worksafebc-physician reference guide-pdf-en

advertisement

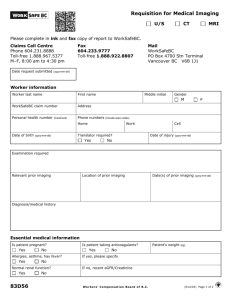

Doctors of BC and WorkSafeBC Physician Reference Guide A Companion Document to the Agreement Between the Workers’ Compensation Board (WorkSafeBC) and the Doctors of British Columbia (BC Medical Association) Department Health Care Services Date April 01, 2014 to March 31, 2019 1 Physician Services Reference Guide May 2018 Contents INTRODUCTION ............................................................................................................................. 3 DOCTORS OF BC/WORKSAFEBC CONTRACT ....................................................................................... 4 Background ................................................................................................................................ 4 Important Information on Prescribing Medication ............................................................................. 4 Community Physician Services for Complex Spinal Cord Injury .......................................................... 4 Fee Code 19509 – Complex Spinal Cord Injury Initial Visit or Yearly Assessment .............................. 4 Fee Code 19510 – Complex Spinal Cord Injury Office Visit ............................................................. 4 Fee Code 19511 – Complex Spinal Cord Injury Home Visit ............................................................. 4 Specialist Services ....................................................................................................................... 5 Expedited Consultations............................................................................................................. 5 Expedited Surgery .................................................................................................................... 6 Surgical Assistants .................................................................................................................... 7 Expedited Anaesthesia Services .................................................................................................. 8 Expedited Surgery Billing Procedure ............................................................................................ 8 BILLING WORKSAFEBC ................................................................................................................... 9 Facts about Timeliness and Electronic Submission............................................................................ 9 Physician Report Form Completion & Submission ........................................................................... 10 PHYSICIAN FORM 8/11 REFERENCE GUIDE ...................................................................................... 11 Injury Coding ............................................................................................................................ 14 APPENDICES FOR PHYSICIAN REFERENCE GUIDE ............................................................................. 15 Appendix A – CSA Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Side of Body Codes ... 16 Appendix B – CSA Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Body Part Codes (CSA Z795). ..................................................................................................................................... 17 Appendix C – Explanatory Codes for Teleplan Rejections ................................................................ 19 Appendix D – Application for Compensation and Report of Injury or Occupational Disease (Form 6) ..... 21 Appendix E –Physician’s Report (Form 8/11) ................................................................................. 24 Appendix F – How to Complete the Form 8/11: Physician’s Report Form ........................................... 26 Appendix G – Surgical Procedures List .......................................................................................... 27 Appendix H – Physician’s Invoice (Form 11A) ................................................................................ 30 Appendix I - Authorization Request for Surgery (83D6) .................................................................. 31 Appendix J - Invoice for Expedited Anaesthesia (83D10) ................................................................ 32 Appendix K – Summary Invoice for Extensive Spine Surgical Assist ................................................. 33 Appendix L - Requisition for Medical Imaging (83D56).................................................................... 34 Appendix M - Summary Invoice for Extensive Spine Surgery (83D8) ................................................ 36 Appendix N - Contact Information ................................................................................................ 37 Appendix O - Summary Fee Schedule with Rate Changes and Effective Dates ................................... 40 2 Physician Services Reference Guide May 2018 Physician Services Reference Manual This manual is intended to assist with specific business processes related to doing business with the Workers’ Compensation Board of BC (WorkSafeBC). This is not a stand-alone document and it is intended that this manual be used in conjunction with the Physician Services Memorandum of Agreement and all the related Schedules. Please ensure that all staff has access to and understand the content of this manual. INTRODUCTION The Workers’ Compensation Board of British Columbia is providing this Reference Guide to assist you with understanding the Agreement between the Workers’ Compensation Board (WorkSafeBC) and the Doctors of British Columbia (BC Medical Association) and for reporting to and invoicing to WorkSafeBC. By law, the Workers’ Compensation Board can only pay for medical services related to an accepted WorkSafeBC claim. That means that the patient’s injury or illness must be determined by WorkSafeBC to be a direct result of a work-related activity or occupational disease to qualify for WorkSafeBC benefits. This adjudicative process may depend on non-medical issues such as employment status and is not solely based on medical evidence. Working with Physicians and Employers in this province, WorkSafeBC’s goal is to facilitate a safe, timely, and durable return to work for injured workers. To this end a number of WorkSafeBC unique fees relate to expedited clinical services with reimbursement reflecting timely services and electronic submission of reports and invoices, as well as return to work services. Payment for WorkSafeBC approved services for fee for service and unique WorkSafeBC fees is provided by electronic funds transfer via HIBC (MSP) Teleplan. Transaction details are provided on Teleplan remittance statements. Please contact HIBC directly at (604) 456-6950 or toll free at 1 866 456-6950 to set up Teleplan billing and electronic fund transfer. Most of the routine medical services such as regular office visit (MSP fee code 00100) are billed to WorkSafeBC using the MSP fee code. An uplift will be applied automatically on all MSP fee codes (not WorkSafeBC unique fee codes and form fees) invoiced to WorkSafeBC. The uplift is 10% if invoicing electronically via Teleplan, or 3% if invoice is submitted by fax to WorkSafeBC. The WorkSafeBC unique fee-for-service fee codes referred to in the Agreement between the Doctors of BC and WorkSafeBC do not have an uplift applied. These fees are negotiated directly between the Doctors of BC and WorkSafeBC. A Note on the Word “Claim” When a person suffers a work-related injury or contracts a work-related disease, he or she can make a claim for compensation to WorkSafeBC. To WorkSafeBC, that claim represents a relationship between the injured worker & WorkSafeBC that lasts for weeks, months or even years. However, in an MSP billing context, a claim is a submission of a new invoice. Please note that throughout this document, the word claim refers to the ongoing relationship between an injured worker and WorkSafeBC, not to new invoices. 