deducted from the value of the part taken. 9. Other Forms of Transfer to the Sovereign: Courts and Dedications Judicial Fiat: Can a Court “Take” Property? Robinson v. Ariyoshi: (9th Cir., 1985, p.242) Facts: In 1889, Gay and Robinson owned substantial land grants on Kauai and had gone to court to have their title confirmed. In 1931, court held that Gay and Robinson were the owners of “normal surplus water” on their land. In 1941, Olokele Sugar Co. succeeded to certain lands that were supplied with water from Gay and Robinson. In 1959, McBryde Sugar Co. Sued several defendants, including P and State to obtain water rights. In 1968, court affirmed McBryde’s rights. In 1973, HI Supreme court sua sponte overruled and adopted the common law doctrine of riparian rights. They also held there was no such thing as “normal surplus water” and that the sovereign state owned all the water. In 1974, US District Court enjoined the state from enforcing any “new” law against Robinson et al. State appeals. Holding: 9th Circuit affirmed district ct re: rights of parties, injunctions are vacated, remanded. Rule: A court can change property rights but a new law cannot divest rights that were vested before the court announced the new law. Relevant Points 1. Where relied on something legal at the time and in reliance expended $, rights become vested. 2. P’s have spent millions improving their land based on the lower court decrees that the water rights were theirs. The state can still take this land through eminent domain but it will have to give just compensation (14th Amendment). The State must bring condemnation proceedings before it can interfere with vested rights and the enjoyment of the improvements. 3. Before being a riparian right state, HI was a “prior appropriation” state (whoever gets the water first gets to use it). Implied Dedication Rogers v. Sain: (1984): Facts: D’s predecessor built a road to his house which is the de facto boundary between P and D’s property. D’s refuse to allow P access to the road, which D’s say is private. Circuit court declared the road to be public. Holding: The road was dedicated by implication as a public road. Judgment of the trial court affirmed. Rule: Some factors which indicate an intent to dedicate: a. The landowner opens a road to public travel. b. Acquiescence in the use of the road as a public road. c. The fact that the public has used the road for an extended period of time. 31 Professor Callies Sarah K. Kam Real Property I d. The roadway is repaired and maintained by the public. Relevant Points 1. When an implied dedication is claimed, the focus of the inquiry is whether the landowner intended to dedicate the land to a public use. 2. Proof of intent to dedicate must be unequivocal but intent may be inferred from surrounding facts and circumstances, including the overt acts of the owner (such acts as would reasonably lead an ordinarily prudent man to infer an intent to dedicate). 3. Implied Dedication – intent still required (in theory), an implied dedication is established by a showing that the private owner has invited or permitted the public to use the land in question for a long period of time. Either complete title to the land or an easement of use may be conveyed by implied dedication. If the court concludes that the private owner intended to implicitly dedicate the land to the public, a subsequent attempt to exclude the public from the property even by the original owner, will be ineffective 4. Transfer of title by implied dedication is different from adverse possession and prescription because it is based on a theory of voluntary transfer rather than a loss of rights through a failure to protest against adverse use. c. It is sometimes difficult to tell them apart because they both could involve continued use by parties other than the original owner. At least one court has said there’s no meaningful distinction between implied dedication and prescription. 3. Dedication – private owner voluntarily transfers title to property to the public. No deed is required. Phillips v. Washington Legal Foundation: (1998) Facts: D’s are opposed to the IOLTA regulation which allows a lawyer to put a client’s fund in a bank account and give the interest to TEAJA, a non-profit established to give low-income legal aid. D’s contend that that’s a taking without just compensation of the interest their money generates. District court granted summary judgment to P. 5th Circuit court reversed and found for D’s. Holding: 5th Circuit affirmed. Rule: Interest follows principal. Relevant Points 1. Even if the value of the interest generated is negligible and even if it will go to a good cause, the owner of money also owns any interest generated on that money and his ownership rights are not based on the net value of the interest but on the intangible concept of property rights. 2. Property is more than economic value. Possession, control, and disposition are valuable rights that inhere in property. 3. A State mandate does not automatically entitle the State to possession or ownership of private property. 10. The Public Trust Doctrine (Revisit Custom) The Public Trust Doctrine 32 Professor Callies Sarah K. Kam Real Property I The Public Trust Doctrine: Provides that submerged and submersible lands are preserved for public use in navigation, fishing and recreation and state, as trustee for the people, bears responsibility of preserving and protecting the right of the public use of the waters for those purposes. Submerged and Submersible Lands: Include tide lands and, by implication, coastlines, harbors and navigable bodies of water. Cannot Transfer: Public trust doctrine protects public use: The state may transfer an interest (title) but CANNOT transfer public’s right in land. Limit: Because the sovereign is obligated to protect these assets, the doctrine imposes a limit on the sovereign’s ability to transfer them to private owners. However, in the past such transfers to private ownership have been made. When that happens, the sovereign has the right to reclaim the property without compensation at a later date. Expanded Application: re: tidelands – “The public uses to which tidelands are subject are sufficiently flexible to encompass changing public needs. In administering the trust the state is not burdened with an outmoded classification favoring one mode of utilization over another. There is a growing public recognition that one of the most important public uses of the tidelands - a use encompassed within the tidelands trust – is the preservation of those lands in their natural state so that they may serve as ecological units for scientific study, as open space, and as environments which provide food and habitat for birds and marine life, and which favorably affect the scenery and climate of the area.” (Marks v. Whitney). Non-Navigable Waters Application: “If the public trust doctrine applies to constrain fills which destroy navigation and other public trust uses in navigable waters, it should equally apply to constrain the extraction of water that destroys navigation and other public interests. Both actions result in the same damage to the public interest.” Parties with rights in trust property - Parties acquiring rights in trust property generally hold those rights subject to the trust, and can assert no vested right to use those rights in a manner harmful to the trust. Some states statutorily prohibit any obstructions to public use (if statute not founded in public trust, then constitute regulatory taking. Could also argue nuisance) Cannot terminate a public trust. A legislature cannot statutorily declare that something is no longer in the public trust. Current USSCt not amenable to expanding public trust because once in public trust, it cannot be taken out! Justifications for leasing lands held in public trust. (1) Balancing public trust against economic gain as long as doesn’t interfere with public use (2) Cannot just declare expansion of public trust. Would have to exercise eminent domain. Would have to argue, “It’s always been there as part of the public trust.” Phillips Petroleum v. Mississippi: (1988): 33 Professor Callies Sarah K. Kam Real Property I Facts: D had maps of state-owned wetland areas drawn. The mineral lease commission then used these maps to issue oil and gas leases on state-owned lands. P’s have record title to non-navigable land under tidal influences predating Mississippi’s statehood. D contends that, upon becoming a state in 1817, the state acquired and held in public trust all land lying under waters influenced by the tides, whether navigable or not. Mississippi Supreme Court held for State (D.) Holding: Affirmed. Rule: States, upon entry into the union, received ownership of all lands under waters subject to the ebb and flow of the tide. (prevailing test) Relevant Points 1. New States, upon admission to the Union got title to lands lying under the waters that were influenced by the tide that were not navigable. 2. Supreme court refuses to disturb the general rule that, under the Constitution, the law of real property is left to the individual states to develop and administer. 3. Equal footing doctrine: All states, upon entering the union, have the same powers as every other state. 4. Littoral (re: shore of lake/ocean/sea) rights of owners include right to use and occupy the waters adjacent to their shore for various recreational purposes, right to erect boat houses and to wharf out into the water. Littoral rights are incidental to property rights are severable from the shore property, and may be conveyed separately from the littoral property. 5. Rights of littoral owners on public waters are subject to the paramount right of the State to control them reasonably in the interests of navigation, fishing and other public purposes. 6. Private shorefront owners are entitled to exercise their property rights in the tidelands so long as they do not unreasonably interfere with the rights of the public. Dissent: (O’Connor) Mississippi is contesting about 42 acres out of P’s claim for about 2,400 acres and there is no reason for it. D is taking land that it doesn’t need away from people who have “owned” it and payed taxes on it for over 150 years just D can make money off the oil, gas, and mineral rights. This decision will take land away from many landowners for no reason and give it to the state, who doesn’t need it. Matthews v. Bay Head Improvement Association (1984): Facts: P, a New Jersey Public Advocate, appealed a judgment of Superior Court, Appellate Division (New Jersey), which granted summary judgment to defendant association, on a claim that D prevented nearby inhabitants from gaining access to the Atlantic Ocean and beachfront in the area. Holding: The public trust doctrine did not allow the sovereign of New Jersey to abdicate its trust over the dry sand beaches to defendant association. The court further stated that the public trust doctrine included bathing, swimming and other shore activities and that the public had a right to access defendant’s beaches to engage in such activities. Furthermore, although defendant was a private association, because it was a nonprofit corporation and its activities paralleled those of a municipality, the court was able to interfere with its internal affairs and compel it to open membership to the public at large. Rule: In New Jersey, the public may use the privately owned dry sand area to the extent needed in the exercise of the public’s right under the public trust doctrine to use the wet sand area and the water. Relevant Points: 34 Professor Callies Sarah K. Kam Real Property I All navigable rivers in which the tide ebbs and flows and the coasts of the sea, including the water and land under the water, are common to all the citizens, and that each citizen has a right to use them according to his necessities, subject only to the laws which regulate that use. The public has a right to use the land below the mean average high water mark where the tide ebbs and flows. These uses have historically included navigation and fishing. However, the public’s rights have been extended to recreational uses, including bathing, swimming and other shore activities. 11. Sovereign Restrictions (Continued): Police Power Police Power: The power of the government to regulate human conduct in order to protect public health, safety, morals and welfare. Police power regulations can be treated as a taking requiring compensation. “Reciprocity of advantage” – Both sides benefit from exactions of police power for safety reasons. Preserving Paradise – Regulatory “Takings” Fifth Amendment – Provides that private property shall not be taken except for public use and upon payment of just compensation. (eminent domain) Fourteenth Amendment – Property shall not be taken without due process of law. Regulatory taking – Whenever all economic use has been removed by the regulation, or not ever if the regulation is to protect the health, environment, or fiscal integrity of the area. Moreover, all of the owners’ property interests – lateral and vertical – are considered in evaluating the extent of remaining use after the regulation. Remedy for regulatory taking, even temporary is compensation. (required by 5th Amend) Govt may impose such conditions, based on its police power, that bear an essential nexus to the proposed use and the problems, if any, that it may cause, which the public/government has a right to remedy. **Lucas (US) – When a land use regulation takes all economic use from land, it is a taking of property protected by the 5th amendment and requires compensation. True regardless of the purpose for which the land-use regulation is applied, unless it is to prevent a “nuisance.” Partial taking where landowner’s legitimate, investment backed expectations frustrated by regulation. Where regulation designed to protect historic and aesthetic values (open space, views, etc.) vs public health and safety, court would more strictly require compensation. Foundation: Police Power and Land Use Pennsylvania Coal Co. v. Mahon (1922): Mahon (P) purchased the surface rights to land and the deed expressly reserves the right to remove all the coal under the land to Penn Coal Co (D) regardless of risks or damages to P. P alleges that the Kohler Act (state statute) negates D’s right to mine the coal under the property. Court of Common Pleas denied an injunction (if apply state statute to this case would be unconstitutional). PA Supreme Court held for P (SCt recognized that D had contractual rights but held that Kohler Act was valid exercise of police power – to protect safety of people). Kohler Act: Forbids the mining of coal in such a way that would cause the sinking of, among other things, any structure used for human habitation. There are certain exceptions, including the mining of land where the surface is owned by the owner of the underlying coal and is more than 150 feet from anyone else’s improved property. 35 Professor Callies Sarah K. Kam Real Property I Holding: So far as private persons or communities have seen fit to take the risk of acquiring only surface rights, we cannot see that the fact that their risk has become a danger warrants the giving to them greater rights than they bought. The statute was a legitimate exercise of the police power and directed a decree for the plaintiffs. USSCt reversed. Rule: While property may be regulated to a certain extent, if regulation goes too far it will be recognized as a taking. This means that use of regulatory power by a government agency can be a “taking” even if no land was actually taken. Relevant Points Statute in question forbade the mining of coal if it caused the subsidence of a structure used for human habitation, unless the surface and the underlying coal are owned by the same owner and is > 100ft from any improved property belonging to another. In 1878, Coal Co. deeded land to Mahon which reserved the right to remove all the coal under the property and the grantee/McMahon took the property with the risk and waives all claim for damages that may arise from mining the coal. Balancing Test to determine if “taking” took place: Extent of the public interest involved (e.g., harms to public) vs Extent of the taking and the diminution of the property value and interest (e.g., value of mineral rights lost). If the harm to the property interest is proportionately less than the police power objective then there is no compensation required. Village of Euclid, Ohio v. Ambler Realty Co. (1926): Facts: A realty company challenged a municipal ordinance which established a zoning plan restricting the use and size of buildings in various districts. Ambler (D) owns 68 acres on the west end of Euclid (P), a village. In 1922, P adopted a comprehensive zoning plan. The effect of the plan was to reclassify D’s lands such that only a part could be used for industry while the rest was residential. This diminished the potential value of D’s land. D contends that the rezoning plan is unconstitutional, depriving him of liberty and property. Lower court held the plan to be unconstitutional and void. Holding: USSCt reversed (ordinance, in its general scope and dominant features, is valid exercise of authority) Rules Zoning ordinances are a valid exercise of the police power and thus do not violate the constitutional protection of property rights. For an ordinance to be declared unconstitutional, it must be clearly arbitrary and unreasonable, having no substantial relation to the public health, safety, morals, or general welfare. Ordinances, laws and regulations must be justified in police power asserted for the public welfare, and must be considered in light of all circumstances and conditions. Relevant Points 36 Professor Callies Sarah K. Kam Real Property I 1. The main question the Supreme court dealt with was whether it was constitutional to restrict apartment buildings and stores from being within purely residential zones. Supreme court decided it was okay. 2. D is making a facial attack, that is, asserting that the entire ordinance is unconstitutional, not just as applied to him. 3. Zoning enforcement officer – one who enforces the building code. (In HI would be Department of Planning and Permitting). 4. City Council – legislative body that passes ordinances and makes amendments. 12. Regulatory “Taking” (Different from Eminent Domain?) Regulatory Takings Taking: When the interference with property can be characterized as a physical invasion by government than when interference arises from some public program adjusting the benefits and burdens of economic life to promote the common good. Partial Regulatory Takings Test: (1) Economic impact of the regulation on the claimant and particularly, the extent to which the regulation has interfered with distinct investment-backed expectations; and (2) The character of the governmental action (eminent domain v. regulation). If the court decides it’s a taking, then owners are entitled to just compensation. Penn Central Transportation Co. v. City of New York (1978): Facts: Penn Central made plans to construct an office building over Grand Central Terminal. P’s application to build on top of this landmark was denied (under NY Landmark Preservation Law-police power based in WELFARE-any changes to a landmark had to be approved by commission). P sued an alleged that their airspace on top of Grand Central was “taken” without just compensation. Trial court granted P’s injunction and declaratory relief. NY Supreme Court, Appellate Division, reversed saying that P’s would have to prove that the landmark regulation denied them all reasonable beneficial use of the property (at trial P only showed that they were denied most profitable use. Holding: The application of New York City’s Landmarks Law has not effected a “taking” of appellant’s property. The restrictions imposed are substantially related to the promotion of the general welfare and not only permit reasonable beneficial use of the landmark site but also afford appellants opportunities further to enhance not only the Terminal site proper but also other properties. Rule: A law which does not interfere with an owner’s primary expectation concerning the use of the property, and allows the owners to receive a reasonable return on his or her investment, does not effect a taking which demands just compensation. Partial Taking Test: To determine if there has been a partial taking, the court will look at: a. Whether the land still has an economically beneficial use. 37 Professor Callies Sarah K. Kam Real Property I b. The owner’s distinct investment-backed expectations on the property. c. The character of the government’s action. Relevant Points 1. The landmark regulation doesn’t interfere with the way P’s have been running Grand Central for the last 65 years, so the regulation doesn’t interfere with what must be regarded ‘as P’s primary expectation concerning the use of the land. 2. P’s haven’t been prohibited from using any of the airspace above their land. They’ve just been prohibited from using it in the fashion they decided they wanted to use it. 3. Ultimate conclusion of USSCt - Application of NYC law not a taking. Restrictions substantially relate to promotion of the general welfare and permit reasonable beneficial use of the landmark site. Also affords opportunities to enhance the Terminal and other sites. Lucas v. South Carolina Coastal Council (1992): Facts: In 1986, Lucas (P) bought two lots of land to construct residential homes. In 1988, SC (D) enacted the Beachfront Management Act which barred P from building anything at all on the lots he had just bought. Lucas claimed that a South Carolina statute which barred him from building on his barrier island property resulted in a taking without just compensation. Trial court found that the prohibition has rendered P’s land “valueless” and thus the regulation was a taking, and D had to pay just compensation. SC Supreme court reversed on the notion that the regulation was validly designed to preserve SC’s beaches and when a regulation is designed to “prevent serious public harm”, no compensation is owed under the Taking Clause. Holding: USSCt reversed and remanded. Rule: A land-use regulation that deprives an owner of all economically valuable use of property by prohibiting uses that are permitted under background principles of property and nuisance law results in a taking, and thus requires just compensation. Total Takings Test: When the owner of real property is required to sacrifice all economically benefical uses of his property in the name of the public good, he must be compensated, unless: a. The owner created a nuisance. (ie. landowner builds a brothel) b. There was a background principle of state property law that wouldn’t allow the owner to collect. (ie. landowner buys land that he knows the state has the right to develop and then sues because he can’t develop it) Relevant Points 1. ????Two situations that are considered to be “takings” without case-specific inquiry into the public interest advanced: a. Regulations that compel the property owner to suffer a physical invasion of his property. b. Regulations that deny all economically beneficial or productive use of land. 2. ????If the state reasonably concludes that the health, safety, morals, or general welfare would be promoted by prohibiting particular contemplated uses of land, then no compensation is necessary for a regulatory taking. 