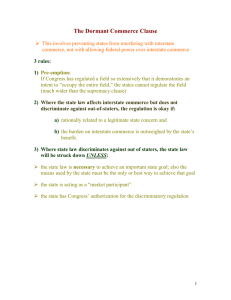

1. Justiciability Doctrines a. 5 standard legal arguments (in order of how they should be made) i. Textualism- adhere to the text. BUT the const. is often vague (maybe deliberately so) ii. Intent- adhere to the intent of the framers. BUT how do we determine the framer’s intent? Why do we care about what they think (they lived in a racist, sexist etc. era)? iii. Precedent- adhere to court decisions. But which precedents? What about bad/irrelevant precedents? iv. Tradition- adhere to US tradition. But which traditions? This would mean no change. v. Policy- Adhere to public policy. b. Justiciability Doctrines (limits courts ability to hear cases) i. Why have it? 1. Feasibility (can only hear so many cases) 2. Separation of powers (court doesn’t want to infringe on the other branches). ii. Advisory opinions/ Non-adversary Suits (has to be conflict) 1. Federal Courts will not resolve friendly suits where everyone agrees. iii. Standing 1. Framework (don’t forget congress can create) a. (1) Injury in Fact – must be concrete and particularized (person suing needs to have been injured) and actual or imminent (not hypothetical- Lujan). i. Clapper created certainly impending standard (lawyer communication possibly getting intercepted case) ii. P can’t manufacture injury to get standing (taking steps to avoid communication interception in clapper not injury) b. (2) Casual Connection between the injury and conduct complained of – injury has to be fairly traceable to the challenged action of the D and not the result of some independent 3rd party i. Allen: injury was not traceable to IRS (gave tax credit to private schools) c. (3) Redressability- injury would be redressed by favorable decision i. Partial redressability okay (Mass v. EPA). ii. Allen: we don’t know schools would desegregate at all if take tax credit iii. Focus on remedy, look at connection between injury & relief requested d. Congress can create standing 2. ASSOCIATIONAL STANDING (EX: NAACP) a. (1) Your member would have standing on their own b. (2) That the claim is germane to the organizations purpose c. (3) You are an effective stand in for the members 3. Third party Standing a. Generally court restricts standing to party directly injured rather than 3rd parties. Some exceptions apply. 1 i. More likely to be recognized the closer the relationship and the greater the unity of interest w/ the rights holder and the greater the unavoidable hindrance to the righsholder’s own assertion of rights. 4. Generalized Grievances a. Taxpayer suits generally no standing, see exception. i. Frothingham: Each taxpayer has comparatively minute and indeterminable interest. It would lead to floodgate of litigation. ii. AZ Christian Schools: tax credit relieves burden. Flast exception does not apply because taxpayers spending own money, not taxpayer money. iii. Exception to taxpayer suits (Flast): allowing taxpayers to challenge on Establishment clause grounds a federal statute granting aid to religious schools. iv. Mootness/Ripeness 1. Mootness a. Case is no longer relevant. Moot only if subsequent events made it clear that the allegedly wrongful behavior could not be reasonably expected to reoccur. b. Mootness may be decided differently for different issues in a case. Ex: claim for injunction vs damages c. Exception: cases that are capable of repetition yet evading review (i.e. pregnancy litigation). 2. Ripeness a. Concrete contest has not emerged yet b. Lair v. Tatum i. Group said that they were likely to be surveilled ii. Court said that it wasn’t a ripe issue yet – haven’t shown that they have been injured yet 2. Federalism & Necessary & Proper Clause a. Federalism and Necessary & Proper Clause i. If end is legitimate congress can use implied powers to accomplish its ends as long as they are reasonable. Don’t have to adhere to enumerated powers, there are implied powers predicated on necessary and proper clause. ii. For N&P clause, we look to see whether the statute constitutes a means rationally related to implementation of an enumerated power. iii. Does not need to be “absolutely necessary.” iv. Necessary proper is a located w/ powers in constitution so must have been meant to expand legislative authority. Not its own power, just helps accomplish other enumerated powers. v. N&P Cases: McCulloch, Comstock, Kebodeaux vi. Federalism Cases: Term limits 1. McCulloch v. Maryland: Maryland imposing tax on Federal bank of the US. a. Enumerated power to lay & collect taxes. Can do what is N&P to accomplish that, including setting up bank. 2 b. N&P is power not limitation, doesn’t need to be absolutely necessary c. State Can’t tax Fed gov, causes externalities (taking money from unrepresented people). Can still tax normal stuff (i.e. property taxes) d. Court held Fed gov can set up bank, it has enumerated power to collect taxes and has implied powers. Fed gov can do whats necessary and proper (power) as long as the activity is a means to an enumerated power. Necessary and proper is a power of Congress not a limitation. Does not need to be “absolutely necessary.” e. State can’t tax the operations of the US bank, causing externalities by taking money from unrepresented people (out of staters). Can still tax normal stuff like property tax on building. Power to tax is power to destroy. State can’t impede the operations of the constitutional laws passed by Congress (i.e. federal law is supreme). 2. US Term Limits v. Thorton: a. Framers intended the Constitution to be the exclusive source of qualifications for Congress and the Framers thereby divested States of any power to add qualifications b. Externalities would affect the nation as a whole - Idea that it would dumb down Congress – due to the lack of experience and seniority of the Arkansas members – the nation as a whole would suffer with a less experience legislature c. Dissent: 10th amendment doesn’t exclude states from changing term limits. When constitution is silent states can do it, not just powers they already had prior to constitution. 3. United States v. Comstock: allowed federal district courts to order the civil commitment of mentally ill, sexually dangerous federal prisoners beyond the dates they would otherwise be released. a. For necessary and proper clause, we look to see whether the statute constitutes a means rationally related to implementation of an enumerated power. b. Court held it was not commandeering because they are telling states to take custody of the person but are not inquiring into “suitability” of intended care and fed gov relinquishing their authority when state asserts its own. 4. United States v. Kebodeaux: Does congress have authority to require a convicted member of the Air Force to register as a sex offender under SORNA, enacted after his conviction? a. Constitution grants power to make rules for armed forces. Necessary and proper clause grants broad power, here its extended to the ability to make the statute 3. Commerce Power i. Commerce Framework: 3 1. What is the activity being regulated? Can’t regulate inactivity (Sebelius). 