3 Physician Services Reference Guide May 2018 DOCTORS OF BC/WORKSAFEBC CONTRACT Background The current Agreement between Doctors of BC and WorkSafeBC is a term from April 01, 2014 to March 31, 2019. Information provided in this section: Discusses the changes in the Doctors of BC/WorkSafeBC Agreement, outlines the business processes and indicates the dates that new rates are to be applied. Provides fee changes and effective dates for Form & Unique Fees and Expedited Service Fees (see Appendices K & L for Schedules B and D which are excerpts from the Agreement). A summary fee schedule with rate changes and effective dates is also provided in Appendix O. Important Information on Prescribing Medication Generic substitution medication is mandatory; write “No Sub” for patients requiring brand name medication. Community Physician Services for Complex Spinal Cord Injury Three fee codes specifically address the unique circumstances that are inherent in caring for an injured worker with a Spinal Cord Injury with Permanent Sequelae. These fees recognize the additional time required to provide services to this population and to acknowledge the complexity of this type of injury. Fee Code 19509 – Complex Spinal Cord Injury Initial Visit or Yearly Assessment • Initial or Annual Assessment (yearly thereafter) to include a complete physical exam • Develop and update a yearly care plan documented on a Form 8/11 A template to assist in developing and documenting the care plan is available on the WorkSafeBC website: https://www.worksafebc.com/en/resources/health-care-providers/guides/spinal-cord-injury-patient-careflow-sheet Fee Code 19509 may be billed once per year. • Form 8/11 outlining a care plan will be paid in addition to Fee Code 19509; there is no additional fee for the Spinal Cord Injury Patient Care Flow Sheet document above. Fee Code 19510 – Complex Spinal Cord Injury Office Visit • Can be billed for all other office visits occurring during the year • Report on a Form 8/11; Form 8/11 will be paid in addition to Fee Code 19510 • Cannot bill in addition to an Initial Visit or Yearly Assessment Fee Code 19509. Fee Code 19511 – Complex Spinal Cord Injury Home Visit • Perform a home visit • Report on a Form 8/11; Form 8/11 will be paid in addition to Fee Code 19511. 4 Physician Services Reference Guide May 2018 • If the home visit is the Initial Visit or the Yearly Assessment then bill both Fee Codes 19511 and 19509 but cannot be billed with Office Visit (Fee Code 19510). Specialist Services Expedited Consultations Expedited Comprehensive Consultations Referrals for Initial and Repeat Expedited Comprehensive Consultations can be made to a Specialist Physician by WorkSafeBC or a referring physician. Non-Specialist Physicians with Areas of Expertise (e.g. Sports Medicine) must be approved by WorkSafeBC to provide Initial Expedited Comprehensive Consultations. Once approved for the Initial Expedited Consultation, the Repeat Consultations do not require approval. The fees include the physical examination and report. No other office visit or report fees may be billed in addition. Standards for reporting for an expedited comprehensive consultation shall contain the following core information: • Purpose of examination • Nature of injury • Present complaints • Objective findings • Diagnosis or differential diagnosis • Information regarding causation including risk factors other than work; and • Recommendations regarding work restrictions as related to the work injury/disease. (It is not possible to provide a specific diagnosis in every case. It may, however, be possible to exclude serious or progressive conditions that may be worsened by work.) Specialist Physicians and Physicians with Areas of Expertise are entitled to the Expedited Comprehensive Consultation fee if the following criteria are met: • Reporting Timeliness Criteria: • The Initial Expedited Comprehensive Consultation report must be received by WorkSafeBC within fifteen (15) business days from the referral. If after the Initial Expedited Consultation, a referral is made for a Repeat Expedited Consultation, the report must be received within fifteen (15) business days of the referral. • For any other Consultations (e.g. Repeat Consultation scheduled by the consulting physician versus being referred): the report must be received within five (5) business days of the consultations. • Where following a consultation the consulting physician concludes the Worker is fit to return to work, this information must be received by WorkSafeBC within three (3) days of the consultation. Initial Expedited Comprehensive Consultation (Fee Code 19911): • The Physician is entitled to the Initial Expedited Comprehensive Consultation fee for the first consultation on each claim. A new Initial Expedited Comprehensive Consultation may occur if: • more than six (6) months lapsed since the physician last saw the Worker; and • the consultation is as a result of a new referral. 5 Physician Services Reference Guide May 2018 Repeat Expedited Comprehensive Consultation (Fee Code 19912): • The Physician is entitled to the Repeat Expedited Comprehensive Consultation fee for one (1) repeat consultation when the repeat consultation occurs within twelve (12) weeks of the first Consultation following the referral. Any other repeat consultation is not entitled to expedited fees. • In the case of a post-operative consultation, that follow up visit and report are to be invoiced as the post-operative consultation service as described in Fee Schedule B, using fee code 19931. The post-operative consultation is not considered a Repeat Expedited Comprehensive Consultation. • If the expedited time frames outlined above for submission of the report are exceeded, then bill the appropriate MSP specialty consultation fee code. If applicable, bill a Non-Expedited specialist consultation report, initial or repeat (fee code 19908), for consultation services that do not include a report in the MSP fee item description. Report must be received by WorkSafeBC within seven (7) business days following date of service or following request by WorkSafeBC. Expedited Surgery Expedited Surgical Services Timeline The surgeon must submit an Authorization Request for Surgery. Please refer to Form 83D6 found in Appendix I of this Reference Guide. The Authorization Request for Surgery (Form 83D6) must be submitted to WorkSafeBC within five (5) business days following the Consultation Report that includes the surgeon’s recommendation for surgery. NOTE: authorization for surgery does not equate to payment of expedited rates for surgery. Expedited rates will be paid if the surgery meets the eligibility criteria indicated herein. In the case of emergency (trauma) surgery performed, the prescribed Authorization for Surgery Form (Form 83D6 – Authorization Request for Surgery) is submitted within five (5) business days following the emergency (trauma) surgery to the Claims Officer for entitlement approval, along with the comprehensive consultation report. Upon entitlement approval and receipt of the comprehensive consultation report, the expedited surgery fee will be paid. All elective procedures must be performed within forty (40) business days from the date of the last consultation. The one exception is Expedited Extensive Spine Surgery (see below). Where it is not possible to schedule a surgery within the forty (40) business days, the surgeon may seek approval from Health Care Services to extend the time frame in order to ensure that the surgery will be performed on an expedited basis and will be billable as such, if approved. Otherwise, for procedures performed after forty (40) business days, WorkSafeBC Expedited Surgery rates will not apply. The operative report must be received within twenty (20) business days of the date of surgery, and is a requirement for WorkSafeBC to process payment. NOTE: If requirements are met, a premium uplift on the fees is paid. If not met, the regular MSP fees will be paid. Only the first three (3) elective surgeries per patient will be considered for expedited payment per each surgeon. This applies only to repeat surgeries performed on the same site. Any subsequent surgical consideration for additional surgery requires a second opinion by a Richmond VSC Specialist and further surgery will require authorization from the Health Care Services Program Manager. Expedited payment may be extended beyond the first three elective procedures for multiple non-emergent reconstructive procedures (both surgical and anesthesia services) when the following process occurs: 6 Physician Services Reference Guide May 2018 • • • A letter is submitted providing early identification of the complexity by outlining the patient details, volume and proposed procedures, and timeline to completion; A Surgical Authorization form is directed to the Claims Officer for entitlement approval; and A letter is directed to the Health Care Services Program Manager for payment approval and system activation. Extensive Spine Surgery These sessional rate fees are designed for surgeons performing