410 Part Three Advanced Costing and Control

Customer-related activity costs:

Processing sales orders

Scheduling production

Setting up equipment

Inspecting batches

Total

$1,100,000

600,000

1,800,000

2,400,000

$5,900,000

Required:

1.

Assign the customer-related activity costs to each category of customers in proportion to the sales revenue earned by each customer type. Calculate the profitability of each customer type. Discuss the problems with this measure of customer profitability.

2.

Assign the customer-related activity costs to each customer type using activity rates. Now calculate the profitability of each customer category. As a manager, how would you use this information?

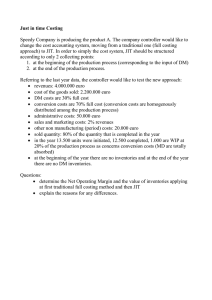

11-5

JIT and Traceability of Costs ___________________________

Lg g Assume that a company has recently switched to JIT manufacturing. Each manufacturing cell produces a single product or major subassembly. Cell workers have been trained to perform a variety of tasks. Additionally, many services have been decentralized. Costs are assigned to products using direct tracing, driver tracing, and allocation. For each cost listed, indicate the most likely product cost assignment method used before JIT and after JIT. Set up a table with three columns: Cost Item, Before JIT, and After JIT. You may assume that direct tracing is used whenever possible, followed by driver tracing, with allocation being the method of last resort.

a.

Inspection costs b.

Power to heat, light, and cool plant c.

Minor repairs on production equipment d.

Salary of production supervisor (department/cell) e.

Oil to lubricate machinery f.

Salary of plant supervisor g.

Costs to set up machinery h.

Salaries of janitors i.

Power to operate production equipment j.

Taxes on plant and equipment k.

Depreciation on production equipment l.

Raw materials m.

Salary of industrial engineer n.

Parts for machinery o.

Pencils and paper clips for production supervisor (department/cell) p.

Insurance on plant and equipment q.

Overtime wages for cell workers r.

Plant depreciation s.

Materials handling t.

Preventive maintenance

11-6

JIT Features and Product Costing Accuracy

L 0 4 ,

L 0 5

Prior to installing a JIT system, Pohlson Company, a producer of bicycle parts, used maintenance hours to assign maintenance costs to its three products (wheels, seats, and handle bars).

The maintenance costs totaled $1,960,000 per year. The maintenance hours used by each product and the quantity of each product produced are as follows:

Chapter 11 Strategic Cost Management

Maintenance Hours Quantity Produced

Wheels

Seats

Handlebars

60,000

60,000

80,000

52,500

52,500

70,000

After installing JIT, three manufacturing cells were created, and cell workers were trained to perform preventive maintenance and minor repairs. A full-time maintenance person was also assigned to each cell. Maintenance costs for the three cells still totaled $1,960,000; however, these costs are now traceable to each cell as follows:

Cell, wheels

Cell, seats

Cell, handlebars

$532,000

588,000

840,000

Required:

1.

Compute the pre-JIT maintenance cost per unit for each product.

2.

Compute the maintenance cost per unit for each product after installing JIT.

3.

Explain why the JIT maintenance cost per unit is more accurate than the pre-JIT cost.

Backflush Costing versus Traditional: Variation 1

Jackson Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses the purchase of materials as the first trigger point and the completion of goods as the second trigger point. During the month of

August, Jackson had the following transactions:

Raw materials purchased

Direct labor cost Overhead

$810,000

135.000

675.0

cost Conversion cost applied

*$135,000 labor plus $742,500 overhead.

877,500

*

There were no beginning or ending inventories. All goods produced were sold with a 60 percent markup. Any variance is closed to Cost of Goods Sold. (Variances are recognized monthly.)

11-7

L0 5

Required:

1.

Prepare the journal entries that would have been made using a traditional accounting approach for cost flows.

2.

Prepare the journal entries for the month using backflush costing.

Backflush Costing: Variation 2

Refer to Exercise 11-7 .

