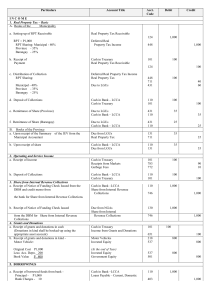

Pro-forma Accounting Entries

advertisement

Particulars Account Title Acct. Code Debit Credit INCOME 1. Real Property Tax – Basic A. Books of the Municipality a. Setting-up of RPT Receivable Real Property Tax Receivable 124 RPT = P1,000 RPT Sharing: Municipal - 40% Province - 35% Barangay - 25% b. Receipt of Payment Deferred Real Property Tax Income Cash in Treasury Real Property Tax Receivable 1,000 448 1,000 101 100 124 c. Distribution of Collection RPT Sharing: Deferred Real Property Tax Income Real Property Tax Municipal - 40% Province - 35% Barangay - 25% d. Deposit of Collections e. Remittance of Share (Province) f. Remittance of Share (Barangay) B. Books of the Province a. Upon receipt of the Summary Municipal Accountant of the JEV from the b. Upon receipt of share 2. Operating and Service Income a. Receipt of Income b. Deposit of Collections 3. Share from Internal Revenue Collections a. Receipt of Notice of Funding Check Issued from the DBM and credit memo from 100 100 Due to LGUs 448 711 431 Cash in Bank – LCCA Cash in Treasury 110 101 100 Due to LGUs Cash in Bank – LCCA 431 110 35 Due to LGUs Cash in Bank – LCCA 431 110 25 Due from LGUs Real Property Tax 131 711 35 Cash in Bank – LCCA Due from LGUs 110 131 35 Cash in Treasury Receipts from Markets Garbage Fees 101 783 772 100 Cash in Bank – LCCA Cash in Treasury 110 101 100 Cash in Bank –LCCA Share from Internal Revenue Collections 110 1,000 Due from NGAs Share from Internal Revenue Collections 130 Cash in Treasury Income from Grants and Donations 101 40 60 100 35 25 35 35 90 10 100 746 1,000 the bank for Share from Internal Revenue Collections b. Receipt of Notice of Funding Check Issued from the DBM for Share from Internal Revenue Collections 4. Grants and Donations a. Receipt of grants and donations in cash (Donations in kind shall be booked-up using the appropriate asset account) b. Receipt of grants and donations in kind Motor Vehicle: Original Cost P1,000 Less: Acc. Depn. 200 Book Value P 800 1,000 746 1,000 100 Motor Vehicles Invested Equity 651 218 537 100 (At the end of Year) Invested Equity Government Equity 537 501 800 110 1,000 800 800 800 5. BORROWINGS a. Receipt of borrowed funds from bank Principal - P1,000 Bank Charges - 10 Cash in Bank –LCCA Loans Payable – Current, Domestic 403 1,000 Particulars Interest Expense- 12 b. Receipt of borrowed funds from other agency - Principal P1,000 Interest Expense - 6 c. Payment of loan amortization Account Title Bank Charges Interest Expenses Cash in Bank –LCCA Cash in Treasury Loans Payable – Current, domestic Interest Expenses Cash in Bank – LCCA Acct. Code 951 952 110 Debit Credit 10 12 22 101 1,000 403 952 110 6 1,000 6 Loans Payable – Current, Domestic 403 110 200 Subsidy to Other Funds Cash in Bank – LCCA 897 110 500 Cash in Treasury Subsidy from Other 101 500 Cash in Bank - LCCA 200 6. SUBSIDIES a. Subsidy from Other Funds (General Fund to Special Education Fund) GENERAL FUND BOOKS Transfer of subsidy to Special Education Fund (Aid to SEF to finance its projects) 500 SPECIAL EDUCATION FUND BOOKS Receipt of subsidy funds from Other funds Funds 605 500 b. Special Accounts (subsidy from General Fund proper to Operation of Public Market) BOOKS OF GENERAL FUND PROPER Transfer of subsidy to Special Account Subsidy to Special Accounts Cash in Bank – LCCA 898 110 500 110 500 500 BOOKS OF SPECIAL ACCOUNT (OPERATION OF PUBLIC MARKET) Receipt of subsidy from General Fund Proper 7. REFUND OF CASH ADVANCES a. Cash Advance by an Officer for Local Travel a. To take up the cash advance Cash in Bank – LCCA Subsidy from Special Accounts 500 Due from Officers & Employees Cash in Bank – LCCA b. To take up refund of cash advance 606 Cash in Treasury Due from Officers & Employees 128 110 10 101 10 10 128 10 b. Cash Advance by a Disbursing Officer for Salaries and Wages a. To take up the cash advance Cash – Disbursing Officers Cash in Bank – LCCA b. To take up refund of cash advance Cash in Treasury Cash – Disbursing Officers 107 110 10 101 10 10 107 10 8. RECEIPT OF CASH BONDS a. To take up receipt of performance bond in cash b. To take up deposit of performance bond Cash in Treasury Performance/ Bidders/ Bail Bonds Payable 101 Cash in Bank – LCCA Cash in Treasury 110 101 50 414 50 50 50 Particulars c. To take up refund of performance bond Account Title Performance/ Bidders/ Bail Bonds Payable Cash in Bank – LCCA Acct. Code Debit 414 110 Credit 50 50 Acct. Particulars Account Title Code Debit Credit 1. Payment through Cash Advances a. Cash advance for personal services Enter obligation in RAAOPS for P18,000 Salaries and Wages, P5,000 Additional Compensation, and P3,000 Personnel Economic Relief Allowance (PERA). 