Chapter 4

advertisement

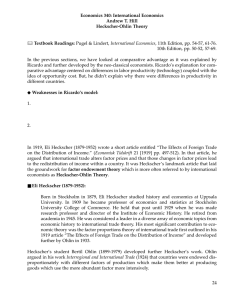

TestBanks Chapter 04: Trade and Resources: The Heckscher­Ohlin Model 1 Which of the following statements is TRUE? The Heckscher­Ohlin model offers a reasonable explanation of the pattern of trade and the gains from trade. The Heckscher­Ohlin trade model does not offer an explanation of the pattern of trade. The Heckscher­Ohlin trade model does not offer an explanation of the gains from trade. The Riparian trade model (with labor as the only input) offers a better explanation of the pattern of trade and the gains from trade than the Heckscher­Ohlin model. 2 A long­run model of trade basic to the determination of how mobile factors of production affect national welfare and the returns to the factors is known as: the specific­factors model. the Riparian model. the Chicago model of trade. the Heckscher­Ohlin model. 3 The Heckscher­Ohlin model of international trade uses _____ and ______ to explain trade patterns. comparative; absolute advantage factor abundance; factor intensity factor availability; factor usability tariffs; quotas 4 The Heckscher­Ohlin theorem explains patterns of trade between countries using: economies of scale. monopoly power in the industry. abundance or scarcity of resources. tariffs and quota. 5 The Heckscher­Ohlin model simplifies the analysis by assuming: there is unemployment of workers in the home country. there are a variety of levels of workers and types of capital. land is an important factor of production. there are only two nations, with two goods and two factors of production. 6 Which of the following statements is CORRECT? The HO model assumes that all resources can freely move between industries. The specific­factors model assumes that all resources can freely move between industries. Both the HO and the specific­factor models assume that all resources can freely move between industries. Neither the HO nor the specific­factor model assumes that all resources can freely move between industries. 7 The Heckscher­Ohlin model assumes that factors of production can move freely _______, but cannot move _______. domestically; internationally after they are fully trained; before the training period is over internationally; domestically within unskilled occupations; into high­skill jobs 8 The implication of resources being mobile domestically is that: there is often unemployment. capital and land are often not suited for use in other industries. labor and capital are paid the same wage and rental price in all domestic industries. they lose the chance to become guest workers in other nations. 9 The Heckscher­Ohlin model assumes that the factors of production are mobile ______, but immobile _____. in the short run; in the long run in the long run; in the short run domestically; internationally internationally; domestically 10 In a capital­intensive industry, the labor/capital ratio will: rise as the wage/rental ratio falls. fall as the wage/rental ratio falls. rise as the country's capital stock rises. fall as the country's capital stock falls. 11 The Heckscher­Ohlin model assumes that production techniques within a nation use the factors of production: at different intensities depending on changing technology and which nation you are discussing. at different intensities for each industry, so that one is more or less intensive in that factor than the other. at the same intensity for each industry—for example, the ratio of capital to labor is the same for every industry in the nation. in no definite pattern. 12 In the text, which of the following statements is NOT an assumption of the Heckscher­Ohlin model? There are two countries, each of which produces two goods using labor and capital. Labor and capital can move freely between the production of two goods. There is free trade between the countries. Labor and capital can move freely between the two countries. 13 The Heckscher­Ohlin model assumes that there are two countries, each of which produces two goods (say manufactures and agriculture) using labor and capital. Which of the following is an additional assumption of the Heckscher­Ohlin model? The ratio of the quantity of labor to the quantity of capital is different for each nation, resulting in different “endowments” of capital and labor. One nation has larger quantities of both capital and labor than the other country. Capital is a specific resource in producing manufactured goods, and labor is a specific resource in producing agricultural goods in each country. Labor and capital can move between countries. 14 The Heckscher­Ohlin model assumes that technology in each industry: Is the same in each nation—each firm has access to the most profitable technology. has increasing returns so that one nation will be able to gain a comparative advantage by developing new technology. is very different across the world—some nations have access to technology, whereas others do not. is hard to access because R&D is very expensive especially for low­income nations. 15 The Heckscher­Ohlin Model assumes that: factor endowments are the same. consumer tastes are different across countries. the technologies used to produce the two goods are different across the countries. consumer tastes and technologies are the same across countries. 16 It may be unrealistic to assume that consumer tastes are the same across nations and invariant with respect to income: so it is not one of the HO assumptions. but it is an HO assumption because it enables the analysis to focus on other issues that drive trade and prices. but it actually is true so it is an HO assumption. and it is not an HO assumption because consumer tastes within a nation are not relevant to international trade. 17 According to the application in the text, why can Nike shoes be produced at low cost in foreign countries? Foreign countries have superior technology. Foreign countries are strategic allies for the home country. Labor costs in foreign countries are lower than in the United States. Nike has no competition in the foreign country. 18 United States' agricultural production is ________ in comparison with Chinese agricultural production. capital intensive labor intensive less subsidized more restrictive 19 A situation in which one nation produces good A using labor more intensively (relative to capital) than good B and a second nation, producing good A, uses capital more intensively (relative to labor) than good B is called: a reversal of factor intensities. a paradox of factor intensities backward technology. micro intensity. 20 Suppose that country 1 is capital abundant relative to country 2. Both produce two goods (X and Y). Factor­ intensity reversal occurs whenever: X is capital intensive in country 1 and labor intensive in country 2. X is capital intensive in both countries. Y is capital intensive in both countries. X is capital intensive in country 1, and Y is labor intensive in country 2. 