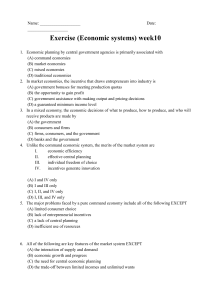

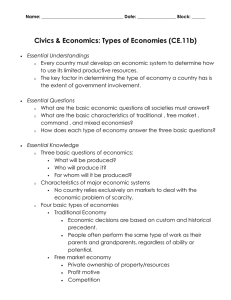

Economies of scale

advertisement

IMPORTANCE of ECONOMIES OF SCALE ECON 390 12/12/2018 1 Importance of Economies of Scale Economies of scale (EOS) have been at the core of development in financial field in the previous two decades. Leaps forward in the field of modern association currently consider the demonstrating of increasingly complex market structures. This has invigorated essential improvements in the fields of global exchange, monetary development, area and genuine business cycle hypothesis. Two sorts of scale economies can be considered. EOS that are interior to the firm are an imperative element for displaying monopolistic rivalry (Bhagwati, 2013). With an expanding interest for models with a progressively thorough microeconomic establishment and an expanding enthusiasm for various market structures, monopolistic rivalry has turned into a standard fixing in a few fields of financial hypothesis. EOS that are external to the firm are imperative for the clarification of combined wonders, numerous harmony and way conditions. In spite of their imperative effect on financial hypothesis, exact proof on EOS stays tricky and remains behind the hypothetical commitments to this subject. This paper expects to review the experimental writing on EOS and to evaluate their exact significance for certifiable monetary wonders. The terms internal and external economies of scale are utilized contrastingly by various creators. The pivotal distinction is the dimension of accumulation at which the isolating line is drawn. A few creators allude to the business as the principle protest of study. At that point internal EOS emerge on the business level, while external EOS emerge on the local dimension. In this study, I recognize EOS on the firm dimension, the industry level, and the territorial dimension. I utilize the term inner EOS with reference to the single plant or firm as it were. This has the favorable position that 2 Importance of Economies of Scale interior alludes to those EOS that can be affected by the activity of a solitary financial specialist. External EOS at that point alludes to those EOS that can't be impacted by a solitary financial operator. They emerge on the business level or provincial dimension, which are totals of monetary specialists that generally don't frame a unit of financial basic leadership. Interior EOS (InEOS) emerge on the dimension of the single firm Bhagwati, 2013. External EOS (ExEOS) emerge on the dimension of the business or the district. Static EOS raise efficiency levels. Dynamic EOS raise profitability development rates. Static InEOS diminish the unit expenses of the plant or firm with its very own expansion current yield by then in time, InEOS win if the versatility of expenses regarding firm yield is short of what one. This implies unit costs fall with an expansion in yield anytime, as a result of diminishing peripheral expenses or the presence of settled costs underway. InEOS can have a few sources. An essential source isthe spreading of settled expenses over a bigger size of yield. Extra sources might be laws of nature or specialized physical connections, economies of expanded measurements and economies of specialization. With a higher yield, laborers can practice all the more barely on an exceptional errand that they may preferred perform over on the off chance that they gave just a small amount of their work time to that assignment. Dynamic InEOS decrease the unit expenses of the firm with an expansion in its total yield. They are additionally called learning impacts. An expansion in firm yield may prompt higher profitability through realizing with the end goal that unit costs decline over creation time. Furthermore, spreading of specific costs like expenses for licenses, item improvement 3 Importance of Economies of Scale and expenses for capital gear and plant development decline unit costs after some time. They are free of the size of creation, yet vital for any gainful action. Further sources are upgrades in hierarchical structures, limit of specialists to work all the more profitably and mechanical enhancements. These upgrades might be diverse in various phases of generation. Firms in new businesses are bound to display vast learning impacts than in develop ventures. To aggregate up, static InEOS lead to a descending development along the normal costs bend because of an expansion in current yield at a given point in time. Learning impacts lead to a descending movement of the normal costs bend because of total yield. On account of external EOS (ExEOS), additionally called positive external impacts, externalities or agglomeration economies, firms profit by being near different firms. At that point agglomeration of monetary exercises is profitable in view of in reverse and forward linkages in the generation of goods, work showcase pooling, sharing of regular resources like framework, and information or mechanical overflows. Static ExEOS result in a higher efficiency level, though powerful ExEOS result in a higher profitability development rate. Having any kind of effect among static and dynamic ExEOS is essential regardless of whether both lead to agglomeration financial matters, on the grounds that the starting point of these externalities is altogether different. Static ExEOS win if the flexibility of unit expenses of a firm regarding industry or on the other hand territorial yield is short of what one. They decrease unit expenses of a firm through localized externalities (LocEOS). 