sales-outline

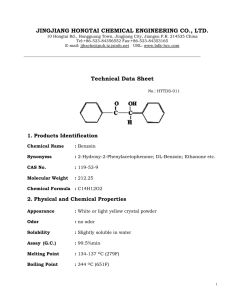

advertisement