21 If agriculture is a capital­intensive industry in the United States and a labor­intensive industry in India, then: India should export agricultural goods to the United States. neither country will have an advantage in agricultural production. there is factor­intensity reversal in agricultural production between the two countries. it is difficult to determine which country is labor abundant. 22 There are many real­life examples of factor­intensity differences across the same industries in different nations. How does the Heckscher­Ohlin model handle this? The HO model makes no assumptions about different factor intensities. The HO model assumes that all firms require equal amounts of capital and labor just to be on the safe side. The HO model ignores the possibility of different factor intensities and instead assumes that each industry has the same factor intensity in every nation. This assumption enables the model to predict trade based on other factors. Actually, the factor­intensity reversal issue does not change the predictive value of the model. 23 Why is the PPF bowed out in the Heckscher­Ohlin model? Capital is specific to the production of one good. Labor is specific to the production of the other good. There are increasing opportunity costs of producing each good. Labor is not perfectly mobile between the production of the two goods. 24 According to the text, identical technologies are a more reasonable assumption for: the shoe industry. the call center industry. neither the shoe nor call center industry. both the shoe and call center industries. 25 The PPF of a country will be skewed toward the good that: uses its scarce factor intensively. uses its abundant factor intensively. uses its intensive factor abundantly. does not use its intensive factor abundantly. 26 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) Which line in the graph represents the Home relative price of computers in terms of shoes? A B C U 27 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) According to the shapes of the two PPFs, which nation has a comparative advantage in the production of computers? Home Foreign neither Home nor Foreign There is not enough information to answer this question. 28 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) According to the graph, which nation has a higher no­trade equilibrium relative price for computers (in terms of shoes)? Home Foreign neither Home nor Foreign There is not enough information to answer this question. 29 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) Which line in the graph represents Foreign's relative price of computers in terms of shoes? A* B* C* U* 30 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) At which point will Home find its no­trade equilibrium consumption and production point? A B C U 31 Figure: Home and Foreign Autarky Equilibria Reference: Ref 4­1 (Figure: Home and Foreign Autarky Equilibria) If shoes are a labor­intensive industry, which nation has more labor resources relative to its capital resources? Home Foreign neither Home nor Foreign There is not enough information to answer this question. 32 Most trading nations do not completely specialize. Incomplete specialization is mainly due to: decreasing opportunity costs. increasing opportunity costs. constant opportunity costs. perfectly substitutable resources. 33 Wages generally: are higher in labor­abundant countries than in capital­ abundant countries. are lower in labor­abundant countries than in capital­ abundant countries. are the same in both labor­abundant and capital­ abundant countries. have no relationship to labor abundance. 34 The international equilibrium price (or world price) and quantity for a traded item is determined by: the WTO. the U.S. Department of Commerce. the intersection of the export supply schedule and the import demand schedule. trade negotiations conducted by representatives in the two nations. 35 Consider two products, automobiles and shoes. If shoes are labor intensive and automobiles are capital intensive, what can we expect in free­trade conditions? The relative price of automobiles in the auto­exporting country will decrease. The relative price of shoes in the shoe­exporting country will increase. The capital­abundant country will produce more shoes. The labor­abundant country will produce more automobiles. 36 Suppose that the United States and China each produce steel and cloth. In the Heckscher­Ohlin model, if the United States enjoys a comparative advantage in steel production, then: China must have an absolute advantage in cloth production. the United States will also have a comparative advantage in cloth production. China must have a comparative advantage in cloth production. the United States must have an absolute advantage in steel production. 37 LCD TVs are capital intensive, and tennis rackets are labor intensive. Suppose Canada has $100 billion of capital and 2 million workers and Mexico has $10 billion of capital and 20 million workers. According to the HO model: Canada will specialize in and export LCD TVs. Mexico will specialize in and export LCD TVs. Canada will specialize in and export tennis rackets. Mexico will import tennis rackets. 38 Malaysia is relatively abundant in labor, whereas Canada is relatively abundant in capital. In both countries, shirt production is relatively more labor intensive than computer production. According to the Heckscher­Ohlin model, Malaysia will have a(n) ________ advantage in the production of __________. absolute; shirts and computers absolute; computers comparative; shirts comparative; computers 39 Table: Capital Intensity Across Industries U.S. Capital/Labor Ratios in Selected Industries Industry Apparel and other textile products K/L ($/worker) $8,274 Leather and leather products $12,466 Furniture $21,736 Lumber and wood products $39,134 Textile mill products $44,060 Electronic and electric equipment $54,582 Primary metal industries $123,594 Paper and allied products $171,730 Chemicals and allied products $192,593 Reference: Ref 4­2 (Table: Capital Intensity Across Industries) According to the table, which industry is the MOST labor intensive? Apparel and other textile products Lumber and wood products Primary metal industries Chemicals and allied products 40 Table: Capital Intensity Across Industries U.S. Capital/Labor Ratios in Selected Industries Industry Apparel and other textile products K/L ($/worker) $8,274 Leather and leather products $12,466 Furniture $21,736 Lumber and wood products $39,134 Textile mill products $44,060 Electronic and electric equipment $54,582 Primary metal industries $123,594 Paper and allied products $171,730 Chemicals and allied products $192,593 Reference: Ref 4­2 (Table: Capital Intensity Across Industries) Suppose that the United States is labor abundant relative to Canada. According to the table, which of the following U.S. industry(ies) is (are) MOST likely to export products to Canada? Furniture Electronic and electrical equipment Primary metal industries Paper and allied products 41 Table: Capital Intensity Across Industries U.S. Capital/Labor Ratios in Selected Industries Industry Apparel and other textile products K/L ($/worker) $8,274 Leather and leather products $12,466 Furniture $21,736 Lumber and wood products $39,134 