difficult and extensive spinal procedures requiring stabilization or multilevel procedures or revisions discectomy (one level index discectomy is not meant to be covered by these fees). Pre-approval by WorkSafeBC is required. The 40-business day requirement in Article 3.3.3 of the WorkSafeBC-Doctors of BC Agreement are waived for these services. Billing – Expedited Surgery All expedited surgical procedures (with the exception of extensive spinal surgery) must be billed electronically through HIBC Teleplan: • Bill the applicable MSP Surgical Procedure Fee Codes • Apply WorkSafeBC Out-of-Office Hours Surcharge using one of the following fee codes as applicable: • 19320: Expedited Surgical Procedure Surcharge, Operative Evening • 19321: Expedited Surgical Procedure Surcharge, Operative Night • 19322: Expedited Surgical Procedure Surcharge, Operative Sat/Sun/Holidays • Apply MSP Out-of-Office Premiums – Call Out Charges, Continuing Care Surcharges – Operative, as applicable • Fax the operative report to (604) 233-9777 or Toll Free at 1 888 922-8807 Extensive spinal surgery must be billed on paper by completing the Summary Invoice for Extensive Spine Surgery (form 83D8) and fax to (604) 244-6292 or toll free 1-877-279-7590 along with the operative report. Refer to the chart on page 9 for an example of application of the Expedited Surgery billing process. Surgical Assistants Procedures recognized as qualifying for Surgical Assistants performed in private surgical facilities have been identified, and the Surgical Assist Procedures list is posted on the Health Care Practitioners and Providers page in WorkSafeBC.com website (Physicians - Medical and Surgical Specialists): http://www.worksafebc.com/health_care_providers/health_care_practitioners/medical_and_surgical_speci alists/default.asp. The current list is included in Appendix N. If a procedure is not listed, the Physician must contact the Program Manager, Health Care Services at WorkSafeBC for approval prior to the surgery. The list will be reviewed from time to time by the WorkSafeBC/Doctors of BC Liaison Committee. This list does not apply to surgeries performed in hospitals. Extensive Spine Surgery Assist These sessional rate fees are designed for surgical assistants performing difficult and extensive spinal procedures requiring stabilization or multilevel procedures or revisions discectomy (one level index discectomy is not meant to be covered by these fees). No additional fee codes or surcharges are billable in addition to the sessional fee code. 7 Physician Services Reference Guide May 2018 Billing – Expedited Surgical Assist All expedited surgical procedures (with the exception of extensive spinal surgery assist) must be billed electronically through HIBC Teleplan: • Include only one applicable MSP Surgical Assist Fee Code • Apply MSP Out of Office Premiums – Call Out Charges Continuing Care Surcharges – Operative, as applicable • Plus one of the appropriate time based unique WorkSafeBC Fee Code: Fee Codes 19545 to 19552 (Levels 1-7) • Apply WorkSafeBC Out of Office Premiums using one of the following fee codes as applicable: • 19410: Expedited Surgical Procedure Surcharge, Operative Evening • 19411: Expedited Surgical Procedure Surcharge, Operative Night • 19412: Expedited Surgical Procedure Surcharge, Operative Sat/Sun/Holidays Extensive spinal surgical assist must be billed on paper by completing the Summary Invoice for Extensive Spine Surgical Assist (form 83D9) and fax to (604) 244-6292 or toll free 1-877-279-7590. Refer to the chart on page 9 for an example of application of the Expedited Surgery Assist billing process. Expedited Anaesthesia Services Billing – Expedited Anaesthesia Surgical Services • Anaesthesia services for all expedited surgical procedures (with the exception of nerve block injections and extensive spinal surgery) must be billed electronically through HIBC Teleplan using: • the appropriate MSP Fee Code (Intensity & Complexity Index), and • WorkSafeBC Unique Fee Code 19507 – Expedited Anesthesia Services (time based fee code per 15 minute time block) • Apply MSP and WorkSafeBC Out-of-Office Surcharges as applicable. • The anaesthetic time includes a pre-operative assessment, as well as the time from induction until the anaesthesiologist is no longer in attendance and the injured worker can be safely discharged for the post-anesthetic recovery (PAR). If the pre-operative and PAR times are significantly longer than fifteen (15) minutes, respectively, or a total of thirty (30) minutes, then an explanatory note shall accompany the record of anesthesia. • A copy of the Record of Anesthesia must be faxed to (604) 233-9777 or Toll Free at 1 888 9228807. Be sure to include the Claim Number on the Record of Anesthesia. • Expedited extensive spine anaesthesia sessional fee must be billed on paper by completing the Expedited Surgery Summary Invoice for Anesthesia (Form 83D10) and fax along with the Record of Anaesthesia to (604) 244-6292 or toll free at 1-877-279-7590. Be sure to include the Claim Number on the Record of Anesthesia. Refer to the chart on page 9 for an example of application of the Expedited Anaesthesia billing process. Expedited Surgery Billing Procedure Billing Procedure Example • • • 8 Surgery: Fractured Tibia- Open Reduction & Internal Fixation (ORIF) Time: Tuesday 0125-0425 hours Surgery duration: three (3) hours Physician Services Reference Guide May 2018 Expedited Surgical Billing Process: Surgeon Billing MSP Fee code- ORIF MSP Out-of-Office Surcharge(s) Fee Code 56755 Apply as required Process Bill through Teleplan Bill through Teleplan WorkSafeBC Out-of-Office Hours Surcharge Apply as required Bill through Teleplan Anaesthesiologist Billing MSP Level 3 for time of 3.5 hours Fee Code 01173 Process Bill through Teleplan WorkSafeBC Unique FeeAnaesthesia Time Based Block for time of 3.5 hours MSP Out-of-Office Surcharge(s) 19507 Bill through Teleplan Apply as required Bill through Teleplan WorkSafeBC Out-of-Office Surcharge Apply as required Bill through Teleplan Surgical Assist Billing MSP Surgical Assists fee code WorkSafeBC Unique Expedited Surgical Assist – Level 4 MSP Out-of-Office Surcharge(s) Fee Code 00197 19548 Process Bill through Teleplan Bill through Teleplan Apply as required Bill through Teleplan WorkSafeBC Out of Office Surcharge Apply as required Bill through Teleplan BILLING WORKSAFEBC WorkSafeBC has an agreement with HIBC Teleplan: • To enable physicians to electronically submit invoices and Form 8/11 Physician’s Report to WorkSafeBC. Submission of Form 8/11 by fax will result in reduced payments. Physicians will not be paid for invoices for Form 8/11 submitted to WorkSafeBC via mail service, courier service or any like service. • To issue payments through electronic funds transfer (EFT). Reimbursement is made to physicians for WorkSafeBC related services, using either MSP fee codes and or WorkSafeBC Forms Fees and Unique fee codes. Facts about Timeliness and Electronic Submission Form 8/11 Physician’s Report Submission Only one (the first) Form 8 received for a claim will be paid as a Form 8. The date the Form 8 is received is the determining factor for payment. Any subsequent Form 8 received by WorkSafeBC for the initial visit will be paid at the appropriate Form 11 (Progress Report) rate. Form 8/11 shall be submitted electronically through HIBC Teleplan within three (3) business days of the date of service. A penalty will be applied for Form 8/11 submitted electronically when received between four (4) and six (6) business days of the date of service. No payment for Form 8/11 submissions received after six (6) business days. The Office Visit will be paid. 9 Physician Services Reference Guide May 2018 A higher payment rate will be paid for the submission of a Form 8/11 received through HIBC Teleplan than via fax to WorkSafeBC. Following entry of Form 8/11 information into your Form 8/11 software package, please ensure that you SUBMIT each report to HIBC Teleplan immediately. Entry into Teleplan’s system is completed only when you click SUBMIT. Payments and remittance statements are provided bi-weekly. Electronic Invoice Submission Background: Software designed for submission through Teleplan must be used. Software information/installation for electronic submission of reports and invoices can be obtained from Software Vendors. Software vendor information can be obtained by contacting www.msva.ca or calling 1-800-663-2094 (Medical Software Vendors Association). After installation of software follow the instructions provided by