4 Importance of Economies of Scale At that point unit costs decline with the yield of all organizations of the business. Localization favorable circumstances are for example work showcase pooling, resource sharing, and the accessibility of progressively concentrated middle of the road input providers. On the off chance that the starting point of the externalities exists in the area or the city where the firm is found, they are called urbanization externalities (UrbEOS). At that point unit costs decline with the yield of all organizations in the area. An urbanization advantage is for example the nearness to customers, which lessens transport and advertising costs. Dynamic ExEOS accelerate development rates of an industry. They emerge as geographic grouping of firms causes learning or innovations to overflow from firm to firm. A qualification has been made concerning the idea of the externalities. Marshall (2012) accept that most learning and information overflows occur inside individual businesses, while Jacobs (2014) recommends that the most noteworthy overflows come from external the possess business, regardless of whether they are progressively uncommon. Along these lines, dynamic ExEOS are called Marshall-Arrow-Romer externalities (MAREOS) in the event that they are of an intra-industry nature. They are called Jacobs externalities (JaEOS) on the off chance that they are of a between industry nature. That is, dynamic in the yield of different firms. The expansion in yield may occur on the dimension of the business or the district, contingent upon the birthplace of the external impacts. On the off chance that the inception of the externalities exists in the association's own industry they are called limitation. 5 Importance of Economies of Scale The decrease of unit costs because of the joint creation of a scope of merchandise and ventures at the firm dimension is called economies of extension. Scheref et al. (2015) contend that economies of extension are energized by the accompanying sources: Risk spreading and back of capital raising, favorable circumstances of scale advancement, innovative work overflows, multiplant creation and physical appropriation, progressively prudent administration benefits, a typical pool of money related organizers, bookkeepers, economic analysts and legal counselors, and economies of specialization in a few capacities on the administrative dimension. Observationally, economies of scale and economies of degree are hard to unravel, in light of the fact that most firms have various plants or deliver a scope of related items and administrations. At that point costs are regularly hard to identify with a unique item. By utilizing a more extensive meaning of an item bunch in the rest of the paper, I accept that each firm creates one item just, which enables me to concentrate on InEOS as opposed to economies of degree and to set equivalent plant and firm dimension EOS. EOS are forgotten in this exploration because of system externalities as displayed by Farell and Saloner (2015) and Katz and Shapiro (2009). With system externalities, the utility got from the utilization of a decent ascents with the quantity of purchasers of a similar decent. System externalities are EOS on the interest side, while this review centers around the supply side. The phone arrange is a case for such interest symptoms, since the estimation of a phone for one individual ascents with the quantity of individuals she can converse with. Since there is regularly just the decision between not very many 6 Importance of Economies of Scale elective models or systems, exact proof of interest side externalities generally takes the type of stories. Basic precedents are those of Betamax versus VHS videosystems, the QWERTY versus the Dvorak console, or Netscape versus other web programs. As right on time as 2008, Young alluded to the "less complex and progressively comprehensive view, such as a portion of the more seasoned financial specialists took when they differentiated the expanding returns which they thought were normal for assembling industry taken all in all with the unavoidable losses which they thought were predominant in horticulture." (Empnasis included). Also, Bhagwati (2013) points out that "The exchange scholars who have utilized defectively aggressive models as of late bone-dry who at that point continue to profess to be pioneers in considering conceivable hypothetical contentions for takeoffs of organized commerce, appear to us like men who, on visiting a whore, gloat of having denied her of her viitiie". Undoubtedly one finds expanding returns in as early work like Smith (2016). Adam Smith recommended that expanding returns may prompt contrasts in national per capita salary levels and Ohlin focused on their job for clarifying worldwide exchange streams. Be that as it may, regardless of their initial acknowledgment, EOS have not assumed a noteworthy job in monetary hypothesis until the 1970s. Traditional hypothesis rather based on the supposition of steady returns. This has just mostly been because of the challenges with which EOS could be displayed. It was additionally because of the offbeat properties of EOS. These properties can be condensed under four points. 