1. Grant of cash advance for payroll 2. Liquidation of cash advance for payroll Cash – Disbursing Officers Cash in Bank – LCCA Salaries and Wages – Regular Pay PERA Additional Compensation Withholding Taxes Payable GSIS Payable PAG-IBIG Payable Cash – Disbursing Officers 107 110 21,000 801 804 805 18,000 3,000 5,000 21,000 410 411 412 107 2,000 1,500 1,500 21,000 Enter obligation in RAAOPS for P1,500 Life and Retirement Insurance Contributions and P1,500 PAG-IBIG Contributions. 3. Government share for life and retirement insurance and PAG-IBIG Contributions Life and Retirement Insurance Contributions PAG-IBIG Contributions 817 1,500 818 411 412 1,500 GSIS Payable PAG-IBIG Payable 105 110 6,000 1,500 1,500 b. Petty Cash Fund For establishment of fund, Enter obligation in RAAOMO as Other Expenses for P6,000 1. Release of cash advance for petty cash fund miscellaneous expenses Petty Cash Fund Cash in Bank – LCCA 6,000 Enter obligation in RAAOMO for Office Supplies P2,500, Travelling Expenses P500, Office Equipment Maintenance P1,000 and Other Expenses of P800. 2. Replenishment of petty cash fund during the year Traveling Expenses – Local Office Supplies Expenses 831 500 849 2,500 882 950 110 1,000 800 831 1,000 849 105 4,000 Office Equipment Maintenance Other Expenses Cash in Bank – LCCA 4,800 Enter obligation in RAAOMO for Office Supplies P4,000 and Traveling Expenses of P1,000. 3. Liquidation at year end Traveling Expenses – Local Office Supplies Expenses Petty Cash Fund Cancel RAAOMO for setting up of petty cash fund at the start of the year and refund for a total of P6,000. 4. Return of unused Petty Cash Fund. Cash in Treasury 101 Petty Cash Fund 105 5,000 1,000 1,000 Particulars Account Title Acct. Code Debit Credit c. Cash advance for travel Enter obligation in RAAOMO for Travel of P1,000 1. Grant of cash advance Due from Officers and Employees Cash in Bank – LCCA 2. Liquidation of cash advance during the current year (assuming only P900 was utilized and P100 was refunded) 128 110 1,000 831 128 900 Cash in Bank – LCCA Due from Officers and Employees 110 128 100 Rent Expense Cash in Bank – LCCA 841 110 3,000 835 837 110 1,500 2,000 Training and Seminar Expenses Cash in Bank – LCCA 833 110 1,000 Bank Charges Cash in Bank – LCCA 951 110 300 Interest Expenses Cash in Bank – LCCA 952 110 400 Traveling Expenses – Local Due from Officers and Employees 1,000 900 Adjust RAAOMO for refund of cash advance of P100 3. For amount refunded where official receipt was issued 100 2. Payment by Check a. Maintenance and Other Operating Expenses Enter obligation in RAAOMO for rent P3,000 1. Payment of rent 3,000 Enter obligation in RAAOMO for electricity of P1,500 and telephone/internet of P2,000 2. Payment of utilities (MERALCO and PLDT) Electricity Telephone/Telegraph and Internet Cash in Bank – LCCA 3,500 Enter obligation in RAAOMO for training and seminar expenses of P1,000 3. Payment of seminar fee 1,000 b. Financial Expenses Enter obligation in RAAOFE for bank charges of P300 1. Bank charges upon receipt of bank statement 300 Enter obligation in RAAOFE for interest expense of P400 2. Interest Expense 400 c. Office Equipment – Enter obligation in RAAOCO for P6,000 for purchase of equipment 1. Issuance of PO to dealer 2. Receipt of office equipment No entry Office Equipment Cash in Bank – LCCA 222 110 d. Construction of Roads by Contract – Enter obligation in RAAOCO for P800,000 for construction of road. 1. Payment of first billing for 50% accomplishment Construction in Progress – Roads, Highways and Bridges 232 Withholding Taxes Payable 410 Cash in Bank – LCCA 110 2. Payment of second billing 100% accomplishment 3. Remittance of taxes withheld Construction in Progress – Roads, Highways and Bridges 232 Withholding Taxes Payable Cash in Bank – LCCA Withholding Taxes Payable Cash in Bank – LCCA 410 110 410 110 6,000 6,000 400,000 