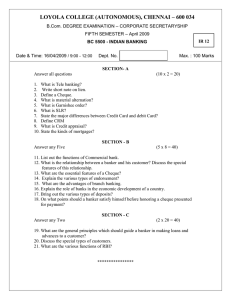

Banking and Insurance

advertisement