7 Importance of Economies of Scale Path dependence: In local financial aspects, way conditions imply that any irregular unsettling influence from an equivalent scattering of enterprises would be enhanced by the presence of ExEOS. EOS have a self-fortifying system. Myrdal (2012) called this roundabout causation, Arthur (2013) utilizes the term positive criticisms, and Hirschman (2008) alludes to forward and in reverse linkages. Every one of these articulations imply that on the off chance that one area or innovation begins with an underlying cost advantage, EOS put it on a way that extends this preferred standpoint. Such a way leads from the underlying design. In this way, EOS are non-ergodic, which implies that "little occasions are not found the middle value of away or overlooked by the elements - they may choose the result" (Arthur, 2013). A similar idea applies to firms that vie for pieces of the overall industry and to nations that may understand dynamic relative preferences. Multiple equilibrium: EOS can prompt numerous balance. In territorial financial matters, this implies out of a few similarly invested locales that contend, as areas of modern creation, each could wind up with the main part of enterprises if firms were allowed to set up generation in any district. On the off chance that EOS are unbound, roundabout causation would lead to predominance of one district and, thusly, to another balance in which this haphazardly developed locale works in the generation of mechanical products. Be that as it may, any [Other area could have been in its place too. This implies EOS likewise lead to eccentric and vague arrangements on account of 8 Importance of Economies of Scale numerous harmony. Besides, it suggests non-linearity that may present investigative challenges in the count of express arrangements. Lock-in effects E OS can prompt secure impacts. Oneself strengthening system that supports an innovation, a locale, or a firm that accomplished an underlying .head-begin, can avoid different advancements, areas or firms from effective rivalry. A balance that is once achieved will be secured and can't: be invert; by the market procedure within the sight of EOS. This implies EOS lead to resolute arrangements out of which exit is troublesome. Wasteful aspects'. In the event that various harmony are conceivable, it is similarly well conceivable that a second rate balance ends up overwhelming due to an underlying head begin. David (2015) contends that the QWERTY requesting of letters on a console is a wasteful mechanical standard that has been secured by an early mishap. Cowan (2010) points out that dynamic EOS through learning and development encounter have secured in the atomic business into the utilization of light water reactors in spite of gas-cooled reactors may have been prevalent. Along these lines, EOS may prompt monopolistic and wasteful arrangements. They can make obstructions to passage, in this way, shielding early participants from viable market rivalry. Together with the inability to disguise positive external impacts of generation and too low yield levels, this is the reason EOS may lead to advertise disappointments. Under specific conditions, these thusly may legitimize government intercession. 9 Importance of Economies of Scale For long, the above properties of EOS did not seem exceptionally engaging. About various balance, for example, Schumpeter wrote: "Different harmony are not really futile, but rather from the angle of any correct science the presence of a exceptionally decided balance is, obviously, absolutely critical; regardless of whether evidence must be acquired at the cost of extremely prohibitive presumptions; with no probability of demonstrating the presence of [a] interestingly decided balance a field of marvels is extremely a tumult that isn't under explanatory control." In 2009, Hicks even cautioned that conceding expanding returns would prompt "the destruction of most of monetary hypothesis". This did not occur chiefly because of enhancements in the hypothesis of modern association. Dixit and Stiglitz (2017) enhanced the demonstrating of InEOS and Chamberlinian monopolistic rivalry. Advancement in PC advances has made it simpler to deal with even exceptionally complex models and to work with models displaying logically ungainly properties like way reliance and different equilibria. Subsequently, numeric arrangements and reenactment techniques turn out to be progressively acknowledged as methodological methodologies in financial aspects. Withdrawing from mechanical association, EOS have vanquished various subfields in financial hypothesis as of late, start