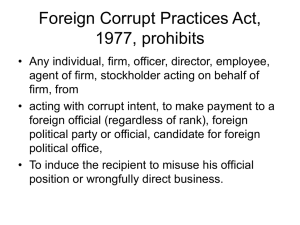

Ala'i - Civil Consequences of Corruption in International Commercial Contracts stamped

advertisement