38 Professor Callies Sarah K. Kam Real Property I 3. For example, the owner of a nuclear generating plant, if the state forces him to deconstruct the plant because it’s found that it’s sitting on an earthquake fault line, wouldn’t be entitled to compensation even though he may have lost all economically productive use of his land because building a nuclear plant on a fault line wasn’t previously permissible under property law. (Nuisance) 4. In this case, the State justified the law in – Federal law (complementary landmark preservations); health and welfare; and protect environment. USSCt says in spite of above, still a taking if it leaves owner with no economic use! 13. Local Land Use Controls: Zoning (Ordinances and Amendments) Generally: The main type of public land-use regulation is zoning. Zoning is generally done on the local, municipal, level. The municipality’s power to zone comes from the state “police power,” or power to act for the general welfare, which is delegated by state statute to the municipality. Use Zoning: Most zoning is use zoning, by which the municipality is divided into districts, in each of which only certain uses of land are permitted (e.g., a residential-only district, a commercial district, etc.) Density Controls: Other zoning laws govern the density of population or construction. Thus a town might establish a minimum lot size for single-family homes, minimum set-back requirements, minimum square footage for residences, and height limits. Legal Limits on Zoning: Constitutional Limits: (1) Taking Clause: The Fifth Amendment’s Taking Clause means that if a zoning regulation is so overreaching that it deprives the owner of all economically viable use of his land, or is not substantially related to some legitimate public purpose, the zoning will be treated as a taking for which compensation must be paid. (2) Procedural Due Process: The Fourteenth Amendment’s Due Process Clause imposes certain procedural requirements on the zoning process. For a zoning action that is administrative rather than legislative (e.g., the granting of a variance or special-use permit for a particular property), an owner is entitled to a hearing, an impartial tribunal, and an explanation of the government’s decision. (3) Substantive Due Process: If the zoning law fails to bear a rational relation to a permissible state objective, it may violate the substantive aspect of the Due Process Clause. (e.g., A zoning law that limits a district to single-family occupancy, and defines “family” so as to exclude most extended families, violates substantive due process). (4) Equal Protection: A zoning law that is adopted for the purpose of excluding racial minorities will trigger strict judicial scrutiny, and will probably be found to be a violation of the Equal Protection Clause of the Fourteenth Amendment. Aesthetic Zoning: Most courts hold today that aesthetic considerations may constitute one factor in a municipality’s zoning decision. But aesthetics may not be the sold factor. 39 Professor Callies Sarah K. Kam Real Property I Administration of Zoning: Bodies Involved in: Several governmental bodies generally get involved in zoning: (1) Town Council: The zoning code is enacted by the municipal legislature. Usually this is the town council. (2) Board of Zoning Appeals: A “board of adjustment” or “board of zoning appeals” usually exists to award or deny variances, and to hear appeals from the building department’s enforcement of the zoning laws. (3) Planning or Zoning Commission: The town council generally appoints a planning commission or zoning commission. The commission generally advises the town council on (but does not independently determine) the contents of the zoning code. The Zone Pierro v. Baxendale: (1955) (deals with zoning ordinances as they exist today) (TEXT amendment) Facts: In 1939, Palisades Park adopted a zoning ordinance that didn’t allow motels in certain areas. P’s applied for a motel permit in 1954 and was denied. A supplemental zoning ordinance was adopted later, which forbade construction of a motel anywhere in the town. P sued to declare the supplemental ordinance void. Trial judge found the supplemental ordinance invalid and granted P’s a building permit. Holding: Appellants, building inspector, mayor, and council, as policy makers for the city were entitled to make classifications as they deemed necessary and as long as their classifications were based upon reasonable grounds so as not to be arbitrary or capricious. The classification was reasonable as a protection of the community’s general welfare where the area in which motels were restricted was a previously residential area. SCt Reversed. Rules: Legislative bodies may make such (zoning) classifications as they deem necessary and as long as their classifications are based upon reasonable grounds so as not to be arbitrary or capricious they will not be upset by the courts. (“Equal protection”) (Doctrine of Fischer v. Bedminster) Reasonable restrictions designed to preserve the character of a community and maintain its property values are with the proper objectives of zoning. Reasonable restrictions designed to preserve the character of a community and maintain its property values are within the proper objectives of zoning. Unreasonableness - A complaining party must show that the legislative decision/ordinance was unreasonable, arbitrary AND capricious! Analysis to determining reasonableness of ordinance – What is it the landowner wants to do? Why can’t the landowner do what they want? (what is the ordinance) What is the nature of the area? Relevant Points 1. The operation of motels in some areas would impair existing property values. That is part of the general welfare and there’s no reason that such communities as part of their zoning can’t exclude such enterprise. 40 Professor Callies Sarah K. Kam Real Property I 2. A court CANNOT substitute its decisions for those of legislative bodies (courts DEFER to legislative bodies) Dissent: (Heher) The supplemental ordinance is discriminatory because it doesn’t allow for motels while does allow for boarding houses. Amendments Amending the zoning ordinance is the most extreme method for a landowner to obtain permission for a presently non-permitted land use. Bartram v. Zoning Commission of City of Bridgeport (MAP amendment) (1949): Facts: In 1926, D set up zoning regulations. In 1937, they were amended to add business zone #3. This changed the zoning classification of P’s land from residential to business #3. The landowner requested a change in zoning that would have allowed him to construct a building that housed five separate businesses. Apart from the landowner, no other residents appeared at the hearing to support the application, however P residents at the hearing opposed it. The residents focused on their fear that the business zoning would open the area up to further business zoning. The commission granted the landowner’s application because there was a need for the shopping center within the community and it was the commission’s policy to encourage decentralization of business in order to relieve traffic congestion. Trial court reversed concluding this was “spot zoning” and therefore void. Holding: It was not an abuse of discretion for the commission to grant the landowner’s application because its decision was justified as being in furtherance of the town’s general plan, which had been properly adopted, and served the best interests of the community as a whole. Judgment is set aside, remanded with directions to enter judgment dismissing the appeal. (SCt held not spot zoning) Rule: A court is without authority to substitute its own judgment for that vested by the statutes in a zoning party. Relevant Points 1. Regulations which are adopted must be made in accordance with a comprehensive plan, not “spot zoned.” 2. Zoning commissions – usually come into existence only to create an ordinance. Once ordinance created, commission usually dissolved as would compete with government re: amendments) 3. “Spot zoning” in obnoxious sense - Action by a zoning authority which gives to a single lot or a small area privileges which are not extended to other land in the vicinity is in general against sound public policy and obnoxious to the law. It can be justified only when it is done in furtherance of a general plan properly adopted for and designed to serve the best interests of the community as a whole. 4. Lack of neighborhood support does not deprive commission of the power to rezone. Even if residents unanimously oppose, commission still have duty to look beyond the effect of the change to the general welfare of the city. 5. Indications of spot zoning – Deals with a small area (in relation to size of area dealt with) Must be inconsistent with present uses of area Contrary to overall policy or plan of area (indicia of un/reasonableness for most courts dealt with spot zoning issue). Look at effect of change on general welfare of populace. 41 Professor Callies Sarah K. Kam Real Property I 14. Zoning: Special Use, Variance, Nonconformities Special or Conditional Uses In may local (and some state) land use schemes, it is possible to obtain a change of use without obtaining an amendment by means of a special or conditional use permit, or special exception. This avoids the problem of spot zoning. Special Uses: Zoning ordinances also usually provide for “special use” permits. Typically, a special use permit must be obtained for such things as private schools, hospitals and churches. Generally, an applicant is not entitled to a special use permit “as of right,” but only in the discretion of the zoning board; however, usually no showing of “special hardship” has to be made (as in the case for a variance). Conditional Zoning: Many ordinances provide for conditional zoning. Under this device, the rezoning of a particular parcel is made subject to the developer’s promise to comply with certain conditions, which will protect neighbors. (e.g., O owns a parcel in an area zoned residential-only. If the ordinance allows for conditional zoning, the town might rezone O’s parcel for light industry, but only if O agrees to large set-backs, a low floor-space-to-land-area ration, or other condition). Permitting a use which is not listed under the permitted use category of the subject property’s zoning does provide the local authority with more flexibility, at least in theory, than it has when faced with a simple map or text amendment request. Spot Zoning: Action by a zoning authority which gives to a single lot or a small area privileges which are not extended to other land in the vicinity is in general against sound policy and obnoxious to the lawSpecial treatment for one relatively small lot. Kotrich v. County of Du Page (1960): Facts: Salt Creek Club (one of Ds) owns land zoned residential. County (D) granted a special use permit to construct a private outdoor recreation center, in spite of zoning board recommendation that permit not be granted. P’s (adjacent property owners) sued to challenge the permit and the zoning ordinance under which the permit was granted. Circuit court upheld the validity of the special use ordinance and the permit. Holding: A special use permit was a permissible means of implementing the powers conferred by statute to regulate and restrict the location and use of buildings. Precise standards to govern the determination of the county were not required because the ordinance contemplated that the desirability of the proposed use would be weighed against its potential adverse impact. Likewise, no written findings of fact had to accompany the granting of a special use permit, as with a variance, because that was a decision for the legislature to decide, not the court. Since the county imposed several restrictions to protect nearby homes from excessive light and noise, the county’s actions were not arbitrary and did not deprive the owners of property rights without due process of law. SCt affirmed. Rule – Characteristics of special use: 42 Professor Callies Sarah K. Kam Real Property I Special use permits provide for infrequent types of land use which are necessary and desirable but which are potentially incompatible with uses usually allowed in residential, commercial, and industrial uses. Generally relate to a large tract of land They cannot be categorized in any given use zone without danger of excluding beneficial uses or including dangerous ones. Relevant Points 1. If you have a choice between rezoning and special use, look at which you’re more likely to get and which is better for your client. Special use is administrative and quasi-judicial while rezoning is fully legislative. Variance Variances may alter the use to which property may be put (e.g., commercial use in a residential zone), or grant area or bulk concessions (e.g., modify setback lines or height requirements). Virtually all zoning ordinances have a provision for the granting of variances, i.e., relief in particular case from the enforcement of an ordinance. Standard Zoning Enabling Act: Has served as a model for zoning enabling acts in many jurisdictions. It provides a local zoning board of appeals primarily for the purpose of granting such variances after a hearing, but some jurisdictions converted such boards into hearing agencies only. Requirements: Most states impose these requirements for a variance: (1) Denial would result in “unnecessary hardship” to the owner; (2) The need for the variance is caused by a problem unique to the owner’s lot (not one shared by many lots in the area); and (3) The variance would not be inconsistent with the overall purpose of the ordinance, or inconsistent with the general welfare of the area. Topanga Association For a Scenic Community v. County of Los Angeles (1954): Facts: County (D) granted a variance permit to a development company to build a 28 acre (93 space) mobile home park in Topanga Canyon. Upon recommendation of zoning board (and despite Ps opposition) planning commission granted the variance. P appealed to the county board of supervisors and lost (exhausted administrative remedies). Holding: The court reversed and remanded the judgment that llowed respondent property developer a zoning variance, because the planning commission’s summary of factual data did not establish that a variance was necessary to bring respondent into substantial parity with other parties holding property interests in the zone. The court concluded that the variance amounted to a prohibited “special privilege.” Rule: A variance from the terms of the zoning ordinance shall be granted only when, because of special circumstances, the strict application of the zoning ordinance deprives such property of privileges enjoyed by other property in the vicinity and under identical zoning classifications. A variance shall not constitute a grant of special privileges inconsistent with the limitations upon other properties in the vicinity and zone in which such property is situated. 43 Professor Callies Sarah K. Kam Real Property I Relevant Points 1. The variance board MUST set forth findings sufficient to enable the parties to determine whether and on what basis the parties should seek review and to apprise a reviewing court of the basis for the board’s action. (findings should bridge analystic gap between the raw evidence and ultimate decision or order) 2. Guidelines for court reviewing grant of a variance - a reviewing court, before sustaining the grant of a variance, must scrutinize the record and determine whether substantial evidence supports the administrative agency’s findings and whether these findings support the agency’s decision. In making these determinations, the reviewing court must resolve reasonable doubts in favor of the administrative findings and decision. 3. Local authorities (counties) are allowed to supplement zoning ordinances with local legislation! 4. A zoning scheme is like a contract. Each party foregoes rights to use his land as he wishes in return for the assurance that the use of neighboring property will be similarly restricted, the rationale being that such mutual restriction can enhance total community welfare. 5. Development Co used wrong technique – should have asked for area to be rezoned or for a SPECIAL USE permit, rather than a variance. 6. NOTE – use variances prohibited by CA law in 1970. Nonconformities Non-Conforming Uses: When a zoning ordinance is enacted or made more stringent, the pre-existing uses that are now banned by the ordinance are called “non-conforming uses.” Virtually all ordinances either: (1) grant a non-conforming user a substantial period within which he may continue his use; or (2) let him continue that use indefinitely. Constitutional Issue: Probably it would be a violation of an owner’s due process or other constitutional rights for him not to be given at least a substantial period within which to phase out the non-conforming use. Amortization: If the ordinance does give an owner a substantial period to phase out his use, most courts hold that no violation of the owner’s constitutional rights results form the fact that he must eventually cease the non-conforming use. City of Los Angeles v. Gage: (1954) Facts: In 1930, Gage (D) bought 2 lots and built buildings on them. One, he rented out part for residential, and the rest was devoted to D’s plumbing business. In 1946, P passed an ordinance which rezoned D’s land to full residential and allowed D 5 years to remove his business as a nonconformity, as part of an amortization (spread out the loss) plan to phase out all nonconformities. Trial court found the ordinance void as applied to D. Holding: Reversed. The ordinance, as applied to D, is constitutional (valid exercise of police power). D has 5 years to remove his business. Rule: The ordinance is a valid exercise of police power if it is not arbitrary or unreasonable or if it has a substantial relation to the public’s health, safety, morals or general welfare or if it is not an unconstitutional impairment of a person’s property rights. 44 Professor Callies Sarah K. Kam Real Property I Relevant Points 1. Nonconforming use is a lawful use existing on the effective date of the zoning restriction and continuing since that time in nonconformance to the ordinance. 2. A provision permitting the continuance of a nonconforming use is ordinarily included in zoning ordinance because of the hardship and doubtful constitutionality of compelling the immediate discontinuance of nonconforming uses. 3. In order to be protected, use or structure must have been legally commenced or used from the beginning. 4. The theory in zoning is that each district is appropriate for the uses permitted in that area and therefore the existence of nonconforming uses will impair the development and stability of the area for appropriate uses. Nonconformities endanger the benefits to be derived from a comprehensive zoning plan. 5. The elimination of existing nonconforming uses within a reasonable time (amortization) does not amount to a taking nor does it necessarily restrict the use of property so that it can’t be used for any reasonable purpose. 6. There are nonconforming structures and nonconforming uses. This case is about a nonconforming use. The building itself was permitting in the area. He didn’t have to tear it down. He just can’t run a business in it. 7. Nonconforming buildings/structures are more likely to be “vested” than nonconforming uses (since difficult to change buildings). Most courts will uphold the termination of a nonconforming use/building at some point in time. If it’s a building, the time frame would have to be longer. 15. Special Controls-Aesthetics and Historic Preservation Aesthetics and Historic Preservation The use of the police power through zoning to regulate for aesthetic concerns raises some difficult philosophical and legal problems. Commonly done by covenants. Reid v. Architectural Board of Review of City of Cleveland Heights (1963): Facts: P wanted to build a one story house with a ten foot wall all around it in a two storey neighborhood. D did not approve P’s plan based more on general aesthetics of the community than on value depreciation. Court of common pleas found for D. Holding: The record in this case discloses ample evidence to support the judgment of the trial court that the Board did not abuse its discretion in its decision in this matter. App Ct affirmed. Rule: Concept of public welfare is broad and inclusive. The values it represents are spiritual as well as physical, aesthetic as well as monetary. It is within the power of the legislature to determine that the community should be beautiful as well as healthy, spacious as wells as clean, well-balanced as well as carefully patrolled. BUT aesthetic conditions alone are insufficient to support the invocation of the police power, although if a regulation finds a reasonable justification in serving a generally recognized ground 45 Professor Callies Sarah K. Kam Real Property I for the exercise of that power, the fact that aesthetic considerations play a part in its adoption does not affects its validity. Dissent: (Corrigan) The D wasn’t concerned with anything besides aesthetics and that is too subjective to warrant an exercise of police power. The public health, safety, and welfare wouldn’t be affected by the building of P’s house, so she should be allowed to. Relevant Points: As required by ordinance, the plans and specifications were referred to the Architectural Board of Review. The Board is composed of three architects registered and authorized to practice architecture under Ohio laws with ten years of general practices as such. The board regulations 1) design 2) use of material 3) finished grade lines 4) orientation (new buildings). It is hard to set these objective standards…what is aesthetically pleasing? Note the trust of experts-these are architects-they know what is appropriate for the community. There are no architectural design standards---structure standards-yes, but not design. Most courts today take the position that aesthetic considerations alone justify an exercise of the police power. This is a highly criticized opinion. 16. Subdivision and Planning Subdivision and Planning Plat Acts: Requires that no parcels be divided and sold without the filing of a “plat,” a drawing of the parcel showing the division or divisions into which it had been carved. The plat acts help facilitate real estate conveyancing by producing a more useful property description which could be recorded in deeds and real estate sale contracts in the official land records. Design and Public Facility Shortcomings: Led to state subdivision enabling legislation permitting local communities to adopt subdivision regulations (usually ordinances) to deal with these problems. Design Standards: Width and composition of streets and sidewalks, road perimeter linkage, uniformity of building set backs, and the like. Reservation of Open Space: A number of state enabling acts directed that such sites be left undeveloped by private owners only for a specified length of time, usually a year, by which time the local government either had to purchase the site or let the owner develop it. Subdivision Approval Process: (1) Tentative Map (preliminary map) (plat or plan): A preliminary plat is first submitted to the local plan commission for review. After review by appropriate officials it is either approved, approved with modifications, or rejected/ (2) Final Map (final plat or plan): A more detailed final plat is then submitted, similarly viewed, and if accepted, sent to the city or county council for formal approval, execution, and recording. The restrictions and conditions so recorded thus become burdens that “run with the land”; that is, they become biding on later purchasers of the lot. 46 Professor Callies Sarah K. Kam Real Property I Youngblood v. Board of Supervisors of San Diego County (1978): Facts: June 26, 1974, the Santa Fe Company filed an application for a tentative subdivision map for Rancho Del Dios. On Oct.11, the San Diego County Planning Commission approved the tentative map, subject to conditions. On Dec.10, the Board of Supervisors approved the tentative map subject to conditions. On Dec.31, the county amended its general plan to limit density in Rancho Del Dios to one dwelling per two acres. The tentative map called for one dwelling per one acre. Thus, when the county approved the final subdivision map on Oct.25, 1975, it didn’t conform to the existing general plan. P’s, neighbors of the subdivision, filed two mandamus actions. While the appeal was pending, the Board of Supervisors amended the zoning so Rancho Del Dios now conforms to the general plan. Superior court found for D. Holding: The board did not act unlawfully in approving the tentative map. Affirmed. Rule: The date when a tentative map comes before a governing body for approval is the crucial date when that body should decide whether to permit the proposed subdivision. Once the developer complies with the conditions attached to the approval (on the tentative map) and submits a final map corresponding to the tentative map, approval of the final map is a ministerial act. Relevant Points 1. No city or county can approve a tentative map unless the proposed subdivision is consistent with applicable general or specific plans of the city or county. 2. Conditions are discretionary. 3. Approval of a tentative map subject to conditions is an approval for the purpose of determining the map’s consistency with the existing general plan. (i.e., tentative map/subdivision maps must conform to the general plan in effect on that date.) 4. Approval of a tentative subdivision map is a quasi judicial act subject to judicial review for abuse of discretion. 