Textile mill products $44,060 Electronic and electric equipment $54,582 Primary metal industries $123,594 Paper and allied products $171,730 Chemicals and allied products $192,593 Reference: Ref 4­2 If there are only two nations, one nation's exports are the other's imports; which of the following is identical for both nations? only the equilibrium relative price of the first nation's exports only the opportunity cost of the first nation's exports neither the equilibrium relative price nor the opportunity cost of the first nation's exports both the equilibrium relative price and the opportunity cost of the first nation's exports 42 Suppose that Home is a capital­abundant country. When Home trades with Foreign, a labor­abundant country, the HO model predicts that the price of: the labor­intensive good will rise in Home. the labor­intensive good will rise in Foreign. the capital­intensive good will rise in Foreign. the capital­intensive good will fall in Home. 43 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) At what point will this nation be in a no­trade equilibrium? A B C D 44 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) What are the pretrade quantities of shoes and computers produced by this nation? 300 shoes; 300 computers 225 shoes; 175 computers 225 shoes; 200 computers 150 shoes; 300 computers 45 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) What is the equilibrium post­trade point of production of this nation? A B C D 46 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) What are the post­trade quantities of shoes and computers produced by this nation? 300 shoes; 300 computers 225 shoes; 175 computers 225 shoes; 200 computers 150 shoes; 300 computers 47 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) What happened to the relative price of shoes in this nation after trade? Shoes became relatively more expensive in terms of computers. Shoes became relatively cheaper in terms of computers. Shoes were not as desirable after trade. The price of shoes did not change—only the quantity. 48 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) The trade triangle shows the exports that were exchanged for imports. What are the three points of the trade triangle? A, B, C A, B, D A, D, C B, C, D 49 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) How many shoes will this nation export? 0 125 350 500 50 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) How many shoes will this nation import? 0 125 350 500 51 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) How many computers will this nation export? 0 125 350 500 52 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) How many computers will this nation import? 0 125 350 500 53 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) If the new international relative price of computers increases from its pre­trade position, how will the slope of the price line change in the graph? The slope will increase. The slope will decrease. The slope will not change but the price line will shift to the right. The slope will not change but the price line will shift to the left. 54 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) Suppose that the new international relative price of computers increases from the pretrade price. If we then subtract the number of computers purchased domestically at the new international price from the number of computers produced, we will get one point on ____________ for computers. the import demand schedule the export supply schedule the production possibilities frontier the indifference curve 55 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­3 (Figure: A Country's Before and After Trade Equilibria) Suppose that the new international relative price of computers increases from the pretrade price. If we then subtract the number of shoes produced domestically at the new international price from the number of shoes consumed at this price, we will get one point on ____________ for shoes. the import demand schedule the export supply schedule the production possibilities frontier the indifference curve 56 For which of the following does the Heckscher­Ohlin model offer an explanation? I. gains from trade II. the pattern of trade. III. the effects of international trade on the returns to mobile resources. I I and II I and III I, II, and III 57 What is the conclusion of the Heckscher­Ohlin model? In the real world, with unlimited goods, nations will buy products that satisfy their demands and sell products they have no use for. If there are limited resources, such as capital and land, production varies directly with the amount of labor used. Some factors of production are fixed and some are variable. We need only consider the variable factors when we analyze international trade. With two goods and two factors, each country will export the good that uses intensively the factor of production it has in abundance and will import the other good. 58 The conclusion that a labor­abundant country exports the good using labor intensively in production and a capital­ abundant country exports the good using capital intensively in production is known as: factor­intensity reversal. the Heckscher­Ohlin theorem. Riparian comparative advantage. the Stolper­Samuelson theorem. 59 Consider two products, automobiles and shoes. If shoes are labor intensive and automobiles are capital intensive, what will happen under the HO model? The labor­abundant country will export automobiles. The capital­abundant country will export shoes. The labor­abundant country will import shoes. The capital­abundant country will import shoes. 60 Suppose Portugal has 700 workers and 26,000 units of capital, and France has 18,000 workers and 700 units of capital. Technology is identical in both countries. Assume that wine is the capital­intensive good and cloth is the labor­intensive good. Which of the following statements is CORRECT? Portugal will export wine and import cloth. France will export wine and import cloth. There is no basis for trade between France and Portugal. Portugal will export cloth and import wine. 61 Suppose Portugal has 700 workers and 26,000 units of capital, and France has 18,000 workers and 700 units of capital. Technology is identical in both countries. Assume that wine is the capital­intensive good and cloth is the labor­intensive good. Which of the following statements is CORRECT if the nations start trading with each other? Wages will increase in Portugal. Rental rates in France will increase. Wages in France will decrease. Rental rates in Portugal will increase. 62 Table: Data on Suburbia Use this table, which represents autarkic and free trade production and consumption and resource usage for Suburbia, to answer the following question(s). Autarky Free­Trade Production of good X 1,000 units 2,000 units Consumption of good X 1,000 units 1,000 units Capital used to produce good X 1,000 units 2,000 units Labor used to produce good X 1,000 days 1,250 days Production of good Y 1,000 units 500 units Consumption of good Y 1,000 units 2,000 units Capital used to produce good Y 1,500 units 1,000 units 500 days 250 days Labor used to produce good Y Reference: Ref 4­4 (Table: Data on Suburbia) Which of the following statement is CORRECT? Surburbia is a labor­intensive country. Suburbia is a labor­abundant country. Suburbia is a capital­intensive country. Suburbia is a capital­abundant country. 