the Software Vendor for billing. Invoices must be submitted electronically through HIBC Teleplan, unless otherwise specified. If invoices are submitted to WorkSafeBC via fax, WorkSafeBC will submit the invoice electronically to HIBC Teleplan on your behalf through our Paper Invoice Processing System (PIPS). This may result in service charges and delayed payments. For submission via fax, please use Form 11A unless otherwise specified. See Appendix O for a sample of Form 11A. It can also be obtained from the WorkSafeBC website: http://www.worksafebc.com/forms/assets/PDF/11a.pdf. Because Teleplan is an automatic system, the information you provide must be correct and consistent before the system will allow payment for your services. The date of service, payee number and fee item submitted must exactly match the date of service, payee number and fee item on the invoice transmitted to WorkSafeBC. If they do not match, your invoice will be rejected and you will need to correct the differences and resubmit the invoice. Since Workers usually have a WorkSafeBC claim number within two weeks of initial treatment, physicians can help WorkSafeBC match an invoice with a valid WorkSafeBC patient claim by adding the claim number to billings. Not providing the claim number will delay processing of payment. Physicians must bill WorkSafeBC within ninety (90) days of providing service. A remittance statement returned to you following an invoice submission may include the explanatory code “BK”. A “BK” explanatory code means that WorkSafeBC has received the submission and is currently making a decision on the injured worker’s claim. Some complex claims can take more than sixty (60) days to make an entitlement decision, so patience is appreciated. Do not re-bill because payment has not been received. When a decision has been reached payment will be made or a rejection code will be provided indicating why payment will not be made. The status of a Worker’s claim can be checked using the online tool here: http://www.worksafebc.com/claims/managing_claims/view_claims/default.asp. Three pieces of information are required: your payee number, the Worker’s claim number, the Worker’s personal health number (PHN). If you receive a refusal code of “AA”, the Worker does not have a PHN or is not a resident of BC. Resubmit the invoice via fax to WorkSafeBC. Indicate on the invoice that a PHN is not available. Physician Report Form Completion & Submission Physician Report Forms Physicians will report using the combined Form 8/11 for either the first report or a progress report. A first report must be filed to establish an injury claim with WorkSafeBC. Critical Information for Completing the Physician Report - Form 8/11: 10 Physician Services Reference Guide May 2018 • Form 8 – Physician’s First Report • Should be submitted only if the doctor suspects time loss beyond the day of the injury or if the claim is for a hernia, back problem, shoulder/knee strain or sprain, mental disorder, or occupational disease. • Form 11 – Physician’s Progress Report A Form 11 should be submitted as a progress note, if: • There is a change in medical condition; • There is a change to the Worker’s treatment plan; • There is a change in Return to Work status; • It has been more than 4 weeks since the last Form 11 was sent, or • A Form 11 is requested by a WorkSafeBC Officer. Clinical Information reporting – This area provides space for clinical reporting. The Addendum page to Form 8/11 is used when more reporting space is required than is available in the clinical information area on Form 8/11. IMPORTANT: Electronic submission of a Form 8 and a Form 11 is the best way to send your reports. However, there is a limitation on the length of the free text in three boxes on the form. The Clinical Information section of the report Form 8/11 is presently limited to 800 characters of text and punctuation. The Prior or Other Problems section of the report is limited to 160 characters. The Current Restrictions section is limited to 240 characters. Please use a new electronic form each time you submit a report. If you exceed the number of characters limitation in any of the sections noted above, please submit the second part of your report as another Form 8/11 using billing fee code 19943 for a Form 8, and using billing fee code 19944 for a Form 11. Any text after the characters limitation will not be received by WorkSafeBC. Form 8 reports submitted through Teleplan are billed with fee code 19937. All Form 11 reports submitted through Teleplan are billed with fee code 19940. Return to Work Planning – Return-to-work planning is an important reporting component of Form 8/11. The information the physician provides, along with physician participation in the return-to work consultation process assists WorkSafeBC in handling each Worker’s claim efficiently and appropriately. A Requested First Report (Requested Form 8) should be submitted only when a Physician’s First Report (F8) was not originally required and has subsequently been requested by WorkSafeBC (usually via a fax or phone call from a WorkSafeBC officer). Invoice fee code 19927 through Teleplan. Detailed instructions for completing the Form 8/11 can be found in the next section. PHYSICIAN FORM 8/11 REFERENCE GUIDE Please use this reference guide when completing Physician’s reports. Form 8/11 – Physician’s Report Form Field Name Physician’s First Report (F8) 11 Description Selecting this field indicates the report is a Physician's First Report (Form 8). It should be submitted to WorkSafeBC if the Physician thinks there may be time loss beyond the day of the injury or if the claim is for a Physician Services Reference Guide May 2018 or The Worker’s condition or treatment has changed (F11) Employer's name Operating location address and Mailing address WorkSafeBC claim number Worker’s last name First name Worker’s contact telephone number Worker’s PHN from health card Date of injury Date of service Who rendered the first treatment? Are you the Worker’s regular practitioner? If “Yes”, how long has the Worker been your patient? hernia, back problem, shoulder/knee strain or sprain, occupational disease, or mental disorder. Selecting this field indicates the report is a Physician's Progress Report (Form 11) and should be submitted if the Worker's condition or treatment has changed since last report or if the Worker is ready for Return to Work. A report is not necessary or desired if the Worker's condition is stable and there will be a planned follow up at an appropriate future date. A report is also not necessary if the Worker is enrolled in a WorkSafeBC-sponsored rehabilitation program. Payment of benefits to a Worker is not contingent on follow-up every two weeks if the above conditions are met. The full corporate or company name of the Worker’s employer. The address or description of where the Worker was employed on the day of the injury. For example the branch address, campsite location or administrative office. This includes the address information and city. WorkSafeBC claim number specific to this injury. Do not include the two-letter claim prefix if there is one. The Worker’s legal last name or surname. It should match the surname on the Worker’s British Columbia CareCard. The Worker’s full first or given name. Initials or abbreviated names should not be used. It should match the given name on the Worker’s British Columbia CareCard. A contact area code and telephone number for the Worker. Usually this would be the Worker’s home phone number, but could be a cellular number or work number. Worker’s Personal Health Number as shown on the British Columbia CareCard. The date when the WorkSafeBC related injury occurred. In the case of occupational diseases, this is the date when medical attention was first sought. The date when the physician’s service described on this report was performed. Medical practitioner (name) or facility (emergency department, clinic, hospital, etc.) who provided the first treatment. This does not include first aid at the worksite. If “Yes”, WorkSafeBC may contact you for medical history or to discuss claims issues. Select the duration for which the Worker has been your patient. This information is useful for claims information. Form 8/11 12 Form Field Name Description Prior/Other Problems affecting injury, recovery and disability This is a free text field of up to 160 characters (text, spaces, and punctuation) maximum to provide details about pre-existing or new non-occupational conditions that may affect injury, recovery or