with global exchange hypothesis. In universal exchange hypothesis, the presentation of InEOS in mix with inclinations for assortment made conceivable a clarification of the vast part of intrar-industry exchange add up to exchange, which couldn't well be clarified by customary exchange hypothesis depending on consistent returns. In area hypothesis, ExEOS have since quite a while ago served to clarify why firms might need to situate close different firms. The 10 Importance of Economies of Scale clarification of agglomeration economies by ExEOS has been known as the Folk-Theorem of spatial financial matters (Scotchmer and Thisse, 2012). The arrangement of agglomerations is clarified by a higher efficiency level or higher benefits that emerge by the presence of static ExEOS. In present day area hypothesis, InEOS have manufactured formal microeconomic foundation^ for the models. For models with internal and additionally external EOS see Rivera-Batiz (2008). In financial development hypothesis, the presentation of ExEOS made conceivable an endogenous clarification of monetary, development. In these models, learning by doing, interest in R&D, or the improvement of specific contributions to generation lead to dynamic economies of scale that upgrade growth.12 being developed financial matters ExEOS added to the clarification of destitution traps, huge push industrialization, and unequal monetary development. Additionally present day genuine business cycle models frequently depend on either monopolistic rivalry, EOS, or both. Additionally, EOS have animated dialogs about ideal financial approaches. In the event that organizations work on the diminishing piece of the normal costs bend, there are potential advantages of an expansion in scale. Government mediations may be supported, on the grounds that EOS can prompt market disappointments. At that point the explicit idea of EOS assumes a pivotal job. On the off chance that they are external to the business, particular modern focusing on won't be fruitful. Vital exchange arrangement, mechanical or innovation strategy and territorial approach are further 11 Importance of Economies of Scale fields where the dialog of monetary strategies depends on the pervasiveness of EOS. Since EOS have considerably affected financial hypothesis and monetary strategy discourse, it is critical to comprehend the degree to which EOS matter by and by. Sadly, there is no broad accord about their reality, not to discuss their quantitative significance. The estimation of static InEOS faces serious challenges. The length of the creation run can only with significant effort be expanded or decreased for exploratory purposes for countless, to such an extent that the level of EOS can be estimated precisely. Subsequently, frequently helper measures rather than econometric appraisals are taken as an evaluation of the significance of InEOS. Solid InEOS support substantial firms, oligopolistic showcase structures and the grouping of creation. Subsequently, the accompanying four pointers are regularly utilized as a roundabout proportion of the quality of EOS in an industry. The Price-Cost Margin additionally called the Lerner Index is determined as value less peripheral cost separated by normal cost, It demonstrates the level of stamped intensity of a firm inside an industry. The n-Firm Concentration Ratio demonstrates the extent of aggregate deals in the business represented by the n biggest firms. The Herfindahl-Hirschman Index is the entirety of the squared pieces of the pie of all organizations in the business and increments with higher centralization of creation. Equivalence of firm dimension EOS is additionally muddled if firms work with an alternate size of generation at which the level of EOS is assessed, in light of the fact that the level of EOS differs with the dimension of yield at which they are estimated. Within the sight of settled costs, the normal cost bend is descending slanting notwithstanding for steady minor costs, since normal settled costs 12 Importance of Economies of Scale decrease. At that point, the decrease of unit costs from expanding yield by a given supreme dimension is most elevated at low dimensions of yield. Assuming this is the case, scale economies might be increasingly significant for little firms and may as of now be progressively misused by expansive firms. Along these lines, Bain (2016) proposed to gauge the level of InEOS at a settled purpose of the long run normal cost bend. This could be 1/3 or 1/2 of the Minimum Efficient plant Size (MES). The MES is the measure of the firm at which the long run normal cost bend begins being level with the end goal that a multiplying of yield prompts a unimportant decrease of unit costs, say by under 5 percent. The level of InEOS is then estimated by the expansion of unit costs from the MES to 1/3 or 1/2 of MES. Moreover, the MES itself is a proportion of EOS, since high MES point to a decrease of unit costs over an expansive scope of yield. The three methodologies most normally used to evaluate and gauge immediate or roundabout proportions of static InEOS are the survivor system, econometric appraisals