FX Delta reconciliation for MTM CCS

advertisement

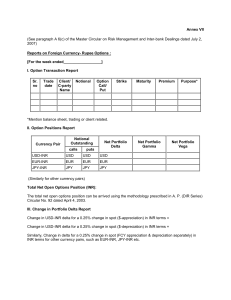

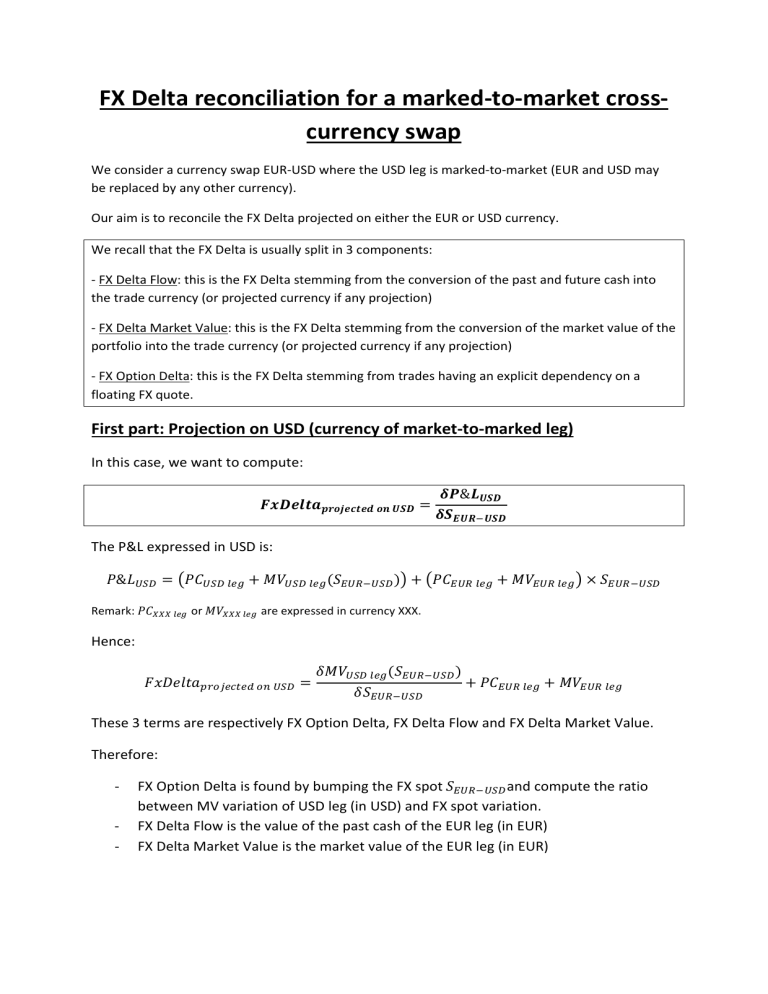

FX Delta reconciliation for a marked-to-market crosscurrency swap We consider a currency swap EUR-USD where the USD leg is marked-to-market (EUR and USD may be replaced by any other currency). Our aim is to reconcile the FX Delta projected on either the EUR or USD currency. We recall that the FX Delta is usually split in 3 components: - FX Delta Flow: this is the FX Delta stemming from the conversion of the past and future cash into the trade currency (or projected currency if any projection) - FX Delta Market Value: this is the FX Delta stemming from the conversion of the market value of the portfolio into the trade currency (or projected currency if any projection) - FX Option Delta: this is the FX Delta stemming from trades having an explicit dependency on a floating FX quote. First part: Projection on USD (currency of market-to-marked leg) In this case, we want to compute: = & The P&L expressed in USD is: = & Remark: ... !"# !"# + %& !"# (() * ), + ) * !"# + %&) * !"# , × () * or %&... !"# are expressed in currency XXX. Hence: /0123456789":;"< 8= = >%& !"# (() * >() * ) + ) * !"# + %&) * !"# These 3 terms are respectively FX Option Delta, FX Delta Flow and FX Delta Market Value. Therefore: - FX Option Delta is found by bumping the FX spot () * and compute the ratio between MV variation of USD leg (in USD) and FX spot variation. FX Delta Flow is the value of the past cash of the EUR leg (in EUR) FX Delta Market Value is the market value of the EUR leg (in EUR) Second part: Projection on EUR (currency of non-market-to-marked leg) In this case, we want to compute: & = The P&L expressed in EUR is: & = ) * + %& !"# !"# (() * ), × ( ) * + ) * !"# + %&) * !"# , Hence: /0123456789":;"< 8= ) * = !"# !"# (() * + %& )+ >%& !"# (() * >( ) ) * ×( ) * These 3 terms are respectively FX Delta Flow, FX Delta Market Value and FX Option Delta. Since the USD is indexed on the spot () with this spot direction. We obtain: >%& !"# (() * >( ) ) * = = = >%& >%& >%& ×( ) * !"# (() * >() * >() * >() * !"# (() * !"# (() * = * >%& , we may be willing to express the derivative !"# (() * ) × >() * 1 B ) > ? A( ) * × ×( >( ) * ) (−1) × ) D×( ( ) * ) × (−() * ) >() >( * ) * ×( ) * ) * * And we get: /0123456789":;"< 8= ) = * !"# + %& !"# (() * )+ >%& !"# (() * >() * ) × (−() * ) Therefore: - FX Delta Flow is the value of the past cash of the USD leg (in USD) FX Delta Market Value is the market value of the USD leg (in USD) FX Option Delta is found by bumping the FX spot () * , compute the ratio between MV variation of USD leg (in USD) and FX spot variation and finally multiply this ratio by −() * (taking the original spot).