63 Table: Data on Suburbia Use this table, which represents autarkic and free trade production and consumption and resource usage for Suburbia, to answer the following question(s). Autarky Free­Trade Production of good X 1,000 units 2,000 units Consumption of good X 1,000 units 1,000 units Capital used to produce good X 1,000 units 2,000 units Labor used to produce good X 1,000 days 1,250 days Production of good Y 1,000 units 500 units Consumption of good Y 1,000 units 2,000 units Capital used to produce good Y 1,500 units 1,000 units 500 days 250 days Labor used to produce good Y Reference: Ref 4­4 (Table: Data on Suburbia) What is the ratio of total capital to total labor in Suburbia? 1 unit/day 1.5 units/day 1.67 units/day 3 units/day 64 Table: Data on Suburbia Use this table, which represents autarkic and free trade production and consumption and resource usage for Suburbia, to answer the following question(s). Autarky Free­Trade Production of good X 1,000 units 2,000 units Consumption of good X 1,000 units 1,000 units Capital used to produce good X 1,000 units 2,000 units Labor used to produce good X 1,000 days 1,250 days Production of good Y 1,000 units 500 units Consumption of good Y 1,000 units 2,000 units Capital used to produce good Y 1,500 units 1,000 units 500 days 250 days Labor used to produce good Y Reference: Ref 4­4 (Table: Data on Suburbia) How many units of which product will Suburbia import? 2,000 units of X 1,000 units of X 2,000 units of Y 1,500 units of Y 65 Table: Data on Suburbia Use this table, which represents autarkic and free trade production and consumption and resource usage for Suburbia, to answer the following question(s). Autarky Free­Trade Production of good X 1,000 units 2,000 units Consumption of good X 1,000 units 1,000 units Capital used to produce good X 1,000 units 2,000 units Labor used to produce good X 1,000 days 1,250 days Production of good Y 1,000 units 500 units Consumption of good Y 1,000 units 2,000 units Capital used to produce good Y 1,500 units 1,000 units 500 days 250 days Labor used to produce good Y Reference: Ref 4­4 (Table: Data on Suburbia) Did the capital­labor ratio used in the production of good X rise, fall, or remain unchanged as Suburbia moved from autarky to free trade? It rose. It fell. It remained the same. There is not enough information given in the table to answer this question. 66 Table: Data on Suburbia Use this table, which represents autarkic and free trade production and consumption and resource usage for Suburbia, to answer the following question(s). Autarky Free­Trade Production of good X 1,000 units 2,000 units Consumption of good X 1,000 units 1,000 units Capital used to produce good X 1,000 units 2,000 units Labor used to produce good X 1,000 days 1,250 days Production of good Y 1,000 units 500 units Consumption of good Y 1,000 units 2,000 units Capital used to produce good Y 1,500 units 1,000 units 500 days 250 days Labor used to produce good Y Reference: Ref 4­4 (Table: Data on Suburbia) Which of the following statements is TRUE regarding the change in the marginal product of labor as Suburbia moved from autarky to a free­ trade situation? The MPL in good X production rose. The MPL in good Y production fell. The MPL in good X and good Y production both rose The MPL in good X and good Y production both fell. 67 Leontief suggested that his results were not a paradox once we account for differences in: resource endowments. capital stocks. labor forces. resource productivities. 68 Table: Factor Use in Trade Exports Capital ($ million) $3.55 Labor (person­years) 192 Capital/Labor ($/person) Imports $5 160 Reference: Ref 4­5 (Table: Factor Use in Trade) In the hypothetical economy provided in the table, what is the capital­to­labor ratio for imports? $31,250 $21,500 $1,600 $3,125 69 In his test of the HO model for the United States, Leontief found that : the United States was importing labor­intensive commodities. the U.S. capital/labor ratio for imported goods was larger than that for the exported goods. the U.S. capital/labor ratio for imported goods was smaller than that for the exported goods. there was a trade imbalance in the United States. 70 Economist Wassily Leontief tested the Heckscher­Ohlin model to determine whether it correctly predicted the capital and labor content of imports and exports of: Russia. China. the United States. Belgium. 71 Table: Factor Use in Trade Exports Capital ($ million) $3.55 Labor (person­years) 192 Capital/Labor ($/person) Imports $5 160 Reference: Ref 4­5 (Table: Factor Use in Trade) In the hypothetical economy provided in the table, what is the capital­to­labor ratio for exports? $1,849 $35,500 $18,490 $1,920 72 The Leontief paradox found that: exports should always be capital intensive. imports should always be labor intensive. U.S. exports were labor intensive. U.S. exports were capital intensive. 73 Leontief discovered a “paradox” in his test of the HO­model for the United States. He expected the United States to export _____­intensive goods and import _____­ intensive goods; but his study indicated the reverse was TRUE. land; technology labor; land capital; labor labor; capital 74 Which of the following statements is NOT an explanation of Leontief's paradox? Leontief ignored the fact that the United States imports a variety of products rather than just one. He ignored the fact that U.S. labor is highly skilled. He ignored the importance of land as a factor in many U.S. exports. Trade patterns in 1947 might have been affected by the fact that World War II had ended only two years earlier. 75 Leontief found that: U.S. trade increased after World War II. U.S. exports were capital intensive compared with its import­competing production. U.S. exports were labor intensive compared with its import­competing production. U.S. exports were neither capital nor labor intensive. 76 The Leontief paradox questioned the validity of: the the the the 77 comparative advantage model. Heckscher­Ohlin model. Riparian model. specific­factors model. Leontief's study of U.S. post­World War II trade concluded that the: United States United States HO model did United States. United States 78 did not gain from trade. exported labor­intensive goods not explain trade between Europe and the exported capital­intensive goods. What was “paradoxical” about Leontief's test of the HO model on U.S. trade? Leontief concluded that U.S. intensive than U.S. exports. Leontief concluded that U.S. intensive than U.S. exports. Leontief concluded that U.S. agricultural products. Leontief concluded that U.S. internationally competitive. 