of benefit and cost capacities and building gauges. In this segment, I center primarily around econometric and designing appraisals, since these methodologies can yield: correct gauges the measure of InEOS. Conversely, the survivor strategy is regularly utilized as a first measure to survey the size structure in an industry before increasingly thorough econometric methodologies are connected. The method has been proposed by Stigler (2008). He contends that as opposed to assessing potential expenses at various dimensions of yield it would be increasingly suitable to check whether firms at various sizes can endure. The ideal firm dimension can be seen from 13 Importance of Economies of Scale the development rates of firms at various size, gatherings. He recommends: "Characterize the organizations in an industry by size and ascertain the offer of industry yield originating from each class after some time. On the off chance that the offer of a given class falls it is moderately wasteful and all in all is increasingly wasteful the more quickly the offer falls”. On the off chance that a class of firms can endure it will have in any event MES. The survivor test has the favorable position that its expenses are much lower than that of different methodologies. This is valid for information gathering and in addition information preparing. The issue that Stigler himself found is that an extensive scope of firm sizes finishes the survivor test which shows low InEOS. The survivor test may likewise be one-sided on the grounds that it can't control for different impacts than size by including further informative factors like heterogeneity of data sources, the nature of the administration, or the measure of the market. Like the specialization of generation, ideal firm size is likewise an expanding capacity of the extent of the market, reflecting exchange costs as opposed to scale effectiveness. Additionally, the procedure of firm shrinkage and development is an extremely steady one. As firms begin little and develop, the size structure in an industry additionally mirrors its recorded life design rather than its probability to endure. It may likewise be that the optimal innovation shifts with different attributes of a firm and ideal size is an element of innovation. On the off chance that additionally firm size shifts in the item cycle, there may be firms with non-wilderness innovations that ought not change their size until the point when the current innovation has been deteriorated, which predisposition firm size classes further. Another technique for evaluating InEOS is the 14 Importance of Economies of Scale correlation of expenses or benefits of firms in an industry at various sizes of yield based on cross-segment, time arrangement and board information. Likely the best concentrated mechanical division is the electric power age, where most examinations find significant InEOS. These, be that as it may, may change after some time. For example, Christensen and Green (2006) examine InEOS with cross-area information for US electric power firms. While huge undiscovered scale economies could be found in 1955, most firms were working at the level piece of the normal cost bend in 1970. Lyons (2010) gauges MES of firms in 118 UK exchanges. He finds that for most exchanges MES is beneath 250 representatives, which shows rather little InEOS. Ringstad (2016) dissected assembling enterprises in Norway. From the information on in excess of 5000 firms, they discover proof for little economies of scale in the scope of 4 percent that are not exceptionally delicate to the creation work utilized, and indicated little contrasts crosswise over businesses. The creators call attention to that the evaluations might be dubious, yet it is similarly well conceivable that they are excessively low or excessively substantial. Baldwin and Gorecki (2006) gauge cost and generation capacities for Canadian enterprises on the 4 digit level. For 1979 they discover comes back to scale to average around 10 percent for 107 assembling businesses. Most noteworthy InEOS were found in tobacco, non-metallic mineral merchandise and sustenance and refreshments, though low InEOS were found in apparel produce, sewing, cowhide and materials. Owen (2003) gauges InEOS utilizing cost and cost information for the European vehicle, truck and shopper durables businesses. He discovers costs decreases because of an expansion of yield, yet does 15 Importance of Economies of Scale not recognize static and dynamic InEOS. He examine the connection between firm size and figure profitability five Indian enterprises. Except for machine apparatus producing no InEOS could be discovered once specialized proficiency was controlled for by the normal experience of the work drive, the age of the capital stock, the experience of the business person and the dimension of limit usage. He also presents benefit rates for little also, extensive US firms for the 1960s and the 1970s. He discovers proof that bigger firms have higher benefit rates, yet these evaluations might be one-sided upwards because of varieties crosswise over size classifications in the bookkeeping traditions