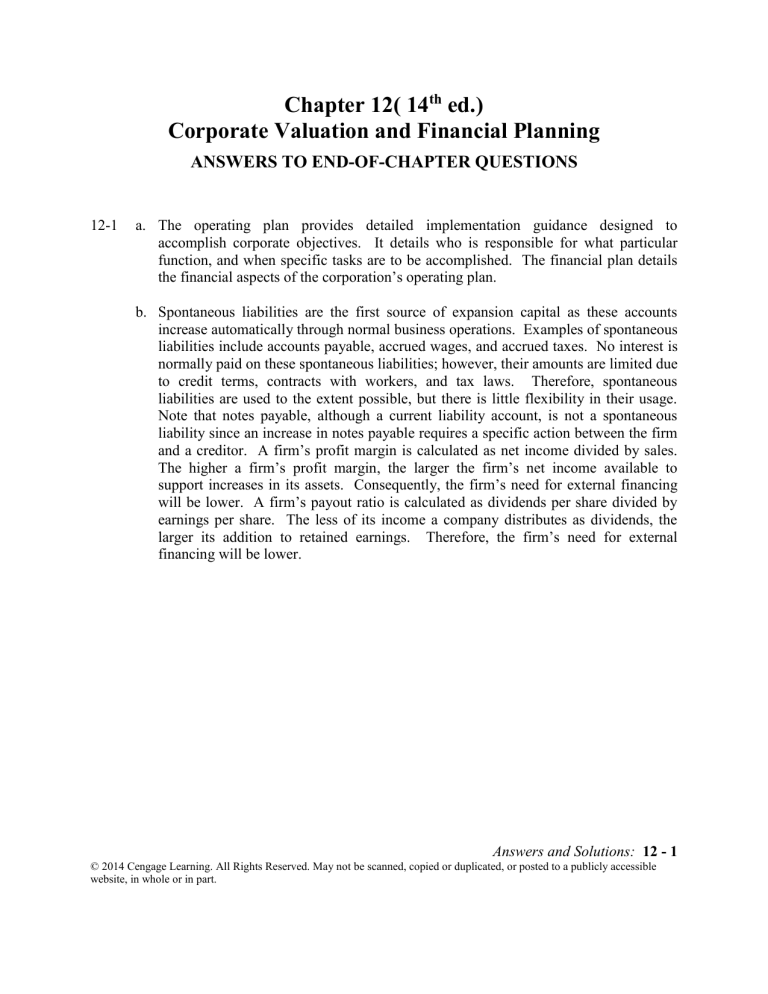

Chapter 12( 14th ed.)

Corporate Valuation and Financial Planning

ANSWERS TO END-OF-CHAPTER QUESTIONS

12-1

a. The operating plan provides detailed implementation guidance designed to

accomplish corporate objectives. It details who is responsible for what particular

function, and when specific tasks are to be accomplished. The financial plan details

the financial aspects of the corporation’s operating plan.

b. Spontaneous liabilities are the first source of expansion capital as these accounts

increase automatically through normal business operations. Examples of spontaneous

liabilities include accounts payable, accrued wages, and accrued taxes. No interest is

normally paid on these spontaneous liabilities; however, their amounts are limited due

to credit terms, contracts with workers, and tax laws. Therefore, spontaneous

liabilities are used to the extent possible, but there is little flexibility in their usage.

Note that notes payable, although a current liability account, is not a spontaneous

liability since an increase in notes payable requires a specific action between the firm

and a creditor. A firm’s profit margin is calculated as net income divided by sales.

The higher a firm’s profit margin, the larger the firm’s net income available to

support increases in its assets. Consequently, the firm’s need for external financing

will be lower. A firm’s payout ratio is calculated as dividends per share divided by

earnings per share. The less of its income a company distributes as dividends, the

larger its addition to retained earnings. Therefore, the firm’s need for external

financing will be lower.

Answers and Solutions: 12 - 1

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

c. Additional funds needed (AFN) are those funds required from external sources to

increase the firm’s assets to support a sales increase. A sales increase will normally

require an increase in assets. However, some of this increase is usually offset by a

spontaneous increase in liabilities as well as by earnings retained in the firm. Those

funds that are required but not generated internally must be obtained from external

sources. Although most firms’ forecasts of capital requirements are made by

developing forecasted financial statements, the AFN formula is sometimes used as an

approximation of financial requirements. It is written as follows:

Additional

funds

needed

AFN

=

Required

asset

increase

–

=

(A0*/S0)S

–

Increase in

spontaneou s –

liab.