2. Does it fit one of the limitations? a. Channels of interstate commerce (gibbons) b. Instrumentalities of interstate commerce (things moving through commerce) c. Substantial effect on interstate commerce (aggregation is allowed for intrastate economic activity) i. Lopez Thomas concurrence: substantial affect test if taken to its extreme gives federal police power and is boundless. Should go back to traditional meaning of commerce. 3. Other Arguments/Considerations: a. State sovereignty i. Is the issue traditionally handled by the states? (i.e., family and criminal law- Lopez, Morrsion) b. Economic v. non-economic activity i. Morrison said we can’t aggregate intrastate non-economic activity even though there are congressional findings showing it may have a substantial effect on interstate commerce. ii. Gonzales: classified as economic because market for drugs (albeit illegal). iii. Gonzales Scalia concurrence Congress can use necessary and proper power to regulate interstate commerce. Including regulating non economic intrastate activity if it’s a necessary part of a more general regulation of interstate commerce. iv. Morrison Breyer dissent: economic/noneconomic distinction is difficult to apply. Why should we give critical constitutional importance to whether an activity is economic or not when it affects interstate commerce? Where do we draw the line? These distinctions seem unlikely to help the object of protecting areas of traditional state regulation from federal intrusion. Congress not the courts should strike the appropriate balance. c. Is there a jurisdictional element/nexus. i. After Lopez congress added nexus and been upheld in circuit courts. d. Are there congressional findings? i. Not dispositive, but can help show substantial effect on commerce. ii. Lopez ii. Cases: 1. US v. Lopez: congress banning guns in school zones claiming cost of crime in the aggregate affects interstate commerce. a. Court held law did not regulate interstate commerce i. (1) can’t aggregate non-commercial activity 4 ii. (2) area traditionally regulated by the states (police power), (3) Lack of jurisdictional nexus iii. (4) No congressional findings of actual impact on commerce b. After the case congress added jurisdictional nexus (gun has to move through interstate commerce) and law has been upheld in circuit ct. c. Thomas concurrence: substantial affect test if taken to its extreme gives federal police power and is boundless. Should go back to traditional meaning of commerce, drop 3rd prong. d. Dissent: congress only needs to establish rational basis- loose connection w/ commerce should be adequate. Commercial/non commercial distinction will fail, it previously failed. 2. US v. Morrison: challenge against federal law imposing civil damages for violence against women a. Court held the law did not regulate interstate commerce i. No nexus/jurisdictional element, non-commercial activity, criminal/family law typically reserved to the states b. Aggregation can only be used if economic activity c. Congressional findings are not dispositive d. Dissent Souter: any rational connection to commerce is enough. Court should not be determining what is adequate. e. Dissent Bryer: economic/noneconomic distinction hard to apply. Congress should be responsible for striking appropriate state/federal boundaries. 3. Gonzales v. Raich: CA law allows for possession and manufacture of marijuana for medicinal purposes. Federal law prohibits this. Can congress regulate local cultivation of marijuana? Court held congress can regulate. a. Congress was regulating production and distribution of drugs, unlike Morrison and Lopez theres no question congress can do that. Only contested issue was whether applies to home grown MJ for own use b. Court held this is economic. There is an established, albeit illegal interstate market. c. Concerned w/ spillover effects & effect on interstate market(legally grown mj getting into other states where its illegal). Enforcement concerns, hard to distinguish home grown vs illegal grown MJ. i. Like in Wickard congress is regulating national market of a commodity and home grown MJ in the aggregate affects supply and demand in the national market. d. Scalia concurrence: Congress can use necessary and proper power to regulate interstate commerce. Including regulating non economic intrastate activity if it’s a necessary part of a more general regulation of interstate commerce. e. Dissent O’Connor: Lopez makes clear that possession is not itself commercial activity. They grew it, so no commerce here. Wikard concerned the growing of six tons of wheat in a crisis period- that does not give congress the power to extend the commerce clause to one's home garden. 5 f. Dissent Thomas: Congress did not demonstrate that regulation of medical marijuana is necessary to combat the interstate drug trade. Accordingly, Congress’s actions violate the Tenth Amendment. 4. NFIB v. Sebelius (Individual mandate): requires people to buy insurance or pay penalty. Congress says people not buying insurance increases costs of premiums which has substantial effect on interstate commerce. Congress also says everyone will one day participate in health care market. a. Court held government can’t regulate inactivity (only pre-existing economic activity). Government would be using commerce clause to force people to enter a market, w/ that logic they could make fat people buy vegetables instead of insurance. b. Any police power to regulate people as opposed to their activities remains vested w/ the states. c. Dissent: everyone will enter healthcare market. b. 10th Amendment Restraints on Commerce Power (Commandeering) i. Framework 1. Who is being regulated? (all or just gov’t) a. Traditional state function distinction proved unworkable- Garcia b. Cannot compel only state’s to comply with federal regulation - NY c. Cannot direct state officials to comply with federal regulation- Printz 2. Positive or negative command? a. Reno: negative command and applied to everyone. Even though but for the state not selling other actors would not be able to sell anyway. ii. Alternatives to Commandeering – Spending Power, Commerce Power, or conditional preemption (threaten to enact federal law) iii. Cases (Garcia, NY, Printz, Reno) 1. Garcia v. San Antonio: Congress: same facts as national league of cities. Congress trying to extend wage requirements to state owned railroad (already applied to private sector). a. Court held effort to define “traditional government functions” that are immune from federal regulation proved unworkable. It invites unelected judicial officials to make decisions about which state policies it favors or disfavors. Congress commerce power limited internally and by our structure of government. b. The political process ensures that the states will not be unduly burden by regulations- the states have a direct influence over the house, senate, and the Presidency." Each state is equally represented in the senate- their interests are preserved. c. Dissent: people instead of state legislatures now elect senators and senators are not held as accountable by the people and try to appeal to a national audience. Also the staff draft the laws not the senators and they are less informed about state interests. 