5. Discretionary vs quasi judicial vs ministerial – determines at what point disapproval STOPS developer. (indications of ministerial – no more discretionary decisions) Gatri v. Blane (1998): GATRI submitted special management area (SMA) application to develop a restaurant park commercial project in Kihei (under community plan property designated as single family residential). After contested hearing planning commission deferred action on SMA app until potential changes to community plan were voted on by council. GATRI then submitted a SMA minor permit (cost < $125k, no substantial adverse environmental/ecological effects, processed by Director). Director did not approve minor SMA permit due to inconsistency with general plan. Informed Gatri that application could not be processed unless a community plan amendment to designate business is processed concurrently with the SMA permit application. Gatri did not request concurrent processing of its application and a general plan amendment, as was allowed. Gatri appealed. Circuit court reversed decision not to process application since the community plan did not have the force and effect of law. Holding: The county general plan does have the force and effect of law insofar as the statute requires that a development within the SMA must be consistent with the general plan. SCt reversed circuit court, holding that the circuit ct erred in finding that the community plan did not have the force and effect of law. Rules: 47 Professor Callies Sarah K. Kam Real Property I Coastal Zone Management Act, SMA permit procedures – established to avoid permanent loss of valuable resources and the foreclosure of management options, and to ensure adequate access to public owned/used beaches/rec areas/natural reserves. State policy to preserve, protect and restore natural resources of HI’s coastal zone. HRS - Mandatory guidelines for SMA permit. No development approved unless authority has found o The development will not have any substantial adverse environmental or ecological effect (except as such adverse effect minimized to the extent practicable and clearly outweighted by public health, safety, or compelling public interests) o Development is consistent with the objectives, policies and special management area guidelines of chapter and of leg. o The development is consistent with the county general plan and zoning. (concurrent processing of general plan or zoning amendment not precluded) HRS - General Plan Requirements o Indicate desired population and physical development patterns for each county and regions within each county (address unique problems and needs) o Formulated on the basis of sound rationale, data, analyses and input from state and county agencies and the general public, and contain objectives and policies as required by the county charter. o County plans should contain objectives to be achieved and policies to be pursued re: population density, land use and other matters required for coordinated development of county and county regions. o County plans should contain implementation priorities and actions to carry out policies to include but not be limited to land use maps. Therefore, SCt held the general plan does have the force and effect of law insofar as the statute requires that a development within the SMA must be consistent with the general plan. (NOT a sweeping statement that all development must comply with the general plan) 17. Land Development Conditions The major constitutional issue with respect to fees, dedications and exactions, is the relationship between such land development, and the land dedication or fee for the public facility, or other condition imposed or levied by government. Test of Validity of Conditions Imposed: Purpose - public interest substantially advanced o proper police power goal/public purpose; substantially legitimate interest o Benefit that a condition is trying to protect must PRE-EXIST development (cannot get developer to provide for problem they are not creating) Nexus (between problem development causing and condition imposed) Proportionality (compare conditions imposed against impact of proposed development)??? Relevant Points: Although these cases dealt with land dedications, test applies to nonland dedications as well – such as fee exactions Essential nexus requirement establishes a remoteness test where a court inquires into whether there exists a reasonable causal connection between the prevention of the perceived adverse impacts of the development project and the condition the government has imposed on the permit. 48 Professor Callies Sarah K. Kam Real Property I Subdivision exactions are similar to the 3-part test and must meet land development conditions. Cannot impose land development condition on the zoning process! (because the reclassification may/may not be developed). As soon as courts see transaction as imposing a tax due to an increase in value – view as unconstitutional (since only STATE governments have authority to tax, not local govts) Nollan v. California Coastal Commission (1987): P’s own beachfront land with a little bungalow on it. They originally leased the land with an option to buy, contingent on P’s promise to demolish the bungalow and build a house. In order to do this, P’s needed to get a permit from D. D said they’d grant the permit subject to P’s allowing a public easement on the beach (easement NOT allow beach access, but went along beach). Superior court invalidated the condition and remanded to the Commission for full evidentiary hearing. D held public hearing, made further factual findings and reaffirmed the condition. Superior court voided it again (not comply with CA Coast Act where proposed development not approved if adverse impact on public access to the sea). D appealed and while they did so, P’s built the new house and bought the land. Court of Appeals reversed (found for D). Holding: California required the use of eminent domain to obtain easements across private property, and the condition imposed was not a use of eminent domain. The condition was a taking, and if the state wanted an easement they would have to compensate appellants. Reversed. Rule: If a regulatory condition is imposed on a development permit, that condition must substantially advance the same governmental purpose that refusing the permit would serve or else the action will constitute a taking and require just compensation. “One of the most essential sticks in the bundle of rights that are commonly characterized as property” is the right to exclude others. Land use regulation not taking if it substantially advances legitimate state interests (e.g., landmark preservation, residential zoning, scenic zoning) AND does not deny an owner economically viable use of his land. (Agins v. Tiburon) and “A use restriction may constitute a taking if not reasonably necessary to the effectuation of a substantial government purpose.” (Penn Central) There must be a NEXUS between the condition imposed by the government and the original purpose of the building restriction. Relevant Points 1. Permanent physical occupation: When individuals are given a permanent and continuous right to pass to and fro, so that the real property may continuously be traversed, even though no particular individual is permitted to station himself permanently on the premises. Dolan v. City of Tigard: (1994) (Dolan problem – proportionality prong of test) Facts: P owns a store in the middle of the city. She wants to expand and D said they’d grant the permit if P gave D 10% of her land for use in a drainage project and a bicycle path. Supreme Court of Oregon held for D. 49 Professor Callies Sarah K. Kam Real Property I Holding: If a nexus existed, then exactions imposed by respondent must be roughly proportionate to the projected impact of the proposed development. Respondent’s conditions were not reasonably related to the impact of the proposed development, and therefore, the judgment was overturned. USSCt reversed. Although there was nexus, the conditions imposed were not proportional to the impact of Ps proposed development Rule: Exactions are constitutional provided the benefits achieved are reasonably related and roughly proportional, both in nature and extent, to the impact of the proposed development. ROUGH PROPORTIONALITY TEST (USED BY USSCt) – City must make individualized determination that the required dedication is related both in nature and extent to the impact of the proposed development. (must make some effort to quantify its findings in support of the required dedication) 18. Coastal Zones and Wetlands Coastal Zone 1. Types of permits Fill permit (Clean Water Act – Army COE) SMA permit Floodplain permit (COE ???) Army COE permit needed for anything affecting navigable waterways and extends to all wetlands adjacent to a navigable waterway. 2. The Coastal Zone Management Act (CZMA) requires a state’s coastal zone management program to consider: a. A definition of the boundaries of that part of the coastal zone that is subject to the program. b. Objectives and policies for coastal zone protection. c. A statement of permissible land and water uses. d. The identification of special management areas (SMA). 3. Takings analysis FOR COASTAL ZONES/WETLANDS ONLY! There has been a regulatory taking if: (DOUBLE CHECK!!!) a. There was a denial of economically viable use of the property as a result of the regulatory imposition. b. The property owner had distinct investment-backed expectations; and c. It was an interest vested in the owner, as a matter of state proper law, and not within the power of the state to regulate under common law nuisance doctrine. Federal Coastal Zone Management Act of 1972 (CZMA): This is a national program of coastal zone management. Designed largely to encourage states in coastal areas to plan, manage, and regulate the use of land therein, the CZMA provides funds for the creation and implementation of state coastal zone management plans, on the condition that they follow various coastal land regulatory and management guidelines. 50 Professor Callies Sarah K. Kam Real Property I State program must include a management plan/program, implementation regulations and consistency regulations. Requires a state’s coastal zone management program to include 9 planning elements, the most important plan themes of which are: • A definition of the boundaries of that part of a coastal zone that is subject to the program • Objectives and policies for coastal area protection • A statement of permissible land and water uses • And the identification of special management areas. Coastal Boundaries – coastal waters and adjacent shorelands that are “strongly influenced by each other.” Zone extends seaward to the outer limit of the US territorial sea, but the inland boundary is based on the extent of area necessary to control shorelands, the use of which have a direct and significant impact on coastal waters (e.g., salt marshes and wetlands, beaches, state determined floodplains, islands and watersheds). State must define its inland boundary with sufficient precision so that “interested parties” can determine whether their activities are controlled by the management program. Topliss v. Planning Commission: (1993) P has land that lies on an intersection next to a highway within an SMA. P applied for a permit from D to build 2 multi-story office buildings. D denied the permit petition. P filed petition to amend the boundaries of the SMA. D denied petition to amend boundaries (entered findings of fact and conclusions of law). 3rd Circuit court affirmed for D. Holding: Absent a finding that the impact on the public facilities would result in a substantial adverse environmental or ecological effect, or render the development inconsistent with the objectives, policies, and guidelines of the CZMA, the commission’s finding that the development would have significant adverse effects and impact on the existing highway system in the area of the development did not provided a sufficient basis for denying the permit petition. However, the court held that the developer’s property was property included within the special management area. Denial of the SMA boundary amendment affirmed. Denial of the permit vacated and remanded to consider whether granting of permit will have substantial adverse environmental or ecological effects. Rule: Under CZMA, development cannot be approved within SMA unless the development Will not have any substantial adverse environmental or ecological effect except where the substantial adverse effect is minimized and clearly outweighed by public health, safety, or compelling public interests Is consistent with the objectives, policies and SMA guidelines of the CZMA and Is consistent with the county general plan and zoning. Per ICA, as long as proposed development meets above, Commission must approve permit. Purpose of CZMA is to control development, not prevent/prohibit development. Thus, if development does not violate policies, objectives and purposes of CZMA, then Commission must approve. Per ICA, even if found to have substantial adverse environmental or ecological effect, Commission required to determine if effect could be minimized, and when minimized, if effect is outweighed by public health, safety, or compelling public interests. Protection of coastal areas and waters from adverse environmental impact is an objective of the CZMA as is protection against interference with coastal scenic resources. Relevant Points 51 Professor Callies Sarah K. Kam Real Property I 1. Construing the CZMA (policies and objectives) – Comprehensive State regulatory scheme to protect the environment and resources of our shoreline areas. Imposes special controls on the development of real property along the shoreline areas in order to “preserve, protect, and restore the natural resources of the coastal zone of Hawaii.” (state policy declared by leg.) In enacting CZMA, HI leg. specifically found that special controls on developments within an area along the shoreline are necessary to avoid permanent losses of valuable resources and foreclosure of management options, and to ensure that adequate access by dedication or other means, to public owned or used beaches, recreation areas, and natural reserves is provided. Leg. authorized counties to establish special management areas to carry out policies and objectives of the CZMA. 2. CZMA’s objectives and policies include the protection, preservation, restoration and improvement of the quality of coastal scenic and open space resources and the designing and locating of new developments to minimize the alteration of existing public views to and along the shoreline. (NOTE – NOT FROM SHORELINE TO DEVELOPMENT) 3. The purpose of the CZMA is to control development within an SMA through use of the SMAP, not to totally prevent or prohibit development in an SMA. 4. D found only that P’s plan would detrimentally increase traffic, but court says that D didn’t even try to work with P on the issue. They just refused the SMAP. 5. If development will have an adverse effect, but the effect can be practicably minimized and, as minimized, the effect is clearly outweighed by public health, safety, or compelling public interests, the SMAP should be approved. Wetlands Solid Waste Agency of Northern Cook County, Petitioner v. United States Army Corps of Engineers, Et. Al. (2001): Facts: Petitioner was a consortium of municipalities which sought to develop an abandoned gravel pit as a solid waste disposal site. Respondent United States Army Corps of Engineers denied petitioner’s application for a disposal permit on the ground that, even though the gravel pit ponds constituted nonnavigable, isolated, intrastate waters, there were subject to protection as habitations for migratory birds. Holding: Judgment was reversed; even though petitioner’s proposed waste disposal site was a habitat for migratory birds, federal agency jurisdiction did not extend to such nonnavigable, isolated, intrastate waters under the clean water statute which expressly limited such jurisdiction to navigable waters. Rule: Migratory Bird Rule: Migratory birds migrate across state lines. The authority the Corps gets comes from the interstate commerce clause. 52 Professor Callies Sarah K. Kam Real Property I Navigable waters: waters such as intrastate lakes, rivers, streams, mudflats, sandflats, wetlands, sloughs, prarie potholes, wet meadows, playa lakes, or natural ponds, the use, degradation or destruction of which could affect interstate or foreign commerce. Relevant Points: The lack of legislation overruling respondent’s interpretation did not indicated congressional acquiescence to such jurisdiction, and respondent’s regulation effectively eliminated the statutory limitation of such jurisdiction to navigable waters. The significant constitutional issues presented by respondent’s attempt to usurp the states’ traditional and primary power over land and water use precluded administrative deference and warranted reading the statute as written rather than as interpreted by respondent. 19. Clean Air, Water and Endangered Species (review nuisance) Clean Air Clean Air Act 1. The clean air act provides for geographically uniform federal quality standards for ambient air (the air around us), emission standards (the air at a point of discharge into the atmosphere), for new stationary sources of pollution (factories, power plants, etc.) to be established by the EPA. The standards are to be enforced through a state implementation plan (SIP). 2. Establishes Nat’l Ambient Air Quality Standards (NAAQS) for five major air pollutants (sulfur dioxides, carbon monoxide, nitrogen dioxide, particulates and photochemical oxidants). EMISSION STANDARDS – mobile and stationary 3. To counteract no-growth effect of statute, established “offset program”, which permits states to develop plans which allow construction of new pollution sources where accompanied by a corresponding reduction in an existing pollution source. 4. If factory emit carbon monoxide, sulfur dioxide, or particulates – then offsetting pollution source must be within the immediate vicinity. (“site specific” requirement) 5. If factory emit hydrocarbons and nitrogen oxide – then offsetting source may be located anywhere within a broad vicinity of the new source. 6. Base time period – period used to calculate how much reduction is needed in existing pollutants to offset the new source. (selected by EPA) Citizens Against Refinery’s Effects, Inc. v. US EPA: (1981) Facts: D approved a plan to build a refinery in Virginia and to offset the potential pollution by having the state use a less harmful type of asphalt. Proposed refinery is in a “Dirty Air Region” with respect to that pollutant. P contends that this plan is no good. Administrator for the EPA found for D. 53 Professor Callies Sarah K. Kam Real Property I Holding: The EPA’s approval of the use of three highway districts as the area in which pollution reduction was to be measured was neither arbitrary, capricious, nor outside the act. Affirmed. Rule: The offset program permits states to develop plans which allow construction of new pollution sources where accompanied by a corresponding reduction in an existing pollution source. Possible to sell offsets with approval of EPA or other state designated agency. (EX: if had a dirty plant that was willing to shut down to provide offset to other business entity needing offset to operate, could sell offset) Relevant Points 1. Congress intended that the states and the EPA have flexibility in the design and implementation of such plans. 2. Because the offset program was initiated to encourage economic growth, a plan designed to reduce pollution in order to attract another industry was a reasonably contribution to economic growth without a corresponding increase in pollution. 3. The fact that the state had been voluntarily reducing pollution by the same method did not effect the plan’s validity because the voluntary plan did not guarantee a reduction in pollution. 4. A base time period, defined as the first year of the SIP or the year when a construction permit application is filed, must be determined in which to calculate how much reduction is needed in existing pollutants to offset the new source. 5. The offset program requires that the new source adopt the Lowest Achievable Emissions Rate using that most modern technology available in the industry. 6. The offset program was made to encourage economic growth while still attaining clean air standards. The Clean Water Act: A Selective Overview The Clean Water Act contains several parts that have a particularly strong bearing on the use of land: (1) Section 208 wastewater planning; (2) Pollution discharge (point and nonpoint source); (3) U.S. Army Corps of Engineers’ dredge and fill permit programs; and (4) Wastewater treatment plan construction. Principal Purpose: The cleaning and maintenance of the nation’s waters. It attacks the problem broadly by means two different techniques to eliminate the discharge of pollutant’s into the nation’s waterways: (1) Structural Techniques: Pertain to the financing and construction of wastewater treatment plants and ancillary facilities. (2) Nonstructural techniques: Pertain primarily to regulatory mechanisms, such as planning and land use controls. Shift in Emphasis: The shift in emphasis toward nonstructural techniques, together with the increased role of the Corps of Engineers in granting or not granting permits to dredge and fill navigable waterways, appears to represent current EPA policy. 54 Professor Callies Sarah K. Kam Real Property I State and Local Governments: City, county, village, and special districts constructs, operates, and maintains the facility and attempts to implement the various rules and regulations concerning connections, pretreatment of effluent, and the like, which come with the money. Regional unit of state or local government does planning, especially the wastewater management planning upon which much regulatory implementation depends. State and local government also monitors, regulates, and enforces compliance. Draconian Effects: It is illegal to discharge pollutants into a waterway without a permit from a state agency under the National Pollution Discharge Elimination System (NPDES). The NPDES permit requirement extends to both private and public-facility discharges-including publicly owned treatment works (POTWs)/ Permits are issued by an approved state agency only upon condition that such discharge will meet the effluent and other standards set by the administrator of the EPA. For the EPA administrator to approve a state permitting program, the state agency must have the power to revoke a permit violating its terms. The state program must also insure that any permit for a POTW will include conditions that guarantee compliance with pretreatment standards for private-source hookups (industrial/commercial facilities connected to the POTW). These standards require the treatment of sewage for the removal of some pollutants before the sewage reaches a POTW, in order to avoid overburdening the plant. Section 208 Plans and Section 404 Permits The purpose of the 208 planning process is to halt water pollution by the management of water quality and land use in metropolitan areas. The purpose of Section 404 is to prohibit discharge of dredged or fill materials into navigableincluding coastal-waters of the United States without a permit from the U.S. Army Corps of Engineers. Homestake Mining Co. v. US EPA (1979): Facts: In 1974, South Dakota revised its water quality standards and designated a creek as a permanent fishery and for recreational use. P was used to dumping waste into a tributary of the creek. P declined all opportunities to get a hearing on its complaint and now asks the court to find D’s act invalid (since state standards more stringent than federal standards). Holding: The establishment of South Dakota’s water quality standards and EPA’s approval of them appeared to be in compliance with the FWPCA. Therefore, the summary judgment motion of the EPA and the state as granted and the mining company’s motion for summary judgment was denied. Judgment for D. Rule: Federal Water Pollution Control Act (FWPCA): Prohibits the discharge of any pollutant by any person unless certain sections of the act are complied with. An existing pollutant source can continue to discharge waste pursuant to an NPDES permit. The state is allowed to adopt more stringent standards than those established by the Act. Relevant Points 55 Professor Callies Sarah K. Kam Real Property I 1. EPA is also responsible for keeping groundwater unpolluted. Its principal authority comes from the Safe Drinking Water Act which establishes a national regulatory program for injection of pollutants into certain underground water sources. Endangered Species Protection and Property Rights Endangered Species Act (ESA): provides a means where by the ecosystems upon which endangered species and the threatened species depend may be conserved, to provide a program for the conservation of such endangered species and threatened species, and to take such steps as may be appropriate to achieve the purposes of the treaties and conventions set forth. Congress demonstrated an awareness that wildlife not only has esthetic value, but ecological, educations, historical, recreational, and scientific value. Congress amended the ESA several times to strike a better balance between species protection and development. Controversial Issue: One of the more controversial issues under the ESA is whether the modification of habitat on private lands constitutes a “taking” of an endangered or threatened species. Section 9 of the ESA explicitly prohibits the “taking” of any endangered species of animal or plant. ”take”: to harass, harm, pursue, hunt, shoot, wound, kill, trap, capture, or collect or to attempt to engage in any such conduct. Defenders of Wildlife v. Bernal (2000): Facts: Defendant school district sought to build a new high school. The pygmy-owl was an endangered species under the Endangered Species Act. The school site fell within the area designated as critical habitat for the owl. Defendant redesigned the project so that the western portion of the property would remain undeveloped and fenced off. Plaintiffs alleged that the proposed construction was likely to harm or harass a pygmy-owl, a violation of §9 of the ESA. Holding: Judgment affirmed; district court’s factual finding that school construction would not “take” a pygymy-owl was not clearly erroneous; defendant was not required to seek an Incidental Take Permits; exclusion of expert’s was not abuse of discretion; and denial of new trial was appropriate because evidence could have been obtained with the exercise of due diligence at the time of trial. 