(L0*/S0)S –

Increase in

retained

earnings

MS1(1 – Payout rate)

Capital intensity is the dollar amount of assets required to produce a dollar of sales.

The capital intensity ratio is the reciprocal of the total assets turnover ratio. It is

calculated as Assets/Sales. The sustainable growth rate is the maximum growth rate

the firm could achieve without having to raise any external capital. A firm’s selfsupporting growth rate can be calculated as follows:

Self-supporting g =

M(1 POR)(S0 )

A 0 * L 0 * M(1 POR)(S0 )

d. The forecasted financial statement approach using percent of sales develops a

complete set of financial statements that can be used to calculate projected EPS, free

cash flow, various other financial ratios, and a projected stock price. This approach

first forecasts sales, the required assets, the funds that will be spontaneously

generated, and then net income, dividends, and retained earnings.

e. A firm has excess capacity when its sales can grow before it must add fixed assets

such as plant and equipment. “Lumpy” assets are those assets that cannot be acquired

smoothly, but require large, discrete additions. For example, an electric utility that is

operating at full capacity cannot add a small amount of generating capacity, at least

not economically. When economies of scale occur, the ratios are likely to change

over time as the size of the firm increases. For example, retailers often need to

maintain base stocks of different inventory items, even if current sales are quite low.

As sales expand, inventories may then grow less rapidly than sales, so the ratio of

inventory to sales declines.

Answers and Solutions: 12 - 2

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

f. Full capacity sales are calculated as actual sales divided by the percentage of capacity

at which fixed assets were operated. The target fixed assets to sales ratio is calculated

as actual fixed assets divided by full capacity sales. The required level of sales is

calculated as the target fixed assets to sales ratio multiplied by the projected sales

level.

12-2

Accounts payable, accrued wages, and accrued taxes increase spontaneously. Retained

earnings may or may not increase, depending on profitability and dividend payout policy.

12-3

The equation gives good forecasts of financial requirements if the ratios A0*/S and L0*/S,

the profit margin, and payout ratio are stable. This equation assumes that ratios are

constant. This would not occur if there were economies of scale, excess capacity, or

when lumpy assets are required. Otherwise, the forecasted financial statement method

should be used.

12-4

The five key factors that impact a firm’s external financing requirements are: Sales

growth, capital intensity, spontaneous liabilities-to-sales ratio, profit margin, and payout

ratio.

12-5

The self-supporting growth rate is the maximum rate a firm can achieve without having

to raise external capital. The self-supporting growth rate is calculated using the AFN

equation, setting AFN equal to zero, replacing the term ΔS with the term g × S 0, and

replacing the term S1 with S0 × (1 + g). Once the AFN equation is rewritten with these

modifications, you can now solve for g. This “g” obtained is the firm’s self-supporting

growth rate.

12-6

a. +.

b. +. It reduces spontaneous funds; however, it may eventually increase retained

earnings.

c. +.

d. +.

e. –.

f. –.

Answers and Solutions: 12 - 3

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

SOLUTIONS TO END-OF-CHAPTER PROBLEMS

12-1

12-2

AFN = (A0*/S0)∆S – (L0*/S0)∆S – (PM)(S1)(1 – payout rate)

$5,000,000

$900,000

=

$1,200,000 –

$1,200,000 – 0.06($9,200,000)(1 – 0.4)

$8,000,000

$8,000,000

= (0.625)($1,200,000) – (0.1125)($1,200,000) – ($552,000)(0.6)

= $750,000 – $135,000 – $331,200

= $283,800.

$7,000,000

$900,000

AFN =

$1,200,000 –

$1,200,000 – 0.06($9,200,000)(1 – 0.4)

$8,000,000

$8,000,000

= (0.875)($1,200,000) – $135,000 – $331,200

= $1,050,000 – $466,200

= $583,800.

The capital intensity ratio is measured as A0*/S0. This firm’s capital intensity ratio is

higher than that of the firm in Problem 9-1; therefore, this firm is more capital

intensive—it would require a large increase in total assets to support the increase in

sales.

12-3

AFN = (0.625)($1,200,000) – (0.1125)($1,200,000) – 0.06($9,200,000)(1 – 0)

= $750,000 – $135,000 – $552,000

= $63,000.