including devaluation. He finds no reasonable connection among size and productivity in the US. A few businesses are described by positive, others by negative and others by ho connection among size and benefit. Board information examinations that have been utilized by Tybout and Westbrook (2012) to dissect scale impacts in Chilean and Mexican assembling firms of various three digit ventures. These appraisals unique from settled costs, which might be a solid wellspring of InEOS. Tybout and Westbrook (2012) discover scale impacts of in excess of 2 percent in just 3 of 20 businesses. They utilize a few estimators, eminently OLS, between estimators, inside estimators,& distinction estimators each with and without instrumental factors discover comes back to scale to shift somewhere in the range of 0.8 and 1.2 between various businesses. Utilizing Gensus information to appraise the relationship of expenses or productivity on the one side and the size of yield on the opposite side has a few further 16 Importance of Economies of Scale downsides. The meaning of most Census exchanges incorporates the creation of an expansive scope of merchandise for which InEOS and different attributes like market size and development may shift significantly. The appraisals may likewise reflect impacts of differing relative factor costs at various yield levels. An overlooked variable issue emerges when attempting to deal with cost investment funds related with scale from those because of other conceivable sources, For instance, bring down expenses and higher benefits may likewise be caused by higher restraining infrastructure intensity of bigger firms. Benefits are regularly lower in littler firms not as a result of lower proficiency, but since proprietor directors, pay themselves higher pay rates so as to keep away from twofold tax collection. Little firms improve the situation in blasts than extensive firms and less well in through mirroring a less differentiated item and buyer structure* and bigger firms have more potential outcomes to smooth revealed profit in their records. For the observational investigation the fundamental issue is the manner by which to quantify the cost decline. Genuine perceptions additionally incorporate the effect of different factors like item heterogeneity, contrasts of capital vintages between firms inside an industry, and the quality and costs of the components of generation. Cost information may downplay InEOS, on the grounds that focused weight kills a higher offer of genuine or dormant littler firms than bigger ones. Since just the most proficient little firms can endure, the example is one-sided, which prompts a flimsier watched estimate cost relationship than that suggested in the innovation. Another piece of the writing on InEOS depends on Hall (2010). Lobby sees that costs vary significantly 17 Importance of Economies of Scale from peripheral expense in US enterprises, and that the Solow lingering neglects to be uncorrelated with item request and factor value developments. There are a few given clarifications of the disappointment of this invariance property. Corridor infers that the no doubt is monopolistic rivalry and expanding returns,' the two of which negate the critical suspicions of Solow's way to deal with measure efficiency development. He builds up a technique to determine a file of profits to scale and gauges of check ups over peripheral expenses. Utilizing esteem included information for US fabricating, he evaluates check ups for 26 two digit enterprises and discovers comes back to scale to surpass 1.5 in every one of them yet services.19 His methodology has been embraced and further created by Caballero and Lyons (2010) Caballero and Lyons incorporate a measure for total assembling in Hall's methodology. This empowers them to recognize interior and outer EOS. In their investigation inside EOS allude to efficiency increments because of industry wide yield development, in this way, catches something in the middle of InEOS and LocEOS in my arrangement. They locate no expanding inside returns, yet a positive connection between's profitability in an explicit industry and in general mechanical movement. They infer that outer EOS as opposed to inside EOS are the most critical purpose behind the disappointment of the invariance of the Solow leftover. The utilization of significant worth included that in these examinations has been reprimanded by Basu and Fernald (2015). They demonstrate that with blemished rivalry esteem included information predispositions the evaluations 18 Importance of Economies of Scale so one discovers huge clear externalities regardless of whether they don't exist. Rather yield information ought to be taken. Utilizing gross yield information for 21 two digit US fabricating ventures, they discover practically zero noteworthy impacts of an expansion of yield in one assembling area on the profitability of other sectors. 