Prepare the journal entries for the month of August using backflush costing, assuming that

Jackson uses the sale of goods as the second trigger point instead of the completion of goods.

Backflush Costing: Variations 3 and 4

Refer to Exercise 11-7.

11-8

L0 5

11-9

L0 5

411

Chapter 11 Strategic Cost Management

External Linkages, Activity-Based Customer Costing, and Strategic Decision Making

Jazon Manufacturing produces several types of bolts. The products are produced in batches according to customer order. Although there are a variety of bolts, they can be grouped into three product families. The number of units sold is the same for each family.

The selling prices for the three families range from $0.50 to $0.80 per unit. Because the product families are used in different kinds of products, customers also can be grouped into three categories, corresponding to the product family they purchase. Historically, the costs of order entry, processing, and handling were expensed and not traced to individual products.

These costs are not trivial and totaled $6,300,000 for the most recent year. Furthermore, these costs had been increasing over time. Recently, the company had begun to emphasize a cost reduction strategy; however, any cost reduction decisions had to contribute to the creation of a competitive advantage.

Because of the magnitude and growth of order-filling costs, management decided to explore the causes of these costs. They discovered that order-filling costs were driven by the number of customer orders processed. Further investigation revealed the following cost behavior:

Step-fixed cost component: $70,000 per step; 2,000 orders define a step*

Variable cost component: $28 per order * Jazon currently has sufficient steps to process 100,000 orders.

The expected customer orders for the year total 140,000. The expected usage of the orderfilling activity and the average size of an order by product family are as follows:

Family A Family B Family C

Number of orders

Average order size

70,000

600

42,000

1,000

28,000

1,500

As a result of the cost behavior analysis, the marketing manager recommended the imposition of a charge per customer order. The president of the company concurred. The charge was implemented by adding the cost per order to the price of each order (computed using the projected ordering costs and expected orders). This ordering cost was then reduced as the size of the order increased and eliminated as the order size reached 2,000 units.

(The marketing manager indicated that any penalties imposed for orders greater than this size would lose sales from some of the smaller customers.) Within a short period of communicating this new price information to customers, the average order size for all three product families increased to 2,000 units.

11-13

|_0 2

Required:

1.

Jazon traditionally has expensed order-filling costs (following GAAP guidelines).

Under this approach, how much cost is assigned to customers? Do you agree with this practice? Explain.

2.

Consider the following claim: By expensing the order-filling costs, all products were undercosted; furthermore, products ordered in small batches are significantly undercosted. Explain, with supporting computations where possible. Explain how this analysis also reveals the costs of various customer categories.

3.

Calculate the reduction in order-filling costs produced by the change in pricing strategy.

(Assume that resource spending is reduced as much as possible and that the total units sold remain unchanged.) Explain how exploiting customer linkages produced this cost reduction. Jazon also noticed that other activity costs, such as those for setups, scheduling, and materials handling costs, were reduced significantly as a result of this new policy. Explain this outcome, and discuss its implications.

415

416 Part Three Advanced Costing and Control

4.

Suppose that one of the customers complains about the new pricing policy. This buyer is a lean, JIT firm that relies on small frequent orders. In fact, this customer accounted for

30 percent of the Family A orders. How should Jazon deal with this customer?

5.

One of Jazon’s goals is to reduce costs so that a competitive advantage might be created. Describe how the management of Jazon might use this outcome to help create a competitive advantage.

11-14

Life-Cycle Cost Management and Target Costing ____________

L

0 3

Nico Parts, Inc., produces electronic products with short life cycles (of less than two years).

Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that postpurchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was $130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be $120 per unit.

Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded.

Brian: Mark, as you know, we agreed that a profit of $15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isn’t acceptable. Total profits need to be increased. Cathy, what suggestions do you have?

Cathy: Simple. Decrease the selling price to $125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well.

Brian: You’re right. However, keep in mind that I do not want to earn a profit that is less than

$15 per unit.