Under this scenario the company would have a higher level of retained earnings

which would reduce the amount of additional funds needed.

Answers and Solutions: 12 - 4

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

12-4

S0 = $5,000,000; A0* = $2,500,000; CL = $700,000; NP = $300,000; AP = $500,000;

Accruals = $200,000; M = 7%; payout ratio = 80%; A0*/S0 = 0.50; L0* = (AP +

Accruals)/S0 = ($500,000 + $200,000)/$5,000,000 = 0.14.

AFN = (A0*/S0)∆S – (L0*/S0)∆S – (M)(S1)(1 – payout rate)

= (0.50)∆S – (0.14) ∆S – (0.07)(S1)(1 – 0.8)

= (0.50)∆S – (0.14)∆S – (0.014)S1

= (0.36)∆S – (0.014)S1

= 0.36(S1 – S0) – (0.014)S1

= 0.36(S1 – $5,000,000) – (0.014)S1

= 0.36S1 – $1,800,000 – 0.014S1

$1,800,000 = 0.346S1

$5,202,312 = S1.

Sales can increase by $5,202,312 – $5,000,000 = $202,312 without additional funds

being needed.

12-5

a.

Total liab. = Accounts + Long -term + Common + Retained

payable

stock

earnings

and equity

debt

$2,170,000 = $560,000 + Long-term debt + $625,000 + $395,000

Long-term debt = $590,000.

Total liab. = Accounts payable + Long-term debt

= $560,000 + $590,000 = $1,150,000.

b. Assets/Sales (A0*/S0) = $2,170,000/$3,500,000 = 62%.

L0*/Sales = $560,000/$3,500,000 = 16%.

2014 Sales = (1.35)($3,500,000) = $4,725,000.

AFN = (A0*/S0)(∆S) – (L0*/S0)(∆S) – (M)(S1)(1 – payout) – New common stock

= (0.62)($1,225,000) - (0.16)($1,225,000) - (0.05)($4,725,000)(0.55) - $195,000

= $759,500 - $196,000 - $129,937 - $195,000 = $238,563.

Alternatively, using the forecasted financial statement method:

Answers and Solutions: 12 - 5

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

Total assets

Current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

Total common equity

Total liabilities

and equity

2013

$2,170,000

$ 560,000

590,000

$ 1,150,000

625,000

395,000

$ 1,020,000

Forecast

Basis %

2014 Sales

0.62

0.16

Additions (New

Financing, R/E)

195,000*

129,937**

$2,170,000

AFN = Additional long-term debt =

2,929,500 – 2,690,937 =

2014

$2,929,500

$ 756,000

590,000

$ 1,346,000

820,000

524,937

$ 1,344,937

$2,690,937

$ 238,563

*Given in problem that firm will sell new common stock = $195,000.

**PM = 5%; Payout = 45%; NI2014 = $3,500,000 x 1.35 x 0.05 = $236,250.

Addition to RE = NI x (1 - Payout) = $236,250 x 0.33 = $129,937.

Answers and Solutions: 12 - 6

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

12-6

Cash

Accounts receivable

Inventories

Net fixed assets*

Total assets

$ 100.00

200.00

200.00

500.00

$1,000.00

2.0

2.0

2.0

1.0

=

=

=

=

$ 200.00

400.00

400.00

500.00

$1,500.00

Accounts payable

Accruals

Notes payable

Long-term debt

Common stock

Retained earnings**

Total liabilities

and equity

$

+

+

+

+

2

2

0

0

0

40

=

=

=

=

=

=

$ 100.00

100.00

150.00

400.00

100.00

290.00

50.00

50.00

150.00

400.00

100.00

250.00

$1,000.00

$1,140.00

AFN = $ 360.00

*Capacity sales = Sales/0.5 = $1,000/0.5 = $2,000 with respect to existing fixed assets.

Target FA/S ratio = $500/$2,000 = 0.25.

Target FA = 0.25($2,000) = $500 = Required FA. Since the firm currently has $500 of

fixed assets, no new fixed assets will be required.

**Addition to RE = (M)(S1)(1 – Payout ratio) = 0.05($2,000)(0.4) = $40.

12-7

a. AFN = (A0*/S0)(S) – (L0*/S0)(S) – (M)(S1)(1 – payout)

$122.5

$17.5

$10.5

=

($70) –

($70) –

($420)(0.6) = $13.44 million.

$350

$350

$350

b.

