barra handbook GEM

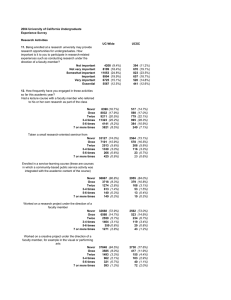

advertisement