Accounting Fundamentals: Introduction to Financial Principles

INTRODUCTION

What is accounting?

Business organizations and sources of finance

Financial statements: P&L and the balance sheet

The role of the accountant and the accounts office

THE ACCOUNTING MODEL

Recording financial transactions: the ledger system and trial balance

The running balance method of recording

The purchase day book and the returns day book

VAT

Banking services

Cash book / bank reconciliation statements / petty cash books

Capital and revenue expenditure

The trial balance, journal and suspense accounts

MANAGEMENT CONTROL

Control accounts

Sales and purchase ledgers

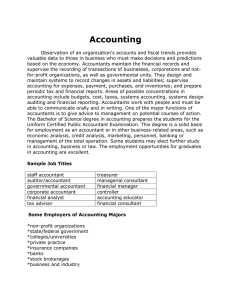

Definition of accounting

1.Accounting is the recording of financial transactions along with storing, sorting, retrieving, summarizing, and presenting the results in various reports and analyses. Accounting is also a field of study and profession dedicated to carrying out those tasks.

2. Accounting is the systematic and comprehensive recording of financial transactions pertaining to a business. Accounting also refers to the process of summarizing, analyzing and reporting these transactions to oversight agencies, regulators and tax collection entities

Accounting is one of the key functions for almost any business. It may be handled by a bookkeeper or an accountant at a small firm, or by sizable finance departments with dozens of employees at larger companies. The reports generated by various streams of accounting, such as c ost accounting and management accounting , are invaluable in helping management make informed business decisions. While basic accounting functions can be handled by a bookkeeper, advanced accounting is typically handled by qualified accountants who possess designations such as Certified Public Accountant (CPA) in the United States, or Chartered Accountant (CA),

Certified General Accountant (CGA) or Certified Management Accountant (CMA) in Canada.

Generally Accepted Accounting Principles

In most cases, accountants use generally accepted accounting principles (GAAP) when preparing financial statements. GAAP is a set of standards related to balance sheet identification, outstanding share measurements and other accounting issues, and its standards are based on double-entry accounting, a method which enters each expense or incoming revenue in two places on a company's balance sheet.

What are Generally Accepted Accounting Principles - GAAP

Generally accepted accounting principles (GAAP) refer to a common set of accepted accounting principles, standards, and procedures that companies and their accountants must follow when they compile their financial statements. GAAP is a combination of authoritative standards (set by policy boards) and the commonly accepted ways of recording and reporting accounting information. GAAP improves the clarity of the communication of financial information.

GAAP is meant to ensure a minimum level of consistency in a company's financial statements , which makes it easier for investors to analyze and extract useful information. GAAP also facilitates the cross comparison of financial information across different companies.

Principles of GAAP

The Business Entity Concept

The business entity concept provides that the accounting for a business or organization be kept separate from the personal affairs of its owner, or from any other business or organization. This means that the owner of a business should not place any personal assets on the business balance sheet. The balance sheet of the business must reflect the financial position of the business alone.

Also, when transactions of the business are recorded, any personal expenditures of the owner are charged to the owner and are not allowed to affect the operating results of the business.

The Continuing Concern Concept

The continuing concern concept assumes that a business will continue to operate, unless it is known that such is not the case. The values of the assets belonging to a business that is alive and well are straightforward. For example, a supply of envelopes with the company's name printed on them would be valued at their cost. This would not be the case if the company were going out of business. In that case, the envelopes would be difficult to sell because the company's name is on them. When a company is going out of business, the values of the assets usually suffer because they have to be sold under unfavorable circumstances. The values of such assets often cannot be determined until they are actually sold.

The Principle of Conservatism

The principle of conservatism provides that accounting for a business should be fair and reasonable. Accountants are required in their work to make evaluations and estimates, to deliver opinions, and to select procedures. They should do so in a way that neither overstates nor understates the affairs of the business or the results of operation.

The Objectivity Principle

The objectivity principle states that accounting will be recorded on the basis of objective evidence. Objective evidence means that different people looking at the evidence will arrive at the same values for the transaction. Simply put, this means that accounting entries will be based on fact and not on personal opinion or feelings.

The source document for a transaction is almost always the best objective evidence available.

The source document shows the amount agreed to by the buyer and the seller, who are usually independent and unrelated to each other.

The Time Period Concept

The time period concept provides that accounting take place over specific time periods known as fiscal periods. These fiscal periods are of equal length, and are used when measuring the financial progress of a business.