Self-supporting g =

=

M(1 POR)(S0 )

A 0 * L 0 * M(1 POR)(S0 )

0.03(1 0.40)( 350)

122.5 17.5 .03(1 .4)( 350)

= 6.38%

Answers and Solutions: 12 - 7

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

c.

Upton Computers

Pro Forma Balance Sheet

December 31, 2014

(Millions of Dollars)

Cash

Receivables

Inventories

Total current assets

Net fixed assets

Total assets

Accounts payable

Notes payable

Line of credit

Accruals

Total current liabilities

Mortgage loan

Common stock

Retained earnings

Total liab. and equity

2013

$ 3.5

26.0

58.0

$ 87.5

35.0

$122.5

$

9.0

18.0

0.0

8.5

$ 35.5

6.0

15.0

66.0

$122.5

Forecast

Basis %

2014 Sales

0.0100

0.0743

0.1657

Additions

0.100

0.0257

0.0243

7.56*

2014 Pro

Forma

$ 4.20

31.20

69.60

$105.00

42.00

$147.00

$ 10.80

18.00

0.00

10.20

$ 39.00

6.00

15.00

73.56

$133.56

Financing

+13.44

2014 Pro

Forma after

Financing

$ 4.20

31.20

69.60

$105.00

42.00

$147.00

$ 10.80

18.00

+13.44

10.20

$ 52.44

6.00

15.00

73.56

$147.00

Deficit =

$ 13.44

*M = $10.5/$350 = 3%.

Payout = $4.2/$10.5 = 40%.

NI = $350 1.2 0.03 = $12.6.

Addition to RE = NI – DIV = $12.6 – 0.4($12.6) = 0.6($12.6) = $7.56.

Answers and Solutions: 12 - 8

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

12-8

Stevens Textiles

Pro Forma Income Statement

December 31, 2014

(Thousands of Dollars)

a.

Sales

Operating costs

EBIT

Interest

EBT

Taxes (40%)

Net income

2013

$36,000

32,440

$ 3,560

460

$ 3,100

1,240

$ 1,860

Dividends (45%)

Addition to RE

$ 837

$ 1,023

2014

Forecast

Basis

1.15 Sales13

0.9011 Sales14

0.10 × Debt13

2014

Pro Forma

$41,400

37,306

$ 4,094

560

$ 3,534

1,414

$ 2,120

$ 954

$ 1,166

Answers and Solutions: 12 - 9

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

Stevens Textiles

Pro Forma Balance Sheet

December 31, 2014

(Thousands of Dollars)

Cash

Accts receivable

Inventories

Total curr. assets

Fixed assets

Total assets

2013

$ 1,080

6,480

9,000

$16,560

12,600

$29,160

Accounts payable

Accruals

Line of credit

Notes payable

Total curr. liabilities

Long-term debt

Total debt

Common stock

Retained earnings

Total liab. and equity

$ 4,320

2,880

0

2,100

$ 9,300

3,500

$12,800

3,500

12,860

$29,160

Forecast

Basis %

2014 Sales

0.0300

0.1800

0.2500

Additions

0.3500

0.1200

0.0800

1,166*

Deficit =

2014 Pro

Forma

$ 1,242

7,452

10,350

$19,044

14,490

$33,534

$ 4,968

3,312

0

2,100

$10,380

3,500

$13,880

3,500

14,026

$31,406

$ 2,128

2014

Financing

+2,128

2014 Pro

Forma after

Financing

$ 1,242

7,452

10,350

$19,044

14,490

$33,534

$ 4,968

3,312

+2,128

+2,128

$12,508

3,500

$16,008

3,500

14,026

$33,534

*From income statement.

b.

Line of credit = $2,128 (thousands of $).

c.

If debt is added throughout the year rather than only at the end of the year, interest

expense will be higher than in the projections of part a. This would cause net income to

be lower, the addition to retained earnings to be higher, and the AFN to be higher. Thus,

you would have to add more than $2,228 in new debt. This is called the financing

feedback effect.

