Project Management introduction

advertisement

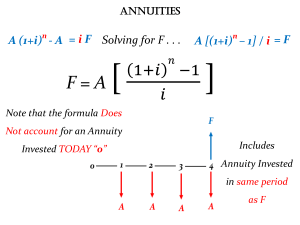

Project Management – Part I (Finance) The Time Value of Money • We refer to a series of cash flows lasting several periods as a stream of cash flows. We can represent a stream of cash flows on a timeline, a linear representation of the timing of the expected cash flows. The Three Rules of Time Travel • 1) It is only possible to compare or combine values at the same point in time. A dollar today and a dollar in one year are not equivalent. • To compare or combine cash flows that occur at different points in time, you first need to convert the cash flows into the same units or move them to the same point in time. • 2) To move a cash flow forward in time, you must compound it. (compound interest) • FV = C * (1+r) * (1+r) * … * (1+r) = C(1+r)^n An initial deposit of $1000, %10, 2-year period The Three Rules of Time Travel • 3) Moving Cash flows back in time • Present Value of a Cash Flow • PV = C / (1+r)^n The Time Value of Money • Megan wants to buy a designer handbag and plans to earn the money babysitting. Suppose the interest rate is 6% and she is willing to wait one year to purchase the bag. How much babysitting money (to the nearest whole dollar) will she need to earn today to buy the bag for $400 one year from now? The Time Value of Money • Johnny and Darren both earn $100 working on their respective neighbors' big farms. Johnny puts his $100 in the piggy bank that his parents gave him to encourage him to save. Darren puts his money in a savings account his parents set up for him. The savings account pays 3% interest. They both take their money out after 5 years. How much more money does Darren have than Johnny? The Time Value of Money • Rondo is in the market for a new car. He has narrowed his search down to 2 models. Model A costs $32,000 and Model B costs $28,000. With both cars he plans to pay cash and own them for 4 years before trading in for a new car. His research indicates that the trade in value for Model A after 4 years is 60% of the initial purchase price, while the trade in value for Model B is 45%. The interest rate is 5%. For simplicity assume that operating and maintenance costs for the models are identical. Which model is the better decision and how much "cheaper" is it than the alternative? The Time Value of Money • Christine is a new homebuyer. She wants to make sure that she incorporates the cost of maintenance into her decision. She estimates that routine repairs and maintenance on the home she is considering will be $1,590 in the first year (one year from now). Due to the increasing age of the home, she expects that maintenance costs will increase 6% annually. The interest rate is 5%. If she plans to be in the home for 10 years, what is the present value of all future maintenance? (Note that maintenance costs will change annually, and starts one year from now and she plans to do the last one before selling her house.) Annuities • An annuity is a stream of N equal cash flows paid at regular intervals. The difference between an annuity and a perpetuity is that an annuity ends after some fixed number of payments. Most car loans, mortgages, and some bonds are annuities. We represent the cash flows of an annuity on a timeline as follows. Annuities • Future Value of the annuity (1 + 𝑖)𝑛 − 1 𝐹𝑉 = 𝐶 ∙ 𝑖 • Present Value of the annuity 1 − (1 + 𝑖)−𝑛 𝑃𝑉 = 𝐶 ∙ 𝑖 Annuities • You are about to purchase a new car and have two options to pay for it. You can pay $20,000 in cash immediately, or you can get a loan that requires you to pay $500 each month for the next 48 months (four years). If the monthly interest rate you earn on your cash is 0,5 %, which option should you take? • 𝑃𝑉 48 𝑝𝑒𝑟𝑖𝑜𝑑 𝑎𝑛𝑛𝑢𝑖𝑡𝑦 𝑜𝑓 $500 = $500 ∙ 1 0.005 1−