disability. If insufficient Physician Services Reference Guide May 2018 Diagnosis: CSA BP (code): CSA AP (code): CSA NOI (code): ICD9 (code) From injury or since last report, has the Worker been disabled from work? If Yes, as of what date? (if known) Clinical Information Is the Worker now medically capable of working full duties, full time? 13 space, add remaining information to “Clinical Information” box. For example the Worker sustained an MVA while receiving care for the WorkSafeBC claim. Provide a text description of the injury diagnosis. This is a 5-character (numeric) code for the area of injury (body part) from the WorkSafeBC subset of CSA codes (80/80 list). Full set of codes available at: http://www.worksafebc.com/health_care_providers/Assets /PDF/body_parts_complete.pdf This is a code for the anatomical position code (side) of the injury from the WorkSafeBC subset of CSA codes (80/80 list). Left L Right R Left and Right B Not applicable N Use this for body systems, a major body part such as skin, heart or stomach, or multiple/other parts. This is the 5-character (numeric) code for the nature of injury from the WorkSafeBC subset of CSA codes (80/80 list). Full set of codes available at: http://www.worksafebc.com/health_care_providers/Assets /PDF/nature_injury_complete.pdf This is the ICD9 diagnosis code and is also entered on the invoice (claim record). Full set of codes available at: http://www2.gov.bc.ca/gov/content/health/practitionerprofessional-resources/msp/physicians/diagnostic-codedescriptions-icd-9 If the Worker has been disabled from work since the injury or the last report, select “Yes”. Otherwise, select “No”. If known, enter date when Worker was first disabled from the work place in the format yyyy/mm/dd. This is a free form text field of up to 800 characters (text, spaces, and punctuation) for the physician to describe the Worker’s current situation in the usual fashion clinical notes are constructed. The following information might be included: • What happened • Presented injury, disease, complaints and etc. • Subjective symptoms • Examination finding • Treatments and medications being used • The name and date of specialist referral, if appropriate. Indicate “Yes” if the Worker has no medical restrictions and can return to their normal pre-injury duties. If “No”, elaborate in the “restrictions” area below. This is a free Physician Services Reference Guide May 2018 What are the current physical and/or psychological restrictions? Estimated time before the Worker will be able to return to the workplace in any capacity. If appropriate, is the Worker now ready for a rehabilitation program? If “Yes”, select Work Conditioning Program or Other If possible, please estimate date of Maximal Medical Recovery Payee Number Practitioner Number text field of up to 240 characters (text, spaces, and punctuation) maximum. Describe the physical and/or psychological restrictions related to the injury that you impose as barriers to the patient returning to work. This information will be used by the case managers and medical advisors in working with employers to find suitable alternative/modified work. Estimate the length of time before the Worker can return to the workplace in ANY capacity. For example, the earliest possible return to the workplace if suitable duties were available. Enter “No” if Worker is not ready for a rehabilitation program or if a rehabilitation program is not appropriate. If “Yes”, select WCP (Work Conditioning Program) or indicate the type of rehabilitation program in the following field. If ”Other rehabilitation program” is selected, indicate type of program (for example, occupational rehabilitation program, pain program, etc.) by including this recommendation in the “Clinical Information” area above in the report. Maximal medical recovery (full recovery or best possible recovery) date. This is sometimes also called date of “maximal medical improvement”. It refers to the date at which no further improvement in condition is expected. At that time the Worker may still have significant impairment/disability or may be fully recovered. It is recognized that the "date" indicated is an estimate only and may change if the clinical course changes. Enter the payee number issued by MSP that uniquely identifies the individual or organization who submits the associated invoice to WorkSafeBC and who will be paid by WorkSafeBC. Enter the practitioner number issued by MSP that uniquely identifies the Physician who performed the service and provided the information for this report. Injury Coding WorkSafeBC has adopted the Canadian Worker’s Compensation Board injury coding standards (Version 2).These codes are mandatory fields on all Form 8/11 Physician’s Reports and invoices submitted through HIBC Teleplan either by the Physician’s office or WorkSafeBC’s PIPS system. Injury coding consists of three components: • Side of body or AP (Appendix A) • Body part or BP (Appendix B) • Nature of injury or NOI (Appendix C) These codes are a key element for case management and early intervention. They also assist in the matching of invoices to claims, which results in more timely payment. 14 Physician Services Reference Guide May 2018 APPENDICES FOR PHYSICIAN REFERENCE GUIDE A Companion Document to the Agreement Between the Workers’ Compensation Board (WorkSafeBC) and the Doctors of British Columbia (BC Medical Association) April 01, 2014 – March 31, 2019 Appendices have been provided for your convenience. A - CSA Side of Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Side of body codes B - CSA Body Part Codes for WorkSafeBC Reporting & Invoicing Purposes. Body part codes (CSA Z795) C - Explanatory Codes for Teleplan Rejections D – Application for Compensation and Report of Injury or Occupational Disease (Form 6) E – Physician’s Report (Form 8/11) F – How to Fill Out Form 8/11: Physician’s Report Form G – Surgical Procedures List H – Physician’s Invoice (Form 11A) I – Authorization Request for Surgery (Form 83D6) J – Invoice for Expedited Anaesthesia (Form 83D10) K – Invoice for Expedited Extensive Spine Surgical Assist (Form 83D9) L – Requisition for Medical Imaging (Form 83D56) M - Summary Invoice for Extensive Spine Surgery N – Contact Information O – Summary Fee Schedule with Rate Changes and Effective Dates 15 Physician Services Reference Guide May 2018 Appendix A – CSA Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Side of Body Codes 16 Physician Services Reference Guide May 2018 Appendix B – CSA Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Body Part Codes (CSA Z795). Below is a Quick Reference Guide, for the complete list please go to: http://www.worksafebc.com/health_care_providers/Assets/PDF/body_parts_complete.pdf 17 Physician Services Reference Guide May 2018 Appendix B – CSA Body Codes for WorkSafeBC Reporting & Invoicing Purposes. Body Part Codes (CSA Z795) Continued. 18 Physician Services Reference Guide May 2018 Appendix C – Explanatory Codes for Teleplan Rejections The list is available online at: http://www.worksafebc.com/health_care_providers/Assets/PDF/explanationcodes.pdf 19 Physician Services Reference Guide May 2018 20 Physician Services Reference Guide May 2018 Appendix D – Application for Compensation and Report of Injury or Occupational Disease (Form 6) 21 Physician Services Reference Guide May 2018 22 Physician Services Reference Guide May 2018 23 Physician Services Reference Guide May 2018 Appendix E –Physician’s Report (Form 8/11) 24 Physician Services Reference Guide May 2018 25 Physician Services Reference Guide May 2018 Appendix F – How to Complete the Form 8/11: Physician’s Report Form 26 Physician Services Reference Guide May 2018 Appendix G – Surgical Procedures List This list is available online at: http://www.worksafebc.com/health_care_providers/Assets/PDF/Surgical_procedures_list.pdf 27 Physician Services Reference Guide May 2018 28 Physician Services Reference Guide May 2018 29 Physician Services Reference Guide May 2018 Appendix H – Physician’s Invoice (Form 11A) 30 Physician Services Reference Guide May 2018 Appendix I - Authorization Request for Surgery (83D6) 31 Physician Services Reference Guide May 2018 Appendix J - Invoice for Expedited Anaesthesia (83D10) 32 Physician Services Reference Guide May 2018 Appendix K – Summary Invoice for Extensive Spine Surgical Assist 33 Physician Services Reference Guide May 2018 Appendix L - Requisition for Medical Imaging (83D56) 34 Physician Services Reference Guide May 2018 35 Physician Services Reference Guide May 2018 Appendix M - Summary