79 imports were more labor imports were more capital imports were primarily exports were not Which of the following offers an explanation for the Leontief paradox? I. Leontief's assumption that U.S. and foreign technologies are the same is incorrect. II. Leontief did not incorporate land and other resources. III. Leontief did not distinguish between skilled and unskilled labor. I, II, and III I and II I and III I 80 Which of the following is NOT an explanation of Leontief's paradox? Leontief did not distinguish between high­skilled and low­skilled labor. The United States was not engaged in completely free trade in 1947 as the HO assumes. The data from 1947 might be unusual because the war had recently ended. United States' trading partners gave preferential treatment to US exports. 81 Which of the following countries has the MOST physical capital? the United States China Japan India 82 Which of the following countries had the MOST R&D scientists in 2010? the United States China Japan India 83 Which of the following countries had the MOST illiterate labor in 2010? the United States China Japan India 84 Compared with the rest of the world in 2010, the United States was MOST abundant in: capital. skilled labor. less­skilled labor. arable land. 85 Compared with the rest of the world in 2010, the United States is LEAST abundant in: capital. skilled labor. unskilled labor. illiterate labor. 86 To determine whether a nation has an “abundance” of a resource, economists look at: the exports of the nation. the imports of the nation. the total quantity of that resource compared with the total quantity of the other resource. a nation's share of the resource compared with its share of world GDP. 87 A problem with measuring the factor shares to determine scarcity or abundance is that: it is very hard to count workers in some nations. estimates are very unreliable. the quantity of a factor may not be as important as its productivity. scientists disagree over the method by which to compute “share.” 88 A country's effective factor endowment is defined as its: actual factor endowment times factor productivity. actual factor endowment times GDP. effective factor endowment times factor productivity. actual factor endowment divided by its factor productivity. 89 If we measure scarcity or abundance correctly, we should use the concept of “effective factor endowment.” This means: the actual factor endowment multiplied by the average productivity of workers compared with its share of world GDP. trying to find out how much labor and capital are really involved in producing goods competing with imports and exports. measuring more effectively a nation's actual factor endowment. the actual factor endowment of labor multiplied by the productivity of capital, because, effectively, the productivity of one depends on the quantity of the other. 90 Compared with other countries, the United States' effective factor endowment is greatest for: capital. R&D scientists. arable land. unskilled labor. 91 According to the text, which of the following statements BEST describes U.S. factor abundance in 1947? Taking into account different labor productivities, the U.S. “effective” labor force was much larger than the “effective” labor force in the rest of the world. Taking into account different labor productivities, the U.S. '”effective” labor force was much smaller than the “effective” labor force in the rest of the world. Taking into account productivities of capital in different industries, the U.S. “effective” capital stock was much smaller than the '”effective” capital stock force in the rest of the world. Corrected data indicate that the United States was actually was a labor­abundant and capital­poor country in 1947. 92 Suppose that Home has 20% of the world's capital, 10% of the world's skilled labor, and 30% of the world's unskilled labor and produces 20% of the world's GDP. What does this information suggest? only that Home is capital abundant only that Home is skilled­labor abundant only that Home is abundant in unskilled labor Home is not abundant in capital, skilled labor, or unskilled labor. 93 After accounting for differing _________ as well as _________, evidence for many countries is broadly consistent with the Heckscher­Ohlin model. factor productivities; factor endowments preferences; factor productivities preferences; factor endowments factor endowments; generalities 94 Assume that Home is relatively abundant in labor and relatively scarce in land. The Heckscher­Ohlin model predicts that trade with other countries will cause increased returns to: Home's labor. Home's land. neither both Home's labor nor land. both Home's labor and land. 95 If the wage­rental ratio in Japanese auto production is lower than the wage­rental ratio in U.S. auto production, then: Japan must have a comparative advantage in the production of autos. Japan must have an absolute advantage in the production of autos. auto production costs must be lower in Japan than in the United States. auto production costs could be lower in the United States if U.S. labor productivity is higher than Japanese labor productivity. 96 In a capital­abundant country, free trade will cause a(n) __________ in the rental of capital and a(n) ____________ in the marginal product of capital. increase; increase increase; decrease decrease; decrease decrease; increase 97 In a labor­abundant country, free trade will cause a(n) __________ in the rental of capital and a(n) _________ in the marginal product of capital. increase; increase increase; decrease decrease; decrease decrease; increase 98 The wage paid to labor should increase when: the capital/labor ratio increases. the capital/labor ratio decreases. a country's labor force increases. a country's capital stock decreases. 99 100 With the “opening” of trade, the item exported experiences a(n) ________ in demand and therefore a(n) ________ in its relative (domestic) price, whereas the item imported experiences a(n) ________ in demand and therefore a(n) ________ in its relative (domestic) price. increase, increase; decrease, decrease increase, decrease; increase, decrease decrease, decrease; increase, increase decrease, increase; decrease, increase The HO model predicts that the factor of production used more intensively in the production of exports will experience: decreased demand and a decline in its relative price. decreased demand and an increase in its relative price. increased demand and an increase in its relative price. no change in its demand because the factors of production are fixed in the short run. 101 As trade occurs, increased imports will force domestic import­competing firms to decrease price and production. Labor and capital will move to exporting firms. What will then happen to wages and returns to capital? Both wages and returns to capital will increase. Both wages and returns to capital will decrease. Wages will increase and returns to capital will decrease. Wages will decrease and returns to capital will increase. 