56 Professor Callies Sarah K. Kam Real Property I PART II: PRIVATE RESTRICTIONS/LAND USE/RIGHTS IN LAND/ANOTHER 20. Rights of Common Ownership: Concurrent Estates Concurrent Ownership Generally: There are three ways in which two or more people may own present possessory interests in the same property: (1) joint tenancy (which includes the right of survivorship); (2) tenancy in common (which does not have the right of survivorship); and (3) tenancy by the entirety (which exists only between husband and wife, and which includes not only survivorship but “indestructibility.”) (1) Joint Tenancy: Two or more people own a single, unified interest in real or personal property. General Attributes: (1) Survivorship: Each joint tenant has a right of survivorship; if there are two joint tenants, and one dies, the other becomes sole owner of the interest that the two of them had previously held jointly. (2) Possession: Each joint tenant is entitled to occupy the entire premises, subject only to the same right of occupancy by the other tenant(s). (3) Equal Shares: Since the joint tenants have identical interest, they must have “equal shares.” Thus one joint tenant cannot have a one-fourth interest, say, with the other having a threefourths interest. (1) Four Unities: Lack in any of these unities makes it a tenancy in common rather than a joint tenancy: Time: Tenants acquire interest for the same duration. Title: Tenants acquire interests from the same instrument. Interest: Tenants must acquire identical interests (i.e. fee simple, life estate, etc.) Possession: Tenants have an equal right to use the property. (2) Creation: Must be created by a single instrument (deed or will), and must be created in both or all joint tenants at the same time. Language Used: A joint tenancy is created by specific language: “To A and B as joint tenants with rights of survivorship.” Conveyance by A to B: At common law, A (owner of fee simple) cannot create a joint tenancy between himself and another by conveying “to A and B as joint tenants.” But many states, by statute or case law, now permit this result. (3) Severance: Severance normally results in the creation of a tenancy in common. Conveyance by one joint tenant: A joint tenant may convey his interest to a third party. Such a conveyance has the effect of destroying the joint tenancy. Three or more joint tenants: If there are three or more original joint tenants, a conveyance by one of them to a stranger will product a tenancy in common as between the stranger and the remaining original joint tenants, but the joint tenancy will continue as between the original members. 57 Professor Callies Sarah K. Kam Real Property I Granting of mortgage: Courts are split as to whether the granting of a mortgage by one joint tenant severs the joint tenancy. In so-called “title theory” states, the mortgage is treated as a conveyance, and thus serves the joint tenancy (so that the mortgagee can foreclose on the undivided one-half interest of the mortgagor, but the interest of the other party is not affected). In “lien theory” states, the mortgage does not sever the joint tenancy; in some but not all lien theory states, if the mortgagee dies first, the other joint tenant takes the whole property free and clear of the mortgage. (4) Lease: Most courts seem to hold that a lease issued by one joint tenant does not act as a severance. (2) Tenancies in Common: Each tenant has a separate “undivided” interest. No Right of Survivorship: The most important difference between the tenancy in common and the joint tenancy is that there is no right of survivorship between tenants in common. Thus each tenant in common can make a testamentary transfer of his interest; if he dies intestate, his interest will pass under the statute of descent. Unequal Shares: Tenants in common may have unequal shares (unlike joint tenants). Rebuttable Presumption of Equality: If the conveyance does not specify the size of the interests, there is a rebuttable presumption that equal shares were intended. Presumption Favoring: Most states have a presumption in favor of tenancies in common, rather than joint tenancies, so long as the co-tenants are not husband and wife. But this can be rebutted by clear evidence showing that the parties intended to create a joint tenancy. Heirs: Apart from a conveyance directly creating a tenancy in common, a tenancy in common can result from operation of law, including the intestacy statute: if the intestacy statute specifies that two persons are to take an equal interest as co-heirs, they take as tenants in common. (3) Tenancy by the Entirety: A form of concurrent ownership that can be created only between husband and wife, holding as one person. No Severance: The key feature of the tenancy by the entirety is that it is not subject to severance. So long as both parties are alive, and remain husband and wife, neither one can break the tenancy. Most significantly, each spouse knows that if he or she survives the other, he/she will get a complete interest. (Even if the husband kills his wife, the tenancy will not be severed and he will obtain the property). Usually Abolished: Only 22 states retain the tenancy by the entirety. Even in these states, it is no longer the case (as it was at common law) that a conveyance to husband and wife necessarily creates a tenancy by the entirety-instead, there is usually just a rebuttable presumption that a conveyance to a husband and wife is intended to create a tenancy by the entirety. Some states have just abolished the sexist standards. Divorce: If the parties are divorced, the tenancy by the entirety ends. The parties are then treated as owning equal shares (usually as tenants in common or joint tenancy, if the parties choose to create one). 58 Professor Callies Sarah K. Kam Real Property I Four Unities: The same four unities are required as for joint tenancy. (Time, title, interest and possession). Right to Possess: Each spouse owns an equal share of the property and has the right to possess the whole property. Severance by one person is impossible because under a tenancy by the entirety, the husband and wife are one person and both must agree. Absent consent of one of the spouses, only a severance of the marital relationship may destroy the tenancy by the entirety. A spouse acting alone can encumber or convey his own interest in the property. A creditor’s acquisition of a spouse’s interest by way of default is subject to complete defeasance based on survivorship rights of the other spouse. (i.e. the bank must wait until the wife dies). Joint Tenancies and Tenancies in Common Giles v. Sheridan (1965): Facts: P bought property when she was 83 which describes as grantees P and John and Helen (deceased) Sheridan, (D’s) as joint tenants and not as tenants in common. Trial court held that P has 19/20 of 1/3 interest, D’s have 2/3 interest, but that D’s must pay P back for the money she spent on that part of the land. Holding: A joint tenant who pays off an encumbrance on the property, under such circumstances, does so for the common benefit of the joint tenants and is entitled to contribution. Affirmed. Rule: Where a conveyance of property was made to two or more persons and the instrument is silent as to the interest which each is to take, the rebuttable presumption is that their interests are equal. Relevant Points 1. An estate in joint tenancy can be destroyed by an act of one joint tenant which is inconsistent with joint tenancy and such act has the effect of destroying the right of survivorship incidental to it. 2. If one of two joint tenant disposes of his interest by conveyance inter vivos, the other joint tenant and the grantee become tenants in common. 3. If one of three or more joint tenants conveys his interest to a 3rd person, the 3rd person becomes a tenant in common, instead of a joint tenant, although the others remain joint tenants between themselves. 4. Each joint tenant has the right to convey her interest. A conveyance of the tenant’s entire interest or share severs the joint tenancy with respect to that share. Either a conveyance to a third person or to another joint tenant severs the share conveyed from the joint tenancy. A deed to a third person severs the joint tenancy even though the other joint tenant does not know about the deed. 5. In most jurisdictions a lease does not sever the joint tenancy, though this is apart from the old common law rule. Rights of Concurrent Tenants McKnight v. Basilides (1943): 59 Professor Callies Sarah K. Kam Real Property I Facts: In 1907, D moved to Seattle with his wife, two kids from her earlier marriage, and their child. D bought two pieces of property. D’s wife died intestate and D has been living in one house and renting the other out since. D claims ownership by adverse possession. Trial court disagreed and divided up the properties. Holding: Appellant used the “big house” as a home for many years, and it was proper that he be charged with the reasonable rental value of that use and made to account to his cotenants for their share of that rental value. However, appellant should not be charged with the rental value of the “little house” after its sale, for the reason that he did not receive any rent, nor did he occupy or use it in any way. Affirmed. Rule: Generally, the entry of a co-tenant on the common property will not be considered adverse to the other others. Rather, such acts will be construed in support of the common title. Relevant Points 1. At common law, one tenant in common who occupied all or more than is proportionate share of the common premises is not liable, because of such occupancy alone, to the cotenants for rent or for use and occupation. 2. The court holds against the common law rule, saying it isn’t equitable to allow one cotenant to reap a financial benefit by occupying property owned in common without paying for his use of the part owned by the co-tenants. Condominiums and Common Ownership Dutcher v. Owens (1983): Facts: P owned a condo which he leased to D. Ownership of the condo includes a 1.5% ownership in the common elements of the project. A faulty light started a fire, destroying most of D’s possessions. D sued and trial court awarded D’s money from the homeowner’s association and money from P, who the court said was vicariously liable for a defect in a common element. Court of Appeals reversed. Holding: Because of the limited control afforded a unit owner by the statutory condominium regime, the creation of the regime effects a reallocation of tort liability. The liability of a condominium co-owner is limited to his pro rata interest in the regime as a whole, where such liability arises from those areas held in tenancy-in-common. The judgment of the court of appeals is reversed and the judgment of the trial court is affirmed. Rule: The liability of a condo co-owner is limited to his pro-rata interest in the regime as a whole, where such liability arises from those areas held in tenancy in common. Relevant Points A condo is a fee simple ownership of an apartment or unit in the condo and a tenancy in common with the other co-owners in the common elements. The individual apartment can’t be conveyed separately from the undivided interest in the common elements. Individual unit owners are subject to tort liability for injuries occurring inside their respective units. All of the unit owners are jointly liable for injuries occurring in the common areas that 60 Professor Callies Sarah K. Kam Real Property I they own as tenants in common. The owners’ association may also be liable for such injuries (on the ground that it has assumed management control of the common areas), but this has no effect on the owners’ personal liability. Each purchaser of a condominium until will have to make sure the owners’ association maintains adequate liability insurance to cover her personal liability for such injuries. Unit owners’ liability for torts in common area limited to pro rata share of ownership. 21. Marital Property The Common-Law System: Rights during Marriage Common-Law System: All but eight states govern marital property in a way that is derived from traditional common-law principles. The Feudal System: The feudal system gave the husband extreme dominion over his wife’s property, by means of the doctrines of coverture and jure uxoris: (1) Doctrine of Coverture (Personal Property): All personal property owned by the wife at the time of the marriage became the property of the husband. (2) Doctrine of Jure Uxoris (Real Property): The husband had the right to possess all his wife’s lands during the marriage, and to spend the rents and profits of the land as he wished. Married Women’s Property Acts: All states have enacted Married Women’s Property Acts, which undo coveture and jure uxoris, give the woman equality, and protect her assets from her husband’s creditors. Divorce Traditional “Title” View: Under traditional common-law principles, if the parties were divorced, the division of their property depended heavily on who held formal legal “title” to the property. Modern “Equitable Distribution”: Every common-law property state has abolished the “title” approach to property division at divorce. Instead, property is divided by the court according to the demands of fairness, not based on who has title. Most states allow the court to divide only “marital property” under equitable distribution principles. Marital Property: Only property acquired during the marriage from the earnings of the parties. (So property acquired before marriage, or acquired by one spouse through a gift or bequest to that spouse, is not included in the assets to be distributed. Community Property Community Property: In eight states, the rights of husband and wife in property are governed by the civil-law concept of community property. Property acquired during the marriage (with exceptions) belongs jointly to husband and wife from the moment it is acquired. Thus upon divorce or death, the property is treated as belonging half to each spouse. Exceptions to Community Property: (4) Before Marriage: Property acquired by either spouse before marriage is separate, not community property. 61 Professor Callies Sarah K. Kam Real Property I (5) Gift or Inheritance: Property acquired by gift, inheritance or bequest, even after marriage, is separate property. (6) Earnings: Income produced by either spouse’s labor is community property. Tenancy by the Entirety Tenancy by the Entirety v. Joint Tenancy The Key Feature of the tenancy by the entirety is that it is not subject to severance. So long as both parties are alive, and remain husband and wife, neither one can break the tenancy. Most significantly, each spouse knows that if he or she survives the other, he/she will get a complete interest. Impossible for either party to voluntarily sever a tenancy by the entirety. Impossible by any action (unless he/she dies). Otherwise it is similar to joint tenancy-survivor takes all. Robinson v. Trousdale County (1974): Facts: P’s husband and wife, sue D for the taking of lands owned by them as tenants by the entirety for the purpose of widening a public road. D says that they have a deed to the land signed by P-husband. Trial judge gave D the land and gave P-wife damages for her land taken. Court of Appeals affirmed but said that P-wife doesn’t get the money unless her husband dies or she divorces (disability of coverture). Holding: Disability of coverture is abolished in Tennessee. The estate of tenancy by the entirety is not abolished, but we strip it of the artificial and archaic rules and restrictions imposed at the common law. Rule: As tenants in entirety, each tenant shall have a joint right to the use, control, incomes, rents, profits, usufructs, and possession of property so held and neither may dispose of or encumber any portion except his or her right of survivorship without the consent of the other. Relevant Points 1. For a tenancy by the entirety, the four unities must be satisfied with the requirement of a valid marriage as the fifth unity. 2. Tenancies by the entirety are useful because neither spouse’s creditors can get the property. Only if the husband and wife together owe a creditor can he get the land. 3. About ½ of states recognize tenancy by the entirety. (At the time of the case – See notes). 4. The courts in the majority of states recognizing the tenancy by the entirety hold that the equality intended by the Married Women’s Property Act can be achieved in this way: (i) give both husband and wife equal rights to possession during the marriage (thus, with respect to possession, putting the wife in the same position the husband had at common law), and (ii) forbid both husband and wife, acting alone, to convey his or her interest (thus, with respect to voluntary transfer and creditors, putting the husband in the same position the wife had at common law). Under this view, creditors of one spouse cannot reach the property because neither the husband nor the wife acting alone can transfer his or her interest. Doubtless this exemption from creditors is one of the main reasons for the survival of the tenancy by the entirety. It serves to protect the family home from assignment by one spouse and from creditors of one spouse. 62 Professor Callies Sarah K. Kam Real Property I Other Forms of Marital Property Hoak v. Hoak (1988): Facts: Appellant working spouse was married to appellee spouse during which time appellee obtained a profession degree in medicine. Appellant monetarily supported appellee spouse during his education. Appellant petitioned this court alleging that the circuit court had erred by failing to hold that a license to practice medicine earned during marriage was marital property subject to equitable distribution under W. Va. Code §§ 48-2-1(e)(1) (1986) and 48-2-32 (1986). Holding: A professional degree is not marital property. The Court adopts instead the concept of reimbursement alimony as a means of compensating the working spouse in this kind of “professional degree degree/divorce decree” case. Judgment of the lower court is reversed and the case is remanded for further proceedings, for reasons set out more fully below. Rule: A professional degree or license earned during marriage is not marital property subject to equitable distribution. Relevant Points: The value of a professional degree is the value of the enhanced earning capacity of the degree-holder. Not only is that value speculative, but also it represents money or assets earned after dissolution of the marriage. As such, it falls outside our statutory definition of marital property as “all property and earnings acquired by either spouse during a marriage.” However, “reimbursement alimony” is designed to repay or reimburse the supporting spouse for his or her financial contributions to the professional education of the student spouse. Therefore, the trial judge in a divorce proceeding may in an appropriate case award reimbursement alimony to a working spouse who contributed financially to the professional education of a student spouse, where the contribution was made with the expectation of achieving a higher standard of living for the family unit, and the couple did not realize that expectation due to divorce. 22. Estates in Land – Present & Life Tenants The Estate Concept Present v. Future Uses: Ownerships may be divided between two or more individuals with simultaneous claims over time, with one owner entitled to the present use and another to its future use. Future Interest Definition: A future interest is a nonpossessory interest capable of becoming possessory in the future. A future interest is a present interest in the sense that it is a presently existing interest. But it is not a presently possessory interest, and that is why it is called a future interest. Categories Limited: Just as possessory estates are limited in number (fee simple, fee tail, life estate, leaseholds), so are future interests. There are five future estates: (1) the possibility of reverter; (2) the right of entry; (3) the reversion; (4) the remainder; and (5) the executory interest. 63 Professor Callies Sarah K. Kam Real Property I Estate Concept: Recognizes that interests in land may be temporal and that ownership is more than just the right of present possession. o The highest for of estate is fee simple absolute. o Concurrent estates allow more than one individual to possess an estate in fee simple absolute in the same parcel of property. Periodic Tenancy: An estate for a fixed period of time which continues for periods equal to the original one unless either the landlord or tenant gives notice of an intention to terminate the estate. The period may be of any length although periodic tenancies of less than one week or more than one year are extremely rare. Under the traditional rule, notice of termination must be given prior to the beginning of the next period. Tenancy at Will: Is an arrangement whereby either the landlord or the tenant can terminate the estate at any time. Tenancy at Sufferance: Comes into being when an estate holder remains on the land after the expiration of his or her estate. The tenant at sufferance (also called a holdover tenant) can be evicted at any time. Under some circumstances, the landlord may renew the tenant’s lease instead of evicting him. While those who hold property under these arrangements are not without legal rights, their ownership interest is so tenuous that it does not make a great deal of sense to characterize them as joint owners of the land with those who have the authority to terminate their possessory interest. Freehold Estates: Life estate and fee tail. Non-Free Hold Estates: Estate for years, the periodic estate, the tenancy at will, and the tenancy at sufferance. Conceptual Difference: The holder of the freehold estate had “seisin,” i.e., legal ownership while the holder of a non-freehhold estate only had possession. The Estate Concept Freehold Estates: The three freehold estates are (1) the fee simple (which may be either absolute or defeasible); the fee tail; and (3) the life estate. Non-Freehold Estates: (1) the estate for years; (2) the periodic estate; and (3) the estate at will. Fee Simple Absolute: The highest form of estate. The holder owns the property absolutely. The duration of his ownership is potentially infinite (fee); there are no restrictions on the inheritability of the property (simple); and no event will automatically divest the owner of his interest (absolute). When an owner possesses an estate in fee simple absolute, no future interests are held by anyone. It is possible for more than one individual to possess an estate in fee simple absolute in the same parcel of property. (This is typically the case with concurrent estates). Inheritable: The fee simple absolute is inheritable under intestacy statutes. Thus if the owner of a fee simple absolute dies, the property passes to the people deemed to be his “heirs” under the intestacy statute of the state where the land is located. 