21 Hall's methodology has been further developed!by Roeger (2015) who controls for the conceivable nearness of defective rivalry. By considering positive check ups over minor costs, he can demonstrate that more than, 90 percent of the contrast among basic and double efficiency measures can be clarified by defective rivalry. As a side-effect he gets increase gauges for US fabricating businesses. His appraisals are significantly lower than Hall's and; lie between 15 percent in clothing and 214 percent in the electric, gas and clean administrations industry. Other authors further broaden Roeger's technique by including transitional information sources. This makes it conceivable to evaluate checkups by utilizing yield rather than value added information. This expels the upward predisposition of the estimation with esteem included information (Basu and Fernald, 2015). Summing up, most econometric investigations discover positive economies of scale. Be that as it may, there are a few troubles with econometric evaluations. Evaluations of stamp ups appear to yield hearty proof for the flight of flawless rivalry bone-dry minor cost valuing, which underpins the speculation of the significance of InEOS. Be that as it may, it ought to be noticed that, while these investigations gauge 19 Importance of Economies of Scale the significance of firm dimension EOS, they don't utilize firm dimension however industry level information in their estimation. Observational investigations of dynamic InEOS or learning impacts return to Wright (2013). He found that the efficiency of airplane creation increments with firm total yield. Such expectation to absorb information impacts have been overviewed by and and broadly contemplated by Ghemawat (2008). Ghemawat incorporated 97 examines that break down learning impacts for 102 assembling items. Worldwide exchange might be the field in which the incorporation of InEOS has the most immediate hypothetical effect. The huge offer of intra-industry exchange add up to exchange is hard to clarify by conventional exchange hypotheses. Hence, most present day approaches depend on inclinations for assortment and InEOS. With inclinations for assortment, however many products as could reasonably be expected are devoured. Settled expenses of generation limit the number: of products that a nation can deliver. 'Henceforth, items from one's very own and from all other nations are purchased. Exchange costs, in any case, guarantee that the utilization of each home assortment is higher than the utilization of external assortments; Large nations create with a bigger size of yield than little nations. Thus, a bigger size of yield is related with lower normal expenses. The higher are settled expenses and InEOS, the littler is the quantity of merchandise created in a nation and the higher is import request. This prompts two testable theories. To start with, extensive nations have a relative preferred standpoint in merchandise subject to substantial InEOS. 20 Importance of Economies of Scale A few methodologies have been utilized to appraise static ExEOS. A few investigations break down whether grouping of financial action raises efficiency in essence, some gauge how much profitability decays with rising separation from the middle. Others recognize confinement and urbanization externalities. Segal 2015 use generation capacities to assess the effect of urban size on modern profitability, which turns out to be sure up to a specific city estimate. He dissect venture choices in the US. Be that as it may, they attempt to deal with blessing contrasts of various states so as to segregate overflow impacts. They locate that Japanese assembling venture is probably going to be situated close other Japanese firms of a similar industry, and does not just mimick the topographical example of US firms in their industry. They likewise find that the watched overflows don't stop at state outskirts. They come to comparative results, investigating the area of Japanese subsidiary assembling foundations in car related ventures. They find that these organizations uncover solid inclinations for areas with other Japanese car constructing agents, holding consistent a few different determinants. From this, they finish up the significance of in reverse and forward linkages as wellsprings of agglomeration economies. Another collection of research looks at the idea of agglomeration economies. That is, they gauge whether urbanization or confinement economies win. This is imperative so as to evaluate whether specific or expanded urban areas lead to the most proficient division of generation. For example, the previous communist nations clearly had faith in confinement economies and, thusly, made huge nanostructured areas. Greytak and Blackley (2015) evaluate the overall significance of urbanization and 21 Importance of Economies of Scale confinement economies. They broke down cross-sectional information for the US and Brazil to gauge the nature and degree of ExEOS. He finds that ExEOS are as a rule; more due to confinement than to urbanization. The specialization of a city prompts restriction externalities, which, be that as it may, dwindle with an expansion of city estimate.; Since ExEOS subside, one ought to expect little and medium size urban communities to be more particular than bigger urban communities. Other researchers likewise examines