2. NY v. US: required states to provide for the disposal of such waste generated within their borders and provided 2 incentives and a take title sanction- state that failed to dispose of all internally generated waste by set date must take title and become liable for all damages suffered by the waste generator/owner. 6 a. Court struck down law. Commandeering doctrine is premised on singling out state government – basically forcing them to use its legislative and regulatory authority to take title – different from the Fair Labor Standards Act, because it also involved private actors. b. Congressional alternatives to commandeering: i. Spending power: Congress may condition the payment of relevant federal funds on a state’s agreement to comply with Congressional legislative acts. ii. Commerce power: require states to limit production; impose a federal tax on interstate commerce iii. Conditional Preemption: Congress may threaten to pass federal legislation under the Commerce Clause unless states choose to regulate according to federal standards. In upholding “access” incentives as involving such powers. 3. Printz v. US: court held invalid federal law that required state local cops to conduct background check on prospective gun buyers. Appears permissible under commerce clause (regulating instruments of commerce), but violates anti-commandeering doctrine of 10th amendment. a. Congress can’t compel State nor States’ officers directly 4. Reno v. Condon: Upheld federal act that bars states DMV (as well as private resellers who get DMV info) from disclosing personal information. a. Court upheld as it applies to everyone and is Negative command (do not sell info) b. This act does not require SC to enact any laws or regulations, nor does it require state officials to assist in enforcement of a federal law regulating private individuals. c. It regulates the "entities that act as suppliers" of this information, not the DMVs specifically. d. regulated “state activities" rather than "seeking to control the manner” in which states regulate activities. 4. Taxing Power a. Framework (penalty not allowed): i. Who is imposing the tax? Only congress can do it. ii. Does it raise revenue? 1. If yes, then likely valid. Irrelevant if the amount is negligible (Kahriger) iii. Is it regulatory? No less of tax just because has regulatory effect (Sozinsky) 1. Considerations a. Size of tax, might a rationale economic actor choose to pay it (Sebelius- yes & Bailey- no) b. Who is collecting the tax & how is it paid (ex IRS vs. other agency) c. Scienter requirement implicates acts like a penalty (Bailey) d. Is it called a penalty? Not dispositive (Sebelius) e. A tax statute does not necessarily fail because it touches on activities that Congress might not be able to otherwise regulate (Sanchez) 2. Valid factors: 7 a. Is it to prevent an activity + revenue oriented? b. Federal tax does not cease to be valid merely because it deters activity taxed (Kahriger) c. Court is not free to speculate motives of Congress if it raises revenue. d. Licensing regulation/rate structure okay (Sozinsky) 3. Invalid factors: a. Can’t use constitutional hook as a pretext to regulate (Bailey). i. i.e., we just want to get rid of child labor* b. Is it meant to prevent the activity without being revenue oriented (Bailey)? c. Is it imposed upon the commission of a crime? (Sanchez) iv. Note: 1. Taxing power not limited by other enumerated powers (Butler) 2. After Sebelius some say it’s not clear whether there is really a difference between a tax and penalty. b. Taxing power differences from Commerce Power i. Broader than commerce power. Can tax more things. However, gives less power over the individual. Can only make people pay taxes, commerce clause can give greater control over the person such as restricting what they can grow in their yard (wickard), discrimination, etc. ii. Taxing power is its own distinct power and is not limited by the other enumerated powers. c. Cases i. Bailey: federal tax of 10% of net profits if knowingly employ children 1. Doesn’t seem to be designed to raise revenue. Will produce no revenue if successful. Huge tax 10% of net profits. 2. Scienter requirement & pretext to regulate child labor after failed in Hammer ii. Sozinsky v. US: court upheld $200 annual license tax on dealers in firearms 1. Court looked at the fact that every tax has a regulatory effect to some extent 2. No less of a tax just because it has a regulatory effect 3. Court seems to be OK with general rate structures 4. Tax generated revenue so “we are not free to speculate as to the motives which moved Congress to impose it, or as to the extent to which it may operate to restrict activities taxed” iii. US v. Sanchez: Marijuana Tax; Any person who transfer marijuana needs to be registered with the Commission and pay a special tax of $1/oz; if not registered $100/oz; 1. Tax does not cease to be valid merely because deters the activities taxed 2. A tax statute does not necessarily fail because it touches on activities that Congress might not be able to otherwise regulate. 3. A persons tax liability does not rest on criminal conduct iv. NFIB v. Sebelius: individual mandate tax- referred to itself as penalty in the act. Amount due was less than cost of insurance would be. 1. Labeling as penalty is not dispositive. Court took functionalist approach 8 2. Not regulatory, because rational person might choose to pay the tax instead of insurance 3. No scienter requirement 4. Paid like a tax directly to IRS 5. Dissent: when an act adopts a criterion of wrongdoing then imposes penalty then its regulatory v. US v. Kahriger: imposed a tax on gambling and required gamblers to register with the Collector of Internal Revenue. Challenger claimed Congress was trying to penalize gambling under the pretense of its taxing power, and thus infringed upon the police power reserved to the states. 1. A federal excise tax does not cease to be to be valid merely because it discourages or deters the activities taxed. 2. Nor is the tax invalid b/c the revenue gained is negligible. 5. Spending Power a. General description i. Congress must exercise its power to tax and spend for the “general welfare.” Congress can use spending power to condition grants for states to do things that congress couldn’t otherwise require them to do. b. Four Criteria for Spending Power (Dole test): i. Who is using spending power? Only congress can use, unless delegated. ii. (1) A purpose to serve the general welfare (easily met); 1. Courts should defer substantially to the judgment of Congress. iii. (2) A clear statement of the condition (easily met) 1. “Must do so unambiguously … enabling the States to exercise their choice knowingly, cognizant of the consequences of their participation.” iv. (3) Germaneness: relationship between the condition and the purpose of spending/activity being regulated. 