64 Professor Callies Sarah K. Kam Real Property I Words to Create: Generally, a fee simple absolute is created by using the words “and his heirs.” But most states have abolished the requirement that the phrase “and his heirs” be used. May Alienate: The owner of an estate in fee simple absolute may choose to alienate his entire estate to another owners; he may choose to alienate only a portion of it and thus retain the possessory right to it at a future time; or he may transfer a portion of the estate to one party and the future interest in it to another. The Fee Tail Fee Tail Generally: The fee tail allows the owner of land to ensure that the property remains within his family indefinitely. Words to Create: The most common way of creating a fee tail is by a grant “to A and the heirs of his body.” Modern Treatment: Most states a grant or bequest that would be a fee tail at common law is simply converted by statute to a fee simple absolute. No states today fully enforce the fee tail as a method of ensuring that property will descend along bloodlines and will not be conveyed outside the family tree. The Life Estate Definition: A life estate is an interest which lasts for the lifetime of a person. Ordinarily, the lifetime by which the life estate is “measured” is that of the holder of the life estate. Duties and Powers of Life Tenant: Duties: The life tenant has a number of duties vis a vis the future interest. Most importantly, he may not commit waste, i.e., he may not unreasonably impair the value which the property will have when the holder of the future interest takes possession. Thus he must make reasonable repairs, not demolish the structure, pay all property taxes, etc. Powers: The life tenant cannot convey a fee simple, or any other estate greater than the life estate he holds. But he may convey the interest which he does hold, or a lesser one. Waste: Waste is conduct by the life tenant that permanently impairs the value of the land or the interest of the person holding title or having some subsequent estate in the land. A common law form of action entitled “waste” lay against the life tenant for damages to the land. Types of waste recognized: Affirmative (Voluntary) Waste: Occurs when the life tenant actively causes permanent injury by , destroying buildings or ornamental trees on the land, or removing the natural resources. However, cutting of trees in clearing woodland for conversion into more valuable cultivated farm land is not waste. Permissive (Involuntary) Waste: Occurs when the land is allowed to fall into disrepair, or the tenant fails to take reasonable measures to protect the land from the elements. Failing to pay the taxes and allowing the property to be sold at a tax sale is treated as permissive waste. Ameliorating Waste: Occurs when the principal use of the land is substantially changedusually by tearing down a building-but the change increases the value of the land. 65 Professor Callies Sarah K. Kam Real Property I Ameliorating the waste is actionable if the court finds that: (i) the grantor intended to pass the land with the specific buildings on it to the holder of the remainder; and (ii) the building can reasonably be used for the purposes built. Duties of Life Tenants Life estates may be created either for the life of the grantee (as in O to A for the life of A) or for the life of a third party (O to A for the life of B). When ambiguous, the life of the estate will ordinarily be assumed to be the life of the grantee. Life estates are rarely used today. The holder of the life estate has the exclusive right or present possession and use of the property and can exclude all others, including the holder of the reversion or remainder. Brokaw v. Fairchild (1929): Facts: In 1886, Isaac Brokaw bought land in NYC and built houses which he left to his children as life estates. P lives in one of these mansions and wants to tear it down and build a 13-floor apartment building. D contents that P doesn’t own the future estate and isn’t allowed to remove the house. Holding: Found for D. P is not allowed to remove the house. Rule: Waste: Any act of the life tenant which does permanent injury to the inheritance. Relevant Points 1. In this case, P has a present possessory interest and the owner of the future interest has a reversionary interest. 2. A life tenant can do whatever is required for the general use and enjoyment of his estate as he received it but he cannot exercise an act of ownership. 3. Fee Simple Determinable: An estate that automatically ends when some specified event (limitation) occurs. The grantor’s future interest is the “possibility of reverter”. 4. Fee Simple Subject to Condition Subsequent: An estate that doesn’t automatically end upon breach of the condition but gives the grantor an option to terminate the estate if he chooses. The grantor’s future interest is the “right of entry” of the “power of termination”. 5. Fee Simple Subject to Executory Limitation: An estate with a condition where breach will transfer the estate to a 3rd party. The 3rd party’s future interest is a “shifting executory interest”. The transfer of the estate is automatic. 6. If O to A for life, then to B. a. A has a life estate. b. B has a vested remainder c. O has no reversionary interest. Even if A and B die, it will go to B’s heir. d. Courts have said this is a contingent remainder cause it is dependent on the survival 7. If O to A for life, and if B attains age 21, then to B. a. A has a life estate. 66 Professor Callies Sarah K. Kam Real Property I b. B has a contingent remainder (contingent on his turning 21). c. O has a reversionary interest (if B doesn’t turn 21, O gets the property back). 8. If O to A for life, then to B and if B fails to reach 21, then to C. a. A has a life estate. b. B has a vested remainder subject to divestment. c. C has an executory interest. d. O has no reversionary interest. 9. If O to A provided that the property is used for church purposes. a. A has a fee simple determinable (this is a defeasible fee). b. O has a possibility of reverter. 23. Estates in Land-Transfers: Future Interests The Transfer of Future Interests Freely Transferable: Life estates and estates for years are freely transferable. The same is true for reversions and remainder. o If O to A for A’s life, then A can transfer his estate to B (and B will have an estate pur autre vie). When A dies, the land will revert to O, regardless of who is holding it at that time. If B has died and left his estate pur autre vie to someone else, they will still have to relinquish the property to O whenever A dies. Rutherford v. Keith (1969): Reversionary interest and a Reversionwhen it goes back to O If it follows life estate then it is a contingent remainder Facts: These are the parties: Julia (Wife)=L/E Sister in Law (Medie)=C/R her remainder is never possessory because she gets married Brothers=C/R Conditioned upon survival and they DIED; their contingent remainder fails Children of Brothers=C/R Fishback-Julia and her second husband conveyed the land to S.W. (L/E) S.W. & J.M. executed a deed attempting to convey the farm to Fishback. Fishback transferred her interest. these transferees get nothing since Fishback got a life estate and nothing!!! Get nothing since the brothers died!! Fishback’s interest was dependent upon the survival of the brothers!! These C/R are alternate contingent remainders. On or the other is almost certain to become possessory. There is no way that it is going back to O. Rule: 67 Professor Callies Sarah K. Kam Real Property I O retains a theoretical reversion because O always has a reversion following a contingent remainder. If there are 30 contingent remainders, O still has a reversion! Remember this!! After a vested remainder, there is nothing. Always a reversion following a contingent remainder. If there is a condition, then it is a contingent remainder. Conditional and Determinable Estates: The Threat of Divestment as a Form of Land Use Control Ways that sellers of land might restrict the ways in which the new owner may make use of the property. Qualified Forms of the Fee Simple Estate-Fee Simple Defeasible: The holder of a fee simple defeasible may hold or convey the property, but he and those who take from him must use the property subject to a restriction. Three types: (1) the fee simple determinable (2) the fee simple subject to a condition subsequent; and (3) the fee simple subject to an executory limitation. o General Principal: The holder of the estate had all the rights of a fee simple owner so long as he or she did not violate a specific limitation or condition attached to the estate at the time of its creation. Consequently, the estate was of potentially infinite duration since it would never terminate if the limitation or condition were honored. However, if the limitation or condition was violated, either the estate ended automatically or the holder of the future interest had the power to terminate it. Either way, the offending owner effectively forfeited his ownership interest in land. (1) Determinable: A fee simple which automatically comes to an end and when a stated even occurs (or fails to occur). Restriction on Uses: Most often used to prevent the property from being put to a certain use which the grantor opposes. The limitation controls even after the property changes hands numerous times. Possibility of Reverter: The creator of a fee simple determinable is always left with a “possibility of reverter,” the possibility that title will revert to him of the stated event occurs. Statute of Limitations: Many states have enacted statutes of limitation which bar a possibility of reverter after a certain period. Some statutes begin to run after the fee simple determinable is created, others don’t start to run until the stated event occurs. Words Creating: Usually created by words that make it clear that the estate is to end automatically upon the occurrence of the stated event. Such words include “so long as…,” or “until…,” or “during…” Also, if the conveyance says that the property is to “revert” to the grantor, that’s a sign of fee simple determinable. (2) Fee Simple Subject to Condition Subsequent: Also geared to the happening of a particular even, but unlike the fee simple determinable, the fee simple subject to a condition subsequent does not automatically end when the event occurs. Instead, the grantor has a right of entry, i.e. a right to take back the property-but nothing happens until he affirmatively exercises that right. Words Creating: Usually have a “conditional” flavor, such as “upon express condition that..,” or “provided that…” Also, most courts require that there also be a statement that the grantor may enter the property to terminate the estate if the stated event occurs. Distinguishable from Fee Simple Determinable: When a f.s. determinable is involved, the holders of the possibility of reverter often have a long or unlimited time to sue. But in the case of an f.s. subject to condition subsequent, the statute of limitations usually starts to run 68 Professor Callies Sarah K. Kam Real Property I upon the occurrence of the stated event, and usually is for a very short period-so if the holder of the right of entry does not promptly re-enter or sue, he will lose the right. (3) Fee Simple Subject to Executory Limitation: Provides for the estate to pass to a third person (rather than the grantor) upon the happening of the stated event. Automatically Forfeited: The present estate is automatically forfeited in the event of breach of its accompanying condition, and the holder of the executory interest becomes the owner of the property. Storke v. Penn Mutual Life Insurance Co. (1945): Facts: Plaintiff grantors' heirs filed an action against defendant property owner in the Circuit Court of Cook County (Illinois) requesting that the trial court establish their title in the property because of the breach of a covenant that liquor not be sold on the premises. The trial court ruled in the property owner's favor and the heirs appealed. Holding: The court determined the character of the condition, covenant, or reservation contained in the deed from the original grantors and found that they did not contain a right of re-entry. Therefore, the restrictions in the deed did not constitute a conditional limitation. The court found that the heirs' action was partition and, in order to maintain partition, it was requisite that the heirs have title. The court held that it was not within the power of equity to make the legal estate necessary to maintain a suit in partition. There being no title in the heirs, and there having been no re-entry, or provision for re-entry, the case was properly dismissed, as lacking in the elements necessary to maintain a partition suit. If the provisions in the deed were construed as a restrictive covenant, they could not be enforced by the heirs because the stipulation of facts and findings of the trial court showed that the change in the circumstances and use of the property in the subdivision had been brought about by the acts of the grantors or their assigns. Under such circumstances, they cannot be enforced. The court affirmed the trial court's decree denying the heirs right to recover, and confirming the title of the property owner. Rule: If the grantor creates a fee simple subject to condition subsequent, the grantor retains a right of entry. The law does not require that a right of entry be expressly retained by the grantor. If the words of the instrument are reasonably susceptible to the interpretation that this type of forfeitable estate was contemplated by the parties, the court will imply a right of entry. Future Interests in the Grantor 1. Possibility of Reverter: When the owner of a fee simple absolute transfers a fee simple determinable, the grantor automatically retains a possibility of reverter. All states allow this possibility of reverter to be inherited, or to be devised by will; most but not all states also allow it to be conveyed inter vivos. Example: O conveys Blackacre “to A and his heirs so long as liquor is not sold on the premises.” A has a determinable fee; O has a possibility of reverter. Created Only in Grantor: A possibility of reverter cannot be created in a grantee. The analogous future interest created in a grantee is called an executory interest. Alienability: At common law, a possibility of reverter could not be transferred inter vivos. (Rationale: A possibility of reverter was not viewed as an existing interest, but rather as a mere possibility of becoming an interest. Hence it was not a thing that could be transferred. However, on the death of the owner of a possibility of reverter, the possibility of reverter was treated as a thing; “it” descended to the owner’s heirs). 69 Professor Callies Sarah K. Kam Real Property I Modern Law: In most jurisdictions, a possibility of reverter is freely alienable, both during life and by will. (Rationale: The possibility of reverted is now viewed as a property interest, and alienability is an inherent characteristic of any property interest). Releasable: A possibility of reverter, although inalienable to a stranger at common law, was releasable to the owner to the determinable fee. Termination: Termination of a possibility of reverter is discussed below in connection with a right of entry. 2. Right of Entry: If the holder of an interest in land (e.g. a fee simple absolute) conveys his interest but attaches a condition subsequent, the transferor has a “right of entry.” Most commonly, one who holds a fee simple absolute and who then conveys a fee simple subject to a condition subsequent has a right of entry. Example: O conveys Blackacre “to A and his heirs, but if intoxicating liquor is ever sold on the premises, O has a right to reenter and retake Blackacre.” A has a fee simple subject to condition subsequent; O has a right of entry for breach of the condition subsequent. Alienability: At common law, a right of entry was inalienable inter vivos because it was treated as a chose in action, and choses were inalienable. It was not thought of as a property interest, but rather as a special right in the grantor to forfeit the grantee’s estate if he wished. A right of entry could be released, however, to the owner of the fee simple, and it was inheritable by the heirs of the grantor. In some states, the right of entry is now alienable; in others, common law is followed. 3. The Reversion: A reversion is created when the holder of a vested estate transfers to another a smaller estate; the reversion is the interest which remains in the grantor. Example: O conveys Blackacre “to A for life, then to revert to O.” Where it is not expressly retained, a reversion will arise by operation of law where no other disposition is made of the property after the expiration of the lesser estate. Quantum of Estates: A reversion arises when the grantor transfers a vested estate of a lesser quantum than she has. The hierarchy of estates determines what is a lesser quantum: The fee simple is of longer duration than the fee tail; the fee tail is of longer duration than a life estate; the life estate is of longer duration than the leasehold estates. Reversions are Vested Interests: All reversions are vested interests even though not all reversions will necessarily become possessory. The significance of a reversion being vested is that it is alienable, accelerates into possession upon the termination of the preceding estate, and is not subject to the Rule Against Perpetuities. Alienability: A reversion has always been regarded as fully transferable both inter vivos and by way of testate or intestate succession. The transferee gets only what the transferor had-an interest that cannot become possessory until the preceding estate terminates. Compared to Possibility of Reverter: A possibility of reverter arises where the grantor carves out of his estate a determinable estate of the same quantum. Most often it arises where the grantor conveys a fee simple determinable. A reversion arises where the grantor conveys a lesser estate than he has and does not in the same conveyance create a vested remainder in fee simple. There is no such interest as a “possibility of reversion.” Summary 70 Professor Callies Sarah K. Kam Real Property I POSSIBILITY OF REVERTER RIGHT OF ENTRY REVERSION Fee Simple Determinable Fee Simple Subject to a Condition Subsequent Life Estate Example “To A so long as alcohol is not used on the premises.” “To A on condition that if alcohol is used on the premises, O shall have the right to reenter and retake the premises.” “To A for life.” Rights of Grantor Estate automatically reverts to grantor upon the occurrence of the stated event. Estate does not revert automatically; grantor must exercise his right of entry. Estate automatically reverts to grantor on life tenant’s death. Alienability Transferable, descendible, and devisable. Descendible and devisable, but some courts hold not transferable inter vivos. Transferable, descendible, and devisable. Correlative Present Interest 24. Remainders-Contingent Remainders, Vested Remainders & Perpetuities Future Interests in the Grantees 4. The Remainder: A remainder is a future interest which can become possessory only upon the expiration of a prior possessory interest, created by the same instrument. It is called a remainder because on the expiration of the preceding estate, the land “remains away” instead of reverting to the grantor. A remainder never divests or cuts short the preceding estate; instead it always waits patiently until the preceding estate expires. Example: O conveys Blackacre “to A for life, then to B if B is then living.” B has a remainder because B’s interest is capable of becoming possessory upon the termination of the life estate. Requirements: The essential characteristics of every remainder are: (1) Must Have Preceding Estate: A remainder can be created only be express grant in the same instrument in which the preceding possessory estate is created. Unlike a reversion, it cannot arise by operation of law. If no preceding possessory estate has been created in a transferee, the future interest is not a remainder. (2) Must Follow a Fee Tail, Life Estate, or Term of Years: A remainder can follow any of these estates. But a remainder cannot follow a fee simple. If an interest is created in a third person to follow a fee simple determinable, that interest is called an “executory interest,” not a remainder. (3) Must be Capable of Becoming Possessory on Natural Termination of Preceding Estate: A remainder cannot divest a preceding estate prior to its 71 Professor Callies Sarah K. Kam Real Property I normal expiration. A divesting interest in a transferee is an executory interest, not a remainder. Classification of Remainders: Take each interest in sequence as it appears in the instrument. Determine whether it is given to an ascertained person or is subject to a condition precedent. Classify it. Move on to the next interest and do the same thing. Classification of each interest in sequence is the key to correct classification. (1) Contingent Remainders: A remainder will be contingent if: (1) it is subject to a condition precedent; or (2) it is created in favor of a person who is either unborn or unascertained at the time of creation. Condition Precedent: The “condition precedent” branch of “contingent” means that if some condition must be met before the remainder could possibly become possessory, the remainder is contingent. Unborn or Unascertained: A remainder is also contingent rather than vested if it is eld by a person who, at the time the remainder is created, is either (1) unborn or (2) not yet ascertained. Contingent remainders are subject to the Rule Against Perpetuities. Contingent remainders get their name because we have no way of knowing at the time of their creation if these remainders will ever become certain. The holder of a contingent remainder is normally not required to survive the previous estate. a. If O to A for life, then to B and his heirs if B graduates from law school, otherwise to C and his heirs. C doesn’t have to outlive A for his interest to vest in possession. Of course, C would be dead, but C’s heirs could vest in possession if A dies without heirs and B doesn’t graduate from law school. O to A for life then to A’s heir. We can now only identify A’s heir apparent, so A’s heir’s remainder is contingent because its holder cannot be ascertained. If O to A for life, then to A’s heirs, otherwise to B, C, and D and their heirs. a. A has a life estate. b. A’s heirs have a contingent remainder, contingent on their being born. c. B, C, and D all have contingent remainders contingent on A dying without heirs. d. O has reversionary interest expectant on A,B,C, and D all dying without heirs. 