Invoice for Extensive Spine Surgery (83D8) 36 Physician Services Reference Guide May 2018 Appendix N - Contact Information WorkSafeBC Contact Information: 1. WorkSafeBC Online Information (www.WorkSafeBC.com). Visit www.WorkSafeBC.com for additional information regarding: • • • • • Resources such as brochures and post-surgical rehabilitation guidelines Injury coding tables Instructions for billing & reporting Contact information Links to related sites 2. Payment Services Billing Inquiries or Billing Assistance (including Paper Invoice Processing System - PIPS) Phone: (604) 276-3085 or Phone Toll free: 1-888-422-2228 Operations Manager Payment Services, Physician Inquiries Direct line (604) 232-5808 Mailing Address Payment Services WorkSafeBC P.O. Box 94460 Stn Main Richmond, BC V6X 8V6 3. Medical Services Inquiries (Medical Administration) Medical Administration General Inquiries (604) 244-6224 Manager of Medical Services (604) 232-5825 4. Visiting Specialist Clinic – Specialist Consultations/Diagnostic Imaging Bookings/Inquiries Phone: (604) 214-6700 Toll free phone: 1-888-967-5377 Fax: (604) 214-6799 5. Clinical/Management Matters call: Program Manager Health Care Services: (604) 232-7787 Films Distribution Phone: (604) 276-3066 Fax: (604) 231-8890 Email: Films@worksafebc.com 6. Medical Imaging Expedited Referral Request Complete Form 83D56 ‘Requisition for Medical Imaging’ & fax to 604-233-9777 or toll free at 1-888922-8807. 37 Physician Services Reference Guide May 2018 7. Call Centre (Claim/Claimant Inquiries) (604) 231-8888 or 1-888-967-5377 8. Ordering WorkSafeBC Forms: www.WorkSafeBCstore.com Toll free phone: 1-866-319-9704 Toll free fax: 1-888-232-9174 Email: customer.service@WorkSafeBCstore.com Store hours: Mon – Fri 8:30am – 4:30pm You may download copies of forms and brochures from WorkSafeBC.com website at the following address: www.WorkSafeBC.com. Select “forms” or “publications” 9. For non-MSP billing inquiries, please contact Purchasing Services at 604-276-3344 or toll free 1-844276-3344. 10. Mailing Information WorkSafeBC PO Box 5350 Stn Terminal Vancouver BC V6B 5L5 External Contact Information: 1. Contact HIBC (MSP) Teleplan for Billing Support/Teleplan transmission problems Vancouver: (604) 456-6950 Other areas of B.C. (toll-free): 1 866 456-6950 For any status, address or licensure updates, Physicians should contact the College of Physicians and Surgeons of BC and MSP. 2. Medical Software Vendors (provide software for electronic submission to HIBC Teleplan) www.msva.ca 1 800 663-2094 (Software Vendor Association) 3. Workers’ Advisory Office - Patient Resource: Physicians can advise injured workers that they can obtain free claim advice or assistance from the Workers’ Advisory Office (independent of WorkSafeBC). Website: www.labour.gov.bc.ca Contact phone numbers: Vancouver/Lower Mainland Richmond Phone: (604) 713-0360 Toll free phone: 1 800 663-4261 Fax: (604) 713-0311 Island Campbell River Phone: (250) 830-6526 Toll free phone: 1 800 661-4066 Fax: (250) 830-6528 38 Physician Services Reference Guide May 2018 Nanaimo Phone: (250) 741-5504 Toll free phone: 1 800 661-4066 Fax: (250) 741-5516 Victoria Phone: (250) 952-4393 Toll free phone: 1 800 661-4066 Fax: (250) 952-4399 Interior Kelowna Phone: (250) 717-2096 Toll free phone: 1 800 663-6695 881-1188 Fax: (250) 717-2010 Kamloops Phone: (250) 371-3860 Toll free phone: 1 800 663-6695 Fax: (250) 371-3820 39 Physician Services Reference Guide May 2018 Appendix O - Summary Fee Schedule with Rate Changes and Effective Dates This fee schedule includes fees for: Form fees, WorkSafeBC Unique Fees. 1.0 FORM FEES Fee Code Description Form 8 - Report of First Injury, received by WorkSafeBC within three (3) business days of date of service and transmitted electronically. 19937 If Form 8 is received by WorkSafeBC within four (4) to six (6) business days of the date of service and transmitted electronically, then a reduced fee is paid. Effective Apr 1, 2014 Effective* Jul 23, 2015 Effective Apr 1, 2016 $50.96 $51.96 $52.61 $35.61 $35.97 $36.67 $37.13 $33.96 $34.30 NA $34.73 $50.46 Effective Apr 1, 2015 Effective Apr 1, 2017 Effective Apr 1, 2018 $54.20 Bill in addition to office visit $37.69 $38.25 Bill in addition to office visit $35.25 $35.78 Bill in addition to office visit. $23.85 Bill in addition to office visit. $53.40 If Form 8 is received seven (7) business days or later following the date of service, the fee paid is $0. Form 8 - Report of First Injury, received by WorkSafeBC within three (3) business days of date of service and submitted via fax transmission. 19900 If Form 8 is received by WorkSafeBC within four (4) to six (6) business days of the date of service and submitted via fax transmission, then a reduced fee is paid. $22.64 $22.87 NA If Form 8 is received seven (7) business days or later following the date of service, the fee paid is $0. 40 Physician Services Reference Guide May 2018 $23.15 Comments $23.50 Fee Code 19927 Description First Report of Injury (Form 8) that is requested by WorkSafeBC after the injured worker is seen where the form is not initially required (See Form 8 Rules), received within ten (10) business days of the faxed or telephone request. Effective Apr 1, 2014 Effective Apr 1, 2015 Effective* Jul 23, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $56.61 $57.18 NA $57.89 $58.76 $59.64 Bill in addition to office visit. $41.46 $41.87 $42.37 $42.90 $43.55 $44.20 Bill in addition to office visit $18.82 $19.01 $19.24 $19.48 $19.77 $20.07 Bill in addition to office visit Submissions received after ten (10) business days of request will not be paid. Fee Code 19904 may not be billed in addition as this fee includes copying of any existing reports or chart notes from an injured worker’s file. Form 11 - Progress Report Physical Examination, received within three (3) business days of date of service by WorkSafeBC and transmitted electronically. 19940 If Form 11 is received by WorkSafeBC within four (4) to six (6) business days of the date of service and transmitted electronically, then a reduced fee is paid. If Form 11 is received seven (7) business days or later following the date of service, the fee paid is $0. * Date of ratification for Doctors of BC 41 Comments Physician Services Reference Guide May 2018 Fee Code Description Form 11 - Progress Report Physical Examination, received within three (3) business days of date of service by WorkSafeBC and submitted via fax transmission. 19902 If Form 11 is received by WorkSafeBC within four (4) to six (6) business days of the date of service and submitted via fax transmission, then a reduced fee is paid. Effective Apr 1, 2014 Effective Apr 1, 2015 Effective* Jul 23, 2015 Effective Apr 1, 2016 Effective Apr 1, 2018 Comments $30.55 $30.86 NA $31.25 $31.72 $32.20 Bill in addition to office visit. $15.27 $15.42 NA $15.62 $15.85 $16.09 Bill in addition to office visit. If Form 11 is received seven (7) business days or later following the date of service, the fee paid is $0. * Date of ratification for Doctors of BC 42 Effective Apr 1, 2017 Physician Services Reference Guide May 2018 2.0 WORKSAFEBC UNIQUE FEES Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 19904 WorkSafeBC request for copy of a consultation, operative, chart notes or other existing report – first twenty pages, received within three (3) business days of request. Not to be paid in addition to other Fee Codes except Fee Code 19906. $41.99 $42.41 $42.94 $43.58 $44.23 19905 WorkSafeBC requested copy of consultation, operative, or other existing report – first five (5) pages or less sent by mail. $26.24 $26.50 $26.83 $27.23 $27.64 19919 Office Consultation with a WorkSafeBC Officer or designate (up to fifteen (15) minutes) $58.79 $59.38 $60.12 $61.02 $61.94 19906 Continuation of Fee Code 19904 – over twenty (20) pages additional per page. $1.26 $1.27 $1.29 $1.31 $1.33 19907 A factual written summary or reasoned medical opinion upon written request from WorkSafeBC (19904 may not be billed in addition). If extractions included over five (5) pages – may bill Fee Code 19906. $267.70 $270.38 $273.76 $277.87 $282.04 $52.49 $53.01 $53.67 $54.48 $55.30 19930 Telephone consultation with WorkSafeBC Claims Adjudicator/Case Manager or designate or allied health care provider* in fifteen (15)-minute increments (not to be billed for routine inquiries) up to a maximum of forty-five (45) minutes (i.e. to a daily maximum of three (3) units) per claim. *Community allied health care providers include providers involved in the care of an injured worker, such as physiotherapist, occupational therapist, psychologist, WorkSafeBC-sponsored treatment program physician or other program staff. 