1. Grants may be illegitimate if unrelated “to the federal interest in particular national projects or programs.” 2. Broad standard, Dole- conditioned highway funds on alcohol age restriction. “Drunk teens driving across border will cause more v. (4) No inducement to states to violate any independently protected constitutional rights. 1. Can’t induce states to engage in activities that would themselves be unconstitutional. Dole 21st amendment was not barrier. a. Can’t require someone to relinquish constitutional rights in exchange of power. i. EX: cruel and unusual punishment ii. EX: we will give you $ if you relinquish search and seizure privacy rights. 2. Financial inducement can’t be so coercive it turns into compulsion. Threat of loss, not hope of gain. a. Dole 5% of highway funds (.5% of total state budget) was ok even though every other state took the grant. b. 10% of total state budget was compulsion in Sebelius. 9 vi. Note: Factors 1-2 easily met, 3-4 are usually where issues arise. c. Cases i. US v. Butler: majority struck down law that gave conditional grant to farmers for restricting amount of crops that was funded by tax on processors 1. Dissent became modern theory: Threat of loss, not hope of gain, is the essence of economic coercion. Spending power is not limited to achieve enumerated powers; Congress has some leeway to spend in furtherance of the general welfare as long as it does not violate other constitutional provision. ii. Steward Machine: tax imposed on employers of 8+, if they pay to state unemployment fund they get 90% fed tax credit. Credit provision in the tax sought to induce the enactment of state laws that complied with federal standards 1. Court held: not coercive, states have choice to establish the fund. 2. States were unable to give the requisite relief, collective action that must be addressed. States were afraid if they set up unemployment fund employers would move to states w/ out them. 3. The purpose of Congress here is to safeguard its own treasury and as an incident to that protection to place the states upon a footing of equal opportunity. iii. Helvering v. Davis: Upholding the old age benefits provisions in Social Security act which imposed fed taxes on employer/employees. 1. Court held: even when a broad view of the power to spend is accepted, the line must still be drawn between local and general welfare, but this discretion belongs to Congress unless their choice is clearly erroneous. a. Problem is clearly national here, states couldn’t deal w/ it alone. Needy people would move to states that had old age benefits, employers move away. 2. Rehnquist: greater deference given under the Spending Clause than under some of the other powers iv. South Dakota v. Dole: congress passed act raising minimum drinking age act to 21 and states lose 5% of federal highway funds if they don’t comply. 1. Court held 5% was not coercive (actually only less than .5% total state budget) even though every other state took the grant. 2. v. NFIB v. Sebelius: Change to Medicaid provided that states must now cover people up to 133% of poverty level (many states didn’t cover this high). Fed gov would provide increased funding, but failure to cover these people would result in not only loss in funding for those requirements, but also loss of all Medicaid funding. 1. Court held this crossed line from condition to coercion. Medicaid budget is over 10% of many states total budget 6. DCC, P&I, & Premption a. Dormant Commerce Clause i. Definition: into the affirmative grant of the commerce power the courts have read judicially enforceable limits on state legislation when Congress has not acted. ii. Policy: we want to promote free markets between states. 10 iii. Framework 1. Look at statute, pick category- don’t forget market participant exception 2. Facially discriminatory or facially neutral w/ protectionist purpose or effect a. State has to show compelling state interest and that there are not less restrictive means. These laws are almost always struck down as virtually per se invalid. (Exception Maine v. Taylor- baitfish case) b. If any less burdensome (affect on commerce) or less discriminatory (difference in treatment of in/out of staters) means are available it will be struck down. c. Noxious articles? 3. Facially neutral w/ disproportionate adverse effect on interstate commerce a. Rule: Where the State has regulated evenhandedly to effectuate a legitimate local public interest, and its effects on interstate commerce are only incidental, it will be upheld unless the burden imposed on such commerce is clearly excessive in relation to the putative local benefits. b. Pike balancing test: balance putative local benefits vs. effects on interstate commerce. Is the burden on commerce clearly excessive in relation to the putative local benefits? i. If less burdensome alternatives on commerce are available the law can still be valid if those alternatives do not promote the state interests as well. 4. Congress can consent to state regulations that would violate DCC. iv. Home processing requirements: these can fall into any category above. We are concerned w/ banning the importation of processing services. v. Taxes & Subsidies 1. Subsidies to in state companies from general fund are okay. a. Okay because residents can vote to use the money. Whereas other 2 categories below people can’t vote and are being charged higher tax burdening commerce. 2. Cannot give tax break/credit only to instate co (charge higher taxes to out of state co). Irrelevant if for profit/non profit co. a. Differential tax may be okay if it merely compensates for costs charged in other ways. 3. Can not charge tax then rebate part of that specific tax to only instate companies. Essentially a tariff. vi. Market Participant Exception 1. Rule: State or municipality can favor its own residents in the course of its own dealings; but it does not permit that government to regulate other private parties beyond the market in which it is a participant. 2. State can’t impose conditions after a sale (SC Timber). In White, restriction occurred while the parties still had ongoing commercial relationship in which state retained continuing interest in subject of the contract 3. Inquiry: Key to whether a state qualifies as a market participant lies in how broadly or narrowly the relevant market is defined. The court has said that in applying the market participant doctrine, it will define markets narrowly 11 so as to keep the doctrine from “swallowing up the rule that states may not impose substantial burdens on interstate commerce. 4. Cases a. Alexandria Scrap: state can burden interstate commerce if they are market participant. b. Reeves: state can choose who to do business with just like private companies. c. White: city required city funded projects to be completed by 40% local residents. Court rejected argument that the city was regulating employment contracts between contractor and employees because everyone effected in a substantial sense was working for the city d. South Central timber: state can’t impose down stream regulations with regulatory effect outside of particular market they are participating in. vii. Facial Discrimination Cases 1. Philadelphia v. NJ: banned import of out of state waste for “health” a. Facial discriminatory. No difference between in/out of state waste. Different from quarantine laws because they prevent movement regardless of point of origin. 