72 Professor Callies Sarah K. Kam Real Property I (2) Vested Remainders: A contingent remainder becomes “vested” if: (1) no condition precedent is attached to it; and (2) the person holding it has already been born, and his identity is ascertained. Vest remainders are not subject to the Rule Against Perpetuities. It is not necessary that the holder of the remainder be eligible to take immediate possession for a contingent remainder to vest, it may never vest in possession. Unless there is a vested remainder in fee simple absolute, the original grantor retains a reversion. (Since all reversions are vested, there is no such thing as a contingent reversion). If O to A for life, then to B for life if she graduates from law school. B’s remainder becomes vested as soon as she graduates, even if A is still alive. But if B dies before A, her vested remained is divested without ever having been a present possessory right. B’s remainder is therefore vested subject to divestment. Doctrine of Destructibility of Contingent Remainders: At common law, a contingent remainder is deemed “destroyed” unless it vests at or before the termination of the preceding freehold estates. o Modern Rule: The traditional rule has been abolished in most states. In these jurisdictions, a contingent remainder that has not yet vested when the estate preceding it has come to an end will not be destroyed. Instead, it will remain a valid future interest and will vest in possession when the condition is satisfied. If O to A for life, then to B if she graduates from law school. If B graduates law school after A dies (which would be the termination of the preceding estate), B’s interest will vest in possession. o The Effect: The effect of the abolition of the destructibility rule is to covert what was once a contingent remainder into an executory interest. o Merger: It is also possible to destroy a contingent remainder through the principle of merger. Consistent with the abolition of the destructibility rule, most states no longer permit the destruction of a contingent remainder by this method. In the above example, if A’s life estate and O’s reversionary interest and both transferred to the same person, B’s contingent remainder would be destroyed because the recipient of A and O’s interests now has fee simple absolute. Abo Petroleum Corp. v. Amstutz (1979): Facts: The heirs' grandparents owned in fee simple the disputed property, where they conveyed life estates to the heirs' parents. Later deeds conveyed an "absolute title to the grantee." Thereafter, the parents 73 Professor Callies Sarah K. Kam Real Property I attempted to convey the property to the claimant's predecessors. When the claimant brought suit to quiet title, the heirs contended that original deeds only gave their parents life estates in the property; thus, they could only convey life estates to claimant's predecessors. The claimant argued that the subsequent deeds vested the parents with fee simple title, and that such title was conveyed to his predecessors. The trial court found in favor of the claimant, and the court reversed and remanded. Holding: The court expressly declined to adopt the doctrine of destructibility of contingent remainders. Therefore, the attempted conveyances of the property did not destroy the contingent remainders in the heirs, and they acquired no more interest in the property by virtue of the later deeds than they had been granted in the original deeds. Any conveyance by the parents transferred only the interest they had originally acquired, even if it purported to convey a fee simple. Rule: The destructibility rule has been abolished in the large majority of the states by judicial decision or statute. Where destructibility is abolished, a contingent remainder takes effect if the contingency occurs either before or after the termination of the life estate. The Rule Against Perpetuities Statement of Rule: “No interest is good unless it must vest, if at all, not later than 21 years after some life in being at the creation of the interest.” Paraphrase: Paraphrasing, an interest is invalid unless it can be said, with absolute certainty, that it will either vest or fail to vest, before the end of a period equal to: (1) a life in existence (and specified in the document creating the interest) at the time the interest is created plus (2) an additional 21 years. Judged in Advance: The common-law version of the Rule requires that the validity of the interest be judged at the time it is created, not at the time the interest actually vests. So if it is theoretically possible (even though very unlikely) that the interest will vest later than 21 years after the expiration of lives in being, the interest is invalid. This is true even if it actually turns out that the interest vests before the end of lives in being plus 21 years. Applicability of Rule to Various Estates: 1. Contingent Remainders: The Rule applies to contingent remainders. 2. Vested Remainder: A vested remainder, by contrast, can never violate the Rule, because a vested remainder vests at the moment it is created. 3. Reversion: The Rule does not apply to reversionary interests (reversions, possibilities of reverters, and rights of entry). These are deemed to vest as soon as they are created. 4. Executory Interests: The Rule applies to executory interests, because such interests are not vested at their creation. 5. Options to Purchase Land: An option to purchase land will often be subject to the Rule. Option as Part of Lease: If an option to purchase property is part of a lease of that property and is exercisable only during the lease term, then the option is not subject to the Rule. 74 Professor Callies Sarah K. Kam Real Property I Option “in gross”: But if the option is not part of a lease or other property interest, most states hold that the Rule does apply. Such an unattached option is called an option “in gross.” Lives In Being: Lives in being means one or more persons who are actually mentioned in the conveyance or bequest. These are sometimes called measuring lives. Special Situations: There are some remote possibilities that nonetheless count for the purposes of the Rule: (1) Fertile Octogenarian: There is a conclusive presumption that any person, regardless of age or physical condition, is capable of having children. This is the “Fertile Octogenarian” rule, which will sometimes make a reasonable gift invalid. (2) Unborn Widow: In an interest is created which will flow through the “widow” of X (by naming and relying on her in determining when the interest will vest), the common-law view is that the interest must fail. (3) Class Gifts: If a gift is made to all members of a class, the entire gift fails unless it can be said that each member of the class must have his interest vest or fail within lives in being plus 21 years. This rule will be triggered if the class could obtain new members following a testator’s death. Wait and See Statutes: Many states reject the common-law principle that if a scenario could be imagined whereby the interest might vest too remotely, it is invalid regardless of how things actually turn out. These states have adopted “wait and see” statutes, by which if the interest actually vests within lives in being at the time of creation plus 21 years, the fact that things might have worked out differently is irrelevant. 25. Trusts and Executory Interests Rule in Shelley’s Case Rule Generally: If a will or conveyance creates a freehold in A, and purports to create a remainder in A’s heirs (or in the heirs of A’s body), and the estates are both legal or both equitable, the remainder becomes a remainder in A. Usually, the result is that A ends up getting a fee simple. o Freehold in Ancestor: For the Rule to apply there must be a freehold estate given to the ancestor. The ancestor must have a life estate. o Remainder in Heirs or Heirs of the Body: There must be a remainder, and it must be in the heirs of the ancestor, or in the heirs of the ancestor’s body. The heirs cannot have an executory interest (as opposed to a remainder). o Life Estate and Remainder Separated by Other Estate: The Rule applies even if there is another estate between the life estate and the remainder. Thus the Rule may apply even though there is no subsequent merger of the life estate and the remainder. 75 Professor Callies Sarah K. Kam Real Property I Modern Treatment: About two-thirds of the states have enacted statutes abolished the Rule. But the remaining states still apply the common-law version. Also, some of the statutory abolitions apply only to wills, not to inter-vivos deeds. Doctrine of Worthier Title Doctrine Generally: One cannot either by conveyance or will, give a remainder to one’s own heirs. o Consequence: If the owner of a fee simple attempts to create a life estate or fee tail estate, with a remainder to his own heirs, the remainder is void. Thus the grantor keeps a reversion. (This is why the Doctrine is sometimes called the “rule forbidding remainders to grantors’ heirs.”) Rule of Construction: In most states, the Doctrine has been transformed into a rule of construction. The Doctrine only applies where the grantor’s language, and the surrounding circumstances, indicates that he intended to keep a reversion. So in most states, the Doctrine today just establishes a presumption that a reversion rather than a remainder in the grantor’s heirs is really intended. The Trust as a Form of Divided Ownership Trust: Takes the present ownership interest and divides it into separate legal and equitable ownership interest. Legal title is held by a trustee while equitable title is vested in the trust beneficiary. (A form of concurrent ownership). 1. Settlor/grantor – party establishing the trust 2. Trustee – party who holds the transferred property for the benefit of another (the bene); he holds “legal” title. The death or resignation of the trustee will not terminate the trust. If no provision is made in the trust instrument, the court will appoint a replacement trustee. 3. Beneficiary – party/parties who benefit from the trust; equitable title is vested in the trust bene. There may be both present and future benes. 4. Deed of trust – used in some states to secure the creditors’ interest in a mortgage. It allows parties to conduct foreclosure proceedings without having to go to court. 5. There may be multiple role playing with a trust so long as the entire legal and equitable interest is not held by 1 party. (e.g., the party can be the settler and also name himself as trustee. He may also be either the present or future bene but not both.) Advantages of land trust over the concurrent estate: A group of individuals (the benes) can derive the economic benefits of land ownership without having to worry about exercising control over the land itself, title to which remains with the trustee. It may result in a saving of probate costs and guarantee a smoother transition of ownership between generations (formal proceeding not required to transfer legal ownership from one generation to the next). Ease with which the land can be sold if that course of action is deemed appropriate. If authorized, the trustee can transfer a fee simple title to a 3rd party and then replace the land in the trust res w/ sale proceeds. This act can be done without the approval of the benes unless specified otherwise in the trust document. (Unlike life estate where requires consent of parties with present/future interest holders.) Trustee is better able to borrow money on the land or secure a long-term tenant. 76 Professor Callies Sarah K. Kam Real Property I Chances of waste occurring are reduced. Since the trustee controls the property, disputes between the present and future interest holders can be resolved without going to court. Drawbacks of a trust: Unless the instrument created specifically reserves the right of revocation, the settler cannot change his or her mind and revoked the trust. Deiss v. Deiss: (1989) Facts: P (mother), created irrevocable trust for land along with her husband, with their son as trustee. The trustee was to manage the trust and pay net income to settlors. At death of either settlor, net income was to be paid to surviving spouse. Under trust provisions, trust continues until P dies and all the mortgages on the trust are paid in full. When husband died all mortgages were paid in full. P-wife says the trust violates the rule against perpetuities (per provisions, each child of settlors were to receive a life estate with the remainder to the settlors grandchildren or to the great grandchildren if the grandchild predeceases the parent). Trial court found for Ds (trust NOT void/no violation of rule of perp). Holding: The trust is not violative of the rule against perpetuities. Affirmed. Rule: The rule against perpetuities doesn’t apply to vested interests. Relevant Points 1. The theory of trusts is one of divided ownership. The party establishing the trust transfers a property, real or personal, to one party (the trustee) who holds it for the benefit of another (beneficiary or cestui que trust). There may be both present and future beneficiaries. The trustee holds legal title while the beneficiary has equitable title. The property that’s the subject of the trust is the trust res. 2. This is a classic generation-skipping trust. 3. Other instruments using similar language were found to be a vested interest, subject to divestment during the life of a life tenant where a remainderman predeceases a life tenant. Defeasible Estates and the Rule Against Perpetuities 5. The Executory Interest: An executory interest is a future interest in a grantee that, in order to become possessory, must divest or cut short the prior estate, or spring out of the grantor at a future date. The basic difference between a remainder and an executory interest is that a remainder never divests the prior estate, whereas an executory interest almost always does. Executory interests are future interests created in a transferee which become possessory by prematurely terminating a preceding estate or vested future interest. If O to A for 10 years but if the house burns down, then to B for the rest of the 10 years. a. A: Fee simple determinable. b. B: Executory interest. 77 Professor Callies Sarah K. Kam Real Property I c. O: Reversion in fee simple absolute. 2 types of executory interests: (1) Shifting: Executory interests which divest an estate transferred to another by the grantor. (2) Springing: Executory interests which divest the grantor. Comes into beingt only when the grantor creates a possessory interest to take effect in the future with no intervening estate other than what the grantor already holds. Executory interests follow vested interests, not contingent. It serves to cut short the previous estate. Executory interests can divest other future interests EX: O to A for life then to B unless B marries C in which case B’s interest is to pass to D. Bas has a vested remainder which will vest in possession upon A’s death. If B marries C while A is still alive, his remainder is divested by C’s interest even though A is still entitled to the present possession of Blackacre. Consequently, B is said to have a vested remainder subject to divestment and D has an executory interest. Valid and Invalid Interests Fletcher v. Ferrill: (1950) Facts: Decedent conveyed a life estate to himself then to the masonic lodge as long as they use it for an orphanage. In 1948, the orphanage was closed. Decedent’s wife, Fletcher (D) (residuary devisee), and Ferrill and 47 other heirs under statutes of descent and distribution (Ps), are fighting over the land. Chancellor found for P. Holding: The Lodge’s determinable fee might have continued for a period far in excess of that allowed by the rule against perpetuities, and hence an executory limitation to Fletcher’s heirs would necessarily be void. This leaves the possibility of reverter in the grantor, as an interest not conveyed by the deed. Thus it is clear that the appellant must prevail under either construction of this instrument. SCt reversed. Rule: A possibility of reverter is an interest that can be devised by will. When decedent stated, “property shall revert to the heirs of the said JW Fletcher,” use of “heirs” in this context (where he also reserved a life estate in himself) was one of limitation (same as if he said, “revert to grantor and his heirs” = grantor). Even if SCt found that it was a word of purchase, Ps would get estate by executory interest, which would be void due to the rule of perpetuities. Relevant Points 1. Retention by the grantor of a possibility of reverter doesn’t offend the rule against perpetuities, even though the reverter may take place in the distant future. 2. Words of purchase: defines who receives an interest. 3. Words of limitation: defines the estate they receive. 78 Professor Callies Sarah K. Kam Real Property I 26. Problems in Estates and Future Interests See Worksheet 27. Landlord and Tenant, Sublease and Assignment Lease for Intended Use Anderson Drive-In Theatre, Inc. v. Kirkpatrick (1953): Facts: P’s are farmers who knew their land was boggy but looked firm, and leased it to P, knowing full well P wouldn’t be able to put a drive-in theatre there. Trial court sustained P’s demurrer. Holding: Affirmed. Rule: There is no implied warranty that leased premises are fit for the purposes for which they are let; that they are fit for the particular use for which they are intended,; that they shall continue to be fit for the purpose for which they were demised. Relevant Points 1. In the absence of express warranty The rule of caveat emptor applies. The tenant is under a duty to investigate.(Exceptions- where concealed defects are known and the landowner fraudulently represents) 2. At the time of renting the premises the landlord nee not exercise care to discover and inform the tenant of hidden defects. 3. A purchaser of property has no right to rely on the representations of the vendor of the property as to its quality, where he has a reasonable opportunity of examining the property and judging for himself as to its qualities. 4. To make a seller liable for not disclosing any nonapparent defect which materially reduces the value, and similarly to require every buyer liable who doesn’t disclose any nonapprent virtue that materially enhances the value is not currently a standard the ct wants to enforce 5. In HI, we have been pressed to produce substantial protections to residents than commercial bldg landowners. The Duty to Put the Tenant into Possession Adrian v. Rabinowitz: (1935) Facts: D leased a store to P, but when the time for commencement of the lease came, D’s prior tenant still hadn’t left. D had to bring an action to get him out so P could move in. District court found for P. Holding: There was no evidence of a breach of her undertaking to deliver possession of the demised premises at the stipulated time. Affirmed. Rule: The English Rule: (Majority Rule) Where the term is to commence in future, there is an implied understanding by the lessor that the premises shall be open to the lesee’s entry, legally and actually, when 79 Professor Callies Sarah K. Kam Real Property I the time for possession under the lease arrives. Tenant can terminate the lease and has a cause of action against the landlord. Relevant Points 1. The American Rule: (Minority Rule) Landlord has no duty to deliver actual possession when the time for possession arrives under the lease. If it’s not delivered, tenant has a cause of action against the party in wrongful possession, but not against the landlord. Also, the tenant can’t terminate the lease. 2. URLTA follows modified English Rule. The landlord can bring action for possession directly against anyone wrongfully in possession and can recover damages. But unlike the reg Eng rule, the tenant can also proceed w/ an action for possession. Sublease and Assignment 1. Assignment: A tenant’s transfer of the entire remaining time of the term. Tenant /sublessor parts w/ interest in prop Transferee/sublessee now held of the original lessor Creates a privity of K between assignee and landlord Orig. can collect rent from sublessee even if sublessee already paid sublessor Sublessor may not be paid increased rent b/c the orig landlord acquires the sublessee rights and payment will be made to the orig landlord 2. Sublease: A tenant’s transfer of less than the entire remaining time of the term. Sublessor retains a reversion Subtenant is insulated from original lease and the orig lease cant be enforced on the subtenant Jaber v. Miller: (1951) Facts: P rented a building from 1946-1951. In 1949, P tranferred the lease to Norber and Sons. They later transferred the lease to D, who arranged with P to pay promissory notes as rent. The building then burned down. The chancellor said the notes were rental payments and should be cancelled. Holding: Reversed. Rule: Minority Rule: The intention of the parties is to govern in determining whether an instrument is an assignment or a sublease.( the duration of the primary term is a factor to consider but it shouldn’t not be the sole consideration.) Relevant Points 1. Majority Rule: (The English Doctrine) If the instrument purports to transfer the lesee’s estate for the entire remainder of the term, it’s an assignment, regardless of its form or of the parties’ intention. If the instrument purports to transfer the lesee’s estate for less than the entire term - even a day less - it is a sublease, regardless of its form or of the parties’ intention. a. Said differently, if the tenant reserves some interest in the property (ie. a reversion for one day), it is a sublease. If the tenant conveys the entire interest to the subtenant, it is an assignment. 80 Professor Callies Sarah K. Kam Real Property I 2. An assignment creates “privity of contract” between the assignee and the landlord, whereas a sublease does not. Thus, a landlord has a legal cause of action against an assignee but not against a sublesee because the landlord only has “privity” with the assignee. 3. Courts have found “reserved interests” sufficient to create a sublease when: a. the tenant reserved the right of re-entry; b. the transfer contained a covenant to surrender possession to the original tenant at the end of the subtenant’s term; c. the subtenant had to pay a different rent than in the original lease; d. the transfer was made on different terms of conditions from those containecd in the main lease. 4. At common law, tenants had a presumptive right to transfer their interest to a 3rd party. 5. Leases commonly contain a clause allowing a landlord to withhold consent to a sublease or assignment. The majority rule doesn’t require a landlord to give reason for withholding consent. 6. A minority of states have statutes providing that landlords must give good reasons for rejecting potential subtenants. 28. Landlord and Tenant: Duty/Repair and Construction, Evictions and Warranties Abandonment Reid v. Mutual of Omaha Insurance Co. (1989) Facts: Mutual entered a five year agreement to rent office space from Reid to conduct an insurance sales business. Mutual felts that the Reids did not respond adequately to the frequent complaints about the neighbors and gave notice and vacated the premises. Reid filed suit claiming that Mutual had breached the lease. Mutual said it was constructively evicted. While the litigation was proceeding, the Reids remodeled the premises at issue and leased them to Intermountain for the remainder of the five-year term. However, before the lease was up, Intermoutain vacated and declared bankruptcy. The premises were left vacant. Rule: Traditional Rule: Landlords are not required to mitigate by reletting. Trend Rule: Landlords have an obligation to relet; landlords have to take steps to mitigate their losses. Policy Reasons: (1) The economies of both the state and the nation benefit from a rule that encourages the reletting of premises which returns them to productive use; (2) The trend rule is more in keeping with the current policy disfavoring contractual penalties; 3) The trend rule is more in line with the policy favoring mitigation that we have adopted in other areas of the law. Constructive Eviction Petroleum Collections, Inc. v. Swords (1975) 81 Professor Callies Sarah K. Kam Real Property I Facts: In 1969, Texaco leased land with a gas station and a big sign to D. The lease was for 10 years at $500 month. The sign was a fire hazard so Texaco removed it and didn’t put in a new one for D. So D stopped paying rent. When D stopped paying rent, he subleased the space out for 11 months and didn’t pay anything to P, the collection agency for Texaco. Trial court found for D, saying that Texaco breached the implied covenant of quiet enjoyment. Holding: Reversed. It probably wasn’t reasonable for D to sublease the space for so long and not pay P because the covenant was broken until D finally vacated. Rule: In the absense of language to the contrary, every lease contains an implied covenant of habitability. An implied covenant of quiet enjoyment and an express covenant to pay rent are independent when there is no loss of possession. Relevant Points 1. In this case there was evidence that D and sublessee remained in possession for 11 months, thus D wasn’t relieved of obligation to pay rent during the 11 months, and the covenant wasn’t breached until D vacated the premises. 2. Actual eviction: When the tenant is physically dispossessed of the property. 3. Constructive eviction: When the tenant is dispossessed of the beneficial use of the property such that he vacates the premises. 4. The doctrine of constructive eviction expanded the traditional covenant of quiet enjoyment from a guarantee of the tenant’s possession of the premises to a protection of his beneficial enjoyment of the premises. 5. What constitutes a claim for constructive eviction varies by jurisdiction, but it includes problems with “essential” services. Most courts use the local housing codes. 6. Constructive eviction does not require a finding that the landlord had the express intention to compel a tenant to leave the demised premises or to deprive him of their beneficial enjoyment. 