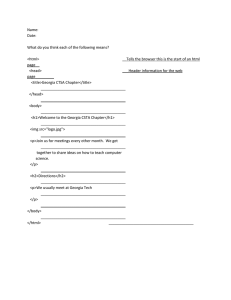

Macroeconomic Analysis: Singapore and Georgia. GLOBAL BUSINESS AND MACROECONOMICS ASSIGNMENT 27.11.2018 Table of Contents INTRODUCTION ............................................................................................................................................................. 3 BACKGROUND: SINGAPORE & GEORGIA ....................................................................................................................... 3 INFORMATION AT A GLANCE......................................................................................................................................... 4 ECONOMIC FREEDOM SCORE ........................................................................................................................................ 5 GLOBAL COMPETITIVENESS INDEX 4.0 2018 .................................................................................................................. 6 INTERNAL FACTORS: SINGAPORE & GEORGIA ............................................................................................................... 7 EXTERNAL FACTORS: SINGAPORE & GEORGIA ..............................................................................................................11 CONCLUSION ANALYSIS ................................................................................................................................................15 2 Introduction In this assignment the aim is to compare two economics with their microeconomic performance over the recent years and assessing various policies from a critical perspective. Government policies, taxes and regulations in some countries are so extreme that capitalism is dying slowly, yet there are some economies that are built on a capitalist mind-set. Those are the free market economies and for my analysis I have chosen two economies one from the Asia-Pacific: Singapore and the other from Europe: Georgia. Comparisons are made between the two countries based on the internal factors such as growth, demography, labour, government as well as external factors such as trade performance, FDI’s and exchange rates. I would also like to mention, if any, significant timelines in history that have played a major role in the economic development of the two economies. The document concludes with an analysis supported by the data provided earlier. Background: Singapore & Georgia Singapore enjoys the status of being one of the prosperous nations in the world. Since its independence in 1965 from the UK, the country has been ruled mostly by one party, the People’s Action Party. In power, since December 2003, Prime Minister Lee Hsien Loong has led Singapore’s government and the year 2021, would be Lee Hsien Loong's last election as Prime Minister. Even though some policies have restricted certain civil liberties, the People’s Action Party have embraced liberalisation in terms of economy and trade. Singapore’s economy is service dominated yet it also manufactures electronics and chemicals and has one of the largest port’s in the world. Main exports include, computers, circuits and refined petroleum products. Similar to the UK, Russia in 1921 incorporated Georgia forcibly into the Soviet Union. Georgia unlike Singapore got its freedom after a few decades in 1991. Even though Abkhazia and South Ossetia are considered as integral parts of Georgia, Russia still occupies these territories. Together they represent 20% of the country’s territory. Billionaire Bidzina Ivanishvili founded the Georgian Dream coalition which defeated the United National Movement in 2012. The coalition’s political power was reinforced when Prime Minister Giorgi Kvirikashvili won the elections in 2016. Nevertheless, Georgia is not immune to the reginal economic downturn. Georgians consider themselves part of Europe in spite of the technical geographic location counting them as an Asian country. Owning this they signed an Association Agreement in 2014 with the European Union showing their firm commitment to be integrated as a part of Europe and in 2017 secured visa-free travel within the Schengen Area. 3 Information at a Glance: Singapore & Georgia (Certain Macroeconomic Factors) Index Year: 2018 Singapore1 Georgia2 719.2 sq. km 69,700 sq. km 5.6 3.7 57,713.3** 4,098.6** 4.2 3.6 0.42 0.03 1.0 2.5 0.4 -3.5 19.7 -12.0 111.7 58.0 High Lower-middle 2nd 16th Overall Score 88.8 Overall Score 76.2 2nd 66th 5th 59th 1.37616 SGD / 1 USD 2.65850 GEL / 1 USD Trade (% of GDP as in 2017)6 322 113 Unemployment Rate %4 2.0 11.6 5-year average FDI inward flow % GDP 21.3 9.9 Area Population (in Millions) GDP Per Capita: US ($) Average 10-year GDP Growth (%) GDP (PPP) % world GDP Inflation (Yearly Average, %) Budget Balance (% GDP) Current Account Balance (% GDP) Public Debt (% GDP) Income Group Index of Economic Freedom3 The Global Competitiveness Index4 4.0 2018 Rankings Global Innovation Index GII 2018 rank5 Exchange Rate (Current Rate 27.11.2018) 1 https://www.globalinnovationindex.org/analysis-economy https://www.globalinnovationindex.org/analysis-economy 3 https://www.heritage.org/index/ranking 4 http://www3.weforum.org/docs/GCR2018/05FullReport/TheGlobalCompetitivenessReport2018.pdf 5 https://www.globalinnovationindex.org/analysis-indicator 6 https://data.worldbank.org/indicator/NE.TRD.GNFS.ZS?end=2017&start=1960&view=chart 2 4 Economic Freedom Score The Graph-17 above shoes the economic freedom enjoyed by both the nations. The Index of Economic Freedom measure the impact of liberty and free