2. Granholm v. Heald: state ban wine shipment bought online from out of state co. meant to reduce access to alcohol for teens a. Struck down, there were less restrictive means. b. 21st amendment lets states prohibit against interstate commerce, but has to be evenhandedly. 3. Maine v. Taylor: ban out of state bait fish so don’t infect home ones a. Ban held legitimate and no less restrictive means viii. Tax/Subsidies Cases 1. Oregon Waste: higher tax on out of staters not allowed. Unless differential 2. West Lynn Creamery: Tax imposed on all milk co then rebate to in state not allowed. Essentially a tariff. Concerned w/ taxing unrepresented people 3. Camps New found: can’t give tax breaks to in state only (non or for profit) ix. Home Processing Cases (barring importation of processing services) 1. Dean Milk: did not matter that also discriminated against in state 2. C&A Carbone: private public partnership for landfill. a. Facially neutral protectionist purpose Revenue generation not compelling state interest. There were less restrictive means. 3. United haulers: Same as carbone but government already owned a. Upheld, important state benefited from any burden placed on interstate commerce. b. Waste disposal traditional state gov activity. We abandoned this distinction in commerce clause analysis yet we use it here. 4. Davis: Kentucky muni bonds exempt from state tax, but not other states a. Similar to united haulers, government is benefiting & traditional state function. Bonds used to shoulder civic welfare b. Government function is not susceptible to standard dormant commerce clause scrutiny owing to its likely motivation by legitimate objectives distinct from the simple economic protectionism the clause abhors 12 x. Facially neutral w/ impermissibly protectionist purpose/effect cases 1. Baldwin: NY set min law for milk @ price NY produced. a. Facially neutral /protectionist. State claims its to control supply/demand. There are less restrictive means. 2. Hood & sons: NY denied MA milk co license to open 4th store because market already adequately served. Struck down. Less restrictive means. 3. Hunt: Apple case. Protectionist. Less restrictive means available. 4. Bacchus: Tax on all alcohol except one from indigenous plant. Protectionist 5. Exxon: upheld law restricting producers of petroleum to operate retail. No gas producers in state. a. Court held neutral and doesn’t discriminate against interstate commerce. Just limits everyone’s ability to own gas stations 6. Clover Leaf: Pulpwood case. Court held not protectionist because other states would absorb increased pulpwood demand. a. A nondiscriminatory regulation serving substantial state purposes is not invalid simply because it causes some business to shift from predominately out of state industry to a predominately in state regulation b. Applied Pike & burden was not clearly excessive in light of interest. xi. Facially neutral w/ disproportionate adverse effect on interstate commerce 1. Pike: Az required melons grown in AZ packed/stamped in AZ a. State’s tenuous interest in having cantaloupes identified as originating in AZ cannot constitutionally justify the requirement that the company build and operate an unneeded $200k packing plant in the state 2. Kassel: Iowa prohibits trucks over 55ft. exemption for in state border cities. a. Burden on interstate commerce clearly outweighs State interest in highway safety and reduced wear on roads. Safety reasons not rational hear, this law may be more dangerous & huge burden on commerce. 3. Egar: court held unconstitutional Illinois business takeover act which regulated tender offers made to target companies based in Illinois a. held this imposed a substantial burden on interstate commerce, that was not outweighed by its punitive local benefits. Pike balancing test. b. Discourages out-of-state buyers from buying in-state companies vs. IL interest in preventing takeovers of its companies, many of these protections already exist by SEC. b. Privileges & Immunities i. P&I Clause Art IV §2 2: “The citizens of each state shall be entitled to all P&I of citizens in the several States. ii. Purpose: to help fuse into one nation a collection of independent sovereign States. It was designed to insure to a citizen of State A who ventures into State B the same privileges which the citizens of State B enjoy. iii. Framework: 1. Did state A (or city) discriminate against citizen of state B? Does not apply to corporations & no market participant exception 13 a. Just because there’s also in state discrimination does not mean it does not apply - United Building. 2. Is it a traditional “fundamental right” (right to make a living) being burdened? 3. If so, does the state have a substantial reason to discriminate against out of staters? Virtually always struck down if violate fundamental right a. Inquiry: whether such reasons do exist and whether the degree of discrimination bears a close relation to them. As part of any justification offered for the law, nonresidents must somehow be shown to “constitute a peculiar source of evil at which the statute is aimed.” b. The inquiry must also be conducted with due regard for the principal that the State’s should have considerable leeway in analyzing local evils and prescribing appropriate cures. 4. Congress can’t give authorization to violate privileges and immunity because constitutional right. No market participant exception iv. Cases 1. Toomer: license fee for fisherman of $25 residents & $2500 non-residents. Also 1/8 cent tax per pound of fish. State trying to conserve fish population a. P&I violation, fundamental right to make a living. b. State argued that they were trying to conserve shrimp supply & claimed non-residents used larger boats – didn’t want those bigger boats in the state waters taking up space, etc. There is no reasonable relation b/w the danger presented by non-residents and the severe discrimination practiced upon them. 2. Baldwin v. Montana Fish & Game: elk hunting = recreational activity. 3. United building city law required 40% of contractor’s employees working on city projects to be city residents discriminated against in & out of staters. 4. New Hampshire v. Piper: Court held that a state rule limiting bar admissions to in-state residents violated the P&I Clause. a. Fundamental right violated, right to make a living b. No substantial important state purpose for this law. None of the states reasons for this law (out-of-staters are less likely to follow rules, be available for court proceedings, or do pro bono work) are "substantial." c. Preemption i. Preemption is derived from the Supremacy Clause (Art. VI) which states that the “Constitution, laws, treaties… are the supreme law of the land.” ii. Framework 1. Analyze whether the statute is constitutional before talking about preemption. Then assuming its constitutional is there preemption? 