Mark: Does that $15 per unit factor in preproduction costs? You know we have already spent

$100,000 on developing this product. To lower costs will require more expenditure on development.

Brian: Good point. No, the projected cost of $120 does not include the $100,000 we have already spent. I do want a design that will provide a $15-per-unit profit, including consideration of preproduction costs.

Cathy: I might mention that postpurchase costs are important as well. The current design will impose about $10 per unit for using, maintaining, and disposing our product. That’s about the same as our competitors. If we can reduce that cost to about $5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Mark’s request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of $6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features.

Required:

1.

Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current

(initial) design offers (including preproduction costs).

2.

Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to $125.

a.

Calculate the target cost for the $125 price and 35 percent market share.

b.

How much more cost reduction is needed?

c.

What are the total life-cycle profits now projected for the new product?

d.

Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction?

Chapter 12 Activity-Based Management

Non-Value-Added Activities: Non-Value-Added Cost

Bienstar Company has 15 clerks that work in its accounts payable department. A study revealed the following activities and the relative time demanded by each activity:

Activities

Comparing purchase orders and receiving orders and invoices

Resolving discrepancies among the three documents

Preparing checks for suppliers

Making journal entries and mailing checks

The average salary of a clerk is $38,000.

Percentage of

Clerical Time

15%

70

10

5

Required:

Classify the four activities as value-added or non-value-added, and calculate the clerical cost of each activity. For non-value-added activities, indicate why they are non-value- added.

Root Cause (Driver) Analysis

Refer to Exercise 12-3 .

Required:

Suppose that clerical error—either Bienstar’s or the supplier’s—is the common root cause of the non-value-added activities. For each non-value-added activity, ask a series of “why” questions that identify clerical error as the activity’s root cause.

12-3

L0 2

12-4

L0 2

Process Improvement/Innovation

Refer to Exercise 12-3 . Suppose that clerical error is the common root cause of the nonvalue-added activities. Paying bills is a subprocess that belongs to the procurement process.

The procurement process is made up of three subprocesses: purchasing, receiving, and paying bills.

12-5

L 0 2 ,

L 0 5

Required:

1.

What is the definition of a process? Identify the common objective for the procurement process. Repeat for each subprocess.

2.

Now, suppose that Bienstar decides to attack the root cause of the non-value- added activities of the bill-paying process by improving the skills of its purchasing and receiving clerks. As a result, the number of discrepancies found drops by 30 percent.

Discuss the potential effect this initiative might have on the bill-paying process. Does this initiative represent process improvement or process innovation? Explain.

Process Improvement/Innovation

Refer to Exercise 12-5 . Suppose that Bienstar attacks the root cause of the non-value- added activities by establishing a totally different approach to procurement called electronic data interchange (EDI). EDI gives suppliers access to Bienstar’s online database that reveals

Bienstar’s production schedule. By knowing Bienstar’s production schedule, suppliers can deliver the parts and supplies needed just in time for their use. When the parts are shipped, an electronic message is sent from the supplier to Bienstar that the

12-6

L 0 2 ,

L 0 5

453

458 Part Three Advanced Costing and Control

12-13

L 0 3

12-14

L 0 2 ,

L 0 3

Required:

1.

What kaizen setup standard would be used at the beginning of each quarter?

2.

Describe the kaizen subcycle using the two quarters of data provided by

Daspart.

3.

Describe the maintenance subcycle using the two quarters of data provided by Daspart.

4.

How much non-value-added cost was eliminated by the end of two quarters? Discuss the role of kaizen costing in activity-based management.

5.

Explain why kaizen costing is compatible with activity-based responsibility accounting while standard costing is compatible with financial-based responsibility accounting.

Activity Flexible Budgeting, Performance Report,

Volume Variance

Innovator, Inc., wants to develop an activity flexible budget for the activity of moving materials. Innovator uses eight forklifts to move materials from receiving to warehouse. The forklifts are also used to move materials from warehous e to the production area. The forklifts are obtained through an operating lease that costs $12,000 per year per forklift. Innovator employs 25 forklift operators who receive an average salary of $45,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production. Crates are disposed of after one cycle

(two moves), where a cycle is defined as a move from receiving to warehouse to production.