102 SCENARIO: FRANCE AND ITALY (1) France and Italy only trade with each other; (2) each produces wine and bread; (3) The production of bread is relatively capital intensive, and the production of wine is relatively labor intensive, and (4) France is relatively abundant in capital, while Italy is relatively abundant in labor. Reference: Ref 4­6 (Scenario: France and Italy) Which of the following statements is CORRECT? Italy has a larger labor force than France. France has a larger labor force than Italy. The ratio of Italy's total capital stock to its labor force is smaller than the same ratio for France. The ratio of Italy's total capital stock to its labor force is larger than the same ratio for France. 103 SCENARIO: FRANCE AND ITALY (1) France and Italy only trade with each other; (2) each produces wine and bread; (3) The production of bread is relatively capital intensive, and the production of wine is relatively labor intensive, and (4) France is relatively abundant in capital, while Italy is relatively abundant in labor. Reference: Ref 4­6 (Scenario: France and Italy) According to the HO model, what product(s) will Italy export? bread wine neither bread nor wine both bread and wine 104 SCENARIO: FRANCE AND ITALY (1) France and Italy only trade with each other; (2) each produces wine and bread; (3) The production of bread is relatively capital intensive, and the production of wine is relatively labor intensive, and (4) France is relatively abundant in capital, while Italy is relatively abundant in labor. Reference: Ref 4­6 (Scenario: France and Italy) According to the HO model, free trade between Italy and France should cause: a decrease in the French price of wine and a decrease in the Italian price of wine. increases in the price of wine in Italy and in France. an increase in the French price of wine and an increase in the Italian price of bread. a decrease in the Italian price of bread and a decrease in the French price of wine. 105 SCENARIO: FRANCE AND ITALY (1) France and Italy only trade with each other; (2) each produces wine and bread; (3) The production of bread is relatively capital intensive, and the production of wine is relatively labor intensive, and (4) France is relatively abundant in capital, while Italy is relatively abundant in labor. Reference: Ref 4­6 (Scenario: France and Italy) According to the HO model, free trade between France and Italy should result in increased wages in both countries decreased wages in both countries. increased wages in France and increased returns to capital in Italy. increased returns to capital in France and increased wages in Italy. 106 According to the Heckscher­Ohlin model, international trade for a nation with a relative abundance of skilled labor and a relative scarcity of unskilled labor will tend to: widen or aggravate the income disparity between skilled and unskilled workers. reduce the income disparity between skilled and unskilled workers. lower the wages of both groups of workers. raise the wages of both groups of workers. 107 SCENARIO: CANADA AND THE UNITED STATES Canada and the United States produce computers and chemicals using labor and capital as the only inputs in production. The United States is capital abundant, and Canada is labor abundant. Computer production is more labor intensive than chemical production in both countries. Reference: Ref 4­7 (Scenario: Canada and the United States) What does the Heckscher­Ohlin model predict will happen to wages and returns to capital after trade takes place between Canada and the United States? Wages of Canadian workers should rise. Returns to capital in Canada should rise. Wages of U.S. workers should rise. Returns to capital in the United States should fall. 108 SCENARIO: CANADA AND THE UNITED STATES Canada and the United States produce computers and chemicals using labor and capital as the only inputs in production. The United States is capital abundant, and Canada is labor abundant. Computer production is more labor intensive than chemical production in both countries. Reference: Ref 4­7 (Scenario: Canada and the United States) What does the Heckscher­Ohlin model predict will happen to prices of computers or chemicals in the two countries? The price of chemicals should rise in the United States. The price of chemicals should fall in the United States. The price of computers should fall in Canada. The price of chemicals should rise in Canada. 109 SCENARIO: CHILE AND THE UNITED STATES Chile and the United States use capital and labor to produce wheat and automobiles. The United States is capital abundant, and Chile is labor abundant. Wheat production is more labor intensive than automobile production. Reference: Ref 4­8 (Scenario: Chile and the United States) According to the Heckscher­Ohlin model: Chilean workers should support U.S.­Chile free trade. Chilean owners of capital should support U.S.­Chile free trade. U.S. owners of capital should oppose U.S.­Chile free trade. both U.S. and Chilean owners of capital should oppose U.S.­Chile free trade. 110 SCENARIO: CHILE AND THE UNITED STATES Chile and the United States use capital and labor to produce wheat and automobiles. The United States is capital abundant, and Chile is labor abundant. Wheat production is more labor intensive than automobile production. Reference: Ref 4­8 (Scenario: Chile and the United States) What is the MOSTimportant reason why U.S. workers might oppose U.S.­Chile free trade? Returns to capital in the United States are expected to rise as a result of U.S.­Chile free trade. Wages in the United States are expected to rise as a result of U.S.­Chile free trade. Returns to capital in Chile are expected to rise as a result of U.S.­Chile free trade. Wages in the United States are expected to fall as a result of U.S.­Chile free trade. 111 Which statement BEST describes the Heckscher­Ohlin model? It only offers an explanation of the gains from international trade. It only offers an explanation of the pattern of international trade. It only offers an explanation of the effects of international trade on returns to mobile resources. It offers an explanation of the gains, the pattern of international trade, and the effects of international trade on returns to mobile resources. 112 What does the HO model predict will happen to the real returns to factors of production after trade occurs? Labor and capital must be used together in production, and there is no room for competition for remuneration. Capital owners always get the “gains from trade.” Resources used intensively in export industries (such as labor in China and capital in the United States) will see an increase in their returns, whereas the resources used intensively in import­competing industries will see a decline in their return. Poor nations will always get the least returns to their factors of production. 113 If Home is capital abundant, then when it begins to freely trade with the rest of the world, the return to capital in Home should _________ and the real wage in Home should _______. fall; rise fall; fall rise; rise rise; fall 114 In the long run, when factors are mobile, an increase in the relative price of a good will increase the real earnings of the factor used intensively in the production of that good. This is known as: the Heckscher­Ohlin model. the Stolper­Samuelson theorem. the Riparian model. the specific­factor theorem. 