markets around the world. The index confirms a strong positive relationship between economic freedom and progress. Singapore is the 2nd freest economy with a score of 88.8 in the 2018 Index. The overall score from the preceding year has increased by 0.2 due to the improvements in government integrity, labour freedom, and property rights that outweigh the low scores in the freedom of business and fiscal health indicators. The favourably developed free-market economy is a success only because of its open and corruption free environment for business, economic and financial policies that are prudent and a transparent judicial framework. Singapore’s overall score in the Asia-Pacific region is well above the world averages. Ranking 16th in the world, Georgia is within the top 20. With the economic freedom score of 76.2, a 0.2 increase from last year Georgia is experiencing significant improvements in property rights criteria offsetting ordinary declines in government integrity, legal effectiveness and Financial health. Nevertheless, Georgia is ranked in the top 10 Nations in the European region and scores well above the world average. 7 https://www.heritage.org/index/visualize?cnts=singapore|georgia&src=ranking#top 5 Global Competitiveness Index 4.0 2018 With rapid changes in technological, politics and economy the new Global Competitiveness Index 4.0 includes new factors for productivity in the Fourth Industrial Revolution with productivity emerging as the most important factor in long-term growth. The 4 factors to determine the competitiveness of countries are (a) enabling environment (b) human capital (c) markets (d) innovation eco-system. Singapore surpasses Georgia’s performance as shown in the Graph 2 below on the Global Competitiveness Index 4.0 2018. Georgia has to catch-up a lot as compared to the world leader USA, on the other hand Singapore is close to or even ranks 1st in some aspects compared to USA. Singapore ranks 1st in infrastructure, health and product market. It also ranks in the top 5 list for institutions, ICT adoptions and labour market and financial systems while lagging behind at the 42nd place in macroeconomic stability. Georgia is doing better in institutions, ICT adoptions, skills and labour & product markets. Business Dynamism is growing even though it lags behind substantially in market size. Global Competitiveness Index 4.0 2018 Graph-2 USA Pillar 12: Innovation capability Pillar 11: Business dynamism Singapore Pillar 1: Institutions 100 Georgia Pillar 2: Infrastructure 80 60 Pillar 3: ICT adoption 40 20 Pillar 10: Market size Pillar 4: Macroeconomic stability 0 Pillar 9: Financial system Pillar 5: Health Pillar 8: Labour market Pillar 6: Skills Pillar 7: Product market Graph-28 8 Graph-2: Data sourced from the below report and the graph was created using this data. http://www3.weforum.org/docs/GCR2018/05FullReport/TheGlobalCompetitivenessReport2018.pdf 6 Apart from the factors we saw earlier, there are other Internal and External factors that we could consider. Internal Factors: Singapore & Georgia Singapore’s exceedingly developed free-market economy is successful due to it’s open and corruption-free business environment, stable prices, prudent monetary and fiscal policies, and a transparent judicial framework. Unemployment in Singapore is incredibly low. Singapore heavily depends on exports, mainly electronics, petroleum commodities, chemicals, medical and optical devices, pharmaceuticals and on the wellconnected transport system, large business and financial services. In 2009 the economy was affected by the global financial crisis but shows significant continual growth since 2010. Growth from 2012 -2017 was slower than the previous decade, due to slowing structural growth as Singapore touched high-income levels and a lax global demand for exports. Growth now has reached the per capita average GDP % in 2018 to 4.2 which will moderate slightly in the coming year. In the immediate aftermath of the recession, Singapore struggled with high inflation rates. From over 5% in 2011, they have now managed to reduce this to just under 1% in 2018. Unemployment rates have remained mostly stable since 2007, averaging at 2%. 7 GRAPH 3 The government is trying to reform Singapore’s economy to lower its dependence on foreign labour, increase productivity growth, and raise wages amid slowing labour force growth and an aging population. Above all, its reliance on exports has proved to be a burden in times of global economic uncertainty. Singapore attracts major investments in advance manufacturing, pharmaceuticals and medical technology production and will continue to strengthen itself as a leading financial and technology hub in Asia. Georgia's main activities include cultivation of agricultural products: citrus fruits, grapes, hazelnuts; mining of manganese, gold and copper; producing non-alcoholic and alcoholic beverages, metals, machinery and chemicals in smaller industries. The country imports almost all of its needed supplies of natural gas and oil products. All of its electricity needs are now provided by hydropower. Georgia's has a strategic advantage due to its location between Europe and Asia as a transit hub for gas, oil, and other goods. Georgia's economy in terms of GDP grew more than 10% in 2006-07, with strong foreign investments, remittance and healthy government spending. However, due to conflict with Russia in 2008 the GDP growth decelerated and went negative 4 % in 2009 as foreign investments and remittances declined because of the 