2. Express: federal law specifically, clearly, and unequivocally, states it preempts state or local law. a. When preemption is express, only issue is whether a statute falls within the area preempted. 3. Implied: occurs in circumstances when a valid federal statute supersedes even in the absence of Congress clearly stating preemption in express 14 terms, but by perceived congressional intent and statutory language to preempt state/local law. a. Field Preemption i. Look at what field Congress is occupying & whether the act in question is regulating in that field. ii. Court requires clear showing that Congress meant to occupy a field and so displace the states from regulation on that subject matter. iii. States are precluded from regulating conduct in a field that Congress has determined must be regulated by its exclusive governance. The intent to displace state law altogether can be inferred from a framework of regulation: 1. “so pervasive . . . that Congress left no room for the States to supplement it” or 2. where there is a “federal interest . . . so dominant that the federal system will be assumed to preclude enforcement of state laws on the same subject. iv. Pacific Gas: court should not try to determine state true intent for what “field” state says its regulating. 1. Consider: How comprehensive is the federal regime - are there many agencies and statutes passed? v. Cases: Arizona, Pacific Gas (wasn’t field), Florida Lime b. Conflict Preemption i. Physical Impossibility to comply w/ both 1. State law is preempted when “compliance with both federal and state regulations is a physical impossibility. 2. Consider: is one or more of the laws compelling someone to do something prohibited by the other law 3. Cases: Pacific Gas (not but discusses), Florida Lime ii. Obstacle to accomplishment of federal objective 1. State law stands as an obstacle to the accomplishment and execution of the full purposes and objectives of Congress. 2. What is a sufficient obstacle is a matter of judgement, to be informed by examining the federal statute as a whole and identifying its purpose and intended effects. 3. Cases: Arizona, Crosby 4. Overarching rule a. In preemption analysis courts should assume that the historic police powers of the states are not superseded unless that was the clear and manifest purpose of congress. 5. Don’t forget to look for other issues assuming not preempted like DCC iii. Congressional Consent to state regulations 1. Mccaran act:. No act of congress shall be construed to supersede or invalidate a state law for purposes of tax/regulation of insurance companies 15 iv. Cases 1. Pacific Gas: fed statute over safety of nuclear & purpose of act to promote nuclear. CA law imposed moratorium on certificates for new nuclear plants until safe disposal methods in place. No express preemption here. a. Court held CA said state act was for economic not safety reasons so it was not field preemption. b. Need for new power facilities/economic feasibility are areas that have been characteristically governed by the States. c. Not physical impossibility preemption. d. Not obstacle preemption because promotion of nuclear power under fed act is not to be accomplished at all costs. Congress has allowed state to make economic decision of having fossil fuel vs nuclear e. Takeaway: what field is congress occupying. Does the act in question assert a right to act in a matter regulated by fed gov. 2. Florida Lime & Avocado Growers: CA had higher avocado standards than fed gov. a. Not field preemption, the federal law here was just minimum rather than uniform standards. The fed regulation in this area is not so comprehensive to be exclusive and displace state law. b. Not physically impossible to comply with both. 3. Gade v. National solid waste: court found state law provisions for licensing workers who handle hazardous waste preempted by OSHA regulations. Court found there was conflict preemption and couldn’t physically comply with both. 4. AZ v. US: SB 1070 found preempted because national gov has power to establish uniform standard for immigrant registration. a. Section 3 imposed misdemeanor for failure to comply w/ state registration requirements: court held there is field preemption. Congress regulates entire field of immigrant registration including penalties. b. Section 5 makes it misdemeanor against employee for working unlawfully. Conflicts w/ federal sanctions. Found to be obstacle to the regulatory system congress chose. c. Section 6: conflict preemption, violates principle that Fed gov determines who is removable/process for removal. Creates obstacle to full purpose. d. Section 2: could be potentially interpreted in way that’s allowed so was upheld. 5. Crosby: state law barred entites from buying goods from Burma. a. Court held congress's passage of federal law imposing mandatory and conditional sanctions on Burma preempted state law since the state's more stringent standards presented an obstacle to accomplishment of Congress's full objectives to impose sanctions but limit economic pressure. States sanctions would interefere w. that purpose. 16 7. Separation of Powers: concern regarding concentration of power in 1 branch; spread out authority; slow things down/making it harder to make changes; impose checks and balances; preserve individual liberties and the people. a. Executive Powers: Vesting (he is “vested), protect/defend constitution, take care/faithful execution, veto, pardon, appointments, reception clause, treaties (w/ consent of senate), commander in chief b. Executive Assertions of Power Youngstown Framework – look here if President acting i. (1) Acts pursuant to express or implied authorization of Congress. Presidents authority is at its maximum here, it includes his powers and all that congress can delegate. If a law is held unconstitutional in this category it usually means that the fed gov as an undivided whole lacks power 1. Dames & Moore: in category 1 if congress has given implied authorization through acquiescence. 2. If in time of war then may be able to do things not allowed in times of peace (Korematsu). ii. (2) Acts on which Congress is silent, president can rely on his own independent powers but there is a zone of twilight where congress may have concurrent powers, or in which distribution is uncertain. Power likely to depend on imperatives of the event rather abstracts theory of law. 1. Test of power here depends on the facts. 2. Look at enumerated + inherent + gloss of presidential power. Things executive has done over time and not been questioned about. Exec Agreements allowed w/ out consent/approval of Congress. iii. (3) Acts incompatible with the express or implied will of Congress. His power is at the lowest ebb, he can rely only on his own powers minus any constitutional powers of congress over the matter. 1. Consider enumerated + inherent powers. 