PROBLEM SET #3

1. Heard in the MBA lounge: “The demand curve (schedule) faced by one producer among many

producers is much more elastic than market demand when all the producers produce the same

product”. Do you agree with this statement? Why or why not? (3 lines)

2. In a meeting, a sales manager presents a pessimistic profit outlook, and predicts higher unit

sales for the next quarter. The production manager attending the meeting says, “Aha, this

means that demand will increase and remain strong, and if demand is strong we should not be

that pessimistic!” What would you say to the production manager? (3 lines)

The production manager should be pessimistic if the demand is inelastic, cus if price goes up,

total revenue goes up.

3. True or False and why? A product with perfect substitutes has a price elasticity of zero. (2 lines)

False, perfectly substitute=0 and a perfectly inelastic demand is an increase in price has no

effect on quantity. Therefore, it is elastic

4. Suppose that fish can be classified according to two basic categories, “fine” and “ordinary”. Fine

fish is priced higher than ordinary fish. You are told that fresh fine fish fluctuates more in price

than fresh ordinary fish. Provide an explanation for this (Hint: consider the options available to

the types of customers) (4 lines)

Fine fish has a substitute so demand for it is changing which leads to price flunctuation. Fine fish

is an elastic demand.

5. A producer estimates demand as Qd = 200 – P. Is the price elasticity of demand the same if the

producer had estimated the equation as lnQd = 200 – ln P? Why or why not? Specifically, what

is the price elasticity for each equation? (2 lines)

6. Overhead in a 504 seminar: “Product x and product y are substitutes and product x and product

z are complements. Under downward sloping demand and upward sloping supply conditions, If

price of x increases, people should buy more y (the substitute) but less of z (the complement). I

just witnessed something that defies economic theory. Price of x rises but more of product z is

purchased. Economic theory cannot explain this phenomenon”. Do you agree with this

comment? Specifically, ‘under economic theory’, can the price of product increase and the

demand for its complement increase at the same time? Why or why not? (4 lines)

Yes and no

Yes, if the product has very few substitutes (inelastic demand)

No, if the product has a lot of substitues (elastic demand)

7. Heard in Building 255: “If the demand for gold is inelastic, and the price of gold falls, then

producers of gold should experience a reduction in their profits over time” Do you agree? Why

or why not? (2 lines)

No. if Gold is inelastic, when the price should rise the profit should rice also and when the price

falls total revenue should fall.

8. A farmer is a happy because a record crop harvest is expected for her product. Provide an

explanation why she will be happy knowing that a record crop will increase supply and reduce

prices. (2 lines)

The crop has an elastic demand. So when supply increases and price reduces, revenue increases.

Q.9

You manage region 5 of your company’s market. You asked your intern to determine the demand

function for your region and present a report to your boss. You gave your intern data on quantity

demanded (Qx), price of your product (Px), price of a substitute (Py), average Income levels in your market

area (Income), advertising budget (Adv), . You asked her to run a log-log regression model. Following her

presentation to your boss, you received the following note from your boss.

“One of your MBA interns sent this spreadsheet in response to the question I asked regarding certain

forecasts about our industry. This is nuts – do they not teach people how to speak in words anymore?

Can you help me out?” All I need are:

a. Is this a good model? Explain (2 lines)

Yes it is a good model because the R square shows 82%

b. What is the regression equation and what does it mean? (4 lines)

Qdx=a-bpx + cpy+ di+ ead+e.

c. Tell me what variables are significant in explaining our demand (3 lines)

d. What pricing policy should we adopt if we wish to increase our quantity demanded by 20%?

(1 line)

e. The following events have been forecasted for our industry :

i)

price of product Y will drop by 20%,

ii)

Average income level will rise by 2.85%.

iii)

I have decided to cut our advertising budget by 15%

Based on our present operations, what will be the total effect on our quantity demanded if

ALL these events occur? (2 lines)

f.

What action can we take to offset the effect you have calculated in (e) above? Specifically,

what action can we take with respect to our prices to restore our quantity sold back to the

present levels if these events happen? (2 lines)

g. Should we be worried about the forecast of 2.85% drop in incomes? Why or why not?

Explain fully (3 lines)

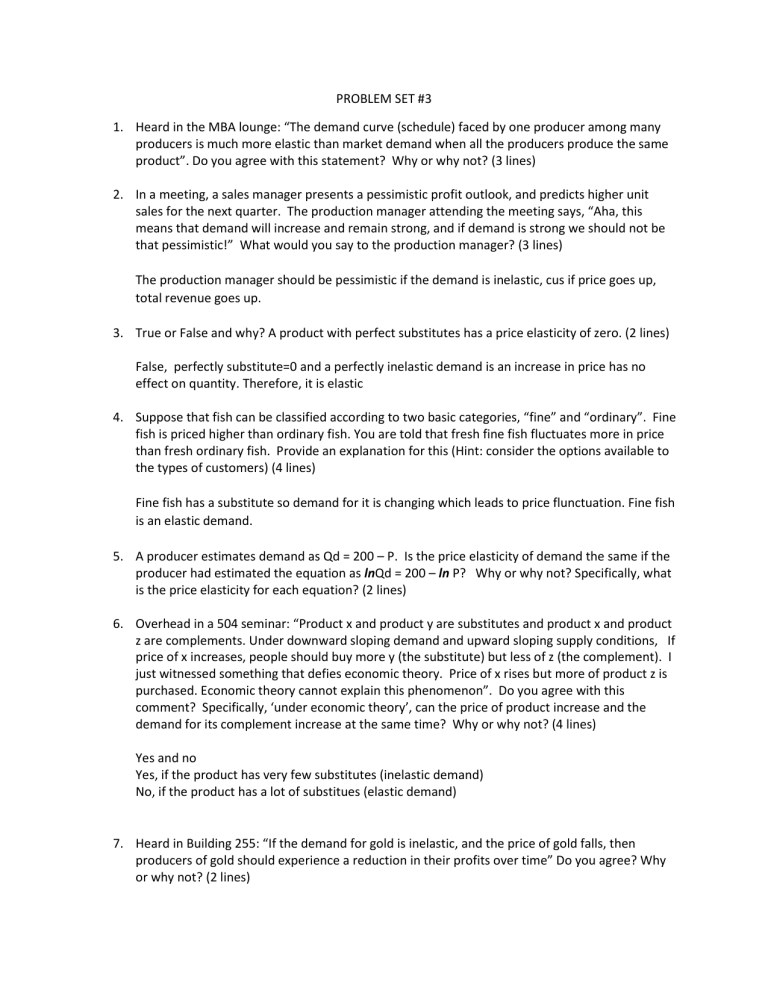

SUMMARY OUTPUT

Regression Statistics

R Square

0.825

Adjusted R Square

Observations

Intercept

Ln Px

Ln Py

Ln Income

ln Adv

0.797

300

Coefficients

-3.24

-2.020

0.583

0.332

2.11

Standard Error

3.74

0.44

0.56

0.042

1.809

t Stat

-0.87

4.60

-1.041

7.904

1.166

P-value

0.394

0.000

0.308

0.000

0.260