7. Uniform Residential Landlord and Tenant Act: (URLTA) Provides a remedy if the landlord fails to comply with the rental agreement or fails to supply heat, water, hot water, or essential services. The tenant may: a. procure reasonable amounts of these services, b. recover damages based on the diminution of the fair rental value of the dwelling, c. procure reasonable substitute housing during the period of the landlord’s noncompliance. Rent is suspended during this period and the tenant may recover the reasonable cost of substitute housing and attorney’s fees. The Implied Warranty of Habitability Common Law View: At common law, T takes the premises as is. L is not deemed to have made any implied warranty that the premises are fit or habitable. Nor does L have any duty to repair defects arising during the course of the lease (unless the parties explicitly provide that he does). Modern Implied Warranty of Habitability: The vast majority of states (either by statute or case law) impose some kind of implied warranty of habitability. If L leases residential premises to T, he impliedly warrants that the premises are in at least good enough condition to be lived in. If L breaches this warranty, T may (among other remedies) withhold rent, and use the withheld rent to make the repairs himself. 82 Professor Callies Sarah K. Kam Real Property I Javins v. First National Realty Corp. (1990) Facts: By separate written leases, each of P’s rented an apartment from D because P’s defaulted on rent. Trial court refused P’s offer of proof that the apartment complex didn’t comply with the housing code and found for D. Court of Appeals affirmed. Holding: Reversed and remanded. Rule: Housing regulations imply a warranty of habitability, measured by the standards which they set out, into leases of all housing that they cover. (Must be implied into the housing leases.) Relevant Points 1. Recently, courts have been introducing contract law in interpreting leases. 2. The old CL rule( no duty to lessor and duty to lessee) was never really intended to apply to residential urban leaseholds. 3. Implied warranty of fitness: A merchant will be held to warrant that his goods are fit for the ordinary purposes for which such goods are used and that they are at least of reasonably average quality. 4. Implied warranty of merchantability: A merchant will be held to warrant that if his goods are required for a specific purpose, they are fit for that purpose. 5. The common law rule imposing an obligation upon the lessee to repair during the lease term was never intended to apply to residential urban leaseholds. 6. Implied warranty of habitability, when a city dweller seeks shelter today this includes adequate heat, light, ventilation, plumbing, etc. 7. The implied warranty of habitability generally applies only to residential leases, not commercial. 29. Landlord and Tenant: Housing Codes and Rent Control The Modern Urban Housing Code Housing Codes: Housing codes require the maintenance of housing in good condition, the provision of necessary facilities, and limit occupancy by requiring a minimum amount of space for each occupant of dwelling. Housing codes depend on private, as well as public, enforcement. Housing codes are retroactive but building codes are not. Edwards v. Habib (1968) Facts: (1968) P leased month by month from D. P complained of housing code violations and D evicted P. Court found for D. Court of Appeals affirmed. Holding: While the landlord may evict for any legal reason or for no reason at all, he is not free to evict in retaliation for his tenant’s reporting of housing code violations to the authorities. Reversed and remanded. Rule: A landlord can’t evict in retaliation for tenant’s reporting housing code violations. Relevant Points 83 Professor Callies Sarah K. Kam Real Property I 1. Proof of such a retaliatory action can serve as a defense for evictions. 2. To permit retaliatory evictions would clearly effectuate the effectiveness of housing codes 3. Javins, Brown, and Edwards all shift the initiative for enforcement of housing codes from the public to the private sides. This is a reactive, not proactive, approach. Rent Control Rent Control in Theory and Practice: 1. Rents regulation rather than rent control is probably a better term to use for laws that limit tenant rents. 2. Rents are not frozen, as due process requires that landlords earn a fair return. 3. Rent control ordinances usually allow for periodic increases, either a fixed statutory amount of a discretionary amount determined by a local agency that is based on increases in the cost of living index or in landlord costs. 4. There may also be provisions for individual adjustments for landlords who require and exceptional rent increase because of extraordinary operating expenses or for other reasons; adequate maintenance is required as a condition for a rent increase. 5. Rent control laws may provide for vacancy decontrol, which means that a housing unit is decontrolled once it becomes vacant. 6. This option is subject to abuse because a landlord may trigger vacancy decontrol by moving into the unit and then re-renting at a higher rent once the previous tenant is evicted. 7. The economic impact of rent controls is to prevent excessive rent-charging, and that protections to tenants in the form of controls on evictions and other protections may be as important as restraints on rent levels. The Constitutionality of Rent Control: The Case of Mobile Homes 1. “Mobile Home” is actuall the term used for a housing unit that is manufactured off-site and then shipped for site placement. 2. Because mobile homes are more affordable than conventional housing, they are particularly attractive as a housing resource to the elderly and the relatively poor, and may make up a substantial part of the housing stock in some municipalities and in rural areas. 3. Tenants own their mobile homes in mobile home parks, and pay a monthly rental for the mobile home “pad” to the park owner in addition to the mortgage payment on the home, if it is not paid off. 4. Rent control determines the amount of rent a mobile home park owner can charge for a pad. 5. Because zoning regulations usually limit the amount of land available for mobile home parks, the owners of parks would be able to charge a monopoly rent in the absence of controls. 6. Existing mobile home owners in parks benefit from this arrangement, but subsequent owners who purchase a mobile home from an existing owner will not benefit because they will probably have to purchase the mobile home at a premium. 7. This is so because eviction from the park is severely restricted, and rent controls will diminish the monopoly rent the park owner would be able to charge in the absence of controls. 84 Professor Callies Sarah K. Kam Real Property I Yee v. City of Escondido (1992) Facts: P owns mobile home park and sued D, alleging that a new ordinance with strict controls effected a physical taking. Superior court dismissed P’s complaint. 11 other similar complaints were dismissed, then all consolidated on appeal, which affirmed the dismissal. Holding: Because the Escondido rent control ordinance does not compel a landowner to suffer the physical occupation of his property, it does not effect a per se taking under Loretto. Affirmed. Rule: If a landowner voluntarily opens his property to occupation by others, he cannot assert a per se physical taking based on inability to exclude particular individuals (Rent control isn’t a physical taking). Relevant Points 1. This isn’t a physical taking by the government. P rented out his land and is just complaining about the repercussions. 2. The right to exclude means the right to originally keep people off the land. Once the land is rented out, there is no more right to exclude. 3. FYI- while property may be regulated to a certain extent, if regulations goes too far it will be recognized as a taking. 4. This case is criticized for interesting social policy and terrible law. 30. Easements: Appurtenant, Affirmative, and In Gross Easements Appurtenant Easement Appurtenant: An easement created for the use of the owner of an adjacent parcel of land. Servient Tenement or Estate: The tract of land burdened by the easement. Dominant Tenement: The parcel which benefits form the easement. Easement in Gross: Confers upon the easement holder some personal or pecuniary advantage that is not related to his use and enjoyment of his land. There is a servient tenement, but no dominant tenement, since the easement holder derives a gain that is independent of his or her ownership of land. Formation of an Easement/Creation of Easements: (1) (2) (3) (4) By an Express Grant Reservation By Implication (usually express) By Strict Necessity (implication) By Prescription (not a fee simple interest in property-just an interest) Cushman Virginia Corp. v. Barnes (1963) Facts: P sued D praying for an easement appurtenant over D’s land. Chancellor found for P but limited it to a width that P found objectionable. (This was express, appurtenant,and reserved in deed) Holding: Decree modified. 85 Professor Callies Sarah K. Kam Real Property I Rule: Where an easement has been granted or reserved by deed, the rights of the parties must be ascertained from the words of the deed. Where the language is ambiguous, look to the language in light of the surrounding circumstances and the land. Relevant Points 1. When a portion of the dominant estate is conveyed away, without excepting the right of way, the owner of that portion has the right to make use of the easement if his land is accessible thereto. The Scope of an Easement: §482: “the extent of an easement created by a conveyance is fixed by the conveyance.” If the court determines that the language is ambiguous, extrinsic evidence must be considered to ascertain the parties’ intent. §483: An assessment should be made of the circumstances under which the conveyance was made, whether the grant was gratuitous, and the use made of the servient land before and after the conveyance. Transfer of Easements Appurtenant: The easement appurtenant passes automatically with the dominant tenement and its burden passes with the servient estate. (The only exception is when the servient tenement is acquired by a bona fide purchaser with no actual or constructive notice of the easement.) The easement in gross is presumed personal to its holder and is usually not transferable. There is a judicial preference for easement appurtenant. Easements in Gross 1. Examples of easements in gross include a utility company’s entitlement to place a power line on privately owned land, the right to swim in another’s lack, and the right to erect a billboard on another’s private lot. 2. In each of these examples, there is a servient tenement but no dominant tenement. 3. Instead, there is an individual who reaps some personal or commercial benefit independent of the ownership of an adjacent tract of land. Miller v. Lutheran Conference & Camp Ass’n (1938) Facts: The Pocono spring water company granted ¾ of Naomi Lake for fishing and boating to P, ¼ to Rufus. Rufus’ executors granted use to D. P filed an injuction which the court granted. Holding: Affirmed. Rule: One Stock Rule: An easement is gross is assignable if the parties to its creation evidence their intention to make it assignable. But if there is a division, the easements must be used or exercised as an entirety. Relevant Points 1. A number of courts have held divisibility to be permissible so long as the total burden does not exceed that contemplated in the original grant. 86 Professor Callies Sarah K. Kam Real Property I 2. Whether an easement is appurtentant or in gross depends on the parties’ intent as reflected in the language of the deed and relevant surrounding circumstances. 3. This is an easement in gross because Rufus needs no possession of any land to make use of the lake. 4. Majority of states hold that easements in gross aren’t assignable but this is a commercial easement in gross. **Handout Case Clog Holdings v. Bailey (Whitney v. Harrison) (1999) Facts: In 1976, Baileys divided their land and created an easement on one of the lots. The properties were transferred a number of times and dispute arose between P and D over it. Trial court found there was an easement. Circuit court changed the location of the easement. Holding: There is an easement (affirmed) but it was clearly specified and shouldn’t have been moved (reversed). Rule: A court can exercise its equitable powers to relocate an easement only where the easement is not definitely located in the grant or reservation, and the dominant and servient owners fail to agree. Relevant Points 1. Where width, length, and location of an easement are specified, it is definite. 31. Easements by Operation of Law and by Government Regulation Express Easements: An easement that is created by a writing. 1. The writing itself is known as the deed of easement. 2. May be created by grant or reservation. 3. The modern trend is to allow easements to be reserved on behalf of third persons. Easements by Operation of Law Helberg v. Coffin Sheep Co. (1965): Facts: P leased land from D for 10 years, after which P would but it. The land was landlocked except for one road. D then locked a gate across that road. Trial court found for P and declared it a public road. Holding: Helberg is entitled to access to his property over the old Coffin road, either on the basis of a way of necessity or on the basis of an implied easement appurtenant to the land. Affirmed in part, reversed in part, and remanded. Rule: Where land is sold or leased that has no outlet, the vendor or lessor by implication of law grants ingress and egress over the parcel to which he retains ownership, enabling the purchaser or lessee to have access to the property. Relevant Points 87 Professor Callies Sarah K. Kam Real Property I 1. Easement by implication: Requires: a. A former unity of title. b. A seperation by a grant of the dominant tenement. (becomes a real easement as soon as interests are separated) c. A reasonable necessity for the easement in order to secure and maintain the quiet enjoyment of the dominant estate. 2. Unity of title and subsequent seperation are the key elements. 3. Easement of necessity: An expression of a public policy that will not permit property to be landlocked and rendered useless. 4. Cts have more trouble b/c its not bargained for, or foreseeable it was implicated by law Cts wont all if owner had everything; sold and then forgot to reserve an easement. Ct wont allow if the owner screws up. Palama v. Sheehan (1968): Facts: P’s wanted to quiet title to land and a pond. D’s contended that they had fishing rights in the pond and an easement based on Hawaiian tradition. Trial court found no fishing rights, but granted the easement. Holding: Affirmed. Rule: If there is reasonable (not strict) necessity, and the easement has been used in a way that’s apparent and continuous, this can be held to be evidence of an intention to grant or reserve an easement. 32. Termination and Prescription Easements by Prescription MacDonald Properties, Inc. v. Bel-Air Country Club (1977): Facts: In 1936, D owned a golf course and Weber owned adjacent land. Weber and D entered into a nonmonetary agreement whereby D gave Weber some land to be used as access to her home, subject to building restrictions (because the land served as a “rough” for D’s 6th hole) and Weber conveyed a permanent easement to D which would link D’s 5th green and 6th tee. In 1950, Hilton bought Weber’s property. In 1963, Hilton transferred remainder interest to P. Trial court granted D a prescriptive easement to use Weber’s land as a “rough”. Holding: No triable issue of fact existed on the subject of consent to the user, because, as stated, all affidavits indicated that plaintiff knew of the use of the property and made no protest against it. Affirmed. Rule: A presciptive easement in property may be acquired by open, notorious, continuous, adverse use, under claim of right, for 5 years. The owner of the servient property must have actual knowledge of its use. Relevant Points 1. Continuous use of an easement over a long period of time without landowner’s interference in presumptive evidence of prescription. 88 Professor Callies Sarah K. Kam Real Property I 2. A grantor can acquire title by adverse possession against his grantee. 3. There is no logical support for the contrary argument. Why? Would make no sense on the deal that the Π would not prevail. The deal was to let the balls fall. Ryan v. Tanabe Corp. (1999) Facts: P and D own adjacent land with a common driveway. Both parcels of land were leased for Bishop Estate until 1986, when they were purchased. D decided to build a new structure on the land and seperated the driveway. P sued, alleging that they have a prescriptive easement over the whole driveway. Circuit court granted D’s motion for summary judgment. Holding: Affirmed. Rule: The prescriptive period does not begin to run until the unity of ownership of the dominant and servient tenements is severed. Relevant Points 1. The elements necessary to have a prescriptive easement are the same as those required to acquire title by adverse possession. 2. In Hawaii, presciptive period is 20 years. 3. The possession by a tenant of lands adjoining the demised premises is to be considered the possession of the landlord and cannot be adverse to the landlord’s interests. 4. A judicial decision constitutes an unconstitutional taking of private property if it involved retroactive alteration of state law such as would constitute an unconstitutional taking of private property. Termination of Easements Termination: Easements can be terminated in different ways: a. By their own terms: Easement is over when the contract says it’s over. b. Unity of title: Easement is over when title to the easement and title to the servient estate become vested in the same person. c. Release: Easement is over when the holder of the easement executes a written release to the holder of the servient tenement. d. Abandonment: Easement is over when the easement holder demonstrates, by physical action, an intention to never use the easement again. e. Estoppel: Easement is over if the servient owner materially acts in reasonable reliance on the easement holder’s assurances that the easement will not longer be enforced. f. Prescription: Easement is over if the owner of the servient tenement interferes with the use of the easement in a manner that’s actual, adverse, open and notorious, continuous, for the appropriate statutory period, and is under a claim of right. g. Lack of necessity: Easement is over if it was created by operation of law once the necessity ends (doesn’t terminate if created by express grant). h. Condemnation of the servient estate: A governmental taking of the servient estate by eminent domain serves to extinguish the easement. *turns on law in each state, but most are pretty much the same 89 Professor Callies Sarah K. Kam Real Property I Preseault v. United States (1996): Facts: P owns land on which the Vermont Railroad Co. had three easements to run trains, acquired in 1899. In 1970, railroad stopped running trains of the land. In 1975, it removed the tracks and equipment. D now contents the easements still exist. Trial court found that the easements were abandoned. Holding: The determination of the trial court that abandonment of the easements took place in 1975. Rule: For abandonment, in addition to nonuser, there must be acts by the owner of the dominant tenement which conclusively or unequivocally manifest either a present intention to relinquish the easement or a purpose inconsistent with its future existence. Relevant Points 1. An easement isn’t a possessory state of freehold, but gives the easement holder a right to make use of the land over which the easement lies. 2. Cts will never terminate b/c of non-use, there must be some act/affirmative act 33. Profits and Licenses Profits a Prendre St. Helen Shooting Club v. Mogle: (Mich.S.Ct., 1926, p.508) Facts: In 1904, the St. Helen Development Co. owned all the land bordering lake St. Helen. They transferred the hunting rights to P and some land so P could build club houses. D purchased some land bordering the lake and maintains a summer resort there. P alleges that D has been letting his guests hunt on the land. Chancellor dismissed. Holding: The conveyance in question here is a valid one, and that it is not void on the ground of public policy. For these reasons the decree of the trial court must be reversed and one entered in accordance with this opinion. The plaintiff will recover its costs in both courts. Rule: The right to hunt is a profit a prendre and is assignable and inheritable. It is within the statute of frauds, because it is a property interest, and must be in writing. Relevant Points 1. Profit a prendre: A right “growing out of the soil”. An incorporeal right, growing out of the real estate. Licenses Easements and Profits: Rights in land. They are property interests which endure for a determinate period of time or perpetually. License: A license is a privilege-a revocable entitlement to enter the land of another for some narrow, delineated purpose. 90 Professor Callies Sarah K. Kam Real Property I **The distinction between a license and an easement or profit is easy to state, but identifying a particular interest as one or the other is not always easy. McCastle v. Scanlon (1953): Facts: D conveyed all lumber on his land for one year to P. P then tried to sell this right to a 3rd party, at which time D revoked the conveyance. Trial judge instructed that P had a right to assign his interests and jury found for P for $1000. Holding: Reversed and remanded. Rule: The intention of the parties largely determines whether there is a license or a grant of land and the scope of the license. Relevant Points 1. A license is a permission to do some act or series of acts on the land of the licensor without having any permanent interest in it. It is founded on personal confidence and is therefore not assignable (generally). 2. Licenses aren’t real property interests, so they fall outside of the statute of frauds. They can be created orally and enforced without a writing. The Revocation of Licenses Revocation: Licenses may be revoked at any time unless estoppel principles bar revocation or unless the license is coupled with an interest. The licensor will be estopped from revoking the license only when the licensee has invested substantial money and/or labor in reliance on the reasonable expectation that the license would not be revoked. Holbrook v. Taylor (1976): Facts: In 1942, P bought property and allowed a hauling road to run from a local coalmine over their land to a highway for a price. The mine closed in 1949. In 1964, D bought adjacent land and used the road. D also made improvements to the road. In 1970, P tried to cut off D’s use of the road. Trial court found that D’s right to use the road had been established by estoppel. Holding: The evidence justifies the finding of the lower court that the right to the use of the roadway had been established by estoppel. Affirmed. Rule: The right to use a road over lands of another can be established by estoppel. Relevant Points 1. The licenser will be estopped from revoking the license only when the licensee has invested substantial money and/or labor in reliance on the reasonable expectation that the license would not be revoked. 2. License coupled with an interest: (Restatement 2nd 513) One which is incidental to the ownership of an interest in a chattel personal located on the land with respect to which the license exists (ex. If A sells a car located on his land, B has automatic license to enter the land to get the car). 91 Professor Callies Sarah K. Kam Real Property I 34. Negative Easements and Equitable Servitudes The Nature and Scope of Negative Easements Affirmative Easement: Restricts a property owner’s ability to use his own property. Those restrictions stem from the affirmative easement holder’s right to use the servient tenement. Negative Easement: Give the holder no right to use the servient tenement but they do operate to restrict the way in which the owner of the affected property can make use of his land. Negative easements are narrowly defined so as to apply in only limited circumstances. The courts have generally resisted the expansion of the types of negative easements. Four Types of Negative Easements: (1) (2) (3) (4) Easements of light; Easements of air; Easements of subjacent or lateral support, Easement of the flow of an artificial stream. Peterson v. Friedman (1958): *This case represents a departure from the tradition of resisting the expansion of the types of negative easements: Facts: P sued to perpetually enjoin D from violating an express easement to light, air, and unobstructed view by putting up tv antennae. Trial court found for P. Holding: It has been held in this state that interference with an easement of light, air, or view by a structure in the street is ground for an injunction. Affirmed. Rule: Easements to light, air, and view may be created by express grants. Relevant Points 1. Negative easements can only be created by an express writing. 