Answers and Solutions: 12 - 10

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

12-9

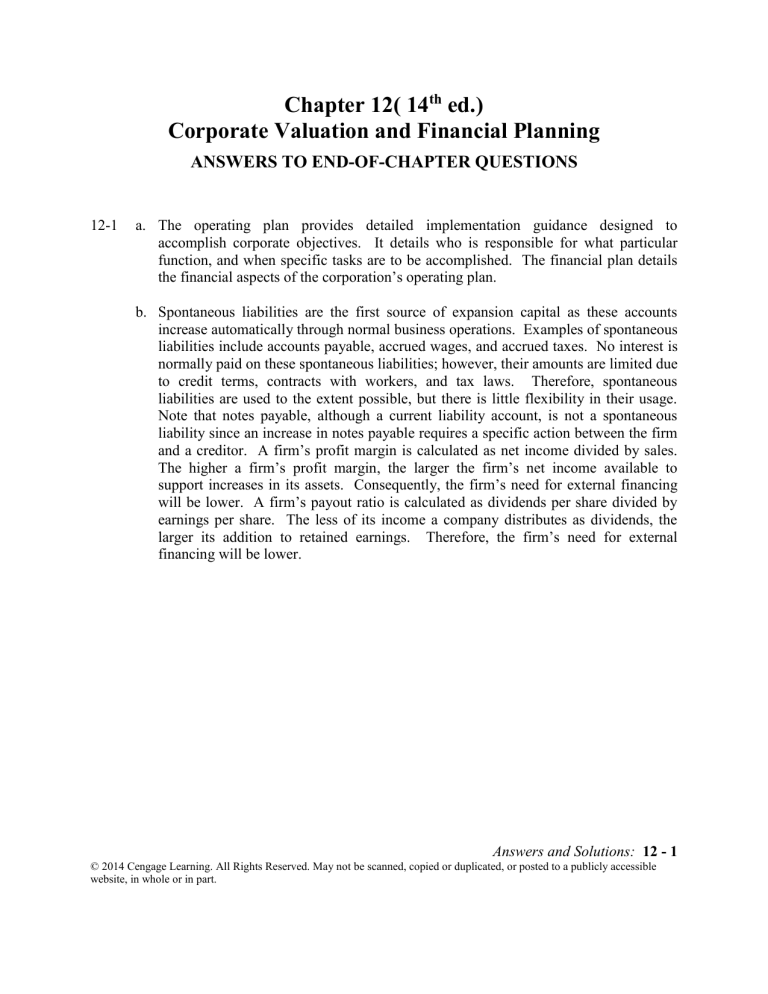

Garlington Technologies Inc.

Pro Forma Income Statement

December 31, 2014

Sales

Operating costs

EBIT

Interest

EBT

Taxes (40%)

Net income

2013

$3,600,000

3,279,720

$ 320,280

18,280

$ 302,000

120,800

$ 181,200

Dividends:

Addition to RE:

$ 108,000

$ 73,200

Forecast

Basis

1.10 Sales13

0.911 Sales14

0.13 × Debt13

Set by management

Pro Forma

2014

$3,960,000

3,607,692

$ 352,308

20,280

$ 332,028

132,811

$ 199,217

$ 112,000

$ 87,217

Garlington Technologies Inc.

Pro Forma Balance Statement

December 31, 2014

2013

Cash

Receivables

Inventories

Total curr. assets

Fixed assets

Total assets

Forecast

Basis %

2014 Sales

$ 180,000

360,000

720,000

$1,260,000

1,440,000

$2,700,000

0.05

0.10

0.20

Accounts payable

$ 360,000

Notes payable

156,000

Line of credit

0

Accruals

180,000

Total curr. liabilities $ 696,000

Common stock

1,800,000

Retained earnings

204,000

Total liab.

and equity

$2,700,000

0.10

0.40

0.05

Additions

2014

$ 198,000

396,000

792,000

$1,386,000

1,584,000

$2,970,000

$ 396,000

156,000

0

198,000

$ 750,000

1,800,000

87,217* 291,217

$2,841,217

AFN

Effects

With AFN

2014

$ 198,000

396,000

792,000

$1,386,000

1,584,000

$2,970,000

$ 396,000

156,000

+128,783128,783

198,000

$ 878,783

1,800,000

291,217

$2,970,000

Deficit = $ 128,783

*See income statement.

Answers and Solutions: 12 - 11

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

SOLUTION TO SPREADSHEET PROBLEMS

12-10 The detailed solution is available in the file Ch12 P10 Build a Model Solution.xls at the

textbook’s Web site.

12-11 The detailed solution for is available in the file Ch12 P10 Build a Model Solution.xls at

the textbook’s Web site.

Answers and Solutions: 12 - 12

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.

Mini Case: 12 - 13

© 2014 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible

website, in whole or in part.