115 The conclusion that international trade will lead to an increase in real earnings of a country's abundant resource is known as: factor­intensity reversal. the Heckscher­Ohlin model. Riparian comparative advantage. the Stolper­Samuelson theorem. 116 The Stolper­Samuelson theorem suggests that, over time, free international trade should lead to: equalization of real wages across the world. greater divergences in real wages across the world. equalization of prices across the world. greater divergences in prices across the world. 117 If a country finds its comparative advantage in computer production, which is capital intensive, what will happen to the rental rate on capital when trade occurs? It will decrease. It will stay the same. It will increase. Not enough information is given to answer this question. 118 Suppose that, with trade, the price of shoes (which are labor intensive) increases by 10%. Then which of the following can you say for sure about returns to labor and capital in the country? Wages will rise by more than 10%. Rental rates will rise by more than 10%. Wages will rise by no more than 10%. Rental rates will fall by at least 10%. 119 Feenstra and Taylor describe the “magnification effect” of trade. This effect describes how: workers tend to complain more about trade than is justified. owners of capital can “magnify” their earnings if they are able to trade. small changes in relative prices as a result of trade lead to larger long­run changes in the real wage or rental of factors. unemployment is a big problem among workers but not capital because workers have to move when they are laid off. 120 Suppose that all countries eliminate their barriers to trade. The Heckscher­Ohlin model predicts that: wages should become more equal throughout the world. wages should become more unequal throughout the world. the volume of international trade should fall. there should be increased migration of labor among countries. 121 Surveys have found that ____________ are the strongest proponents of placing limits on imports. unskilled workers farmers skilled workers college professors 122 Which of the following groups is MOST likely to favor free trade for the United States? unskilled workers barbers more educated workers None of these is likely to favor free trade. 123 Which of the following groups will NOT gain if China and the United States engage in completely free trade? U.S. U.S. U.S. U.S. 124 unskilled labor consumers of Chinese made products skilled labor owners of capital The Heckscher­Ohlin model offers an explanation of: only the gains from international trade. only the pattern of international trade. only the effects of international trade on returns to mobile resources. gains from international trade, the pattern of international trade,and the effects of international trade on returns to mobile resources. 125 Table: Factor Use in Latvian Trade Factor Contents of Latvia's Trade Dollars of capital per million dollars of: Years of labor per million dollars of: Import Substitutes Exports $4,000 $3,000 2,000 3,000 Reference: Ref 4­9 (Table: Factor Use in Latvian Trade) Does Latvia import capital­ or labor­intensive products? capital intensive labor intensive neither capital nor labor intensive both capital and labor intensive 126 Table: Factor Use in Latvian Trade Factor Contents of Latvia's Trade Dollars of capital per million dollars of: Years of labor per million dollars of: Import Substitutes Exports $4,000 $3,000 2,000 3,000 Reference: Ref 4­9 (Table: Factor Use in Latvian Trade) According to the Heckscher­Ohlin model, Latvia's capital/labor ratios are consistent with: Latvia being a capital­abundant country. Latvia being a labor­abundant country. Latvia being neither a capital­ nor labor­abundant country. Latvia being both a labor­ and capital­abundant country. 127 The following table represents autarkic and free trade production and consumption and resource usage for Suburbia. Autarky Free­Trade Production of good X 100 units 200 units Consumption of good X 100 units 100 units Capital used to produce 100 units 200 units good X Labor used to produce 100 days 125 days good X Production of good Y 100 units 50 units Consumption of good Y 100 units 200 units Capital used to produce 150 units 100 units good Y Labor used to produce 50 days 25 days good Y A) Is Surburbia a labor­ or a capital­abundant country? Explain your answer. B) What is the price of good X in autarky? With free trade? C) How many units of what product are exported? How many units of what product are imported? D) Has the marginal product of labor in good X production increased or decreased? Explain your answer. E) Has the marginal product of capital in good Y production increased or decreased? Explain your answer. Answer: A) Surburbia is a labor­abundant country since its export product (X) is labor intensive. B) The price of good X is 1Y = 1X since it produces and consumes 100X and 150Y in autarky. C) 100 units of good X are exported since 200 units are produced and 100 are consumed; 150 units of good Y are imported since 50 are produced and 200 are consumed. D) The MPL in good X has increased since the capital­ labor ratio in X production has risen from 1 unit/day to 200 units/125 day. Note the same is true in good Y production since its capital­labor ratio also rose from 150 units/50 days to 100 units/25 days. E) The MPK decreased in good Y production since 1 unit E) The MPK decreased in good Y production since 1 unit of capital now has fewer units of labor with which to work (compare 3:1 with autarky to 4:1 with free trade). 128 Figure: A Country's Before and After Trade Equilibria Reference: Ref 4­10 (Figure: A Country's Before and After Trade Equilibria) Using the graph, how can you decide whether the nation has “gained” from trade and has a higher standard of living? Answer: Using all of its resources to produce both computers and shoes allows this nation to get on indifference curve U1. After trade, by exporting computers and importing shoes, this nation is able to increase its standard of living and move to the higher indifference curve, U2. 129 Suppose the information given in the following table is for a country with abundant labor. Does this information indicate that the country's trade pattern violates the HO model? Exports Imports Capital ($ million) $3.55 $5 Labor (person­ 192 160 years) Capital/Labor ($/person) Answer: No; the factor content of its exports ($18,490 of capital per person­year of labor) is less than the factor content of its import­competing production ($31,250 of capital per person­year of labor). It is a labor­abundant country and is exporting labor­intensive products, which is consistent with the HO model. 