The Revenue Recognition Convention

The revenue recognition convention provides that revenue be taken into the accounts

(recognized) at the time the transaction is completed. Usually, this just means recording revenue when the bill for it is sent to the customer. If it is a cash transaction, the revenue is recorded when the sale is completed and the cash received.

It is not always quite so simple. Think of the building of a large project such as a dam. It takes a construction company a number of years to complete such a project. The company does not wait until the project is entirely completed before it sends its bill. Periodically, it bills for the amount of work completed and receives payments as the work progresses. Revenue is taken into the accounts on this periodic basis.

It is important to take revenue into the accounts properly. If this is not done, the earnings statements of the company will be incorrect and the readers of the financial statement misinformed.

The Matching Principle

The matching principle is an extension of the revenue recognition convention. The matching principle states that each expense item related to revenue earned must be recorded in the same accounting period as the revenue it helped to earn. If this is not done, the financial statements will not measure the results of operations fairly.

The Cost Principle

The value recorded in the accounts for an asset is not changed until later if the market value of the asset changes. It would take an entirely new transaction based on new objective evidence to change the original value of an asset.

There are times when the above type of objective evidence is not available. For example, a building could be received as a gift. In such a case, the transaction would be recorded at fair market value which must be determined by some independent means.

The Consistency Principle

The consistency principle requires accountants to apply the same methods and procedures from period to period. When they change a method from one period to another they must explain the change clearly on the financial statements. The readers of financial statements have the right to assume that consistency has been applied if there is no statement to the contrary.

The consistency principle prevents people from changing methods for the sole purpose of manipulating figures on the financial statements.

The Materiality Principle

The materiality principle requires accountants to use generally accepted accounting principles except when to do so would be expensive or difficult, and where it makes no real difference if the rules are ignored. If a rule is temporarily ignored, the net income of the company must not be significantly affected, nor should the reader's ability to judge the financial statements be impaired.

The Full Disclosure Principle

The full disclosure principle states that any and all information that affects the full understanding of a company's financial statements must be include with the financial statements. Some items may not affect the ledger accounts directly. These would be included in the form of accompanying notes. Examples of such items are outstanding lawsuits, tax disputes, and company takeovers.

BUSINESS ORGANIZATIONS AND SOURCES OF FINANCE

DEFINITION OF BUSINESS FINANCE

This is the amount of money you need to start your business. It enables you to buy machinery and equipment, build your business premises, hire labor and meet daily obligations of your business. Finance needed to start your business is commonly known as capital.

As an entrepreneur, the primary types of capital that you are likely to arrange for include startup capital, working capital and expansion capital. Startup capital is the capital you will require to begin a business while working capital is the amount you would need to meet the day to day activities of the business. Expansion capital is the capital you will require to help your business grow.

SOURCES OF BUSINESS FINANCE

1. Equity financing:

The main source of equity financing is your personal savings. Some experts say that one half of the money needed to start a small business should come from the owner. This may mean ‘you’, as the future owner must work and save for several years before having enough money to start the business.

Another popular source of equity financing is money from your family and friends. Equity financing can also be obtained by selling part of your business to others. This can be done in several ways e.g. you could get one or more partners. With the partners putting in a portion of their own money, you will find it easier to raise the total amount needed. Equity financing can also be obtained by selling part of your own property.

2. Borrowing from lending institutions:

When your sources are not enough, you have the option of borrowing from other sources.

Lenders will usually lend you money for starting a business if they know and trust you. Lenders want to be sure they will not lose their money on businesses that fail. Most lenders, therefore, will want to review your business plan carefully. The plan should describe how the business will operate, how much money will be needed, how it will be used and when the business will be profitable. Most people think of banks when borrowing money. Banks lend money when the risks of losing it are extremely low. Usually, they will only lend to customers whom they have known for a long time.

3. Borrowing from cooperative societies:

If you are a member of a co-operative society, you may be able to borrow money for business use. Some loans can be obtained with just your signature. Cooperative society interest rates are usually lower than bank rates. Commercial finance companies may lend you money to start your business. Because they take greater risks, commercial finance companies usually charge high interest rates.

Some people borrow money against their life insurance policies. This is an easy way to obtain some of the money needed to start the business. Life insurance policy loans are based on cash that is already paid in. Life insurance companies offer these loans at low interest rates. If you need to buy land or building for a new business, you will be able to borrow money from a savings and loan institution. They specialize in real estate finance. The loans they give out are called mortgages. Their interest rates are similar to those of banks.