2. Negative easements are always appurtenant and, unless specified, don’t terminate when the dominant or servient tenement is transferred. 3. This case is really about view, because a tv antenna doesn’t affect light or air. Conservation Easement Conservation Easement: Recognized over the last several decades as a way to preserve scenic areas and open space. Defined by the Uniform Conservation Easement Act (UCEA) §1 as a nonpossessory interest of a holder in real property imposing litimitations or affirmative obligations the purposes of which include retaining or protecting natural, scenic, or open-space values of real property, assuring its availability for agricultural, forest, recreations, or open-space use, protecting natural resources, maintaining or enhancing air or water quality, or preserving the historical, architectural, archaeological, or cultural aspects of real property. 1. Created when a landowner relinquishes the right to use a particular parcel of land in some specified way that would detract from, diminish, or extinguish its natural qualities. 2. Enforced by the Uniform Conservation Easement Act (UCEA). 92 Professor Callies Sarah K. Kam Real Property I 3. Landowners can grant future conservation easement’s, severely restricting the use of their land in the future. 4. The conservation easement is clearly enforceable and potentially infinite in duration. Problems with Conservation Easement: Since it can exist without a dominant tenement, it is technically a negative easement in gross which under traditional easement theory did not exist. Solutions to this Problem: (1) Treat conservation easements as easements appurtenant, thereby “running with the land.” (2) Avoid the term easement and characterize the new interest as a “conservation restriction” which is freely transferable. (3) Most states have simply recognized the anomalous nature of the conservation easement and have enacted statutes that render conservation easements enforceable, assignable, and perpetual in duration, even in the absence of a servient tenement. Restrictive Covenants 1. Because of their flexibility and durability, as well as the relative ease with which they are created, restrictive covenants are often the most desirable form of land use restriction. 2. A restrictive convenant imposes a restraint on another’s land while an affirmative convenant imposes an obligation or duty on the burdened landowner. 3. At least two generations before the advent of systematic zoning, private landowners used the mechanisms of the restrictive covenant to create and enforce promises pertaining to the use of land, the maintenance of common facilities, and the race and religion of individuals to whom the land could be sold. Equitable Servitudes Equitable Servitudes: So long as the restriction pertained to the land (and land use restrictions always did) and those who acquired the affected land had notice of the restriction and the fact that it was to bind subsequent owners, American courts were willing to enforce the terms of the original agreement, even between those who were not in privity of contract. Elements of an Equitable Servitude: For a covenant to be enforced as an equitable servitude against subsequent owners, the original parties to the covenant must have: (1) intended the agreement to bind later owners and (2) the later owners must have had notice of the restriction and (3) the covenant must touch and concern the land. Covenants in Equity: Since the action is in equity, the proper remedy is injunctive relief rather than money damages. The Meaning of Notice: Actual or constructive notice is necessary to enforce a covenant as an equitable servitude. (1) Constructive Notice/Record Notice: Usually means record notice, i.e., that the agreement creating the restriction is recorded within the current owner’s chain of title. There is some disagreement as to what constitutes a chain of title for purposes of record notice. (2) Constructive Notice/Inquiry Notice: Defendants could be held to notice of a covenant restricting the use of their land even though the covenants were not in their chain of title, and they lacked actual knowledge of their existence of they were “put to inquiry.” Defendants should have inquired and would have found out of they did so. 93 Professor Callies Sarah K. Kam Real Property I Doctrine of General Plan: (Common Scheme) So long as it can be established that there was a consistent use of covenants to control development and that this common plan was in place at the time D purchased the lot, the restriction in question will be enforced against a lot owner who lacks reference to it in his or her chain of title. Cheatham v. Taylor (1927): Facts: In 1890, Rivermont Co. owned 2000 acres next to Lynchburg city. They put a covenant on some of the land that all residences must be 20 feet from the street. P bought some of the land and, in 1925, built an addition so a drugstore was only 5 feet from the street. D sued for an injunction. Trial court granted the injunction. Holding: P’s petition for appeal is denied. Rule: a. Equitable Servitudes: (Tulk v. Moxhay Doctrine, Doctrine of Restrictive Covenants in Equity) When there’s a covenant on a transfer of land, the restrictions will be enforced by equity, at the suit of the benefitted party, against any subsequent owner of the land except a purchaser for value without notice of the agreement. b. For a covenant to be enforced as an equitable servitude, i. the original parties to the covenant must have intended for the agreement to bind later owners and ii. the later owners must have had notice of the restriction. iii. The covenant must touch the land and iv. there must have been a common grantor. Relevant Points: 1. The equity enforced is the prevention of a third person from violating the equitable rights of another of which he has notice, actual or constructive. 2. An equitable servitude is like a negative easement. 3. Constructive notice usually means record notice (chain of title) or inquiry notice (the situation should make you reasonably conclude that you should inquire). Waterhouse v. Capital Investment Co., LTD.: (1960): Facts: P owns ten beachfront lots all of which are restricted to residential use. After all the land was sold, the vendors then sold one lot to D without restrictions for use as a motel. Trial court granted D’s motion for summary judgment. Holding: Reversed and remanded. Rule: For the enforcement of mutual restrictions on use, structures, lot size, etc. in Hawaii, the statute of frauds applies (the restrictions are not enforceable against D unless agreed to in writing signed by D). Relevant Points 1. Implied Reciprocal Negative Easements: Where there is no express restriction in the chain of title of the particular lot the use of which is sought to be restricted there must be proof of a “scheme of restrictions” originating from a common owner. 2. HI uses certificate of title notice, which means that constructive notice is very hard to prove because if the restriction isn’t recorded in land court on the certificate of title, then it’s usually not enforceable. Sanborn v. McLean: (1925): 94 Professor Callies Sarah K. Kam Real Property I Facts: P owns land with a reciprocal negative easement to stay residential. D bought nearby land and started to build a gas station. Trial court enjoined D from nonresidential construction. Holding: Affirmed. Rule: Reciprocal Negative Easements: If the owner of two or more lots, so situated as to bear the relation, sells one with restrictions of benefit to the land retained, the servitude become smutual and, during the period of the restriant, the owner of the lots retianed can do nothing forbidden to the owner of the lot sold. Relevant Points 1. There must be a common owner who created the reciprocal negative easement. 2. Reciprocal negative easements are never retroactive. 3. In this case, D had constructive notice on inquiry which is to say by looking at the surrounding lots, D should have realized that he ought to inquire as to whether there were any restrictions on the land. 35. Covenants, “Appurtenant” and “In Gross” Real Covenant: A promise to do or to refrain from doing something related to land. 1. The real covenant “runs with the land” if it binds not just the current owner but future owners as well. 2. Unlike the equitable servitude, the covenant running with the land is not a real property interest but a contractual limitation. The Relationship of Equitable Servitudes and Real Covenants Running With the Land: A single covenant can be, and usually is, enforceable as either (or both). Enforced as Equitable Servitudes:Most restrictive covenants have been, and are, enforced as equitable servitudes, since injunctive relief is usually the remedy of choice in such cases. Situations where a Party may Desire to Enforce a Covenant as a Real Covenant Running with the Land rather than an Equitable Servitude: 1. Where the plaintiff desires money damages instead of, or in addition to, equitable relief. As long as the law/equity distinction is honored, money damages should not be available as a remedy for breach of an equitable servitude. 2. When the covenant is for some reason unenforceable in equity but nevertheless enforceable at law. In such situations the only available remedy for the beneficiary of the covenant will be at law under a real covenant running with the land theory. 3. When the successor owner of the burdened property had no notice of the restriction. While notice is a precondition for the enforcement of an equitable servitude, it is technically not a requirement for a valid covenant running with the land, although most modern recording acts make notice a de facto requirement. The Limits of Equity Moseley v. Bishop (1984): Facts: In 1896, P and D’s predecessors in interest made a contract where D agreed to permanently maintain a drain over his land which benefitted P for $40. In 1976, P’s son asked D to repair the drain and D refused. Trial court found for D (said the covenant didn’t run with the land). Holding: The trial court’s judgment denying Moseley damages for crop losses and rejecting her claim against the defendants other than the Gateses is affirmed, in all other respects, the trial court’s judgment is reversed. Costs to the appellees. 95 Professor Callies Sarah K. Kam Real Property I Rule: Generally, a covenant imposing an affirmative burden will run with the land if: 1. The covenantors intended it to run (from specific language used and circumstances at the time it was made). 2. The covenant touches and concerns the land. 3. There is privity of estate between P and D. a. Vertical Privity: Where the party seeking to enforce the covenant and the party against whom it’s going to be enforced are successors in title to the property of the covenantee and covenantor respectively. b. Horizontal Privity: Where the original parties had some mutual or successive interest either in the land burdened by the covenant or the land benefitted by it. P must generally prove that the covenant was made in the context of a transfer of an interest in the affected land. Relevant Points 1. The contract in this case created an easement appurtenant over D’s land. 2. Absent some indication of an intention to limit its duration, a real covenant generally survives as long as the estate with which it runs. 3. Real covenants must be created by a writing signed by the promisor. Cannot arise by implication, nedcessity, or prescritpion. 4. Modern Rule: (Restatement rule) No horizontal privity is necessary to create a binding agreemnt. 5. Many of the jurisdictions that recognize a horizontal privity requirement apply itonly to burden and not the benefit of a covenant. 6. For the burden, in some jurisdictions, the successor must take the whole estate. In more liberal jurisdictions, just part must be taken. The standards for benefits are more relaxed. Whitinsville Plaza, Inc. v. Kotseas (1979): Facts: In 1968, D conveyed parcel A to the 122 Trust with many covenants ensuring the relationship of a shopping center on parcel A abutting D’s property. D had a covenant not to use his land for competition. The covenant was in writing and expressly ran with the land. P took the trust’s interest and D then leased his land to CVS, a competitor. Trial court dismissed. Holding: To the extent they dismiss Plaza’s claims for violation of real covenants or for interference with contractual relations, the judgments are erroneous and must be vacated. The cases are remanded to the Superior Court for further proceedings consistent with this opinion. Rule: Reasonable convenants against competition may be considered to run with the land when they serve a purpose of facilitating orderly and harmonious development for commercial use. Relevant Points 1. Norcross, Shade, and Shell Oil used to hold that a covenant not to compete contained in a deed does not touch and concern the land to be benefitted. The case overruled them. 2. A burden is said to touch and concern if it affects the burdened party in his capacity as landowner. 3. A benefit is said to touch and concern if it increases the covenantee’s enjoyment of the land and the enjoyment comes directly from the ownership of the land. 4. Common Recording Act: Requires covenants to be recorded to be enforced (grafting a notice requirement on to the covenant running with the land). Waikiki Malia Hotel, Inc. v. Kinkai Properties Limited Partnership (1993): 96 Professor Callies Sarah K. Kam Real Property I 36. Interpretation and Termination of Covenants Lauderbaugh v. Williams (1962): π wants the agreement to be declared void. π instituted an action to quiet title in March 1958 after her husband being deceased. The agreement is a restraint on alienation-have to sell the property to people in the association. πs own all the land. πs are the developers. Purpose of the association: to control the development along the shore of the lake. πs wanted classy lakeside homes. The device is different here-usually the covenants are attached to the property. But in this case, you don’t get to buy unless you are in this club. π wanted to sell to a party that wasn’t part of the association. Buyers were rejected from the association. Then Mrs. Lauderbaugh was sued. There seems to be a fairly unrestricted method-there are no standards for admission. Why were these buyers rejected? Probably because they were Jewish. This was based on ethnicity. Might thinks on these kinds of restraints on alienation generally. What kind of associations are permitted to discriminate on grounds of likeness or unlikeness? We don’t permit discriminatory clubs around. Abolishing restrictions in Hawaii. How far should we push this? (Hula halau, Japanese baseball etc.) How much exclusion do we permit? These are interesting questions. These issues are reached often by covenants. In Black Pointe-Caucasian only clauses attached to most of the deeds. El Di, Inc v Town of Bethany beach (1984): Facts: P wanted an injunction preventing D from selling alcoholic beverages at restaurant. TrCt granted the injunction. Holding: In view of the change in conditions in the C-1 district of Bethany Beach, we find it unreasonable and inequitable now to enforce the restrictive covenant. To permit unlimited “brownbagging” but to prohibit licensed sales of alcoholic liquor, under the circumstance of this case, is inconsistent with any reasonable application of the restriction and contrary to public policy. We emphasize that our judgment is confined to the area of the old-Town section zoned C-1. The restrictions in the neighboring residential area are unaffected by the conclusion we reach herein. Rule: A court will NOT enforce a restrictive covenant where a fundamental change has occurred in the intended character of the neighborhood that renders the benefits underlying imposition of the restrictions incapable of enjoyment. Relevant Points 97 Professor Callies Sarah K. Kam Real Property I 1. There was a “change of circumstances”Change in character of C-1 area substantial enough to justify modifying the deed restriction: (covenant was to maintain quiet residential area. BB evolved from church-affiliated residential community to summer resort visited by many tourists and commercial. Pattern of alcohol use and consumption based on brown bagging supports change. ) 2. Sufficiency of change – Change of circumstances arguments usually succeed only if the change is so pervasive that the entire area or subdivision’s essential character has been altered. The party violating the covenant must demonstrate more than piecemeal or borderlot change; a change in the character of the surrounding community is NOT sufficient. Would need to look to entire subdivision. Mountain Park Homeowners Association v Tydings (1994): Facts: P wanted to enforce covenant against antennas (negative appurtenant covenant). TrCt said that enforcement of covenant was discriminatory. Ct of Appeals reversed saying that P didn’t abandon or selectively enforce the covenant, and the covenant wasn’t unreasonable. Rule: If a covenant which applies to an entire tract has been habitually and substantially violated so as to create an impression that it has been abandoned; equity will not enforce the covenant. Violations must be material to the overall purpose of the covenant. Violations of other independent covenants are irrelevant to a defense of abandonment. Relevant Points 1. Other equitable defenses: Merger (joined burden and benefit, thus the covenant ends) Release (parties get together and agree to end it) Unclean hands Acquiescence (passively agree, implied consent) Abandonment Laches (delay of claim) Estoppel Changed Neighborhood Conditions 2. If the land is condemned by the state theough eminent domain MAJ view says: owner of benefitted propert is entitled to compensations ; MIN view: no need pay compensation. Hiner v Hoffman (1999): Facts: P wanted to enforce restrictive covenant on height not exceeding 2 stories to preserve viewplane. (This Covenant is negative/appurtenant.) Trct upheld covenant saying that the covenant was not ambiguous. Rule: When construing a restrictive covenant, the parties’ intentions are normally determined from the language of the deed … Substantial doubt or ambiguity is resolved against the person seeking its enforcement. Relevant Points: 1. Even if covenants are ambiguous must consider context. 98 Professor Callies Sarah K. Kam Real Property I 2. Policies : 1) favoring careful drafting of covenants in order to reduce uncertainty and litigation and 2) favoring unrestricted use of property where, as here, then language of a covenant is ambiguous (3) favoring unrestricted use of property subject to State land use and County zoning regulations. Since D’s home does not violate any govt regulations, SCt will not enforce ambiguous language Riss v. Angel (1997) This is an example of a restriction that is designed to protect the board-basically we get to approve or not approve; vary or not vary. This is facially binding on these parties because this is a covenant-you bought in and nobody enforced it. If you don’t like this, you should go to an uncovented area. A homeowners association may not impose restriction under a general consent to construction covenant which are more burdensome than provided for by specific objective restrictive covenants. Court should have visited the site before they made the decision. Should have considered the neighbors. All going to a particular standard-good faith and reasonable. Callies is pushing for governmental standards in cases like this. Particularly in Hawaii, it’s hard to get out of a regulated community. It’s hard to get out of a homeowners association. In Hawaii, your homeowners association becomes your local government since there are only four counties. What standards do we apply? This is a big issue. 37. Remedies for Breach Sandstrom v Larsen (1978): Facts: P wanted mandatory injunction to require ∆ to remove top story of house. Height Restriction that couldn’t be more than 1 ½ stories.(This covenant is negative, and appurtanent). TrCt issued the injunction. Rule: When either a deliberate or intentional violation is show, π is entitled to an injunction against violator, but when a subsequent purchaser, even if they are not innocent purchaser, is asked to bear the burden, we’re going to balance the equities…look at the harm on both side and the court will determine whether damages or an injunction are appropriate. Relevant Points 1. This is famous b/c it was a very harsh case in that it required them to remove the top story of their house. Pelosi v Wailea Ranch Estates(Supreme Ct of HI, 1999) Facts: P wanted a mandatory injuction claiming that D had breached the CCR by building a tennis court and a roadway. TrCt said D use was nuisance. ICA said that TrCt should have issued a mandatory to remove the tennis ct and the roadway. 99 Professor Callies Sarah K. Kam Real Property I Rule: Relative hardship test should be applied when a prior landowner has affirmatively violated a restrictive covenant and a subsequent purchaser is asked to bear the burden of a mandatory injunction to remove the violation. Relevant Points 1. If there is no prior land owner, and they were just neg. and not intentional-> then Ct probably wouldn’t apply the test and would rather use Sandstrom. 2. Latches - there must have been a delay by P in bringing his claim - the delay must be unreasonable under the circumstances 3. In this case, b/c D’s didn’t present evidence to show that removing the tennis ct would be a hardship, the ct granted an injunction. McNamee v Bishop Trust (1980): Facts: P wanted to add a 2nd story but required approval from the committee prior to building (this was the covenant, negative and appurtenant). P sued when the board did not approve their plans.TrCt dismissed P’s complaint. Rule: Most cts have found that approval clauses to be valid are enforceable as long as the authority to consent or approve is exercised reasonably and in good faith. Relevant Points 1. In this case, the board acted reasonably and in good faith w/ their reasons to deny ( restrict privacy, aesthetically offensive, purpose of covenant was to preserve attractiveness, allowing one would lead to proliferation). It was shown that the Committee had never before approved a 2nd story. 2. Hard to sue a design committee b/c to live their its contractual and if you don’t like it you can leave 3. Main point: private covenants are generally enforceable. 4. If you agree to buy into a development that requires private approval, you are stuck with that- their decision must be reasonable. 5. Standard for abandonment.—very high hurdle. 6. Test for changed circumstances: changed circumstances won’t be shown by the passage of time, etc., change has to be so great or so radical to destroy the purpose of the restriction. 38. Native Hawaiian Property Rights In order for a defendant to establish that his or her conduct is constitutionally prot3ected as a native Hawaiian right, he or she must show, at minimum the following three factors: 1. He or she must qualify as a Native Hawaiian, within the guidelines set out in PASH. PASH acknowledged that the terms “native,” “Hawaiian,” or “native Hawaiian” are not defined in our statutes, or suggested in legislative history. PASH stated that “those persons who are descendants of native Hawaiians who inhabited the islands prior to 1778 and who assert 100 Professor Callies Sarah K. Kam Real Property I otherwise valid customary and traditional Hawaiian rights are entitled to constitutional protection regardless of their blood quantum. 2. Once a defendant qualifies as a native Hawaiian, he or she must then establish that his or her claimed right is constitutionally protected as a customary or traditional native Hawaiian practice. 3. Finally, a defendant claiming his or her conduct is constitutionally protected must also prove that the exercise of the right occurred on undeveloped or less than fully developed property. 39. Hawaii Real Property in Historical Perspective 101