130 A) Is the United States a net exporter or importer of agricultural products? B) Consider an HO model with arable land as one of the two resources. Are the model's predictions consistent with the data presented in the text? Answer: A) It is a net exporter of agricultural products. B) Since the United States is a net agricultural exporter, it should be abundant in arable land relative to the countries to which it exports agricultural products, that is, its aggregate ratio of arable land to the other resource (e.g., labor) should be higher than the same ratio in countries that import U.S. agricultural imports. However, the data indicate that the United States was scarce in arable land (11.8% of the world's total as compared with 19.1% of the world's GDP). The model and the data are not consistent, since the United States is a major exporter of agricultural commodities. 131 Why is the specific­factors model referred to as a “short­ run” version of the Heckscher­Ohlin model? Answer: If no factors are specific, then the predictions of the specific­factors model are the same as those of the Heckscher­Ohlin model. Thus, if we allow all factors to move, as occurs in the long run when it is possible to reassign raw materials, retrain labor, or refit machines, then the specific­factors model approaches the Heckscher­ Ohlin model. Because it is not always possible to make these changes in the short run, the specific­factors model can be thought of as a short­run version of Heckscher­ Ohlin. 132 Suppose that Home has 20% of the world's capital, 10% of the world's skilled labor, 30% of the world's unskilled labor, and produces 20% of the world's GDP. What does this information suggest about Home's resource endowments? Explain your answer. Answer: It suggests that Home is abundant in unskilled labor. Its ratios of its shares of the world's resources to its share of world GDP are: capital 20%/20% = 100%; skilled labor 10%/20% = 50%, and unskilled labor 30%/20% = 150% indicate that it is relatively more abundant in unskilled labor than to capital (100%) and to skilled labor (50%). 133 Suppose that the following table gives annual employee compensation (including fringe benefits) in the United States, China, and India for various industries. According to the HO model, which U.S. industries are MOST likely to face the strongest competition from Indian imports? Explain your answer. Table: Employee Compensation Across Industries in the United States, Chile, and India Industry United States Chile India Apparel and clothing $25,290 $16,200 $7,400 Chemical products $70,242 $50,200 $20,700 Industrial machinery and equipment $53,452 $46,500 $26,600 Instruments and related products $59,268 $49,300 $39,700 Leather and leather products $30,528 $20,600 $10,800 Textiles and textile products $31,897 $24,000 $12,900 Answer: Apparel and clothing, leather and leather products, textiles and textile products are the most likely because the differences between US and Indian employee compensation are largest in those industries. 134 According to the Stolper­Samuelson theorem, would you expect U.S. skilled workers to benefit from free trade worldwide? Answer: Yes; since the U.S. appears to be skilled labor abundant and trade causes returns to a country's abundant factor to increase (according to the Stolper­Samuelson theorem). Freer trade should benefit U.S. skilled workers and harm U.S. unskilled workers. 135 The United States and China, respectively, had 21.4% and 20.9% of the world's R&D scientists in 2010. Why then did the United States have 24.1% of the world's “effective” R&D scientists and China have 9.1% of the world's “effective” R&D scientists in 2010? Answer: The reason is because the “effective” measure corrects for the productivity of R&D scientists. It is the ratio of the product of the number of R&D scientists multiplied by R&D spending per scientist in a particular country to total world R&D spending. In this case, the United States spends more than the world average per scientist than China, thus increasing the U.S. “effective” share and reducing China's effective share. 136 One way to measure a country's labor endowment is to adjust its share of the world's population using wages as a measure for differences in labor productivity and then compare this adjusted share to the country's share of world GDP. Country A World A's share of World Population 100,000,000 3,000,000,000 GDP $4 trillion $30 trillion Wages $3 trillion $20 trillion Answer: Use the hypothetical data in the following table to compute a country's share of world GDP, its share of world population, and its share of “effective” labor, as measured by wages. Country A World A's share of World 137 Population 100,000,000 3,000,000,000 3.33% GDP $4 trillion $30 trillion 13.33% Wages $3 trillion $20 trillion 15.00% According to the Stolper­Samuelson theorem, would you expect all workers across the globe to favor limiting trade? Why or why not? Answer: No; the Stolper­Samuelson theorem indicates that wages will fall in the labor­abundant country but rise in the capital­abundant country when trade is limited. Thus, one would not expect worldwide support for limiting trade. 138 If China has a comparative advantage in producing low­ skilled, labor­intensive goods, what should happen to Chinese low­skilled workers' wages as trade barriers against Chinese imports fall across the world? What should happen to returns to capital in China? Answer: Wages of Chinese low­skilled workers should rise relative to wages of similar workers in their trading partners. Returns to capital should fall relative to returns to capital in their trading partners. Note: Widely publicized reports of wage increases in many Chinese firms during the summer of 2010 corroborate this expectation. 139 In a labor­abundant nation, will workers be more or less favorable to international trade? What about a capital­ abundant nation? Why? Answer: Workers will be more favorable to trade in a labor­ abundant nation because trade increases their real wage and standard of living. In a capital­abundant nation, workers would see a decline in their real wage and a decrease in their purchasing power as a result of lower wages and higher prices—thus, they would oppose trade. 140 Who is likely to lose if the United States imposed restrictions on its imports from China? Answer: Losers include: consumers of Chinese­made goods; workers and firms directly engaged in the production of exports to China; and workers and firms supplying material inputs used in the production of exports to China. 141 Who is likely to gain if the United States imposed restrictions on its imports from China? Answer: Gainers include: consumers of Chinese­made goods; workers and firms directly engaged in the production of exports to China, and workers and firms supplying material inputs used in the production of exports to China. 142 Consider the Heckscher­Ohlin theory and the Stolper­ Samuelson theorem. What do they suggest about what are the gainers and the losers from International trade? Answer: The HO theory suggests that the import­competing sector will shrink and the export sector will expand. The Stolper­ Samuelson theorem suggests that, as resources move from the import­competing sector to the export sector, returns to the country's abundant resource will increase and returns to the country's scarce resource will decrease. Hence, returns to capital will increase and returns to labor will decrease in a capital­abundant country and vice­versa in a labor­abundant country.