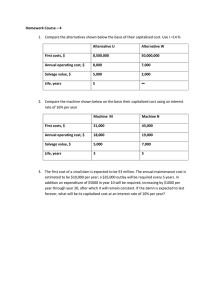

Name : Student Number : Course–Year–Section : CENG24A – Engineering Economy Capitalized Cost, Lecture Capitalized Cost, K - An application of perpetuity. The capitalized cost of a project, structure or machine is the sum of the first cost (FC), and the present worth of all future payments and replacements which is assumed to continue for a long time or forever If a project requires a first cost of FC, annual operation and maintenance of OM for n years, a salvage value of SV after every n years, and a replacement cost of RC after every end of n years, then the capitalized cost is: sv Capitalized Cost, K 𝐾 = 𝐹𝐶 + 𝑂𝑀 𝑅𝐶 − 𝑆𝑉 + 𝑖 (1 + 𝑖) − 1 If RC is not specified, use RC = FC Capitalized cost may also be defined as the first cost plus the present worth of annual maintenance and operation cost plus the present worth of depreciation assumed to continue forever. Annual Cost, AC 𝐴𝐶 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑜𝑛 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 + 𝐴𝑛𝑛𝑢𝑎𝑙 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 𝑎𝑛𝑑 𝑀𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 + 𝐴𝑛𝑛𝑢𝑎𝑙 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝐶𝑜𝑠𝑡 In relation to capitalized cost, AC is: 𝐴𝑛𝑛𝑢𝑎𝑙 𝑐𝑜𝑠𝑡, 𝐴𝐶 = 𝐾𝑖 𝐴𝐶 = (𝐹𝐶)𝑖 + 𝑂𝑀 + (𝑅𝐶 − 𝑆𝑉)𝑖 (1 + 𝑖) − 1 Note: If two or more different articles are available for the same purpose, they are equally economical if the corresponding present worth, annual cost or capitalized costs are the same. Arithmetic and Geometric Gradient In certain cases, Engineering Economy problems involve a series of disbursements or receipts that increase or decrease in each succeeding period by varying amounts. If the change in succeeding periods is constant, then the series is known as a “uniform arithmetic gradient”. A “geometric gradient” series is a sequence consisting of end-of-period payments, where each payment increases or decreases by a fixed percentage. In a geometric gradient, payment begins at the end of the first period. = 𝑃 = 𝑃 + 𝑃 ; 𝑃 = 𝐴(𝑃/𝐴, 𝑖%, 𝑛) where: A = uniform periodic amount equivalent to the arithmetic gradient series G = arithmetic gradient change in the periodic amounts at the end of each period P = present worth of the uniform gradient F = future worth or accumulated amount of the uniform gradient at the end of n periods 𝑃 = 𝐺(1 + 𝑖) + 2𝐺(1 + 𝑖) 𝑃 = + 3𝐺(1 + 𝑖) … + (𝑛 − 2)𝐺(1 + 𝑖) 𝐺 (1 + 𝑖) − 1 1 −𝑛 𝑖 𝑖 (1 + 𝑖) 𝑃 = 𝐺(𝑃/𝐺, 𝑖%, 𝑛) + (𝑛 − 1)𝐺(1 + 𝑖) Sample Problems 1. A machine costs PhP 300 000 new and must be replaced at the end of each 15 years. If the annual maintenance required is PhP 5 000, find the capitalized cost, if money is worth 5% and the final salvage value is PhP 50 000. 2. A certain equipment costs PhP 150 000 lasts for 6 years and has a salvage value of PhP 30 000. How much could an investor afford to pay for another machine for the same purpose whose life is 10 years and salvage value is PhP 40 000, if money is worth 5%? 3. A manufacturing plant installed a new boiler at a total cost of PhP 150 000 and is estimated to have a useful life of 10 years. It is estimated to have a scrap value at the end of its useful life of PhP 5 000. If interest is 12% compounded annually determine its capitalized cost and annual cost. 4. Determine the amount needed now to purchase a machine for PhP 100 000, provide an annual fund of PhP 15 000 for operation and maintenance, and to replace it at the same cost at the end of every ten-year period. Money is worth 7.5% compounded annually. 5. Find the value of each of the following: a. (P/G, 12%,10) b. (P/G, 15.6%, 10) c. (F/G, 7.8%, 10) d. (F/G, 12.5%, 10) 6. Deposits are made to an account listed below which bears interest at the rate of 12% compounded annually a. Present worth of the series b. How much will there be in the account at the end of the tenth year? c. What is the equivalent uniform series? End of Year Deposit 1 500 2 1 100 3 1 700 4 2 300 5 2 900 6 3 500 7 4 100 8 4 700 9 5 300 10 5 900 7. An amount of PhP 100 000 was borrowed and was to be repaid in ten installments at the end of every year thereafter with each payment PhP 1 000 more than the preceding. If interest is 12% compounded annually, determine the amount of the first payment and the total amount paid by the borrower. 8. Suppose a man receives an initial annual salary of PhP 60 000, increasing at the rate of PhP 5 000 a year. If money is worth 12%, determine the equivalent uniform salary for a period of 8 years.