8 global financial crisis. The economy recovered post 2012 but the FDI inflows were not fully recovered. The FDI’s are a major part of Georgia’s economic growth. The country hopes for a faster growth by concentrating efforts to build better infrastructure, support entrepreneurship, simple regulations and improved professional education to attract foreign investments and labour force. They also are focusing on improved transportation, tourism, hydropower and agriculture. Georgia also had failed tax collection revenues; however, since 2004 the government policies simplified the tax code, increased tax enforcement and made laws against corruption more stringent leading to higher revenues. The World Bank ranked Georgia high for improving business transparency. After the election of the Georgian Dream-led government in 2012 the government continued the previous policies of low-regulation, low-tax, free market policies, while reasonably spending on social policies and amending the labour policies as per the international standards. In 2014, the association agreement with the EU, paved way for free trade and visafree travel. Georgia signed a Free Trade Agreement (FTA) with China in 2017 as part of its efforts to diversify its economic ties. Georgia is also developing its Black Sea ports to facilitate East-West trade in the future. 9 10 External Factors: Singapore & Georgia Trade performance Trade is very vital to Singapore’s economy; the combined value of exports and imports equals 318 percent of GDP. Singapore mostly imports machinery and equipment, chemicals, mineral fuels, foodstuffs and consumer goods and exports electronics and telecommunications products, pharmaceuticals and other chemicals and refined petroleum products. To facilitate trade Singapore has no tariffs although non-tariff barriers impede some trade. The government has been opening the domestic market to foreign banks with 95% banks are of foreign origin operating in Singapore. According to the newly adopted agreement between EU-Singapore EUSFTA which eliminates any remaining (product specific) tariffs within the three to five years excluding agricultural products. Whereas, Singapore already had allowed more than 99% of all goods coming from the EU duty-free access. The agreement aims at establishing co-operation regarding regulatory standards as well as eliminating any unnecessary barriers to trade. Singapore also positively contributes with its service industry including finance, computer, research & development and travel & tourism to name a few. Singapore recorded a trade surplus of 4520.91 Million SGD in October of 2018. Balance of Trade in Singapore averaged 877.35 Million SGD from 1964 until 2018, reaching an all-time high of 7827.21 Million SGD in December of 2011 and a record low of -2000.77 Million SGD in October of 19939. 9 https://tradingeconomics.com/singapore/balance-of-trade#calendar-table 11 Like Singapore trade is important to Georgia’s economy as well; the combined value of exports and imports equals 103 percent of GDP. The average applied tariff rate is 0.3 percent and the non-tariff barriers impede some trade for Georgia as well. Like Singapore, Georgia also has a growing banking sector and offers improved financing services but the stock trade remains underdeveloped. Georgia’s trade deficit widened to USD 565.5 million in October of 2018 from USD 468 million in the corresponding month of the previous year, as imports rose more than exports. Exports rose 15 percent from a year earlier to USD 303 million and imports went up at a faster 18.7 percent to USD 867.9 million. Considering the first ten months of 2018, the deficit was recorded at USD 4.8 billion, compared to a USD 4.1 billion gap in the same period of 2017. Balance of Trade in Georgia averaged -233.45 USD Million from 1995 until 2018, reaching an all-time high of -6.34 USD Million in April of 1995 and a record low of -629.01 USD Million in December of 201410. 10 https://tradingeconomics.com/georgia/balance-of-trade 12 Exchange rates over time The central banking system in Singapore tightened the monetary policies twice in a year with a steady economic growth despite the conflict between USA-China trade. The main policy tool used by The Monetary Authority of Singapore (MAS) is the ‘exchange rate’. The MAS raised the currency band slope marginally, which will in effect seek currency appreciation for the SGD in the future. The dollar is at 1.37616 SGD against 1 USD with a 0.3 % climb. Dollarization of the Georgian Lari (GEL) was very high; considering over 60 % of bank loans are denominated in foreign currency, and the local currency continued to devalue in 2017. The Georgian government introduced de-dollarization measures11 coupled with an improved macroeconomic environment and fairly stable exchange rate led to a reduction in dollarization. These factors had an overall positive effect even though it had a very miniscule contribution towards GDP growth. In spite of this the unrest in Turkey almost wiped out all gains the GEL managed to make, yet due to strong market fundamentals the adjustments in the currency means that the lari could make price correction and preserve its competitiveness12. The lari is at 2.65850 GEL against 1 USD. Inward/outward investment – FDI Singapore attracts a lot of foreign direct investment because of its trade openness, location and corruptionfree environment. Singapore is ranked 3rd for ease of doing business. Singapore is favourable to foreign investors with simple regulatory system, tax