the general effect of confinement and urbanization externalities. Furthermore, he recognizes, between, various businesses. Restriction economies are increasingly critical for r ''overwhelming: - enterprises", though urbanization economies are progressively imperative for "light businesses". Von Hagen and Hammond (2014) test for the presence of restriction economies, on the off chance that they exist "the connection of business changes ought to be more grounded among firms; of a similar nearby industry than among firms relating to various neighborhood enterprises" which they find is to be sure the situation. Resource sharing and work showcase pooling impacts are two generally refered to wellsprings of confinement externalities. Von Hagen and Hammond find that the previous overwhelms in increasingly develop work markets and the last in territorially developing work markets. Static ExEOS are imperative in area hypothesis. As appeared, they help to clarify urban agglomerations and the bunching of firms of one industry in a similar district. These rise since components of creation acknowledge higher rewards because of static 22 Importance of Economies of Scale ExEOS. So as to survey the quantitative significance of static ExEOS, a few creators look at the relationship of thickness or separation to a provincial focus and factor costs. 23 Importance of Economies of Scale References Arthur, W.B. (1990). Positive Feedbacks in the Economy. S cientific American, 2: 92- 99 Bain, J. (1956). Barriers to New Competition. H avard University Press, Cambridge. Baldwin, J., P. Gorecki (2006). The Role of Scale in Canada-US Productivity Differences in the Manufacturing Sector: 1970-1979. University of Toronto Press, Toronto Basu, S., J.G. Fernald (2015). Constant Returns and Small Markups in U.S. Manufacturing. B oard of Governors of the Federal Reserve System, Washington, DC, International Finance Discussion Paper, 483 Bhagwati, J. (2013). Fair Trade, Reciprocity, and, Harmonization: The Novel Challenge to Theory and Policy of Free Trade. I n: D. Salyatore (ed.), Protectionism and World Welfare. Cambridge University Press. Caballero, R., R. Lyons (2010). The Role of External Economies in U.S. Manufacturing. NBER Working Papers, 3033 Christensen L., W. Green (2006). Economies of Scale in US Electric Power Generation. Journal of Political Economy, 84 (4): 655-676 Cowan, R. (2010). Nuclear Power Reactors: A Study in Technological Lock-in. Journal of Economic History, 50 (3): 541-567. David, P.A. (1985). Clio and the Economics of QWERTY. A merican Economic Review, 75 (2): 332-337 Dixit, A.K., J.E. Stiglitz (1977). Monopolistic Competition and Optimum Product Diversity. A merican Economic Review, 67: 297-308 Farell, J., G. Saloner (2015). Standardization, Compatibility and Innovation. R and Journal of Economics, 16 (1): 70-83 Ghemawat, P. (2008). Building Strategy on the Experience Curve. H arvard Business Review, 63 (2): 143-149. Greytak, D. P. Blackley (1985). Labor Productivity and Local Industry Size: Furter Issues in Assessing Agglomeration Economies. S outhern Economic Journal, 50: 1121-1129. Hirschman, A.O. (1958). The Strategy of Development. Yale University Press, New Haven. 24 Importance of Economies of Scale Jacobs, J. (2014) Cities and the Wealth of Nations: Principles of Economic Life. Vintage, New York Lyons, B. (2010). A New Measure of'Minimum Efficent Plant Size in U.K. Manufacturing Industry. E conomic Marshall, A. (2012). Principles of Economics. M acmillan, London, 8th edition Owen, N. (20033). Economies of Scale, Competitiveness and Trade Patterns within the European Community. Clarendon Press, Oxford. Ringstad, V. (2016). Economies of Scale and the Form of the Production Function. Swedish Journal of Economics, 80 (3). Rivera-Batiz, r L. (1988). Increasing Returns, Monopolistic Competition, and Agglomeration Economies in Consumption and Production. R egional Science and Urban Economics, 18:125-153. Rogers, R. (2015). The Minimum Optimal Steel Plant and the Survivor Technique of Cost Estimation. A tlantique Economic Journal, 21 (3): 30-37. Scherer, F.M., A. Beckenstein, E. Kaufer, R. Murphy: (2015). The Economics of Multiplant Operation. An international Comparison Study. C ambridge, US Scotchmer; S., J.F. Thisse (2012). Space and Competition A Puzzle. A nnals of Regional Science, 26: 269-286. Segal, D. (2015). Are there Returns to Scale in City Size? Rev. Econom. Statist., 58: 339-350. Shapiro, M. (2009). Measuring Market Power in US Industry. N BER Working Paper 2212. Smith, A. [1776] (2016). The Wealth of Nations. S trahan and Cadele, London, reprinted by Penguin Stigler, G. (2008). The Economies of Scale. T he Journal of Law and Economics, 1: 56-71 . Westbrook, M.D. and J. R. Tybout (2013). Estimating^Returns to Scale with Large, Imperfect Panels: An Application to Chilean Manufacturing Industries. The World Bank Economic Review, 7 (1): 85-112. Wright, T.P. (1936). Factors Affecting the Cost of Airplanes. Journal of Aeronautical Science, 3: 122-128. 25 Importance of Economies of Scale Young (2008). Increasing Returns and Economic Progress. The Economic Journal, 38 (152): 527-542. 26