Each crate costs $1.20. Fuel for a forklift costs $1.80 per gallon. A gallon of gas is used every

20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50 weeks per year.

Required:

1.

Prepare a flexible budget for the activity of moving materials, using the number of cycles as the activity driver.

2.

Calculate the activity capacity for moving materials. Suppose Innovator works 90 percent of activity capacity and incurs the following costs:

Salaries

Leases

Crates

Fuel

$1,170,000

96,000

91,200

14,450

Prepare the budget for the 90 percent level and then prepare a performance report for the moving materials activity.

3.

Calculate and interpret the volume variance for moving materials.

4.

Suppose that a redesign of the plant layout reduces the demand for moving materials to one-third of the original capacity. What would be the budget formula for this new activity level? What is the budgeted cost for this new activity level? Has activity performance improved? How does this activity performance evaluation differ from that described in Requirement 2? Explain.

Activity-Based Management, Non-Value-Added

Costs, Target Costs, Kaizen Costing

Jerry Goff, president of Harmony Electronics, was concerned about the endof-the-year marketing report that he had just received. According to Emily Hagood, marketing manager, a price decrease for the coming year was again needed to maintain the company’s annual sales volume of integrated circuit boards. This would make a bad situation worse.

Chapter 12 Activity-Based Management

The current selling price of $18 per unit was producing a $2-per-unit profit—half the customary $4-per-unit profit. Foreign competitors keep reducing their prices. To match the latest reduction would reduce the price from $18 to $14. This would put the price below the cost to produce and sell it. How could the foreign firms sell for such a low price? Determined to find out if there were problems with the company’s operations, Jerry decided to hire Jan

Booth, a well-known consultant who specializes in methods of continuous improvement. Jan indicated that she felt that an activity-based management system needed to be implemented.

After three weeks, Jan had identified the following activities and costs:

Batch-level activities:

Setting up equipment Materials handling Inspecting products

Product-sustaining activities:

Engineering support Handling customer complaints Filling warranties Storing goods

Expediting goods Unit-level activities:

Using materials Using power

Manual insertion labor 1 Other direct labor Total costs

$ 125,000

180,000

122,000

120,000

100,000

170.0

80,000

75.000

diodes, resistors, and integrated circuits are inserted manually into the circuit board. b This total cost produces a unit cost of $16 for last year’s sales volume.

500.000

48.000

250.000

150.0

$1,920,000 b

Jan reported that some preliminary activity analysis shows that per-unit costs can be reduced by at least $7. Since Emily had indicated that the market share (sales volume) for the boards could be increased by 50 percent if the price could be reduced to $12, Jerry became quite excited.

Required:

1.

What is activity-based management? What connection does it have to continuous improvement?

2.

Identify as many non-value-added costs as possible. Compute the cost savings per unit that would be realized if these costs were eliminated. Was Jan correct in her preliminary cost reduction assessment? Discuss actions that the company can take to reduce or eliminate the non-value-added activities.

3.

Compute the target cost required to maintain current market share while earning a profit of $4 per unit. Now, compute the target cost required to expand sales by 50 percent.

How much cost reduction would be required to achieve each target?

4.

Assume that Jan suggested that kaizen costing be used to help reduce costs. The first suggested kaizen initiative is described by the following: switching to automated insertion would save $60,000 of engineering support and $90,000 of direct labor. Now, what is the total potential cost reduction per unit available? With these additional reductions, can Harmony Electronics achieve the target cost to maintain current sales? To increase it by 50 percent? What form of activity analysis is this kaizen initiative: reduction, sharing, elimination, or selection?

5.

Calculate income based on current sales, prices, and costs. Now, calculate the income using a $14 price and a $12 price, assuming that the maximum cost reduction possible is achieved (including Requirement 4’s kaizen reduction). What price should be selected?

459