4. Borrowing in the form of trade credit:

This is another source of business finance. It is where a business receives, on credit, raw materials and also other goods used to start up business. Suppliers grant credit to their clients for a period of 3 to 6 months. The seller finances the buyer who wants to start a business.

5. Borrowing through factoring:

This is a financial service designed to help a firm in managing their debt books and receivables in a better manner. The debt books and receivables are assigned to a bank or an institution called the “factor”. The bank then advances cash to the firm.

6. Bank Overdrafts financing:

Overdrafts are allowed by banks to current account holders, who are allowed to withdraw from up to a certain limit of a given amount.

7. Youth Enterprise Fund:

This is managed by the Ministry of Youth and Sports. It mainly funds youth projects. A youth in this case is regarded as a person between the ages of 18 and 32 years.

8. Friends and Relatives

Founders of start-up businesses may look to private sources such as family and friends when starting a business. This may be in the form of debt capital at a low interest rate. However, if you borrow from relatives or friends, it should be done with the same formality as if it were borrowed from a commercial lender. This means creating and executing a formal loan document that includes the amount borrowed, the interest rate, specific repayment terms (based on the projected cash flow of the start-up business), and collateral in case of default

.

Roles of accountant

Cost Accountant

Cost accountants help organisations to reduce costs and maximise profits. They do this by using financial tools to determine accurate costs of products and services. As cost accountants provide financial information that is aimed at helping managers to make good business decisions, they are allowed to focus on providing information that is relevant to a specific environment, instead of adhering strictly to the generally accepted accounting principles.

Financial Accountant

The role of a financial accountant is to record, summarise and report on the financial transactions of an organisation in such a way that it is possible for someone outside of the organisation to get an accurate picture of the organisation’s financial position and performance.

Financial accountants are therefore responsible for preparing the financial statements of an organisation. These financial statements will then be used for decision-making purposes by business owners, shareholders, suppliers, banks, employees, government agencies and other stakeholders.

Forensic Accountant

Forensic accountants use a combination of accounting and investigation skills to investigate the accuracy of financial information, as well as to help uncover financial crimes such as fraud, embezzlement and money-laundering. They also assist in risk management and risk reduction, and may be asked to give advice in relation to transactions such as mergers and acquisitions.

Forensic accountants are often employed by accounting firms, financial institutions, risk management consulting firms, government departments, attorneys, insurance companies and law enforcement agencies to perform the functions described above.

Internal Auditor

Internal auditors evaluate and report on the efficiency and effectiveness of the activities, processes and procedures within an organisation. They are involved in compliance, risk management and corporate governance.

Internal auditors usually report to the highest level of management, and will give recommendations for improvements to the structures and processes within an organisation.

Management Accountant

Management accountants assist in strategic planning by providing accurate and timely financial and non-financial information to the managers and key decision-makers within an organisation.

They:

Prepare weekly or monthly reports that can be used to make short-term decisions.

Explain the financial implications of the projects undertaken by an organisation.

Participate in risk assessment and risk management activities.

Assist in the formulation of business strategy.

The role of management accountant is a senior advisory one, and management accountants are therefore expected to conduct themselves with professionalism and integrity at all times.

Project Accountant

Project accountants are responsible for tracking the financial progress of projects. They usually work closely with project managers, and will be responsible for activities such as:

Preparing and monitoring project budgets.

Investigating budget variances.

Compiling financial reports for individual projects.

Reporting on the profitability of individual projects.

Compiling information that is required by internal and external auditors.

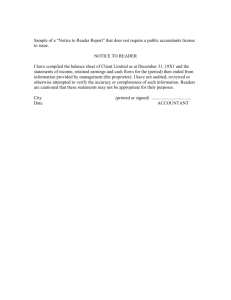

Public Accountant

Public accountants provide a wide range of accounting services to businesses, individuals, nonprofit organisations and government departments. They usually work as external consultants in public accounting firms. This allows them to remain objective when rendering accounting services to clients.

Tax Accountant

Tax accountants provide tax-related advice to individuals and organisations. They provide a range of tax-related services, such as:

Preparing tax returns.

Explaining tax legislation and advising on the implications of changes in the tax laws.

Devising strategies for minimising tax liability.

Advising on tax compliance.