2. No power if not self executing treaty iv. Factors to consider: more deference to president in foreign policy, but can’t use foreign issues as pretext to do things domestically. Has congress declared war? Theatre of war does not expand power. v. Cases 1. Youngstown: Exec order to seize steel co’s - labor dispute b4 Korean war a. Majority: Congress has not declared war and “theatre of war” does not expand so far as to taking of private property. Foreign/domestic distinction? Executive has more power in foreign affairs, but can’t use foreign issues as pretext to do things domestically. 2. Zivotofsky: birth certificate in Isreal/Jerusalem. Category 3 a. President has enumerated power to receive ambassadors and inherent in that the power to recognize foreign state. b. Congress’s act unconstitutionally violates President’s inherent power to recognize nations (survived category 3) c. Thomas concurrence: roots authority in vesting clause. President executive power doesn’t say “herein granted” like congress’ verting clause so it’s not limited. d. Roberts Dissent: reception clause is duty not power, can’t expand. This isn’t recognition anyway, passport doesn’t recognize country. e. Scalia: congress has power of naturalization so they control here. 17 3. Belmont Exec Agreement suspending w/ USSR assigning claims to US against Americans holding Russian co funds seized after revolution a. Executive agreements are valid and trump state law (supremacy clause). Don’t require approval/consent of Senate 4. Dames & Moore: Exec agreement w/ Iran to release hostages & US would terminate all litigation in US courts involving claims against Iran a. Upheld: Category 1 through acquiescence & realm of foreign policymore deference to President. 5. Medellin v. Texas: Bush declared US would comply w/ treaty under Vienna Convention/ICJ judgement. a. Bush lacked authority because not self-executing treaty (not requiring congress to act to make law) b. Congress has power to make treaties, no gloss argument (category 3) 6. Korematsu: internment camps based on 1942 congress act (category 1) a. We have had recent occasion to quote approvingly the statement of former Chief Justice Hughes that the war power of the Government is “the power to wage war successfully.” The validity of action under the war power must be judged wholly in the context of war b. Frankfurter Concurrence: just because this wouldn’t be allowed in time of peace doesn’t mean its unconstitutional in time of war… this is slippery slope c. Executive Discretion in times of War or Terrorism i. Congress power to declare war & raise armies/navies ii. President power= commander in chief. iii. Suspension Clause Art I §9 cl.2: "the privilege of the writ of Habeas Corpus shall not be suspended, unless when in cases of rebellion or invasion the public safety may require it. iv. Habeas corpus: It gives detained right to have a court direct the government official holding him in custody to produce him and provide good reason for "having the body" - or else release him. When it is suspended, a detainee ordinarily has no immediate legal recourse, even if his detention is unlawful. v. Ex parte Merryman: Court held only congress can suspend writ of habeas corpus even in time of war. Court described its role as declaring the law and leaving its execution to the President. vi. War Powers Resolution of 1973: Limitation on presidential war powers—Congress asserts power to declare war, save in emergency situations of attack where the President MUST respond quickly. 1. President may introduce troops into hostilities pursuant ONLY to: a. (a) Congressional declaration of war b. (b) Specific statutory authorization, or c. (c) A national emergency created by an attack upon the US, its territories or possessions, or armed forces 2. If President introduces troops into hostilities, President must: a. (a) Within 48 hours notify Congress of the reasons for the action (submit report), and b. (b) Within 60 days terminate the use of force, UNLESS Congress has approved use, extended period, or can’t physically meet (then 30 more days). 18 vii. Obama Libyan Incident: claimed not in hostilities, just logistical support. viii. Miligan: Even when Habeas Corpus is constitutionally suspended, non belligerent US citizens are entitled to trial by art III court if they are open (as opposed to military commission). ix. Quirin: US citizenship does not protect you from consequences of a belligerency and US citizen can be subject to trial by military commission. President can order trial by military commission, when as here, he has congressional approval (articles of war) x. Eisentrager: non-citizen, unlawful enemy combatant, captured & held in nonsovereign territory, tried by commission outside US, conduct was outside US. Habeas petition not extended here. xi. AUMF gives President authorization to detain citizens as enemy combatants by stating he can use "all necessary and appropriate force." (Category 1 of Youngstown). However, citizens should be given a meaningful opportunity to combat factual allegations of status as enemy combatants (Hamdi). xii. Hamdan: Even if the President can order trials by military commission solely relying on his powers, his power is limited by restrictions placed on him by Congress. Only certain violations of the law of war can be tried by military commission. Even if conspiracy is one of them he has to comply with the UCMJ and laws of nations (Geneva convention), which he did not here. DTA did not strip court of jurisdiction over Habeas petition xiii. MCA (response to Hamdan): sought to give president authority to try any violation of the law of war by military commission. Expanded DTA's removal of habeas petition review over all enemy combatant detainees regardless of where they are held xiv. Habeas Corpus (Boumediene rules) 1. If you are within the reach of the suspension clause you are entitled to Habeas corpus unless: a. The writ has been formally suspended; or b. You have been given adequate substitute process 2. Factors to consider in determining if detainee is in reach of suspension clause: a. Citizenship and status of detainee and adequacy of process through which the status determination was made; i. Non-citizen/citizen and lawful/unlawful enemy combatant. ii. CSRT did not provide adequate substitute process b. Nature of site where apprehended and detention took place; and i. Sovereign territory or not? Guantanamo w/ in US jurisdiction for habeas review c. Practical obstacles inherent in resolving the prisoner’s entitlement to the writ. i. Eisentrager: was in occupation zone, needs troops. Similar threats not apparent in Guantanamo. 