1 1 Change to allied health care providers will be effective date of ratification July 23, 2015 43 Physician Services Reference Guide May 2018 Fee Code 00129 Description Emergency call-out when a Physician (General Practice or Specialist) has to immediately leave his or her home or office (outside of hospital) to attend an injured worker. This fee is billed over and above medical service fees. 19942 WorkSafeBC Job-site meeting 19922 Materials used in conjunction with sterile tray fees. Bill the actual cost of materials. 19908 Non-expedited specialist consultation report, initial or repeat, for consultation services that do not include a report in the fee item description. Report must be received by WorkSafeBC within seven (7) business days following date of service or following request by WorkSafeBC. 44 Physician Services Reference Guide Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $70.53 $71.24 $72.13 $73.21 $74.31 $309.69 $312.79 $316.70 $321.45 $326.27 Actual Cost Actual Cost Actual Cost Actual Cost Actual Cost $28.34 $28.62 $28.98 $29.41 $29.85 May 2018 Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective* Jul 23, 2015 $136.47 $137.83 $170.59 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $172.72 $175.31 $177.94 EXCESSIVELY PROLONGED OR COMPLEX CASES 19929 Excessively prolonged or complex cases. At the request of WorkSafeBC, a Physician will review the file(s), examine the injured worker, and develop a report on an injured worker whose recovery is prolonged or complicated. The Parties agree that, unless it is not practical, such cases should be referred to the WorkSafeBC medical rehabilitation program for appropriate review, assessment and case planning. In situations where WorkSafeBC requires information about a Worker who is not under active treatment but who continues to have an injury claim, WorkSafeBC may request a Physician, who had treated the Worker, to review the file(s) and develop a report describing the details of the injury, diagnosis, and treatment. Report must be received within twenty (20) business days of service. Submissions received after twenty (20) business days will not be paid. * Date of ratification for Doctors of BC 45 Physician Services Reference Guide May 2018 Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $78.73 $79.52 $80.51 $81.72 $82.95 POST OPERATIVE CONSULTATION 19931 In recognition of WorkSafeBC‘s need to have surgeons involved in disability management, WorkSafeBC agrees to pay a post-operative visit and a Form 11 or a consultation report fee for a total value as indicated on the right to assess a Worker’s potential to return to work on a graduated or full time basis; or to refer the Worker to the appropriate treatment program in the WorkSafeBC continuum of care; or if neither are appropriate, to recommend a treatment plan with an estimate of recovery and return to work. This WorkSafeBC unique service would occur within the forty-two (42) day post-operative period, usually at four (4) weeks post-surgery. Report must be received within five (5) business days of service. Submissions received after five (5) business days will not be paid. 46 Physician Services Reference Guide May 2018 Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 $272.95 $275.68 $21.00 $21.21 Effective* Jul 23, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $ 300.24 $303.99 $308.55 $313.18 NA $21.48 $21.80 $22.13 RETURN TO WORK CONSULTATION Purpose is to facilitate a safe, early return to work. Can be initiated by WorkSafeBC Officer or delegate, WorkSafeBC Physician, employer or by treating Physician. 19950 2 Must include consultation by Physician with employer and WorkSafeBC Officer, and follow up to discuss RTW with Worker. Consultation and RTW plan must be documented and submitted on Form 11. One further consultation cycle may be billed if initial attempt at RTW is unsuccessful. Fee allinclusive. * Refer to Appendix A – Memorandum of Agreement 19952 Accounts initially rejected but found to be WorkSafeBC responsibility. Bill directly to WorkSafeBC by fax transmission. * Date of ratification for Doctors of BC 2 Appendix A – Memorandum of Agreement 47 Physician Services Reference Guide May 2018 Fee Code Effective Apr 1, 2014 Effective Apr 1, 2015 $125.98 $127.24 19976 Return to Work planning request. A request initiated by a WorkSafeBC Officer or designated rehabilitation provider to a Physician to endorse a one (1) page Return to Work planning request form. $15.75 19508 Telephone consultation between a WorkSafeBC Medical Advisor and a community Physician which takes place within 24 hours of being initiated by the Medical Advisor $74.54 Description Effective* Jul 23, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 NA $128.83 $130.76 $132.72 $15.91 $25.00 $25.31 $25.69 $26.08 $75.29 NA $76.23 $77.37 $78.53 WorkSafeBC Request For Existing Report or Chart Notes - ISOLATING SPECIFIC INFORMATION 19953 When WorkSafeBC requests a copy of an existing report or chart notes and where complying with that request requires the Physician to review the chart or report for the purpose of severing identified personal information not relevant to the claim prior to submission of photocopied material, or identifying previous injury or illness relevant to the current claim, or area of injury in question from prior records and separating that information from other clinical information prior to submission to WorkSafeBC. The Physician may bill Fee Code 19953. Fee Codes 19904, 19905 or 19906 may not be billed in addition to this Fee Code. Must be received within ten (10) business days of request of service and includes all courier charges. * Date of ratification for Doctors of BC 48 Physician Services Reference Guide May 2018 Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 19509 Complex Spinal Cord Injury initial visit or yearly assessment. Visit to include a complete physical exam and updated care plan documented and presented on a form 8/11. Only payable once per patient per year, by noted regular physician. Form 8/11 will be paid in addition. $154.38 $155.92 19510 Complex Spinal Cord Injury office visit, cannot bill in addition to a yearly assessment fee (Fee Code 19509) for one visit. Form 8/11 may be reimbursed if changes in condition $102.92 19511 Complex Spinal Cord injury home visit. The physician must also complete and bill for a Form 8/11. This fee cannot be billed with office visit (Fee Code 19510) $205.84 Effective* Jul 23, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 NA $157.87 $160.24 $162.64 $103.95 NA $105.25 $106.83 $108.43 $207.90 NA $210.50 $213.66 $216.86 * Date of ratification for Doctors of BC 49 Physician Services Reference Guide May 2018 Fee Code Description 19556 Image-guided diagnostic and therapeutic injection. New fee code to be billable only when the injection requires imaging guidance (e.g. CT, fluoro, ultrasound) and is arranged at a WorkSafeBC-contracted private surgical facility, or where the physician utilizes their own imaging equipment within their own office. $230.54 19557 Use of physician’s own imaging equipment for imageguided diagnostic and therapeutic injection. This fee code cannot be invoiced in addition to a surgical facility fee code. $135.00 50 Physician Services Reference Guide Effective Aug 23, 2015 May 2018 Effective April 1, 2016 Effective April 1, 2017 Effective April 1, 2018 $233.42 $236.92 $240.47 $136.69 $138.74 $140.82 3.0 STANDARDIZED ASSESSMENT FEE Standard Assessment Form is to be completed by Physician only when requested by WorkSafeBC or a surgeon. This Service is to be provided for specific assessments upon request. Standard Assessment Fee includes the physical examination and completion of the report form. Refer to the Physicians Reference Guide for guidelines on specific reports for unique assessment types. The Physician shall not complete a Form 11 for the examination when a Standard Assessment form is requested. The Standard Assessment Form must be completed and received by WorkSafeBC and/or surgeon (if applicable) within fifteen (15) business days of the request. Fee Code Description 19909 19910 51 Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Standardized Assessment Form received by WorkSafeBC and surgeon (if applicable) within fifteen (15) business days of request by WorkSafeBC $78.73 $79.52 $80.51 $81.72 $82.94 Standardized Assessment Form received by WorkSafeBC and surgeon (if applicable) after fifteen (15) business days of request by WorkSafeBC $73.49 $74.22 $75.15 $76.28 $77.42 Physician Services Reference Guide May 2018 4.0 MEDICAL-LEGAL MATTERS The requirements for receiving Fee Codes 19932 and 19933 are as follows: 1. Medical Legal Report is applicable to all medical Physicians. 