incentives, quality real estate and importantly political stability. Foreign Direct Investment in Singapore increased by 32853.80 SGD Million in the third quarter of 2018 in spite of a global downward trend in foreign investment. Singapore is open to foreign investment and offers tax incentives to companies after they register with Economic Development Board. However, the country continues to maintain monopolies in certain sectors (finance, professional services, media and telecommunications). Government linked corporations play a dominant role in the domestic economy and to a large extent, on investment, snagging the 5th spot in the world's top 20 foreign direct investment hubs, the 2018 World Investment Report of the United Nations Conference on Trade and Development (UNCTAD) revealed. The main investors in the country are the United States, British Virgin Islands, Cayman Islands and the Netherlands13. 11 http://georgiatoday.ge/news/9996/No-News-is-Good-News-for-Georgia%2C-as-Forecasts-Point-to-Stable-Growthhttps://www.bloomberg.com/news/articles/2018-08-14/currency-most-exposed-to-turkey-meltdown-swept-fromhero-to-zero 13 https://en.portal.santandertrade.com/establish-overseas/singapore/foreign-investment 12 13 Securing the 9th position in the world Georgia is easiest place to do business according to the World Bank's 2018 Business Report. Georgia accomplished cheaper electricity, strengthened minority investor protections and made resolving insolvency easier. FDI’s reached USD 1.8 billion in 2017, estimated at USD 17.4 billion represents 126.7% of the country’s GDP according to the UNCTAD 2018 World Investment Report. Infrastructure, transportation, tourism and finance are the main sectors where Georgia focuses their FDI’s. Georgia also attracts investors by offering tax and legislative benefits. Recovering from the past the Georgian economy is now fully liberalised and offers a very investment friendly atmosphere. Corruption has been largely eradicated – a major breakthrough in terms of attracting FDI. It also ranks 46th in the Transparency International's Corruption Perceptions Index. Due to the Shah-Deniz pipeline under construction Azerbaijan has invested 378 million USD in the first six months of 2017. 14 Conclusion Analysis Both the economies are strong in their own aspects. I would like to summarise with the identified strengths and weaknesses in both economies. Singapore is now a major reginal and international trading hub in Asia for the financial sector. There are huge FDI inflows thanks to the advantageous tax policies, political stability and a very holistic business climate. It also has a strong non-price competitiveness. Development of the product and service sectors which are high value sectors. Leading exporter of capital Asia through government of the Singapore investment Corporation and Temasek. Georgia on the other hand has developed due to past experiences good resistance to regional economic crisis. It has great growth potential in the agricultural, mineral, hydroelectric and tourism sectors. Georgia is backed by international institutions like the EU and the IMF. Its strategic geographic location makes it a transit point for oil and gas movement across regions. It enjoys a democratic political system. The economies also have some drawbacks with Georgia having more weaknesses compared to Singapore. Singapore economy is heavily depended on exports. Due to its small area and ageing population it faces shortages of skilled labour. It depends on China for a lot of its exports and this is venerable to any slowdown in the Chinese economy. Georgia on the other hand has structural deficits, low diversification and valuation of exports. Significant poverty due to unemployment and inadequate educational training. This also leads to low innovation in a nation. Low productivity on agriculture is surprising and needs reform as it forms 50 % of the assets in Georgia yet only adds 10% value. Georgia suffers from poor transport infrastructure. The political instability in the past has soured the relations with Russia over the regions of Abkhazia and South Ossetia. Singapore can manage its weaknesses by exploring new markets for exports instead of relying on one major nation. Stringent laws and small size of the nation Singapore is cautious of its immigration policies and should consider relaxing these laws in return for trained, educated workforce. Georgia has a lot to amend in terms of providing basic facilities to its citizens such as infrastructure and quality education& training. Furthermore since 50% of its assets are agriculture government should invest in research and development in these sectors to increase value towards GDP. If Georgia utilizes its ties with the EU and IMF and shows strong policies to reduce their external debt, can recover more swiftly. Singapore is an established economy and Georgia is on its way there. Over the last several years Georgia is trying to be the Singapore of Europe. Though 100 times bigger than Singapore yet considerably small to control Georgia is tearing down the barriers to free-trade. They have made the economy easy for businesses and investments. Georgia’s location is the key factor, it is right in the middle of Europe and Asia. While neighbouring countries suffer corruption Georgia will thrive in future as the only transparent and tax efficient nation. As suggested above if Georgia can follow the “Singaporization” model successfully it can secure its spot in the top 10 economies with ease. 15 THANK YOU 16