40,000 360,000 400,000 40,000 360,000 80,000 80,000 Particulars If funded from regular agency income – 4. To take up roads completed 5. To transfer completed roads to Registry of Public Infrastructures at the end of the year Account Title Acct. Code Public Infrastructure Construction in Progress – Roads, Highways and Bridges 243 Government Equity Public Infrastructures 501 243 Debit Credit 800,000 232 800,000 800,000 800,000 Note: Using the JEV for the above transactions, the public infrastructures shall be recorded in the Registry of Public Infrastructures. If funded from a loan – 6 To record completed Public Infrastructures 243 800,000 roads Construction in Progress – Roads, 232 Highways and Bridges At year end,upon full payment of laon – Government Equity Public Infrastructures 501 243 800,000 800,000 800,000 e. General Repair/Construction of Building by Administration 1. Approval of the project P1M No entry Enter obligation in RAAOCO for P600,000 for construction materials 2. Issue PO for building materials: Lumber, nails, cement, sand and gravel, paints, etc. = P600,000 3. Payment for construction materials received 4. Issuance of materials P590,000 No Entry Construction Materials Inventory Withholding Taxes Payable Cash in Bank – LCCA Construction in Progress – Agency Assets Construction Materials Inventory 156 410 110 600,000 230 156 590,000 107 110 350,000 230 410 380,000 60,000 540,000 590,000 Enter obligation in RAAOCO for P380,000 for labor 5. Cash advance granted to Disbursing Officer for payroll 6. Liquidation by Disbursing Officer of paid payroll Cash – Disbursing Officers Cash in Bank – LCCA 350,000 Construction in Progress – Agency Assets Withholding Taxes Payable Cash – Disbursing Officers 30,000 350,000 107 7. Remittance of withholding tax Withholding Taxes Payable Cash in Bank – LCCA 410 30,000 30,000 110 8. Accomplishment Report approved by the LCE Buildings Construction in Progress – Agency Assets 204 230 970,000 201 410 110 2M 970,000 f. Acquisition of Land Enter obligation in RAAOCO for P2million for purchase of land 1. Payment made for land purchased 2. Remittance of withholding tax Land Withholding Taxes Payable Cash in Bank – LCCA Withholding taxes Payable Cash in Bank – LCCA 410 110 200,000 1.8M 200,000 200,000 Particulars Account Title Acct. Code Debit Credit g. Land and Building Enter obligation in RAAOCO for P600,000 for land and P400,000 for building 1. Payment of the land and building (assessed value of land is P600,000) for P1,000,000 2. Remittance of withholding tax Land Building Withholding Taxes Payable Cash in Bank – LCCA 201 204 410 110 600,000 400,000 Withholding Taxes Payable Cash in Bank – LCCA 410 110 100,000 Spare Parts Inventory Withholding Taxes Payable Cash in Bank – LCCA 155 410 110 2,500 Office Supplies Inventory Withholding Taxes Payable Cash in Bank – LCCA 149 410 110 3,000 Subsidy to Local Government Units Cash in Bank – LCCA 895 110 30,000 Subsidy to Other Funds Cash in Bank – LCCA 897 110 10,000 889 110 500,000 100,000 900,000 100,000 h. Purchase of Inventories Enter obligation in RAAOMO for purchase of P2,500 worth of spare arts 1. Payment of delivered spare parts 250 2,250 i. Enter obligation in RAAOMO for purchase of office supplies 1. Payment of office supplies delivered 300 2,700 j. Fund Transfers Enter obligation in RAAOMO for subsidy to LGU – XYZ 1. Cash assistance to LGU –XYZ 30,000 k. Enter obligation in RAAOMO for subsidy to SEF 1. Cash transfer to SEF as subsidy 10,000 l. Enter obligation in RAAOMO for grants and donation to Trust Fund 1. Cash transfer to Trust Fund as counterpart LGU funds. Grants and Donations Cash in Bank – LCCA Particulars Account Title Acct. Code 500,000 Debit Credit 1. Cash Shortage a. Cash shortage of the of the Disbursing Officer To take up cash shortage Due from Officers and Employees Cash – Disbursing Officers 128 107 50 Due from Officers and Employees Cash in Treasury 128 101 50 50 b. Cash Shortage of the Treasurer To take up cash shortage 50 2. Grant of Relief from Accountability for Loss of Government Funds To record the loss of fund by a Disbursing Officer (allegedly thru theft) = P50 Due from Officers and Employees Cash – Disbursing Officers 128 107 50 To take up relief from accountability Loss of Assets (current year) or Prior Years’ adjustments (prior years) Due from Officers and Employees 948 128 50 50 50 Particulars Account Title 3. Cash Settlement in case of denial of Request for Relief from Accountability To take up payment/settlement Cash in Treasury Due from Officers and Employees Acct. Code 101 Debit Credit 50 128 50 4. Cash Overage To take up cash overage discovered during cash examination Cash in Treasury Other Specific Income of LGU 101 50 792 50 5. Dishonored Checks From payment of real property tax in the current year or prior year Upon receipt of advice of dishonored check and cancellation of Official Receipt Receipt of refund/settlement Real Property Tax Receivable Deferred Real Property Tax Income 124 448 50 Due to LGUs Real Property Tax Income Cash in Bank – LCCA 431 711 110 30 20 Cash in Treasury Real Property Tax Receivable 101 124 50 Cash in Bank – LCCA Accounts Payable 110 401 50 Accounts Payable Cash in Bank – LCCA 401 110 50 Receivables – Disallowances/ Charges Office Supplies Expense 138 10 50 50 50 6. Lost/Destroyed/Stale/Obsolete Checks Check issued in the current/prior year for replacement Check cancellation Replacement 50 50 7. Disallowances and Charges a. Recording of disallowance for current year’s transaction When the disallowance becomes final and executory – Overpayment of Office Supplies Amount paid Should be Difference - P100 - 90 - 10 Settlement of Disallowance Cash in Treasury Receivables – Disallowances/ Charges 849 101 10 10 138 10 b. Recording of disallowance for prior year’s transaction When the disallowance becomes final and executory Receivables – Disallowances/ Charges Prior Years’ Adjustments 138 533 10 10 Settlement of disallowance Cash in Treasury Receivables – Disallowances/ 101 Charges 10 138 10 c. Settlement of Charges c.1 Recording of charges which collection were made in the current year When the charge becomes final and executory – Underpayment of Franchise Tax Amount Paid - P 100 Should be - 110 Charge - 10 Receivables – Disallowances/ Charges Franchise Tax 138 724 10 10 Particulars Account Title Settlement Cash in Treasury Receivables – Disallowances/ Charges c.2 Recording of charges which collection were made in the prior year When the charge becomes final and executory Receivables – Disallowances/ Charges Prior Years’ Adjustments Acct. Code 101 Debit Credit 10 138 10 138 533 10 Cash in Treasury Receivables – Disallowances/ Charges 101 138 10 To record overpayment of salaries and wages (When overpayment is ascertained) Due from Officers and Employees Salaries and Wages – Regular Pay 128 801 10 To record refund of overpayment Cash in Treasury Due from Officers and Employees 101 128 10 Refund of overpayment of Salaries and Wages – Regular Pay during the current year Cash in Treasury Salaries and Wages – Regular Pay 101 801 10 To take up refund of over – payment in the ensuing year Cash in Treasury Prior Years’ Adjustments 101 533 10 Settlement 10 10 8. Refund of Overpayment a. Overpayment taken up as receivable 10 10 b. Refund of overpayment not taken up as receivable Particulars 1. Report of supplies utilized for P2,000. 2. Application of advance RPT for P2,500. Account Title Office Supplies Expense Office Supplies Inventory Deferred Credits to Income Real Property Tax Particulars 1. Receipt of the Notice of Funding Check Issued for the December Share from Internal Revenue Collections for P20,000. Account Title Due from NGAs Share from Internal Revenue Collections 2. Unpaid salaries and wages of employees, at end of accounting period, P50,000. Salaries and Wages – Regular Pay Due to Officers & Employees Particulars 1. To close the Revenue accounts to the Income and Expense Summary account. Account Title Real Property Tax Share from Internal Revenue Collections Business Taxes & Licenses Registration Fees Income and Expense Summary Income and Expense Summary Retained Operating Surplus 2. To close the Income and Expense Summary to Retained Operating Surplus account. Acct. Code 849 149 440 711 Acct. Code 130 746 801 428 Acct. Code 711 746 723 761 532 532 10 10 Debit 2,000 2,000 2,500 2,500 Debit 20,000 To close the Retained Operating Surplus to Government Equity account. Retained Operating Surplus Government Equity 534 501 Credit 20,000 50,000 50,000 Debit 100 10,000 50 20 Credit 10,170 5,670 534 3. Credit 5,670 5,670 5,670