2. Medical-Legal Opinion is applicable only to Specialists with relevant qualifications, or other Physicians with recognized expert knowledge. 3. These fees require prior approval by the Review Board or Appeal Division, or Senior Medical Advisor or Director of the Board or Client Service Manager. 4. These fees include examination, review of records, and other processes leading to completion of the written Opinion/Report. Fee Code Description 19932 Medical-Legal Report: A report which will recite symptoms, history and records and give diagnosis, treatment, results and present condition. This is a factual summary of all the information about when the injured worker will be able to return to work and might mention whether there will be a permanent disability. 19933 Medical-Legal Opinion: An opinion will usually include the information contained in the Medical-Legal Report and will differ from it primarily in the field of expert opinion. This may be an opinion as to the course of events when these cannot be known for sure. It can include an opinion as to long-term consequences and possible complications in the further development of the condition. All the known facts will probably be mentioned, but in addition there will be the extensive exercise of expert knowledge and judgment with respect to those facts with a detailed prognosis. 52 Physician Services Reference Guide Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 $898.62 $907.61 $918.96 $932.74 $946.73 $1,501.21 $1516.22 $1535.17 $1558.20 $1581.57 May 2018 5.0 EXPEDITED CONSULTATIONS Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 19911 Initial expedited comprehensive consultation from Specialists in Internal Medicine Neurology, Neurosurgery, Orthopedics, Physical Medicine, General Surgery, Plastic Surgery, Psychiatry, Urology, Otolaryngology, Ophthalmology and Dermatology. $347.17 $350.64 $355.02 $360.35 $365.76 19912 Repeat Expedited Comprehensive Consultation after Fee Code 19911. $168.68 $170.37 $172.50 $175.09 $177.72 19934 Initial expedited comprehensive consultation from an Anesthesiologist for diagnostic opinion and/or therapeutic management. To include a physical examination and a written report. If followed by a diagnostic or therapeutic nerve block, the consultation may be charged in addition to the nerve block fees on the first occasion. $347.17 $350.64 $355.02 $360.35 $365.76 19935 Repeat Expedited Comprehensive Consultation after Fee Code 19934. $168.68 $170.37 $172.50 $175.09 $177.72 19945 Initial expedited comprehensive consultation from a Physician With Areas of Expertise, only when requested by WorkSafeBC. $277.47 $280.24 $283.74 $288.00 $292.32 19946 Repeat Expedited Comprehensive Consultation after Fee Code 19945. $134.94 $136.29 $137.99 $140.06 $142.16 53 Physician Services Reference Guide May 2018 6.0 EXPEDITED SESSIONAL SERVICES Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Comments 1150464 Initial Expedited Consultation Service Fees / Sessional Rate (VSC ONLY) $2,107.82 $2128.90 $2155.51 $2187.84 $2220.66 Bill as per contract 1150465 Repeat Expedited Consultation Service Fees / Sessional Rate (VSC ONLY) $2,107.82 $2128.90 $2155.51 $2187.84 $2220.66 Bill as per contract 19519 Expedited Sessional Interventional Pain management Services under personal services agreement. $1,613.80 $1629.94 $1650.31 $1675.06 $1700.19 Bill as per contract 54 Physician Services Reference Guide May 2018 7.0 EXPEDITED SURGERY OUT-OF-OFFICE HOURS SURCHARGES BILLABLE BY SURGEONS Fee Code Description 19320 Expedited Surgery, Out of Office Hours Surcharge, Operative Evening (18:00 to 23:00 hours) 19321 Expedited Surgery, Out of Office Hours Surcharge, Operative Night (23:00 to 08:00) 19322 Expedited Surgery, Out of Office Hours Surcharge, Operative Sat/Sun/Holidays 55 Physician Services Reference Guide Effective Nov 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Comments Apply this percentage, or 17.5%, or 17.5%, or 17.5%, or 17.5%, or minimum of $65 to the paid minimum $65 minimum $65 minimum $65 minimum $65 MSP surgery procedure fees 28%, or minimum $105 28%, or minimum $105 28%, or minimum $105 28%, or minimum $105 Apply this percentage, or minimum of $105 to the paid MSP surgery procedure fees Apply this percentage, or 17.5%, or 17.5%, or 17.5%, or 17.5%, or minimum of $65 to the paid minimum $65 minimum $65 minimum $65 minimum $65 MSP surgery procedure fees May 2018 8.0 EXPEDITED ANAESTHESIA RATES FOR EXPEDITED SURGICAL PROCEDURES Fee Code Description MSP Fee Code Expedited Anaesthesia Services: Invoice one (1) appropriate MSP fee code plus applicable number of units of block billing time-based fee code 19507. 19507 Expedited Anaesthesia Time. One unit equals 15 minutes. 19518 Expedited Extensive Spine Anaesthesia – Sessional fee (no MSP fee code applicable) 19405 19406 19407 56 Expedited Anaesthesiology, Out of Office Surcharge, Operative Evening (6 to 11 pm) - applied to 19507 Expedited Anaesthesiology, Out of Office Surcharge, Operative Night (11 pm to 8 am) -- applied to 19507 Expedited Anaesthesiology, Out of Office Surcharge, Operative Sat/Sun/Holidays -applied to 19507 Physician Services Reference Guide Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Comments Bill through Teleplan Bill through Teleplan $76.71 $77.48 $78.45 $79.62 $80.82 Per unit Per unit Per unit Per unit Per unit $2,352.77 $2376.30 $2406.00 $2442.09 $2478.72 Bill by fax to WorkSafe BC 32.77% Bill same number of units as is billed for fee code 19507. 52.54% Bill same number of units as is billed for fee code 19507. 32.77% Bill same number of units as is billed for fee code 19507. 32.77% 52.54% 32.77% 32.77% 52.54% 32.77% May 2018 32.77% 52.54% 32.77% 32.77% 52.54% 32.77% 9.0 EXPEDITED SURGICAL ASSIST RATES FOR EXPEDITED SURGICAL PROCEDURES Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Comments MSP Fee Code Invoice one (1) appropriate MSP surgical assist fee code related to surgical procedure, plus applicable block billing time-based fee code below. 19545 Expedited Surgical Assist - Level 1 (surgery time up to 1.5 hours) $233.63 $235.97 $238.92 $242.50 $246.14 Bill through Teleplan 19546 Expedited Surgical Assist - Level 2 (surgery time 1.51 to 2.0 hours) $337.58 $340.96 $345.22 $350.40 $355.66 Bill through Teleplan 19547 Expedited Surgical Assist - Level 3 (surgery time 2.01 to 2.5 hours) $463.14 $467.77 $473.62 $480.72 $487.93 Bill through Teleplan 19548 Expedited Surgical Assist - Level 4 (surgery time 2.51 to 3.0 hours) $566.07 $571.73 $578.88 $587.56 $596.37 Bill through Teleplan 19549 Expedited Surgical Assist - Level 5 (surgery time 3.01 to 3.5 hours) $674.13 $680.87 $689.38 $699.72 $710.22 Bill through Teleplan 19551 Expedited Surgical Assist - Level 6 (surgery time 3.51 to 5.99 hours) $993.19 $1003.12 $1015.66 $1030.89 $1046.35 Bill through Teleplan 19552 Expedited Surgical Assist - Level 7 (surgery time 6.00 hours plus) $1,523.23 $1538.46 $1557.69 $1581.06 $1604.78 Bill through Teleplan 19517 Expedited Extensive Spine Surgical Assist – Sessional fee (no MSP fee code applicable $1589.59 Bill by fax to WorkSafeB C 57 Physician Services Reference Guide Bill through Teleplan $1,508.82 $1523.91 May 2018 $1542.96 $1566.10 19410 19411 19412 58 Expedited Surgical Assist, Out of Office Surcharge, Operative Evening (6 to 11 pm) Expedited Surgical Assist, Out of Office Surcharge, Operative Night (11 pm to 8 am) Expedited Surgical Assist, Out of Office Surcharge, Operative Sat/Sun/Holidays Physician Services Reference Guide 32.77% 52.54% 32.77% 32.77% 52.54% 32.77% May 2018 32.77% 52.54% 32.77% 32.77% 52.54% 32.77% 32.77% Bill this percentage applied to applicable Level fee code billed. 52.54% Bill this percentage applied to applicable Level fee code billed. 32.77% Bill this percentage applied to applicable Level fee code billed. 10.0 MEDICAL ADVISORS Fee Code Description Effective Apr 1, 2014 Effective Apr 1, 2015 Effective Apr 1, 2016 Effective Apr 1, 2017 Effective Apr 1, 2018 Comments Not applicable Medical Advisor, sessional rate. $532.68 per session $538.01 $544.74 $552.91 $561.20 Billing as instructed Not applicable Specialist Medical Advisor, sessional rate. $669.50 per session $676.20 $684.65 $694.92 $705.34 Billing as instructed 59 Physician Services Reference Guide May 2018