3. If detainee is w/ in reach of suspension clause, analyze if there was adequate process or a constitutional suspension of the writ: a. If the writ is to be denied Congress must act in accordance w/ requirements of the Suspension Clause (has to be time or rebellion or invasion and public safety requires it). MCA = unconstitutional suspension of the writ. 19 b. DTA did not provide adequate substitute process. Detainee must be given opportunity to present relevant exculpatory evidence that was not made part of the record in earlier-proceedings. d. Congressional Control over actions of the Executive i. Nondelegation Doctrine: so long as Congress lays down by legislative act an intelligible principle to which the person or broadly authorized act is directed to conform, such legislative action is not a forbidden delegation of legislative power. ii. One House veto: not allowed it violates bicameralism & presentment. 1. Chadha: one house veto a. Congress must abide by its delegation once made. Can legislate to take it away or write law more specifically. b. Dissent: leaves impossible choice of giving away too much power or not writing specifically enough to cover every circumstance iii. Line Item veto: not allowed, gives President unilateral power to amend bills, effectively creating new ones (Clinton v. NY). iv. Nixon v. Adm’r General Services: Can congress regulate disclosure of exec docs? 1. Rule: in determining whether the act disrupts the proper balance between the 3 branches, the proper inquiry focuses on the extent to which it prevents the Executive Branch from accomplishing its constitutionally assigned functions. Only where the potential for disruption is present must we then determine whether the impact is justified by an overriding need to promote objectives within the constitutional authority of congress. 2. Relevant exec retained control of docs & previous acts have regulated disclosure of exec docs. 3. Framers sought to provide a comprehensive system, but the separate powers not intended to operate w/ absolute independence. Law upheld. e. Appointment & Removal of Executive Officers i. Appointments Clause: President shall appoint Superior officers (such as cabinet heads) w/ the advice and consent of the Senate. Congress can vest appointment of inferior officers in President, heads of depts (e.g. cabinet heads), or Court of law. ii. Congress can not vest appointment power in themselves iii. Who is an inferior officer? 1. Nature of the duties (i.e., executive or adjudicative/judicial character); 2. independence; 3. scope: tenure (i.e., we only keep them so long as needed); limited jurisdiction, lacked significant administrative authority, lacks policymaking authority iv. Congress can restrict President removal power when: 1. Real question is whether the removal restrictions are of such nature that they impede the President's ability to perform his constitutional duty, and the functions of the officials in question must be analyzed in that light. (Morrison) a. Morrison: President retained sufficient control over IC because AG can remove IC for good cause. 2. Double tenure requirement not allowed. That impedes his duties (Free enterprise) v. Mistretta: Congress created commission in judicial branch to create uniform prison sentences. 3 members to be appointed by President & removable for good cause 20 f. 1. Congress could delegate legislative authority to judiciary. 2. The constitution at least as a per se matter does not forbid judges from wearing two hats; it merely forbids them from wearing both hats at the same time 3. We cannot see how the service of federal judges on the commission will have a constitutionally significant practical effect on the operation of the judicial branch. Executive P&I + Impeachment i. Text: no exec privileges or immunities mentioned in constitution. ii. Stronger presumption of exec privilege when doc sought by congress rather than court iii. US v. Nixon: several Nixon associates being criminally prosecuted after Watergate. Prosecutor requesting docs from Nixon and he tries to claim generalized privilege. 1. The President does not enjoy an absolute generalized privilege which would allow him to shield all communications from a subpoena in a criminal proceeding. 2. Utmost deference from the courts when executive communications are regarding military, diplomatic, or national security secrets (none of those here) 3. Criminal Suits: Court balances the type of claim asserted (general v. specific privilege) against the needs of the fair administration of criminal justice. iv. Comm. On Oversight & Gov’t relations: ATF had questionable tactics, did not respond to congress’ subpoena for documents. 1. The President does not have blanket privilege from Congressional demands. 2. mere fact that there is a conflict between the branches over a congressional subpoena does not preclude judicial resolution of the conflict. v. Nixon v. Fitzgerald 1. President permanently immune for official acts taken while in office. Don't want to worry about him being sued for official actions vi. Clinton v. Jones: no presidential immunity for unofficial acts taken prior to becoming president. vii. Impeachment 1. Article II, Section 4 states: “The President, Vice President and all civil Officers of the United States, shall be removed from Office on Impeachment for, and Conviction of, Treason, Bribery, or other high Crimes and Misdemeanors.” 2. A majority vote in the House is necessary to invoke the charges of impeachment. A two-thirds vote in the Senate is necessary to remove. No one has every been removed. Andrew Johnson and Clinton impeached but not removed 8. Trump Section a. Emoluments i. Foreign Emoluments Clause: “no person, holding any Office or Profit or Trust under [the United States], shall, without the Consent of Congress, accept any present, Emolument, Office, or Title, of any kind whatever, from any King, Prince, or foreign State.” ii. Text: sweeping and unqualified and evinces an intent on the part of the Framers to adopt a prophylactic rule governing foreign gift giving. 21 iii. Tradition reveals that presidents have almost invariably sought legal guidance or congressional consent before accepting foreign gifts, even for rugs, or elephant tusks. Exception: Obama book sales iv. Policy: A republican form of government relies, to a large degree, on transparency, on the ability of the voting public to hold elected officials accountable for their actions. b. Pardon power i. Article II recognizes the power of the President to “grant Reprieves and Pardons for offenses against the United States, except in Cases of Impeachment. ii. Limits on Pardon Power: 1. Has to be federal crime, anything but impeachment, can't increase punishment. Can impose any conditions, even if not authorized by statute iii. US v. Arpaio: trump pardoned arpaio. Criminal contempt is a pardonable offense. 1. President's pardon must be accepted to be effective. D accepted pardon here after being held in contempt. A pardon releases the wrongdoer from punishment, it does not erase a judgement our conviction 2. Problematic because pardoning for violation of the constitution iv. Schick v. Reed: death row inmate sentence changed to LWOP. Death penalty banned after he’s pardoned so he tries to get Life w/ parole instead since that what death row inmates changed to. 1. conditions he can impose are boundless, he can't increase punishment, but can put any condition he wants, even if not authorized by statute 22